Understand Fha Property Requirements

You can only buy or refinance primary homes with FHA loans, which are houses where you mean to live most of the time. You cant finance second homes, rental properties, or investment properties with an FHA loan. There are also minimum health and safety standards the house must meet to qualify for financing.

Best Lenders For Fha Loans In December 2021

FHA loans offer several benefits including low rates and low down payments. Compare some of the best FHA lenders to find the right fit for your needs.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

You might think all Federal Housing Administration lenders are the same. But even when youâre looking for an FHA loan, itâs always smart to shop at least three lenders. Their mortgage rates, fees and other costs to borrow can vary substantially.

NerdWallet has picked some of the best FHA lenders in a variety of categories so you can quickly determine which one is right for you.

» MORE:Compare FHA mortgage rates

The coronavirus pandemic introduced some new challenges to getting a mortgage. Many lenders facing high loan demand and staffing issues increased their fees, adjusted minimum required credit scores or temporarily suspended certain loan products. While some products and business practices have returned to pre-pandemic levels, you might still find delays and limited options. If you canât pay your current home loan, refer to our mortgage assistance resource. For information on how to cope with financial stress during this pandemic, see NerdWalletâs financial guide to COVID-19.

Can An Fha Loan Be Used For A Fixer

Another plus for an FHA loan is that they offer funding tor home improvements through the FHA 203k program. A 203k loan lets you borrow money for home ownership and home improvements in one loan. It is guaranteed by the FHA, which can help to keep your interest rates low .

So is a 203k loan for you? It does offer competitive rates, and you can often buy a home that traditional lenders might not provide funding for. As with other FHA loans, the maximum on the loan depends on the location of the property. As a general rule, you can use the 203k loan to borrow up to 110% of the homes projected value after improvements are made. And by having only one loan for both the home and the improvements, youll have a lot less paperwork to complete!

The biggest draw for a 203k loan is that youre able to make the home improvements you want to make. Say you want to update a kitchen and bath or add on a new room on the home youre planning to buy everything is taken care of IN ADVANCE. And youre even allowed to set aside some money to cover your housing while the repairs are being completed.

There are limits, of course. The home improvements must cost $5000 at a minimum. And, if youre project will cost under $35,000, the FHA offers a streamlined 203k loan, which makes the process a lot easier. But remember: if you make a mistake and underestimate your costs, youre going to be out of luck. You cant increase the loan amount once its finalized.

Don’t Miss: How Long Does The Sba Loan Take To Process

Where To Get An Fha Loan

FHA loans are backed by the government, but you apply and obtain them through FHA-approved lenders. You can find a list of approved lenders on the Housing and Urban Development website.

Keep in mind that because the government doesn’t directly finance these loans, it doesn’t set the interest rates or termsthe lenders do. That means the costs of FHA loans can vary, so it could be worth shopping around to find the best deal.

Additionally, while FHA loans tend to have competitive interest rates, HUD recommends homebuyers still compare FHA loans with other types of mortgages in case an FHA loan isn’t the most affordable option. While FHA loan interest rates may be the lowest option for those with credit issues, a conventional loan may have better rates for those with stronger credit.

Benefits Of A Univest Fha Loan

- Available to first-time homebuyers and repeat borrowers

- As little as 3.5% down payment

- Available in a variety of fixed-rate and adjustable-rate loan options

- Flexible income, debt and credit requirements

- 100% gift or grant allowed for down payment and closing costs

- Non-occupying co-borrowers allowed

- Up to 6% seller paid closing costs

- FHA program is available for all income levels

Also Check: Usaa Car Loan Application

What Is The Difference Between Grants For First Time Home Buyers And First Time Home Buyer Programs

A first home buyer grant is a predefined amount of money that is given by the government or specific organization to a first-time home buyer for the specific purpose of assistance in buying a first home. Grants for first-time home buyers are usually available based on region.

A first home buyer program is an incentive offered by the mortgage lender which outlines special rates, terms, or benefits that are offered exclusively to first-time home buyers. These programs are highly unique to each lender.

