Does Elephant Insurance Offer Sr

Yes, Elephant offers SR-22 insurance in Illinois, Indiana, Tennessee, Texas and Virginia.

An SR-22 is a court-order document that auto insurance companies file with the state as evidence that you meet the minimum liability coverage requirements. The state typically requires drivers with DUI convictions or multiple driving offenses to file an SR-22.

Auto Insurance From Elephant

Elephant sells the standard types of auto insurance you will find at other auto insurance companies:

Elephant also sells additional coverage types, including:

- Custom parts and equipment. This covers aftermarket parts, such as rims, electronic equipment or a custom paint job.

- Legal services. This add-on gives you access to legal assistance after a traffic violation or accident.

- Non-owner car insurance. This is a liability policy for people who donât own a car but need car insurance. Non-owner car insurance is a good option for those who often borrow or rent cars, or for someone without a car who needs to show proof of car insurance .

- Pet injury coverage. This covers up to $1,000 if your pet is hurt due to a problem covered by your policy, such as a car accident.

- Rental reimbursement. If your car is in the shop due to a problem covered by your policy , rental reimbursement insurance helps pay for a rental car or substitute transportation, like bus fare.

- Roadside assistance. If you are stranded on the road due to a problem like a flat tire or dead battery, roadside assistance insurance can help get you back on your way.

Check Auto Refinance Rates

If your lenders unable to help you with your upside-down car loan, consider auto refinancing if you have good credit. This could help you get a new car loan with a lower interest rate and lower monthly payment, letting you pay the negative equity off faster.

You can start by reaching out to your bank or credit union to see if you would qualify for auto refinancing based on your financial situation and remaining loan balance. After this, speak with a few third-party lenders to gauge interest rates and find the best deal.

