Personal Loan Interest Rate

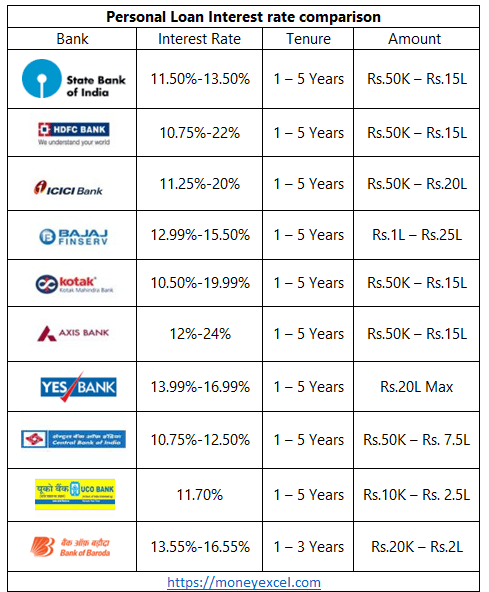

The personal loan interest rates range between 7.90% p.a. and 49% p.a. Depending on the loan amount availed by you, your credit score, and repayment tenure, the rate of interest on your loan is decided. If you maintain a high credit score and have a good relationship with the bank, then the interest rate on your personal loan can be lowered.

