What Occurs During Parent Plus Processing

- Once the loan application has been completed, the servicer performs a .

- The servicer notifies the parent of acceptance or rejection of the loan.

- If the loan is approved, funds are sent directly to MSU and applied against the student’s bill.

- Any PLUS funds that exceed MSU charges are given as a refund by the Student Accounts division of the Controller’s Office.

Parent Plus Loan Application

You, as the parent, will not need to complete the Direct PLUS loan application. You will need to log into Student.Aid.gov with your FSA ID.

Complete the Direct PLUS loan application. You will need to identify how much you would like to borrow, and authorize a credit check. The U.S. Department of Education will then conduct a credit check to determine if you have adverse credit. If you are determined to have adverse credit, you can then:

- file an extenuating circumstances appeal, or

- apply with a cosigner.

~ Granting Parent Borrower Mywsu Access

The student grants the parent borrower Third Party Access to the form.

Recommended Reading: Usaa Auto Loan Rates

What Is The Interest Rate For A Direct Plus Loan

The interest rate for Direct PLUS Loans first disbursed on or after July 1, 2021, and before July 1, 2022, the interest rate is 6.28%. This is a fixed interest rate for the life of the loan.Interest is charged on Direct PLUS Loans beginning the date of the loans first disbursement. See detailed information from the office of Federal Student Aid.

What To Consider Before Applying For A Parent Plus Loan

Megan Walter, a policy analyst at theNational Association of Student Financial Aid Administrators says that PLUS loans can be a good alternative to taking out private loans, primarily because of all of the protections that PLUS loan borrowers receive.

Some of these include being able to put the loans in deferment or forbearance if theyre in financial trouble, and being eligible forPublic Service Loan Forgiveness if they work for a qualifying employer.

However, they also come with some drawbacks that are worth considering.

Recommended Reading: Navy Federal Auto Loan Pre Approval Hard Inquiry

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Is Adverse Credit History

- A current delinquency of 90 or more days on more than $2,085 in total debt or

- More than $2,085 in total debt in collections or charged off in the past two years or

- Default, bankruptcy discharge, foreclosure, repossession, tax lien, wage garnishment, or write-off of federal student loan debt in the past five years

You May Like: Usaa Car Financing Calculator

Ascent Student Loans Disclosures

Ascent loans are funded by Bank of Lake Mills, Member FDIC. Loan products may not be available in certain jurisdictions. Certain restrictions, limitations and terms and conditions may apply. For Ascent Terms and Conditions please visit: AscentFunding.com/Ts& Cs.

Rates are effective as of 10/01/2021 and reflect an automatic payment discount of either 0.25% OR 1.00% . Automatic Payment Discount is available if the borrower is enrolled in automatic payments from their personal checking account and the amount is successfully withdrawn from the authorized bank account each month. For Ascent rates and repayment examples please visit: AscentFunding.com/Rates.

1% Cash Back Graduation Reward subject to terms and conditions, please visit AscentFunding.com/Cashback. Cosigned Credit-Based Loan student borrowers must meet certain minimum credit criteria. The minimum score required is subject to change and may depend on the credit score of your cosigner. Lowest APRs are available for the most creditworthy applicants and may require a cosigner.

I Cant Pay My Parent Plus Loan What Now

Life happens, and no one plans on not being able to pay their student loans â but it happens. If you can’t pay your Parent PLUS Loan, here are 8 options to consider:

The federal government doesn’t offer a loan program that would allow you to move the liability for a Parent PLUS Loan to a spouse or to the student. However, some private lenders will allow a parent to transfer a Parent PLUS Loan to a child through refinancing.

Parent PLUS Loans are not eligible for IBR, PAYE, or REPAYE forgiveness programs. But they are eligible for ICR.

Parent PLUS Loans can be forgiven if the parent borrower suffers a total disability that renders them unable to repay the loan.

If possible, you should always avoid going into default. Federal student loans can garnish your wages or tax refund to get the repayment theyâre owed.

For weekly student loan tips and tricks, life-changing info, and great resources, . Iâll only send you stuff that you should know as a borrower.

You May Like: Capital One Auto Loan Private Seller

Repaying Parent Plus Loans

Helping your child cover their college costs can feel rewarding. But its important to know when the repayment period for Parent PLUS Loans kicks in. In most cases, youre expected to start payments immediately after the loan is disbursed, if you dont request deferment while your child is enrolled in school.

If you secure a deferment, youll start payments after a six month grace period following your childs graduation date, or whenever your child falls below half-time enrollment status.

