What Are Points On A Mortgage

Mortgage discount points allow you to essentially buy a lower interest rate when it comes to home loans. Heres how it works:

A 0.25% discount might not look like a lot on paper, but over the course of a 30-year mortgage, points can mean serious savings.

On a $300,000 loan, for example with a 20% down payment and no mortgage insurance the difference between a 3.50% rate and a 3.25% rate would be about $33 per month and nearly $12,000 over the life of the loan.

Heres how two home loans would look with and without points:

| Total interest paid over loan term | $147,975 | |

| Total payments over loan term | $387,975 | $376,018 |

| Note: All numbers here are for demonstrative purposes only and do not represent an advertisement for available terms. |

Buy Down Break Even Point Calculator

You dont need a special points calculator to determine the amount of mortgage points being charged. There are three steps to determine if is it worth paying points:

Better Mortgage Can Point The Way

The decision to purchase mortgage points depends on several factors, including the types of loans and interest rates available to you. If youre unsure whether purchasing mortgage points is the right move for you as a homebuyer, getting pre-approved can help clarify your budget and see details about your loan options. At Better Mortgage, you can get pre-approved in as little as 3 minutes.

Recommended Reading: Jp Morgan Chase Lien Release Department

Comparing Monthly Mortgage Principal & Interest Payments With Discount Points

A home-buyer can pay an upfront fee on their loan to obtain a lower rate. The following chart compares the point costs and monthly payments for a loan without points with loans using points on a $200,000 mortgage.

| Points | |

|---|---|

| $9,072.22 | $17,997.21 |

Some lenders advertise low rates without emphasizing the low rate comes with the associated fee of paying for multiple points.

A good rule of thumb when shopping for a mortgage is to compare like with like. Shop based on

- annual percentage rate of the loan, or

- a set number of points

Then compare what other lenders offer at that level.

For example you can compare the best rate offered by each lender at 1 point.

Find the most competitive offer at that rate or point level & then see what other lenders offer at the same rate or point level.

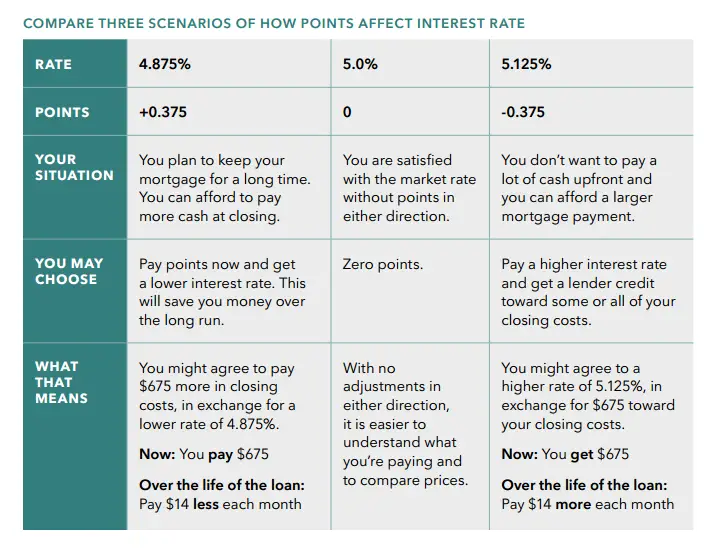

About Negative Points And Fractional Points

Negative discount points are an option a lender may offer to reduce closing costs. They work just opposite of positive discount points instead of paying money to receive a lower rate, you are essentially given money in return for a higher rate.

These are often a feature of “no closing cost” mortgages, where the borrower accepts a higher rate in return for not having to pay closing costs up front. This Mortgage Points Calculator allows you to use either positive or negative discount points.

Fractional points are commonly used by lenders to round off a rate to a standard figure, such as 4.75 percent, rather than something like 4.813 percent. Mortgage rates are typically priced in steps of one-eighth of a percent, like 4.5, 4.625, 4.75, 4.875 percent, etc., but the actual pricing is more precise than that. So lenders may charge or credit a fractional point, like 0.413 points or 1.274 points to produce a conventional figure for the mortgage rate.

