Types Of Fees Charged

Chase charges a $50 origination fee and a $50 annual fee. There are no other closing costs unless you live in certain states, where you might be on the hook for government taxes or fees.

You also dont have to pay a fee to convert your variable-rate HELOC to a fixed interest rate. However, there is a 1 percent fee if you cancel the lock more than 45 days after the lock date.

The bank allows you to get an interest rate discount of up to 0.62 percent on your line of credit, which includes:

- 0.25 percent if you have a qualified Chase checking, savings or investment account.

- 0.25 percent when you provide contracts or bids for an upcoming $30,000 home improvement project, or you withdraw $30,000 at closing.

- 0.12 percent when you make automatic payments from your Chase checking account.

Chase Debt Consolidation Loans To Payoff Credit Card Debt

Are you struggling to pay your monthly payments? Do you need to save a little from your credit card and auto loan repayments? Why not consider consolidating your debts to lower your monthly payments and save some hard-earned cash?

Chase Bank does not offer debt consolidation loans directly to its customers however, personal loans and home equity lines of credit offered by the bank can be used to consolidate your debts.

Making multiple monthly payments on your loans is not easy and you may face defaults and your credit rating may be affected by it.

Advantages And Disadvantages Of A Heloc

HELOC Advantages

HELOC Disadvantages

Recommended Reading: What Do You Need For Va Loan

How Does Lendingtree Get Paid

LendingTree is compensated by companies on this site and this compensation may impact how and where offers appears on this site . LendingTree does not include all lenders, savings products, or loan options available in the marketplace.

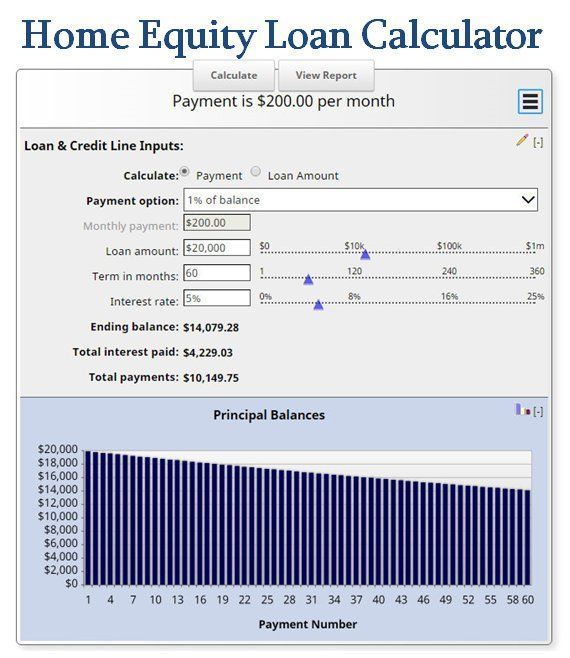

Use our home equity loan calculator to learn how much you can borrow to fulfill your financial goals. Home equity is the difference between how much you owe on your mortgage and your homes value. As you pay down your mortgage, youll build equity in your home.

What Are My Home Equity Options

Does Chase offer a fixed rate on a home equity line of credit?

Yes, the Chase Fixed-Rate Lock Option allows you to lock in an interest rate on all or a portion of your outstanding balance during your draw period. If you want a fixed monthly payment amount for major purchases, this option lets you set up a regular payment schedule, while maintaining easy access to your remaining line of credit funds.

Contact us to learn more or request a lock.

How can I compare different home equity line of credit options?

For a home equity line of credit, comparing the annual percentage rate of different options and lenders may not be enough to find the right option for you because the APR only considers the interest rate on the line of credit. You should ask lenders about any fees, payment options and the length of their draw and repayment periods when comparing your options.

You May Like: Bad Credit Refinancing Auto Loans

Chase Home Equity Utilization

You currently must have or open a Chase checking or savings account in order to transfer funds over the phone or in a Chase branch.

Home Equity Line of Credit Lock Feature: You can switch outstanding variable interest rate balances to a fixed rate during the draw period using the Chase Fixed Rate Lock Option. You may have up to five separate locks on a single HELOC account at one time. There is no fee to switch to a fixed rate, but there is a fee of 1% of the original lock amount if the lock is cancelled after 45 days of the lock date. Minimum lock amount is $1,000 and maximum lock amount is up to 95% of the credit limit at closing or 100% after closing. The minimum lock term is 12 months and the maximum term depends on the remaining term of your HELOC. All locks must be paid in full not later than 2 months before the final HELOC account maturity date.

Tax Deductibility: JPMorgan Chase does not offer tax advice. Please consult your tax advisor regarding the deductibility of interest.

Home lending and deposit products offered by JPMorgan Chase Bank, N.A. Member FDIC.

