Are Sole Props Or Contractors Eligible For The Eidl Program

Yes, sole proprietors and independent contractors can apply to the EIDL program as long as they have verifiable business income for 2019 or January of 2020. Any business formed or conducted after January 31, 2020, does not qualify. If you have filed for bankruptcy, you are ineligible unless you have an approved plan of reorganization.

You must be able to prove that you made an income as a sole prop or contractor, through tax returns or other documents. If you don’t have an official “salary” but draw your income from net profits, the SBA can still determine your income by your bank statements and any other financial documentation.

Do I Qualify For An Eidl

While taking out an EIDL may seem like an extremely attractive and even necessary step for your business, youll first have to make sure you qualify. Lets cover some of the basic criteria youll have to meet in order to receive an EIDL, as well as some factors that may prohibit you.

You can qualify if your business:

- It was in operation before January 31, 2020

- Has 500 employees or less or be considered a small business by the SBA

- Was affected by the Covid-10 pandemic

Its important to note that sole proprietors, private contractors, and self-employed persons also qualify for this loan. Furthermore, there is no set credit requirement to qualify for an EIDL, but there are factors to consider. For instance, being delinquent on child support obligations or having judgments against you for federal debts hinder your eligibility.

Even if you have less than satisfactory credit or isolated instances of missed payments, you can still qualify as long as you explain the lapse and have other accounts of agreed payment records. Additionally, if you dont qualify for an EIDL, there are still plenty of business loans outside of the SBA that you can apply for.

