What Are The Eligibility Requirements For A Parent To Get A Direct Plus Loan

- You must be the biological or adoptive parent of the student for whom you are borrowing.

- Your child must be a dependent undergraduate student who is enrolled at least half-time at a school that participates in the Direct Loan Program. Generally, your child is considered dependent if he or she is under 24 years of age, has no dependents, and is not married, a veteran, a graduate or professional degree student, or a ward of the court.

- You cannot have an adverse credit history .

- In addition, you and your child must be U.S. citizens or eligible non-citizens , not be in default on any federal education loans, not owe an overpayment on a federal education grant, and meet other general eligibility requirements for the federal student aid programs.

Plus Loan Eligibility And Application Process

From the Department of Educations website:

To take out a Direct Loan for the first time, you must complete a PLUS Application and master promissory note . The MPN is a legal document in which you promise to repay your loan and any accrued interest and fees to the Department. It also explains the terms and conditions of your loan. The MPN will be provided either by your child’s school or the Department.

If your child’s school offers the option of completing the MPN electronically, you can do so online at the StudentLoans.gov website. If you are borrowing Direct PLUS Loans for more than one student, you’ll need to complete a separate MPN for each one. To complete an MPN online, you will be required to use your Department of Education-issued PIN . If you do not have a PIN, you may request one from the official PIN site.

In most cases, once you’ve submitted the MPN and it’s been accepted, you won’t have to fill out a new MPN for future loans you receive to pay for the educational expenses of the same student. Unless your child’s school does not allow more than one loan to be made under the same MPN, you can borrow additional Direct Loans on a single MPN for up to 10 years.

You’ll receive a disclosure statement that gives you specific information about any loan that the school plans to disburse under your MPN, including the loan amount and loan fees, and the expected loan disbursement dates and amounts.

When Parent Plus Loans Are A Bad Idea

A Parent PLUS Loan can also quickly become a financial risk. As the parent taking out the loan, you are legally responsible for repayment. Many students and their parents who decide to take out Parent PLUS Loans come to an agreement that the student will take on loan repayment. However, students often fail to make payments, leaving their parents with a hefty financial burden and a possible dent to their credit score.

Don’t Miss: Fha Land Loan

The Nitty Gritty On The Steps Involved In Double Consolidation

The strategy is called double consolidation, but youre actually consolidating three times with three different servicers . Thats why it takes time. According to the federal government, consolidation takes 30-90 days, though Landress has seen 30-45 days.

Typically, you wont start the process until after youve finished borrowing for your student that could be four or more years after the first loan and its generally best to leave your own education loans out of the process because you dont want to restart the clock on those loans if theyre already in one of the income-driven plans.

Landress has written a very detailed article on double consolidation, but heres an overview.

Should You Take Out A Parent Plus Loan

Parent PLUS loans can be a smart option for some borrowers, but theyre not always the best choice for every family.

Here are some situations where getting a parent PLUS loan could make sense for you:

- Youve exhausted all other financial aid. If your child has received all of their available subsidized and unsubsidized loans and there are gaps in coverage, a parent PLUS loan might be helpful.

- You can make payments yourself. As the parent borrower, youre responsible for repayment, not your child. So make sure youre ready for that obligation. Also note that even if you consolidate your parent PLUS loan, it cant be consolidated with other federal loans. You might be able to combine all your loans by refinancing with a private lender and even have the option to transfer it into your childs name, but not all lenders offer this option.

- You want to avoid private student loans. Even though private student loans are available year-round, they dont come with the same benefits and protections that federal student loans do. Since PLUS loans allow you to borrow up to the cost of attendance after other aid is given, you might not need to tap into private student loans at all.

Don’t Miss: Can You Refinance An Upside Down Car Loan

I Was Awarded A Parent Plus Loan Should I Take It

Several different types of financial aid are available for students enrolling in college, including scholarships, grants and loans. While scholarships and grants require no repayment, borrowers must eventually repay the full balance of their student loans plus interest.

As the parent of a student in college, you may be offered a unique type of financing known as a Parent Loan for Undergraduate Students, or PLUS loan. Before you decide whether to accept a PLUS loan, it helps to learn a little about how these loans work.

