Best Bank For Refinancing Your Pnc Bank Loan

Best Auto Loan Refinance Companies of 2021

- Best for Great Credit: Credit Unions

- Best for Checking Rates Without Impacting Your Credit: Capital One.

- Best Trusted Name: Bank of America, Chase or WellsFargo.

- Best for The Most Options: WithClutch.

- Best for Members of the Military: USAA or Navy Federal CU.

- Best for Peer-to-Peer Loans: LendingClub although not recommendable.

- Digital Credit Union and PenFed.

How Pnc Bank Personal Loans Compare

You can borrow up to $100,000 with Wells Fargo, which is a much higher maximum loan amount than PNC’s top amount of $35,000 and Prosper ‘s maximum of $40,000. If you need a larger personal loan, Wells Fargo may be a better option.

Wells Fargo’s repayment terms range from one to seven years, while PNC’s range from 6 to 6 months. If you want a shorter term length and to save money on overall interest in the process PNC may be the choice for you.

Prosper will charge you an origination fee between 2.41% and 5% of your total loan amount, while Wells Fargo and PNC won’t charge an origination fee at all.

See our ratings methodology for personal loans »

What You Need To Know After Closing The Auto Loan

Upon closing the refinance auto loan, you will be required to ensure you are listed as the registered title owner and PNC Bank as lienholder.

If you are currently listed on the title, PNC Bank will need the original title and state required form signed/dated. Everyone’s situation may be different, so if there are additional steps needed to be taken to secure the title, a representative from PNC Bank will be in contact with the you to further instruct.

Recommended Reading: Does The Va Loan Cover Land

Lowlights Of Pnc Auto Loans

- Select locations only: Mostly in states east of the Mississippi River.

- Strong credit required: PNC is not transparent about its credit requirements.

- Used car restrictions: 2011 or newer vehicles only

- Consumer vehicles only: Small business owners must apply for a business auto loan as if its a personal auto loan.

- Autos only: PNC does not finance RVs, motorcycles or boats.

- Low ratings: PNC Bank loans and auto loan modification get a B- rating at the Better Business Bureau.

What To Do If You Get Turned Down For A Pnc Auto Loan

If your application is denied by PNC, you should:

- All lenders, including PNC, are legally required to tell you why you werenât approved. If you donât get this information online, call the bank and ask. Then youâll know what next steps you need to take to become qualified.

- Review your credit. If your application was denied because of your credit rating, try to improve your credit score. Or if there are errors in your credit report, submit a dispute through all three credit reporting agencies to get it fixed.

- Try again later. Sometimes timing is the issue. For example, the length of time youâve been at your current job, a recent bankruptcy or a large purchase could have affected your application. If this is the case, ask your lender to give you a timeframe for when it might be best to reapplyâand what you should do before then.

- Consider a co-signer. If your application is rejected due to bad credit, consider adding a co-signer to help secure the loan and potentially get a better rate.

You May Like: What Is The Best Student Loan Program

Compare Offers To Find The Best Loan

When searching for a personal loan, it can be helpful to compare several different offers to find the best interest rate and payment terms for your needs. With this comparison tool, you’ll just need to answer a handful of questions in order for Even Financial to determine the top offers for you. The service is free, secure and does not affect your .

This tool is provided and powered by Even Financial, a search and comparison engine that matches you with third-party lenders. Any information you provide is given directly to Even Financial and it may use this information in accordance with its own privacy policies and terms of service. By submitting your information, you agree to receive emails from Even. Select does not control and is not responsible for third party policies or practices, nor does Select have access to any data you provide. Select may receive an affiliate commission from partner offers in the Even Financial tool. The commission does not influence the selection in order of offers.

How Pnc Auto Loans Work

PNC offers loans to buy a car from a dealer or private party, buy out your lease, or refinance an existing loan. You have to visit a branch if you’re buying from a private party. Other lenders don’t provide all of these options, so you may find your choices are less limited with PNC.

Loan terms range from 12 to 72 months, but keep in mind that the longer your term, the more you’ll pay in interest. A long loan term could also cause you to go upside down on your loan, meaning you owe more money on your car than it’s worth.

The lender has a program called PNC Total Auto. You’ll see what other people in your area have paid for a specific car to better understand how much money you’ll need to take out. Then you can get approved for financing before going to the dealership.

PNC does allow cosigners on its loans. If you have a poor credit history or simply want to qualify for a better rate, you can enlist someone with a better credit score to improve your chances or getting approved for a loan.

PNC Bank offers financing for cars model year 2014 or newer if you want to buy an older car, you won’t be able to get a loan through PNC. You’ll get your money as soon as the day after your loan is approved.

