Types Of Auto Loans Offered

Navy Federal offers financing for new and used vehicles, along with auto loan refinancing. The loan amounts offered for new and used vehicles are the same, falling between $250 and $500,000. Refinancing has a minimum loan amount of $5,000, but Navy Federal does not specify a maximum.

For new car purchases and refinancing a new car, you can choose a term between 36 and 96 months. For used car purchases and refinancing a used car, you can choose between 36 and 72 months.

Where Navy Federal Stands Out

Wide range of loan amounts: Borrowers can choose loan amounts from $250 to $50,000 when applying for a personal loan at Navy Federal. This is an especially wide range among lenders and could make the loan a fit for a small expense like an emergency repair or something larger like a home improvement project.

Term availability: For most loans, repayment terms range from one to five years, but borrowers funding a home improvement project have more choices. With a $25,000 minimum loan amount, you could qualify for a term from five to seven years, and with a $30,000 minimum, you could qualify for a term up to 15 years.

» MORE:Best home improvement loans

Co-signed, joint and secured loans: Members can add a co-signer or co-borrower to their application. Adding someone with better credit or higher income can help your chances of getting a lower rate or a higher loan amount. Co-signers will not have access to the funds but are responsible for any missed payments.

Borrowers can also secure their loan with a Navy Federal savings account or CD, which could help you qualify for an especially competitive rate. Depending on the account you choose, your APR would be your share rate or certificate rate, plus 2% to 3%.

| N/A |

Long auto loans

Alternatives To Navy Federal Business Loans

Even if youve decided not to go with a Navy Federal business loan, you still have plenty of strong business financing options from which to choose. And some of them also boast no prepayment penalties, just like Navy Federal business loans.

Before you move on to alternative lenders that will meet your financing needs, first explore traditional banks that you might qualify for. Two top options are Wells Fargo business loans and SunTrust business loans.

Also Check: How To Pay Off Auto Loan Faster Calculator

Who Is Navy Federal Best For

An auto loan with Navy Federal is likely the best option for military members and their families, especially those with good credit who can qualify for some of the lowest rates in the business. Its also a great choice for drivers looking for expensive new cars Navy Federals maximum loan amount is $500,000, meaning you could drive off in a brand-new vehicle with all the bells and whistles.

Navy Federal Credit Union New Auto Loans

Whats unique about Navy Federal auto loans for new cars is not that it offers one of the lowest APRs available its unique because of the way it classifies a new car. To NFCU, a new car or truck was manufactured in the last three years, including the current year. So, for the current year, 2017, a new vehicle includes the 2015 and 2016 model years, as long as its mileage is less than 7,499.

