Apply For Loan Forgiveness

If you are a public defender, work for a legal aid organization, or are employed by a non-profit organization or government agency, you may be eligible for Public Service Loan Forgiveness. Under this program, federal loan borrowers can qualify for loan forgiveness after 10 years of working full-time for an eligible employer while making 120 monthly payments.

Include Payments In Your Budget

Build your student debt payments into your budget and make payments that are larger than the minimum payments. You can also speak with your financial institution about setting up automatic payments.

When planning your budget and automatic payments, make sure you know when your payments are due. Remember that if you have more than one loan or line of credit, you may have more than one payment due date.

How To Pay Off $100000+ In Student Loans

Use a tactic that saves money , lowers payments or does both .

Six-figure student debt isnt the norm. So when youre facing a student loan balance of $100,000 or more, the standard, 10-year federal repayment plan may not be right for you.

Standard monthly payments will likely exceed $1,000 with that much debt. But you could save money in interest, decrease monthly payments or do both even pay off your student debt faster with a different repayment approach.

The best strategy is usually the one that costs the least overall, provided you can afford the monthly payments. Here are options for paying off $100,000+ in student loans, and how to decide which is right for you.

Read Also: What Is The Current Va Loan To Value Rate

How To Use This Calculator

Youll get the most accurate results if you enter your loan amounts separately with their precise interest rates, but you can also estimate or use the sample loan amounts and interest rate provided.

You may have a mix of federal and private loans. If you dont know how much you owe, search for your federal loans in the National Student Loan Data System or contact your private student loan lender.

This calculator assumes youll be paying monthly for 10 years once repayment begins, which is the standard term for federal loans and many private loans.

Enter the total amount you borrowed for each loan. You can enter up to three loans for each year youre in school, up to four years. Its possible to include 12 loans total.

Enter the interest rate for each loan amount. Your interest rates will vary depending on whether your loans are federal or private, the year you borrowed and, in some cases, your credit score. Check with your federal loan servicer or your private lender to find out your interest rate.

Interest will accrue daily on unsubsidized federal and private loans while youre in college. The total amount accrued will capitalize and be added to your total loan amount when repayment begins. During repayment, interest will continue to accrue and will be included as part of your monthly bill amount.

Select Yes if you have a subsidized federal loan or No if you have an unsubsidized federal loan or a private loan.

Heres Your Average Student Loan Payment Under 6 Different Plans

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

Weve got your back! Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

Bottom line: Were here for you. So please learn all you can, email us with any questions, and feel free to visit or not visit any of the loan providers on our site. Read less

* * *

Read Also: Where Can I Pay My Capital One Auto Loan

Auto Prices Finally Begin To Creep Down From Inflated Highs

DETROIT All summer long, Aleen Hudson kept looking for a new minivan or SUV for her growing passenger shuttle service.

She had a good credit rating and enough cash for a down payment. Yet dealerships in the Detroit area didnt have any suitable vehicles. Or theyd demand she pay $3,000 to $6,000 above the sticker price. Months of frustration left her despondent.

I was depressed, Hudson said. I was angry, too.

A breakthrough arrived in late September, when a dealer called about a 2022 Chrysler Pacifica. At $41,000, it was hardly a bargain. And it wasnt quite what Hudson wanted. Yet the dealer was asking only slightly above sticker price, and Hudson felt in no position to walk away. Shes back in business with her own van.

It could have been worse. Hudson made her purchase just as the prices of both new and used vehicles have been inching down from their eye-watering record highs and more vehicles are gradually becoming available at dealerships. Hudsons van likely would have cost even more a few months ago.

Not that anyone should expect prices to fall anywhere near where they were before the pandemic recession struck in early 2020. The swift recovery from the recession left automakers short of parts and vehicles to meet demand. Price skyrocketed, and theyve scarcely budged since.

Our analysis shows that we are coming off the high values that we saw before, Manley told analysts Thursday.

We can feel some pullback, he said.

____

Most Read

Interest On Postgraduate Loan

You currently pay interest of 6.3% on Postgraduate Loans.

The interest rate on Postgraduate Loans is usually the Retail Price Index plus 3%. However, the interest rate is currently capped until 31 August 2023 due to inflation. Interest rates on Postgraduate Loans will not go above 7.3% while the cap is in place.

You can find out how Postgraduate Loan interest is calculated and interest rates for previous years.

Also Check: How Auto Loan Interest Works

Average Monthly Payment Of Student Loans

Its not an easy time to be a student.

In fact, its probably one of the hardest times in your life. Youre only just starting to figure out how to get by on your own, but youve got all of this debt hanging over your head.

And its not just about the moneyalthough thats certainly a big part of it. Its also about the stress of having to take on so much responsibility at such a young age and trying to figure out what kind of future you want while still being expected to perform well in school without having had any experience with adult life yet.

