How We Chose The Best Home Equity Loans

To narrow down our list of best home equity loans, we vetted each mortgage lender by evaluating them on the following criteria:

- Loan features: We evaluated the types of loans offered, minimum and maximum loan amount, interest rates, loan terms and credit score requirements for each lender.

- Price transparency: We preferred lenders that openly disclose loan costs, discounts, fees and other charges on their website.

- Application process: We checked eligibility requirements and approval times. In addition, we compared application and evaluation fees, and whether application services were available online, by phone and/or in person.

- Reputation and customer satisfaction: We looked into two main data sources: J.D. Power’s 2021 U.S. Primary Mortgage Servicer Satisfaction Study and complaint data as reported by the Consumer Financial Protection Bureau .

Can I Get A Home Equity Loan Or Heloc Without A Job

If you dont have a job, it might be hard to get a home equity loan or HELOC you might not meet the lenders income requirements. However, you might be able to qualify for a home equity loan if you have other sources of income.

Heres a list of non-employment income sources lenders might consider:

- Pension or retirement.

- Interest and dividends.

- Trust fund.

A lender will consider the income of a co-signer or co-borrower if you have one. That way, you could potentially meet the DTI requirements to qualify for a home equity loan or HELOC without a job. Before you apply, reach out to the lender to see what income sources are acceptable.

Home Equity Loans With Bad Credit

Those who have had past credit issues know that it tends to be easier and less costly to obtain a home equity loan than a personal loan. The reason for this is there is less risk involved for lenders because home equity loans are secured by your home. On the other hand, If youre unable to keep up with your monthly payments, the lender can foreclose on your home to recoup costs.

If youve built up a fair amount of equity in your home and have a low debt-to-income ratio, your chances of obtaining a home equity loan will be higher in spite of your low credit score. If you find yourself in this situation, your home equity loan will likely come with higher interest rates and fees.

If your finances demonstrate to lenders you may be unable to repay the money borrowed, youll find it more challenging to obtain a home equity loan. Since the housing crisis, more restrictions have been placed on lending practices.What are the home equity loan rates?

The current average for a home equity loan interest rate is 5.76%. The average for a home equity line of credit is 5.51%. Home equity loan rates are dependent upon the prime rate, credit score, credit limits, lender and loan-to-value ratios.

Recommended Reading: What Type Of Loan Can Be Used For Debt Consolidation

To Pay Off Car Loans Or Credit Cards

A cash-out refinance can be a good idea if your home has gone up in value. It is often the best option if you need cash right away and you also qualify to get a better interest rate than on your first mortgage.

If your credit score is much higher than when you purchased your home, then a lower rate can help offset the higher payment that will come with a larger balance that includes the cash-out amount. If you use the cash-out amount to pay off other debts, such as car loans or credit cards, then your overall cash flow may improve. Your credit score may even rise enough to warrant another refinance in the future.

It is often a good idea to speak with a qualified before applying for a loan.