How Much Can A Self

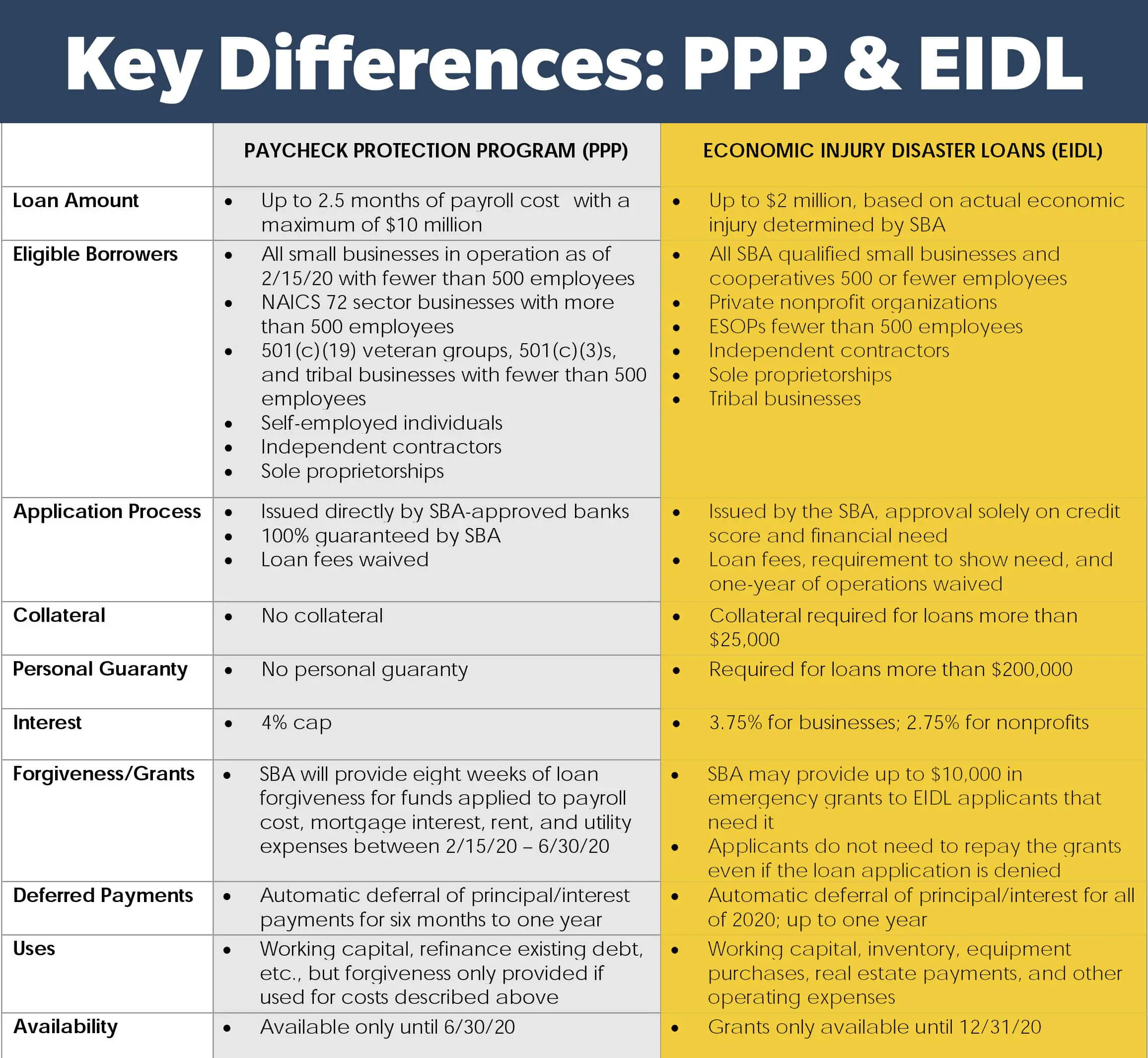

The maximum amount for a PPP loan is 2.5 times your average monthly payroll costs. Income listed on a Schedule C in your personal tax return is the only payroll that can be used to calculate your PPP loan amount. If youve hired 1099 workers, they cannot be included in your PPP loan calculation and may apply for their own PPP loans.

Don’t Miss: People Who Got The Ppp Loan

Ppp Loans For The Self

UPDATE: The PPP loan application period ended May 31, 2021. Learn about financing options available for small businesses today at Lendio.com

Over the past year, the SBA has rolled out a series of updates and adjustments to better serve the self-employed who need/want a Paycheck Protection Program loan. Heres everything you need to know:

How Much Money Can You Get

You can qualify for 2.5 times your monthly payroll costs based on either your net profit or gross income during the calculation period.

In March 2021, the SBA released new guidance allowing the self-employed to choose whether they want to calculate their PPP loans based on net profit or gross income. Previously, calculations were limited to net profit, which limited the funds you could access if youre in the habit of maximizing tax deductions.

If you have additional employees on your payroll, their payroll can be used to calculate payroll numbers. You cannot include 1099 workers in your payroll calculations, as they are entitled to apply for their own PPP loans.

Read Also: What Are Capital One Auto Loan Rates

When To Expect Your Funds

The EIDL process takes a minimum of 21 days to complete according to the SBA. Not surprisingly, the actual length of time is on a case-by-case basis, depending on whether there are questions or additional information is required.

While applications for EIDL loans and Targeted Advances will only be accepted through Dec. 31, 2021, they will be processed after that date, including reconsideration. Applications for Supplemental Targeted Advances will be neither accepted or processed after Dec. 31.

Eidl: A Topic Of Interest

EIDLs are also unique because of their interest rates. EIDLs have fixed interest rates of 4%. This rate is even lower for nonprofits, sitting at 2.5%. For reference, interest rates for average personal loans sit closer to 10%

EIDLs also offer a longer repayment period of up to thirty years, taking away the added stress of having to pay back the amount borrowed quickly. Furthermore, there are no prepayment penalties, which are typically set in place to prevent borrowers from paying off their loans early, which would prevent lenders from collecting as much interest.

Also Check: How To Loan Money From Zenith Bank

What Else Do I Need To Know

Misinformation and rumors are everywhere online due to the sensitive nature of the issue and piecemeal launch of both EIDL and PPP. One prime example is the fact that on Monday, the SBA’s Massachusetts district office posted on its website that EIDL advances were being limited to $1,000 per employee up to $10,000 . Meanwhile, the national SBA website continues to show that the advances are $10,000.

That makes a huge difference, especially if you’re self-employed. If a business owner has been counting on getting $10,000 and putting expenses on a credit card in the meantime, and all of a sudden they learn they’re only getting $1,000, they may be stuck with that debt.

Another prevalent rumor is that EIDL loans may in fact be capped at $15,000 for two months. The SBA did not return Money’s request for clarity on this or the advances.

“If they are now changing the rules of the game, that’s really hard for business planning,” McCracken says.

Eidl Could Help You Through Tough Times

Lantern Credit lets you compare lendersTo check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. A hard credit pull, which may impact your credit score, is required if you apply for a SoFi product after being pre-qualified.The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

Don’t Miss: What Determines Your Mortgage Loan Amount

Can I Put My Eidl Loan In A Savings Account

The answer was no. More precisely, the answer was EIDL funds cannot be deposited into interest bearing accounts. That means, no to a brokerage account. No to a money market account. No to a savings account. And, technically-speaking, it is even a no to an interest-bearing checking account as well.

