Should You Refinance A Home Equity Loan

Modified date: Jun. 1, 2022

Taking out a home equity loan can help you get a cash infusion based on the amount of ownership you have in your property. But is there ever a time when you should think about refinancing that home equity loan?

The answer is yes, absolutely! There are many circumstances in which you could potentially benefit from a refinance. Today, Ill cover both the pros and cons of refinancing your home equity loan.

Whats Ahead:

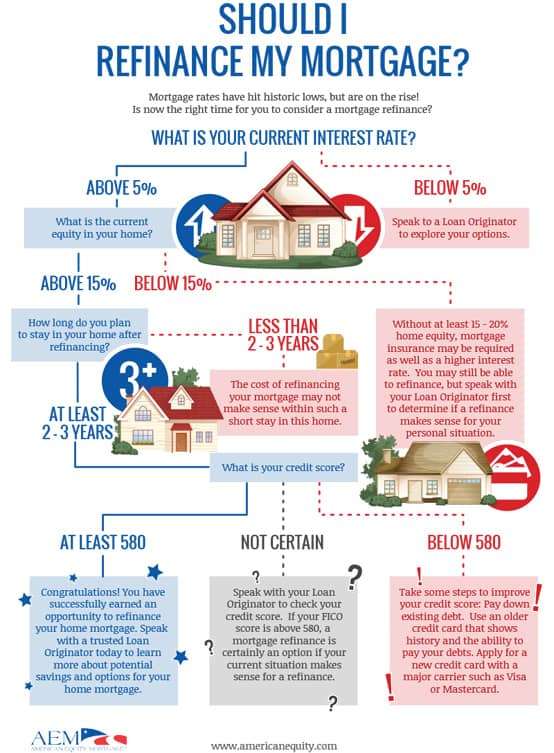

When Is Refinancing The Right Choice For You

- If you have some equity in your home and youve paid off more than 20% of your homes current value

- If you plan to stay in your home for at least 5 more years

- If your renovation project has a high price tag

- If the current interest rate is lower than your existing mortgage rate

- If you can afford closing costs

A nice benefit of refinancing is that, in some cases, you may lower your interest rate, reducing the overall cost of the loan, without increasing your mortgage payment.

You Dont Need To Flip A Coin When Choosing Between A Home Equity Loan Or Refinancing Your Mortgage

There are a lot of similarities between home equity loans and mortgage refinancingâbut there are also plenty of clear differences between the two to help you decide. Homeowners enjoy different benefits and face different challenges with both options. By understanding the upsides and potential pitfalls of each, you can make a more informed decision and get the financial support you need.

Read Also: Fha Loan Refinance

Scenario : Low Principal Balance

Lets say you have a home thats worth $300,000 with a small principal remaining say, $25,000. You currently make payments of $1,500 per month, most of which is principal balance since your loan is amortized and your interest-heavy payments were paid earlier in your loan term.

| Cash-out refinance |

| $418 |

If you choose a cash-out refinance, youll pay closing costs on a $75,000 loan your existing principal balance of $25,000 plus the $50,000 in cash youre withdrawing. Youll have a single monthly payment for your refinanced home loan including your cash withdrawal. But amortization on this new loan will restart.

NOTE: Talk with your financial advisor to discuss whether the $50,000 cash you plan to withdraw is worth the total amount of interest you will be required to pay on the new loan. You can work with your lender on less traditional amortization schedules such as 10-year or 27-year amortization. Talk with your financial advisor to discuss whether the $50,000 cash you plan to withdraw is worth the total amount of interest you will be required to pay on the new loan. You can work with your lender on less traditional amortization schedules such as 10-year or 27-year amortization.

If you choose a home equity loan, youll pay closing costs on your $50,000 loan amount with monthly payments of principal and interest in addition to your monthly $1,500 mortgage payment.

How You Receive Your Funds

Cash-out refinance gives you a lump sum when you close your refinance loan. The loan proceeds are first used to pay off your existing mortgage, including closing costs and any prepaid items any remaining funds are yours to use as you wish.

Home equity line of credit lets you withdraw from your available line of credit as needed during your draw period, typically 10 years. During this time, youll make monthly payments that include principal and interest. After the draw period ends, the repayment period begins: Youre no longer able to withdraw your funds and you continue repayment. You have 20 years to repay the outstanding balance.

Also Check: What Is The Average Motorcycle Loan Interest Rate

When Would You Want To Refinance A Home Equity Loan

There are some scenarios in which it makes sense to refinance your home equity loan. But its only a good idea if the benefits outweigh the costs.

Just like most other types of loans, a new home equity loan will probably come with a fresh set of closing costs. They can range anywhere between 2% and 5% of the loan amount. Calculate your savings potential to figure out how quickly the advantages actually start to pay off.

When Should I Choose A Cash

- You need stability in your budget

With a HELOC, your monthly payments can vary substantially, particularly when you transition from making the interest-only payments during the draw period to the repayment period, when you must pay back principal as well. A cash-out refinance avoids this challenge.