Tax Implications Of Second Mortgages

Prior to the passage of the 2017 Tax Cuts and Jobs Act homeowners could deduct from their income taxes the interest paid on up to $1,000,000 of first mortgage debt and up to $100,000 of second mortgage debt. The law changed the maximum deductible limit to the interest on up to $750,000 of total mortgage debt for married couples filing jointly & $375,000 for people who are single or maried filing separate returns.

The big change for second mortgages is what debt is considered qualifying. Prior to the 2017 TCJA virtually all second mortgages qualified. Now the tax code takes into consideration the usage of the funds. If a loan is used to build or substantially improve a dwelling it qualifies, whereas if the money is used to buy a car, pay for a vacation, or pay off other debts then it does not qualify.

Recommended Reading: Which Student Loan Servicer Is Best

Home Equity Loan Calculator

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Use this home equity loan calculator to see if a lender might give you a home equity loan and how much money you might be able to borrow. Home equity refers to how much of the house is actually yours, or how much youve paid off. Every time you make a mortgage payment, or every time the value of your home rises, your equity increases. As you build equity, you may be able to borrow against it.

» MORE:See todays mortgage rates

The Impact Of The Covid

In Q2 of 2020 the United States economy collapsed at an annualized rate of 31.7%. In response to the crisis the Federal Reserve quickly expanded their balance sheet by over 3 trillion Dollars. In Q3 the economy boomed, expanding at an annualized rate of 33.1%. The Federal Reserve has remained accomodative, suggesting they are unlikely to lift interest rates through 2023. This has caused mortgage rates to drift down throughout the year.

Recommended Reading: Find People Who Loan Money

What Happens At The End Of My Draw Period

When am I supposed to pay off my outstanding balance?

Your repayment period can last up to 20 years, depending on the terms of your credit agreement. You can continue to make monthly payments throughout the repayment period to pay off your outstanding balance. Or, you can pay off the total balance at any time.

Can I have my draw period extended?

The draw period for your existing account cannot be extended. If you meet current credit criteria, you could refinance your outstanding balance into a new home equity line of credit or mortgage loan.

Will my minimum monthly payment go up?

Your minimum monthly payment amount may be adjusted when your repayment period begins, depending on the terms of your credit agreement.

What do I need to do if I want to continue making automatic payments each month?

No action is required on your part for this automatic payment service to continue. However, please consider the impact on your checking account if your minimum payment amount is expected to increase.

How can I close my home equity line of credit?

Follow these steps to close your line of credit:

Regular Mail:

What To Watch Out For

These drawbacks may affect your decision:

- Not available in all states. Residents in AK, HI and SC will have to look elsewhere.

- High maximum APR. Chase says your APR wont exceed 21% over the life of the loan. To compare, Wells Fargo keeps lifetime interest rates under 7%.

- Some fees. Many banks waive the closing costs and application fees, but Chase charges a $50 origination fee and $50 annual fee. Exceptions apply.

Compare Chase HELOC to other lenders

Don’t Miss: What Is The Best Home Loan Company

How To Get A Home Equity Loan

Youll generally be eligible for a home equity loan or HELOC if:

-

You have at least 20% equity in your home, as determined by an appraisal.

-

Your debt-to-income ratio is between 43% and 50%, depending on the lender.

-

Your credit score is at least 620.

-

Your credit history shows that you pay your bills on time.

» MORE:Five ways to get the best home equity loan rates

Mortgage Calculator: Estimate Your Monthly House Payments

Use this mortgage calculator to estimate your monthly principal and interest payments on a new home loan. This calculator also could help

Chase does not offer traditional home equity loans, which makes them somewhat difficult to compare to other lenders. However, their lines of credit are some of

Read Also: What Credit Score For Home Loan

Home Equity Line Of Credit Calculator Bank Of The West

You may qualify for a credit line up to $50,000. Appraised value of home ? Mortgages you owe ? Max loan-to-value ratio ? To learn more, call us today at

Your home equity gives you financial flexibility. Find out how much you may qualify to borrow through a mortgage or line of credit.

Be sure to include any outstanding mortgages, which include first mortgages, second mortgages and any other debt obtained on your home. Select a Calculator

Current appraised value of your home. Outstanding home loans. Total amount of all outstanding home loan balances, including your first mortgage, second mortgage

Why not use it? Home Equity Loans can give you the financial freedom to start new projects and add value to your home. Our competitive rates and credit lines

Home equity loans allow you to borrow against the value of your home. Learn how home equity loans work, how to qualify for one, what to use it for and more.

This includes first mortgages, second mortgages and any other debt you have secured by your home.

