The Sba Loan Approval Process And Time Frames

The U.S. Small Business Administration has been supporting small business owners in the United States since its inception in 1953. Its lead program, the SBA 7 government-guaranteed loan program, is one that has evolved into a very efficient and consistent process for loan approvals among participating SBA lenders.

How Long Does It Take To Get An Sba Express Loan

Of course, situations arise in which you just cant wait that long. In cases where emergency funding is needed, you may be interested in the SBA Express Program. Its a slimmed-down version of the 7 product in that you can only borrow up to $350,000. But, this lends itself to faster SBA loan approval times.

The SBA promises a turnaround time of 36 hours for their express loans. But, that doesnt include the time it takes for the lender to approve the loan, which could tack on another few weeks. So, instead of 60-90 days, youre looking at 30-60 days for the SBA loan processing time when all is said and done.

What Is An Sba 7 Loan & How Long Does It Take To Get Approved

The most popular SBA loan product is the standard 7 loan, which can be used for working capital, acquiring equipment, refinancing other business debt, and various other purposes. Though its flexibility in use makes it very versatile, it cannot exceed a $5 million loan amount.

The SBA 7 loan program is always in high demand, so theres going to be a long wait. The timing for processing from start to finish will depend on you and your lender, but it typically takes about two-three months.

You May Like: Va Loans Investment Property

What Is The Sba 7 Loan

When it comes to business loans, the SBA 7 is undoubtedly one of the most popular. In fact, when small businesses consider taking out a business loan, the SBA 7 is often their first choice. It is the most popular loan that the SBA offers, and it is usually a safe bet if you are a small business in need of money. The SBA 7 loan is guaranteed by the U.S. Small Business Administration, which is a group that was established by the U.S. Government in the 1950s. The Small Business Administration was set up with one sole purpose, and that was to support small businesses. This is why so many small businesses feel like they can rely on the SBA.All the SBA loans come with different eligibility criteria, but the SBA 7 loan has the broadest criteria. This is another reason why it is so popular.

This eligibility criteria will include things such as: being a business with less than 500 employees and being registered as a for-profit business. But remember, this is just a handful of the criteria that you will have to fit into in order to qualify for this type of loan.

Reporting Sba Loans To The Credit Bureaus

Reporting SBA loans to credit reporting agencies is included in SBA guidelines. According to SBA Standard Operating Procedure 50 57 , in accordance with the Debt Collection Improvement Act of 1996, lenders are required to report information to the appropriate credit reporting agencies whenever they extend credit via an SBA loan.

Read Also: How Many Aer Loans Can I Have

Next Steps: Underwriting Approval And Commitment

The next stage of the SBA loan process is underwriting. This is what you might find most daunting because the lender will critique every part of your personal financial history and business. The best advice is to be as open as possible with your lender. Answering questions quickly and accurately will help speed up this part of the SBA loan process.

Here are some of the things that the lender will examine during loan underwriting:

- Your personal and business credit history

- Your other personal and business debts

- Verifying the value of collateral

- Other lenders youâve worked with

- Your businessâs revenue history and projections

- Any tax or legal issues your business has dealt with

Ultimately, underwriting can take a week or two. The lender wants to make sure that youâll able to pay off the loan on time and in full. Even though the SBA guarantees a portion of the loan, enforcing the guarantee would be a last resort. The lender still needs to meet strict underwriting standards.

If you pass underwriting, good newsâyou move to the approval and loan commitment stage. At this point, the lender has found that you pass their credit standards, and theyâve agreed to extend you a loan provided youâre able to provide any remaining documentation.

You can expect to receive a commitment letter within a few weeks outlining the amount of the loan, interest rate, any collateral provided, and other terms. Carefully review and sign the letter to accept the loan offer.

What Is The Sba Loan Forgiveness Program

The SBA Loan Forgiveness Program allows qualifying small businesses to forgo some of their loan repayment permanently or for a specified period of time.

The SBA will forgive principal and interest payments up to the amount you spend for two months on the areas that meet SBA loan criteria:

- Payroll

- Utilities

- Wages and benefits

You will not need to pay back Economic Injury Grant money, but that will count toward your loan forgiveness if you do receive a disaster loan.

Recommended Reading: Usaa Car Loan Rate

Sba 7a Loans Turnaround Time

Adding it all up. From qualifying to moving through the application to being approved for funding, the turnaround time for an SBA 7 loan will mostly depend on how prepared you are to provide financial documents and answer any questions that may arise. Even still, some elements of the process can take longer than others.

