Average Car Loan Interest Rates By Credit Score

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If youre in the market for a new or new-to-you vehicle, average car loan interest rates by credit score may give you an idea of what rate to expect from a lender.

Auto loan rates are provided as an annual percentage rate, or APR, and are based on several factors, such as your income and debt, as well as your credit score.

But your is likely the biggest factor in determining which rate youll get. The higher your credit score, the lower your car loan interest rate will probably be, because lenders perceive you as less likely to default on the loan.

Average Car Loan Interest Rates

|

20.43%. |

The average auto loan interest rate is 4.33% for new cars and 8.62% for used cars, according to Experian’s State of the Automotive Finance Market report for the second quarter of 2022.

With a credit score above 780, youll have the best shot to get a rate below 3% for new cars. If your credit score is less than 501, you can expect a rate above 10% for new cars.

Pros And Cons Of A 72 Month Car Loan

If you are in the market for a car the 72 month car loan is a popular choice, but you need to be sure its right for you. Below you can compare the advantages and disadvantages of a 72 month car loan.

Pros

-

The longer the loan term, the smaller your monthly payments will be.

-

Lower monthly payments mean more financial flexibility.

Cons

-

Longer-term loans typically have higher interest rates than shorter-term car loans.

-

You can end up owing more on the car than it is worth due to .

-

On a new car, the warranty will likely expire long before the loan is paid off adding car maintenance to your transportation bills.

Don’t Miss: Rate On Used Car Loan

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How To Calculate How Much Your Car Costs

In addition to the monthly payment, account for additional costs. These include common expenses like gas, insurance and maintenance. But you should also set aside money for unforeseen accidents at least enough to cover your deductible.

To calculate this number ahead of signing off on a new vehicle you will have to make some estimates.

Recommended Reading: What Car Loan Would I Qualify For

What Are Average Auto Loan Rates

The auto loan rates youre offered depend largely on your credit score. Borrowers with credit scores higher than 660 tend to receive lower interest rates than those who have credit scores below that number.

The table below shows average interest rates for new and used cars, according to Experians Q4 2021 State of the Automotive Finance Market report.

How Much Car Can I Get For $500 A Month

Recommended Reading: How To Get Approved For Home Loan With Low Income

What To Do With Your Trade

Although it’s convenient to trade in your old vehicle to the dealer at the time of purchasing another, it’s not to your best advantage. You are likely to get the least value from the dealer, as they have to move it yet again and need to ensure a safe profit margin on selling it. They do not have to take your old automobile, and will offer you what will make them the highest profit. Some dealerships may offer artificially high trade in values, but only offer them in association with a higher price on the vehicle they sell you.

Selling Your Used Car Privately

The best option typically is to sell your vehicle privately. It seems even government agencies are freely giving out this advice from the Arizona Attorney General to the FTC. Don’t underestimate the value of your old car. Go to Kelly Blue Book online to do your valuation research. If you can sell it, even for a small amount, it’s extra bargaining power for your new vehicle.

Each year Americans buy roughly double as many used vehicles as new vehicles. You can put a”for sale” sign on your car parked out front if you live in a high traffic area. Sites like Craigslist or Auto Trader can also help send buyers your way.

Another option with your old automobile is to keep it. An old pick up truck used for heavy work can help protect the value of a new vehicle by minimizing wear and tear, along with depreciation. Automotive insurance companies typically offer multiple vehicle discounts.

Other Mortgage And Financial Calculators

In addition to the standard mortgage calculator, this page lets you access more than 100 other financial calculators covering a broad variety of situations. Choose from calculators covering various aspects of mortgages, auto loans, investments, student loans, taxes, retirement planning and more.

All rights reserved. Mortgageloan.com® is a registered service mark of ICB Solutions, a division of Neighbors Bank, Equal Housing Lender Member FDIC, NMLS # 491986 ICB Solutions or Mortgageloan.com does not offer loans or mortgages. Mortgageloan.com is not a lender or a mortgage broker. Mortgageloan.com is a website that provides information about mortgages and loans and does not offer loans or mortgages directly or indirectly through representatives or agents. We do not engage in direct marketing by phone or email towards consumers. Contact our support if you are suspicious of any fraudulent activities or if you have any questions. Mortgageloan.com is a news and information service providing editorial content and directory information in the field of mortgages and loans. Mortgageloan.com is not responsible for the accuracy of information or responsible for the accuracy of the rates, APR or loan information posted by brokers, lenders or advertisers.

Also Check: How To Get Business Loan Easily

Can You Get A Personal Loan With Bad Credit

Yes, there are several lenders that work with borrowers who have bad credit. But it might be difficult to qualify for a personal loan amount as large as $40,000.

