Average Auto Loan Rates By Credit Score

Consumers with high credit scores, 760 or above, are considered to be prime loan applicants and can be approved for interest rates as low as 3%, while those with lower scores are riskier investments for lenders and generally pay higher interest rates, as high as 20%. Scores below 580 are indicative of a consumers poor financial history, which can include late monthly payments, debt defaults, or bankruptcy.

Consumers with excellent credit profiles typically pay interest rates below the 60 month average of 4.21%, while those with credit profiles in need of improvement should expect to pay much higher rates. The median credit score for consumers who obtain auto loans is 711. Consumers in this range should expect to pay rates close to the 5.27% mean.

When combined with other factors relevant to an applicants auto loan request, including liquid capital, the cost of the car, and the overall ability to repay the loan amount, credit scores indicate to lenders the riskiness of extending a loan to an applicant. Ranging from 300 to 850, FICO credit scores are computed by assessing credit payment history, outstanding debt, and the length of time which an individual has maintained a credit line.

Why Do Lenders Look At Your Credit

When lenders run credit checks, they’re trying to assess what kind of borrower you’ll be, and going over your credit score and report can help them understand how you’ve historically managed credit. Late payments, maxed-out credit cards and accounts in collections may paint you as an unreliable borrower.

How Can I Pay My Loan Off Faster

How to Pay Off Debt Faster

Recommended Reading: Can You Put Closing Costs Into Va Loan

How Much Can I Save By Paying Off My Car Loan Early

How much you can save depends on several factors, including how much time you have left on your term, your loan balance and your interest rate. Use our car loans calculator to learn the difference between repaying your loan according to your current term and paying it off early if you have no prepayment penalties.

How To Pay Off A Car Loan Faster

This article was co-authored by Hovanes Margarian. Hovanes Margarian is the Founder and the Lead Attorney at The Margarian Law Firm, a boutique automotive litigation law firm in Los Angeles, California. Hovanes specializes in automobile dealer fraud, automobile defects , and consumer class action cases. He holds a BS in Biology from the University of Southern California . Hovanes obtained his Juris Doctor degree from the USC Gould School of Law, where he concentrated his studies in business and corporate law, real estate law, property law, and California civil procedure. Concurrently with attending law school, Hovanes founded a nationwide automobile sales and leasing brokerage which gave him insights into the automotive industry. Hovanes Margarian legal achievements include successful recoveries against almost all automobile manufacturers, major dealerships, and other corporate giants. This article has been viewed 217,322 times.

There are many benefits to paying off a car loan quickly. You save money on your loan interest and improve your credit rating, to name just two. Although most financial institutions may expect you to make a car loan payment each month, there are methods you can practice in your financial planning that will allow you to pay your car loan off faster and save money. To get started, figure out the details of your loan, what steps you can take, and how to save more money to get the loan paid off more quickly.

You May Like: How Long Does Sba Take To Approve

What Determines Your Interest Rate On A Car Loan

Interest rates are not the same for every person and are determined based on several factors. Here are some of the things that may affect your interest rate when financing your vehicle:

Typically, the higher your credit score, the lower your interest rate will be. Thats because a high credit score indicates that you have a good history of paying off your debts on time, so youre a less risky borrower. If youd like to check your credit score, you can use Chase Credit Journey to find your score for free without hurting your credit.

The vehicle

The vehicle you purchase may also affect your interest rate. New vehicles tend to have a lower interest rate, sometimes even as low as 0%, while used vehicles usually have a higher interest rate.

Loan term

Longer loan terms tend to have higher interest rates than short-term loans. So, while you will have to pay a higher amount each month on the principal, with a short-term loan , you may save a lot of money on interest.

Lender

Interest rates vary. You should compare interest rates from several lenders to see which ones offer the best prices. You can also finance your vehicle through the vehicle manufacturer whose rates may be different.