To contact customer support, call PNC Monday through Friday from 7:00 a.m. to 10:00 p.m. ET, or Saturday through Sunday from 8:00 a.m. to 5:00 p.m. ET. You’re also able to log into your account and using the secure messaging center.

Recommended Reading: Loans That Don’t Check Credit

Servicemembers Civil Relief Act

The SCRA provides financial relief and protections to eligible servicemembers and their dependents. PNC is grateful for your service and we would like to help you understand your benefits and protections under SCRA as well as other similar benefits that PNC may be able to provide to you.

To find out more, please contact us at:

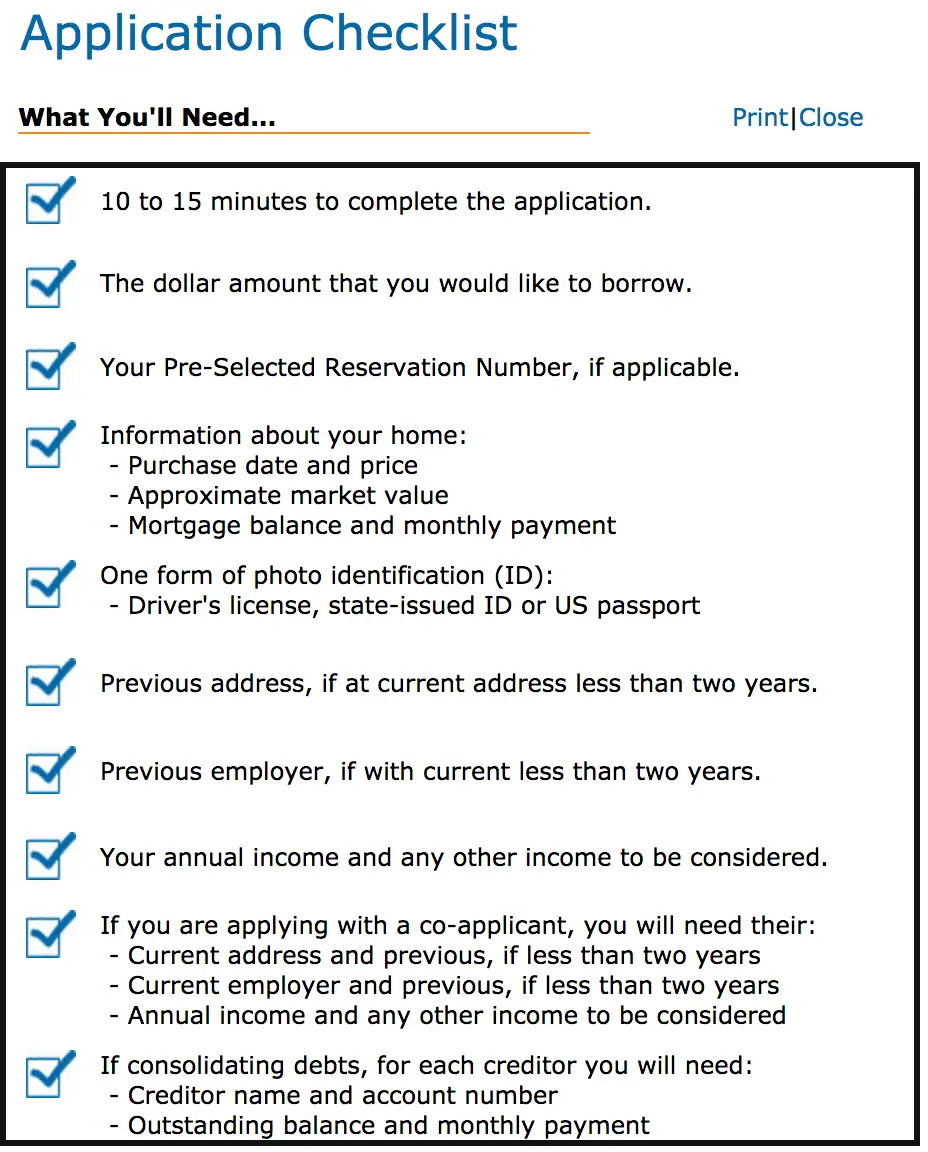

How To Apply For A Pnc Car Loan

When you apply for an auto loan or refinancing at PNC, youll need to first check that there is a branch within 50 miles of your location. If not, then you are not eligible for an auto or refinancing from the bank. You can either use its location finder or call the customer service line to see if your area is serviced by PNC.

Once youve determined that you are in an area that PNC services, you can start an application for a new or used car auto loan either online, by phone or in-person at a local PNC branch. For new and used car auto loans youll need the following documents:

- The amount of the loan

- Your government-issued ID

- Your address: If youve been at your current address for less than two years, youll need your previous address as well.