If youre struggling to get approved, consider applying with a cosigner to improve your chances. Not all lenders allow cosigners on personal loans, but some do. Even if you dont need a cosigner to qualify, having one could help you get lower interest rates than youd get on your own.

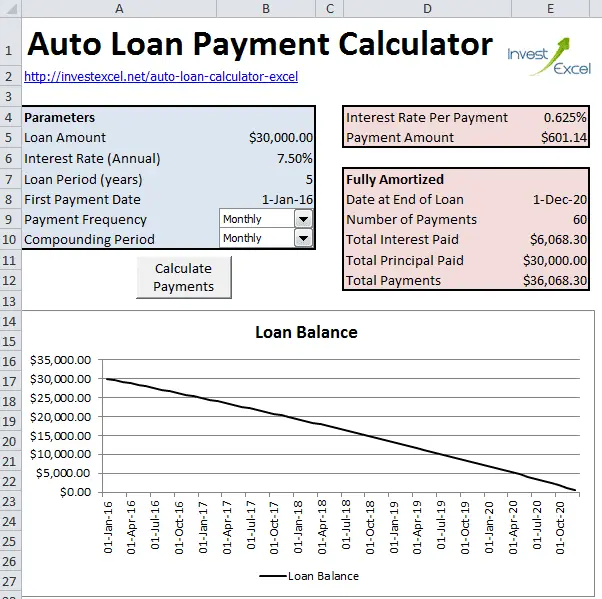

Auto Loan Calculator Faqs

How can I calculate car payments with taxes and fees?

Sales taxes and other fees that typically come with car purchases can be rolled into the auto loan financing. This means that those fees will be calculated alongside the auto price, down payment, loan term, and interest rate. However, in some cases, especially for buyers with low credit scores, the fees might have to be paid upfront.

How to use the auto loan calculator?

To make use of the auto loan calculator, input the total purchase price, loan term in months, interest rate, down payment, sales tax, select your state, and registration fees in the boxes provided. If you would like to carry out a trade-in, input the value of the trade-in. Otherwise, leave it at zero. The calculator will display the monthly payments for your loan.

If you already know how much you can afford each month, and want to see the total purchase price that can allow you to borrow, click the purchase price tab and follow the same procedure as before, but this time enter your potential monthly payment in the box provided.

What is the payment on a $40,000 car loan?

Calculating the monthly payment on a $40,000 car loan is pretty straightforward. All you need to do is head over to our auto-loan calculator, input the interest rate on your loan and the length of the loan term, and your monthly payment will be displayed. For $40,000 loans, monthly payments averagely range between $900 and $1,000, depending on the interest rate and loan term.

Read Also: How Do Mortgage Lenders Determine Loan Amount

Places To Get A $40000 Loan With No Credit Check

Friends and family: Theres no limit on the amount you can borrow from friends and family, as long as theyre willing to lend it. Just be sure to have a solid repayment plan so you dont ruin your relationship.

Pawnshops: Pawnshops typically offer 25% – 60% of an items value and give you time to repay that money with interest to reclaim the item. The interest is expensive, though.

Auto title lenders: You can get a loan for 15 to 30 days of around 25% to 50% of the value of your car. But if you cant pay it back with interest as high as 25% of what you borrow you could lose your car.

There are also quite a few lenders that offer secured personal loans, which are relatively easy to qualify for because the borrower provides collateral that the lender can keep if they default. But theres typically a credit check during the approval process for secured personal loans.

How do personal loans work?

Personal loans let you borrow a sum of money from a lender and then pay it back in monthly installments over a set term usually anywhere from 12 to 84 months. Those monthly payments include equal portions of the original loan amount, plus interest and fees. Personal loans can be used for debt consolidation, home improvements, vacations, big purchases and more. Understanding how things will go, from the time you apply to when you submit your final payment, is the key to making personal loans work for you.read full answer

Examine Your Buying Patterns

In addition to the formula for car affordability, recognizing your own car-buying habits, good and bad, can offer clues to the best strategy for you.

For example, are you someone who buys a car, pays it off and then keeps it for a few years? Buying a new car would work for you: You have a track record of shopping within your means, finishing off the loan and going payment-free for a while. That’s smart.

Do you get bored with a car after a few years? Then leasing is your best bet. What good is it to take out a six-year loan if you’re going to trade in the vehicle during the fourth or fifth year? You’ll likely owe more than the car is worth and will have to roll that balance into the next loan. You’d be better off leasing and paying less per month. Leasing also lets you get a nicer car for less money.

