See Your Next Steps Below:

For over 2 years, the COVID-19 Economic Injury Disaster Loan program provided funding to help small businesses recover from the economic impacts of the COVID-19 pandemic. In that time, over 3.9 million loans totaling over $378 billion were approved across the country.

The program effectively ended the first week of May 2022. As of May 6, the SBA was no longer processing COVID-19 EIDL loan increase requests or requests for reconsideration of previously declined loan applications due to a lack of available funding.

As of May 16, the COVID-19 EIDL portal closed. Borrowers who need copies of their loan documents can still contact Customer Service at 853-5638. Please allow 3-5 business days to receive your materials.

How Do I Apply For An Eidl

Due to the increased need for the EIDL, the U.S. Small Business Administration has released an online application to streamline the process.

Below is a link to the U.S. Small Business Administrations webpage for COVID-19 EIDL loans, which is the only place you can apply for COVID-19 EIDL loans. BEWARE of other websites that claim to be able to help you access this program.

Economic Injury Disaster Loans

You may be eligible for an SBA Economic Injury Disaster Loan if you own a small business, agricultural cooperative, or private nonprofit organization located in a disaster area where you have suffered a substantial economic injury.

Eligible businesses include:

- Businesses that have been affected by a substantial economic injury to the extent that they cannot meet their obligations and pay necessary operating expenses.

- Small businesses that have been impacted by certain disasters and are unable to stay afloat until operations resume.

- Small businesses that the SBA determines are unable to obtain credit anywhere else.

Also Check: How Much Do Mortgage Loan Officers Make

Servicing Your Eidl Loan

Borrowers should review their loan authorization to ensure all terms are being followed. For loans above $25,000, SBA filed a lien on the business assets. If a business owner wants to sell a piece of equipment or the business itself, SBA will need to approve the release of its lien. In some cases, this may require a cash payment to reduce the loan balance. These requests are approved by one of SBAs disaster loan centers and borrowers should be prepared to make their request well in-advance of the actual sale.

EIDL borrowers in Idaho should contact SBAs servicing center in El Paso 487-6019 at . Hours: 8 a.m.-4:30 p.m. MT, Monday through Friday

More Information:

If you have additional questions or require further assistance specific to your COVID EIDL Loan, please call our Disaster Customer Service Center at 1-800-659-2955 or email us at: .

For Federal Text Telephone services, users can access Telecommunications Relay Service to make TTY calls by dialing 7-1-1.

For Video Relay Services and Video Remote Interpreting, users may use any National VRS Provider available via the Federal Communications Commission at no cost to users or federal agencies.

A list of Providers can be found at www.fcc.gov/vrs-providers .

Additional Resources:

Economic Injury Disaster Loan Program For Covid

The Small Business Administration has announced on April 16th that there is a Lapse in Appropriations.

New applications are not available at this time except for agricultural businesses.

Existing Applicants who have already submitted with the U.S. Small Business Administration will continue to be processed on a first come first served basis but may not receive funds due to lack of funding.

You can learn more from the U.S. Small Business Administration here:

If you have questions, please contact the U.S. Small Business Administration disaster assistance customer service center at 1-800-659-2955 or e-mail .

Reminder: SBA.com® is not SBA.gov and cannot help you with EIDL loans. Please direct all EIDL inquiries to the above.

This page describes the EIDL program for the COVID-19 disaster and not other declared disasters. This page is purely informational. You cannot apply for EIDL Loans through SBA.com®. You can only apply for EIDL loans through SBA.gov.

