Choosing A Loan That’s Right For You

With an understanding of key terms and concepts, and how student loan interest works, you can start evaluating private student loans and comparing lenders. To determine which lenders are a good fit, look at the loan options, APR ranges, and additional benefits.

Did You Know?

The APR may be higher or lower than the interest rate offered.

When comparing student loan options, look at the APR. It reflects the annualized cost of credit and includes finance charges such as interest, fees and other charges, and considers whether payments are deferred during school. Because it includes these variables, comparing APRs from different lenders can help you determine which option is potentially the cheapest.

Postgraduate Student Loan Rates & Terms

| Loan Amounts |

| Origination Fee | None |

Discover student loan consolidation will repay existing student loans of your choice with a new student loan, which can give you the chance to secure lower interest rates and simplify repayment. You can refinance up to $150,000 in student loans, though Discover may refinance moreup to the full balancefor specific fields of study.

If you refinance student loans with Discover while theyre in a grace period, you will lose that benefit. Repayment will begin 30 to 45 days after your new student loan is disbursed.

Youre A Parent And Your Child Has Graduated From College

If your plan is to transfer your student debt to your child through refinancing, the sooner you start the process, the less youll have to pay.

If your child hasnt had the chance to build a credit history or earn a high income, you may need to cosign the loan. But this will still shift the responsibility of making payments to your child though you will be responsible for paying if they cant.

And remember, many lenders offer cosigner release, so once your child has made the requisite number of payments and has great credit, you can remove yourself from the loan.

Don’t Miss: Difference Between Lease And Loan

Which Fees Should I Look Out For When Choosing A Private Student Loan

Just like you should read the fine print on a credit card, you should understand the fees you might incur on private student loans. Some lenders will add your fees to the loan principal. When you apply for a private student loan, seek out answers to the following questions:

- Is there a loan application fee?

- Is there a loan origination fee?

- Which types of fees could I incur for making a late payment?

- How do I pay the fees?

Students Want The Degrees So The Schools Charge A Lot

A big part of the answer to why grad school is so expensive is that students want to go and get a graduate education. Moreover, many want to be a veterinarian, dentist, lawyer, doctor, etc. no matter what.

So, I think Discover made a conscious decision that since you cant bankrupt student loans, they could make big profits by lending at super-high interest rates to graduate students who didnt have any other options to get financing and already exhausted their federal student loan options.

Most people target high-interest debt to pay back first, so even if a borrower might be overburdened with student loan payments, Discover probably figured theyd get prepayments that would reduce their risk. But for the borrower, monthly payments can be tough to deal with over the life of the loan.

Recommended Reading: What Is Loan Closing Cost

Discover Student Loans Rates

Discover Student Loans rates vary:

- Variable rates range from 2.99% to 13.99% APR.

- Fixed rates range from 5.49% to 14.99% APR.

Discover Student Loans provides a more comprehensive breakdown of interest rates by loan type on its website.

To get the lowest rates in these ranges, you must have a high credit score, choose an interest-only repayment discount and sign up for automatic payments so you get a 0.25% interest rate reduction. Discover Student Loans does not charge any fees, including application, origination or late fees.

Reasons You May Want To Look Elsewhere

- You can’t get pre-qualified. Many student loan providers provide a pre-qualification, which is only a soft pull on your credit. This gives you the opportunity to compare offers from different lenders. Without that option, you may feel obligated to take the offer Discover provides, at which point they will hit your credit with a hard inquiry.

