Con: Mortgage Insurance Premium

Private mortgage insurance, or PMI, is typically required on any conventional mortgage with a down payment of less than 20 percent. FHA loans require an upfront mortgage insurance payment of 1.5 percent and a monthly mortgage insurance premium which amounts to .5 percent of the loan amount.

References

Qualifying For The Loans

Conventional and FHA loans use different standards for borrower approval. From a credit scoring perspective, FHA loans are easier to qualify for. As of 2018, the minimum credit score you need to qualify for an FHA loan with a 3.5% down payment is 580. It’s possible to get an FHA loan with a credit score below that cutoff, but you’ll need to bump up your down payment to 10% of the purchase price.

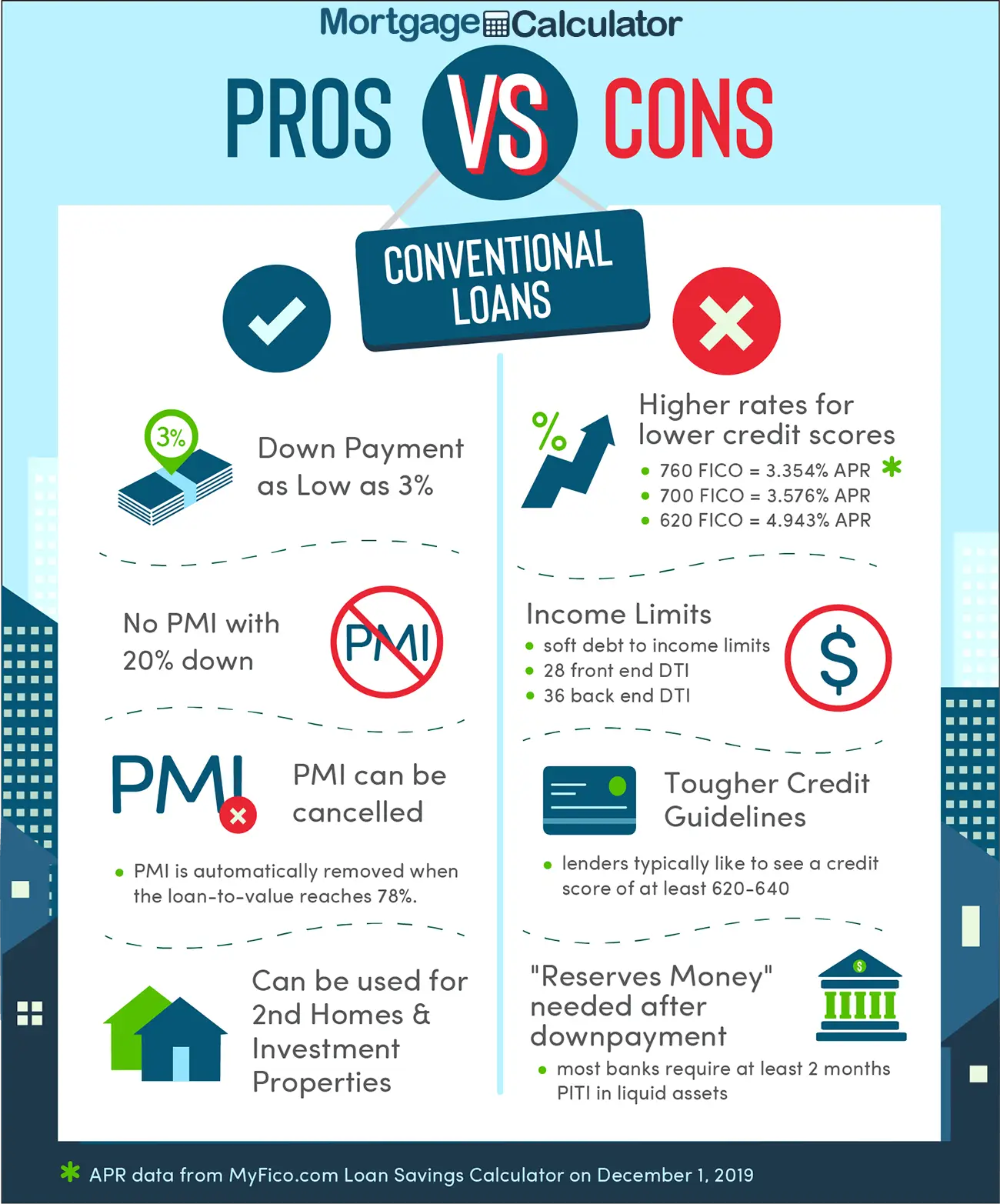

Conventional loans raise the bar on credit standards. A score of 620 or better is generally recommended in order to get approved for a conventional mortgage, but individual banks can require an even higher score. Borrowers for both types of loans will also look at your income and how much of that goes to debt repayment each month. With an FHA loan, you may be able to get approved with a higher debt-to-income ratio, but conventional mortgages typically cap the acceptable DTI ratio at 43%.

