When Should You Consider A Condo

There are some benefits of getting a condo at this price if you can deal with the smaller size and inconvenient location.

Some couples may be earning more than the income ceiling for a housing grant. Under the revised income ceiling, household income cannot exceed S$14,000 to receive a grant. This may result in them turning towards private properties like a condominium for a better deal.

Privacy and security is perhaps the biggest selling point of a condominium. There will be a security check-in and the areas will be gated as well. Having no disturbance from sales agents and the ability to let your young children go to the playground alone without worry is a big plus for many.

There are also larger ânon-chargeable spacesâ like balconies, first floor exclusives – private enclosed spaces .

Amenities like swimming pools, gyms, and barbeque areas are also a plus for the individuals who frequent these facilities.

What Are The Prime Factors That Lenders Consider

Loan-to-value is just one element lenders look at when deciding whether an applicant will qualify for a loan. It is definitely among the most important, but other factors include:

-

Down payment. The bigger your down payment, the more attractive youll seem to a lender. It means it will take less risk in lending you the money to buy a home. Thats why loan-to-value plays such a major role in lending decisions.

-

Cash flow. The amount of money you have left over at the end of the month after paying your recurring debts and expenses is a key indicator of your ability to repay a mortgage.

-

Liquidity. Having money in the bank, in the form of savings or investments, lets the lender know that you can not only pay the closing costs required to complete a loan but have a cash cushion necessary for homeownership expenses, as well.

What Is A Loan

A loan-to-value ratio basically measures the loan amount against the value of the asset being purchased with the loan. The loan balance is divided by the value of the asset to calculate the loan-to-value ratio.

A higher LTV ratio means that you need a higher loan amount to pay for the purchase of the asset. Over time, your LTV will decrease as you continue making loan payments and as the assets value appreciates.

Do you know what the true cost of borrowing is? Find out here.

Read Also: Usaa Used Car Interest Rates

How To Lower Your Ltv Ratio

Need to lower your current LTV ratio? Here are several actions you can take:

- Save up money for a larger down payment.

- Set your sights on a more affordable house.

- Consider an alternative loan option, like a RenoFi Loan, that allows higher LTV ratios.

The lowest LTV ratio is achieved with a higher down payment and a lower sales price. Even though its certainly not an easy thing for everyone to do, making a bigger down payment does usually translate to a lower mortgage rate.

If youre purchasing a home, the important thing is to try and clear the 80% mark, so that you dont need to pay PMI. PMI is another fun acronym that stands for private mortgage insurance.

The average PMI ranges from .5-1.5% of the total annual loan amount. While this seems small, if your mortgage is $400,000, this is another $4,000 you could be saving for something else.

Your LTV ratio can and will change once you start to repay the loan, but these pesky PMI payments are required until the LTV ratio is 80% or lower.

Make Regular Mortgage Payments

Making on-time mortgage payments will lower your principal balance and build your equity. It can be helpful to think of the ratio as a bookshelf, where the top shelf is the loan amount and the bottom shelf is the property value.

Any sturdy bookshelf will be bottom-heavy , with the heaviest books on the bottom and will want to keep the top shelf light. The more you pay off your loan and lighten the top shelf, the sturdier the bookshelf, and the more reliable you look to lenders.

At some point, youll have paid off enough of your loan to reach an 80% LTV ratio, meeting the 20% down payment requirement. This means you no longer need to pay private mortgage insurance, saving you hundreds of dollars per year.

Also Check: Usaa Car Loan Apr

Importance Of The Loan

Generally, a high LTV ratio indicates a high level of lending risk. The rationale behind this is that the purchased property in the mortgageMortgageA mortgage is a loan provided by a mortgage lender or a bank that enables an individual to purchase a home. While its possible to take out loans to cover the entire cost of a home, its more common to secure a loan for about 80% of the homes value. is used as collateral. Thus, the LTV ratio essentially compares the size of the loan requested to the size of the pledged collateralCollateralCollateral is an asset or property that an individual or entity offers to a lender as security for a loan. It is used as a way to obtain a loan, acting as a protection against potential loss for the lender should the borrower default in his payments..

Due to the abovementioned reason, the assessment of the LTV ratio serves a crucial role in mortgage underwriting. For example, conventional mortgage lenders usually provide good loan terms if the LTV ratio is less than 80%.

Personal Loan Options To Consider

If youre not looking for a mortgage but need to borrow for anything else, personal loans come in all shapes and sizes. A few of the most common types include the following:

- Secured loans. With a secured loan, you have to put up some form of collateral , which your lender has a right to sell if you dont pay back your loan. Secured loans usually have lower fees and better terms.

- Unsecured loans.Unsecured loans dont require collateral, but your credit score will go down if you fail to make repayments.

- Guarantor loans. This type of loan requires you to ask a friend or family member to cosign. The only catch is that theyll be responsible for repayment if you default.

- No credit check loans. Some lenders wont ask to do a credit check, but they will usually need you to secure your loan with collateral or have a cosigner.

- Payday loans. Payday lenders could be a good solution if you need less than $2,000. Just keep in mind that they charge extremely high interest rates.

