Discount Points Vs Origination Points

There are two different types of mortgage points: origination points and discount points. Discount points represent prepaid interest that can be used to negotiate a lower interest rate for the term of a loan.

Origination points, on the other hand, are lender fees that are charged for closing on a loan. Origination points dont save borrowers money on interest, although they can sometimes be rolled into the balance of a loan and paid off over time. Discount points, however, have to be paid up front.

What Does The Origination Fee Include

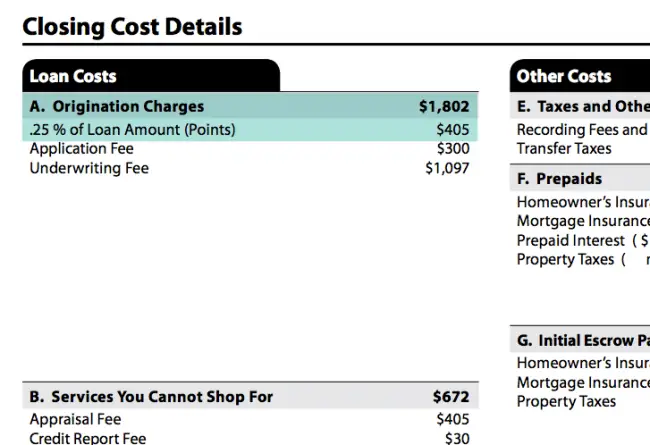

Some lenders charge just the origination fee. Others itemize their closing costs along with the origination points. Each lender has a different method.

Itemized closing costs are the line items on your loan estimate. On Page 2, you’ll see a breakdown of the fees charged. You may see any of the following:

- Points

- Application fee

- Processing fee

- Document preparation fee

Some lenders itemize the fees. Others charge one lump sum. You won’t see the above charges. Instead, you’ll just see points charged. The amount is usually larger than lenders who itemize the fees.

Since the housing crisis, governing agencies try to keep loan fees below 3% of the loan amount. This includes origination fees and all other itemized costs.

Average Loan Origination Fee

- The most common fee is probably 1% of the loan amount

- Which means the cost can vary considerably based on the size of your home loan

- A smaller loan amount could result in a higher percentage fee and vice versa

- You may be charged higher or lower fees depending on loan amount and broker/lender in question

In the mortgage world, its hard to provide universal answers, seeing that mortgages can differ tremendously.

The loan origination fee can vary based on who you decide to work with, the types of loans in question, and how complicated your loan is.

If youve got a cookie-cutter loan that you can get anywhere, this fee should be low. The opposite is also true. Either way, the loan origination fee is negotiable! And it can be offset using a credit, as seen above.

If I had to throw out a number, Id say the most common origination fee is 1% of the loan amount, which many banks will include in the fine print next to their advertised rates.

Wells Fargo used to include this exact disclaimer on their mortgage rates page, but it has since been removed.

Some banks and lenders may not even charge an origination fee explicitly, though a variety of closing costs such as underwriting and processing could amount to a comparable fee when all is said and done.

Thats basically what we saw in the fees worksheet above. It doesnt really matter what they call it.