You May Like: How Long Does Sba Approval Take

Parent Plus Loan Limits

You can borrow up to your childs full cost of attendance each school year, minus all other student aid. Your childs school sets the cost of attendance, which is a sum of all education-related expenses.

Student aid such as scholarships, grants, or your childs student loans are applied to this total cost. The difference between student aid granted and remaining costs is how much you can borrow with parent PLUS loans.

Read Also: Rv Payment Calculator Usaa

Read Also: Usaa Auto Refinance Phone Number

Parent Plus Loan Deadlines

Because the Parent PLUS Loan requires the FAFSA, students should follow the appropriate FAFSA deadline .

The FAFSA opens on October 1st every year for the upcoming school year. It closes on June 30 of the school year the FAFSA is used for. For example, the 21/22 FAFSA opened on Oct 1, 2020, and it will close on June 30, 2022.

Remember, the Parent PLUS loan includes the extra step of the supplementary application, so keep that in mind!

Recommended Reading: Bayview Mortgage Modification

Fill Out The Loan Application

Once your child submits the FAFSA, you can apply for parent PLUS loans. You can usuallyapply for PLUS loans online, but some colleges have their own procedures. Contact the financial aid office of your childs college to see what their process is for PLUS loans.

To complete the application, youll need to provide the following information:

- Requested loan amount

- Student information

- Employer information

The application will prompt you to consent to a credit check. If you have an adverse credit history, your application for a PLUS loan may be denied unless you add a co-signersomeone with good credit who shares responsibility for the loanto the application.