You May Like: Can I Refinance My Fha Loan

Average Car Loan Interest Rates

|

20.99%. |

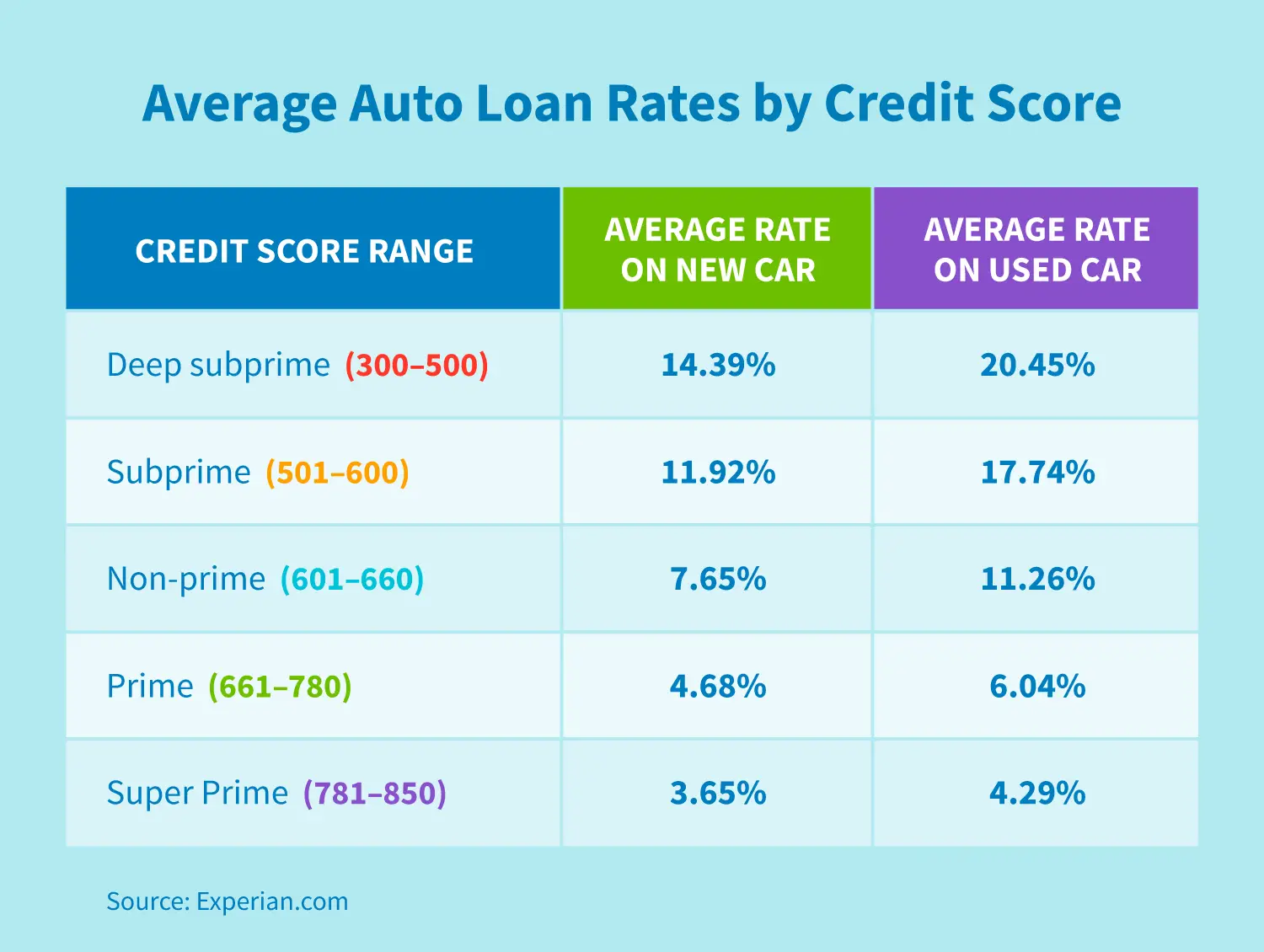

The average auto loan interest rate is 4.07% for new cars and 8.62% for used cars, according to Experian’s State of the Automotive Finance Market report for the first quarter of 2022.

With a credit score above 780, youll have the best shot to get a rate below 3% for new cars. If your credit score is less than 501, you can expect a rate above 10% for new cars.

What Are Other Important Car Ownership Costs To Consider

Beyond the cost of monthly car loan payments, vehicle ownership costs can add up.

Car insurance is one of the more significant costs that come with owning a vehicle. Make sure you understand car insurance rates and the best car insurance companies available in order to select the best car insurance coverage for your needs.

Also, consider maintenance and repair costs, which can start at around $100 per visit but vary by the make and model of your vehicle. Use Edmunds car maintenance calculator to get an estimate of how much youll spend to maintain your vehicle.

Fuel expenses are another cost to keep in mind as you search for a new vehicle. If youre unsure of how much to budget, visit FuelEconomy.gov to view the fuel economy or gas mileage and projected annual fuel costs for the year for the make and model of the vehicle you select.

There are also registration fees, documentation fees and taxes that youll pay when you purchase the car. Youll also pay to renew your registration every one, two or three years. Renewal fees and cycles vary by state.

Estimate your monthly payments with Bankrates auto loan calculator.

Read Also: What Is The Current Auto Loan Interest Rate

Lease Buyout Explained: Should You Buy Your Leased Car

When the end of an auto lease period comes up, it’s not always a given that you need to trade your wheels in for something new. While there are advantages to trading in your car, there may be benefits to buying your leased car.

4 min read

Buying your first car can be intimidating. Our guide can help you understand what financing options are available and how apply for a loan.

9 min read

Should You Get An Auto Loan From A Bank Or Dealership

It’s worth shopping at both banks and dealerships for an auto loan. New car dealers and manufacturers, just like banks, can have attractive loan products. Depending on the borrower’s credit score and market-driven circumstances, the interest rate offered by a car dealer can be as low as zero percent or under the going rates offered by banks.

It’s important to keep dealership financing as a possibility, but make sure to look for auto financing before deciding where to buy a car. Know your credit score and search online for bank and other lender rates. This should give you a range of what you can expect in the open market and help you determine if seller financing is a better deal for you.

You May Like: Bad Credit Online Loans Guaranteed Approval

Used Car Loan Features And Benefits

- Flexible repayment terms are offered by certain lenders.

- The documentation process is simple and minimum paperwork needs to be submitted.

- Depreciation rates and insurance costs are lower for a used car when compared to a new car.

- The loan amount will be less when compared to a new car loan. Therefore, the monthly payments will reduce.

- Up to 90% of the cars value may be provided as a loan.

- It is easy to apply for the loan and most lenders allow you to complete the process online.

- Most banks offer a long repayment tenure.

Paying Interest On Personal Loans

Interest rates on personal installment loans are known for being competitive. Its common for borrowers with both high and low credit scores to turn to personal loans when they need quick and efficient funding.

Like most loans, interest charges for a personal loan are broken up into each monthly installment. That means part of each installment will go towards paying off the principal balance, and the other part will go towards interest charges.