Read Also: How Do I Find Out My Auto Loan Account Number

What Is A Basis Point

A basis point is a unit of measurement frequently used in finance. It is equal to 1/100th of 1 percent, which is 1 permyriad. The concepts of percent, permille, permyriad, and basis point are related in the following manner:

1 percent 1% = 1/100

1 permille 1 = 1/1000

1 permyriad 1 = 1/10000

Our basis point calculator uses these equations to help you convert basis points to percents and permilles.

To know more about how percentage works, check out our percentage calculator.

What Are The Steps To Solving This Discount Point Math Question

I like this one because this is a pretty easy question. That is as long as you know the concept of a discount point. And since Im trying to show how the concepts of these questions can be related to many variations why dont I illustrate this concept here.

That said, the discount point is one percent. Now theres two twists on this within this question. One, its giving you two numbers to try and throw you off. One of which you ignore because, well, it wants 1% of the loan amount and only one of those numbers is the loan amount.

It says the guy obtained a mortgage for $288,000 and thats the number we now take 1% of. So

Lets calculate that 1% of 288,000 is $2,880

Now the second twist it says he is getting charged two points. So thats 2%. The way I do that is simply multiplying 2,880 by 2 which is $5760. Seems way more complicated than it is but if you know that a discount point is 1% youre good to go.

Recommended Reading: Va Loan On Mobile Home

Should I Buy Down For A Lower Interest Rate

Discount points or mortgage points refer to money you pay your lender during closing time to enjoy savings over the term of your loan. If you have the cash to spare and the numbers make sense, buying points to lower your interest rate can mean less money paid monthly and over the course of your mortgage.

Use this calculator to help determine if this makes sense for you.

Buying down the rate refers to the process of paying fees to your lender at closing to get a discount on the mortgage rate. The amount you need to pay and the amount you will get in return will depend on the market and on your lender.

Mortgage Calculator: Should I Buy Points

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Also Check: Why Is My Car Loan Not On My Credit Report

How To Calculate Mortgage Points

Let’s be honest – sometimes the best mortgage points calculator is the one that is easy to use and doesn’t require us to even know what the mortgage points formula is in the first place! But if you want to know the exact formula for calculating mortgage points then please check out the “Formula” box above.

The Bottom Line: Mortgage Points Can Save You Money

Though mortgage points and prepaid interest may be right for some borrowers, they dont make financial sense for everyone. To determine whether you can save with discount points, you have to crunch the numbers. Sit down and assess your budget, down payment, loan terms and future plans before you close. Determine your breakeven point and your likelihood of staying in the home to understand if discount points will save you money in the long run when refinancing or buying a home.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Read Also: Usaa Refinance Car

Key Things To Know About Mortgage Points

The terms around buying points can vary greatly from lender to lender. Here are some important things to consider:

- The interest rate reduction you receive for buying points is not set and depends on the lender and the marketplace.

- Buying points may give you a tax benefit. Contact a tax professional to see whether doing so might affect your tax situation.

- Points for adjustable-rate mortgages typically provide a discount on the loans interest rate only during the initial fixed-rate period. Run the numbers to ensure that your break-even point occurs well before the fixed-rate period expires. For Bank of America customers, however, if rates go up during the adjustable period, your rate will be lower based on the points you initially purchased.

- If you need to decide between making a 20 percent down payment and buying points, make sure you run the numbers. If you make a lower down payment, you may be required to carry private mortgage insurance . Check to see if this additional cost would cancel out the benefit youd get from buying points and lowering your interest rate. The Affordable Loan Solution® mortgage from Bank of America can help eligible low- and moderate-income borrowers secure a home loan with a down payment as low as 3 percent and no PMI required.1

Pros And Cons Of Using Home Mortgage Points

Mortgage points can help you reduce the cost of your loan, but only if you fully understand the advantages and potential drawbacks. Heres what you should know before agreeing to pay points.

The benefits of paying points on a mortgage

When you purchase mortgage points, you gain instant access to a lower interest rate. This means a lower monthly mortgage payment, which can help lessen some of the immediate financial strain on your budget and add up to a substantial amount of savings throughout the duration of your loan.

Buying mortgage points can help you maximize the power of your real estate budget you may even be able to buy a higher-priced home than you originally thought possible by reducing the cost of your monthly payment. Mortgage points may also be tax-deductible .