You May Like: Auto Loan Calculator Usaa

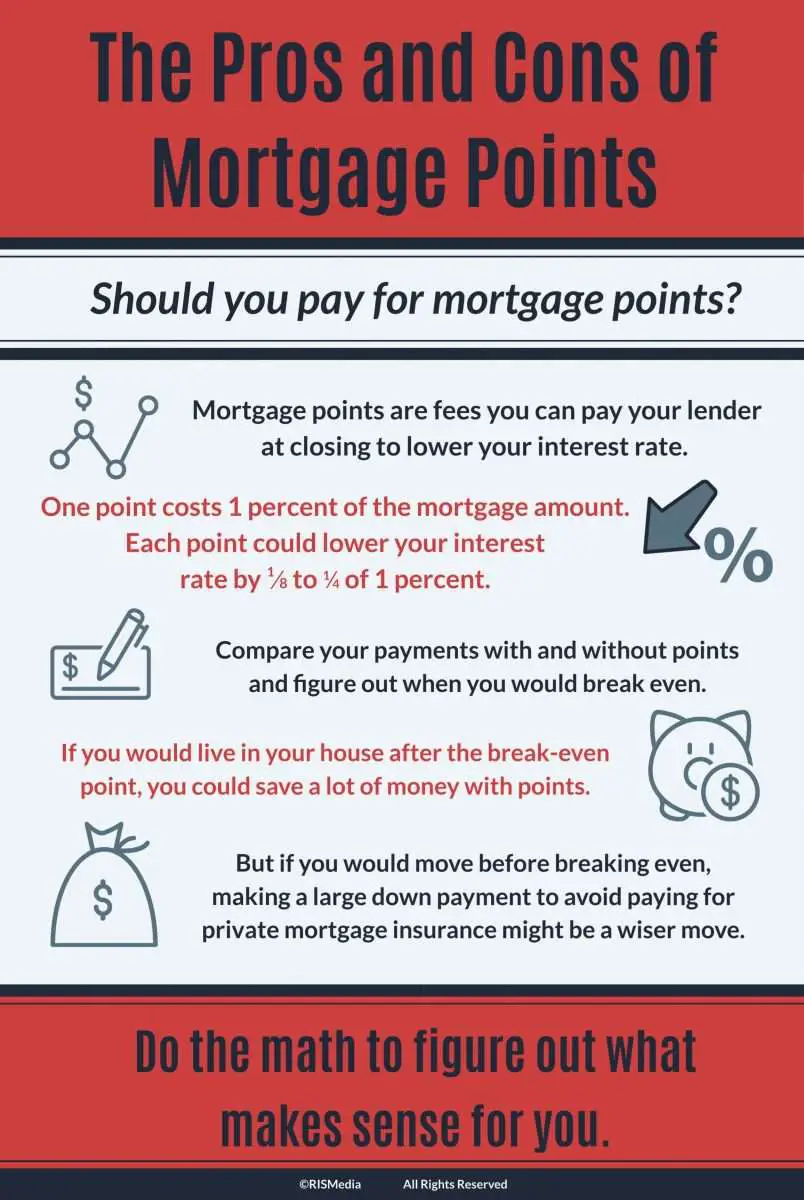

Should You Pay For Mortgage Points

While mortgage points can provide a way to pay off closing costs, or reduce your interest rates, they may not be right for everyone. Before you commit to paying for origination or discount points, ask yourself the following questions:

- Can I afford to purchase points in addition to my down payment and closing costs?

- How long do I plan on staying in my home?

- Am I choosing a fixed-rate or adjustable rate mortgage?

- Will I reap any tax benefits after buying mortgage points?

- Are the long-term savings worth the initial investment?

These questions will help you better determine if paying more fees upfront is the right choice for your unique situation. If you still have questions, talk to your lender to learn more about their mortgage points program â and whether buying points makes sense for you.

Get helpful articles directly in your inbox!

