How To Use The Reverse Auto Loan Calculator

If you know what you can afford each month, a reverse auto loan calculator can tell you how that translates into the total amount you can borrow. Of course, there are variables: the length of the loan and the interest rate you get.

Below you can see how your loan amount changes by moving the sliders for payment and loan term. We’ve provided average rates by credit tier as determined by Experian Automotive.

About the authors:Philip Reed is an automotive expert who writes a syndicated column forNerdWallet that has been carried by USA Today, Yahoo Finance and others. He is the author of 10 books.Read more

Shannon Bradley covers auto loans for NerdWallet. She spent more than 30 years in banking as a writer of financial education content.Read more

How To Calculate Apr On A Loan

To calculate APR, follow these steps:

For example: Finding the APR of a short-term loan of $500 with $60 in total fees and interest and a 14-day term:

What You Need To Know

Before you can calculate your exact payments, youll need to collect some information about your car and finances. The Consumer Financial Protection Bureau has a handy worksheet you can use to gather this information. Just fill in your details next to the example scenario.

First, figure out the overall value of the car and registration. This figure includes the sticker price of your car, along with any taxes, titling fees, warranties, and prior car loan amounts being rolled over into your new car loan. Once youve calculated this cost, you can subtract your down payment, along with any applicable rebates and the trade-in value of your previous vehicle.

Next, take a close look at the terms of the loan. To determine the car payment amount, you will need to know the length of the loan and the interest rate you will pay. The period of vehicle loans is generally stated in months, even if it lasts for years.

The CFPB has documented a steady rise in the length of car loans. Term lengths of six years or more made up just 26% of car loans issued in 2009. By 2017, these long-term loans made up 42% of car loans.

Also Check: Car Refinance Usaa

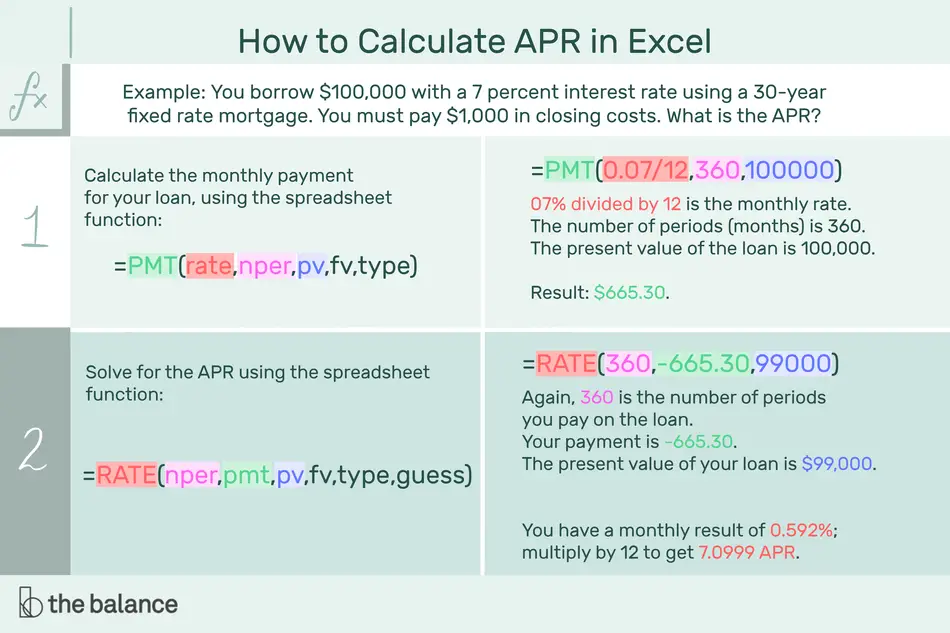

How Do I Calculate Apr On My Car Loan

I’m trying to organize my finances for my future and would like to figure out my APR. However, I don’t understand how it’s determined. How do I calculate my APR on my car loan?

your interest rate, loan amount, duration of your loan, and any additional feesdetermine theRATEfinancial

- The months of your loan term

- Estimated monthly payments

- Value of the loan minus fees

write into the cell on your spreadsheetestimaterefinancing

What Is An Apr

Every auto loan has an APR, which is the annual cost youre charged by the lender for borrowing money. Its slightly higher than the base interest rate the loan carries because it includes fees for servicing the loanlike documentation of the title and taxes, dealer prep and other fees associated with the transaction.