Dont Miss: Usaa Rv Loan Calculator

Put All Windfalls Toward Your Car Loan

We all occasionally collect a one-time windfall. They come in the form of things like tax refunds, work bonuses, gifts, and inheritances.

If you dont want to change your monthly budget in the slightest, you can put all lump-sum payments toward paying down your loan balance. Just ensure you stay disciplined and do it rather than succumbing to the temptation of putting it toward a new TV or a vacation instead.

You May Like: Prosper Credit Requirements

What To Consider Before Paying Extra

Before you pay extra on your car loan, however, it’s important to consider these questions:

- Does your lender allow extra payments? Some auto lenders prohibit early repayment altogether. Others charge prepayment penalties, which can eliminate any savings from making extra payments. Check with your lender to find out what your loan terms allow.

- Do you have other, higher interest debt? In general, auto loan interest rates are fairly low compared with, say, credit card debt. For example, the average credit card interest rate is currently 17.86%, while the average interest rate for a 60-month new-car loan is 4.73%. If you have extra money, use it to pay down high interest debt before tackling low interest debt.

- How will making extra car payments affect your budget? Make sure the extra payments won’t stretch your budget to the breaking point. If you end up short of cash, you might be tempted to put expenses on your credit card, creating high interest debt.

- Could this money be put to better use? Depending on your current needs and future plans, there may be more productive uses for your money than paying extra on a car loan. For instance, you might want to increase your 401 contribution, build up an emergency savings fund or start saving for a down payment on a home.

Is There A Way To Lower A Monthly Car Payment

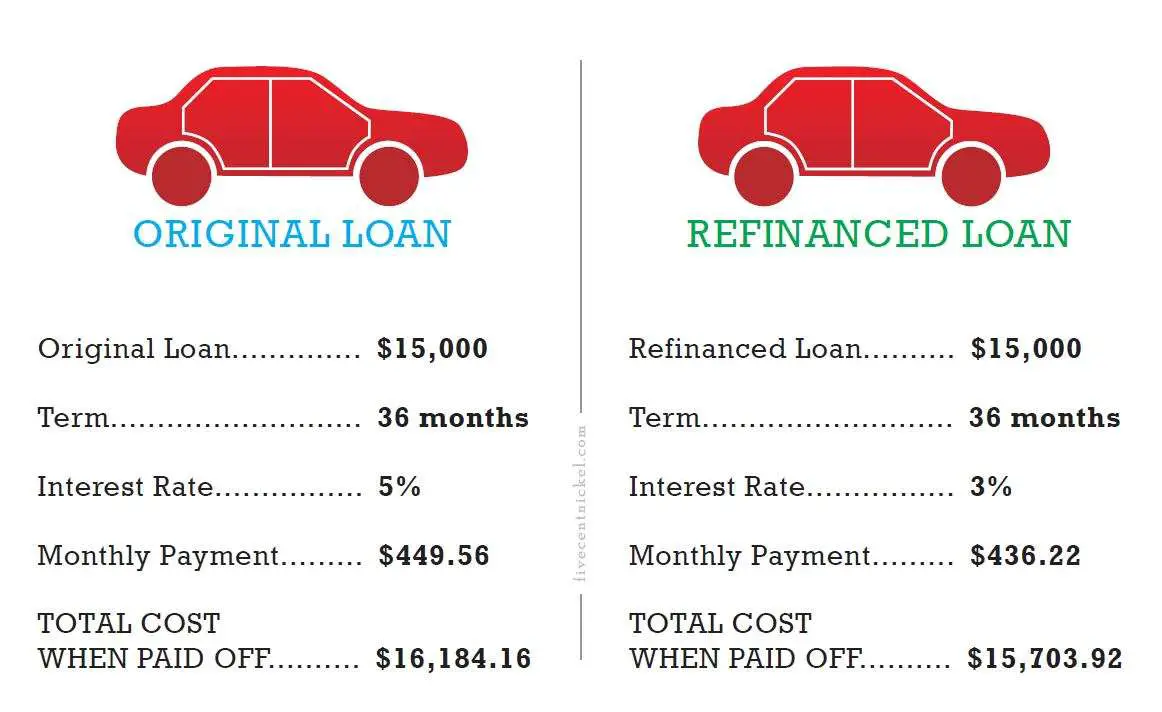

You could consider refinancing your existing car loan to lower the payment. Since refinancing starts a new loan, you should shop several refinance lenders to compare and find the loan that saves you the most money.