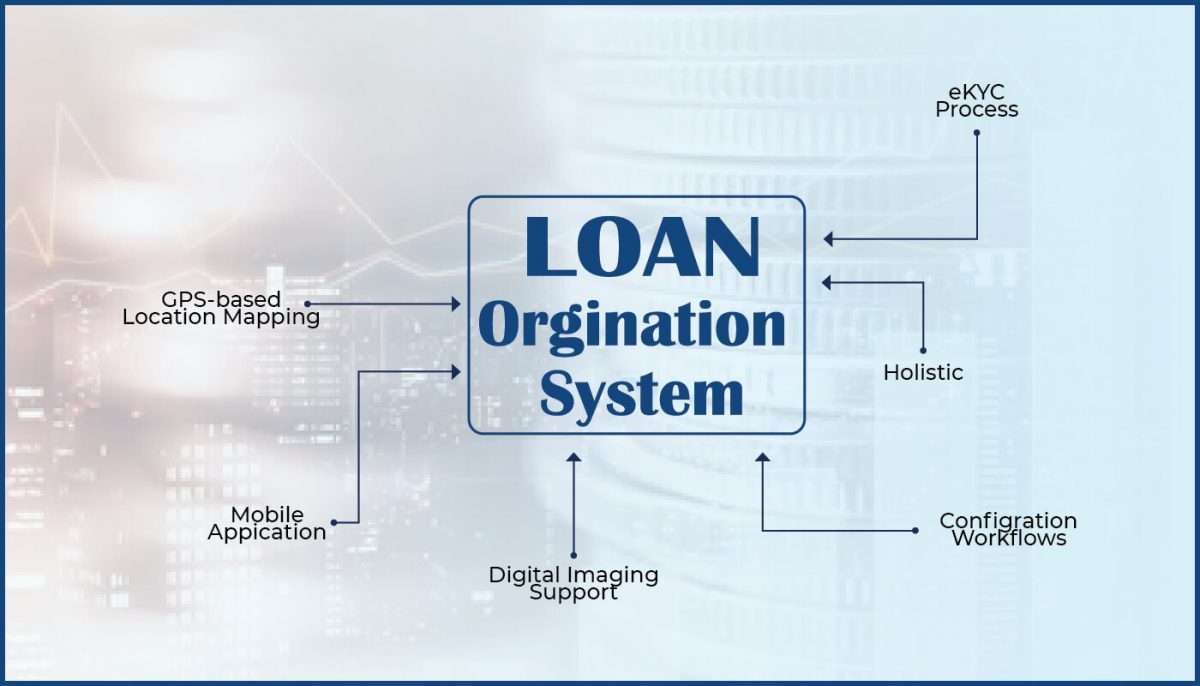

Understanding Origination Fee And Points In Mortgage Process

The concepts of origination points and fees are quite often confused with one another. The Buzzle article will help you understand the difference between origination fee and points in a mortgage process.

The concepts of origination points and fees are quite often confused with one another. The Buzzle article will help you understand the difference between origination fee and points in a mortgage process.

Don’t Miss: Fha Loan To Buy Land And Build Home

Drop Your Interest Rate With Discount Points

Each Washington mortgage lender has a unique pricing structure, and your interest rate will also depend on the type of loan youre seeking and the current state of the mortgage market. You can often lower your interest rate by purchasing discount points, paid for at closing.

In general, each discount point you buy lowers your interest rate by one-eighth to one-quarter of a percent. By purchasing discount points, you have an opportunity to make a significant difference in your monthly payments as well as how much you pay in interest over the life of your loan In some cases, buying discount points is a better use of extra money than making a bigger down payment!.

What Are Points And Lender Credits And How Do They Work

Generally, points and lender credits let you make tradeoffs in how you pay for your mortgage and closing costs. Points, also known as discount points, lower your interest rate in exchange paying for an upfront fee. Lender credits lower your closing costs in exchange for accepting a higher interest rate.

These terms can sometimes be used to mean other things. Points is a term that mortgage lenders have used for many years. Some lenders may use the word points to refer to any upfront fee that is calculated as a percentage of your loan amount, whether or not you receive a lower interest rate. Some lenders may also offer lender credits that are unconnected to the interest rate you pay for example, as a temporary offer, or to compensate for a problem.

The information below refers to points and lender credits that are connected to your interest rate. If youre considering paying points or receiving lender credits, always ask lenders to clarify what the impact on your interest rate will be.

Points

Points let you make a tradeoff between your upfront costs and your monthly payment. By paying points, you pay more upfront, but you receive a lower interest rate and therefore pay less over time. Points can be a good choice for someone who knows they will keep the loan for a long time.

Lender credits

See an example

When comparing offers from different lenders, ask for the same amount of points or credits from each lender.

Don’t Miss: What Credit Bureau Does Usaa Use

Ways To Avoid Paying The Mortgage Origination Fee

Theres no way to avoid mortgage loan origination fees entirely. Whether you pay them with upfront cash or not, the charges will be paid somehow either by the seller or through a higher interest rate or bigger loan amount.