The higher the APR, the more you will pay back to the lender over the life of the loan. This is why its important to shop around for the loan.

You May Like: Bayview Loan Servicing Charlotte Nc

Car Loan Calculator Jd Power

What finance/car loan interest rate do you qualify for? 3.95% is based on average credit score. 5. Loan Term

Use Carvanas auto loan calculator to estimate your monthly payments. See how interest rate, down payment & loan term will impact your monthly payments.What is the usual loan term for an auto loan?How do you calculate monthly car payments?

Use our new and used auto loan payment calculator to estimate your monthly payments, finance rates, payment schedule and more with U.S. Bank.

Use this helpful car payment calculator to determine what your monthly auto loan payment will be, and let us help you secure a loan with great rates for

Heres an example of an annual amortization schedule. Car Price: $20,000. Interest Rate: 4.5%. Loan Term: 60 months. Down Payment: $2,000. Sales Tax: 6%. Titles

Lets calculate a monthly budget that works for you. Vehicle budget APR. Estimated based on your credit rating. How financing works at CarMax.

With dealer financing, the potential car buyer has fewer choices when it comes to interest rate shopping, though its there for convenience for anyone who Loan Term: monthsYour State: Select AlabamaAlaskaArizona

Why Is Apr Important

Knowing the APR on a car loan is important because it helps you understand how much borrowing money from that lender will cost you. The lower the APR, the less youll pay to finance your car.

When comparing loans side by side, pay attention to the APRs to help identify the least expensive loan. The difference of even just one percentage point can add up over time.

For example, lets say youre comparing two $23,000 loans, each with a four-year term. One loan has a 5% APR and the other has a 6% APR. Youd end up paying $503 more in interest on the loan with the 6% APR than you would on the loan at 5% APR.

Recommended Reading: Refinance Car Loan Usaa

How To Find The Apr Of A Credit Card

As a credit card user, chances are you will have to take on some credit card debt at some point in your life. Credit card providers in the United States are required by law to disclose the interest rate of their credit cards to customers. The annual rate youll pay depends on the credit card you choose and your credit score. Those with high credit scores will receive offers with lower interest rates, while those with lower credit scores will receive offers for credit cards with a higher interest rate. When shopping for credit cards, be sure to note the interest rate of the card being offered and compare its APR vs. that of other cards.

Here are some helpful tips from SuperMoney on how to improve your credit score and get better loan offers, credit card offers, and lower interest rates.

What Is The Loan Payment Formula

The payment on a loan can also be calculated by dividing the original loan amount by the present value interest factor of an annuity based on the term and interest rate of the loan. This formula is conceptually the same with only the PVIFA replacing the variables in the formula that PVIFA is comprised of.

Recommended Reading: Refinance Car Loan Usaa

Also Check: Usaa Pre Approval For Mortgage

The Truth In Lending Act Mandate Of Apr Disclosure

In 1968, Congress passed the Federal Truth in Lending Act. The law introduced the concept of the APR, a game-changer for the credit industry.

Before this act was passed, lenders used a variety of misleading and inconsistent methods to calculate interest. Now, most lenders must disclose the total cost of loans by providing potential borrowers with an APR.

However, some lenders prefer not to disclose the APR of their products and instead advertise the cost as a flat fee or monthly interest. This article will teach you how to calculate the APR of the main loan products available.

Dont Miss: How Long For Sba Approval

How Do They Calculate Your Car Loan Apr

The annual percentage rate calculated on your car loan is found by taking the rate per period multiplied by the number of payments you will make in a given year. Annual percentage rate is one way to determine the actual expense of financing in a given year, but it is not always the most accurate. You should also consider the effect of compounding interest. You can find this through the annual percentage yield.

When to Use Annual Percentage Yield

Your car lender will often advertise a rate in terms of APR. This means the lender is not showing you the cost of compounding the interest. When you are seeking a new loan or debt, you should always calculate the annual percentage yield in order to determine a more accurate financing cost. Consider the following example.

You have a $5,000 car loan with an interest rate of 2% per month over a 48 month period.