The drawbacks of mortgage loan points

The most obvious drawback to purchasing mortgage loan points is having to pay higher closing costs. Depending on your overall budget for closing costs, the fee for purchasing mortgage points could impact how much money you can afford to allocate toward your down payment.

Youll want to compare if the savings on your interest rate outweigh the associated costs of carrying a higher loan balance. For example, private mortgage insurance is often required on home loans where the borrower puts less than 20% down.

Also Check: What Is The Commitment Fee On Mortgage Loan

How Do You Calculate Basis Points For Commission

What Determines The Amount Of A Discount Point

Each discount point is equal to one percent of the loan amount. Confusion in this area is what usually trips people up on the real estate exam. A discount point is equal to one percent of the loan amount NOT the purchase price. Be careful of this on the test.

For example, if a buyer purchases a home for $500,000 and puts 20% down in cash while obtaining an 80% loan to finance the rest a discount point would be equal to one percent of $400,000, NOT $500,000. $400,000 is the loan amount, which is 80% of the purchase price. In this case, a point would be equal to $4,000, which is 1% of $400,000.00.

Here is a sample discount point real estate license test question:

Gerry purchases a home for $350,000, and obtains a 4.5% loan for $315,000, with three discount points. How much did Gerry pay total for the discount points?

A. $10,500D. $9,450

Answer: D

Explanation: You have to know two pieces of information to get this question correct. First, you have to know the cost of a point, which is one percent. Second, you have to know that it is one percent of the loan amount, not the sale price of the property.

Discount points are used by lenders to increase the yield on the loans they provide. For a borrower, it is a way to buy down the interest rate on the loan during the term of the loan. Additionally, the money paid for the discount points is generally tax deductible to the borrower.

Recommended Reading: How Long For Sba Loan Approval

Mortgage Points Vs Origination Fees

As mentioned above, mortgage points are tax deductible. Loan origination fees are not.

Loan origination fees can be expressed in Dollar terms or as points. A $200,000 loan might cost $3,000 to originate & process. This can be expressed either in Dollars or as 1.5 origination points.

Origination fees are negotiable but they help a lender cover their basic overhead & mitigate the risk a consumer may pre-pay their mortgage before the overhead is covered. On conforming mortgages this fee typically runs somewhere between $750 to $,1200.

These fees are typically incremented by half-percent. The most common fee is 1%, though the maximum loan origination fee is 3% on Qualified Mortgages of $100,000 or more.

- Smaller homes may see a higher origination fee on a percentage basis since the mortgage broker will need to do a similar amount of work for a smaller loan amount. On loans of $60,000 or below the cap can be as high as 5%.

- VA loans have a 1% cap on origination fees.

- FHA reverse mortgages can charge a maximum of the greater of $2,500, or 2% of the maximum mortgage claim amount of $200,000 & 1% of any amount above that.

Amortization Of A Mortgage Depends On The Apr And Loan Amount

There are several ways to solve this equation. If you are a bit rusty with polynomial equations, you can just guess until you get close enough using Excels built-in formula: PMT. Enter this formula =PMT in a cell and play around with the r variable until you get the right monthly payment.

Notice Excel uses the monthly interest rate, so you need to divide the APR by 12. For example, a 3% APR would be 0.03/12 or 0.0025. Using our example the cell would include =r, 120, 244000 with r being the APR we are trying to find. I started with 4%. A little too high. I tried with 3.5%. Close but too low. After a couple of tries, I found that an APR of 3.54% gives you a monthly payment of $1.500.56. Close enough.

You May Like: Does Va Loan Work For Manufactured Homes

How To Calculate Points On A Loan

Points on loans are most often found on secured loans–specifically mortgages. Points are percentages of a total loan amount. Points are either added to a principal loan amount or paid out of pocket by a borrower. There are two different types of mortgage points: origination points and discount points. Origination points are often called “the cost of doing business,” while discount points can be paid to reduce a mortgage interest rate. Calculating these points is easy.

Calculate your origination points. For example, if you are obtaining a $200,000 mortgage and you are required to pay 1.5 percent in origination, simply multiply the fractional equivalent of this percentage by the total loan amount. In this case your origination is $3,000.