Your credit score and DTI ratio matters for approval because they influence the interest rate you’ll pay on your loan. Generally, FHA loans tend to offer better rates for borrowers than conventional loans. A lower rate means having lower mortgage costs overall, which is especially important when interest rates rise.

Myth 1: Fha Mortgage Insurance Is More Expensive Than Conventional Loan Private Mortgage Insurance

Rates for both PMI and MIP depend on several different factors, so you canât know which will be more expensive for you until you get preapproved for a loan and see your estimates. Your credit score, down payment, and loan-to-value**** ratio will determine your mortgage insurance rates.

PMI generally runs about 0.5 percent to 1.25 percent of the loan, while MIP is charged as an upfront fee of 1.75% and an annual premium. Most FHA borrowers pay an annual MIP of 0.85%.

Read Also: What Is An Unsecured Personal Loan

Bottom Line: Is It A Good Idea To Get An Fha Loan

Whether an FHA loan is right for you will depend on your specific situation. According to the Consumer Financial Protection Bureau, for borrowers with fair or poor credit scores or less money for a down payment, FHA loans are normally less expensive than conventional loans.

On the other hand, if you have good credit and at least 10% for a down payment, an FHA loan may be more expensive than a conventional loan. If you are considering an FHA loan, make sure you check offers from multiple lenders. Remember that the FHA sets minimum eligibility standards, but each lender has its own specific approval requirements, rates and fees.

Myth 1: You Cant Get An Fha Loan If You Have Student Loans

The rules around how lenders count student loans on FHA applications changed in June 2021 â to the buyerâs benefit.

Before, FHA lenders had to use 1% of the outstanding loan balance as part of a borrowerâs monthly debt obligations â regardless of any income-based repayment in place.

For example, a borrower with $100,000 in outstanding student loan debt would have $1,000 per month added to their debt obligations for FHA loan underwriting purposes, even if their actual monthly payments were lower. For many borrowers, this method increased their debt-to-income ratio beyond the allowed criteria and disqualified them from getting a mortgage.

The new FHA rules allow lenders to use borrowersâ actual monthly student loan payments if they are on income-based repayment plans and their payments are more than $0. Otherwise, they can use 0.5% of their total loan balance to calculate their monthly DTI. For someone who has $100,000 in student loans, the lender would count $500, rather than $1,000, toward their monthly debts. That change can make all the difference to getting approved.

Recommended Reading: How To Start Va Home Loan Process

Fha Loan Eligibility Requirements

Here are 2021 FHA loan eligibility requirements you have to meet to get an FHA loan, as summarized by the money advice website Nerdwallet.com:

- Debt-to-income ratio of 50% or less

- 3.5% down payment if your credit score is 580 or higher

- 10% down payment if your credit score is 500-579

- The house must be your primary residence and meet FHAs property requirements

Remember that FHA insures loans for the lender. You still have to work with an FHA approved lender to qualify for a home loan.

Benefits Of Fha Loans

An FHA loan is a government-backed mortgage option that gets its namesake by being insured by the Federal Housing Administration . Since FHA loans are insured by the government, lenders feel more comfortable taking on riskier borrowers, which can grant you, the borrower, more leniency when it comes to meeting certain loan qualifications, like credit score and debt-to-income ratio . Simply put, you may still qualify for an FHA loan without having to be the perfect financial candidate.

For some, this added flexibility on loan qualifications may be just enough to help finally become a homeowner, but for others, a conventional loan could serve their needs perfectly well. Lets break down exactly what FHA loans can offer their borrowers and further explore in which cases an FHA loan might be right for you.

Also Check: Can I Transfer My Mortgage Loan To Another Bank

Borrowing Limits And Loan Maximums

With the added flexibility of FHA loans comes borrowing limits and loan maximums. This is how lenders hedge against the risk of loaning the cost of the home to buyers who may not have good credit or a significant down payment saved. The loan ceiling, or the maximum amount you can borrow, will vary depending on where you live and the cost of housing in your area.