Formula to Calculate Personal Loan EMI

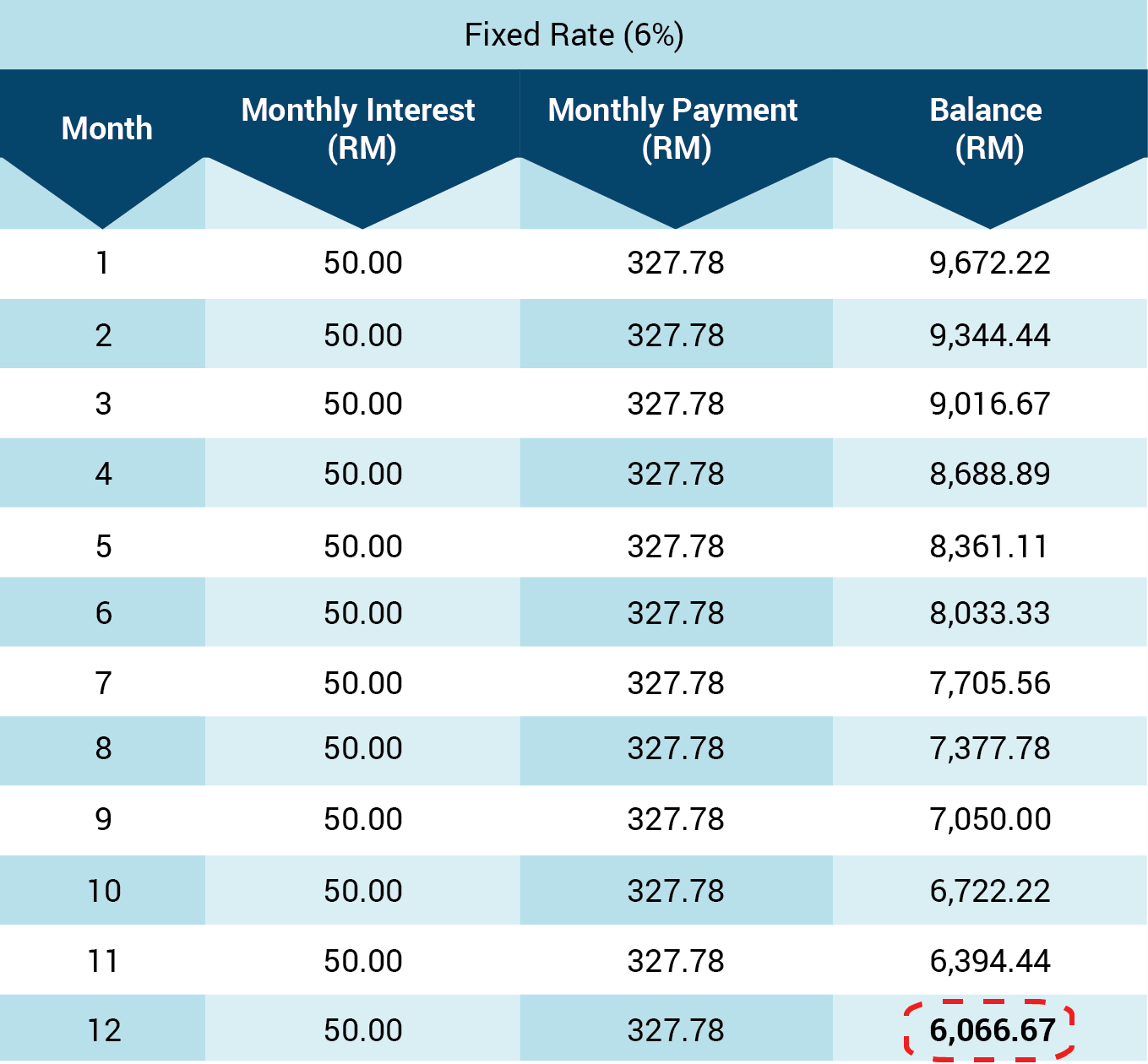

EMI = /, wherein P represents the loan amount, R is the interest rate charged per month, and N indicates the total number of monthly installments.

Illustration

Mr. Mehta, a 33-year old IT engineer, is looking to apply for a personal loan to pay for his wedding expenses. He intends to apply for a loan of Rs.10 lakh and repay the loan over a period of 36 months. He expects to pay an interest of 14% p.a. for the loan.

To calculate the EMI for the personal loan, he will need to navigate to either a bank/NBFCâs website or a third-party website that offers an EMI calculator tool. He will then have to input the loan amount, which is Rs.10 lakh, the loan tenure, which is 36 months, and the interest rate, which is 14% p.a.

Upon entering these details, the EMI payable, which is Rs.34,178 per month, will be displayed. In his case, the total payable interest is Rs.2,30,395, while the total payable amount is Rs.12,30,395.

Choose A Shorter Loan Term

Personal loan repayment terms can vary from one to several years. Generally, shorter terms come with lower interest rates, since the lenders money is at risk for a shorter period of time.

If your financial situation allows, applying for a shorter term could help you score a lower interest rate. Keep in mind the shorter term doesnt just benefit the lender by choosing a shorter repayment term, youll pay less interest over the life of the loan.

Personal Loan Interest Rates Plunge For 5

The latest trends in interest rates for personal loans from the Credible marketplace, updated weekly.

Borrowers with good credit seeking personal loans during the past seven days prequalified for rates that were lower for 5-year loans and higher for 3-year loans compared to the previous seven days.

For borrowers with credit scores of 720 or higher who used the Credible marketplace to select a lender between Sep. 8 and Sep. 14:

- Rates on 3-year fixed-rate loans averaged 11.74%, up from 11.71% the seven days before and up from 11.14% a year ago.

- Rates on 5-year fixed-rate loans averaged 15.03%, down from 15.70% the previous seven days and up from 14.88% a year ago.

Personal loans have become a popular way to consolidate and pay off credit card debt and other loans. They can also be used to cover unexpected expenses like medical bills, take care of a major purchase or fund home improvement projects.

Personal loan interest rates fell over the last seven days for 5-year fixed-rate loans, while rates for 3-year fixed-rate loans rose slightly. Rates for five-year loans fell by 0.67%, while 3-year loans rose by a slight 0.03%. In addition to today’s rate changes, interest rates for both loan terms are higher than they were this time last year. Borrowers can take advantage of interest savings with a 5-year personal loan right now. Both loan terms offer interest rates significantly lower than higher-cost borrowing options like credit cards.

You May Like: What Is Being Done About Student Loan Debt

What To Know Before You Apply

Look into these factors before you start the application process to make sure you get the best personal loan for you.

- Check your credit score online to get an estimate of the number your lender will see, and your credit score range. This can help you understand the types of rates youre eligible for. If your score is below 670, consider taking steps to improve your credit first.

- DTI. Use a calculator to get an estimate of what your DTI is. If its over 43%, you might have trouble qualifying. Try focusing on paying down debt before you apply for a loan.

- Monthly cash flow. Lenders look at how much money you have available each month to cover loan payments after youve paid your bills. You should have enough in there to cover monthly repayments on the loan amount and term youre considering with room for emergency costs.

- Prequalification. If available, going through a lenders prequalification process isnt a waste of your time. Its not a guarantee that youll get approved, but it can show you what kind of loan you might qualify for and what rates the lender may offer. And this process typically doesnt include a hard credit check.

- Exact loan amount. Go in knowing how much you need to borrow so you can rule out lenders who dont offer financing in that range. If youre not sure how much youll need, consider more flexible financing options like a credit card or line of credit instead.

