Tax Benefits To Home Equity Loans And Helocs

A final benefit to using a home equity loan or HELOC to improve your home is that the interest can be tax deductible, just as it is on a primary mortgage. However, the Tax Cuts and Jobs Act , the massive tax reform law that went into effect in 2018, placed new restrictions on this deduction.

Before 2018, you could deduct the interest on up to $100,000 in home equity loans or HELOCs. You could use the money for any purpose and still get the deductionâfor example, homeowners could deduct the interest on home equity loans used to pay off their credit cards or help pay for their children’s college education. The TCJA eliminated this special $100,000 home equity loan deduction for 2018 through 2025.

However, the interest you pay on a home equity loan or HELOC used to purchase, build, or improve your main or second home remains deductible. The loan must be secured by your main home or second home. Thus, for example, you can deduct the interest on a home equity loan you use to add a room to your home or make other improvements.

Repaying A Home Equity Loan

After you receive your loan amount, get ready to start paying it back. Your monthly payments will be a consistent amount throughout the term of your loan and include both principal and interest.

You may think its best to choose a shorter loan term, so you can pay off your debt faster. Remember, a 10-year term will have higher monthly payments than a 15- or 30-year term.

Why Use The Maximum Mortgage Calculator

Once you input your monthly obligations and income, the Maximum Mortgage Calculator will calculate the maximum monthly mortgage payment that you can afford, based on your current financial situation. This calculator will also help to determine how different interest rates and levels of personal income can have an effect on how much of a mortgage you can afford.

Don’t Miss: Usaa Rv Loan Terms

Help From The Mortgage Lender

Most mortgage lenders and banks dont want you to default on your home equity loan or line of credit, so they will work with those struggling to make payments. Its important to contact your lender as soon as possible. The last thing you should do is ignore the problem. Lenders may not be so willing to work with you if you have ignored their calls and letters offering help for months.

When it comes to what the lender can actually do, there are a few options. Some lenders will offer certain borrowers a modification of their home equity loan or line of credit. Modifications can include adjustments to the terms, the interest rate, the monthly payments, or some combination of the three, to make paying off the loan more affordable.

Choosing A Heloc From Becu

Home equity lines of credit allow you to borrow money using the equity or value of your home as collateral. HELOCs may be a better alternative than a credit card, or personal loan, as rates tend to be lower , and interest paid may be tax deductible.

Our home-equity loans stand out in more ways than one:

- No application fee

- No origination fees, potentially saving you hundreds1

- Loans up to $500,000

- No appraisal costs, title insurance fees, document mailing fees, escrow fees or pre-payment penalty fees2

Uses of a HELOC

- Debt consolidation

- Tuition or other ongoing expenses over time

- Home repairs, such as windows, new roof, energy efficient projects

How HELOCs Work

Fixed Interest-Rate Advance

- You can take out any sum up to your HELOC maximum at any time up to your loan limit. However, there are benefits to locking in the rate on larger sums. Here’s how it would work:

- Select any sum of $5,000 or higher

- Elect to fix the rate on a new sum when you have paid off one fixed-rate loan

- Have up to three different fixed-rate loans at one time4

Frequently Asked Questions

How do I access funds?

The line of credit appears as an account in your BECU Online Banking, and you can easily initiate a free, same-day transfer to your checking account.

Do I receive the loan amount over time?

No. It’s paid in one lump sum. Like a credit card, you qualify for an amount, then how you choose to use it is up to you – all of it, some of it, or even just a little of it.

How long can I access a BECU HELOC?

Read Also: Usaa Boat Loan Credit Score

Under The Rule Can I Waive My Right To Cancel The Contract

If you have a personal financial emergency like damage to your home from a storm or other natural disaster you can waive your right to cancel. That eliminates the three-day waiting period so you can get the money sooner. To waive your right:

- You must give the lender a written statement describing the emergency and stating that you are waiving your right to cancel.

- The statement must be dated and signed by you and anyone else who also owns the home.

Your right to cancel gives you extra time to think about putting your home up as collateral for the financing to help you avoid losing your home to foreclosure. If you have a personal financial emergency, you can waive this right, but be sure thats what you want before you waive it.

How Does A Home Equity Loan Work

A home equity loan gives you access to a lump sum of money all at once. If you know how much money youll need and when youll need it to finance a remodeling project with a set budget, for example it may be the right choice.

Youll repay the home equity loan principal and interest each month at a fixed rate over a set number of years. Be sure that you can afford this second mortgage payment in addition to your current mortgage, as well as your other monthly expenses.

» MORE:Compare home equity loan rates

You May Like: How To Become A Mlo In California

Under The Rule How Long Do I Have To Cancel

You have until midnight of the third business day to cancel your loan. Day one begins after all these things have happened

- you sign the loan at closing, and

- you get a Truth in Lending disclosure form with key information about the credit contract, including the APR, finance charge, amount financed, and payment schedule, and

- you get two copies of a Truth in Lending notice explaining your right to cancel

If you didnt get the disclosure form or the two copies of the notice or if the disclosure or notice was incorrect you may have up to three years to cancel.