Do You Qualify For An Sba Disaster Loan

The loss of revenue that comes along with disasters can be more than enough to kill off a business of any size, since the narrow margins leave little room for emergency savings beyond the short term. In response to the imminent threat of such catastrophes, the Small Business Administration provides loans for those affected by related damage, evacuation, or business closures.

Most recently, SBA disaster loans were made more widely available for small businesses affected by COVID-19 as part of the CARES Act . The Coronavirus Relief Bill allocated an additional $20 billion for SBA Economic Injury Disaster Loans Grants to businesses in low-income areas who demonstrate economic hardship due to the pandemic.

Check the SBA website to see throughout the country.

Read Also: Conventional 97 Loan Vs Fha

What Determines The Sba Loan Timeline

As stated, the SBA loan approval process from application to loan closing is about 60 to 90 days. However, this time frame isnt set in stone, as there are numerous factors that can affect the SBA loan timeline.

The type of loan program you apply for and the amount of money you wish to receive will be considered. If you apply for a large loan with a long term, you can expect the process to take longer than someone who opts for a smaller loan with a shorter term.

Also, the lender you use will make a difference in how long it takes. While all SBA lenders in the Preferred Lender Program have the right to underwrite and perform credit checks on SBA loans, theyre not all the same. Some are less experienced and require SBA intervention, prolonging the approval process.

Faq About Sba Disaster Funding:

How long will it take to receive SBA disaster funding?

With us, you can receive capital in as little as 24-48 hours. Our application process will take a short 3 minutes, and you can receive approval within the next day.

Who is eligible for SBA disaster funding?

According to SBA.gov, if you have suffered a substantial economic injury and are one of the following types of businesses located in a , you may be eligible for an SBA Economic Injury Disaster Loan :