How Can I Know If An Fha Loan Is Right For Me

FHA loans are designed for moderate- and low-income borrowers. It may be the right choice if you:

- Have a great score of 580 or higher

- Can afford a monthly mortgage payment but dont have a large down payment saved

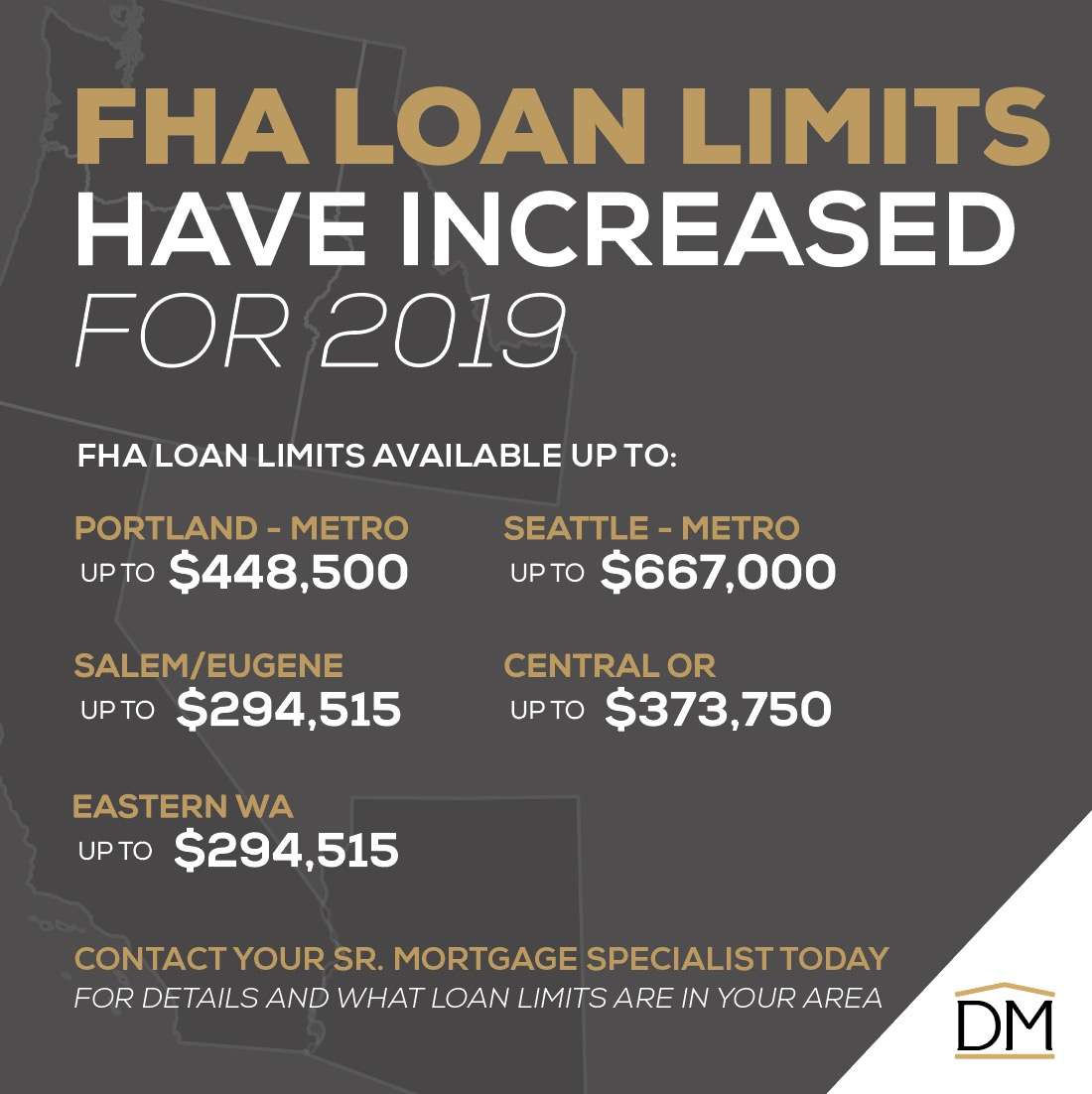

- Are willing to buy a home within the FHAs loan limits

There are no income or geographic restrictions on FHA loans. They can be a great choice if you have only a low down payment available or have a spotty credit history that has affected your credit score.

Also Check: Usaa New Car Loan

History Of The Fha Loan

Congress created the Federal Housing Administration in 1934 during the Great Depression. At that time, the housing industry was in trouble: Default and foreclosure rates had skyrocketed, loans were limited to 50% of a property’s market value, and mortgage termsincluding short repayment schedules coupled with balloon paymentswere difficult for many homebuyers to meet. As a result, the U.S. was primarily a nation of renters, and only one in 10 households owned their homes.

In order to stimulate the housing market, the government created the FHA. Federally insured loan programs that reduced lender risk made it easier for borrowers to qualify for home loans. The homeownership rate in the U.S. steadily climbed, reaching an all-time high of 69.2% in 2004, according to research from the Federal Reserve Bank of St. Louis. As of the second quarter of 2021, it was 65.4%.