There are ways you can lower your origination fees and make your home purchase more affordable, though. To do this, you can:

In some cases, a lender might not charge any origination fees at all. This is more common with online lenders that have less overhead than bigger banks and financial institutions .

But keep in mind:

If youre ready to start looking for a home loan, Credible Operations, Inc. is a good place to start. We will help you compare prequalified rates from multiple lenders, including their origination fees, all with no obligation.

Credible makes getting a mortgage easy

What Are Points And Should I Pay Them

When it comes to your mortgage loan, you will hear the word points a couple of times during the process. Points are fees paid directly to the lender for processing your loan or reducing your interest rate.

Origination points are paid to your lender for giving you a loan. Discount points give you the ability to lower the interest rate on your loan.

In most cases, a point equals 1% of your mortgage loan.

Read Also: Firstloan Com Legit

Using Apr To Compare Loans

Comparing different loans with varying interest rates, lender fees, origination fees, discount points, and origination points can be very difficult. The annual percentage rate figure on each loan estimate helps make it easier for borrowers to compare loans, which is why lenders are required by law to include it on all loans.

The APR on each loan adjusts the advertised interest rate on the loan to include all discount points, fees, origination points, and any other closing costs for the loan. This metric exists to make comparison easier between loans with wildly different discount points, interest rates, and origination fees.

What Are Origination Points And Discount Points

Mortgage points are a type of fee paid to your lender at closing . While the specifics can vary from lender to lender, the value of these points is typically set by your loan amount. In most situations, one point is equal to 1 percent of your loan amount. Therefore, 1 point for a $100,000 loan would cost $1,000, but 1 point for a $300,000 loan would cost $3,000. What is the purpose of mortgage points? That depends. There are two types of mortgage points: origination points and discount points.

Recommended Reading: Usaa Car Payment Calculator

What Is The Average Apr Of A Personal Loan With No Origination Fees

To reiterate, there are bigger factors that affect the APR of your personal loans, but lenders offering no origination fees may actually just be rolling that cost into the principal in this case, the origination fee is added to the interest of the loan. According to the Federal Reserve, the national average interest rate as of the last quarter of 2021 was 9.09%.

Are Origination Fees Just Junk Fees

- Loan origination fees arent necessarily so-called junk fees

- They are commissions paid out for helping you obtain a loan

- And just because you arent charged the fee directly doesnt mean its the better deal

- Look at the big picture to determine the best offer

The loan origination fee is not necessarily a junk fee seeing that many loan originators dont get paid salaries, as noted. So they need to get paid somehow.

But some lenders may not charge them and refer to them as unnecessary or excess charges as a result.

However, if they dont charge you directly, it just means theyre making money a different way, perhaps via a higher interest rate and/or by charging other lender fees.

Certain mortgage bankers can earn a service release premium after the loan closes by selling it to an investor on the secondary market.

This isnt a fee imposed on the borrower directly, though a higher-rate mortgage may fetch a higher SRP.

In any case, someone will be making money for originating your loan, as they should for providing a service.

So dont get fired up about it, just try to negotiate costs lower as best you can. Or go elsewhere for your loan if youre not impressed.

The reason its sometimes given junk fee status is that its often a fixed percentage, which means its not necessarily tailored to your specific loan or the amount of time/risk involved.

If these fees were based on a dollar amount instead, skeptics may not consider them junk. Or may think theyre less junky.

Read Also: How Long Does Sba Loan Take To Process

How Do Mortgage Points Work With Arm Loans

Mortgage points on an adjustable-rate mortgage work like points for a fixed-rate mortgage, but most ARMs adjust at five years or seven years, so its even more important to know the breakeven point before buying points.

Factor in the likelihood that youll eventually refinance that adjustable rate because you may not have the loan long enough to benefit from the lower rate you secured by paying points, says McBride.

What Is An Origination Fee

A mortgage origination fee is an upfront fee charged by a lender to process a new loan application. The fee is compensation for executing the loan. Loan origination fees are quoted as a percentage of the total loan, and they are generally between 0.5% and 1% of a mortgage loan in the United States.