You May Like: Unsubsidized Loan Definition

How To Calculate Your Home Equity And Why It Matters

As prices rise or fall in your area, your home equity also shifts. Hereâs a quick guide for figuring out how much you have, plus tips to potentially increase it.

WEâVE ALL DONE IT â that mental calculation where you try to figure out how much youâd clear if you were to sell your house and pay off your mortgage. But it can be more than just an idle exercise. Even if you never sell your home, the equity you have can help you pursue important personal goals. So understanding how to calculate your equity â and how banks view it â is critical, especially if you want to borrow money against that equity to pay for a home improvement project, cover emergency expenses or help pay for your childâs college tuition, for example. In fact, your homeâs equity also could affect whether you need to pay private mortgage insurance and could determine which financing options may be available to you.

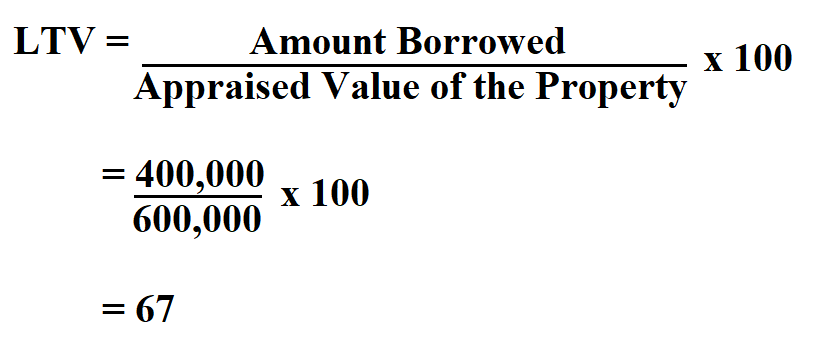

How To Calculate Ltv

Your loan-to-value ratio is the way of expressing what proportion you continue to owe on your current mortgage. Heres the essential loan-to-value ratio formula:

When the Current loan balance is divided by the Current appraised value you get the LTV calculation

Example: You currently have a loan balance of $140,000 . Your home currently appraises for $200,000. So your loan-to-value equation would appear as:

$140,000 ÷ $200,000 = .70

Convert .70 to a percentage which gives you a loan-to-value ratio of 70%.

You May Like: Fha Title 1 Loan Lender

Loan To Value Ratio Mortgage Example Calculation

Suppose you have decided to purchase a home currently worth $400,000 in the market based on a recent appraisal.

Since you do not have enough cash on hand to purchase the house all by yourself, you resort to getting assistance from a bank that offers to provide 80% of the total purchase price, i.e. $320,000.

The remaining 20% must be paid out of your pocket.

- Mortgage Loan = $320,000

- Down Payment = $80,000

The loan to value ratio is 80%, where the bank is providing a mortgage loan of $320,000 while $80,000 is your responsibility.

- Loan to Value Ratio = $320,000 / $400,000

- LTV Ratio = 80%

What Is The Loan To Value Ratio

Loan To Value Ratio is a ratio of the loan amount concerning the total value of a particular asset. Banks or lenders most commonly use it to determine the amount of loan already given on a specific investment or the margin to be maintained before issuing money to safeguard from flexibility in value.

Let us take a simple example. Let us say you want to purchase a home. And you want to take the help of a bank to take a certain amount of loan. Why? Because currently, you do not have that much cash available to buy the home all by yourself. So you go to the bank, understand their LTV and decide to buy a home.

If we add some figures, it will become easy to understand. For example, suppose you want to buy a home worth US$200,000 . However, the bank told you that they could only give you 80% of the amount. And the rest you need to share from your pocket.

So, this 80% is a loan to value ratio. In this case, a bank is paying you a loan on the mortgage of US$160,000, and you need to pay the US$40,000 from your pocket to purchase the home.

You are free to use this image on your website, templates etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:

Also Check: Upstart Vs Avant

Possible Effects On Insurance

If you pay private mortgage insurance on your mortgage, keep an eye on your LTV ratio. Your lender is required by federal law to cancel PMI when a homeâs LTV ratio is 78% or lower than the homeâs original appraised value . This cancellation is generally preplanned for when your loan balance reaches that percentage. However, if your LTV ratio drops below 80% because of extra payments you made, you have the right to request your lender cancel your PMI.

Sample Calculation Of Loan

Lets say a business wants to purchase a building with a market value of $1 million. This amount may be determined by a certified appraiser, or by the two parties who agree to carry out the sale of the building. If the company invests $200,000 in the project and applies for a loan of $800,000, the loan-to-value ratio is 80%.

Secured loan amount: $800,000

Don’t Miss: What Car Can I Afford Based On Salary

A Lower Ltv Ratio Means More Ownership Better Mortgage Rate

- The lower your loan-to-value ratio the more home equity or down payment you have

- Which is another way of saying ownership or skin in the game

- A low LTV equates to a lower mortgage rate because youre viewed as less risky

- It means the bank is risking less since you are more invested in the underlying property

Essentially, the lower the loan-to-value ratio, the better, as it means you have more ownership in the property.