What Is An Fha Loan And How Does It Work

If youre asking what an FHA loan is, youre probably wondering how it works. Named for the Federal Housing Administration that insures them, FHA loans are insured by the government to make homeownership more accessible to more Americans. Originally offered only to first-time home buyers, FHA loans are available to a wider range of buyers. Theres a lower down payment and fewer restrictions in terms of qualifications for FHA loans. That flexibility in loan qualifications helps more buyers become homeowners. Still, if you have more money saved for a down payment or have an excellent credit score, you may decide an FHA loan is not for you. Thats where its helpful to have these pros and cons of FHA loans to help you.

You May Like: How To Apply For Fha 203k Loan

What Are The Pros And Cons Of Fha Loans

Life is filled with choices and its usually our own experiences and circumstances that will influence what we choose: Whether you prefer sweet or savory eats, staying in or going out, or if you were team Iron Man or Captain America it all comes down to you and your personal preferences.

The same goes for deciding what kind of mortgage option is right for you especially because not all mortgages are created equal, and while some might be a good fit for your financial situation, others may not. The best way to rest easy knowing youve found a loan option which works for you is by doing your research and learning what each type of loan can offer borrowers. In this article, well explore the pros and cons of FHA loans so that you can make the best and most informed choice for you.

Con: Looks Bad In Bidding Wars

Because FHA loans dont require high credit scores, some sellers look down upon them. They may think of selling to a buyer with an FHA loan as a last resort or they may choose to sell to the highest bidder with a conventional loanor none at all.

FHA loans also have strict requirements for appraisals and inspections, which could mean that financing falls through if a property doesnt meet their requirements. Buying a home with an FHA loan can look like a risk instead of a sure thing.

While FHA loans are not without their downsides, they still present a great opportunityparticularly for new investors. Anyone with a job who is looking to get into real estate and doesnt have a lot of capital to begin with should seriously consider using an FHA loan to get started.

You May Like: Should You Refinance Car Loan

Myth 1: You Cant Get An Fha Loan If You Have Had A Bankruptcy

Borrowers who have experienced bankruptcy are still eligible for FHA loans.

If you filed Chapter 7 bankruptcy, there is a two-year waiting period before you can qualify for an FHA mortgage. You may be able to qualify in less than two years after Chapter 7 bankruptcy if you can prove that it was caused by circumstances out of your control, and you have proven you can manage your finances and meet your financial responsibilities.

If you filed Chapter 13, you may become eligible a year after your pay-out period begins. You will need to document that youâve been making all relevant payments on time, and the bankruptcy court will need to give you permission to take out a mortgage.

Fha Home Loans Have Flexible Debt

One of the steps to getting approved for a mortgage when buying a home is having a mortgage lender review your debt-to-income ratios, also referred to as DTI ratios. A nice benefit to FHA home loans is they have flexible DTI requirements.

There are some mortgage products that do not allow a buyers DTI to exceed 40%, while FHA prefers a buyers DTI to not exceed 43%. While FHA prefers a 43% DTI ratio, there are some circumstances where a buyer with a DTI ratio of 50% or greater can obtain a home loan.

Typically a buyer with DTI ratios exceeding 50% will be required to have a substantial amount of reserve money saved. Anytime a buyer who has a DTI ratio exceeding 43%, its critical they ask prospective lenders if theyll manually underwrite the loan because itll likely be necessary.

Don’t Miss: Can I Buy Two Houses With Va Loan

Fha Home Loans Require Mortgage Insurance

Arguably the biggest CON of FHA home loans is the requirement of mortgage insurance. Since FHA home loans are considered more dangerous than other types of financing, there is a required amount of upfront and monthly mortgage insurance.

When a buyer is purchasing a home with an FHA home loan and theyre financing more than 90% loan to value, theyre going to be required to pay a monthly mortgage insurance for the duration of the loan. Since FHA mortgages are popular for buyers who dont have a lot of money to put down towards a home, this is often the case for many buyers whore obtaining an FHA home loan.

If possible, its beneficial for buyers to save enough money to make at least a 10% down payment to avoid paying mortgage insurance for the life of the loan. Many buyers dont realize there are many easy tips for saving for a down payment to buy a house, which can save them quite a bit of money over the course of a 30 year mortgage.

Pros And Cons Of An Fha Loan

An FHA loan is a specific type of mortgage issued by an FHA-approved lender and insured by the Federal Housing Administration. The primary purpose of this type of loan is to help individuals with lower credit scores or lower down payments qualify for borrowing. Because they have looser requirements than conventional loans, FHA loans are especially attractive among first-time buyers, but you dont have to be a first-time homebuyer to get one.

