What To Provide To Your Lender Or Mortgage Broker

Before preapproving you, a lender or mortgage broker will look at:

- your assets

- your income

Youll need to provide the following:

- identification

- proof you can pay for the down payment and closing costs

- information about your other assets, such as a car, cottage or boat

- information about your debts or financial obligations

For proof of employment, you may have to provide:

- a proof of your current salary or hourly pay rate

- your position and length of time with the employer

- notices of assessment from the Canada Revenue Agency for the past 2 years, if youre self-employed

Your lender or mortgage broker may ask you to provide recent financial statements from bank accounts or investments. This will help them determine if you have the down payment.

Your debts or financial obligations may include your monthly payments for:

How To Get Pre

If youre wondering how to get pre-approved for a home loan, youre in luck, because its a pretty simple process. On the other hand, determining what type of home loan you are trying to get approved for takes some expertise. First, we must first figure out what type of lender will you qualify under. Most applications for a home loan start with a bank or credit union, but what if your application doesnt fit under these strict guidelines? A mortgage broker can help navigate what types of home loan lenders would work best for your application. Continue reading to learn everything you need to know about pre-approvals for home loans.

Submit Your Loan Application

Once the offer on your house is accepted, you can apply for a home loan. With Credible, you can easily complete the whole process online.

Getting pre-approved for a mortgage can make you a more desirable buyer, and can give you an idea of how much you can really afford to spend on a home, depending on your financial situation.

Ready to get pre-approved?

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

Read Also: Is Student Loan Interest Rate Monthly Or Yearly

What To Bring To Your In

We want you to be ready for the pre-approval process and being prepared will help. For your meeting, you should plan to bring the following:

- Current address

- Previous address

- Current employment information

- Previous employment information

- If self-employed, the last 2 years Notice of Assessments from your Income Tax return

- Value of properties, automobiles, investments, and savings

- Most recent statements for mortgages, loans and lines of credit

- Most recent credit card statements

- Estimated value of your home

- Housing expenses

- Financial information for your co-borrower, if applicable

- Social Insurance Number

Complete A Home Loan Application

To get preapproved, you need to fill out a mortgage loan application. Your lender will usually let you complete your loan application online, over the phone, or in person. Online applications typically take 10-20 minutes to complete.

The loan application, also known as Form 1003, asks for your personal information, social security number, financial information, and loan information.

After your application is completed, the lender will pull a three-bureau credit report known as a tri-merge. This report shows your credit scores and credit history from the major credit-reporting agencies: TransUnion, Equifax, and Experian.

Note, you can apply and get preapproved with any lender you wish. You can even get pre-approved by more than one lender to find the best offer.

Preapprovals are non-binding, and youre free to switch lenders before taking out the loan.

Also Check: How To Figure Out Car Loan Interest Rate

Get Approved With Our Power Buying Process

-

When you find the home you want, you need to be ready to make an offer quickly. The stronger your approval, the better your chances against other buyers. Our Power Buying Process has three levels of approval to help you make the strongest offer.

- Prequalified Approval: You answer a few simple questions, and well check your credit. Based on that information, we give you a Prequalified Approval Letter you can show to your real estate agent and sellers.

- Verified Approval1: Be even more confident youll close on a new home. After checking your credit history, a Home Loan Expert will verify your income and assets. Because we verify more of your information, a Verified Approval letter gives you the strength of a cash buyer.

- RateShield Approval2 : Focus on finding your new home instead worrying about rising interest rates. Get RateShield Approval after speaking with a Home Loan Expert and lock your interest rate for up to 90 days. If rates go up, your rate stays the same. If rates go down, your rate may drop. Either way, you win!1

- Ready to get approved so you can go house hunting? Start online or call a Home Loan Expert at 251-9080.

How Are Mortgage Rates Set

In simple terms, mortgage rates are set by the secondary mortgage market. This marketplace is where investors buy off mortgages from the lenders in order to receive a return on investment . The higher the interest rate, the more appealing it is to investors. However, too high, and potential borrowers wont want to borrow from that lender. So, it is a balance between the two that sets the actual rates. Other factors include inflation, Federal Reserves prices, and US treasury rates.

The rate that you are given is dependent on several factors, including the lender, the value of the house, and your current financial situation. The most important factor, though, is your credit score. Your credit score doesnt just determine whether or not youll qualify for a loan at all, but it also sets the bar for what type of interest rates youll be offered. The better your credit score, the better the interest rates you are going to see on offer. What qualifies as a good rate for someone with poor credit will not be considered a good rate for someone who has excellent credit.

Don’t Miss: What Is The Best Private Loan

How To Get Pre Approved For A Mortgage

Are you wondering how to get pre approved for a mortgage? Its one step in the home buying process you shouldnt overlook.