Who Can Qualify For A Self

To qualify for a PPP loan, self-employed individuals must meet the following criteria:

- You were in operation as of February 15, 2020

- You are an independent contractor, sole proprietor, or other qualifying business classification with self-employment income

- In 2020, you filed a Schedule C or Form 1040

- Your primary place of residence is the United States

- You meet other program requirements

Read Also: How To Reinstate Va Loan Eligibility

Can I Refinance My Debts Using My Eidl Funds

With a recent change made by the SBA, EIDL funds can now be used to pay or prepay commercial debt. Essentially, you can pay down the entire outstanding balance of a commercial loan obtained through traditional lenders with your EIDL funds.

You can also make payments on your federal business debt . However, prepayments are not allowedâyou can only use EIDL funds on your regularly scheduled payments.

How Can You Get Your Ppp Loan Forgiven

The SBA has simplified loan forgiveness applications for PPP loans less than $50,000. This provision was specifically designed to support independent contractors and the self-employed. Loans that meet this threshold will not have to meet the employee retention requirements of larger loans,

If your First Draw loan is $50,000 or less, you can not apply for forgiveness using the simplified Form 3508S.

The SBA has not yet indicated whether or not this guidance will apply to PPP Second Draw loans.

Read Also: How To Calculate Finance Charge On Mortgage Loan

How Eidl Funds May Be Used

EIDL loans werent created just for the coronavirus economic crisis. In fact, theyve been part of the SBAs Disaster Loan program for many years. They often make national headlines when a natural disaster hits an area, like when Hurricane Harvey caused flooding and business disruption for many parts of Texas. So before we dive into specific questions, lets look at how these loans were designed to be used. According to the Standard Operating Procedures for Disaster Loans :

Economic Injury is a change in the financial condition of a small business concern, small agricultural cooperative, small aquaculture enterprise, or PNP of any size attributable to the effect of a specific disaster, resulting in the inability of the concern to meet its obligations as they mature, or to pay ordinary and necessary operating expenses.

Economic injury may be reduced working capital, increased expenses, cash shortage due to frozen inventory or receivables, accelerated debt, etc. Economic injury loan proceeds can only be used for working capital necessary to carry the concern until resumption of normal operations and for expenditures necessary to alleviate the specific economic injury .

While there is no comprehensive list of how EIDL funds may be used, if youre trying to err on the side of caution, there are clues in the section of the SOP that describes how to calculate economic injury. The following examples come from the section of the SOP that relates to calculating economic injury:

What Is The Eidl Program

If you are unfamiliar with Economic Injury Disaster Loan program, here is a quick breakdown. The government created the EIDL program at the beginning of the pandemic to provide relief to small businesses in the form of grants and low-interest loans.

All small businesses, from sole proprietors to Corporations, can apply if they meet the basic requirements of the program, such as a 570 credit score and fewer than 500 employees. The loan offers a 30-year term at 3.75% for qualifying businesses and will close on December 31, 2021.

You May Like: Can You Buy Any Home With An Fha Loan

Can I Use Eidl Funds To Pay Myself

Paying yourself from EIDL funds is a source of confusion for some. This business owner says she hasnt paid herself a set salary in the past and is unsure how to compensate herself using EIDL funds:

Can it be used to pay myself weekly if we never paid ourselves, but transferred funds from the business account to pay personal stuff if needed. How would I calculate?

Another one asks:

Im wondering if there is a limit on how much we can repay ourselves with this loan for lost wages?

It seems clear you cant pay yourself unless its for work you do in your business. After all, the SOP states that EIDL cant be used to pay: Disbursements to owners, partners, officers, directors, or stockholders, except when directly related to performance of services for the benefit of the applicant.

But if you continue to work in your business, paying yourself is a reasonable use of these funds. If you continue to work in your business, it may be helpful to use what youve paid yourself in the past as a guide to how much you can pay yourself. For those who dont pay themselves a salary, you may want to look at what you have taken out in the past as owners draw, disbursements, or as profits. Borrowers getting Paycheck Protection Program loans who are self-employed, for example, use their net profit on Schedule C Line 31 and divide it by 12 to determine their average monthly payroll. Its reasonable to assume that formula could be used to calculate owners compensation for EIDL as well.

What Can Eidl Funds Be Used For

There are several eligible expenses that EIDL funds can be used. For sole proprietors and independent contractors, examples include payroll , rent or mortgage, your utilities, and other ordinary business expenses. The SBA does not define what “ordinary business expenses” means because it depends on the type of business you have.

If an expense is pertinent to your business operation, then it should be covered. If you have questions about your specific business and eligible expenses, ask your loan officer or contact your local SBA office. Remember, there are ineligible expenses for the EIDL program to keep in mind. These include starting a new business and expanding your current business.