- APY = multiplied by 12 months -1 = 2.68% APY

This means, when your interest compounds, you are actually paying 2.68% in interest payments each year instead of just 2%. This will greatly increase the total cost of your financing, which can lead you to take too large of a loan. You should always consider APY when you are taking on a new debt to determine the accuracy of the offer a dealer or lender is making to you.

When to Use Annual Percentage Rate

Other Debts that Compound

Also Check: Does Usaa Do Auto Loans

How Can I Lower My Apr With Waycom

If youre someone whos already paying for a car loan with a high APR, auto refinancing with Way.com is a great way to lower your APR and save money in the long term. The best part is that you neednt go searching for the best deals to lower APRs you have them all on one platform! By just inputting some initial loan details, Way.com will show you multiple lenders willing to refinance your auto loan.

Simply head over to the Way.com Refinance section and use the auto loan calculator to find out how much you can save. Then, compare offers from several of our partners and choose the refinance offer that most appeals to you.

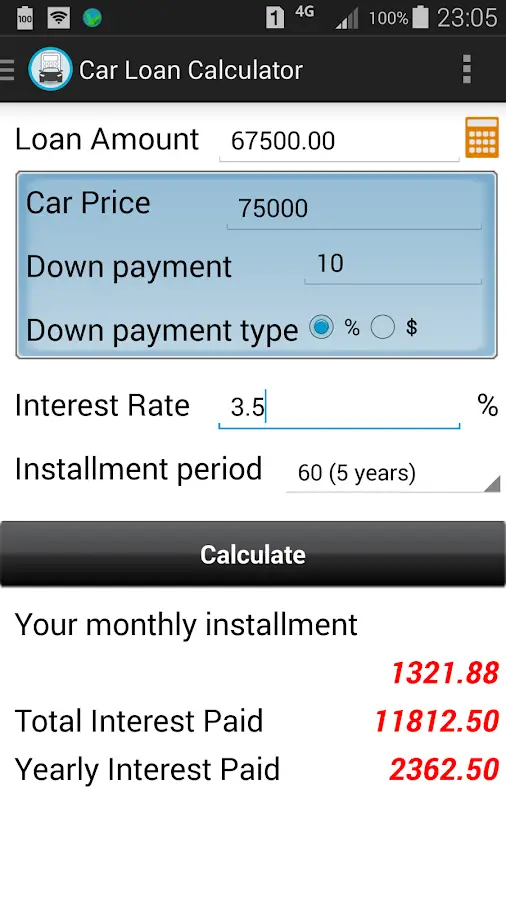

Use A Car Loan Payment Calculator

Skip the hassle of math formulas and get straight to the answer you’re looking for by plugging the necessary information into a loan calculator. A calculator makes it easy to input different combinations of numbers, allowing you to instantly compare the costs of loans.

Some loan calculators allow you to check how increasing your monthly payment affects how fast you can pay your loan off. These variables help you plan ways to reduce your debt. Technically, you can use car loan payment calculators on any of your loans. As long as you know your loan factors, the calculator will work.

Also Check: Fha Vs Conventional 97

Things To Consider When Shopping For A Vehicle

When an individual buys a car, they are typically buying the transportation they will rely on for years to come. For most people this is a major investment, second only to the purchase of a home. Most drivers intend to own the car for a long while. After all, few people have the resources or options to upgrade their vehicle often. The average auto loan hit a record of $31,455 in the first quarter of 2018, with the average used car loan running $19,708. Americans have over $1 trillion in motor vehicle credit outstanding.The following table from Experian shows how much people with various credit ratings typically are charged for loans.

| Borrower |

|---|

Do Not Forget About Car Insurance

Some people forget about the cost of car insurance while budgeting for a new car. It is essential to work that cost into your monthly budget. All 50 states require drivers to have some kind of auto insurance, so this step isnt optional.

Insurance costs vary by the car you drive. If youre considering a new car, get a new insurance quote. This quote will help you more accurately budget for your new car.

You May Like: Parent Plus Loan Interest Deduction

How To Use Credit Karmas Auto Loan Calculator

A car could be one of the biggest purchases youll ever make. Thats why its important to understand how various factors can affect how much you pay to finance a car.

Whether youre just starting to shop for a car or are ready to finance a particular make and model, getting a sense of your monthly loan payment can help with your decision.

Our calculator can help you estimate your monthly auto loan payment, based on loan amount, interest rate and loan term. Itll also help you figure out how much youll pay in interest and provide an amortization schedule .