Don’t Miss: What Can I Afford Mortgage Loan Calculator

Fha Loans With Total Mortgage

There are many FHA advantages and disadvantages to consider, but the choice you make depends on your financial situation. If you dont have the best credit history or you dont have much cash to put down, then an FHA mortgage loan may be an option worth considering.

Total Mortgage currently offers 15, 20, 25, or 30-year fixed-rate FHA mortgages. FHA adjustable-rate mortgages are also available.

Apply today for an FHA loan with Total Mortgage and well close your new purchase in 21 days or less.

Myth : Fha Loans Take Too Long Because They Are Government

FHA lenders are authorized to approve and close FHA loans without getting government approval for each loan. In theory, they can be closed as fast as any other loan type.

However, there can be delays due to the FHA appraisal process. Lenders will require an appraisal for all loan types to determine the market value of the home and whether itâs in sound condition.

But the FHA has strict property requirements to which appraisers must adhere. If they flag something for repair before the loan can close, youâll need to work with the seller to get it fixed, and that can delay the closing.

@home_com More FHA loan myths busted! #howtobuyahouse#mortgage#realestate#realestatetiktok#fha#fhaloan#foryou#foryoupage#fyp#fypã·#homeownership⬠original sound – homedotcom

Read Also: Where Can I Cash My 401k Loan Check

Advantages And Disadvantages Of An Fha Loan And Why It Matters

If you want to become a homeowner, odds are youll need to take out a home loan. Although you could try to get a traditional home mortgage through any number of lenders, you might want to consider looking into alternatives, such as federally backed loans like the FHA loan. But consider all the benefits as well as the potential drawbacks of your mortgage options, including those of an FHA loan, before you apply.

Myth 1: You Cant Get An Fha Loan If Youve Had A Foreclosure

Borrowers can apply for an FHA loan if theyâve owned a property that has gone through foreclosure. However, youâll likely have to wait three years to qualify, unless you can prove that:

- The foreclosure was caused by circumstances beyond your control

- The foreclosure was caused by the serious illness or death of a wage earner

- The foreclosure occurred because your ex-spouse got the house in the divorce and the house went into foreclosure after that point

Generally speaking, however, divorce is not considered a valid reason for waiving the waiting period. If the property went into foreclosure because you couldnât sell it while relocating for personal or professional reasons, the FHA does not consider that an extenuating circumstance either.

Don’t Miss: Can You Get Fha Loan No Down Payment

What Credit Scores Are Required For Conventional Loans Vs Fha Loans

To qualify for a conventional loan, youll need a credit score of at least 680. Borrowers with credit scores as low as 580 may be approved for an FHA loan. If your credit score is lower, you may still qualify, but you will need a minimum of 10% of the homes value for a down payment.

Strict Criteria And Requirements

FHA loans have much stricter criteria and requirements for the type of property you can invest in. For example, the FHA refuses to finance any properties that have electrical, structural, foundational, plumbing, or wiring issues. A home inspection is required and the requirements for that inspection will be much more rigorous compared to a conventional mortgage, which has no inspection requirements.

Because of these restrictions, it also means that you cant buy a fixer-upper with the intention of renovating or repairing issues yourself. The seller must perform any issues discovered during the inspection or the FHA wont approve the loan. This can also be problematic if theres more than one bidder for the house: the seller is more likely to accept bids from someone using a conventional loan since they wont have to go through the hassle of meeting the FHAs requirements.

Recommended Reading: How Much Do Loan Officers Make

It Cant Be Used To Buy Investment Properties

FHA loans also cant be used to buy investment properties. You may be looking at apartment buildings, duplexes, commercial real estate or other types of investment property that could generate an income stream for you. There are other types of mortgage loans for an investment property, so you will be able to get the financing you need if you qualify. The down payment for an investment property is usually higher than for a primary residence.

Pros Of Community Banks

- Personalized service: Community banks are commonly owned and managed by people who live near the bank. As such, bank employees may have long-standing friendships with customers and be able to provide more personalized service.

- Local investment: A banks focus on giving loans to those in its own community helps local businesses and residents thrive.

- Relationship banking: Community bank officers may take into account discretionary spending and family history when making loans, rather than relying solely on impersonal data like credit scores, according to the Independent Community Bankers of America .

- Community service commitment: Like other local businesses, neighborhood banks often give back to their community through volunteer work and supporting local charitable organizations.

- Lower fees: Some community banks charge lower fees than national banks. For instance, fees for overdrafts and nonsufficient funds are 13-19 percent lower at small banks and credit unions than at large banks, according to a 2021 report from the Consumer Financial Protection Bureau.

You May Like: What Does Pre Approval For Home Loan Mean