What Are The Minimum Requirements

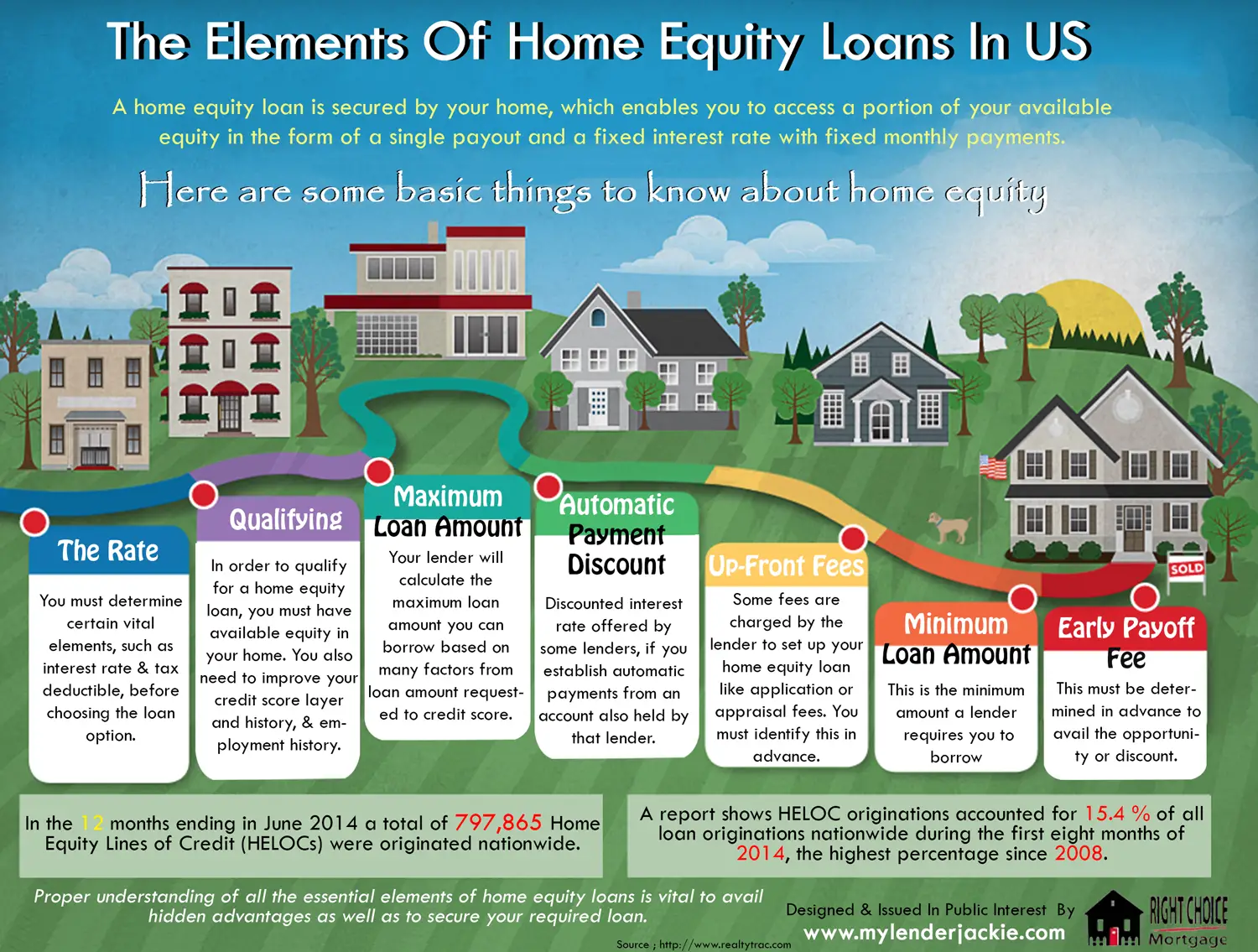

Many lenders have fixed LTV ratio requirements for their home equity loans, meaning you’ll need to have a certain amount of equity in your home to qualify. Lenders will also factor in your credit score and income when determining your rate and eligibility.

Minimum requirements generally include a credit score of 620 or higher, a maximum loan-to-value ratio of 80 percent or 85 percent and a documented source of income.

You May Like: How To Settle On Student Loan Debt

Can I Still Deduct The Interest I Pay On Home Equity Loans

Before the Tax Cuts and Jobs Act of 2017 became law, homeowners could deduct on their taxes the interest they paid on home equity loans no matter how they used the money. That has now changed. According to the IRS, you can now only deduct the interest on home equity loans if you use the money to substantially improve the home that secures the loan.

This means that you cant deduct the interest if you use a home equity loan to pay off credit card debt or cover a childs college tuition, for example.

If you use your home equity loan to build a new primary bedroom suite on your home, you can deduct the interest you pay on that loan. Thats because youre using the proceeds from the loan to improve the home.

Home Equity Loan Rates Are Tied To Prime

Another reason home equity loan rates are higher is because they are tied to the prime rate. This means that when the prime rate adjusts, your interest rate adjusts. This could mean adjusting up or down, depending on the state of the market. How much your interest rate adjusts also depends on the margin set for your loan. This depends on the level of risk you pose to the lender. Borrowers with good credit, stable income, an average LTV, and low DTI will have a lower margin than someone with bad credit, a high DTI, and high LTV.

As with any other loan program, the lender determines your interest rate and every lender has different thresholds. One lender might quote you a higher interest rate than another, which is why you need to shop around when searching for a home equity loan. Dont assume that the rate that one lender gives you is the norm for the area shop around to make sure that you can compare apples to apples when it comes to the fees and the interest rate a lender charges.