Recommended Reading: Usaa Student Loans Review

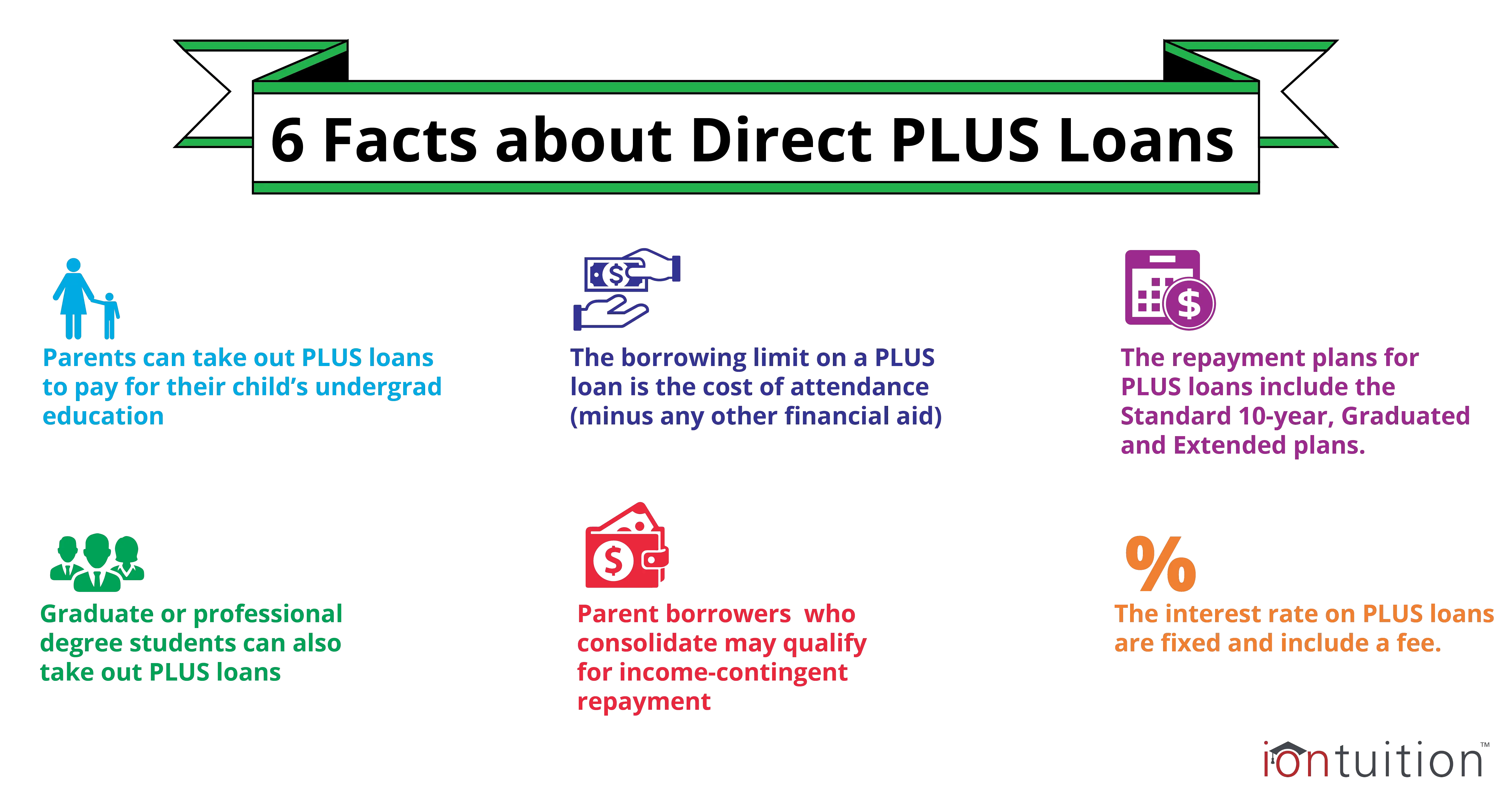

What Are Parent Plus Loans

Parent PLUS loans are offered by the Department of Education. They are loans that are taken out by a parent to help pay for their childs education. Only the biological or adoptive parents of a student can take out a PLUS loan for them. PLUS loans are taken out in the parents name, therefore the parent is responsible for repayment of the debt.

Parents can take out a PLUS loan for up to the schools cost of attendance.

What Is Double Consolidation And What Does It Do

Double consolidation is an unintended loophole in student loan legislation that gives parents more repayment options tied to their earnings. The rules technically state that theres only one income-driven repayment plan available to parent borrowers, the Income-Contingent Repayment plan, and parents can only use it after they consolidate PLUS loans into a Direct Consolidation Loan. That plan caps monthly payments at 20% of your discretionary income and forgives the balance after 25 years of payments.

When you consolidate twice, however, you essentially erase the fact that the original loans were parent loans, and in doing so, you gain access to the income-driven plans for student borrowers.

Those plans, called Income-Based Repayment , Pay as You Earn and Revised Pay as You Earn , set payments based on either 10% or 15% of your discretionary income, says Meagan Landress, a certified student loan professional with Student Loan Planner. The plans also define discretionary income in a way that shields more of your earnings from the payment calculation. In other words, your monthly bills drop to 10% or 15% of your income and that percentage is based on a smaller portion of your take-home pay. Like with income-contingent repayment, the government forgives any balance remaining after a maximum of 25 years.

Double consolidation isnt outlined on the federal website, nor will your loan servicer suggest it. In fact, they might not know about it. Its not illegal, though.

Also Check: Investor Loans With 10 Down

Help Your Child Complete The Fafsa

Your child has to complete the Free Application for Federal Student Aid to qualify for federal, state and even school-based financial aid. If your child doesnt submit the FAFSA, you wont be eligible for parent PLUS loans.

Your child will fill out the FAFSA for the first time as a high school senior. After that, they must renew their FAFSA every year that theyre in school.

Your child can submit the FAFSA online, or they can fill out and mail in a physical copy. According to the Department of Education, most people can fill out the FAFSA in under an hour. For students renewing their FAFSA, it can take even less time.

Discharge Options For Parent Plus Loans

The terms forgiveness and discharge have the same essential meaning, but theyre used to refer to different conditions for loan cancellation.

When your loans are erased because you work in a certain type of job, the government refers to that as forgiveness, while the situations below are considered circumstances for discharge. In both cases, youre no longer required to make loan payments and your repayment is considered complete. Here are the cases when parent PLUS loans are eligible for discharge.

- Discharge due to death. If the parent PLUS borrower or the child for whom they took out a loan dies, the loan is forgiven. To receive the discharge, documentation verifying the death must be provided to the student loan servicer.