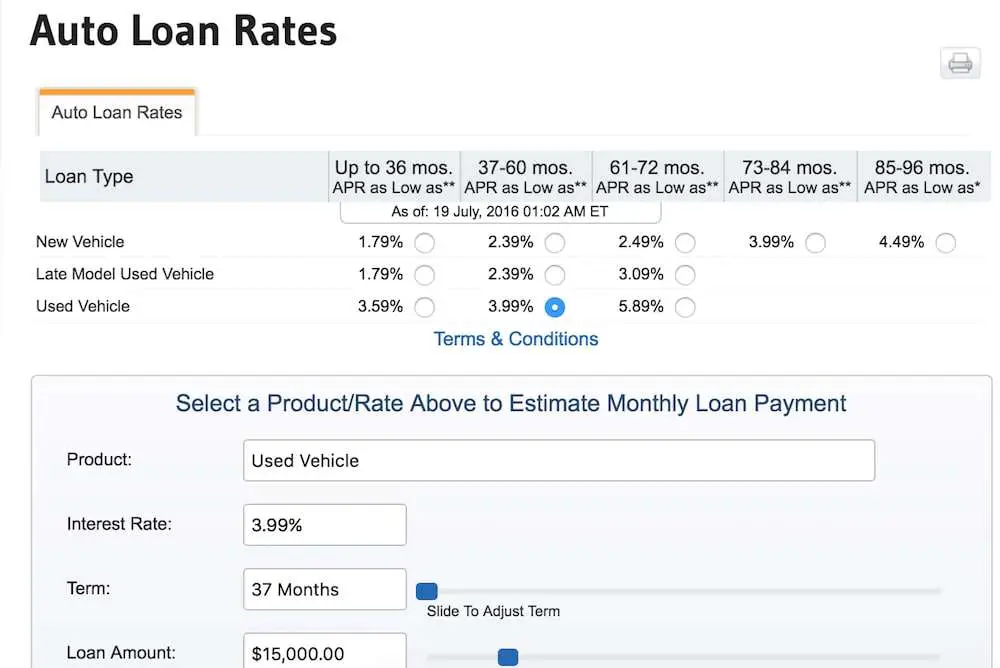

Loan terms range from 12 to 96 months. The lowest current APR of 1.99 percent comes with a loan term of up to 36 months. For a 37 to 60 month loan term the lowest APR is 2.39 percent. The APR bumps up a notch to 2.69 percent for a 61 to 72 month term but it jumps considerably to 4.09 percent on a 73 to 84 month term. While some car buyers might appreciate the longer terms of 85 to 96 months, they will pay much higher rates as the low APR for that range is 4.89 percent. The lowest APRs in all loan ranges are reserved for the most creditworthy borrowers with a credit score of at least 700. Buyers with less than stellar credit can expect to be charged APRs of 15 percent to 19 percent depending on the length of the loan term.

Read Also: Which Is Better Parent Plus Loan Or Private Loan

What Do You Need To Qualify For Navy Federal Credit Union Auto Loan

Navy Federal Credit Union Auto Loan does not have or does not disclose a minimum annual income eligibility requirement. Navy Federal Credit Union Auto Loan will consider borrowers regardless of their employment status if they can prove their ability to repay their obligations. Note that borrowers can add a cosigner or a co-borrower to either meet eligibility requirements or qualify for lower interest rates.

The Military Lending Act prohibits lenders from charging service members more than 36% APR on credit extended to covered borrowers. Active duty service members and their covered dependents are eligible to apply for a loan via Navy Federal Credit Union Auto Loan. Their rates fall within the limits of The Military Lending Act.

U.S. citizens are, of course, eligible for the services offered by Navy Federal Credit Union Auto Loan. Permanent resident / green card holders are also eligible to apply.

To qualify, applicants may need to provide the following documentation:

- Recent pay stubs

Navy Federal Credit Union Auto Loan Payoff Address

Navy Federal Credit Union Payoff Address is contained many other refer addresses to send Money orders or Payoff Cheques for Navy Federal Credit Union Payoff.

So this is no matter what is the official Navy Federal Credit UnionPayoff Address but if you live at the place where the official Navy Federal Credit Union Payoff Address is not available.

But you can visit the Navy Federal Credit Union Payoff Address near you to pay off.

And if you dont have a guideline for the Navy Federal Credit UnionPayoff Address then please check out this post which helps you to know the Navy Federal Credit Union Payoff Address.

So lets check out.

Read Also: Which Student Loan Has No Interest

Bottom Line On Navy Federal Credit Union

A Navy Federal Credit Union auto loan or auto refinance loan can be a good choice for those who qualify for membership. Credit union members can take advantage of low APRs and lengthy loan terms. If youre not in the armed services or part of a military family, youll need to look elsewhere for a loan to finance your vehicle purchase.

Is Navy Federal Trustworthy

Navy Federal Credit Union is not currently rated by the Better Business Bureau, because Navy Federal is in the process of responding to previously closed complaints.

The credit union used to have an A+ rating from the BBB. The BBB determines its score by looking at a company’s response to customer complaints, honesty in advertising, and openness about business practices.

Navy Federal has been involved in a recent scandal. A Navy Federal employee alleged that the lender pressured mortgage underwriters to approve loans even without believing applicants could repay them. She then filed a lawsuit and said Navy Federal retaliated against her whistleblowing by altering her job duties. She dropped the case in late 2020.

You May Like: Who Buys Student Loan Debt

Pentagon Federal Credit Union

Serving members in all 50 states and the District of Columbia, as well as military bases in Guam, Puerto Rico and Okinawa, PenFed Credit Union offers its members substantial options for car financing. The good news is that anyone can join. In addition to standard financing, this credit union also offers an online car-buying service tool.