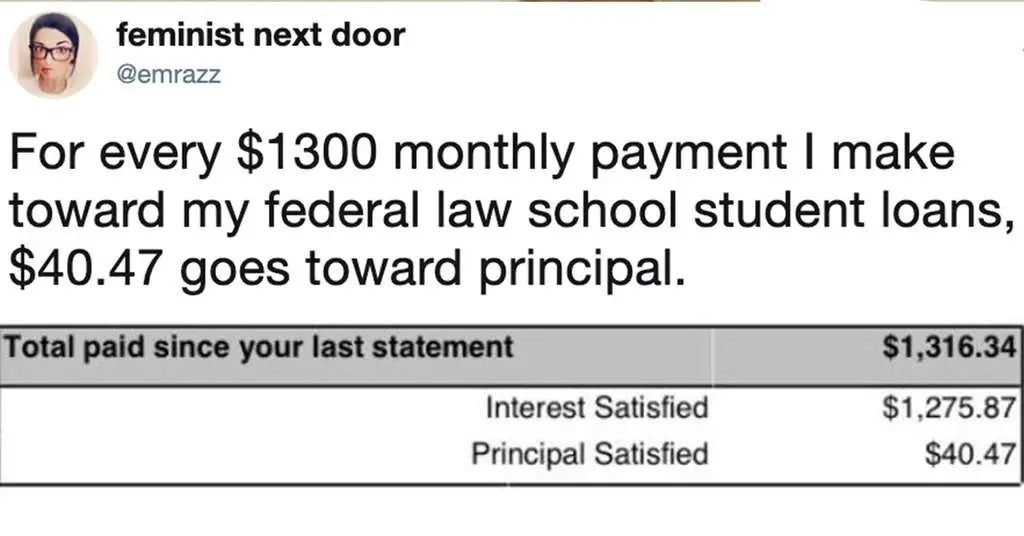

Throughout the deferment and grace periods, interest continues to accrue on your loan even if you arent required to make any payments. As with any loan, the interest rate on these Parent PLUS Loans can add up quickly.

Related: 5 Best Ways to Pay Off Parent PLUS Loans

Since these loans are disbursed on a year-to-year basis for each child, the timing of your repayment start dates can vary. For example, lets say that you apply for Parent PLUS Loan deferment for your younger childs loan, but your oldest child graduated college seven months ago.

In this scenario, youre responsible for starting payments on your Parent PLUS Loans for your recent graduate, but can continue deferring the PLUS Loans for your younger child.

You Can Borrow As Much As You Need

Unlike other types of federal student loans, Parent PLUS Loans have virtually no limits when it comes to borrowing. You can borrow up to the cost of attendance minus any other financial aid received.

This can be helpful if your childs financial aid package falls short or you cant cover your Expected Family Contribution.

At the same time, you have to be careful to not take on too much debt. Since your borrowing is limited only by the cost of attendance, you run the risk of taking out more loans than you can afford to pay back.

Before finalizing your paperwork, crunch the numbers with our student loan calculators to ensure your budget can handle repayment.

Also Check: Usaa Auto Financing

Grad Plus Loans Explained

A grad PLUS loan is another name for a Direct PLUS Loan. It is a federal student loan made to a graduate or professional student.

Understand how a grad PLUS loan works, how to get one, and alternatives to decide if it’s the right federal student loan option for your educational goals and budget.

Other Options To Consider

Sometimes, the additional direct unsubsidized loan the student receives from the PLUS denial processing is still not enough to cover the remaining cost of attending WSU. In these circumstances, a student and/or parent may want to consider the following alternatives:

Loan amounts & limits

Parent PLUS loan amounts will vary widely. You parent can borrow as much as they like as long as they are not exceeding your total cost of attendance.

To figure out how much to borrow, follow this equation:Total annual cost of attendance Other aid awarded =$ parent is allowed to borrow

Should you get a Parent PLUS loan? Use these resources from studentaid.gov to make an informed decision.

Don’t Miss: How To Get A Car Loan When Self Employed

Parent Plus Loan Rates And Terms

Parent PLUS loan interest rates are currently fixed at 7%. They are tied to the rate of the ten-year Treasury note, with a cap of 10.5%.

The PLUS loan is given for one academic year at a time. As a result, parents must qualify for the loan each year. In other words, the credit check at year one does not make parents eligible for four years worth of Parent PLUS Loans. The loan enters repayment once it is fully disbursed, and there are a variety of repayment options available to parents, including deferment.

What Is A Parent Plus Loan

The Federal Student Aid office offers Parent PLUS Loans to parents borrowing on behalf of their children. Parents can borrow up to the full cost of attendance of their childs school minus any financial aid their child has already received.