How We Chose These Lenders

To create this list of best home equity loan lenders, we looked at established banks with a solid history of home equity lending and evaluated them based on a variety of factors, including APR range, the range of loan amounts and loan terms available, and eligibility requirements like the minimum credit score and the maximum loan-to-value ratio. We also looked at transparency and how easy it was to find basic loan information, including APR ranges, on their website without logging in or starting an application. Finally, if a company offers any special benefits like fast funding or rate discounts, we also made note of that in our reviews.

The exact APR you receive will depend on the lender you choose, as well as personal factors such as your creditworthiness, your desired loan amount and loan terms, and your loan-to-value ratio. Lender APR ranges may also change regularly based on market factors. As such, we recommend referring to the official lender websites for the most up-to-date information on APRs, fees, and other loan details.

Certain information may have changed since this page was last updated. Check with your lender for more detailed loan information.

Don’t Miss: Prosper Credit Requirements

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

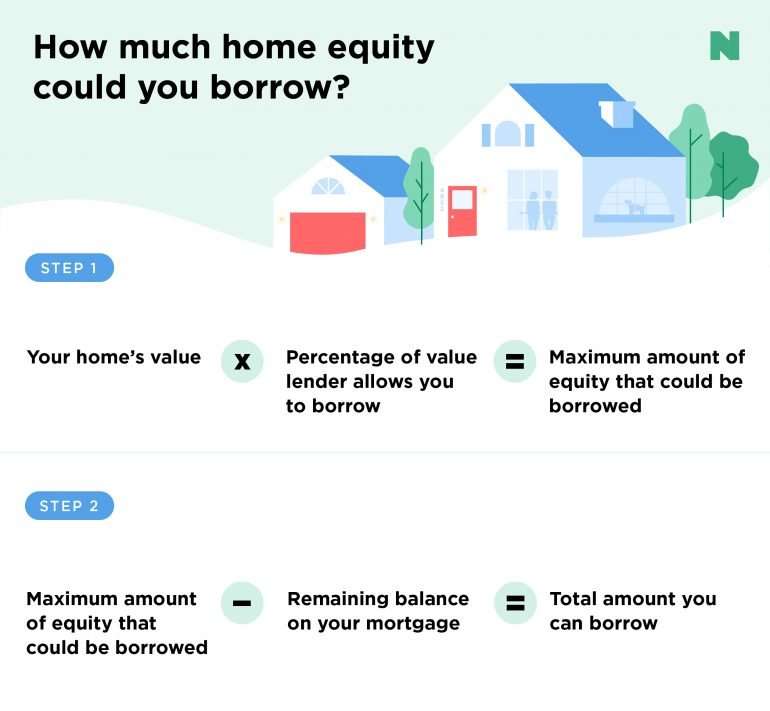

What Is Home Equity

Home equity is the difference between the value of your home and how much you owe on your mortgage.

For example, if your home is worth $250,000 and you owe $150,000 on your mortgage, you have $100,000 in home equity.

Your home equity goes up in two ways:

- as you pay down your mortgage

- if the value of your home increases

Be aware that you could lose your home if youre unable to repay a home equity loan.

Recommended Reading: Rv Loans Usaa

Make A Plan To Use Your Home Equity Line Of Credit

Establish a clear plan for how you’ll use a home equity line of credit. Consider a repayment schedule that includes more than just minimum monthly interest. Make a realistic budget for any projects you may want to do.

You may be able to borrow up to 65% of your homes purchase price or market value on a home equity line of credit. This doesnt mean you have to borrow the entire amount. You may find it easier to manage your debt if you borrow less money.

What Is The Three

Unlike other loans, such as personal loans, home equity loans must go through a closing period. During this period, all home equity loans are legally subject to a three-day cancellation rule, which states that you have the right to cancel your home equity loan until midnight of the third business day after you sign your contract. Changes to the contract, as well as funds disbursement, cannot occur during this time.

You May Like: Bayview Loan Servicing Dallas Tx

Can You Get A High

The short answer is yes, you can get a high-LTV home equity loan. Generally speaking, you may borrow against the equity built in your home if you have at least 5% equity, said John Stearns, a senior mortgage banker at American Fidelity Mortgage Services in Wheaton, Ill.

Still, you need to meet your individual lenders credit and income requirements, since your LTV ratio would be 95% .

How Does A High

If your existing LTV ratio is above 80%, you can be considered a high-LTV borrower, said Stearns. For example, if the LTV ratio on your first mortgage is 90% and youre looking to borrow from your available 10% equity though many lenders wont let you borrow up to the maximum the additional loan youre applying for would be considered a high-LTV loan.

Some lenders, such as Arsenal Credit Union and Signature Federal Credit Union, offer 100% LTV home equity loans. Arsenal offers no-closing-cost loans, while Signature Federal offers closing costs savings of up to $1,000.

Still, if youre taking out a home equity loan without paying closing costs, you may be on the hook for those costs if you pay off and close the loan within three years, or sometimes less. Keep in mind that home equity loan closing costs typically range from 2% to 5% of your loan amount.