You can choose a different loan term and possibly qualify for a lower rate, providing an opportunity to adjust your monthly car payment. You might save $25 a month, but over a 48-month term thats $1,200 back in your pocket.

If you want to dramatically lower monthly payments, though, you’ll most likely need to extend the loan term. Before rushing to do that, know that you may actually pay more overall, due to the extra months of interest. Also, going to a longer term can leave you upside-down on your car loan a situation where you owe more on your car than its worth.

About the author:Shannon Bradley covers auto loans for NerdWallet. She spent more than 30 years in banking as a writer of financial education content.Read more

You May Like: Va Mpr Checklist

Make A Payment Every Two Weeks

Submitting payments every two weeks on your vehicle instead of monthly can also help you pay off the loan a little earlier. By paying half of your monthly payment every two weeks, you end up making a total of 26 payments per year, which is equivalent to making 13 monthly payments in one year rather than 12. Contact your lender to make sure this is an option and for their assistance in setting it up.

Refinance Your Existing Car Loan To A Lower Rate

This is a very powerful way that you can chart your own destiny to save a lot of money if you have any existing high APR car loans. Many people get lost in the here and now shopping for a new car, forgetting they are already a prisoner already to a previous high APR auto loan. So remember that buying a new car is not just about this new car, but rather it involves your entire financial picture.

Does your current financial picture involve you having an existing car loan with a high APR? Maybe a car dealer scammed you on a previous deal with a super high car loan interest rate? This happens all the time.

Perhaps you previously had questionable credit scores and were railroaded into high APR auto financing with little time to think it over. Now you are on the mend, but you still have that high APR baggage from your previous life. You could refinance to a lower APR by using online lenders such as LightStream and CARCHEX.

This is a useful strategy for you to use. Not only are you saving money on your new car using all our consumer advocate advice here and also potentially getting a lower new car loan APR. You are also saving more money on your existing loans by stopping your higher interest rate in its tracks. The money you save by refinancing your previous car loan to lower rates can help pay for your new car.

Also Check: Usaa Car Buying Rates

Can I Get Low Interest Car Loans With Bad Credit

You cant get low interest car loans with bad credit with the majority of lenders. This is because lenders will typically charge higher rates if you have bad credit to compensate for the chance that you might not make your repayments on time.

That said, you may be able to secure a lower interest rate if you apply with a cosigner. You can also secure your loan with an asset to get lower interest rates.

Vehicles Last Longer As Well As Auto Loans

- Cars, SUVs, Trucks last a lot longer than they used to. 100,000 miles used to be considered a pretty good indication your vehicle was nearing the end of its useful life. These days it is not uncommon for a vehicle to go 200,000 miles or more.

Better engines and transmissions, improved corrosion protection, more durable components all add up to vehicles that hold up a lot longer than their predecessors.

- Consumers are also doing a better job of keeping up on auto maintenance schedules.

With cars lasting longer, lenders are willing to make longer auto loans as well. Auto loans of five, six, even seven years are increasingly common because the lender is confident the vehicle will keep running that long.

Longer loans mean lower monthly car payments, which is important when you’re looking at $25,000 or more for even a basic new vehicle. A good used car can easily run $10,000 or more.

- FAQ: Longer loans mean a lower monthly payment and a more affordable vehicle.

Unfortunately, those affordable monthly payments cost you money over the long run. Interest charges pile up over time and with the way loan amortization works, each additional year you add means disproportionately higher interest costs over the life of the loan.