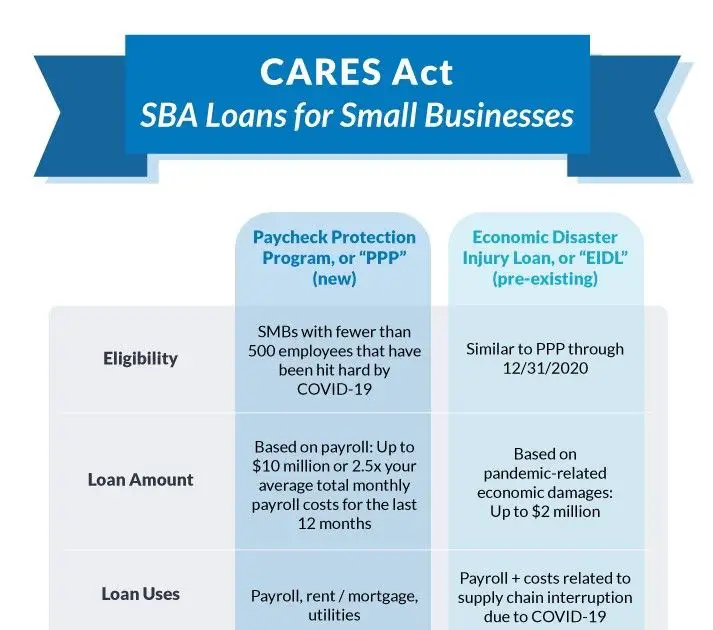

Small business owners in all U.S. states, Washington D.C., and territories may be eligible to apply for an Economic Injury Disaster Loan of up to $2,000,000 because of the COVID-19 disaster. The loan is made by the Small Business Administration directly and a $10,000 advance on the loan can be requested as well. This loan advance will not have to be repaid. You can only apply for this loan directly through the U.S. Small Business Administration website.

Recommended Reading: How To Get Personal Loan With Low Interest

Will The Sba Application Be The Basis Of Referrals To Other Grant Programs

Yes. Submitting the application makes it possible for you to be considered for additional grants. If you apply for an SBA low-interest disaster loan and are not eligible, this may open the door to additional assistance from FEMA. If SBA denies the loan application, you may be eligible for additional FEMA grant assistance to replace essential household items, replace or repair a damaged vehicle, cover storage expenses, or meet other disaster-related needs your Pike County, Kentucky home or business has suffered.

Read Also: Does Health Insurance Cover Work-related Injuries After Settlement

Deadline To Request Sba Eidl Loan Increase Or Reconsideration Is May 6

The deadline to request a U.S. Small Business Administration Economic Injury Disaster Loan loan increase or reconsideration is Friday, May 6. This is for existing borrowers or those who have previously submitted an application and would like to make a request for reconsideration.

As of Jan. 1, the SBA is not able to accept applications for new COVID-19 EIDL loans or advances.

The COVID-19 EIDL portal will close on May 16. Borrowers should download their loan documents from the portal prior to this date.

COVID-19 EIDL loans are offered at very affordable terms, with a 3.75% interest rate for small businesses and 2.75% interest rate for nonprofit organizations, and a 30-year maturity. The maximum loan amount is $2 million. The SBA began approving loans greater than $500,000 on Oct. 8, 2021.

In March, the SBA provided an additional deferment of principal and interest payments for existing COVID EIDL borrowers for a total of 30 months deferment from inception on all approved COVID EIDL loans. Interest continues to accrue during the deferment period and borrowers may make full or partial payments if they choose.

You May Like: How Does Icing An Injury Help

Don’t Miss: Mortgage Calculator For Va Loan

How Do I Appeal A Declined Targeted Eidl Advance Application

Applicants can send a request for reevaluation of a Targeted EIDL Advance application that was declined to the following email address: .

Applicants should follow these instructions when requesting a re-evaluation:

- Send an email to

- Use the subject line Reevaluation Request for

- In the body of the email, include identifying information for the application such as application number, business name, business address, business owner name and phone number

- Important: Include an explanation and any documentation that addresses the reason for the decline, if available. SBA will contact applicants if additional documentation is required to complete the review.

Required Eidl Loan Documents

When applying for the EIDL program, youâll need to provide several documents to help the SBA calculate your economic injury.

All loan applicants must submit the following documents to confirm federal income taxes:

- Federal income taxes

- ODA Form P-022 Standard Resolution

If youâve already filed IRS Form 4506-T for another loan program, youâll need to file a new one for the EIDL.

For those of you applying for a loan greater than $500,000, you need to provide the additional documents:

- SBA Form 413 â Personal Financial Statement

You will also have to provide a list of the real estate you own using the intake form template.