Keep in mind that this calculator provides an estimate only, based on the information you provide. It doesnt consider other factors like sales tax and car title and vehicle registration fees that could add to your loan amount and increase your monthly payment.

Here are some details on the information you might need to estimate your monthly loan payment.

What The Vehicle Loan Really Costs

When it comes to APR vs. interest rate, the APR actually takes into account the total finance charge you pay on your loan, including prepaid finance charges such as loan fees and the interest that accumulates before your first loan payment. When shopping for a loan, make sure youre comparing each lenders APR along with the interest rate.

You May Like: How Long Until Sba Loan Approval Take

Car Loan Apr Calculator

See the real APR of your auto loan by factoring in the interest rate and all the associated costs .

What is your loan’s total interest and fees together?

What’s your loan principal?

How many days in your loan’s term?

Read our 13003 Certified Reviews

We help people save money on their auto loans with a network of 150+ lenders nationwide.

* This value was calculated by using the average monthly payment savings for all RateGenius customers from January 1, 2020 through December 31, 2020.

How To Calculate Apr On A Credit Card

Calculating APR on credit card is different than the method for other loan products. Credit card APRs change as the interest rates and prime rate set by the banks change. A bank or credit card issuer isnt legally obligated to notify you, so its important to monitor for changes.

To find a credit cards APR, add the current U.S. bank prime loan rate and the interest rate the credit card issuer charges. For example, the U.S. prime rate is currently 5%. If the card providers interest rate is 4%, the consumer credit card rate will be 9% APR 5% prime rate + 4% card interest rate = 9% APR.

Don’t Miss: Capital One Auto Loan Minimum Credit Score

Use The Edmunds Auto Loan Calculator To Determine Or Verify Your Payment

You’re gearing up to buy your next car but aren’t sure what the monthly car payment will look like. Getting to a monthly payment usually involves some math, but the good news is that the Edmunds auto loan calculator will do the heavy lifting for you.

Let’s say you have your eye on a compact car or SUV. Choose the make and model you want, or alternatively enter the vehicle’s price into the auto loan calculator. It will ask for a few other details such as the down payment, the loan term, the trade-in value and the interest rate. After that, it will calculate the compound interest, estimate tax and title fees, and display the monthly payment.

This car loan calculator will help you visualize how changes to your interest rate, down payment, trade-in value, and vehicle price affect your loan. Take some time to experiment with different values to find an auto loan setup that works best for your budget.

Which Auto Loan Calculator Should You Use

Use the auto loan payment calculator if you know what you expect to spend.

For example, perhaps you think you can afford a $20,000 loan on a new car. A 48-month loan for the most creditworthy borrowers would be 3% or less. At that rate, you’d pay about $440 a month and $1,250 in interest over the life of the loan. A subprime rate might be 11%, making the payments about $515 and you’d pay more than $4,500 in interest.

Many people reduce payments by lengthening the term of the loan. If you change the term to 60 months, payments on that $20,000 loan at 11% fall from $515 to $435. However, you would pay nearly $6,100 in interest, or an additional $1,600, for doing so.

Use the reverse auto loan calculator if you have a specific monthly payment in mind. Say you have decided that you can afford to spend $350 a month on car. Depending on the interest rate and length of loan you choose, a $350 car payment could repay a $15,600 car loan at 3.66% in 48 months or a $19,100 loan at 60 months.

Read Also: Usaa Used Auto Loan Rates

Calculating Apr Can Help You Make Better Financial Decisions

Learning how to calculate APR on credit cards and loans is a useful skill for when you want to compare the best loan offers. Comparing interest rates doesnt provide the whole picture. Because the APR accounts for interest rate and other costs of borrowing money, youll be able to make a wiser decision on what a loan will truly cost you.

What Is A Good Apr Based On My Credit Score

To get a good baseline of your APR, well start with the average rate for an auto loan based on certain credit score ranges. Vehicle buyers with an excellent credit score ranging from 780 to 850 were able to get new vehicle loans for an average rate of 2.47%. Conversely, buyers with lowest-range credit scores from 300 to 500 saw average rates of 12.53%, according to Experian. Here is the break-down of interest rates based on credit scores for new and used vehicle purchases.

| Average rate for new vehicle loan |

|---|

Recommended Reading: Mlo Endorsement