A cash-out refinance offers the simplicity of maintaining a single payment, usually at a fixed rate and a longer term, which could translate into more stability in your budget, says Sean Murphy, assistant vice president of equity lending for Navy Federal Credit Union.

- You want to improve your interest rate

If you initiated your home mortgage at a time when interest rates were higher and the rates have since declined, a cash-out refinance may allow you to obtain new, more favorable terms.

A cash-out refinance is a good option for borrowers who want to adjust the interest rate of their overall mortgage, while obtaining additional cash for home improvements or remodeling, high-interest debt consolidation or a variety of other financial needs, Giles says.

You May Like: Usaa Used Auto Loan Rates

What Are The Risks And Costs Of Refinancing

Make sure you factor in fees before you decide if refinancing is right for you. You need to pay appraisal costsOpens a popup., legal fees and possible prepayment charges. If you switch lenders, you may have to pay a discharge fee. Also, be aware that taking out home equity comes with risks. For example, if you switch from a fixed-rate mortgage to a variable-rate mortgage, you may deal with rising interest rates and higher monthly payments in the future.

Home Equity Lines Of Credit

Home equity lines of credit work differently than home equity loans. Rather than offering a fixed sum of money upfront that immediately acrues interest, lines of credit act more like a credit card which you can draw on as needed & pay back over time. This means that the bank will approve to borrow up to a certain amount of your home, but your equity in the home stands as collateral for the loan. The interest rates are lower than they would be with a credit card. Often home equity loans have a variable interest rate that will change according to market conditions.

Unlike traditional mortgage loans, this does not have a set monthly payment with a term attached to it. It is more like a credit card than a traditional mortgage because it is revolving debt where you will need to make a minimum monthly payment. You can also pay down the loan and then draw out the money again to pay bills or to work on another project. Your home is at risk if you default on the loan. Many people prefer this loan because of the flexibility. You only have to take out as much as you need, which can save you money in interest.

Don’t Miss: Is Bayview Loan Servicing Legitimate

When Is A Home Equity Loan The Better Option

- If your current interest rate is low and you can afford both your current mortgage and home equity loan payment comfortably

- If youre looking for a shorter process from application to closing than a refinance

- You dont want to pay closing costs

- You plan on moving in 5 years or less

- You dont want to add any length to your mortgage payment plan

Still trying to decide if youre comfortable with a home equity loan payment on top of your existing mortgage? Use this handy calculator to estimate a home equity loan payment.

Because your financial situation and goals are unique to you, the best approach is to sit down with an experienced mortgage lender who can walk you through your options and even illustrate payment plan comparisons, like the one below, just for you.

Please Note: This comparison chart is for illustration purposes only. This chart does not reflect todays actual rates and is not applicable to your individual situation.

How Does An Appreciation Mortgage Work

An appreciation mortgage is a way for homeowners to access home equity. If the balance of a mortgage is more than 60%, this means there is a large amount of earned equity in the home. As detailed above, there are several ways that homeowners can access this cash.

However, many refinance deals have unfavorable loan terms or come with a high-interest rate. In particular, some refinance deals will require homeowners to take out a new mortgage and pay monthly payments â often at the risk of foreclosure.

Some other loans will require a second payment to be paid on top of a mortgage. All of this places challenging demands on homeowners who have already paid their mortgage.

Recommended Reading: Maximum Fha Loan Amount In Texas

When Rates Are Low

If current interest rates are lower than your current mortgage interest rate, a cash-out refinance can be a win-win: You lock in a lower interest rate while also accessing a portion of your equity in cash. If youve owned your home for more than half of your mortgage term, work with a lender to ensure its cost effective to refinance an amortized mortgage at a lower interest rate you may already be making mostly principal payments.

Refinancing Vs Home Equity Loan: An Overview

Your home is not just a place to live, and it is also not just an investment. Your home can moreover be a handy source of ready cash to cover emergencies, repairs, or upgrades, obtained either through a mortgage refinancing or via a home equity loan.

Refinancing pays off your old mortgage in exchange for a new mortgage, ideally at a lower interest rate. A home equity loan gives you cash in exchange for the equity youâve built up in your property as a separate loan.

Donât Miss: Can You Pay Off Sofi Loan Early

You May Like: How Long It Takes For Sba To Approve Loan

Take Out A Second Mortgage

A second mortgage is exactly what it says on the box. Instead of refinancing, you can simply take out a second mortgage against the equity that youâve built up in your home. While youâll avoid some of the fees of refinancing, a second mortgage is almost always the most expensive way to access home equity, as it comes with higher mortgage rates than your primary mortgage. Itâs generally used as a last resort, especially by people with bad credit.

Pros: Allows you to access your home equity without having to requalify for a refinance. While more expensive than other mortgages, second mortgages generally have lower rates than than credit cards or personal loans, so they can still be used to consolidate debt.

Cons: Second mortgages have significantly higher rates than primary mortgages, as well as refinanced mortgages and HELOCs. Second mortgages are the most expensive way to access your home equity.