The SBA may request additional forms from you during the application process. Keep checking your SBA portal and email accounts while waiting to hear back about your application.

Don’t Miss: People Who Got The Ppp Loan

Am I Eligible For An Economic Injury Disaster Loan

If you answer yes to all three questions and have less than 500 employees, theres a very good chance youre eligible for a COVID EIDL.

However, you should confirm you fall within the SBAs size standards before you start applying. Youre eligible for an EIDL if youre:

- An individual who operates a sole proprietorship, with or without employees

- An independent contractor

- A business categorized as a small business according to the SBA size standards

- All other agricultural enterprises are excluded

NEW | In August 2021, the SBA expanded COVID EIDL eligibility to include the hardest-hit industries. Why? Applications for the restaurant revitalization fund exceeded the amount of funding that was available and the program quickly ran out of money. More than 175,000 businesses didnt receive the funds they needed.

*An affiliate is a business that you control or a business you have 50% or more ownership.

What If I Need More Money Than Ive Been Approved For

COVID-19 EIDLs can be modified by increasing the amount up to 24 months of the economic injury or a maximum of $500,000, whichever is less. An increase can be requested either before or after accepting the loan. If the applicant is in urgent need of funds, accept the maximum loan amount offered and then request an increase by providing additional documentation.

Recommended Reading: When Can I Refinance My Home Loan

Check Your Eidl Loan Status By Phone

You can also find out the status of your EIDL loan application by phone. You can use this method if you submitted your application online or by mail. Call 1-800-659-2955 and ask for Tier 2. These reps can answer questions about the application process and your EIDL loan status. If you applied through the COVID-19 portal, the SBA will contact you, but you may be able to get answers by calling the toll-free number.

If you mailed in your application, this is the best way to find out your loan status, as you wont have a username and password to log onto the online portal. On the plus side, this method allows you to talk to an SBA rep that will answer your questions, even if these go beyond finding out your loan status. On the other hand, though, you may be stuck waiting on hold, as other business owners are also inquiring about the EIDL program and loan statuses.

Things You Need To Know Before Requesting An Eidl Loan Increase

If you’ve received an Economic Injury Disaster Loan from the Small Business Administration, chances are you may be eligible for more money. The SBA lifted the cap on EIDL loans up to $2 million, from $500,000, on September 8, 2021. So-called Covid EIDL loans, which offer 30-year maturities and interest rates ranging from 2.75 percent to 3.75 percent, are available to businesses that are struggling amid the pandemic. The SBA has extended what is considered a small business to include businesses that have one of the following NAICS Codes and have 500 or fewer employees per physical location and, together with affiliates, have no more than 20 locations. These NAICS codes begin with 61, 71, 72, 213, 3121, 315, 448, 451, 481, 485, 487, 511, 512, 515, 532, or 812.

Here’s how to determine your eligibility, what you’ll need to apply, and a timeline for when you might actually see the money hit your account.

Also Check: Which Bank Has Lowest Interest Rate On Personal Loan

Economic Injury To Your Pike County Business Operations In Kentucky

For Pike County small businesses, companies, small agricultural cooperatives, small businesses engaged in aquaculture and most private nonprofit organizations, the SBA offers Economic Injury Disaster Loans to help meet working capital needs caused by the disaster. Economic Injury Disaster Loan assistance is available regardless of whether the business suffered any physical damage to property.

Read Also: Austin Texas Personal Injury Attorney

Business Line Of Credit

A business line of credit is a flexible financing option that extends your working capital to cover just about any business-related need. The best part is that youll only pay interest on the portion of the funds you borrow, so if you only end up dipping a little bit into your line of credit, then youll only owe a little bit.

You can hold on to a business line of credit as a disaster-prevention or recovery tooleither way, its a great financing alternative to have in your back pocket.

Don’t Miss: What Are Payments On 30000 Car Loan

I Don’t Have An Application Number Can I Still Check My Status

If you applied through the COVID-19 portal, you will have to wait until the SBA contacts you regarding your loan status, even if you have an application number. Some applicants havent received an email or phone call from the SBA but did receive a deposit in their bank account from the SBA with an attached application number.