Someone with more ownership is less likely to fall behind on payments or foreclose, seeing that they have a greater equity stake, aka financial interest to keep paying the mortgage each month.

Theyve also got more options if they do struggle with payments, as they could just sell the property without taking a loss .

Not only that, but banks and mortgage lenders also set up pricing adjustment tiers based solely on the LTV ratio.

Those with lower LTV ratios will enjoy the lowest interest rates available, while those with high LTVs will be subject to higher mortgage rates and/or closing costs.

For example, if youre being hit by the lender for having a less-than-stellar credit score, that adjustment will grow larger as the loan-to-value ratio increases .

So if your mortgage rate is bumped a quarter percent higher for a loan-to-value ratio of 80%, that same pricing hit may be increased to a half percentage point if the LTV ratio is a higher 90%.

Summary: Ltv Is Just One Factor

Remember, your LTV is only one piece of your mortgage application. The lower your LTV, the lower your interest rates and mortgage insurance is likely to be. Understanding your LTV can help you determine if youre ready to get a mortgage and show you what home loans are available to you.

Our Home Loan Experts can guide you through each loan option and help you decide what will work for you. Visit Rocket Mortgage®or give us a call at 785-4788.

Recommended Reading: What Credit Score Does Usaa Use For Auto Loans

How Ltv Affects Your Ability To Get A Home Loan

In order to get approved for a home loan, its generally good to plan to make a down payment of at least 20% of the homes valuethis would create an LTV of 80% or less. If your LTV exceeds 80%, your loan may not be approved, or you may need to purchase mortgage insurance in order to get approved.

LTV is also important because, if youre buying a home and the appraised value of the home turns out to be substantially lower than the purchase price, you may need to make a larger down payment so that your LTV doesnt exceed limits set by your lender.

If you already own a home and are thinking about taking out a home equity line of credit , most lenders will let you borrow up to 90% of your homes value, when combined with your existing mortgage. If the value of your home has fallen since you purchased it, you may not even be able to get a home equity loan or HELOC.

Lets say you own a home that you bought five years ago and is worth $100,000. If you have a mortgage with an outstanding balance of $65,000, that means that your current LTV is 65%. If your credit is good and you qualify for additional financing, you may be able to borrow up to an additional $25,000 through a HELOC, bringing your total LTV up to 90%.

How Ltv Is Used By Lenders

A LTV ratio is only one factor in determining eligibility for securing a mortgage, a home-equity loan, or a line of credit. However, it can play a substantial role in the interest rate that a borrower is able to secure.

Most lenders offer mortgage and home-equity applicants the lowest possible interest rate when their LTV ratio is at or below 80%. A higher LTV ratio does not exclude borrowers from being approved for a mortgage, although the interest on the loan may rise as the LTV ratio increases. For example, a borrower with an LTV ratio of 95% may be approved for a mortgage. However, their interest rate may be a full percentage point higher than the interest rate given to a borrower with an LTV ratio of 75%.

If the LTV ratio is higher than 80%, a borrower may be required to purchase private mortgage insurance . This can add anywhere from 0.5% to 1% to the total amount of the loan on an annual basis. For example, PMI with a rate of 1% on a $100,000 loan would add an additional $1,000 to the total amount paid per year . PMI payments are required until the LTV ratio is 80% or lower. The LTV ratio will decrease as you pay down your loan and as the value of your home increases over time.

In general, the lower the LTV ratio, the greater the chance that the loan will be approved and the lower the interest rate is likely to be. In addition, as a borrower, it’s less likely that you will be required to purchase private mortgage insurance .

Read Also: Fha Title 1 Loan

What Is The Loan

The loan-to-value ratio is an assessment of lending risk that financial institutions and other lenders examine before approving a mortgage. Typically, loan assessments with high LTV ratios are considered higher risk loans. Therefore, if the mortgage is approved, the loan has a higher interest rate.

Additionally, a loan with a high LTV ratio may require the borrower to purchase mortgage insurance to offset the risk to the lender. This type of insurance is called private mortgage insurance .

S To Lower Loan To Value

In reality, there is no quick-and-easy method to reduce the LTV ratio, as the process can be time-consuming and require some patience.

One option is to spend more on the down payment before taking out the loan however, not every homebuyer has this option.

For those who cannot increase the down payment, the best course of action could be to consider waiting to grow your savings and purchase a more affordable home or car with a lower price tag.

While not ideal, the compromise can pay off in the long run so when the time comes, you can make a larger down payment and own more equity in the property.

Generally, the lower your LTV, the better off youll be over the long-term in terms of interest rates and lending terms.

Another consideration is to get your property re-appraised, especially if there is reason to believe that the property value might have risen over the years .

If so, refinancing or taking out a home equity loan can become easier.

- Refinancing can be negotiated at a lower interest rate since LTV is based on the appraised value rather than the original purchase price.

- Home equity loans are borrowings against the equity on the property, which is beneficial for the borrower if the homes value has been re-valued at a higher value.

Master Real Estate Financial Modeling

This program breaks down everything you need to build and interpret real estate finance models. Used at the world’s leading real estate private equity firms and academic institutions.

Read Also: Usaa Used Auto Rates