Sometimes referred to as discount fees or points, particularly when they equal 1% of the amount borrowed, origination fees pay for services such as processing, underwriting, and funding.

Also Check: How To Find Out Where My Student Loans Are

How To Save On Origination Fees

Mortgage origination fees can be negotiable, but a lender cannot and should not be expected to work for free. Obtaining a reduced origination fee usually involves conceding something to the lender. The most common way to lower the fee is to accept a higher interest rate in return.

Effectively, the lender earns its commission from the YSP instead of the origination fee. This is executed through something called “lender credits.” They are calculated as negative points on a mortgage. As a general rule, this is a good deal for borrowers only if they plan to sell or refinance within a few years because on longer mortgages what you cumulatively pay in interest will generally outstrip what you would have paid in an origination fee. In the case of the latter, consider working with one of the best mortgage refinance companies to ensure you’re getting a good deal.

You can negotiate to have the home seller pay your origination fees. This is most likely to happen in the event that either the seller needs to sell quickly or is having trouble selling the home. You can also negotiate with the lender to have the origination fee reduced or waived. This may not involve accepting a higher interest rate if, for example, you have shopped around and can present evidence of a better offer from a competing lender.

Also, if the mortgage is for a large amount and long term and you have excellent credit and a safe source of income, a lender may find your business attractive enough to go easy on fees.

Can Loan Origination Fees Be Written Off On Taxes

Loan origination fees are tax-deductible. We suggest you consult your tax accountant to understand the amount of money you will receive as a result.

About DFW Hard Money

DFW Hard Money is a private money lender serving real estate investors who are flipping houses, need funds for commercial property investments, transactional funding, developments, and more, for over 20 years.

You May Like: Usaa Auto Loan Approval

What Is A Loan Origination Fee

A good definition of a loan origination fee is the charges and commissions that pay for services like funding the loan, underwriting and administrating it. Usually called discount points or discount fees when exactly 1 percent of the loan is charged to the borrower, loan origination charges are similar to a lender compensation charge and can range from 0.5 percent to 1 percent of the loan amount.

Its important to know that mortgage loan origination fees are frequently negotiable. Although part of closing costs, origination charges and origination fees are not the only . But they are among the few that you can directly negotiate with the lender. When youre wondering how much are loan origination fees going to cost me? remember to explore your options with the lenders to get the best deal you can.

Origination Points Explained In Less Than 5 Minutes

Mortgage origination points are fees charged by your lender to pay for the process of underwriting and approving your home loan application. These fees are not standardized. They can vary widely by lender, so you may be able to negotiate their costs.

Lets take a look at origination points, how they work, and how they’re different from discount points.

Don’t Miss: Www.lowermycarloan.com

How Much Can The Origination Fee Cost You

Origination fees vary. Generally, though, they average around 0.5% to 1.5% of the total loan amount so $1,000 to $3,000 on a $200,000 home loan.

Keep in mind, origination fees can consist of a number of different charges. Heres a quick look at typical fees for each of these:

| Fee |

|---|

Learn More: Mortgage Points: What Are They and Are They Worth It?

How To Calculate Mortgage Points

Picture this scenario. You take out a 30-year-fixed-rate mortgage for $200,000 with an interest rate at 5.5%. Your monthly payment with no points translates to $1,136.

Then, say you buy two mortgage points for 1% of the loan amount each, or $4,000. As a result, your interest rate dips to 5%. You end up saving $62 a month because your new monthly payment drops to $1,074.

To figure out when youd get that money back and start saving, divide the amount you paid for your points by the amount of monthly savings . The result is 64.5 months. So if you stay in your home longer than this, you end up saving money in the long run.

Keep in mind that our example covers only the principal and interest of your loan. It doesnt account for factors like property taxes or homeowners insurance.

Recommended Reading: Usaa Rv Loan Calculator

What Are Mortgage Origination Fees

Origination fees are designed to cover the processing costs associated with your mortgage and usually include costs like:

- Underwriting/processing fees

- Discount points

As a buyer, youll see origination fees listed on Page 2 of any loan estimate you receive .

Learn More:How Long Does It Take to Buy a House?