- Small business

Also Check: Usaa Mortgage Credit Score

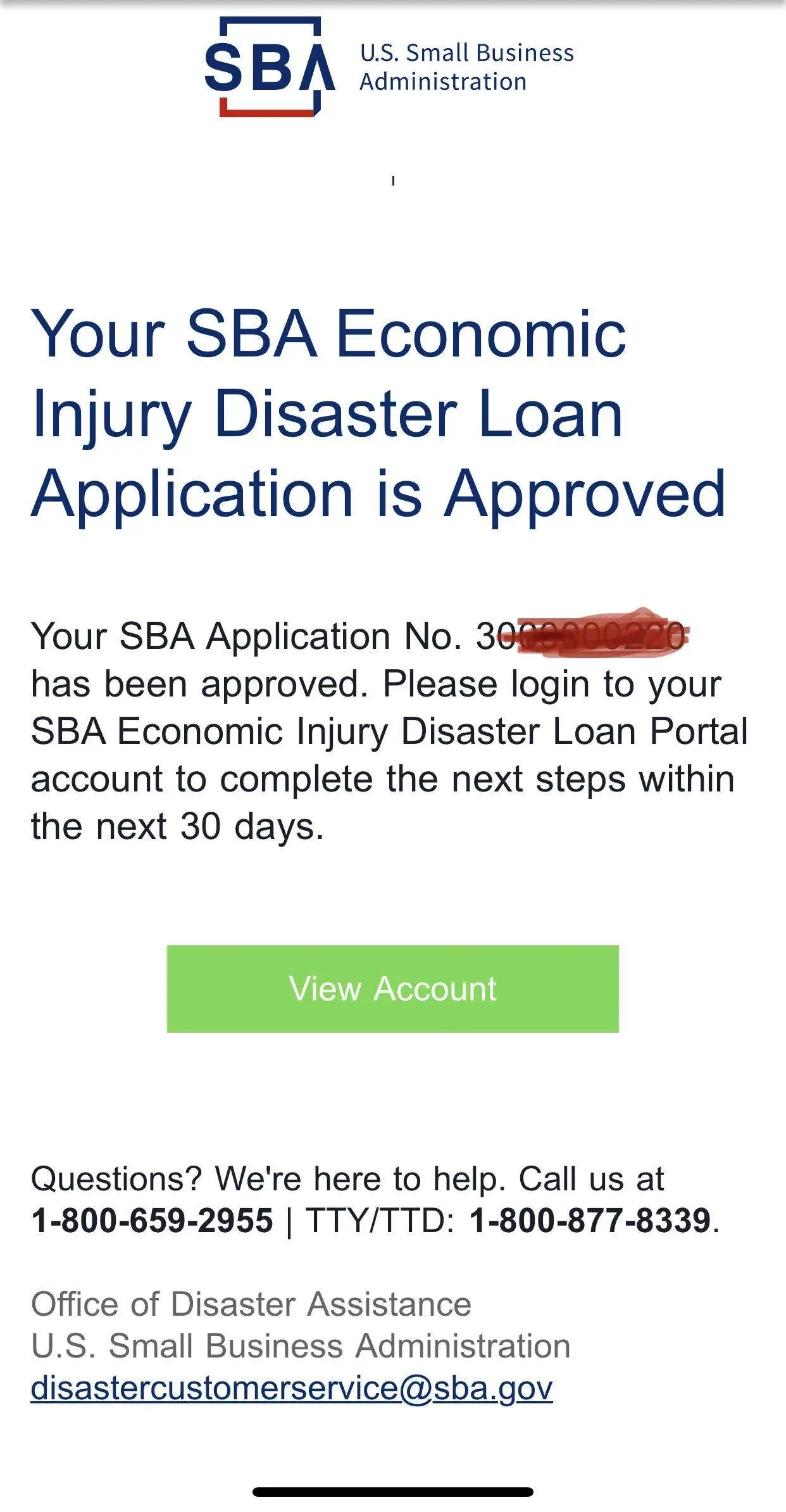

The Sba Portal Account Is Real

Numerous business owners have shared that they received the same EIDL email from the SBA that explains they are entitled to received up to a maximum of $10,000 theyre not guaranteed $10,000 up front. The email reads as follows.

Dear Applicant,

On , following the passage of the CARES Act, the SBA provided small business owners and non-profits impacted by COVID-19 with the opportunity to obtain up to a $10,000 Advance on their Economic Injury Disaster Loan . The Advance is available as part of the full EIDL application and will be transferred into the account you provide shortly after your application is submitted. To ensure that the greatest number of applicants can receive assistance during this challenging time, the amount of your Advance will be determined by the number of your pre-disaster employees. The Advance will provide $1,000 per employee up to a maximum of $10,000.

Business owners are noting that they got an advance deposit within hours to two days after receiving this email.

Heres what the portal looks like, as shared by u/adamlames and confirmed by other small business owners.

One person on Reddit wrote that most business owners received their advance within 24 hours of getting the mass email. Another wrote that the deposit may take as long as two days to arrive after youve gotten the mass email and finished your portal submission.

Can I Sell My House If I Have An Sba Loan

The SBA will be willing to release the mortgage/lien so that the owner can be allowed to sell or refinance the property under the proper circumstances. … The borrower must not receive any of the sales or refinance consideration. Although all proceeds must be distributed in order of priority, it is possible.

You May Like: Usaa Auto Refinance Rate

Other Emergency Loan Options

Generally, SBA disaster loans will offer you the best rates, terms, and affordable financing. But if youre looking to get a small business loan for the coronavirus disaster youll need to exhaust all other emergency loan options before being approved for an SBA disaster loan.

The good news is that your small business can receive a coronavirus emergency loan through an alternative lender that will often be easier and faster than the process for an SBA disaster loan.

In addition to a traditional installment loan, you may consider a one-time line of credit to help cover payroll or business adjustments while you wait for coronavirus regulations to expire, or possibly a short term business loan just to get through a couple of weeks.

How To Apply For Sba Disaster Loans

You can apply for an SBA disaster loan online, in-person at a disaster center or by mail. If you apply for the EBL Pilot Program, you can do it directly with an SBA Express lender. After you apply, the administration will review your credit profile. You must have an acceptable credit history to be eligible for a disaster loan.

After reviewing your credit, the SBA would send an inspector to your property to estimate the total loss to your home or business location. Once the inspection is complete, a loan officer will determine your eligibility for a loan by reviewing any insurance payments or other financial assistance. The SBA encourages you to apply for a loan even if you havent received compensation from your insurer yet you could get loan approval before your insurance claim resolves.

The SBA tries to process applications within two to four weeks. The EBL Pilot Program is designed to provide faster access to funds while you wait for long-term loans. If youre approved, the administration will send you loan closing documents to sign. The SBA could adjust your loan amount after you close based on unexpected costs that arise or insurance money that comes in. For business loans, the SBA will make an initial disbursement of $25,000 within five days of approving the application.

Recommended Reading: Does Usaa Do Auto Loans

Get The Funding You Need To Keep Your Business Moving Forward Through Covid

Thereâs no denying that COVID is presenting major challenges for small businesses. But now that you have a better understanding of the Economic Injury Disaster Loan program youâre armed with the information you need to submit an applicationâand, hopefully, secure the funding you need to keep your business moving forward through the pandemic.

How Long Does Sba Take To Be Approved

The SBA promises a turnaround time of 36 hours for their express loans. But, that doesnt include the time it takes for the lender to approve the loan, which could tack on another few weeks. So, instead of 60-90 days, youre looking at 30-60 days for the SBA loan processing time when all is said and done.