- Employer information: If youve been at your current job less than two years, youll also need the name and address of your previous employer.

- Proof of income

- Your co-applicant or co-signers information, if you have one.

- Vehicle information if youre purchasing used .

For a private-party auto loan youll need to bring all the information you need for financing a new or used vehicle plus:

- Vehicle selling price, year, make and model

- Vehicle trade-in value, year, make and model

- Down payment, if any

- VIN of vehicle to be refinanced or purchased

If you want to refinance youll need all the above information plus:

- The 30-day payoff amount, interest per day , account number and overnight mailing address for sending the payoff check

Also Check: How To Get Marriage Loan

Is Pnc Trustworthy

PNC Bank has an excellent A+ rating from the Better Business Bureau, a non-profit organization focused on consumer protection and trust. The BBB determines its ratings by looking at a business’ responses to customer complaints, truthfulness in advertising, and clarity about business practices.

Keep in mind that a top-notch BBB rating doesn’t guarantee you’ll have a great relationship with the lender. Reach out to anyone you know who has taken out an auto loan with PNC and learn about their experiences with the company.

PNC has been at the center of a recent scandal. In 2019, a federal lawsuit accused PNC of helping a man carry out a fake debt relief scam, which cost customers $85 million overall. In 2014, PNC became suspicious of the man’s account activities and shuttered his bank accounts. But the bank let him open more accounts nine months later.

What Sets It Apart

PNC Bank offers a wider range of financing options than youll find with most providers. And its online application sets it apart from other regional banks, which often require you to visit an office in person.

But you might be able to find a lender thats more transparent about fees. And where most lenders offer everyone a 0.25% autopay discount, you must have a PNC Bank checking account to get a reduced rate.

Want to look for better rates or just shop around before you apply? Compare more providers with our guide to car loans.

Recommended Reading: Can I Use Spouse’s Income For Car Loan

Pnc Bank Auto Loans: At A Glance

- Terms starting at 12 months

- Amounts starting at $5,000

- Good credit required

- Qualified car models must be 2011 or newer.

As we mentioned earlier, PNC starting rates are competitive but the starting APR of 2.79% includes a 0.25% discount thats only applicable if you make automatic car payments through a PNC checking account. Rates are also lowest for the shortest terms, which start at 12 months and stretch as long as 84 months, according to a PNC spokesperson, though the website shows that 72 months is the longest term. You may borrow up to $999,999, according to PNCs calculator, but the spokesperson said upper limits for an auto loan are generally $200,000. APRs shown on the calculator may vary by area.

Well now discuss PNCs auto loan offerings by type. PNC offers a variety of auto loans including:

- Buying a new car from a dealer

- Buying a used car from a dealer or private party

- Minimum loan amount of $7,500

PNC will finance a new car you purchase from a certified dealer. The newer the car and the shorter the term, the lower the rate. Be aware that higher rates may apply for longer terms like 60- or 72-month loans. Rates also depend on your location. Its worth noting again that the rates above include the autopay discount. PNC allows a co-signer or co-applicant.

Used cars dealers

- Minimum loan amount of $7,500

Used cars private party

- Minimum loan amount of $5,000

Refinance loans

- Minimum loan amount of $5,000

Check Ready Auto Loan

- Minimum loan amount of $15,000

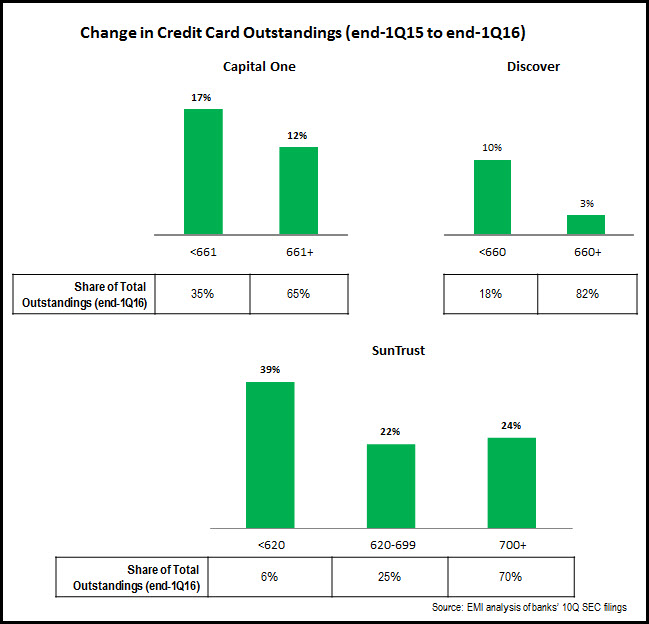

Auto Loan Credit Score Requirements

Of all the lenders on our list, only Lightstream and Capital One disclose their minimum credit score requirements. Lightstream’s is 660 and Capital One has a floor of 500 .