Recommended Reading: Is Personal Loan Installment Or Revolving

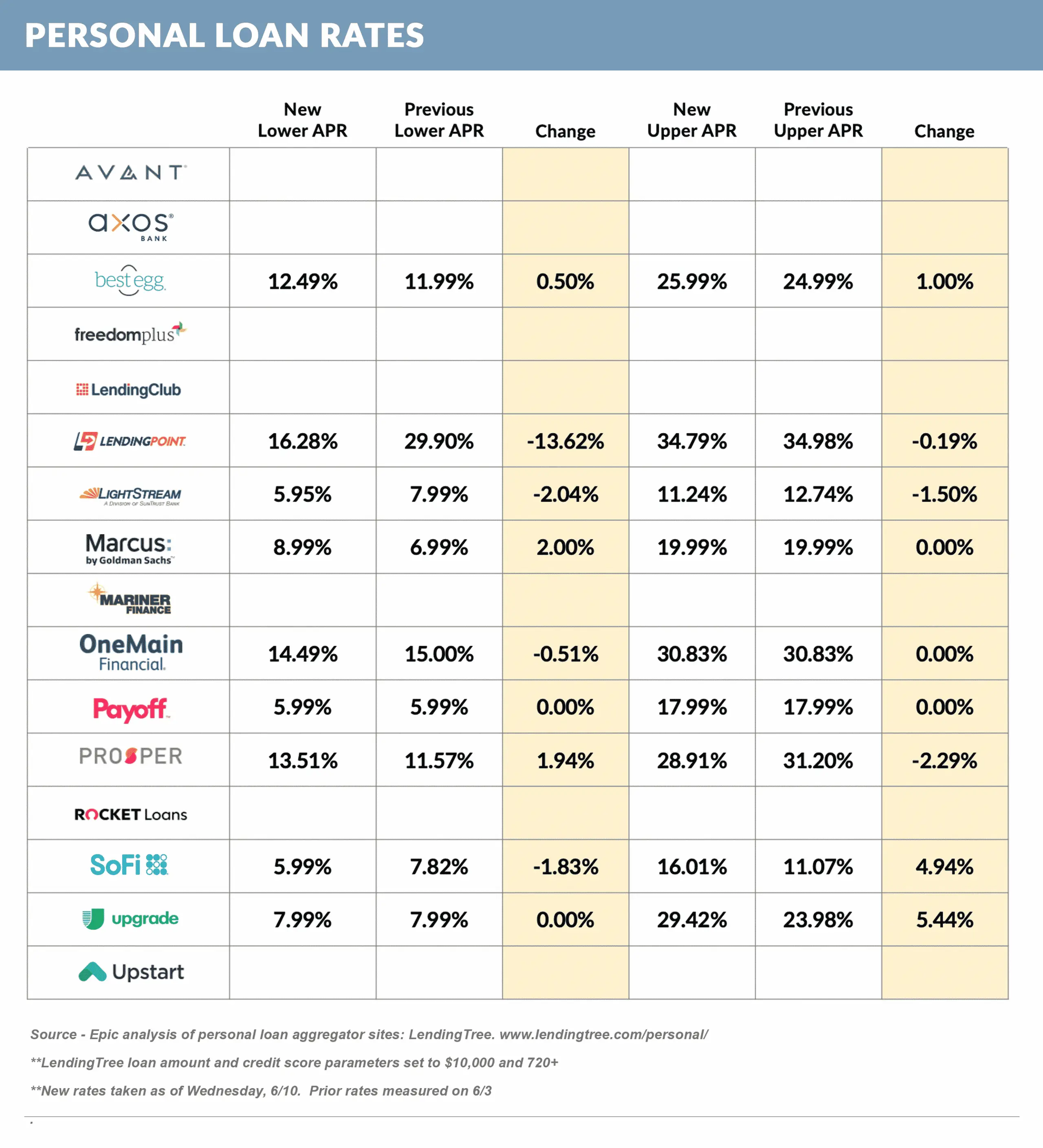

Compare Student Loan Refinance Rates

Unlike the U.S. Department of Education, which standardizes its interest rates for everyone who qualifies, private lenders have their own set of interest rates and criteria for determining whether you qualify.

As a result, shopping around and comparing rate quotes from multiple lenders is the most important step you can take to maximize your savings. If you simply go with the first offer you get or try to go through your bank or credit union because its convenient, you may end up with a more expensive loan.

The prequalification process is the best way to compare student loan refinance rates from the top lenders. With just a soft credit, youll get an initial quote based on the information the lender can see on your credit report once you submit a full application, theyll run a hard credit check and give you a final offer.

If you want to save time and the headache of dealing with multiple lenders individually, consider using Purefys rate comparison tool to do your shopping around. The process is similar to what youd go through with each lender provide some information about yourself and your loans and Purefy can provide rate quotes from several lenders. This makes the process go much more quickly and can make it easier to compare because your options are side by side.

What Is The Difference Between A Fixed Interest Rate And Variable Interest Rate

- A fixed interest rate is set at the time of application and does not change during the life of the loan unless you are no longer eligible for one or more discounts.