- Total and permanent disability discharge . If the parent borrower becomes totally and permanently disabled, their loans may be discharged. The government reaches out to eligible Social Security recipients with student loans to let them know TPD is available to them, but others can apply proactively through the federal website DisabilityDischarge.com.

- Closed school discharge. Parents may also be eligible for discharge if their childs school closed before the child could complete their degree program. Contact your student loan servicer to identify whether youre a candidate.

Don’t Miss: Can You Refinance An Fha Loan

How Do Parent Plus Loans Work

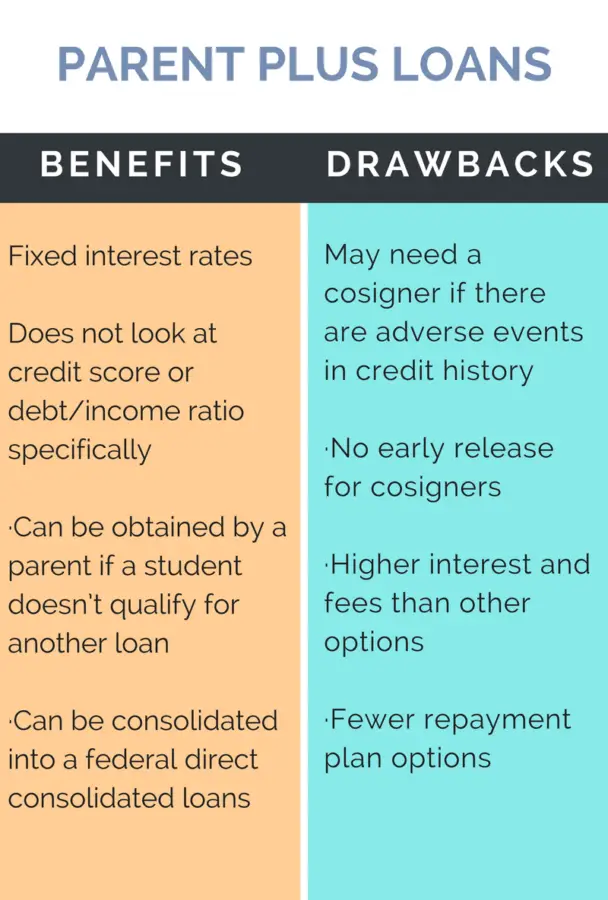

Parent PLUS Loans are federal student loans in the parents name, rather than the students. These loans are available to parents of dependent undergraduate students and could be a good option if applicants cant qualify for enough funding through the less-expensive Direct Subsidized and Unsubsidized Loan programs.

All borrowers get the same rates and fees, which Congress sets each year. And the credit requirements are generally less strict than private student loan providers, making it a potentially better deal than cosigning a private loan with your child.

How much can I borrow?

You can borrow up to 100% of your childs cost of attendance after all other loans and financial aid have been subtracted.

Your childs financial aid award should include information about the COA and financial aid. If your child has yet to apply to school, you can often get an idea of the cost by visiting the schools financial aid office website.

How much does it cost?