The credit score you’ll need to qualify for a loan will depend on the particular lender, though you’ll likely qualify for a better rate with a higher score.

You can find your credit report for free on annualcreditreport.com from any of the three major credit bureaus weekly through the end of 2022. While this report won’t give you your credit score, it will show you information about your credit and payment history, which lenders use to decide whether to give you a loan. Reviewing your credit report can help you know what you need to improve.

You can get your score at no cost on your credit card statement or online account. You can also pay for it from a credit reporting agency.

range between 300 and 850. Here’s how scores break down, according to FICO:

- Very poor: 300 to 579

- Fair: 580 to 669

- Very good: 740 to 799

- Exceptional: 800 to 850

Checking your rates with most companies will not impact your credit score because a majority of lenders will only generate a soft credit inquiry when showing you personalized rates. However, if you choose to accept a loan, lenders will likely conduct a hard credit inquiry, which may negatively affect your credit score. A hard inquiry offers a lender a comprehensive look at your credit history.

Don’t Miss: How Much Va Loan Can I Get

How Do I Choose The Best Auto Loan For Me

To find the best auto loan for your personal situation, look at several key factors. Many borrowers prioritize the lowest interest rate, but also consider any fees, the minimum credit score needed, and the accessibility of the lender’s customer service.

You also need to take into account what type of cars the dealer will finance, how much money they will finance, and the loan term length.

Guides like this one will help you compare multiple lenders in the same place to weigh their pros and cons. Make sure to also read individual reviews of any lenders you’re considering.

Bottom Line On Private Party Auto Loans

Private party auto loans arent as easy to find as standard used car loans. But buying a car from a private seller can have advantages that might make the extra effort worth it.

As with any loan, the keys to finding the best rates are having a good understanding of your financial situation and comparing offers from lenders.

You May Like: How Much Loan Will I Qualify For

You May Like: Can You Get Personal Loan From Bank

Best For Excellent Credit: Lightstream

- Loan amounts range from $5,000 to $100,000

- Loan term lengths range from 24 months to 84 months

- Rate discount of .50% when you sign up for AutoPay

- No restrictions on age or mileage of your car

- Loans made by Truist Bank, member FDIC

If you have a good or excellent credit score, you might want to consider LightStream in addition to Bank of America. A part of SunTrust Bank, Lightstream focuses on auto loans to customers with good or better credit.

Because it focuses on a narrow subset of customers, its rates don’t go too high For a 36-month loan for a new car purchase between $10,000 and $24,999, interest rates range from 2.49% to 6.79%. However, borrowers with lower credit scores may find better rates elsewhere.

Best For Bad Credit: Capital One

- Loan amount range from $10,000 to $80,000

- Repayment terms between 36 to 72 months

- GAP coverage available, which reduces the gap between how much the car is worth and how much you owe on the vehicle if your car is totaled or stolen

- Can’t get a loan in Nevada, Vermont, or Washington, DC

- Funding can take up to a few weeks

- Customer service available by phone and email

- Loans are made by Ally Bank, member FDIC

Online bank Ally doesn’t offer financing to purchase a car. But, if you’re looking to refinance the car you already have, its auto lending division Clearlane offers some competitive rates. As long as your vehicle meet the standards , this lender could offer a competitive rate as low as 3.99% according to NerdWallet. Clearlane also offers auto lease buyouts.

Read Also: What Does It Mean To Refinance Your Auto Loan

About Pnc Bank And Its Auto Loans

PNC Bank offers a variety of consumer and institutional products ranging from home mortgages to wealth management for more than 8 million customers, primarily east of the Mississippi River. PNC currently services only three states west of that: Texas, Kansas and Missouri.

You must be within 50 miles of a physical branch in order to be eligible for an auto loan or refinancing through PNC, though it does offer personal loans or lines of credit that may be used to buy a car anywhere. However, rates may be higher and maximum loan amounts lower than traditional auto loans.

Average Rates For Auto Loans By Lender

Auto loan interest rates can vary greatly depending on the type of institution lending money, and choosing the right institution can help secure lowest rates. Large banks are the leading purveyors of auto loans. Credit unions, however, tend to provide customers with the lowest APRs, and automakers offer attractive financing options for new cars.

Recommended Reading: Can You Pay Off One Main Financial Loan Early

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Things To Consider Before Refinancing

Also Check: How To Settle Defaulted Student Loan