Consider Private Student Loans

After exhausting scholarship, grant and federal student loan options, private student loans could help your child fill any funding gaps left over. However, youll typically need good to excellent credit to qualify for a private student loanso if you have an adverse credit history, youll likely have a hard time getting approved for a private parent student loan.

If your child is unable to qualify on their own, they could consider applying with a creditworthy co-signer. Keep in mind that a co-signer can be anyone with good credit who is willing to share responsibility for the loan, such as another relative or trusted adult.

Should You Get Parent Plus Loans

Parent PLUS loans can help some families pay for college, but they wont be right for everyone. First, consider whether you should borrow for your childs education at all.

Consider how adding new student loan payments will affect your finances. If theyd stretch your budget too thin or detract from other important financial goals like retirement, that might be a sign that its wise to reconsider.

If you can afford this new debt, also investigate alternatives to parent PLUS loans. Max out other , such as scholarships, savings, and lower-cost undergraduate federal loans, first.

Private student loans might be a better fit for some borrowers, too. Parents who dont want to shoulder this debt alone, for example, could co-sign a private student loan with their childmaking both family members legally responsible for this debt.

Special Instructions For Grad Plus Loans

Grad PLUS FAQ

Who is eligible to apply for a Grad PLUS loan?

- Must be enrolled in a Graduate degree program

- Have a valid Social Security Number

- Be a U.S. Citizen / Eligible non-Citizen

- Registered with the Selective Service

- Not be in default

- Not in Title IV grant / loan over-payment

How do I apply for a Grad PLUS loan?

To apply for the Grad PLUS loan you will want to log into studentaid.gov. Davenport will receive the notification of your application in approximately 2-3 business days.

How do I request an Increase to my Grad PLUS loan once it has been awarded?

If your credit check is still valid, please complete the Grad PLUS loan request form to request an increase to your Grad PLUS loan. If your credit check has expired, a new Grad PLUS application would need to be completed. You can complete the Grad PLUS application on studentaid.gov.

How do I request a Decrease to my Grad PLUS loan?

To request a decrease to your Grad PLUS loan, please complete the Grad PLUS loan request from.

How much can I receive in a Grad PLUS loan?

It is recommended that the student maximize his/her federal unsubsidized loans first. We recommend that you borrow direct cost only. Direct costs include tuition, fees, and books. These costs can be found on the student connection under financial tools. You are eligible to have financial aid up to your cost of attendance.

What is the Interest rate for Grad PLUS loan?

How often do I need to apply for a Grad PLUS loan?

- If your credit has expired.

Read Also: Defaulting On Sba Loan

How To Get A Parent Plus Loan With Bad Credit

If your appeal is unsuccessful or you have bad credit, you can still get a parent PLUS loan by adding an endorser to your application.

The endorser also cannot have adverse credit history and, like a co-signer, will be legally responsible to repay the loan if you cant. The child benefitting from the parent PLUS loan cannot be your endorser.

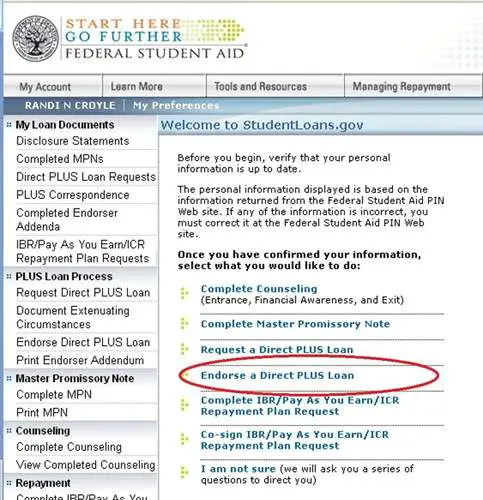

An endorser will need an FSA ID, then they must complete an addendum online. If your endorser is approved, you’re expected to complete credit counseling on the federal student loan website.

Take Care Of All Delinquent Accounts:

If the reason for denial was due to a delinquent account, probably as a result of an adverse reaction, then, you can try fixing this by making payments on the account and making it current. Once you do this, you can either re-apply for the loan again or explain it as an extenuating event.

When you re-apply, you may be required to wait for the change in the account to reflect on your credit report.

Also Check: Usaa Rv Rates

Apply For Additional Direct Unsubsidized Loans

If obtaining a Parent PLUS loan isnt an option, but your student still needs extra money for college, they may be able to qualify for additional federal student loans.

Dependent students whose parents dont qualify for a Parent PLUS Loan may qualify for additional unsubsidized Federal Direct Stafford Loans, the same limits as are available to independent students.

While you arent the borrower, your child is still able to receive the additional funds that they need to pay for their education.