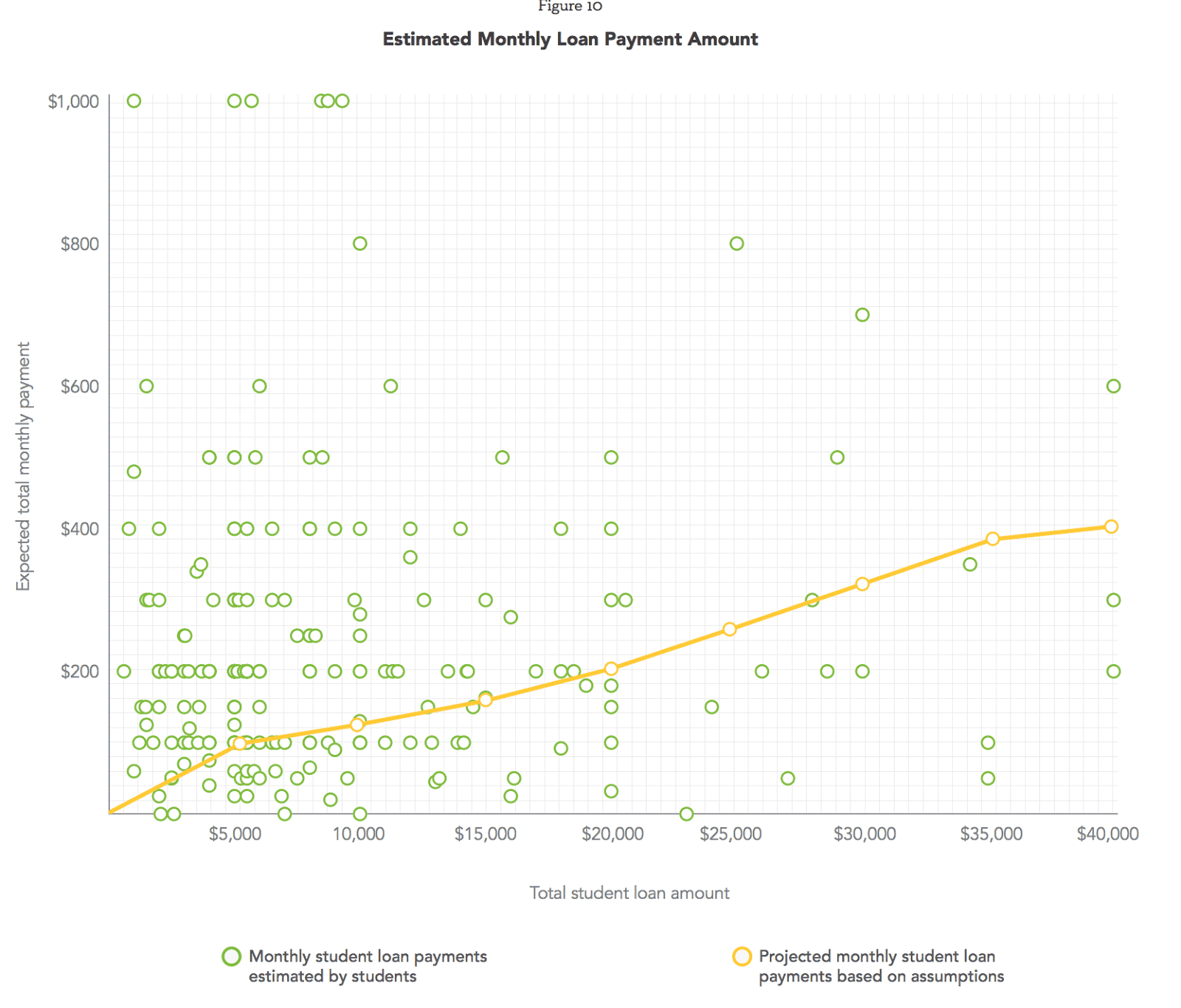

But lets talk about the money for a minute: The average monthly payment for student loans is $351 per month, which is more than half of what most people make after taxes each month! That means that no matter how much you make, if youre paying back student loans , then half of that money is going straight into someone elses pocket instead of yours.

Enter A Repayment Plan

Federal student loan servicers have several loan repayment plans for which you might be eligible. Most are structured to help lower your student loan payment each month. Here are some options you may want to consider:

- Graduated repayment plans increase your monthly payments automatically every two years. After 10 years of graduated payments, your loans could be repaid.

- Extended repayment plans are available to borrowers with more than $30,000 of Direct or FFEL loans. If you qualify, you could extend your repayment period from 10 years to 25 years, lowering your monthly payment. Because you will pay interest for up to 15 more years, your loans will have more accrued interest, resulting in a higher total interest paid overall.