- FAQ: In fact, you may be surprised by how small the difference in monthly payments can be between a six-year and a seven-year auto loan, due to the additional interest costs over the life of the loan.

You May Like: Prosper Loan Approval Time

Can I Pay Off My Car Loan Early

Generally yes, youre allowed to pay off your car loan early. In fact paying off your loan early can cut down on the total cost of your car, because theres less time for interest to compound on your loan. However, loans with pre-computed interest ensure that lenders get their full interest payment, regardless of how soon you choose to pay off your loan. In these cases, early repayment can only get you out of debt faster, but youll pay the same total amount either way.

Pay More On Your Extra Pay Periods

Depending on your pay schedule, you may have an extra paycheck a few times per year. For example, if you get paid weekly, you usually get four paychecks per month. Four months every year, you receive five paychecks.

If you get paid biweekly, you typically bring home two paychecks a month. Two months a year, you’ll get paid three times in a month. These extra paychecks are perfect to put toward your car loan.

This applies any time you receive “extra” or unexpected money. For example, pay raises are an excellent opportunity to pay down debt. Pay raises add a little extra to your paycheck each month, and you can add that extra to your car loan payments. Chances are that you won’t miss it.

Read Also: Can I Use Va Loan For Investment Property

A Lower Monthly Payment On Your Car Loan Doesnt Always Mean Youre Saving Money Heres How Car Loans Work

Purchasing a car typically means taking out a car loan. If youre in the market for a new vehicle, youve probably spent a lot of time researching car options, but do you have a good understanding of how car loans work? When you take out a car loan from a financial institution, you receive your money in a lump sum, then pay it back over time. How much you borrow, how much time you take to pay it back and your interest rate all affect the size of your monthly payment. Here are the 3 major factors that affect both your monthly payment and the total amount youll pay on your loan:

Option : Lower Your Car Payment By Trading Down

Maybe you did buy too much car. That 8-seater is a pain to park. The leather seats on the luxury package minivan are not impressing your kids or their friends. You could sell your car and buy a more economical model. Making this option all the more interesting, and convenient, is the proliferation of new online services that will buy your used car, like Carvana. By entering some basic information about your car on one of these sites, you can quickly get a firm offer. If you agree, these companies will pick your car up at your home and bring a check with them. You can use that check to pay off your old car loan, and buy a smaller, less expensive vehicle.

Recommended Reading: Usaa Prequalify Mortgage

Average Interest Rates For Car Loans

The average APR on a new-car loan with a 60-month term was 4.96% in the first quarter of 2021, according to the Federal Reserve. But as mentioned above, your credit scores and other factors can affect the interest rate youre offered.

|

Loan type |

Note: Experian doesnt specify which credit-scoring model it uses in this report.

The table above isnt a guarantee of the rate you may be offered on an auto loan. Instead, it can help you estimate an interest rate to enter into the auto loan calculator, based on the average rates people with various credit scores received on auto loans in the first quarter of 2021.

Keep in mind that there are different and that various lenders use may different ones. For example, auto lenders may look at your FICO® Auto Scores. And available interest rates and APRs can vary by lender, so be sure to shop around and compare both across your loan offers.

How To Work With Your Lender To Avoid Falling Behind

If you think you may fall behind on your auto loan, and explain your situation. The sooner you contact your lender, the more choices the lender may be able to offer you. And since its often more expensive for a lender to repossess your car than to work with you, your lender may be able to offer options that help you make your payments. Working with your lender also demonstrates a good-faith effort on your part to repay your debt.

You should know that there may be extra costs to the payment options that your lender offers. For example, all of the options discussed below will increase the amount of interest you pay over the life of the loan to varying degrees some options may increase your payment amount or the number of payments you owe. Learn more about the pros and cons of some of the options that may be available to you so that you can determine the best way to keep your car and not fall behind on your loan.

Recommended Reading: Upstart Second Loan