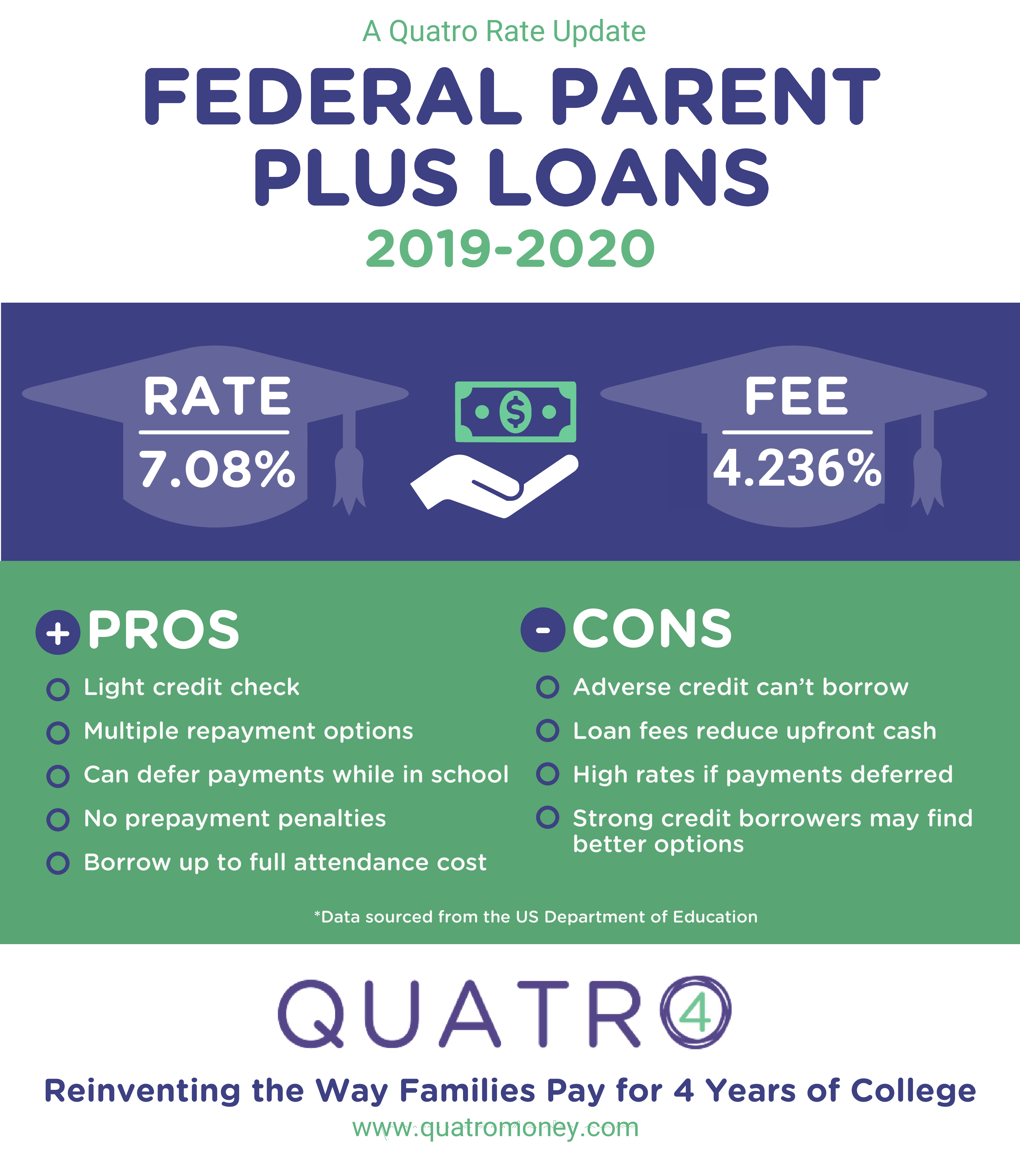

- Fixed interest rate: 6.08%

- Origination fee: 4.236%

The two main costs to consider are interest and fees. All parents get the same fixed rate, which changes on July 1 each year. The Department of Education also deducts an origination fee from the loan before the school receives the funds.

Parent Plus Loan Consolidation

Consolidating parent PLUS loans wont save you money in the long run, but it can lower your monthly payments. Its also necessary for accessing other parent PLUS loan repayment options, such as income-driven repayment plan and loan forgiveness.

When you consolidate parent PLUS loans, they become a federal direct consolidation loan. You can consolidate even if you only have a single parent PLUS loan.

You’ll have 10 to 30 years to repay the consolidated loan, depending on the loan balance. On a longer repayment schedule, you’ll have lower monthly payments but also pay more in interest over time.

Read Also: Usaa Auto Loan Refinance Rates

What Do Parent Plus Loans Mean For My Retirement

Retirement is a big reason that you should be careful when taking parent PLUS loans. If youre stuck repaying loans for the next 25 years, it can vastly deplete the savings you were keeping for retirement or prevent you from saving for retirement at all.

Even as you get closer to retirement, dont think about borrowing against your retirement to pay off the loans. This can result in penalties for taking out the money early, not to mention less savings for you when you actually do retire.