Why it stands out: Their unique car-buying tool allows members to search for new or used cars and get a variety of information such as its value compared with the asking price, as well as an alert showing any PenFed discounts available. Interest rates on auto loans drop to as low as 3.44% APR on cars purchased through PenFeds car buying service.

Pros:

- Loan amounts up to $150,000

- Discounted rates through PenFeds car buying service

- Terms available up to 84 months

Cons:

- Its standard APR rates arent as attractive as rates some other credit unions offer.

What to look for: PenFed Credit Union offers auto loan terms from 36 to 84 months on new vehicles with APRs from 4.24% to 6.04%. Up to 125% financing is available in the U.S.

If You’re Choosing To Purchase A Used Car:

You’ll get the following options:

- Price: You can choose the preferred price for the car you’re purchasing by typing it in the box or moving the bar to the price you want.

- Mileage: You also get to choose the mileage of your car to narrow down the options and give you a clearer view of what you want to purchase.

- Make and model: Once you choose the make of the car, you can select the model and see the options you get on the screen.

- Body style: This drop-down menu allows you to choose the preferred car body type like Convertible, Coupe, Hatchback, Sedan, SUV, Truck, Van, and wagon.

- Color: You have a wide variety of interior and exterior color options to choose from.

- Price rating: You can choose to check one or more of these price rating options Excellent, Great, Fair, and High price.

- Popular features: Here, you get to check one or more of many features, including adaptive cruise control, backup camera, blind-spot system, Bluetooth, cooled front seats, and many more features.

- Condition and history: In this menu, you get to choose what condition the car is in and the history it went through, like Salvage, Lemon, Theft recovery, and Frame damage.

- Transmission: This will allow you to choose between Manual or Auto transmission.

You also get to customize many other options like drive type, engine, fuel type, bed length, cab type, and roof height.

Read Also: How Much Can I Borrow For Home Improvement Loan

Alternative Ways To Build Credit

If you are looking to build your credit history, a credit builder loan is a good option, but it is not the only option. In fact, depending on your individual situation, opening a credit builder loan may not even be the best choice for your credit.

The below alternatives can help you build credit while also conforming to your financial needs.

Refinancing A Car Loan

Refinancing your existing car loan can be a good idea if youve improved your credit score or interest rates are significantly lower than when you initially took out the loan. Navy Federal Credit Union offers refinance auto loans for your vehicle.

To refinance your car with Navy Federal, you must take out a loan thats at least $5,000. Term limits and APRs for refinancing are the same as those for new and used auto loans.

You May Like: Is It Hard To Get An Auto Loan

Tips For Improving Credit

Here are some simple steps to get you started.

Use Navy Federals Mission: Credit Confidence Dashboard to see tips and resources to build, rebuild or manage credit. Use our tools to:

Navy Federal Credit Union Reviews

Navy Federal Credit Union has a strong reputation backed by customer reviews and industry studies. On Trustpilot, the financial institution has an average customer rating of 4.7 stars out of 5.0 from over 10,000 reviews. On the site, 85% of reviews give the company an Excellent rating, while 6% give it a Great rating.

While reviews on Trustpilot are largely positive, Navy Federals customer reviews on the BBB are mixed. The lender is not rated by the BBB and has an average star rating of 1.4 out of 5.0 from just over 140 customers a small number of reviews compared to Trustpilot.

In the J.D. Power 2021 U.S. Consumer Financing Study, Navy Federal Credit Union received a score of 901 out of a possible 1,000 points. That gave it the highest score for overall customer satisfaction among financial institutions that offer auto loans for mass-market vehicles. However, the company didnt formally rank in the study due to its eligibility requirements for membership.

Our team reached out to Navy Federal Credit Union for a comment on these scores but did not receive a response.

Recommended Reading: What Kind Of Auto Loan Can I Get

Navy Federal Auto Loans Resources

Youve got everything you could need to get ready for your auto loan application right at your fingertips through the Navy Federal Credit Union website. From a calculator to determining how much your payment will be, to an auto loan resource section including information about registering your new vehicle, finding the right insurance, and even tips for smart car buying. Youll see the great rates they offer members making them one of the best options for securing an auto loan anywhere. Navy Federal makes it easy for you to determine the right amount to borrow for your next vehicle, so you dont find yourself over-extended with a loan that you cant realistically repay. Navy Federal is interested in protecting its members and giving them the tools to be financially successful.