- A variable interest rate may change quarterly during the life of the loan if the rate index changes. This may cause the monthly payment to increase, the number of payments to increase, or both.

Recommended Reading: Is First Loan Com Legit

Rewards And Benefits Designed With College Students In Mind

Well help regularly remove your personal info from ten popular people-search websites that could sell your data. Activate for free with the Discover app.

Get an unlimited dollar-for-dollar match of all the cash back you’ve earned at the end of your first year, automatically.

As a Discover student cardmember, you can earn a statement credit each time you refer a friend and theyre approved.

Use your Discover student login to set alerts, view your FICO® Score for free and more, all from your smartphone, tablet or wearbale.

Discover Student Loans Review

There are some areas in which Discover stands out from the pack and other areas where they may fall a little short. Prospective borrowers and those looking for private student loans should be sure to consider both before submitting an application.

Reviews for Discover Student Loans are generally positive and focus on the fact that the company has great private loan rates with no application, origination, or late fees. You can read some reviews from Discover customers on their website, where the company maintains a record of 4.5 out of 5 stars.

You May Like: What Is The Max Student Loan Limit

When Does This Loan Make Sense

With variable rates as low as 1.24%, the undergraduate student loan from Discover sounds like a good deal. But most students should avoid private student loans for their undergraduate degree.. Typically, students can pay for an undergraduate degree with a combination of savings, federal loans, scholarships, and work.

Federal loans offer more flexible repayment terms, and your parents or grandparents wont have to cosign on the loans. If youre contemplating private loans for your undergraduate degree, you may need to find a less expensive school.

Need to know more about avoiding student loan debt? Check out these pieces:

Who Benefits From Discover Student Loans

Students who have exhausted all other avenues of financial assistance for college tuition benefit from Discover Student Loans. If you are a good risk, meaning you have good credit or a solid co-signer, they offer rates that compete well with federal student loans. Discover also offers a few benefits you won’t find anywhere else.

You May Like: How To Get More Loan Money For School

You Could Save Thousands Of Dollars

With record-low interest rates available, you could qualify for a much lower interest rate than what youre currently paying.

For example, lets say you have $20,000 in student loans with Discover with a 10-year repayment term. And because your credit wasnt well established yet, you have a 9% interest rate.

Now, lets say your credit has improved dramatically, and your income is in a good place, so you qualify for a 4% interest rate and keep the same repayment term. Comparing those two options, youd save $51 per month with the new loan and $6,103 in total interest over the life of your loan.

Refinancing Discover student loans can also allow you to switch from a variable interest rate to a fixed rate or vice versa. While variable interest rates typically start off lower, they fluctuate based on the current market rates, and because interest rates are so low right now, the chances of your rate going up are high.

Other Lenders To Consider

If Discover doesnt suit your needs, there are plenty of other lenders to consider. Here are Credibles partner lenders that offer student loan refinancing:

| Lender |

|---|

|

All APRs reflect autopay and loyalty discounts where available | 1Citizens Disclosures | 2College Ave Disclosures | 3 ELFI Disclosures | 4INvestEd Disclosures | 5ISL Education Lending Disclosures |

You May Like: How Much Interest On 10000 Loan

Student Loan Interest Rates

Applicants may have the choice of a fixed or variable interest rate loan.

- A fixed interest rate is set at the time of application and does not change during the life of the loan unless you are no longer eligible for one or more discounts.

- A variable interest rate may change quarterly during the life of the loan, if the interest rate index changes. This may cause the monthly payment to increase, the number of payments to increase, or both.

Interest rates for private student loans are credit based. Therefore, the interest rate is not the same for every borrower. Our lowest rates are only available to applicants with the best credit. The APR will be determined after an application is submitted. It will be based on credit history, the selected repayment option and other factors, including a cosigners credit history . If a student does not have an established credit history, the student may find it difficult to qualify for a private student loan on their own or receive the lowest advertised rate.

Consider The Following Before Taking Out A Discover Student Loan

- Higher interest rates compared to federal student loans: Though competitive amongst private lenders, Discover Student Loans may carry higher interest rates compared to federal student loans for some borrowers.