Also Check: How Much Of A Loan Can I Get For A Car

What Are A Few Of The Sba Loan Requirements

Your enterprise should be a for-profit business from an eligible industry based in the USA have a minimum of $100,000 in annual revenue and maintain a 145+ business score and have a personal credit score of 680 or above.

We put together a list of additional documents if youd like to see more eligibility requirements for loans, such as business bank statements, tax returns, balance sheets, and others.

Keep in mind that these requirements do not guarantee acceptance for an SBA Loan. Look ahead to the next question, or reach out to one of our specialists to help you decide which program you may qualify for.

Can I Rent My House If I Have A Loan Modification

If your loan was modified under the condition that you live in the home, you cant simply move out and rent the home. The lender may stipulate that you must continue to live in the home or sell it after a loan modification however, there is generally no minimum time frame you must keep the home after modifying.

Don’t Miss: Usaa Loan Credit Score Requirements

Military Reservists Economic Injury Disaster Loans

MREIDLs are meant to cover operating costs if an essential employee is called up to active duty as a military reservist. MREIDLs are available up to $2 million but the SBA may limit the loan amount based on the businesss interruption insurance, or if the business had enough money to function without the employee.

Economic Injury Disaster Loans

EIDLs are meant to help businesses meet financial obligations they would have met otherwise if not for the disaster. Only small businesses, small agricultural co-ops and some private nonprofit organizations are eligible. You could receive up to $2 million to cover operating expenses, though your loan amount would be based on the SBAs determination of the actual economic injury the business incurred and its financial needs.

Also Check: Notary Loan Signing Agent Databases

Business Owners Guide To Sba 7 Collateral Requirements

Important exceptions for SBA 7 loans of $350,000 or less. There are exceptions to the SBA 7 collateral requirements on loans that are less than $350,000, including all Community Advantage loans: For loans of $25,000 or less, the SBA doesnt require lenders to take any collateral. For loans between $25,001 and $350,000, lenders will do …

The Application Process In Order

- Apply at DisasterLoanAssistance.sba.gov.

- Receive loan quote.

- Choose your loan amount up to the loan quote maximum.

- A loan officer will review your application and ask for more information if needed.

- A decision will be made and you will either be approved or your application declined.

If approved:

- Your loan funds will be transferred to your bank within 5â10 business days.

If declined:

Read Also: Usaa Car Loans Credit Score

Avoid Incompetent Sba Lenders

The bigger, more prevalent reason is that there are a lot of incompetent lenders out there. Lenders that dont know how to process SBA paperwork properly, and take their time learning as they go.Choose someone like National with years of experience with funding thousands of small businesses nationwide with SBA loans, and who has connections to the most competent and knowledgeable SBA lenders in the world. They know what it takes to get the job done right, and how to get it done as quickly and efficiently as possible. Thats how we get it done in 45 days, instead of 6+ months.

Recommended Reading: How Much To Loan Officers Make

What Is The Process For And Turnaround Time From Loan Application To Receiving The Funds

This type of disaster is unprecedented, so no one can predict for sure. However, historically, disaster loans have taken approximately three weeks from time of application until completion of loan officer assessment, submission of any additionally required documentation, and final loan approval. The SBA anticipates the money will be distributed 3 days after that three-week loan officer review and approval period.Loan process:

Also Check: Usaa Car Buying Rates

What Are Eidl Loans

The EIDL program is a disaster relief fund administered through the U.S. Small Business Administration . The SBA Economic Injury Disaster Loan program provides emergency loans to small businesses facing economic hardship and challenges as the result of a declared disasterâlike the COVID-19 pandemic.

Unlike PPP loans, EIDL loans are not forgivable borrowers will need to pay back the full loan amount plus interest. But one major selling point for businesses in need of funding? EIDL loans offer much more competitive terms than traditional loan options.

Currently, Economic Injury Disaster Loans offer a 3.75 percent fixed interest rate , a 30-year repayment period, 24-month payment deferral period, and no fees or prepayment penalties.

Loan proceeds can be used to cover working capital and normal operating expenses, including payroll, purchasing equipment and all forms of debt, with a maximum loan amount of $2 million. If your business has already received a loan via COVID EIDL, you’re likely eligible for an increase and can request one via the SBA portal.

Note: The maximum loan amount increased from $500,000 to $2 million on Sept. 8, 2021, however businesses will need to wait until after Oct. 8 to hear back on whether they’re approved for anything above $500,000. For businesses that apply for loans below $500,000, your application will be processed ASAP, which is part of the SBA’s efforts to ensure small businesses have access to these funds.