Don’t Miss: Is It Easy To Get Loan From Credit Union

What Documents Do You Need To Apply For Ppp If Youre Self

To complete your PPP application, you will need the following documentation. We recommend gathering this information prior to starting the application.

- Copy of government-issued ID for all owners with 20%+ share in the business

- Proof that you were in business as of February 15, 2020:

- If you have W2 employees: IRS Form 941 from Q1 2020 or a third-party processing report from February 2020.

- If you do not have W2 employees: February 2020 bank statement or a customer invoice from February 2020

- If you have employees, youll need to provide proof of payroll costs. Choose one:

- W2s and W3 for your employees

- 3rd-Party Payroll Processing Report

Wait Does Eidl Give Grants Or Loans

This is where it gets interesting. The SBA has said EIDL applicants trying to survive the coronavirus outbreak can get a $10,000 emergency advance on their loans. Because this advance doesn’t have to be paid back, some people have been referring to it as a grant.

“This loan is intended to be a very quick fix to help employers now,” says Mark Baran, principal at accounting firm . “They call it an advance, but it’s just, ‘Here’s $10,000, use it for what you need.'”

Recommended Reading: How Many Pay Stubs For Home Loan

How Much Can I Get

While the criteria for qualifying for an EIDL is pretty broad, the amount received will vary greatly from business to business. The SBA determines loan amounts by utilizing several algorithms, which include your companys actual economic injury and your companys financial needs. The maximum loan amount, however, is $500,000. Additionally, loans over 25,000 will require collateral.

How Bench Can Help

Businesses that received an EIDL loan need to file financial statements to the SBA within 3 months of the end of their fiscal year. With Bench, you get up-to-date financial statements completed and reviewed by an expert bookkeeper every month. Weâll help you meet the reporting requirements for the EIDL and even help you file your taxes. Learn more.

Don’t Miss: What Is Jumbo Loan Limit In California

Can I Use Eidl Funds To Pay Off Debt

It depends. You can use EIDL funds to pay off regular fixed payments, such as your business credit cards. The SBA does prohibit you from paying off specific types of debt, though. This includes repaying direct federal debt , as well as paying down or paying off loans owned or issued by federal agencies.

Income Tax Calculator: Estimate Your Taxes

We will be discussing these and other issues in a free webinar on Saturday, August 1st at 10:00 a.m. . Please e-mail with the subject Saturday for a link to join this 30-minute presentation by myself, Brandon Ketron CPA, JD, LL.M. and Kevin Cameron, CPA. We will also describe how the first $10,000 of any EIDL loan is actually considered to be a grant that does not have to be repaid, except to the extent of amounts borrowed from the PPP program.

While a great many borrowers consider it to be a duty or an entitlement to borrow under the EIDL program, the standard of need appears to be much higher than the treacherous necessity standard that applies for PPP loans and while an EIDL loan is outstanding there can be no dividends or personal expenses paid by the business entity for its owners, as discussed below.

Further, EIDL loan proceeds cannot be spent on any expenses that were already funded and paid for by PPP loan proceeds or medical practice relief loan payments, and must be spent only on the following:

EIDL proceeds may not be used for:

6. Refinancing long term debt

Read Also: What Kind Of Mortgage Loan Should I Get

How You Cant Use Your Eidl

While there are numerous ways to spend your EIDL funds, there are a few restrictions as outlined by the SBA. Lets take a look at the straightforward restrictions, then look at a few that are a little more complicated. You are restricted from using your EIDL funds for the following purposes:

- Dividends & bonuses

- Paying penalties from non-compliance with a government law or regulation

Other restrictions for EIDL funds are:

- Disbursements: EIDL funds cant be used to pay disbursements to owners, officers, partners, directors, or stockholders. The only exception is when disbursements are related to services or performances that are performed for the benefit of the borrower. For instance, an owner that draws a salary if work is performed within the business can be paid a salary from EIDL funds.

- Stockholder/Principal Loan Payments: The SBA restricts borrowers from repaying stockholder and principal loans. The only exception is when the funds were disbursed on an interim basis because of the disaster. It must also be shown that the non-payment of the loan would result in undue hardship on the stockholder or principal.

- Direct Federal Debt: EIDL funds can not be used to repay direct federal debt, including SBA loans.

- Loans Owned By Federal Agencies: Your EIDL funds cant be used to make installment payments, pay down, or pay off any loan owned by a federal agency. This includes the SBA and any Small Business Investment Company licensed under the Small Business Investment Act.