Recommended Reading: What Is The Best Loan

How To Apply For A Home Equity Loan After Your Home Is Paid Off

You can apply for a home equity loan or HELOC by visiting a local lenders branch office or filling out an online application. Youll need to provide the same types of documentation that you do when you apply for a mortgage.

Along with the information on your application and your credit report, the lender will want to see your pay stubs, W-2 forms, documentation of other sources of income, and the most recent monthly statements on all outstanding debts. The lender will also want to obtain an appraisal report in order to determine the current market value of the property, as well as at least 2 years of tax returns.

The lender will evaluate your credit history and total outstanding debt payments as part of the underwriting process to see if you meet the requirements. This is where it will help you to have paid off your home.

You established good borrowing behavior by paying off the debt, you no longer have that debt adding to your overall debt calculation, and you will be able to access the maximum amount of money that could be available based on the current market value of your property.

What Is An Installment Loan

An installment loan provides you with a lump sum that you repay in equal installments over a fixed period. Nearly all home equity loans come with a fixed interest rate. That fixed rate means every payment will be the same over the entire loan term.

So fixed-rate installment loans rarely create nasty surprises. And budgeting for them couldnt be easier.

Read Also: How To Get An Sba Loan

Should You Get A Home Equity Loan Or Heloc

If you need money to fund a home improvement project or consolidate high-interest debt, taking out a home equity loan or HELOC can be a wise decision. Since the loans are secured by your home, the interest rate is usually lower compared to unsecured loan products such as credit cards or personal loans. For example, home equity loan rates range between 3 percent and 12 percent, depending on the lender, loan amount and the creditworthiness of the borrower, while the average credit card rate is above 16 percent.

In addition, if you use the money from a home equity loan to buy, build or substantially improve your home, you may be able to deduct the interest on the loan from your taxes.

However, one major downside to consider is that if you default on the home equity loan, the lender can foreclose on your home. Before you get a loan that uses your home as collateral, make sure you have a solid repayment plan.

Tax Benefits To Home Equity Loans And Helocs

A final benefit to using a home equity loan or HELOC to improve your home is that the interest can be tax deductible, just as it is on a primary mortgage. However, the Tax Cuts and Jobs Act , the massive tax reform law that went into effect in 2018, placed new restrictions on this deduction.

Before 2018, you could deduct the interest on up to $100,000 in home equity loans or HELOCs. You could use the money for any purpose and still get the deductionâfor example, homeowners could deduct the interest on home equity loans used to pay off their credit cards or help pay for their children’s college education. The TCJA eliminated this special $100,000 home equity loan deduction for 2018 through 2025.

However, the interest you pay on a home equity loan or HELOC used to purchase, build, or improve your main or second home remains deductible. The loan must be secured by your main home or second home. Thus, for example, you can deduct the interest on a home equity loan you use to add a room to your home or make other improvements.

You May Like: What Is The Lowest Home Equity Loan Rate

Is A Home Equity Loan Considered A Second Mortgage

Yes. Its considered a second mortgage when your home is used as collateral for the loan, just like the first mortgage.

Thats what helps make a home equity loan cheaper than other types of loans. Its a secured loan thats backed by your home. Worst case, if you dont make payments on the second loan, the lender can foreclose on the loan and repossess your house.

The first loan from your original lender, however, takes legal precedence, so any proceeds from selling the home would first go to pay off the first loan before the second loan is paid. If anything is left, you would receive it.

With up to 30 years to repay, a home equity loan can be equal to or even longer than your first mortgage. If you dont borrow too much, it may take a lot less time to pay it off than the first mortgage.

This is one reason why its important to make sure you can afford both mortgages. Find out how much the monthly payment and other possible costs are of a second mortgage and make sure it fits in your budget. Having a new kitchen or living room remodeled is great, but wont be so enjoyable if you cant afford the loans.

A home equity loan is not a cash out refinance loan, though that is another option for tapping into your homes equity. A refinance loan is your primary loan, whereas an equity loan is a second loan on your home, hence the term second mortgage.

Who Should Consider A Heloc

A HELOC may be worth considering if you want access to credit but don’t need all of it at once. It can also help if you need some flexibility with lower payments during the first months or years of the HELOC term. If you’re concerned about variable interest rates, some lenders allow you to convert some or all of your balance to a fixed interest rate with a fixed repayment schedule.

HELOCs may not be the right fit if you’re planning to borrow for a one-time expense or project. Additionally, they’re not as attractive during times of rising interest rates.