Calculate your discount points, if you choose to pay them. Using the scenario in the step above, say you will be paying half a point to reduce your rate a half a point. Simply multiply your mortgage amount by the fractional equivalent of half a point . Your discount points will be $1,000.

Add your origination and discount fees together. In this example, your total points will cost you $4,000.

References

Talking About Discount Points

Discount points are essentially prepaying a certain amount of your interest. In order to give a borrower a lower interest rate, the lender will charge you discount points. This is considered buying down your interest rate since you are making a payment upfront in order to obtain a lower rate throughout the life of your loan.

Each percentage of your loan is the same as one discount point. If you select to roll the VA funding fee into your mortgage, the total amount, mortgage plus funding fee, is used to determine the amount of each discount point. As an example, if the total amount of your loan is $300,000, then one discount point is $3,000.

There is an assortment of interest rates and closing costs available when looking around for a mortgage. Below is a snapshot of what a VA Mortgage borrower with great credit would qualify for as of early 2015.

| Interest Rate | |

| 2.000% | 3.000% |

As you can see, with the lower interest rates, you will have to pay more in origination fees and discount points. So, how can you determine if paying more upfront will lead to paying less over the life of your loan? There is a simple calculation to figure out how much time it will take for the lowered monthly payments to justify paying for discount points up front. Here it is:

= X

÷ X = Number of months it will take before discount points offset lower payments

Heres how the calculation would work out in the example below:

1,706.37 1,679.97 = 26.40

3,800 ÷ 26.40 = 144 months or 12 years

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

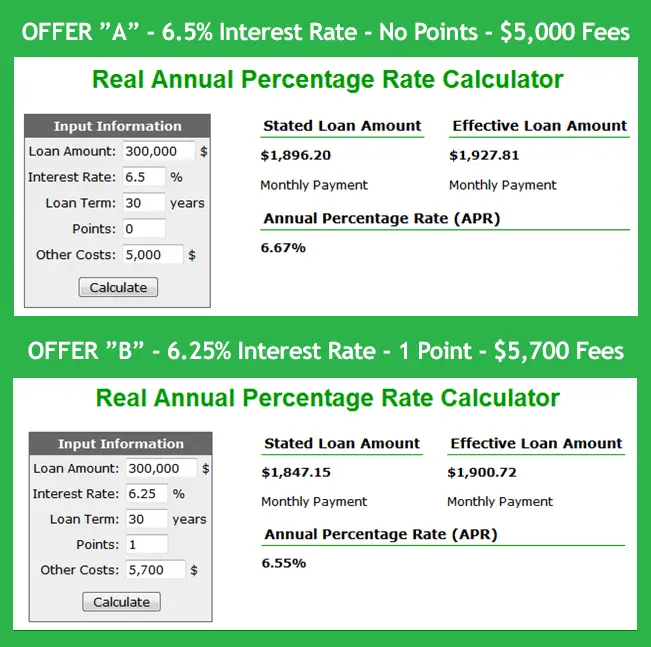

The Interest Rate Your Lender Gives You Isn’t The True Cost Of Your Mortgage

Image: www.401kcalculator.org

When you apply for a mortgage, your lender will probably quote you an interest rate — say, 4.5%. The problem with the interest rate is that is doesn’t usually reflect the true cost of borrowing money, as mortgages can come with up-front fees and costs, particularly discount points. To compare the true cost of a mortgage loan, it’s helpful to determine its effective interest rate, which is also referred to as the annual percentage rate, or APR.

How to calculate the effective interest rate, or APRThe calculation of APR involves a rather complex mathematical formula, but there is a relatively easy “shortcut” method you can use that involves a little bit of trial and error.

- Open a mortgage calculator like this one from Bankrate.

- Add up your discount points, origination fees, and other up-front costs like mortgage insurance premiums .

- Add this amount to the loan amount.

- Using the mortgage calculator, input this adjusted loan amount, along with your loan’s stated interest rate, in order to determine your adjusted monthly payment.

- Finally, using the mortgage calculator, input the original loan amount and find the interest rate that corresponds with the adjusted monthly payment. This is your loan’s effective interest rate, or APR.

An exampleLet’s say your lender offers you a $200,000 mortgage at 4% interest. The lender charges one discount point and an origination fee of $750, making the total up-front cost $2,750.