Also Check: How Can I Lower My Car Loan Interest Rate

Compare Current Car Loan Interest Rates In Canada

| Loan provider | ||

|---|---|---|

| From 4.99% | Autorama is one of the largest used car dealerships in Toronto. | Not specified online |

Note: the information below is just an example and does not take into account all of the factors lenders consider when evaluating a loan application. Actual lenders may charge different interest rates.

Example Auto Loan Payment

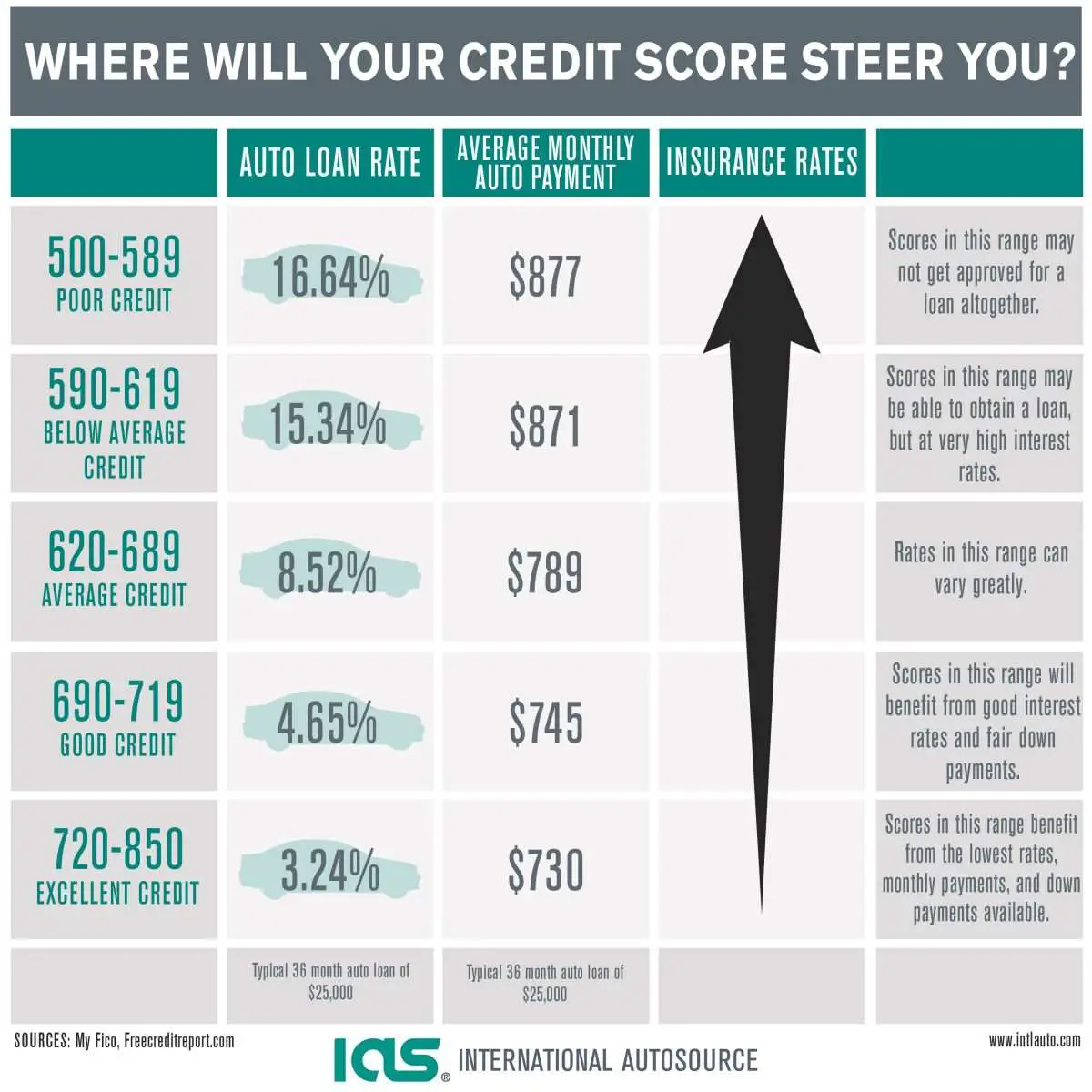

If you dont have great credit, you can expect to have a higher interest rate and pay more in total interest over the total life of your auto loan than someone with great or excellent credit.

Well walk through an example using an auto loan calculator. Lets say youre applying for a new car loan and you need to finance $25,000 over five years and put no money down. Heres an example estimate of what you would pay with an excellent credit score compared to a bad score:

| Source: Experian |

You May Like: Can I Buy Two Houses With Va Loan

What Is The Average Interest Rate On A Car Loan

Auto loan interest rates vary based on a number of factors, including the amount you are borrowing, the loan term, loan type and your credit history. The average interest rate for a new car is 3.86 percent, and the average interest rate for a used car is 8.21 percent according to the Experian State of Automotive Finance Market report from the fourth quarter of 2021.

The Bankrate Guide To Choosing The Best Auto Loan

Auto loans let you borrow the money you need to purchase a car. Since car loans are typically secured, they require you to use the automobile youre buying as collateral for the loan.

This is both good news and bad news. The fact that your loan, or financing, is secured does put your car at risk of repossession if you dont repay the loan, but having collateral often helps you qualify for lower interest rates and better auto loan terms.

Auto loans usually come with fixed interest rates and loan terms ranging from two to seven years, but its possible to negotiate different terms depending on your lender.

Why trust Bankrate?

At Bankrate, our mission is to empower you to make smarter financial decisions. Weve been comparing and surveying financial institutions for more than 40 years to help you find the right products for your situation. Our award-winning editorial team follows strict guidelines to ensure the content is not influenced by advertisers. Additionally, our content is thoroughly reported and vigorously edited to ensure accuracy.

How to choose the best auto loan lender

1. Approval requirements. 2. Annual percentage rate.3. Loan terms.

Read Also: How To Calculate Home Equity Loan Payment

What Vehicle Loans Tell Us About Cars Indians Want

4 min read.howindialives.com

Customer preference for utility vehicles, formalization of the used-car segment and the pickup in electric vehicles is changing business dynamics for lenders. Their loan sizes are becoming larger and they have the potential to earn higher margins if they manage risk well.

Even as supply constraintsprimarily that of semiconductorshit the car industry, demand patterns are changing. Buyers are showing a preference for costlier vehicles, and those seeking lower costs are cosying up to second-hand ones as the segment gets more organized. Mainstream buyers have also started considering electric vehicles. All these have impacted the vehicle-financing industry, which has a unique relationship with vehicle sales: it depends on them and also influences them.

Take the recent preference shown by Indians for costlier vehicles. Utility vehicle sales made up 48.5% of all passenger vehicle sales in 2021-22, up from 27.9% in 2018-19, shows data from HDFC Securities. Even within the compact cars segment, premium compact cars account for one-fifth of all sales, as compared to one-sixth in 2019. Its true even of two-wheelers, indicating a larger trend, one that has been referred to as premiumisation of the passenger vehicle industry.

Understanding Why Interest Rates Change

The Federal Reserve is responsible for setting the short-term rate. In turn, the Federal Reserve focuses on how long it would take the government to repay the loan if the economy were to tank. If they think the government would default on its loans, they raise rates to make it more expensive to borrow money. Unfortunately, there are no clear-cut rules when it comes to long-term interest rates. This means that each lender will use their own set of criteria when setting the rate on a loan. Unfortunately, this means that you may be able to secure a lower rate on a long-term loan, but your deal could be at the expense of your assets.

Don’t Miss: How To Switch Car Loan Companies

Loyalty Programme Introduced By Hyundai For New Customers

A new loyalty programme known as Hyundai Mobility Membership has been launched by Hyundai. Individuals who buy a car on or before 13 August 2020 will be eligible to avail the membership. However, according to Hyundai, all existing customers will also be eligible for the membership in the next phase. The steps that are involved to enrol for the programme are installing the Hyundai Mobility Membership app are registration, interest selection, details of the vehicle, and completing the registration. Details such as the email ID, mobile number, and VIN are needed to complete the registration. The three categories of the programme are lifestyle, mobility, and core. Hyundai has entered into a partnership with several companies so that various benefits will be provided under the programme. Various needs of the vehicle such as tyres, oil, and accessories are provided under the programme.

18 August 2020

Features Of Used Car Loans

The features of the loans available for Used Car are different from the loans available for the new cars, and are mentioned below:

- The loan offered for the Used Car ranges from 60% to 80% of the on-road price of the car.

- As the risk associated with the used car loan is higher. So, the rate charged on used car loans is on the higher side and starts from 13.75%.

- The process for applying for Used Car financing is simple and, most of the time is identical to the new car loan process.

- There are very few or no restrictions on applying for a car loan. Any individual with a permanent income can apply for it.

- The time period for the payment of the Used Car Loan is up to 7 years.

Read Also: Companies That Pay Student Loans

Where Can I Find The Best Car Loan Rates In Canada

You can often find competitive car loan interest rates in Canada from the following providers:

- Dealerships. Dealers have an incentive to offer the best car loan rates in Canada because they want you to buy a car from them. Dealers provide in-house financing and/or are partnered with multiple lenders, including the big banks. You can also negotiate with different dealers to bring your rate down.

- Banks and credit unions. While financial institutions do not have an incentive to sell you a car, they may still offer competitive interest rates. When weighing your options, check if the auto loan is secured or unsecured. Secured loans generally have lower rates than unsecured loans. Most auto loans are secured, but some auto loans from banks or credit unions may not be.

- Online brokers. If you have fair or bad credit below 660 and need help finding a lender who can approve you, you may wish to apply to an online broker that specializes in finding a car loan for borrowers like you. Online brokers are partnered with hundreds of dealers and can match you with multiple car loan rate offers. Be prepared for higher interest rates though, because lenders view borrowers with bad credit as higher risk.

Why An Auto Loan Calculator Is Important

If youre planning on financing your new vehicle purchase, the overall price of the vehicle isnt really the number you need to pay attention to. The most important number, for you, is the payment. Because, as our auto loan calculator will show you, the price you ultimately end up paying depends on how you structure your deal.

The factor that will change your monthly payment the most is the loan term. The longer your loan, the less youll pay each month, because youre spreading out the loan amount over a greater number of months. However, due to the interest youll be paying on your loan, youll actually end up spending more for your vehicle by the time your payments are over. Why? Because the more time you spend paying off your loan, the more times you will be charged interest.

Speaking of interest, the interest rate is the second most important number to consider when structuring a car loan. The interest rate is the percentage of your purchase that is added to the cost of your vehicle annually. So, if you buy a vehicle with 4.99% financing, then youre paying roughly 5% of your vehicles overall price in added interest every year.

Next, consider how much your vehicle is worth if youre trading it in. If youre trading in a vehicle thats worth $7000 and youre buying a vehicle thats worth $22,000, then you will only have to take an auto loan out for $15,000 .

Recommended Reading: How To Apply For Chase Auto Loan

What Documents Should I Prepare To Apply For A Used Car Loan

To ease your loan application process with the bank of your choice, the following are some of the general documents that you should prepare beforehand.

Individual applicants

- Copy of IC

- Copy of a valid driving licence

- Latest 1-month to 3-months payslips

- Latest EPF statement

- Latest 3-months to 6-months bank statement

- Latest BE Form/EA Form with a tax payment receipt

- Copy of Letter of employment

Business/Self-employed applicants

- Copy of IC

- Copy of a valid driving licence

- Copy of business registration form

- Copy of Form D

What Is A Fed Rate Increase And What Does It Mean For Your Auto Loan Interest Rate

A Fed rate increase is when the Federal Reserve Bank raises the overnight lending rate between banks. This can have an effect on your auto loan interest rate because its generally based on the prime rate, which is the interest rate at which banks lend to their best customers.

When the Fed increases rates, the prime rate usually goes up as well, and that can translate into a higher interest rate when you are calculating your car loan. However, there are other factors that affect auto loan interest rates besides the Feds overnight lending rate, so its important to talk to your lender about what you can expect.

Also Check: Best Rates For New Car Loans

Am I Eligible To Apply For A Car Loan For Used Cars

Before you proceed with the loan application for used cars, you can check out the general eligibility requirements for most banks in Malaysia as follows:

How Interest Rates Work On Car Loans

Next to a home, your car may probably be one of the most expensive purchases youll make in your lifetime. And if youre like most people, youll change vehicles a few times in your lifetime. But lets face it, most of us dont have the money to pay for a car or truck outright, which is why we rely on financing to purchase them. Some people may take advantage of financing deals from the automaker while others go to outside lenders. Whichever option you choose, you will have to pay interest on the loan.

But before you sign anything, its important to know how interest rates work on these loans. Getting an auto loan for a longer term with lower interest rates may keep the monthly bill below a budget-busting level, but is it a good deal for you? To answer that question, you need to understand how interest rates on car loans work.

Also Check: What Home Loan Interest Rate Can I Expect

Recommended Reading: How Do You Get An Unsubsidized Student Loan