- Interest begins accruing immediately: Whereas subsidized federal student loans dont begin accruing interest while a borrower is enrolled as a student, during their grace period, or during periods of qualified deferment, interest will begin accruing on student loans borrowed from Discover as soon as they are disbursed, as is common for most private student loan providers.

- Lack other benefits common to federal student loans: Federal student loans are preferable to private student loans for a number of reasons. In addition to low interest rates, federal loans offer borrowers benefits including student loan forgiveness possibilities and options for income-based repayment, which you wont find with Discover .

- Students without a cosigner may be denied: If youve got a limited credit history and no cosigner to help you apply, Discover may not approve you for a student loan. If you are approved, be prepared to pay a higher interest rate due to the increased risk you present to the company.

Also Check: How Much Is My Student Loan Payment Going To Be

You Want To Maximize Your Savings

In early 2021, fixed student loan refinance interest rates hit a record low. And because you have private student loans that arent eligible for federal coronavirus relief or forgiveness, theres no reason you shouldnt at least test the waters and get some quotes.

If you wait, interest rates may increase again, and you may miss out on some of the savings you could have had.

Whats The Difference Between A Student Credit Card And A Regular Credit Card

A regular credit card for people with an established credit history is different than a credit card for students with no credit or a short credit history. Student credit cards may have a lower credit limit, so students can get started, practice responsible use and build their credit history. Over time, credit cards for students may allow an increase to their credit line, as students show responsible use when managing their credit.

Also Check: What Is The Undergraduate Student Loan Limit

How To Get Private Student Loans For Bad Credit

Its possible to get private student loans with bad credit, but youll pay more for the privilege.

Some lenders offer student loans specifically for borrowers with bad credit or no credit. These loans have more relaxed eligibility requirements, and some dont require a credit check at all. Instead, lenders may review alternative factors such as your field of study, grade point average or estimated future earnings to determine your eligibility. However, these loans come with significantly higher interest rates than traditional private student loans.

If you have bad credit, consider federal student loans first. Most of these loan types dont check your credit, and the interest rates are standardized. That means everyone who qualifies for a federal loan receives the same interest rate, regardless of their financial history.

If you dont qualify for federal student loans or have maxed out the federal aid available to you, consider taking steps to improve your credit before applying for a private student loan. If thats not an option, you might add a co-signer to your loan application, which can help you qualify for better interest rates.

Which Is Better: Sallie Mae Or Discover

Sallie Mae and Discover can both be good options for a student loan theyre both reputable companies that have been in the student loan business for years.

Because Discover doesnt offer co-signer release, Discover is a better choice for students who are taking out a loan independently though this only holds true for students who have a great credit score, since Discovers rate caps are high. Discover may also be a good choice for borrowers who want to stick with one lender for every year they need student loans, since subsequent years of funding require only a soft credit check.

On the other hand, Sallie Mae may be best for students who want a bit more flexibility with their repayment. Graduate students in particular can benefit from longer grace periods, interest-only payments after graduation and options to defer loans during residency or internships.

Recommended Reading: Can I Loan My Business Money And Charge Interest

For The Borrower Who Owes A Ton And Has Ridiculous Discover Student Loan Rates

Usually, if you have an 8%+ Discover student loan, you graduated from a degree program carrying a lot of debt in general. Moreover, that debt-to-income ratio can make it hard to refinance and lower your interest rate.

However, there is some weird, good news. If youve got a ridiculously high interest rate, a lot of places will refinance you to a fixed rate in the 6% to 8% camp even if you already owe a bunch of student loan debt. However, with the pandemic, there have been some of the lowest rates in the 2% to 3% range.

While 6% to 8% still isnt that great, that could be a huge improvement for someone with a 10% variable interest rate on a Discover student loan.

Historically Ive had the best luck with Credible for folks who have modest incomes and large debt loads with ridiculously high 8% to 12% variable rate loans. Typically, you need a good credit score, solid income, and to be a U.S. citizen or permanent resident.

If you use that link, you can get a student loan refinancing bonus, too, if you get a better deal and find a lower interest rate. With Credible, you can prequalify to see rates from multiple private lenders without a hard credit check. However, the rate you ultimately get will depend on your credit score, credit history, and the three-month LIBOR index.

You might also score an interest rate reduction with autopay. Check out the various loan repayment options, customer service options, and rates to find the best deal for you.