Recommended Reading: How Can I Check My Student Loan Balance

What Are Home Equity Loans And Helocs

The difference between what your home is worth and what you owe on mortgages and other home loans is called equity. With a home equity loan or HELOC, you use that equity as collateral to get a loan, often to fund home improvement projects or other major expenses.

Home equity loans and HELOCs look different:

Home equity loans are similar to a fixed-rate mortgage, in which you borrow a certain amount of cash and pay it back over a set number of years at a certain interest rate.

HELOCs are more akin to , in that the bank gives you a maximum amount you can borrow at any one time during a draw period and you can take out some, pay it back, and borrow more until the draw period ends. You only have to pay interest on what you borrow. The interest rate tends to be variable, meaning it will change over time with an index like the prime rate published by the Wall Street Journal.

Tips Before You Get A Home Equity Line Of Credit

- Determine whether you need extra credit to achieve your goals or could you build and use savings instead

- If you decide you need credit, consider things like flexibility, fees, interest rates and terms and conditions

- Make a clear plan of how you’ll use the money you borrow

- Create a realistic budget for your projects

- Determine the credit limit you need

- Shop around and negotiate with different lenders

- Create a repayment schedule and stick to it

- What do they require for you to qualify

- Whats the best interest rate they can offer you

- How much notice will you be given before an interest rate increase

- What fees apply

Recommended Reading: How To Find Mortgage Loan Number

Can You Get A Home Equity Loan With No Job

It’s possible to get a home equity loan if you don’t have a job. However, keep in mind that not having a job isn’t the same thing as not having any income.

Home equity loan lenders have two ways to get their money back: Either you pay off the loan, or they force you to sell your house to repay them. If you’re not able to make regular payments with some form of income, you risk losing your home.

If you’re not earning money from a joband many people aren’t, such as people with disabilities, retired folks, and stay-at-home caretakerslenders will want to see that you’re earning a regular, dependable income from elsewhere. That could take the form of a veteran’s pension, a spouse’s employment income, government assistance, alimony, or some other type of income.

The other income you earn will factor into other requirements to get a home equity loan. Although the details vary by lender, that will include the following factors.

How To Borrow Using Your Home Equity In 2022

Join millions of Canadians who have already trusted Loans Canada

As a homeowner starts to pay down their mortgage throughout the years, they begin building home equity. The more they pay toward their mortgage, the more home equity they gain for future use. Your equity will also rise if and when your property increases in value with the fluctuating housing market. Many homeowners choose to use their equity to finance something important. That particular expense might be anything from a large addition to their house, paying off their existing car loan, or to put their children through school. Whatever that cost might be, theyll use their equity to pay it down.

Thinking about paying off your mortgage early? Check this out first.

Read Also: How Much Income Needed For Fha Loan

Some Of The Disadvantages Of Using Your Home Equity

- You need to pay for various fees before you can borrow There are a number of costs that you have to pay for before you are allowed access to it, such as fees for the appraisal, the application, and legal documents.

- Variable rates = variable interest costs You might choose to borrow at a variable rate because initially, the rate might be cheaper than that of the fixed-rate option. However, be aware that if you choose a variable rate your interest rate can change.

- Using your equity for investment purposes comes with its own risks If you decide to use your home equity to make unsheltered investments, not only is it likely that you will have to pay taxes on them, but like any unsheltered investment, theres the possibility that you could lose your money because of how the stock market fluctuates.

- Failure to make your payments can result in your home being taken Defaulting on your payments can lead to your home being foreclosed. So, before taking out a second mortgage, you need to be absolutely certain youll be able to make regular payments.

How Much Can You Borrow With A Home Equity Loan

A home equity loan generally allows you to borrow around 80% to 85% of your homes value, minus what you owe on your mortgage. You can do some simple math to estimate how much you might be able to borrow.

For example, say your home is worth $350,000, your mortgage balance is $200,000 and your lender will allow you to borrow up to 85% of your homes value. Multiply your home’s value by the percentage you can borrow . That gives you a maximum of $297,500 in value that could be borrowed. Subtract the amount remaining on your mortgage , and you’ll get the approximate sum you can borrow as a home equity loan in this case, $97,500.

Alternately, you can ditch the math and use our home equity loan calculator.

Also Check: How To Take Loan From 401k To Buy House