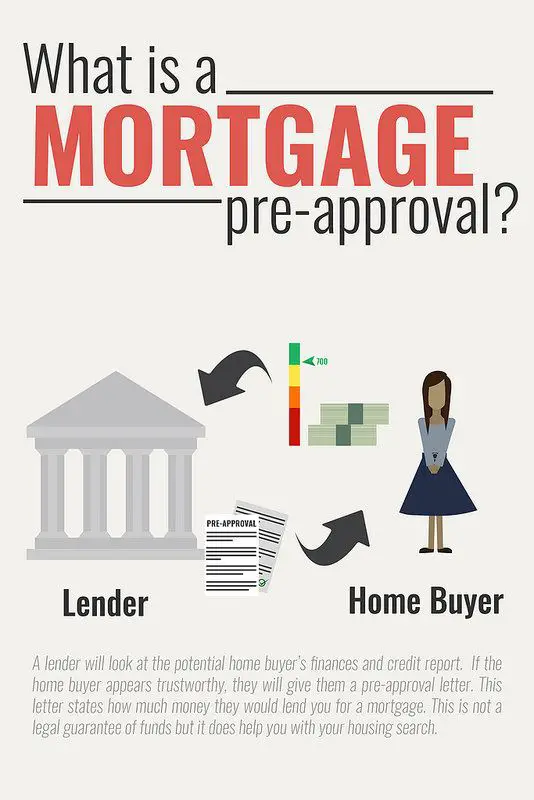

Mortgage pre-approval means that a lender has conditionally approved you for a set home loan amount, based on your credit and finances. Having a mortgage pre-approval letter in your pocket can streamline the mortgage application process later since the lender already has your information and has verified your documents.

Although some information can change and the lender may need to re-verify some of your documents, your credit standing cannot change during the commitment period without impacting your loan.

Changes in the financial conditional and application information could jeopardize the approval status of the application. Avoid taking on additional credit obligations during this period.

Additional contingencies may include an approval up to a maximum interest rate since the rate cannot be locked until the ratified purchase contract is received.

A pre-approval can also give you an edge when youre ready to make an offer on your new home. The pre-approval shows sellers that youre committed to buying and that you can back up your offer with financing. In a bidding war, a pre-approved buyer may win over a buyer who hasnt started the application process.

How to get pre approved for a mortgage starts with knowing what to expect.

Monthly Income And Combined Housing Expense Information

A listing of your base monthly income, as well as overtime, bonuses, commissions, net rental income , dividends or interest, and other types of monthly income, such as child support or alimony.

Also, youll need an accounting of your monthly combined housing expenses, including rent or mortgage payments, homeowners and mortgage insurance, property taxes, and homeowners association dues.

Recommended Reading: How To Calculate Car Loan Interest

Why Is It Important To Get Pre

Getting pre-approved for a mortgage gives a person bargaining power since they have mortgage financing already lined up and can therefore make an offer to the seller of a home in which they are interested. Otherwise the prospective buyer would have to go out and apply for a mortgage before making an offer and potentially lose the opportunity to bid on a home.

Choose Your Debt Amount

Home > Real Estate > How to Get a Mortgage > How to Get a Mortgage Pre-Approval: How Much and Help for Bad Credit

So youve finally found the home of your dreams. It has everything you ever want, but the seller wants something from you: Proof your eyes arent bigger than your bank account!

It comes in the form of a mortgage pre-approval. To which a lot of people say, A mortgage pre-a-what?

If youre wondering what a pre-approved mortgage is, what one costs and where you can get one, please read on.

You May Like: How To Get Loan Officer License In California

Why Should You Get Pre

There are many reasons why you should get pre-approved. The most important reason is that you will get an accurate idea of how much home you can afford. This can help to target your home search and ensure you only look at houses that are truly in your price range. A pre-approval letter also helps you prove to real estate agents and sellers that youre a credible buyer and able to act fast when you find the home you want to buy. Some sellers might even require buyers to submit a pre-approval letter with their offers, though having a pre-approval letter does not guarantee that your offer will be accepted by a seller. A pre-approval letter can make you stand out in a competitive real estate market. If you make an offer on a house without a pre-approval, your offer may not be taken as seriously as an offer from another person with a pre-approval.

Find A Mortgage Company To Pre

Mortgage pre-approvals are available for free through most mortgage websites with no obligation to proceed. Many home buyers get their mortgage from a different mortgage company that pre-approved them. So, dont overthink this step.

The critical part of getting your pre-approval is that you get it. Without a pre-approval, you cannot buy a home.

Don’t Miss: Do Pawn Shops Loan Money

Everything That A Homebuyer Needs To Get Pre

Bottom Line PersonalConsumer ReportsPrevention

As you search for a home, getting pre-approved for a mortgage can be an important step to take. Consulting with a lender and obtaining a pre-approval letter provides you with the opportunity to discuss loan options and budgeting with the lender this step can serve to clarify your total house-hunting budget and the monthly mortgage payment that you can afford.

As a borrower, its important to know what a mortgage pre-approval does , and how to boost your chances of getting one.

Our Advice Its Never Too Soon To Pre

The best time to get pre-approved is when you start thinking about homes. Pre-approved home buyers get better rates and better homes.

Getting pre-approved establishes your home purchase price range and minimum down payment and gives you time to edit and correct your credit.

Most importantly, though, pre-approvals indicate seriousness about buying a home.

Get pre-approved today in under 3 minutes.