The Parent PLUS Loan interest rate was 5.30% as of July 1, 2020, along with a 4.228% origination fee, as of Oct. 1, 2020. To be eligible, the borrower must have a child enrolled at least half-time in a Title IV school.

Plus, parent borrowers cant have an adverse credit history. If they do, it is still possible to qualify by adding a creditworthy endorser to their loan application.

Although Parent PLUS Loans can be a useful way to cover a gap in funding, they come with both pros and cons.

Read Also: Nerdwallet Loans

Interest Rates On Federal Plus Loans

The interest rates on Federal PLUS Loans are fixed rates that change only for new loans each July 1. The new interest rate is based on the last 10-year Treasury Note Auction in May.

The interest rate on the Federal PLUS Loan is the same for both Federal Parent PLUS Loans and Federal Grad PLUS Loans.

Keep in mind, however, that you are not required to pay interest or make payments on any Federal Direct Loan during the current COVID-19 relief period. The relief period is in effect through at least September 30, 2021.

The interest rates are set according to this formula:

| Borrower |

| 4.248% |

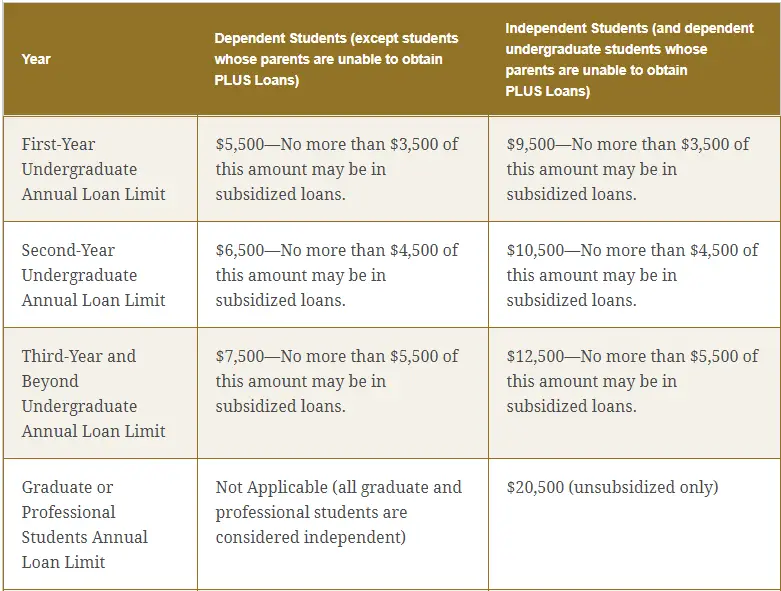

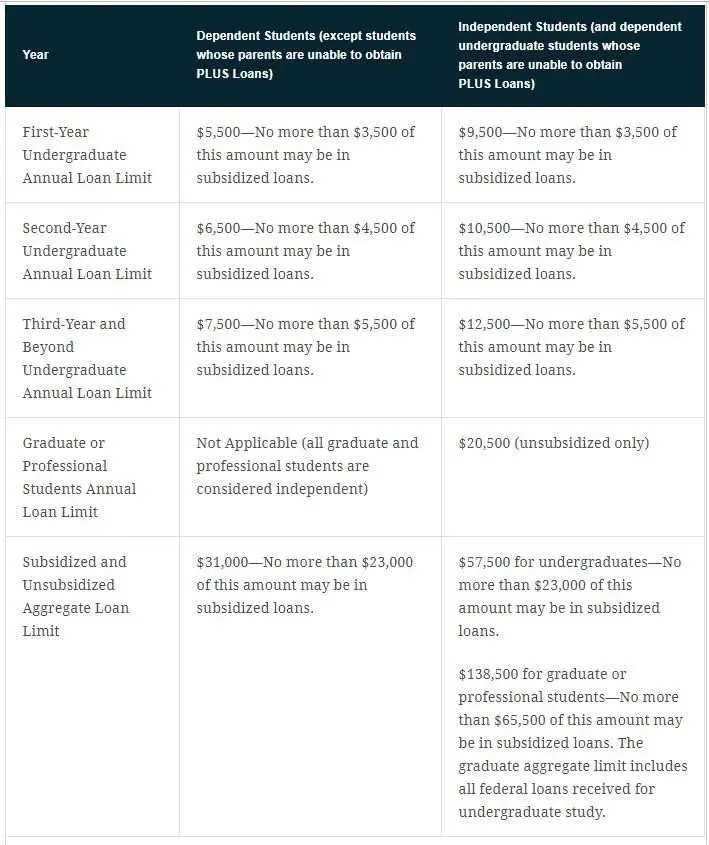

Applying For Unsubsidized Federal Loans

If a parent is ineligible for a Parent PLUS loan, the student may be eligible to receive additional Direct Unsubsidized Loan funds up to the loan limits for independent students.