Low-interest credit cards vs. personal loans

Which Bank Has The Lowest Interest Rate On A Personal Loan

If you have a strong credit score, you can receive the lowest interest rate through LightStream. LightStream has rates as low as 2.49% if you enroll in autopay. Other lenders, like SoFi, PenFed, Wells Fargo, Marcus and U.S. Bank, offer rates as low as 5.99%. Although not as low as LightStream, rates that low still beat out other methods of financing, including credit cards.

You May Like: How To Apply For Sba 504 Loan

How To Qualify For Low

Theres a variety of ways to improve your chances of scoring the best low-interest loan.

Who Sets Federal And Private Interest Rates

Congress sets federal student loan interest rates each year. These fixed interest rates depend on the type of federal loan you take out, your dependency status and your year in school.

Private student loan interest rates can be fixed or variable and depend on your credit, repayment term and other factors. As a general rule, the better your credit score, the lower your interest rate is likely to be.

You can compare rates from multiple student loan lenders using Credible.

Recommended Reading: What Increases Your Total Loan Balance

If You Improve Your Credit Score Will Your Personal Loan Repayments Be Lower

Improving your credit score wont automatically lower the repayments on any outstanding personal loans you may have. However, if you were to apply for another loan, including refinancing your current personal loan, your improved credit score may help you to qualify for a lower personal loan interest rate, which could help to lower your repayments.

How Lenders Determine Personal Loan Rates

Lenders determine personal loan rates based on several factors, but the applicants credit score and overall credit profile are the most important. Many traditional and online lenders also look at the prospective borrowers income and current outstanding debts to determine their debt-to-income ratio .

DTI is the ratio of a borrowers monthly income to their monthly debt service and is used to evaluate an applicants ability to make on-time payments. The higher the DTI, the riskier the borrowerand the higher the interest rate theyll likely receive.

When determining personal loan rates, some online and alternative lenders also look at a prospective borrowers occupation and education to evaluate earning potential. Likewise, lenders may evaluate the risk posed by a borrower based on where they live.

Recommended Reading: Loans With Bad Credit Same Day

Tips For Successful Personal Loan Application

There are a few important things to keep in mind when searching for a personal loan. Check out list of most helpful tips that will certainly help you with your personal loans.

| Do proper research before you apply for a loan | Do not sign your loan documents without understanding every point |

| Do read the fine print carefully | Do not make multiple inquiries regarding loans from different banks |

| Do save your money carefully when you are repaying | Do not take a personal loan without any serious purpose |

| Do pay your loan instalment promptly every single time | Do not be in a hurry to end your loan comparison process |

| Do evaluate your credit score thoroughly | Do not forget to pay your loan instalments |

| Do apply for an affordable loan amount | Do not accept bad loan products |

Read Reviews On The Best Personal Loan Providers

Read Reviews Of Different Personal Loan Providers In Singapore Such as HSBC, UOB, Citibank, POSB and More.

How can a personal loan help?Personal loans can come in handy during a period of cashflow difficulty. Some of such situations include sudden medical costs, weddings, funerals, divorces and more. Rest assured that the bank wont require you to get personal on personal loans and share the reason for taking it up during the approval process.

What are some of the main considerations of a personal loan?A personal loan tends to offer interest rates that range between 3.5% and 11% per annum. When applying for one, do also consider the following key features:

- Choice of loan tenures

- Fixed monthly repayment and repayment period

- Interest rates, barring late fees or other penalties

- Minimum loan amount

Read this article on how to choose the best personal loans to ease your cash flow.

Whats the difference between the annual interest rate and effective interest rate ?The annual interest rate is the interest rate advertised by the bank. EIR is a better gauge of the interest rate you actually incur. The EIR is often higher than the annual interest rate because it factors in other costs such as transaction fees and administrative fees. They add to the final amount you pay.

What are the tenures and maximum APR for each loan?

Step 2: Scroll through the page and see which loan best suits your needs

Recommended Reading: Which Bank Is Good For Mortgage Loan

How To Avoid Rejection Of Personal Loan Applications

The approval of a personal loan application depends on many factors. When you apply for a loan, you should make sure that you are fulfilling all the factors to ensure the approval of your loan application. The eligibility criteria for personal loans may vary from lender to lender. However, there are some common criteria which include the age of the applicant, his or her income, credit score, the status of employment, and so on. Before you apply for a loan, make sure that all the eligibility criteria are being fulfilled. This will help you avoid the rejection of your loan application. Although there are other options that you can resort to in case your loan application gets rejected, it is recommended to double-check before applying to avoid the chances of rejection of loan application.