You Can Make An Offer That Sellers Take Seriously

Preapproval lets you know the price range of homes the lender may approve. You can look for houses in neighborhoods and home styles that suit that range, knowing that approval is likely.

Finally, preapproval gives you a competitive edge over other buyers.

If more than one person bids on the home you want, the seller is very likely to choose folks who have been preapproved. Sellers are picky in this market and will simply toss out offers without strong financing attached.

Recommended Reading: Do Loan Officers Get Commission

Fha 203 Loan Eligibility

You’ll have to meet the usual borrower requirements for a Federal Housing Administration loan, like having a steady, verifiable income and a minimum . As of 2021, you’ll need to come up with a down payment of 3.5% of the home’s purchase price plus repair costs if you have a credit score of at least 580. If your credit score is between 500 and 579, you’ll have to put down 10%. This means that if you are buying a house with an asking price of $150,000 and need repairs of $15,000, you will need 3.5% of $165,000, or $5,775, as your down payment .

Only owner-occupants, not investors, can apply for an FHA 203 loan, and borrowers who qualify are required to purchase mortgage insurance. An FHA loan requires that you pay two types of mortgage insurance premiums an upfront MIP and an annual MIP . Annual MIP payments are required for either 11 years or the life of the loan.

Lenders are typically unwilling to offer a mortgage for a property in need of major repairs or to borrowers who lack of a lot of cash and have lower than average credit scores. FHA 203 loans, which are backed by the Federal Housing Administration, provide reassuranceif a borrower defaults, the FHA pays the lender.

How Much Income Do I Need For An Fha Loan

This depends on the cost of the home you plan to buy and how much down payment you have saved up. However, there is no minimum required salary to qualify for an FHA loan.

FHA loans have been approved for an income of less than $1,000 per month. However, you must prove you hold at least two lines of credit. Examples of these include credit cards and auto loans.

Read Also: Co-applicant In Home Loan

Fha Mortgage Loan Faqs

Looking to learn more about FHA mortgages? You’ve come to the right place! To help get you started, weve answered some of the most commonly asked questions about FHA mortgage loans below.

Where Can I Apply For An Fha Loan

The FHA doesnt offer loans directly, so youll need to contact a private lender to apply.

The majority of lenders are FHAapproved, so youre free to choose a local lender, big bank, online mortgage lender, or credit union.

To find a good FHA lender, you can get recommendations from friends or family whove used an FHA loan. You can also check with the Better Business Bureau to review a bank or mortgage lenders rating and read online reviews.

Keep in mind that credit requirements for FHA loans vary from lender to lender. While many lenders allow a credit score as low as 580, some might set their minimum at 600 or even higher. So if your score is on the lower end of qualifying for an FHA loan you might need to shop around a little more.

Regardless of credit score, you should find at least three lenders you like the look of and apply with them.

FHA mortgage rates can vary a lot between lenders, and you wont know which one can offer you the best deal until youve seen personalized quotes.

Read Also: Does Upstart Allow Co Signers

Apply For An Fha Loan

Think about getting pre-approved for an FHA loan. Pre-approval helps you better understand how much money you might be able to borrow to buy a house, and can make your more bid more attractive to sellers because they will have greater confidence you will be approved for a loan to buy their home.

Pre-approval isnt necessary when you want to refinance your home with an FHA loan. When you want an FHA streamline refinance, the application is often simpler compared to buying a house with an FHA loan. You dont need to provide new documents verifying your income and a new home appraisal is typically not needed. If you are a current Freedom Mortgage customer and qualify for a streamline refinance, we may be able to take your application right on the phone.

It is also possible to refinance and get cash from your home’s equity with an FHA cash out refinance.

Remember that you will need to meet our credit, income, and financial standards to get your FHA loan application approved whether you want to buy or refinance a home.

Looking Ahead: Refinancing An Fha Loan

Many homeowners may wonder about the possibility of obtaining FHA financing affordably. Consider whether you may need to refinance your FHA loan in the future. Homeowners can refinance their FHA loan at any time, including the following:

-

Conventional FHA refinancing options

-

FHA 203 refinances

-

FHA cash-out refinances

Refinancing your FHA loan may allow your family access to funds to afford an emergency or increase your daily quality of life.

Read Also: Refinance Through Usaa

Fha Home Loan Process Timeline

For many homebuyers, the biggest concern is whether or not they can afford the home of their dreams. An FHA loan may be the right loan for you, allowing you to purchase your dream home without the expense of a significant down payment. Purchasing a home is both a huge financial investment and a personal one this will be your primary residence for several years to come.