- An income-driven repayment plan will set a monthly student loan payment amount based on your income and family size and on your state of residence. Income-driven payment plans allow borrowers to pay a set portion of their income each month. After 20-25 years of qualifying payments, you may be able to get student loan forgiveness on the remaining balance.

- Pay As You Earn and Revised Pay As You Earn plans are also income-driven payment plans. They are available only to qualifying federal student loan borrowers. These plans will change as your income changes your monthly payments will always be about 10% of your income. These plans also consider your income and your spouses income, regardless of whether you file separate or joint tax returns.

Recommended Reading: How To Get 0 Apr Car Loan

How To Pay Off $100k In Student Loans

It is possible to pay off six figures in student loan debt, but youll need to take a strategic and determined approach.

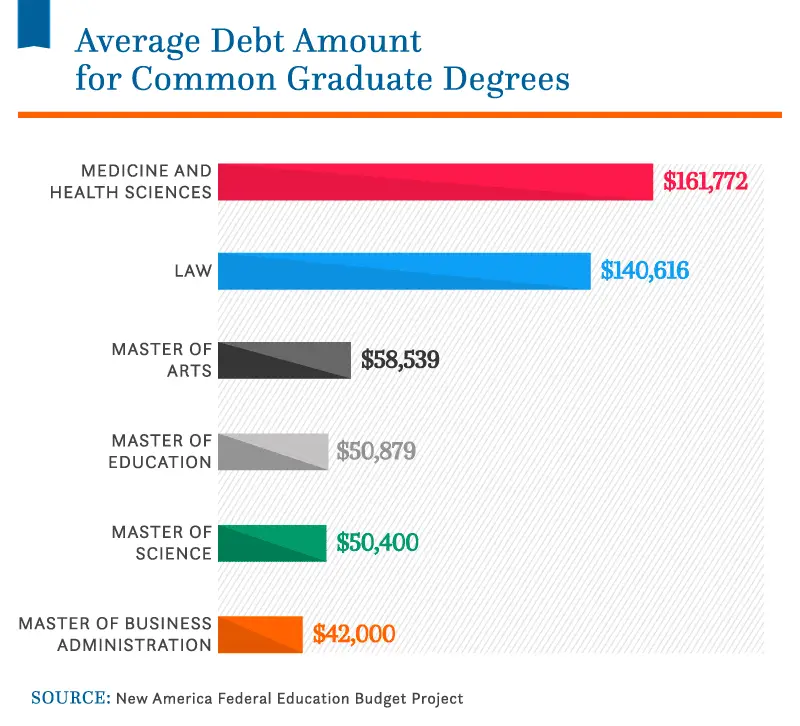

While some college graduates may only owe a few thousand dollars in student loans, many borrowers owe much larger balances. Often a graduates student loan debt is well into six-figure territory especially those with professional degrees or a private-school education.

With a 10-year standard repayment plan, that kind of debt may equate to a monthly payment of more than $1,000, easily affecting your budget and your ability to save for other goals. Plus, owing a lot of money can be really stressful.

If youve got $100,000 in student loan debt, know that youre not alone. You have several options to help you pay off your student loans faster and for less than you may expect.

Heres everything you need to know about paying off $100,000 in student loans.

Dont Miss: Refinancing Fha Loan

Federal Student Loan Repayment Statistics

About $1.05 trillion of Americans student loan debt is in the form of direct loans. Thats a steep increase from five years ago when the total was $508.7 billion. Currently, 52% of direct federal loan debt is in repayment. About 8% is in default because the borrower hasnt made a payment in nine months or longer. The remaining 40% is on hold for a variety of reasons:

- 13% is held by students who are still in school

- 11% is in forbearance

- 5% is in a grace period

- 1% is classified as other

Forbearance and deferment enable many borrowers to postpone payments if they are experiencing economic hardship, like unemployment or a medical crisis are serving in the military or are continuing their studies through a fellowship, residency, or postgraduate study. The main difference is that interest always accrues during forbearance, but does not during some deferments.

The current breakdown is a significant change from the third quarter of 2013, when 42% of federal student loan debt was in repayment, 24% was held by students in school, 13% was in deferment, 8% was in forbearance, 7% was in a grace period, 5% was in default, and 1% was classified as other.

Don’t Miss: Who Can Use The Va Home Loan

Forgiving Some Loan Balances Earlier

And finally, the proposed plan would forgive loan balances after 10 years of payments, instead of the usual 20 years, for those with original loan balances of $12,000 or less. The Department of Education estimates this will allow nearly all community college borrowers to be debt-free within 10 years.

If You Have A Plan 4 Loan And A Plan 1 Loan

You pay back 9% of your income over the Plan 1 threshold .

If your income is under the Plan 4 threshold , your repayments only go towards your Plan 1 loan.

If your income is over the Plan 4 threshold, your repayments go towards both your loans.