Get pre-approved for a mortgage today.

Dan Green

Dan Green is a former mortgage loan officer and an industry expert. He’s appeared on NPR and CNBC, and in The Wall Street Journal, Bloomberg, and dozens of local newspapers. Dan has helped millions of first-time home buyers get educated on mortgages, real estate, and personal finance. Have mortgage questions? Ask Dan in the chat.

Don’t Miss: How Much Will I Be Pre Approved For Home Loan

The Monthly Payment Is Higher Than Pre

Mortgage pre-approvals simulate the purchase of generic homes at specific purchase prices. But, when buyers make offers on real homes, those approvals use real numbers.

As part of the final approval, lenders replace pre-approval numbers with real numbers:

- The purchase price of the home

- The expected down payment

- The homes real estate tax bill

- The expected homeowners insurance premium

- The homes monthly assessment, if applicable

If the newly-calculated housing payment is higher than expected, the buyers pre-approval may be invalidated.

Buying Your First Home

First time home buyers may not have as much experience as seasoned property flippers, but you do have some important advantages working in your favor. As a first time home buyer, you can qualify for lower down payments and more favorable interest rates. You also might qualify to save money on your taxes.

Thanks to these rules for first time home buyers, anyone with a decent credit score should be able to get through the home buying process with a fair mortgage that suits your needs and that wont drain your bank account on day one. When comparing lenders, dont forget to look at factors like APR, loan terms, and closing costs. Always ask what your lender can do for you as a first time buyer.

Don’t Miss: What Is The Max Student Loan Limit

How Can You Pick The Right Lender For Your Pre

Lenders from all sorts of institutions, from banks to credit unions to mortgage corporations, offer pre-approvals and mortgages.

We encourage people to reach out to people they know such as friends who bought a house recently, Bogan says. You can talk with your financial planner, attorney or accountant that you trust and get some feedback from them.

Things To Remember When Applying For A Mortgage

- Any outstanding debts or taxes will need to be paid off before you can be approved for a mortgage

- You will need a down payment of at least 5% of the purchase price of the home

- Be sure to get multiple quotes from different lenders to ensure you are getting the best deal possible

- Keep in mind that getting pre-approved for a mortgage is not the same as being approved for a mortgage

- Be prepared to provide documentation such as proof of income, employment history, and more

- Look for programs and resources that may aid during the mortgage application process. For example, Veterans may be eligible for a VA Loan while first-time home buyers may want to look into an FHA Loan.

Buying a home should be a fun and exciting experience. And while the financial aspect isnât the most thrilling part of the process, it is a necessary one. With a little bit of research, preparation, and due diligence, obtaining a mortgage approval will be an easy task â one that takes you that much closer to homeownership!

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned and has not been endorsed by any of these entities. Opinions expressed here are author’s alone

Advertiser Disclosure

Also Check: Fifth Third Bank Auto Loan Login

What Are My Chances Of Getting Pre

The likelihood that you will get pre approved for a mortgage online depends on several factors, including:

- Your credit history

Bestmoney is a dba of Natural Intelligence Technologies Inc.

Natural Intelligence Technologies Inc. NMLS # 2084135

CT: Mortgage Broker only, not a mortgage lender or mortgage correspondent lender.

- Advertising Disclosure

This site is a free online resource that strives to offer helpful content and comparison features to our visitors. We accept advertising compensation from companies that appear on the site, which impacts the location and order in which brands are presented, and also impacts the score that is assigned to it. Company listings on this page DO NOT imply endorsement. We do not feature all providers on the market. Except as expressly set forth in our Terms of Use, all representations and warranties regarding the information presented on this page are disclaimed. The information, including pricing, which appears on this site is subject to change at any time.

Close

Learn More About The Benefits Of Prequalification And Preapproval

As you look for a home, you may be asked to get prequalified or preapproved. Before you start, its important to understand the difference.

When you want to talk to a lender to establish a general range of home prices, you can get prequalified, which is simply a lenders estimate of what you could potentially borrow.

This can be completed easily and conveniently online, in person, or over the phone in just a few minutes with basic information like your income and expected down payment.

When you want to give yourself a competitive edge over other buyers in the market, you can get preapproved. Having a preapproval lets sellers know that you already qualify for the home financing which greatly increases your chance of having your offer selected.

Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay stubs, bank statements and tax returns.

The lender will then use these documents to determine exactly how much you can be preapproved to borrow.

Once youre preapproved, youll have 90 days to find a home you love. Then you can lock your rate and complete your application.

Whether you choose to get prequalified or preapproved, you will have a better sense of whats in your price range and can hunt for a house with confidence.

Also Check: How To Get Loan Without Interest

Summary Of Moneys Guide For Mortgage Preapproval

The mortgage preapproval process will help get your documents and finances in better shape and make the entire closing process faster. It will also help you understand how much house you can afford and make you more attractive to sellers.

To get a preapproval letter, you’ll need to provide your lender with the necessary documents to verify your employment and financial information.

If you still don’t know what mortgage lender to pick, check out our guide to the Best Mortgage Lenders and the Best Online Mortgage Lenders.

- Categories