What Are The Different Types Of Home Equity Financing

Reading time: 3 minutes

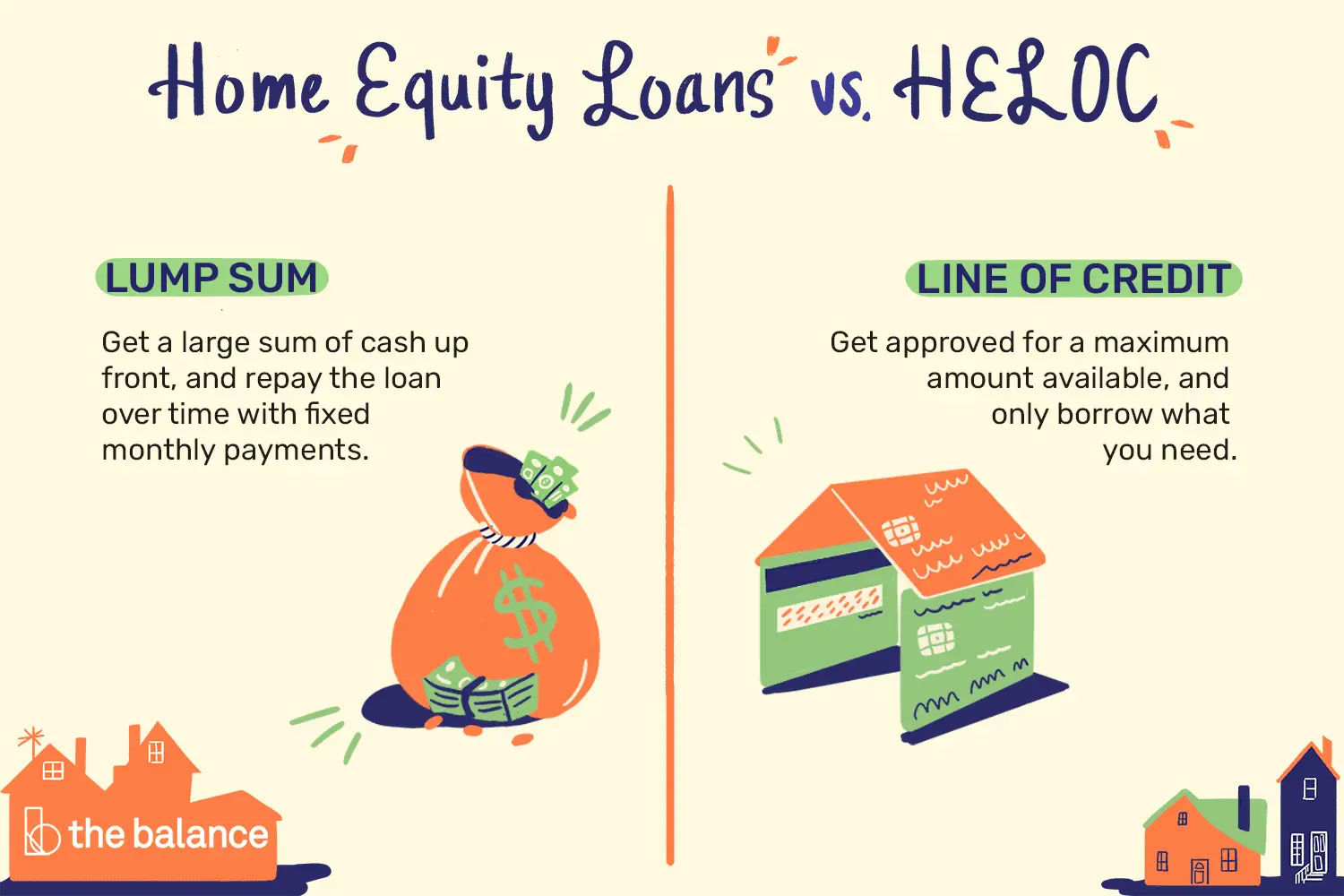

Paying for college, financing home renovations and consolidating debt are just a few of the reasons that homeowners take out home equity loans or lines of credit. Whether you need a one-time lump sum of money or access to cash on an as-needed basis, these types of financing provide flexible and accessible options.

There are two main ways a homeowner can borrow against the equity in their home: a home equity loan and a home equity line of credit .