Monthly payments on a Home Equity Loan or Line of Credit are variable as they fluctuate with interest rate changes. Use this calculator to estimate your

Take care of today, plan for tomorrow. Use a Home Equity Line of Credit* to renovate your home, refinance your mortgage, consolidate debt or prepare for

How Do You Apply For A Home Equity Loan

You must meet several home equity loan requirements to apply and qualify for a loan, such as:

- Having at least 15% equity. Your loan-to-value ratio should be 85% or lower, which means you have 15% equity or more in your home. In some cases, you may qualify for a home equity loan with a high LTV ratio.

- Having a minimum 620 credit score. Some lenders may have higher minimum credit scores, but youll need a score of 740 or higher to get the best interest rates.

- Having a maximum 43% debt-to-income ratio. The percentage of your gross monthly income used to repay debt your DTI ratio should not exceed 43%. Still, some lenders may accept a ratio as high as 50%.

Its important to note that lenders typically limit the amount you can borrow to 85% of your homes value, according to the Federal Trade Commission, so you likely wont be able to tap the full amount. Its also a good idea to leave some equity in your home in case you need to sell it suddenly due to a job change or personal financial emergency.

You May Like: How Often Do Student Loan Interest Rates Change

How Home Equity Loans And Helocs Differ

Both a home equity loan and a HELOC are ways to cash in on your homes equity, but they work differently.

A home equity loan gives you all the money at once with a fixed interest rate. HELOCs act more like credit cards you can borrow what you need as you need it, up to a certain limit. HELOCs have adjustable or variable interest rates, meaning your monthly payment can change, but you pay interest only on the amount you draw.

Home Equity Line Of Credit Calculator

Use this calculator to see how much you quality for. Adjust the value of your home and your outstanding loans for a more accurate estimation.

The calculator also provides an amortization table to show the amount of principal and interest payments a borrower will make over the life of the line of

Outstanding home loans. Total amount of all outstanding home loan balances, including your first mortgage, second mortgage, and any other debt that is

This calculator makes it easy for homeowners to estimate how much interest they will save by Current Mountain View Home Equity Line of Credit Rates.

Explore our checking accounts, savings accounts, mortgages, credit cards and more. Bank online, with our mobile banking app, or at one of our branches in Ann

This is the total of all outstanding mortgages on your home. This should include your first mortgage, second mortgages and any other debt that is secured by

Home equity lines of credit can lower debts, allow renovations, & increase financial independence. Use our HELOC calculators now!

Home Equity Loan Calculator Loans · Auto Loan Mortgage Refinance Home Equity Calculators. Contact Us. Phone Phone 647-1000.

This includes first mortgages, second mortgages and any other debt you have secured by your home.

A DCU Fixed-Rate Equity Loan or Home Equity Line of Credit gives you the ability to borrow against your homes equity to pay for major purchases, home

Excerpt Links

Recommended Reading: How Long Home Equity Loan Take

Are There Any Home Equity Loan Tax Benefits

You may qualify for a tax deduction on your home equity loan, depending on how the money is used. If you took out the loan to buy, build or substantially improve your home, then you can likely deduct the interest paid on your monthly home equity loan payments under the mortgage interest deduction. However, the interest wont be tax-deductible for other purposes, such as debt consolidation or buying a second home.

How To Use Our Home Equity Loan Calculator

Our home equity loan calculator can help you determine how much available equity you might qualify to borrow with a home equity loan or home equity line of credit.

Heres the information youll need to use the calculator:

- Your homes most recent appraised value

- Your outstanding mortgage balance

- Your credit score range

If you need help determining your homes value, reach out to your real estate agent to request a competitive market analysis. Another option is to use LendingTrees home value estimator.

Find out how much you owe on your mortgage by taking a look at your most recent mortgage statement. And if you dont already know your credit score, you can get a free credit score online.

Once youve input this information, the calculator provides the estimated home equity loan amount you might qualify for.

HOME EQUITY LOAN SHOPPING TIP

Once the home equity loan calculator generates a number for you, use it to gather quotes from multiple home equity lenders to find the best deal. Compare the interest rates and costs on each loan estimate you receive, and make sure you gather your quotes on the same day .

Also Check: Which Loan Is Better Conventional Or Fha

How Does A Home Equity Loan Work

A home equity loan is lent in a lump sum, and you repay the amount in flat monthly installments throughout the life of the loan. The monthly payments are fixed, meaning they dont change over time. Home equity loans can be a convenient resource for homeowners who want to access a portion of their equity.

What Is A Home Equity Loan

A home equity loan allows you to access funds by using your homes equity. Your homes equity is the percentage of your homes value that you already own. Its the difference between the amount owed on the mortgage and the value of the home. Your homes equity can build over time as you make payments towards your mortgage or add value to your home.

Recommended Reading: How Much To Refinance Va Loan

Understand Your Home Equity Loan Payments

Our home equity loan calculator doesnt calculate monthly payments youll see the monthly payment information on the loan estimates you collect while youre comparing offers.

There are three factors that will affect your monthly home equity loan payments: