Calculate How Much You Can Afford Each Month

When taking out a personal loan, one of the first things youll want to know is how much you can afford for your monthly payments. Luckily, many lenders and websites offer a monthly payment calculator that will let you see how the different terms can affect your monthly payment.

Typically you will need to enter things like your loan amount, the loan terms, interest rate, credit score, and income to get an idea of what your monthly payments will be.

Major Purchases Or Events

Personal loans are often used to cover major expenses, such as a wedding or vacation.

Who its best for: Anyone who needs to make a large purchase.

What to watch out for: Its not generally a good idea to take on a lot of debt, especially for something that only lasts for a short period of time. Its better to save up or cut expenses than to be paying for something with added interest for years afterward.

When to get started: If you have determined that a personal loan is the best way to go, apply for the loan by the deadlines you would need for the major event or when you plan to make the large purchase.

How to get started:

What We Don’t Like

Preference for Bank of America clients: You aren’t eligible for all of the available discounts if you aren’t a Bank of America client. However, clients get additional discounts, like receiving a discount of up to a 0.375% on your interest rate depending on what kind of account you have.

Early closure fee: Although one of the major benefits of a Bank of America HELOC is the minimal fees, if you close your account within 36 months for any reason, you will be charged a $450 fee and have to reimburse any third-party fees for closing costs that the bank paid on your behalf.

Higher rates for fixed loans: If you do decide to convert your HELOC into a fixed-rate loan, keep in mind your new interest rate will be slightly higher than your original variable interest rate. So although you don’t have to pay a fee to make the conversion, your interest rate will go up a bit. However, your rate may stay lower over the long-term compared with what your variable rate could go up to.

Read Also: Guaranteed Tribal Loans No Credit Check

How To Calculate Your Personal Loan Savings

Compare your existing debt information to see how lowering your interest rate and monthly payments can help you save on total interest. Simply input the amount of your current personal loan or debt, your current interest rate, and the term of the loan. If you have multiple loans or credit cards, enter your average rate into the payoff calculator. Then see a side by side comparison of your loan or debt vs a SoFi personal loan.

Enter Your

Calculated payments and savings are only estimates. All rates shown include the SoFi 0.25% AutoPay discount. Using the free calculator is for informational purposes only, does not constitute an offer to receive a loan, and will not solicit a loan offer. Any payments and savings will depend on the actual amounts for which you are approved, should you choose to apply.

Where Does Bank Of America Fall Short

Not sure Bank of America is right for you? Consider these potential drawbacks first:

- Limited options available. If youre looking to take out a personal loan, personal line of credit or student loan, youll need to look elsewhere.

- Requires a lot of paperwork. As with many bank loans, youll need to provide a lot of documentation for approval. The good news: You may be able to upload most of it online and avoid a long office visit.

- You must apply to see your exact APR. Because so much goes into the APR youre ultimately offered, youll need to submit an application to learn what you qualify for.

- Strong credit recommended. If your creditworthiness isnt good to excellent, you may not be approved for a loan.

Recommended Reading: Applying For An Sba Loan

Privacy & Cookie Policy

Community Bank is a Department of Defense owned banking program operated through a contract with a commercial financial institution. The Defense Finance and Accounting Service, in coordination with the Military Service banking representatives, is responsible for the oversight and management of Community Bank. Community Bank is referred to as “Community Bank” “the Bank” “we” or “us” within this policy.

Bank of America, N.A. currently operates Community Bank under a contract with the Defense Finance and Accounting Service. In accordance with that contract, Community Bank may be identified as “Community Bank, Operated by Bank of America.” Nevertheless, your relationship is with Community Bank, not Bank of America, N.A. Additionally, neither this policy nor other documents associated with your account at Community Bank create a contractual, fiduciary, quasi-fiduciary or special relationship between you and Bank of America, N.A. Community Bank values your privacy and is committed to protecting the information you provide us. The Privacy Policy, effective May 25, 2018, explains how we may collect information from you when you visit our online applications. Customer information means personally identifiable information about a consumer.

Loan Amounts And Terms

- Loan amounts. You may be able to borrow between $100 and $500.

- Loan terms. Regardless of how much you borrow, each loan has a term length of three months, with equally-split payments plus the $5 flat-rate fee. For example, if you borrow $100, youâll repay a total of $105 with three monthly payments of $35 each.

You May Like: How To Get Approved For Parent Plus Loan

Bank Of America Personal Loans: Low Interest Online Bad Credit Alternatives

INVESTORMINT MAY BE COMPENSATED THROUGH THIRD PARTY ADVERTISERS. HOWEVER, WE STRIVE TO OFFER INDEPENDENT RESEARCH, ANALYSIS, COMPARISONS AND REVIEWS. FOR MORE INFORMATION, PLEASE SEE OUR ADVERTISER DISCLOSURE.

YOU ARE SOLELY RESPONSIBLE FOR ALL OF YOUR COMMUNICATIONS AND INTERACTIONS WITH OTHER USERS OR MEMBERS OF THE PLATFORM AND WITH OTHER PERSONS WITH WHOM YOU COMMUNICATE OR INTERACT AS A RESULT OF YOUR USE OF THE PLATFORM, INCLUDING BUT NOT LIMITED TO ANY CUSTOMER MEMBERS, INVESTORMINT Partners OR SERVICE RECIPIENTS. YOU UNDERSTAND THAT INVESTORMINT DOES NOT MAKE ANY ATTEMPT TO VERIFY THE STATEMENTS OF USERS OF THE PLATFORM OR TO REVIEW OR VET ANY INVESTORMINT Services. INVESTORMINT MAKES NO REPRESENTATIONS OR WARRANTIES AS TO THE CONDUCT OF USERS OF THE PLATFORM OR THEIR COMPATIBILITY WITH ANY CURRENT OR FUTURE USERS OF THE PLATFORM. YOU AGREE TO TAKE REASONABLE PRECAUTIONS IN ALL COMMUNICATIONS AND INTERACTIONS WITH OTHER USERS OF THE PLATFORM AND WITH OTHER PERSONS WITH WHOM YOU COMMUNICATE OR INTERACT AS A RESULT OF YOUR USE OF THE PLATFORM, PARTICULARLY IF YOU DECIDE TO MEET OFFLINE OR IN PERSON AND GIVE OR RECEIVE INVESTORMINT Services. INVESTORMINT EXPLICITLY DISCLAIMS ALL LIABILITY FOR ANY ACT OR OMISSION OF ANY USERS OR THIRD PARTIES.

How The 2022 Fed Hike Impacts Personal Loans

In order to combat inflation, the Federal Open Market Committee raised interest rates three-quarters of a percentage point in June, making the new benchmark 1.5-1.75 percent. Officials from the Federal Reserve have indicated that there is likely to be another 0.75 percentage-point rate rise at the FOMCs upcoming meeting.

These rate hikes impact personal loan interest rates. Most personal loans have fixed interest rates, so borrowers who already have personal loans do not need to worry. However, those looking to take out a personal loan may face higher interest rates.

The average personal loan interest rate has risen from 10.41 percent at the beginning of May 2022 to 10.60 percent as of July 20th, 2022. Personal loan interest rates are likely to continue rising if the Fed raises the prime rate again at its next meeting.

Despite rising interest rates, there are things borrowers can do to cut down on costs when taking out personal loans. The rate you receive from a lender depends on factors within your control such as your credit score, desired loan amount and existing debts.

If you want to take out a personal loan and are looking to qualify for a better interest rate, here are some things you can do:

Read Also: How To Get Loan Officer License In California

If I Cant Get A Bank Of America Personal Loan Should I Get A Mortgage Through Them

A mortgage and a personal loan are not the same thing and should not be used interchangeably.

The only time a personal loan may be an option when buying a home is if you have a large deposit and simply need a small top-up that is well within your means as a borrower. Or, if you are purchasing a home in a very low-value area.

If you want to borrow more than $15,000, you likely need a mortgage. You also need to remember that lenders will ask you about any upcoming large purchases and that a personal loan secured against your home cannot be secured against your futurehome, so if you need a mortgage, look for mortgage specific advice.

What’s The Difference Between A Secured Loan And An Unsecured Loan

Secured loans are backed by a piece of the borrowers property as collateral, typically a vehicle or house. Because the borrower stands to lose personal property if they default, secured loans tend to have lower interest rates.

Unsecured loans are not backed by collateral, but instead by the borrowers creditworthiness. Because the lender takes on more of a risk with an unsecured loan, interest rates tend to be higher. Lenders also require that borrowers seeking unsecured loans have higher-than-average credit scores. Learn more about the key differences between secured and unsecured loans.

Also Check: Personal Loans For Self Employed With No Proof Of Income

Recap Of Bank Of America Personal Loan Alternatives

Here is a recap of some alternative options to Bank of America personal loans. Make sure to consider all eligibility requirements before applying with a lender. If a soft credit check is available, that is preferred as it wont impact your credit score. A hard credit check can stay on your credit report for around two years.

Both Upgrade and Upstart offer soft credit checks.

| Lender |

How To Qualify For Bank Of America Balance Assist

Bank of Americaâs Balance Assist loan comes with specific requirements, including:

- Customer history. Balance Assist loans are only available to people whoâve had their Bank of America checking account open for at least one year.

- Bank of America will perform a hard credit check each time you apply for a Balance Assist loan. However, Bank of America does not disclose its minimum credit score requirement.

- Checking account history. If your checking account is already overdrawn, youâre not eligible. Even if youâre listed as a joint account owner with someone else, if they overdraw the account, youâre still not eligible.

- Monthly deposits. You need to have regular monthly deposits into your checking account to be eligible. Bank of America does not disclose the minimum deposit requirement.

- Bank of America loan history. Bank of America limits you to six Balance Assist loans every 12-month period. In addition, if you already have an open loan, youâll need to pay it off in full before youâre eligible for another.

Also Check: How To Get Loan On 401k

Received A Mailer From Us

If you got a letter stating that youre pre-selected for a SoFi loan, youre in the right place. Get started by entering your confirmation number below.

You are now leaving the SoFi website and entering a third-party website. SoFi has no control over the content, products or services offered nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering. SoFi does not guarantee or endorse the products, information or recommendations provided in any third party website.

- Mon-Thu 5:00 AM – 7:00 PM PT

- Fri-Sun 5:00 AM – 5:00 PM PT

Home Loans General Support:

- Mon-Fri 6:00 AM 6:00 PM PT

- Closed Saturday & Sunday

- Mon-Thu 8:00 AM 8:00 PM EST

- Fri 8:00 AM – 7:00 PM EST

- Closed Saturday & Sunday

2750 East Cottonwood Parkway #300 Cottonwood Heights, Utah 84121

To check the rates and terms you qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit.

SoFi Lending Corp. or an affiliate is licensed by the Department of Financial Protection and Innovation under the California Financing Law License No. 6054612. NMLS #1121636 .

Important Information Related To Eu Data Protection

Community Bank recognizes the importance of maintaining the privacy of individual information in compliance with applicable legal and regulatory requirements. Our EU Privacy Notice outlines how Community Bank in the European Union collects, uses, processes, and shares personal information as well as the rights individuals may have in relation to our use of that information. To review a copy of the EU Privacy Notice, please

Don’t Miss: What Is An Upside Down Car Loan

Home Equity Lines Of Credit

HELOCs let you turn some of the equity youve built into your home into cash. Much like a credit card, your lender will give you a credit limit, which is the most theyre willing to lend to you.

You can go to the lender and request cash from your HELOC, which will be deposited into your checking account.

Each month youll be billed for whatever your HELOCs balance is, plus interest.

If you havent taken money from your HELOC, you wont be billed. It serves as a line of credit that you have the option of using, but are not obligated to.

HELOC interest rates are closer to mortgage rates than credit card rates because your house serves as collateral. That makes them a good way to consolidate other loans or fund home improvements.

Should I Use A Bank Of America Credit Card Instead

Again, take a step back and think about the financial product you need and why you need it. Credit cards are a great way to build up credit or use it to spread the cost of car repairs over a few months, but there arent going to be many circumstances in which you can use a credit card in place of a personal loan.

If you have a great interest rate or a 0% interest period and a big enough line of credit for the purchase you intend to make, a credit card may work just as well as a personal loan .

You should also ask yourself if you will make a concerted effort to pay it off each month, because if not, its easy to get into financial difficulty.

Recommended Reading: What Is The Cheapest Personal Loan

What Alternatives To Bank Of America Personal Loans Are There

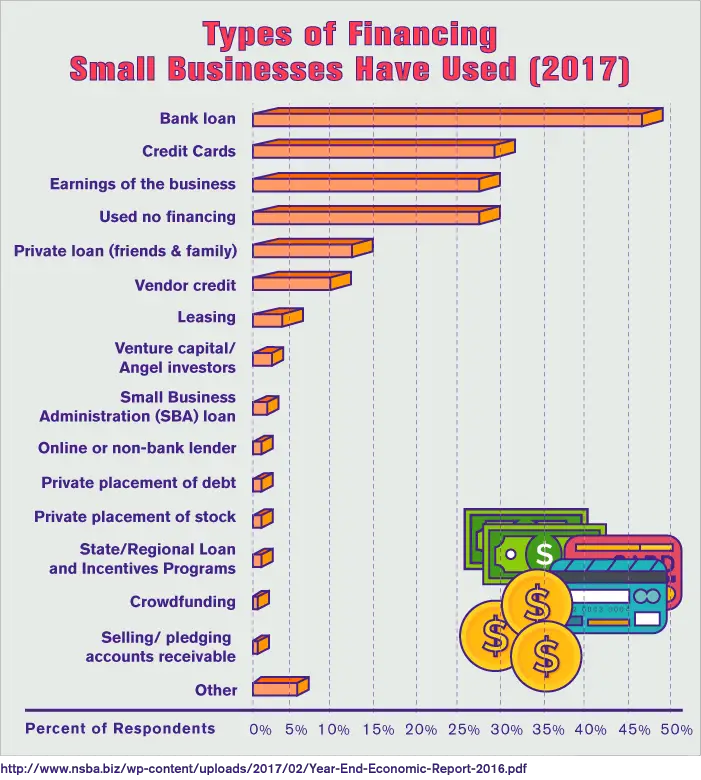

Personal loans arent just available from large, traditional banks, and its likely youll actually find a better deal if you compare lenders instead of applying directly with whoever you bank with. Besides traditional banks, youll also find personal loans from credit unions and online lenders.

Generally, online lenders will have more flexibility in who they accept and the rates they offer, as they aim to out-compete large banks and credit unions, so always compare personal loans before making a decision.

Are Bank Of America Loans Safe

Bank of America is the second-largest bank in the US with a longstanding history of providing financial service. Its website is easy to use, offering customer support and encryption to safeguard information. Its also consistently won an award for Best Overall Identity Safety by Javelin Strategy & Research for the past nine years. Beyond this, it offers resources to help customers further protect their information such as free online security tools and educational videos about how to keep your identity safe

If youre having trouble or have questions, contact BofA customer service by phone or visit a branch in person.

Recommended Reading: How To Negotiate Home Loan Interest Rate

Lightstream: Low Interest Rates

Why consider LightStream: LightStream is the online lending division of Truist. What sets it apart from other lenders are its low interest rates and its rate beat program.

Here are some more details on LightStream.

- Rate beat program LightStream offers a rate that is 0.1 percentage points lower than the rates offered by competing lenders if you meet certain requirements.

- Competitive interest rates Interest rates are very competitive, depending on your credit and other factors and they may include a 0.5% rate discount for setting up automatic payments.

- Loan amounts Loan amounts range from $5,000 to $100,000, which you can repay over two to 12 years. And you might be able to receive loan funds as soon as the same business day.

- No prepayment penalty LightStream doesnt charge a prepayment penalty if you want to pay off your loan early. It also doesnt charge origination or late payment fees.

Learn more about LightStream in our review.

Why Should I Consider Taking Out A Bank Of America Loan

Bank of America works to make taking out a loan easy. Here are some reasons people choose it:

- Coborrowers welcome. You can typically list a spouse or partner on your loan, which could possibly get you a larger loan amount or lower interest rate or both.

- Potential discounts for current members. For example, you can get a 15% discount on an auto loan if you have a BofA checking account. Check with Bank of America to see if you qualify for any other discounts.

- Convenient online application. For its auto and home loans, you can complete a convenient online application. And for its small business loans, you can schedule an appointment online for phone or in-person consultations. Then, you can create an account and upload documents, download loan disclosures, track the progress of your loan and e-sign your paperwork all online.

- Low rates. Home mortgages and auto loans offer low interest rates for borrowers with good to excellent credit. And youll have the option of making online payments.

- Fast approvals. You may be approved in minutes for an auto loan. Other loans come with turnaround times of a few days.

You May Like: How Can I Pay Less Interest On My Car Loan