Factors That Affect Personal Loan Interest Rates

- Income: Loan providers take the applicantâs income into account when deciding the interest rate. Individuals who have a high income pose a lower risk to the bank and, thus, might be offered a lower interest rate. On the other hand, those with lower annual incomes may have to pay a higher interest rate.

- Employer Details: If you work for a reputed organisation, the bank/financial institution is more likely to offer you a lower rate of interest.

- Nature of the Employment: Loan providers may offer different interest rates to applicants based on whether they are self-employed or salaried.

- Age: The age of the applicant can also have an impact on the interest rate quoted by the loan provider. Individuals who are nearing the retirement age may be charged a higher interest rate.

- Relationship with the Loan Provider: Existing customers of the bank/financial institution may be offered a lower rate of interest at the time of applying for a personal loan, provided they have a good relationship with the loan provider. This is, however, at the discretion of the bank and not all existing customers will be offered a preferential interest rate.

Also Check: What Are The Best Online Personal Loan Lenders

Which Is Better: Personal Loans Or Credit Cards

You can use both personal loans and credit cards to cover a variety of expenses. But it’s important to keep their differences in mind as you comparepersonal loans versus credit cards.

Personal loans

A personal loan is a kind of installment loan where you receive the funds as a lump sum to use how you wish and then pay off your balance in monthly installments over a period of time.

You might want to consider a personal loan if you:

-

Want a lower interest rate:

Personal loans tend to have lower interest rates than credit cards, which means you likely wont pay as much interest in comparison.

-

Want fixed monthly payments:

Personal loans typically have fixed interest rates, which means you can count on your payment staying the same from month to month.

-

Need a longer repayment period:

You could have one to seven years to pay off a personal loan, depending on the lender. Just keep in mind that choosing a longer term means youll pay more in interest over time.

Unlike a personal loan, a credit card is a type of revolving credit that gives you access to a credit line that you can repeatedly draw on and pay off.

A credit card might be a good choice if you:

Why Do Banks Charge Interest On Personal Loans

Money lending is a risky business because there is no guarantee you can get the money back on time and in full.

Banks will usually charge interest as a fee for doing business with you and assuming the risk of default.

A personal loan interest rate can be high or low depending on the risk profile of a borrower.

If you have a poor credit history, you may be charged a higher interest rate compared to those with a good credit rating because you are considered a high-risk borrower.

You May Like: Can I Use My Va Loan For Investment Property

How Can I Get A Low

Before applying for a low-interest personal loan, check your credit score. If your score is low, look to improve it first. Some lenders let you prequalify with a soft credit check, which lets you see what type of loan terms you could receive with your current score. Once you find a loan that offers favorable terms for your financing needs, apply with the provider. If you qualify, be sure to set up autopay to earn potential discounts and avoid any late payment fees.

Personal Loan Rates At Credit Unions

The average rate charged by credit unions in June 2022 for a fixed-rate, three-year loan was 8.84%, according to the National Credit Union Administration. Federal credit unions cap the APR on personal loans at 18%.

You have to become a member of a credit union to apply for a loan, which may mean paying fees or meeting certain eligibility requirements.

» MORE:

Don’t Miss: What Kind Of Loan Do You Use To Buy Land

Compare Rates From Different Lenders

Before applying for a personal loan, its a good idea to shop around and compare offers from several different lenders to get the lowest rates. Online lenders typically offer the most competitive rates and can be quicker to disburse your loan than a brick-and-mortar establishment.

But dont worry, comparing rates and terms doesnt have to be a time-consuming process.

Credible makes it easy. Just enter how much you want to borrow and youll be able to compare multiple lenders to choose the one that makes the most sense for you.

Getting The Best Rates

Personal loan interest rates are based on a number of factors, including your overall creditworthiness, credit score, income and debt-to-income ratio. Two quick ways to help you receive more favorable rates include paying down existing debt to help lower your DTI and improving your credit score.

Rod Griffin, senior director of consumer education and advocacy at Experian, recommends checking your credit report and scores three to six months before you apply for a personal loan, as this will give you enough time to make any necessary improvements.

While qualification requirements differ across lenders, a minimum credit score of 720 will typically yield you the best terms. If your score falls below this marker, and youre on a quest for the lowest rate possible, you can take action to improve your score. Try strategies like lowering your credit utilization ratio, removing errors from your credit report and paying your bills early or on time.

Read Also: What Car Loan Will I Be Approved For