How To Determine Your Federal Student Loan Maximum

The maximum federal student loan amount how much you can borrow as direct subsidized, direct unsubsidized, or direct parent PLUS loans varies depending on your situation as you complete your FAFSA . You can figure out the limit to what you can borrow at a particular time by answering these three questions:

Don’t Miss: Refinance Fha Loan Calculator

Sign A Master Promissory Note And Receive Loan Funds

Finally, youll sign a Master Promissory Note through the schools financial aid officethe loan agreement that outlines the terms of your parent PLUS loan.

Loan funds are then disbursed to your childs school and applied to outstanding charges for room, board, tuition, and fees. The school pays out remaining funds to you or the student, per your selection on the loan application.

You May Like: Are Auto Loans Amortized

Options If Your Parent Plus Loan Is Denied

Not everyone will qualify for a parent PLUS loan, but if youre denied you can try these alternatives:

- Get an endorser for your Parent PLUS Loan. This is equivalent to a co-signer: someone with non-adverse credit who agrees to repay the loan if you dont.

- Document extenuating circumstances. Some examples of extenuating circumstances: adverse information thats incorrect, older than reported, or for accounts that are part of a bankruptcy settlement or otherwise resolved. Start the credit appeal process to provide proof of your extenuating circumstances. Youll also need to complete PLUS credit counseling.

If these steps dont work, and your parent PLUS loan is denied, even that can have an upside. Students whose parents cant get PLUS loans can gain access to more federal student loans.

A dependent first-year student can only borrow up to $5,500 in federal student loans per school year, for example. But that limit goes up to $9,500 if the students parents were denied PLUS Loans.

Recommended Reading: What Happens If You Default On A Sba Loan

Youre Asking For Too Much

Trying to borrow more than your school-certified cost of attendance or more than the lenders maximum loan balance could also result in a loan denial.

Each school specifies the amount of money that they believe it should cost a student to attend for the yearincluding tuition, room and board, and other expenses. Youre typically not allowed to borrow more than the school says it should cost you to attend. If you already have borrowed for school or have received scholarships or grants, these other sources of funding will reduce the amount youre eligible to borrow.

> > Read More: Federal Student Loan Limits

Getting Denied Can Be A Good Thing

Even if youre certain you wont meet the credit requirements, you might still consider applying for a Parent PLUS loan. Why? Because federal student loan limits are actually higher for students whose parents have been denied the loan. Ironically, if you are denied a Parent PLUS loan, it could trigger greater access to federal student loans for your child.

Recommended Reading: Refinancing With Usaa

When Do Student Loans Get Disbursed

Category: Loans 1. Receiving Financial Aid Federal Student Aid Grants and Student Loans Generally, your school will give you your grant or loan money in at least two payments called disbursements. In most cases, your The anticipated disbursement date is the date that the school will expect to disburse

Pursue Additional Student Unsubsidized Loan

In cases of a parent credit denial or when an eligible endorser is not available, the student can be considered independent for loan purposes only. As such, eligibility for the Federal Direct Unsubsidized Loan increases. This additional student borrowing will likely be less than the PLUS but can assist the student in meeting educational costs.

Freshmen and sophomores are eligible for an increase of up to $4,000 based on cost of education and other aid. Juniors and seniors can get up to an additional $5,000. This increase is not available if any parent passes the credit check or an endorser is approved through the PLUS credit check process.

Requests of the additional unsubsidized loan can be made to One Stop .

Borrowers who are seeking to replace the denied PLUS Loan through one of the options noted may not be able to do so at the dollar amount originally offered or desired. Families may have to seek additional means to address the bill outside of the final aid package.

Of course, parent and student loans increase the borrower’s indebtedness. Whenever possible, borrowers should consider how they can reduce their reliance on loan funds through increased income, adjustment of priorities, or reduced expenses.

Students, in particular, too often seek out loans to meet their expenses rather than consider ways to reduce costs. Developing a budget is the first step toward good financial management.

University of Cincinnati

You May Like: How Much Can I Qualify For A Car Loan

Appealing The Parent Plus Loan Denial

When your child applies for financial aid for college, they should focus on getting scholarships and grants first, using any money in savings for college, and applying for subsidized federal student loans. Then, unsubsidized federal loans can be beneficial. After these options have been exhausted, you and your child can look at parent PLUS loans or private loans to make up any financial gaps. After considering other funding sources, these loans may be small. If you need to apply for a parent PLUS loan for your child and you are denied due to adverse credit history, you have some options for recourse.

- Obtain a loan endorser who does not have an adverse credit history. This could be your childs other parent, another family member, or close family friend. If your parent PLUS loan is then approved with an endorser, you need to obtain a new master promissory note for each endorsed loan.

- Document, to the satisfaction of the U.S. Department of Education, the extenuating circumstances related to your credit history. This is an appeal process offered through the Department of Education. Youll state that the reported adverse credit history is incorrect or that there are extenuating circumstances.

In both scenarios, you must also complete the Department of Educations PLUS credit counseling within 30 days of the denial of your PLUS loan. It is not a lengthy, multi-session form of counseling and typically takes just 15 to 20 minutes to complete.