How These Loans Compare

As we mentioned above, while equity loans, HELOCs, or cash-out refinancing have similar qualities, they are distinct types of loans.â

Similar criteria

Some of the similarities between these loans are to do with eligibility. Homeowners will be subject to income and credit score checks should they apply. Additionally, the amount of home equity needs to meet a specific threshold to borrow against the property.

This principal is referred to as the combined loan-to-value ratio.

For example, a financial institution may have a CLTV ratio of 80%. This is the minimum rate against which they will accept a loan against a property.

A client owns a home worth $400,000. They currently own $200,000 on their first mortgage.

Therefore, $400,000 x 0.80 = $320,000.

Then, minus the $200,000 still owed on the first mortgage, this means the client is eligible for a loan of $120,000 against their property.

Also Check: Usaa Credit Score For Auto Loan

Apply For Your Mortgage Refinance With Confidence

Taking out any of these loans will affect the way you handle paying your mortgage going forward. Depending on which choice you make, your monthly payment can go up or down, or the length of your loan could change.

Be sure to reach out to a financial professional you trust if you need help choosing between using your homeâs equity or refinancing your loan to better terms.

Still looking for the right rate? We’re here to help.

How To Refinance A Home Equity Loan

Refinancing a home equity loan is similar to the process you went through when you applied for your home loan. Heres a quick refresher.

You May Like: Usaa Auto Interest Rates

Does It Cost Anything To Refinance A Home Equity Loan

Yes, both paths to refinancing a home equity loan typically come with closing costs. The lender will likely charge an origination fee of up to 5% of the loan amount. Youll also need to have an appraisal done to verify the value of the home. That usually costs between $300 and $500 depending on where you live and the size of your home.

Switch From An Adjustable

With your ARM having adjustable interest rates, you might start off with the first few years at a fixed rate. But after that, the rate can adjust based on a lot of factors, like the mortgage market, and the rate that banks themselves use to lend each other money.

Bottom line is, ARMs transfer the risk of rising interest rates to youthe homeowner.

So, in the long run, an ARM can cost you an arm and a leg! Thats when refinancing into a fixed-rate mortgage could be a good financial move. Its worth it to avoid the risk of your payments going up when the rate adjusts.

Read Also: How Long For Prosper Loan Approval

Get A New Home Equity Loan

One option is to apply for a new home equity loan. The refinanced loan would pay off the existing home equity loan, then youd keep the leftover cash to use as needed. The goal is to get new terms that help you meet your refinancing goals.

You dont have to apply with the same lender as your existing home equity loan. Instead, shop around to find the best option you qualify for.

Credible is a lender network that lets you review multiple offers while only having to submit one application. That saves you a lot of time and effort, not to mention helps you avoid taking the first offer when it may not be the best.

Currently, the best way to refinance a home equity loan through Credible is to apply for a cash-out refinance. In fact, the pre-qualification process takes just three minutes. You can browse both fixed and adjustable rate mortgages to find the product that best fits your needs. Most lenders allow you to cash-out as much as 80% of your current home equity.

First Steps For Getting A Home Equity Loan

Here are some of the first things you should do when youâre ready to apply for a home equity loan.

Don’t Miss: How Long Does An Sba Loan Take To Get Approved

When To Choose A Mortgage Cash

Choose a mortgage refinance with cash-out to secure the lowest variable and fixed rates available if you need a large lump sum of cash. Furthermore, the expansive suite of mortgage loan options allows you to shop for the solution that meets your needsnow and in the future. You’ll pay higher closing costs and fees with a mortgage cash-out refinance, but it’s possible that these are offset by the competitive interest rates available in today’s market. Just make sure you have a need for all or most of the cash you’re getting and compare the total of your new mortgage with alternatives.

Pros And Cons Of Refinancing

Before you look at the different types of refinancing, you need to decide whether refinancing is right for you. There are several advantages to refinancing. It can provide you with:

- A lower annual percentage rate of interest

- A lower monthly payment

- A shorter payoff term

- The ability to cash out your equity for other uses

However, you shouldn’t see your house as a good source of short-term capital. Most banks wont let you cash out more than 70% of the homes current market value, and the costs of refinancing can be significant.

The mortgage lender Freddie Mac suggests budgeting about $5,000 for closing costs, which include appraisal fees, credit report fees, title services, lender origination/administration fees, survey fees, underwriting fees, and attorney costs. Closing costs are likely to be 2% to 3% of your loan amount for any type of refinancing, and you may be subject to taxes depending on where you live.

With any type of refinancing, you should plan to continue living in your home for a year or more. It can be a good idea to do a rate-and-term refi if you can recoup your closing costs with a lower monthly interest rate within about 18 months.

If youre not planning to stay in your home for a long period of time, refinancing might not be the best choice a home equity loan might be a better choice because closing costs are lower than they are with a refi.

Don’t Miss: Prosper Loan Denied After Funding