Federal student loans can be reliable borrowing options because they often have lower interest rates and could have better repayment terms than other loans available to students. However, its worth making sure that a student isnt taking out more debt than they can handle after graduation.

Read Also: Nslds.ed.gov Legit

Definition And Examples Of A Grad Plus Loan

When the federal government extends a Grad PLUS loan to a graduate or professional student, it’s known as a grad PLUS loan. This type of loan is available to eligible students through schools that take part in the Direct PLUS loan program offered by the U.S. Department of Education.

- Alternate name: Direct PLUS loan

If you’ve looked into graduate school, which includes medical and law school, you know how expensive it can be. While graduate students aren’t eligible for some of the loans they may have been able to receive as an undergraduate, they may be able to receive a federal student loan through the grad PLUS loan.

Borrow The Direct Loan First

The Federal Direct loan has a lower interest rate than the Parent PLUS loan so families should exhaust Stafford loan eligibility before turning to the Parent PLUS loan. The unsubsidized Direct loan is available without regard to financial need, just like the Parent PLUS loan, so you do not need to be poor to qualify for this loan.

Unfortunately, many families do not take full advantage of the Stafford loan. Nothing prevents parents from helping their children with the payments on their Stafford loans, and the lower interest rate will save money, so it is best to borrow the Stafford loan first.

Read Also: How Long Does Sba Loan Take To Get Approved

What Credit Score Is Needed For A Parent Plus Loan

No minimum credit score is needed to get a parent PLUS loan. Federal loans aren’t like private parent student loans, which use your credit score to determine whether you qualify and what interest rate you’ll receive.

But parent PLUS loans do have a credit check, and you won’t qualify if you have adverse credit history. That can include negative line items on your credit report like payments that are 90 days late, tax liens and more.

Check your credit for adverse information before applying for a parent PLUS loan. You are entitled to one free report a year from each credit reporting bureau Equifax, Experian and TransUnion or you can get a free credit report through NerdWallet.

~ Parent Completes Wsu Loan Application

The parent completes the WSU PLUS Loan Application.

Recommended Reading: Va Business Loan For Rental Property

Why You Might Need A Financial Professional

Even after all that work, you still may have some complicated questions to sort through, including which income-driven plan makes the most financial sense for your circumstances. For example, Pay as You Earn and Revised Pay as You Earn are the most affordable, basing your payment on 10% of your income, but REPAYE counts spousal income in the payment calculation, while PAYE has stricter eligibility parameters. Married people may benefit more from the Pay as Your Earn and Income-Based Repayment plans, because these plans calculate payment off a single income. But that also means filing taxes as married, filing separately to qualify. Experts typically recommend changing your tax filing status the year before in preparation for consolidating.

Finding the right advice isnt always easy.

Loan servicers and financial aid officers cannot provide any tax or personal finance advice, and tax professionals dont understand student loan payment, Amrein says.

Thats why a financial advisor with a Certified Student Loan Planner designation and a tax background may be worth consulting. Check the Certified Student Loan Advisors Institute for someone in your area. This person can also help you assess whether jumping through the hoops to complete a double consolidation is worth the work for your personal circumstances.

Youll have to understand the numbers, Amrein says.

Cons Of Parent Plus Loans

Loan Origination Fee

Interest isnt the only expense youll encounter with Parent PLUS loans. Theres also a loan origination fee. The fee amount is a percentage of the loan, and it varies depending on the disbursement date of the loan. For loans after October 1, 2018 but before October 1, 2019, the fee is 4.248% of the loan amount. That means that if you borrow $30,000 using a Parent PLUS loan, youd pay a fee of $1,274.40.

This fee is proportionately deducted from each loan disbursement, which essentially reduces the amount of money borrowers have to cover education-related costs. Since many private student loans dont have a fee, its worth looking into private options to determine which loan has the lowest borrowing costs.

Relatively High Interest Rate

Currently set at 7.60%, Parent PLUS loans certainly dont have the lowest rate out there. If you have strong credit and qualify for a better rate, you might consider a different loan that will cost less in the long run. Direct Subsidized Loans currently carry a 5.05% interest rate, while Direct Unsubsidized Loans are at 6.60%. On the other hand, some private lenders have interest rates as low as 2.795%.

Limited Grace Period

Also Check: Usaa Car Loan