If you are a first-time homebuyer, you may be wondering how to start the FHA loan process. At CIS Home Loans, we developed this guide to break down the FHA loan process step by step.

What Documents Do I Need To Apply For An Fha Loan

When you initially apply for an FHA loan, lenders will ask about your income, savings, debts, and assets.

Once you decide to move forward with the loan, theyll need proof of the information you provided. That means submitting a variety of financial documents.

Borrowers are typically asked to provide:

- Tax returns from the past two years

- W2s from the past two years

- Bank statements from the previous 60 days

- Financial statements for other assets

- Recent paycheck stubs

- Proof of other income such as Social Security or disability income

- Name and address of your employers over the previous two years

- Yeartodate Profit and Loss statement, if youre selfemployed

The lender will also pull your credit score and credit reports. Authorizing a credit check allows the lender to view your credit history and verify your current debt load and minimum monthly payments.

Also Check: Can You Use A Va Loan For Land

Can You Get An Fha Loan With Student Loan Debt

Yes. Recent changes to FHA guidelines make it even easier for aspiring homeowners to apply for a mortgage with student loan debt and qualify based on the actual student loan payment. Prior to the change which went into effect in the summer of 2021, FHA-approved lenders were required to calculate 1% of the student loan balance to qualify, regardless of whether the actual payment was lower.

S To Apply For An Fha Loan

FHA loans are insured by the Federal Housing Administration, an arm of the Department of Housing and Urban Development .

Thanks to their government insurance, FHA loans can offer low down payments, looser credit requirements, and low rates. This makes them popular with firsttime home buyers. But repeat buyers are welcome to apply as well.

Although FHA mortgages are insured by the FHA, this agency doesnt actually lend money. You get an FHA loan from a private lender, just like you would a conventional loan.

So the first thing you need to do is choose a lender you want to apply with.

1. Find a lender

The first step to getting an FHA home loan is finding an FHAapproved lender. The good news is that the majority of banks and mortgage companies offer this type of mortgage, so finding a lender shouldnt be too difficult.

You can get FHA financing from banks, mortgage companies, credit unions, and online lenders. You can also use our review of the best FHA lenders as a starting point.

The right lender for you will depend on a few things. For instance, if you have a lower credit score, you want to make sure your lender accepts FHAs minimum of 580 .

You should also think about how you want to work with your lender. Do you prefer persontoperson interactions? Look for a local lender that focuses on inperson and overthephone lending.

2. Apply for a loan

After finding a lender, the next step is to submit a loan application.

3. Provide basic details

4. Compare Loan Estimates

Recommended Reading: Bayview Mortgage Reviews

Fha Supports Fair Housing And Equal Opportunity

HUD is committed to enforcing the Fair Housing Act and to ensuring that people are not discriminated against when they seek housing or housing-related services. If you need assistance in determining your rights under the Fair Housing Act or applicable laws, or believe you have been a victim of housing discrimination and need assistance, we encourage you to review the information on HUD’s Office of Fair Housing and Equal Opportunity webpage.

Are Fha Loans Only For First

No, you do not need to be a first-time home buyer to use an FHA loan. Lower credit score minimums and down payments certainly make FHA loans attractive to first-time home buyers, but current homeowners are eligible, too. In fiscal year 2020, about 83% of FHA purchase loans were made to first-time home buyers â which means 17% went to borrowers who were already homeowners.

» MORE:How to qualify for first-time home buyer benefits

Also Check: Usaa Auto Loan Bad Credit

How Do I Apply For A Fha Loan Online

Best Lenders for FHA Loans in April 2019 NerdWallet If you’re interested in an FHA loan, we’ll help you choose the right lender for you.. Best for online fha mortgage experience: Rocket Mortgage.. and flexible financial requirements so it’s easier for first-time borrowers to obtain a home loan.

Equity Home Loans Chase Some are more generous such as Tesco Bank which allows up to 20 per cent a year. According to online mortgage broker Trussle, the best fixed rate loans for landlords include a two-year deal priced.

Best Lenders for FHA Loans in April 2019 NerdWallet FHA loans in 2019 offer several benefits including low rates and low down payments. If youre interested in an FHA loan, well help you choose the right lender for you. Compare our best FHA.

FHA Loans Apply Online for an FHA Home Loan FHA Online Application. If you wish, we can also secure a no-obligation pre-qualification letter from a lender in your area who will guarantee your loan request and the lowest possible rate . This is a free service available to US citizens above the age of eighteen.

Help-to-Buy scheme: how does it work and how do I apply? To complete the online application process. They will also need to provide details of the mortgage lender and of the mortgage, including the loan-to-value ratio. Clearly, purchasers will need to.