Example

You have a Plan 4 loan and a Plan 1 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Plan 4 monthly threshold of £2,083 and the Plan threshold of £1,657.

Your income is £743 over the Plan 1 threshold which is the lowest of both plans.

You will pay back £67 and repayments will go towards both plans.

Also Check: How To Reduce Interest On Car Loan

Private Student Loan Payments

Private student loans may have different interest rates and terms than federal loans. They frequently do not have a grace period while you’re in school. In addition, private lenders don’t report average student loan amounts to the government, so the data is harder to come by.

We applied a typical range for fixed interest rates across a few different loan amounts and terms. Typically, longer loan terms mean higher interest. Below, see how interest rates impact monthly payments. Keep in mind that payment amounts can change monthly for loans with variable interest rates.

| $621.76 |

How To Estimate Your Monthly Student Loan Costs

The best way to estimate your monthly loan payment is to use a student loan calculator. Youll enter the total loan amount interest rate the length of time youll be paying and any extra amount you can contribute each month beyond the minimum. That will give you a general idea of your monthly and total payment over time.

You can get a more specific view of your federal loans using Federal Student Aids Loan Simulator. By logging in with your Federal Student Aid ID , which you likely created when filing the Free Application for Federal Student Aid , you can view your own real-time federal loan information and explore different repayment options.

Also Check: When Does Student Loan Come In

Enroll In Automatic Payments

Some servicers will lower your student loan payment each month if you enroll in autopay. Some borrowers opt for payments to draft from their bank account automatically. Even the smallest benefit could save you money over the loans lifetime, so see if your lender or servicer offers an advantage for autopay enrollment.

How Do You Get Your Student Loans Forgiven

The U.S. government will currently forgive, cancel, or discharge some or all of an individuals student loan debt only under a number of specific circumstances. Teachers in low-income schools and public service employees may be eligible for forgiveness of a portion of their debt. People who are disabled may be eligible for discharge of the debt. In August, the U.S. Department of Education said it would cancel $5.8 billion in student loans for borrowers who qualify as having a total and permanent disability.

The Federal Student Aid office indicates that those who think they may qualify for loan forgiveness should contact the student loan servicer for their loans. That is the company that handles the loan payments.

As noted above, a federal emergency relief measure suspended student loan repayments from March 2020, and the deadline has now been moved to May 1, 2022. Collections on payments that are in default also were halted. This is a suspension of repayment, not a cancellation or even a reduction of the debt.

Recommended Reading: 500 Loan For Bad Credit

Smart Moves To Make If You Can Afford Your Student Loan Payment

If you have plenty of income left each month after paying your student loans and other bills, that could be a sign that you could save money by paying down your student loans faster.

Here are a few ways to pay off your student loans faster:

- Accelerate payments on your student loans: You can always make more than the minimum payment without being penalized by your loan servicer.

- Refinancing your student loans: If youre paying high interest rates on your loans, refinancing them at lower rates can help you pay them back even faster.

The good news is, Credibles done the heavy lifting for you. Weve partnered with top student loan refinancing lenders to make it easy for you to compare rates all in one place. You can compare your prequalified rates from each of these lenders in two minutes without hurting your credit.

Find out if refinancing is right for you

- Compare actual rates, not ballpark estimates Unlock rates from multiple lenders in about 2 minutes

- Wont impact credit score Checking rates on Credible wont impact your credit score

- Data privacy We dont sell your information, so you wont get calls or emails from multiple lenders

After Learning About The Temporary Pslf Waiver Nadal Still Didn’t Have Hope

Nadal kept making minimum payments on his student loans for years, although he still didn’t have faith that PSLF would actually work for him. Early in 2022, he learned about the temporary PSLF waiver that allows even more payments to count toward the 120 eligible payments to get your student loans forgiven.

Typically, only full, on-time payments made on a qualifying income-driven repayment plan count toward the 120 eligible payments. Under the waiver, however, which expires on October 31, the following payments are now being counted:

- Forbearance periods of 12 consecutive months or greater, or 36 non-consecutive periods of forbearance

- Late payments and partial payments

- Payments from non-qualifying repayment plans

- Months spent in deferment

Nadal didn’t feel hopeful or optimistic about the waiver, even though he knew he would probably qualify. His husband, Kaleo Nadal, took care of filling out the paperwork. “He actually spoke to my servicer and had verbal confirmation from people that this was going to work. Even then, I was like, ‘I will believe it when I see it.'”

Soon, Nadal received emails that his application was being processed. “Then, I got one that said, ‘Your application has been accepted.’ And I’m still not celebrating. Until I see all the zeros in my account, then I’ll believe it.” Finally, weeks later, his student loan account showed a zero balance and he received a letter saying $124,572 of his student loans had been completely forgiven.

Recommended Reading: How Not To Be Upside Down On Car Loan