Another Option: A Home Equity Line Of Credit

A HELOC, though also secured by your home, works differently than a home equity loan. In this type of financing, a homeowner applies for an open line of credit and then can borrow up to a fixed amount on an as-needed basis. The homeowner only pays interest on the amount that is borrowed.

Typically, a HELOC will remain open for a set term, perhaps 10 years. Then the draw period will end and the loan amortizes that is, you begin making set monthly payments for perhaps 20 years.

The main benefit of a HELOC is that you only pay interest on what you borrow. Say you need $35,000 over three years to pay for a childs college education. With a HELOC, your interest payments would gradually increase as your loan balance grows. If you had instead taken out a lump-sum loan for $35,000, you would have been stuck paying interest on the entire amount from day one.

Bmo Harris Bank: Best Home Equity Line Of Credit For Different Loan Options

Overview: BMO Harris Bank has more than 500 branches spread across eight states. However, customers nationwide can bank with BMO online. Its HELOCs start at $25,000, come with flexible repayment terms and have no setup fees.

Why BMO Harris Bank is the best home equity line of credit for different loan options: BMO Harris has a standard variable-rate HELOC, but you can also lock in all or part of your line at a fixed rate for a five- to 20-year term.

Perks: There are no application fees or closing costs, and you get a 0.5 percent discount when you set up autopay with a BMO Harris checking account.

What to watch out for: Borrowers may have to repay setup costs if the line of credit is closed within 36 months. Depending on the state in which you live, you may also have to pay mortgage taxes and an annual fee.

| Lender |

|---|

Also Check: Capitol One Autoloans

You May Like: Fha Loan Limits Fort Bend County

Personal Loan Vs Home Equity Loan: Which Is Best

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here’s how we make money.

How Much Can You Borrow

For both home equity loans and HELOCs, the method of calculating the amount you can borrow is the same. In the example of a house worth $800,000 with $500,000 equity, banks require that 20 percent of the house price must remain, in this case, $160,000. From the equity of $500,000, up to $340,000 can be made available to you in a loan or line of credit. Neither a home equity loans nor HELOC requires that this full amount be applied for you can request as little or as much of it as you need.

You May Like: Capital One Auto Finance Approval

How To Calculate Your Homes Equity

How much you can borrow with a HELOC or home equity loan depends on how much of your home you actually own, and how much of your equity your lender will let you tap.

To calculate the amount of equity you have in your home, subtract your current mortgage balance from the market value of your home.

Lets say your home was recently appraised for $300,000. If you only owe $200,000 on your mortgage, you have $100,000 in equity.

It wouldnt be a good idea to cash out all of your equity, and most lenders will require you to keep at least a 10% ownership stake in your home. To be on the safe side, many homeowners will maintain a 20% ownership stake. Think of the amount of equity that lenders will allow you to take out of your home as your tappable equity.

Is A Heloc Tax Deductible

Interest paid on a HELOC is tax deductible as long as its used to buy, build or substantially improve the taxpayers home that secures the loan,according to the IRS. Interest is capped at $750,000 on home loans . So if you had a $600,000 mortgage and a $300,000 HELOC for home improvements on a house worth $1.2 million, you could only deduct the interest on the first $750,000 of the $900,000 you borrowed.

If you are using a HELOC for any purpose other than home improvement , you cannot deduct interest under the tax law.

You May Like: How Long Does It Take For Sba Loan Approval

What Is A Variable Interest Rate

A variable interest rate is an interest rate on a loan or security that fluctuates over time because it is based on an underlying benchmark interest rate or index that changes periodically.

The obvious advantage of a variable interest rate is that if the underlying interest rate or index declines, the borrowers interest payments also fall. Conversely, if the underlying index rises, interest payments increase. Unlike variable interest rates, fixed interest rates do not fluctuate.

What Does It Mean To Use My Home As Collateral

You use your home as collateral when you borrow money and secure the financing with the value of your home. This means if you dont repay the financing, the lender can take your home as payment for your debt.

Refinancing your home, getting a second mortgage, taking out a home equity loan, or getting a HELOC are common ways people use a home as collateral for home equity financing. But if you cant repay the financing, you could lose your home and any equity youve built up. Your equity is the difference between what you owe on your mortgage and how much money you could get for your home if you sold it. High interest rates, financing fees, and other closing costs and credit costs can also make it very expensive to borrow money, even if you use your home as collateral.