Also Check: 650 Credit Score Auto Loan Interest Rate

How Much Mortgage Can I Get Approved For With A Poor Credit History +

Your credit score plays a crucial role in the type of mortgage that you will be eligible for. This is because that score is what is used to predict how likely you are to repay your new mortgage loan. Your chances of getting a good mortgage value hinges on how good a credit score you have, so it is important to request a copy of your credit report and credit score about a couple of months before you start making your maximum mortgage calculations.

A Heloc Makes It Possible

-

Debt consolidation.

You can transform your multiple loan payments into one simple payment and pay down existing debt while simultaneously improving your credit.

-

Home improvement.

Repair your roof, add on the extension, remodel your kitchen or invest in solar panels. A HELOC makes updating or repairing your home affordable.

-

Further your education.

Do you have a couple courses left or do you have a child heading off to college? No need to worry, the money can cover that too.

-

Vacation time.

The funds you receive from your Home Equity Line of Credit can help you plan the escape you have been waiting for and deserve.

Our application process is meant to impress.

Funding For It All

Don’t Miss: Reloc Line Of Credit

Common Reasons For Borrowing Against Home Equity

There are several reasons a homeowner may choose to borrow from their home equity, including:

- Buying an investment property. You could use some of your equity as a down payment to purchase an investment property, which could be used to host Airbnb guests or rent to long-term tenants, building a passive income stream.

- Consolidating high-interest-rate debt. Getting rid of balances on high-interest credit cards or loans could be a good reason to tap your equity. The interest rate you receive on a home equity loan might be significantly lower than many other financial products.

- Covering home improvement costs. If youve wanted to upgrade your bathroom or kitchen, a home equity loan might make sense. Not only can home improvements potentially boost your homes value, but there are also tax benefits to doing so. Generally speaking, you can deduct the interest paid on mortgages used to buy, build or improve a home, including home equity loans, worth up to $750,000.

- Paying for higher education. As college tuition costs continue to soar, families are likely looking for ways to cover those expenses outside of borrowing student loans. A home equity loan is one avenue to pursue.

Who Is This Calculator For

The Maximum Mortgage Calculator is most useful if you:

- Want to know exactly how much you can safely borrow from your mortgage lender

- Are assessing your financial stability ahead of purchasing a property

- Would like to compare the impact of different interest rates on the amount you can feasibly borrow.

Don’t Miss: Co Applicant For Home Loan

Government Help Due To Covid

There is some protection if you are struggling to pay your mortgage due to the coronavirus pandemic. While the Supreme Court rejected the CDC’s latest extension of its previous moratorium on evictions and foreclosures, there is still help available. The Consolidated Appropriations Act, 2021 passed in December 2020, provided $25 billion to the U.S. Treasury Emergency Rental Assistance program which is still being distributed to those in need.

The National Low Income Housing Coalition provides a searchable list of all the programs available on its website. Some states have instated moratoriums of their own. Consult the Treasury’s list of rent relief programs in your state to know your options.

The government has also encouraged all loan servicers to help prevent foreclosures via mortgage modifications and other relief options. Please check with your mortgage service provideror the company that receives your mortgage paymentsto determine if your mortgage loan qualifies for the moratorium program.

Equity Loan Tax Deductions

Tapping your equity for home renovation projects has another advantage. The Internal Revenue Service lets you write off some of the interest on home equity credit as long as you itemize deductions.

Before the Tax Cuts and Jobs Act of 2017 , taxpayers were able to deduct interest on up to $1 million of mortgage debt, and there were no restrictions on the usage for deductions. The TCJA instituted new limits and restrictions, which run through the end of 2025.

As of 2020, couples can deduct the interest on up to $750,000 of eligible mortgage debt if the debt is used on the home. The deductions can be applied for first mortgages, second mortgages, home equity loans, and home equity lines of credit if the debt is used to buy, build, or substantially improve the home against which it was secured.

You May Like: Auto Loans Usaa

Which Type Of Home Equity Financing Is Right For You

When you buy a home with a mortgage, you build equity with each payment you make. As you pay down the principal on your home loan, you gain more ownership of the home, allowing you increased access to the most valuable asset you own.

There are three main types of home equity financing: a home equity loan, a home equity line of credit , and a cash-out refinance. Each of these allows you to tap into the value of your home equity to borrow cash upfront. The type of loan best for you depends on your situation and goals, says Rebecca Neale, an attorney with Bedford Family Lawyer in Massachusetts.

What Does It Mean To Use My Home As Collateral

You use your home as collateral when you borrow money and secure the financing with the value of your home. This means if you dont repay the financing, the lender can take your home as payment for your debt.

Refinancing your home, getting a second mortgage, taking out a home equity loan, or getting a HELOC are common ways people use a home as collateral for home equity financing. But if you cant repay the financing, you could lose your home and any equity youve built up. Your equity is the difference between what you owe on your mortgage and how much money you could get for your home if you sold it. High interest rates, financing fees, and other closing costs and credit costs can also make it very expensive to borrow money, even if you use your home as collateral.

Don’t Miss: Va Home Loan Benefits 2020