If you applied for an EIDL outside of the COVID-19 portal, you can call the SBAs toll-free number to inquire about your loan status. You can also inquire about your status by email.

What If I Didnt Accept The Full Amount I Was Approved For Can I Get The Full Amount Now

If the applicant accepted the loan for less than the full amount originally offered, they have up to two years after the date of the loan note to request an increase to get additional funds, even after the application deadline of Dec. 31, 2021.

If an applicant declined the original loan offer, the loan offer is considered to be withdrawn. Applicants can request a reacceptance within 6 months of the original offer, even after the application deadline of Dec. 31, 2021.

Don’t Miss: Federal Student Loans Vs Private

How To Request An Increase In The Texas Sba Eidl Loan

Once you log into the Texas SBA online EIDL portal, you may or may not see a button titled Request an Increase or Request more funds. If you do not see that button, an EIDL increase must be done manually and in letter form.

If you dont see the button to increase the loan amount, you can directly reach out to SBA by email and request a loan increase.

Send an email to with the subject line EIDL Increase Request for . Make sure to include all the necessary information such as application number, phone number, etc. in the body of the email.

You will receive a confirmation email for your Texas SBA EIDL loan increase request saying Thank you for contacting the Covid EIDL Increase Team. Your request has been received and will be processed in the order it was received.

It may take several weeks before you receive a response from Texas SBA.

What Youll Need To Check Your Eidl Loan Status

What youll need to check your EIDL loan status varies based on how you contact the SBA.

If you call in, you wont have a username or password, so youll need to provide additional information. If you applied online, have your application number ready. You may also need to verify additional information, such as the name of your business, federal tax ID, and/or your legal name.

If you email the SBA, make sure to provide your legal name and your application number . You may also be required to submit additional information, such as your business name, federal tax ID, or other identifying information.

You May Like: What Is Personal Loan Used For

How Is My Loan Amount Calculated

If your business was in operation before Jan. 1, 2019, your maximum loan amount could be:

- 2019 gross receipts or sales 2019 cost of goods sold x 2 or $500,000, whichever is less

- For rental loss: Actual 2019 rent received actual 2020 rent received x 2 or $500,000, whichever is less

If your business was in operation for part of 2019, part of 2020, or all of 2020, the SBA will calculate your loan amount. Youll provide revenues, cost of goods sold, expenses then the SBA will automatically calculate your maximum loan amount.

If your maximum loan amount is greater than $500,000, the SBA will underwrite the loan and perform a cash flow analysis to confirm your ability to repay the loan, as well as existing debt obligations. Youll have the opportunity to pick your loan amount.

Your options are 1) the maximum loan amount calculated by the SBA or 2) a lesser amount that you set. You cant apply for a loan beyond the SBAs calculated amount or the $2 million cap whichever is lower.

How Does Getting A Texas Sba Loan Increase Working Capital

Getting the Texas SBA EIDL loan increase will allow you to get increased business financing. The new money plus your existing Texas SBA EIDL funds will give you more working capital.

You may use the increased funds for any business purpose such as increasing payroll for Texas employees, buying equipment, or increasing inventory.

Also Check: Ppp Loan Round 3 Deadline

Moving Forward After Sba Disaster Loan Rejection

If youve been denied an SBA disaster loan, you have options. Consider appealing your rejection, and if that proves unfruitful, move forward with looking at FEMA grant funding. After FEMA funding, look at debt financing alternativestheres a variety of loans out there to help your business through the difficult recovery process.

While debt financing may be more expensive than an SBA disaster loan, it still gives your business the much-needed capital it needs to come out of a disaster on top. Start the appeal process as soon as possible to get your business moving onwards and upwards.

asdfad

What Forms Are Needed For The Loan Application

The SBA highly recommends using the online loan application, which can be found at .Small businesses will also need the following:

- Tax Information Authorization for the applicant, principals and affiliates.

- Complete copies of the most recent Federal Income Tax Return.

- Monthly sales figures .

- If you are a sole proprietor, you may need to include SBA Form 5C.

For those with limited web/online capabilities, paper forms can be found at .

Don’t Miss: How To Get Income Tax Loan