Firstdecide How To Deal With Thedefault

Once the debt collector has validated that you owe this money, start considering your options. If you cant pay off the loan immediately, you have two options: rehabilitation and consolidation.

- Rehabilitation: After 9 months of reasonable payments, your loan will be in good standing. Rehabilitation removes the default note from your credit report. A defaulted loan can only be rehabilitated one time.

- Consolidationismuch faster,which may be important if you want to regain eligibility for federal student aid. However,the default willremain inyour credithistory.

- Do not consolidate Parent PLUS loans with otherfederal student loans. Parent PLUS loansdo NOT qualify forall ofthe income-driven repayment plans and loan forgiveness programs. If you combine other loans with Parent PLUS, you will lose those optionsfor yournon-ParentPLUS debt.

Act quickly. The sooner you get out of default, the sooner you can haltconsequences like wage garnishment and collections fees, andregain eligibility for federal student aid.

to discuss your optionsand find out your next steps.

Questionsto ask your servicer about rehabilitation and consolidation

Rehabilitation and consolidation each have pros and cons. Asking your loan servicer these questions can help you decide on the best approach for your circumstances.

About rehabilitation

About consolidation

About both

Also Check: How To Apply For Sss Loan

How To Lower Parent Plus Loan Payments

There are three options to lower Parent PLUS Loan payments:

- switch to the Extended or Graduated Repayment plans

- consolidate and switch to the ICR plan

- refinance with a private lender

The Extended and Graduated Repayment plans lower your payments by giving you a longer repayment schedule of up to 30 years. For many parent borrowers, the ICR plan is the best way to lower monthly payments. The plan looks at your family size and adjusted gross income to determine how much you can afford to pay each month.

Refinancing a parent loan can lower your payments by getting a lower interest rate and better repayment terms. Unlike consolidation, student loan refinancing isnât automatic. You have a pass a credit check. While you donât need excellent credit, you canât have an adverse credit history.

Before refinancing, be aware that you give up Parent PLUS Loan forgiveness options when you refinance with a private lender.

Other Requirements For A Parent Plus Loan

The parent and dependent student must also satisfy the general eligibility requirements for federal student aid and federal student loans.

- Students must be enrolled in school on at least a half-time basis

- Male students must have registered with the Selective Service

- Students and parents must be U.S. citizens or nationals, permanent residents, or eligible noncitizens

- Students and parents cant be in default on a federal student loan

- Parent PLUS Loan proceeds must be used for educational purposes

Recommended Reading: Usaa Auto Calculator

Ask Other Parent To Apply

If you apply for a parent PLUS loan and are denied, consider asking the childs other parent to apply. The other applicant must be the students biological or adoptive parent so if youre divorced or separated, your former partner might still be able to take out a PLUS loan.

Keep in mind that both parents can apply for a parent PLUS loan if theyre divorced and as long as the total aid package doesnt exceed the students cost of attendance. Also note that the following are ineligible for a PLUS loan unless theyve adopted the student:

- Grandparents

Applying For Plus Loan Heading Level 3

How to apply:

Since the parent is responsible for the repayment of the Federal Direct Parent PLUS loan, the parent must follow these steps:

- to complete a Parent PLUS Application

- The Parent borrower will be asked to “Sign In” using their FSA ID

- On the next page, choose loan type “Parent PLUS”

- Parent borrower will authorize an immediate credit check

- If credit is approved and it is the first time that the parent borrower is seeking the Parent PLUS loan at University of Hawaii at Mnoa, then the borrower will be directed to complete the DL Parent PLUS MPN.

The Parent PLUS loan and amount will be approved based on the parent’s credit from their PLUS application and a completed promissory note. Upon approval, the loan will be disbursed to the student’s UH account along with the student’s other aid approximately ten days before the start of the semester at earliest. There may be delays if there are unsatisfied requirements or if enrollment is less than full time .

When the loan is disbursed, it will satisfy any charges that exist . Any excess funds will be refunded via paper check or e-refund approximately one week after disbursement.

You’ll receive a disclosure statement that gives you specific information about any loan that the school plans to disburse under your MPN, including the loan amount and loan fees, and the expected loan disbursement dates and amounts.

Don’t Miss: Fha Max Loan Amount Texas