Also Check: Fha Loan Refinance

Do I Have Enough Equity For A Home Equity Loan Or Heloc To Finance A Remodel

Calculating whether or not a home equity loan could finance your remodel is simple and straightforward.

This will give you an estimate as to how much you could get from a home equity loan or HELOC.

Is this enough to cover the cost of your renovation?

If its not , consider a RenoFi Loan that lets you borrow based on your homes after renovation value and significantly increase your borrowing power.

What Is A Heloc

A HELOC is a revolving line of credit that works like a credit card except its secured by your home. You can withdraw money as needed up to a maximum limit, pay the balance to zero and reuse the line for a set time frame called a draw period. After the draw period ends, you must pay the remaining balance in full or on a fixed-installment schedule.

THINGS TO KNOW

A home equity calculator can provide a glimpse of how much you can borrow. In most cases, youre limited to borrowing a total of 85% of your homes value, according to the Federal Trade Commission .

For example, if your home is worth $250,000, and your current loan balance is $175,000, you could access $37,500 with a home equity loan or HELOC.

The math is straightforward:

$250,000 x 0.85 = $212,500

$212,500 $175,000 = $37,500

Also Check: Prosper Credit Requirements

Whats The Difference Between Home Improvement Loans Home Equity Loans And Home Equity Lines Of Credit

Keeping up with home improvement projects can feel overwhelming for many homeowners. Every year, the list of updates tends to get longer, and funding these projects can put some strain on your bank account.

There are plenty of options available to homeowners who do not want to pay for home-related projects out of pocket. If you have enough equity in a property, you might opt for a home improvement loan or a home equity line of credit. When looking at a home improvement loan vs. a home equity line of credit, the main difference is the type of loan terms and arrangement. Loans are designed to offer a lump sum payment up front, while lines of credit allow the owner to withdraw smaller sums of money as improvement projects evolve.

What Special Protections Are Available For High

A high-cost mortgage is a home equity loan that is: secured by your principal residence and the APR exceed certain threshold amounts that are tied to market conditions. If you have a high-cost mortgage, you may have additional rights under federal law, the Home Ownership and Equity Protection Act and the CFPB has more information about your special rights.

If instead you have a higher-priced mortgage with an APR higher than a benchmark rate called the average prime offer rate , you may have additional rights. You may be entitled to these rights if your higher-priced mortgage is used to buy a home, for a home equity loan, second mortgage, or a refinance secured by your principal residence. These additional protections do not apply to HELOCs. If you have a higher-priced mortgage, the CFPB has additional information about your rights.

Recommended Reading: Refinancing A Fha Loan To A Conventional Loan

Also Check: Calculate School Loan Payment

Why Would You Need A Line Of Credit Or Refinance

As I mentioned I have a business that uses a lot of cash! We flip houses and have done as many as 26 flips in one year. It takes a lot of money to flip houses even if we use financing to buy the properties. We must pay for the carrying costs, repairs, and interest on the loans. I also buy rental properties which can also take quite a bit of money to buy and stabilize when we are purchasing properties that need work. There are many people who can use the money for their business or for investing. Interest rates on refinances and lines of credit are extremely low right now. While it can add more risk, it is worth it to many to take the equity out of properties they own to use for other investments.

There are people who like to constantly take cash out for other reasons like buying cars or vacations. Is that wrong? I am not here to judge people and tell them what they should do with their money. If they have the money and want to spend it a certain way then go for it. I am a big fan of saving and investing but not everyone lives life the same way. I would warn you to be careful about always relying on house values to increase so you can refinance. Housing prices could go down or your own financial situation could make it difficult to get new loans in the future.

How Interest Rates Work For Helocs

The prime rate typically moves in tandem with the Bank of Canadas key interest rate. When the Bank of Canada raises rates, the big banks raise their prime rates in turn. Most banks in Canada have the same prime rate. To provide some context, the Bank of Canada has increased its key rate to 1.25% from 0.5% from a year before. To put that figure into the perspective of the borrower, a rate increase of 0.75% translates into an increase of 23% on a HELOC with an interest rate of 3.2%.