Finally, are you trying to make the most financially sound decision possible? Then buy a lightly used car, pay it off, and keep it for many years. The first owner takes the depreciation hit, and you’ll have a car that’s new enough to avoid major repairs for a while.

Recommended Reading: How To Take An Equity Loan

Determine Your Fuel And Insurance Costs

Before you set out to buy or lease, find out what your fuel expenses will be and what it will cost to insure the vehicle. Both costs vary considerably based on your location, your driving history and the vehicle you’ve chosen. Even though it takes a little work to come up with these estimates, you shouldn’t overlook them. Knowing these costs can help you choose among multiple vehicles. Some may cost more to fuel up others might have a higher cost to insure.

The EPA’s Fueleconomy.gov website has a detailed listing of fuel economy figures as well as annual fuel cost estimates for both new and used vehicles.

For insurance quotes, contact your agent or insurance company about the vehicle you’re interested in. You should be able to get an accurate estimate. Or go to the auto insurance website of your choice, and there should be an option to get an online quote. Do insurance and fuel costs add up to 7% or less of your monthly paycheck? Then you’re OK.

How To Calculate Apr On A Car Loan

In many cases, car loan calculators dont reflect state and local sales taxes or registration fees. Remember, your APR is a combination of your interest rates and any fees or discounts your lender includes. Other variables often left out of car loan calculators include:

- Application fee: Some lenders may charge a fee for submitting a loan application.

- Origination fee: This is a flat fee or a percentage of the loan amount that the lender charges for processing a loan.

- Payment-related fees: This includes late fees, returned-check fees and fees for certain payment methods.

- Prepayment penalty: Some lenders charge a fee if you pay your car loan off early. Its meant to give the lender some of the money it would lose out on by not collecting interest for the duration of your original loan term.

- Discounts: Your lender may offer a discount, such as for setting up automatic payments. This is included in your APR.

You can search online to find out about lenders fees or contact them directly to learn about costs in your area.

An auto loan calculator can also be used to compare lender offers and try different interest rates and loan terms. The knowledge you gain from using this tool can help you negotiate a fair deal with a lender or dealership to get the best auto loan rate for your situation.

Recommended Reading: How Does Co Signing For An Auto Loan Work

No Sales Tax Deduction For Trade

If you live in a state where your sales tax is calculated on your full purchase price, check this box. If this box is unchecked, sales tax is calculated on the purchase price less trade-in. Currently California, the District of Columbia, Hawaii and Michigan allow no deductions for trade-ins when calculating sales tax. In addition, Alaska, Delaware, Montana, New Hampshire and Oregon have no sales tax on autos.

Some Used Cars Are A Real Bargain

Before you take the plunge of buying a new car, consider a used one. Frugal shoppers know that new cars depreciate as soon as they are driven off the lot, and in fact lose on average 15-25% of its value each year the first five years. Buying one that’s a couple years old can still provide you with a reliable vehicle for thousands less while letting someone else take the depreciation hit. If you trade in every few years then depreciation is something to consider, so look for vehicles that traditionally hold their value such as Honda, Toyota or Lexus. If you keep your automobile until it falls apart, then depreciation is not a concern for you. New models for the upcoming year usually arrive late summer or early fall. Although selection may be limited, this is a great time to consider buying last year’s model because the dealer will need to make room for the new ones.

Do Not Buy a Lemon!

Check the used car history by the VIN# on sites like Carfax or AutoCheck. This will help eliminate anything that looks questionable. Anything that says it’s a salvage should raise a red flag. Salvage vehicles are those in accidents that the insurance company has determined repair costs are more than it is worth. Some shops will try to repair them and sale them at a steep discount. These are given salvage titles. Unless you are mechanically savvy, it’s best to avoid these.

Program Cars Are Often a Great Value

Read Also: Can I Use Home Equity Loan For Anything

Reverse Auto Loan Calculator: What Your Payment Buys

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If you know how much car payment you can afford each month, a reverse auto loan calculator can tell you how that translates into the total amount you can borrow. But, of course, there are variables: the length of the loan and the interest rate you get.

Say you have decided that you can afford to spend $400 a month on a car. How far that goes depends on your interest rate. At 3.5%, $400 payments buy you a $22,000 loan for 60 months. At 9.5%, you could finance a $19,000 loan. The loan length has an even more dramatic effect that 9.5% loan stretched out to 84 months would finance $24,500.

Below you can see how your loan amount changes by moving the sliders for payment and loan term. We’ve provided average rates by credit tier as determined by Experian Automotive.