Easiest To Join: Nasa Federal Credit Union

NASA Federal Credit Union

NASA Federal Credit Union may have an intimidating name, but it has easy membership requirements, competitive rates, and some great member perks.

-

No payments for the first 60 days

-

Nationwide coverage

-

Only offers branches in the D.C. area

-

Lower fees only available for high-balance accounts

NASA Federal Credit Union is open to NASA employees, NASA retirees, and their family members. However, you dont have to be a world-class scientist to enjoy membership. It also offers membership to non-employees who join the National Space Society, and the first year is complimentary. After that, your membership will cost $47 a year with automatic renewal. Membership includes their magazine, the latest information on space news, and invitations to conferences and events.

NASA Federal Credit Union offers new and used auto loans and recreational vehicle loans. Auto loan rates start at 2.64% , and although there is no payment due for the first 60 days, interest does accrue. The lowest rates have terms up to 36 months. Longer terms up to 84 months are available, but the rates do increase. You can apply online in a few minutes. You can also reach customer service through email, online chat, and over the phone.

Also Check: Can Personal Loan Increase Credit Score

Navy Federal Credit Union Car Loans Q& a

Get answers to your questions about Navy Federal Credit Union Car Loans below. For more general questions, visit our Answers section.

We work hard to show you up-to-date product terms, however, this information does not originate from us and thus, we do not guarantee its accuracy. Actual terms may vary. Before submitting an application, always verify all terms and conditions with the offering institution. Please let us know if you notice any differences.

Ad Disclosure: Certain offers that appear on this site originate from paying advertisers, and this will be noted on an offers details page using the designation “Sponsored”, where applicable. Advertising may impact how and where products appear on this site . At WalletHub we try to present a wide array of offers, but our offers do not represent all financial services companies or products.

Editorial and user-generated content on this page is not provided, commissioned, reviewed, approved or otherwise endorsed by any issuer.

Best For Bad Credit: Consumers Credit Union

Consumers Credit Union

Consumers Credit Union is easy to join, offers nationwide services, and works with people with bad credit and rebuilding their credit.

-

Fewer educational resources

Consumers Credit Union has physical branches throughout northeast Illinois but services the entire country and is open to members nationwide. It specializes in helping consumers take charge of their finances and works with them to rebuild their credit and improve their credit score. Its an ideal place to start if you want to get a car loan but don’t have good credit.

Consumers Credit Union looks at your overall financial profile, not just your credit score. The company offers auto loans, home loans, home equity loans, personal loans, business services, and a full range of banking products and services.

Anyone can join the credit union by paying $5 and becoming a member of the Consumers Cooperative Association. The website is well laid out and easy to navigate and goes into detail on applying for membership and then applying for a car loan. It offers an online car buying service that claims to save you money and will deliver the car to your home.

Don’t Miss: How Soon Can I Sell My Va Loan Home

How Navy Federal Auto Loans Work

Navy Federal offers financing for new and used cars, and it has options for refinancing your car. Apply on Navy Federal’s website, over the phone, or in person at a branch. In most cases, you’ll receive a decision on your application instantly.

Unlike many other lenders, you need to be a member of Navy Federal to apply for and receive an auto loan. You’re only eligible if you are an active military member or veteran, as well as an employee or retiree of the Department of Defense. Family members of any of the aforementioned groups also qualify.

Loan amounts range from $250 to $500,000 on new and used cars. The minimum you can borrow to refinance is $5,000, and Navy Federal doesn’t list a maximum.

Loan terms start at 12 months and maximum term lengths vary depending on the type of car you’re looking to finance. Your loan term for a new vehicle can be as long as 96 months, while used vehicles have a limit of 72 months. Keep in mind that the longer your loan term, the more likely you are to go upside down on your loan, meaning you owe more on your car than it’s worth.

Navy Federal’s rates vary depending on your term length, the model year of your car, and the number of miles on the vehicle.

The credit union has a mobile app in the and Apple Stores if you want to manage your loan on the go.