For homeowners with a significant portion of their home paid off and access to ample equity, a rise in interest rates can be more comfortably cushioned compared to homeowners who are living pay cheque to pay cheque. According to a study by Mortgage Professionals Canada, over 1.5 million Canadians have a mortgage and a HELOC while approximately 490,000 Canadians have a HELOC and no mortgage.

Lenders typically offer a conventional mortgage in two types of rates fixed and variable. Most Canadians go with a fixed rate mortgage as it makes it easier to budget for payments with an interest rate that is guaranteed for the lifespan of that mortgage. With a HELOC, it is essential to read the fine print to understand what the notice period is for potential rate increases by the lender.

You May Like: Are Auto Loans Amortized

Advantages And Disadvantages Of Home Equity Lines Of Credit

When looking at what to choose between a home equity loan vs a home equity line of credit, you should know that HELOCs work like credit cards.

A HELOC will give you access to a line of credit so that you can borrow as little or as much as you need. In the end, you will only need to repay the amount you had used.

This financial tool has two periods, a draw period and a repayment period, and variable rates which can remain low or not, depending on index fluctuations.

And if you wonder what an index fluctuation includes, it can be factors like how much you borrow, your interest rate and the markets volatility.

In most cases, the smallest monthly payments will cover the interest during the draw period. But since different lenders have different offers, for some HELOCs you will need to pay a large lump sum at the end.

When comparing the differences between a home equity loan and a home equity line of credit, this type of loan has one major benefit: flexibility. HELOCs can be used for anything you want, but are better suited for home repairs and renovation which can raise your homes value.

Like in the case of home equity loans, private lenders saw the potential here too. Many individuals that banks refuse, are well capable of repaying their loans. Thats why, if youre looking for how to get a HELOC with no income or with a weaker credit score, our B-lenders in BC can help you with that too.

What Are The Requirements To Be Approved For A Home Equity Loan

Individual lending requirements will vary, but in general youll need a minimum of 10% equity in your home, with most lenders requiring 15% or more. In addition to having sufficient equity youll also need all the normal things that come with applying for a loan: proof of income, decent credit, and a good debt-to-income ratio. In general the credit score and DTI requirements for a home equity loan are slightly more lenient than for unsecured debt like a credit card as the loan is backed by an asset.

Also Check: Interest Rate For Car Loan With 650 Credit Score

The Disadvantages Of A Home Equity Loan

Taking out a home equity loan, or HELOC, to finance a new car does have certain disadvantages. First and foremost, borrowers must be certain they can maintain the regular monthly payment on their loan. This can sometimes be difficult, especially if the borrower is still paying off their first mortgage. Unlike a standard auto loan, where default means repossession, failure to pay off a home equity loan can put the borrowers home at risk for foreclosure.

Other Ways To Access Your Home Equity

In addition to a home equity loan or a HELOC, theres another way to access the equity in your home, through a refinance.

Refinancing Your Mortgage

Refinancing your mortgage involves replacing your current mortgage with a new one. To get access to extra cash, youll need to borrow more on the new mortgage compared to what you still owe on your current mortgage, leaving you with money left over. This is not only a great way to access your homes equity, but it can also help you lock in at a lower interest rate if the current rate is a lot lower than your previous rate.

Its important to understand that youll have to pay interest on the amount of cash you borrow right away. Plus, you may be charged a penalty fee for breaking your mortgage early. Make sure the fees are worth the refinance.

Also Check: What Credit Bureau Does Usaa Use

Payments And Interest Rate

A home equity loan’s interest rate is fixed, meaning the rate doesn’t change over the years. Also, the payments are fixed, equal amounts over the life of the loan. A portion of each payment goes to interest and the principal amount of the loan. Typically, the term of an equity loan term can be anywhere from five to 30 years, but the length of the term must be approved by the lender. Whatever the period, borrowers will have stable, predictable monthly payments to make for the life of the equity loan.

Understanding How Much You Can Borrow

Lenders will usually allow you to borrow up to 80% of your equity with a cash-out refinance and between 80 to 90% of your equity with a HEL or HELOC.

So, using the same numbers from the original example, if your home is worth $250,000 and you have an outstanding mortgage balance of $150,000, then you could end up with around $62,500 if you took the maximum loan amount :

This is a basic example for illustration purposes. Your final amount may be less due to closing costs or any other expenses associated with each loan.

Don’t Miss: Fha Loan Limits Harris County