Parent Plus Loans Should Be A Last Resort For Most Students

Despite being denied a parent PLUS loan, your financial circumstances may qualify your child for additional federal student loans. Because there is potential financial hardship affecting your family, your child could qualify for unsubsidized student loans if they are still your dependent and an undergraduate earning a bachelors degree. Your student may qualify for:

- $4,000 for freshmen and sophomore students.

- $5,000 for junior and senior students.

Also Check: Fha Title 1 Loans

You Have A Credit Freeze In Place

Freezing your credit can be a helpful option if youre concerned about identity theft or other fraudulent activity. However, freezing your credit restricts access to your credit report, which means you wont be able to open any new credit accounts or take out new loansincluding parent PLUS loans.

If theres a freeze on your credit reports and you apply for a PLUS loan, your application wont be processed until you lift the freeze.

Check Your Parent Plus Loan Eligibility

If you decide to use parent PLUS loans, youll need to meet these requirements:

- Be the biological parent or adoptive parent of a dependent undergraduate student who is enrolled at least half-time.

- Have a non-adverse credit history. If you do, you also must be able to satisfy additional requirements.

- Meet other basic federal student aid eligibility requirements, such as being a U.S. citizen or permanent resident.

Your credit is deemed adverse and disqualifies you from parent PLUS loan if your report lists:

- Accounts with total balances greater than $2,085 that were more than 90 days delinquent, placed in collections, or charged off within the past two years

- A default, repossession, foreclosure, bankruptcy, tax lien, wage garnishment, or federal student loan charge-off within the past five years

Read Also: Fha Loan Refinance

People Are Also Reading

Your credit history will be considered adverse by the Department of Education if your credit report contains:

- Accounts with balances of $2,085 or more that are delinquent by 90 or more days, have been placed in collections or charged off during the previous two years

- Defaulted debt within the past five years

- Bankruptcy discharge listed within the past five years

- Repossession or foreclosure within the past five years

- Charge-off or write-off of federal student aid within the past five years

- Wage garnishment or tax liens within the past five years

Having even just one of these listed on your credit report will lead to a denial of your PLUS loan application.

Why A Parent Plus Loan Might Be Denied

Unfortunately, some Parent PLUS loans are denied. If youve found yourself in that camp, now what do you do?

Parent PLUS loans have credit-related requirements to qualify. If your PLUS loan was rejected, it could be because of something found within your credit history or some other inability to meet eligibility requirements.

According to the Federal Student Aid website , PLUS borrowers cannot have an adverse credit history, such as having a debt payment 90 days overdue or having completed bankruptcy in the last five years.

Was your Parent PLUS loan denied? Dont lose hope yet because you still have options to consider: You could appeal the decision, get an endorser, maybe consider taking out a private loan, have your child request more aid, and search for more scholarships or other educational options with your student.

Read Also: Usaa Pre Approval Car Loan

You Can Borrow As Much As You Need

These loans also differ from other student loans in that there are no limits to how much you can borrow.

Unlike some types of federal student loans which limit how much you can borrow each year, or aggregate, parent PLUS loans dont have a preset limit, says personal finance writer Louis DiNicola. However, youre still limited to the school-determined cost of attendance for the student, minus other financial aid that the student received.

The absence of a cap on borrowing limits can be attractive at the outset, but beware: it can get you into trouble if you borrow more than you can afford.

Federal Direct Parent Plus Loan

The Federal Direct Parent PLUS Loan is a credit-based, federal loan for parents of dependent students. The PLUS Loan allows parents to borrow money to cover any educational costs not already covered by the student’s other financial aid. Because the PLUS loan is in the parents name, they are the financial responsibility of the parents and not the student.

In addition to this website, there are additional tools to assist you with the application process:

Don’t Miss: Firstloan Com Legit

My Parents Were Denied The Parent Plus Loan Are There Any Additional Loans I Can Borrow As A Student

How To Be A Mortgage Underwriter

Category: Loans 1. How to become a Mortgage Underwriter Indeed New graduates may find entry-level positions as junior mortgage underwriters or mortgage writer assistants. However, candidates without formal education Earn A Mortgage Underwriter Certification! · Increased knowledge, skills, and competency · Improves your understanding of how to apply various

You May Like: How Much Car Can I Afford Based On My Salary

A New Mpn Is Required If You Pursue An Endorser

If you are approved with an endorser , you will need to sign a new Master Promissory Note for each endorsed loan.

If you intend to endorse multiple Direct PLUS applications please note the following:

- studentaid.gov will allow you to sign multiple MPN’s at one time but will only link to one award at a time. Once they link the MPN to the first endorsed award all other pending MPN’s will be expired.

- We recommend signing the first MPN and waiting for it to link to the award before signing the MPN for the next award. You will know that it is linked when it appears as an available aid source in LionPATH.

If you have technical difficulty signing the MPN, please contact the U.S. Department of Education’s Student Loan Support Center at 800-557-7394.