What Is A Mortgage Rate Hold

A rate hold allows you to hold a mortgage rate for a certain period of time, typically between 60-120 days, depending on the lender and offer. For variable rates, you wonât lock in the rate itself, but its relation to prime. Itâs important to note that though a rate hold guarantees you a mortgage rate for a specific timeframe, it doesnât guarantee that your mortgage application will be approved.If Ontario mortgage rates are currently low, you may want to find a mortgage with a rate hold until your renewal or closing date.

How Much Can You Save By Refinancing Is It A Good Time To Refi

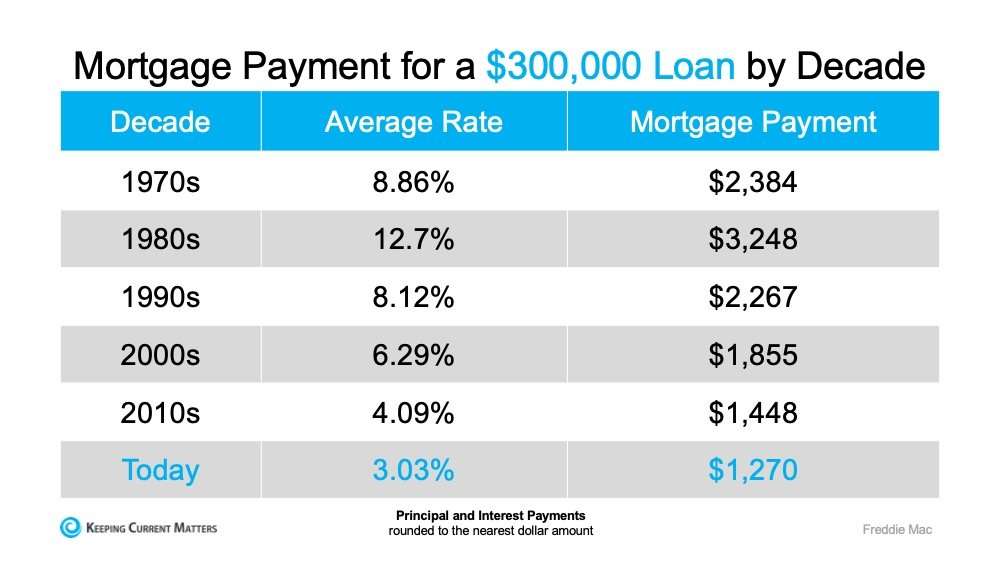

Yes, depending on your situation. Especially with mortgage rates near historic lows, its a great time to refinance. If you have a loan that youve been holding since before 2020, youre almost guaranteed to be able to refinance to a lower-rate mortgage. That can mean significant savings each month and over the life of the loan, so its worth exploring.

Remember, however, youll want to calculate your break-even timeline. If youre planning to move soon, you may not save enough to make up for your closing costs before you do.

Historical Canada Mortgage Rates

Looking at historical mortgage rates is a good way to understand which types of mortgage attract higher rates. They also make it easier to understand whether weâre currently in a low or higher rate environment, relatively speaking.

Here are some of Canadaâs mortgage rates for different types of mortgage over the past five years.

| 2016 |

You May Like: Refinance Car Through Usaa

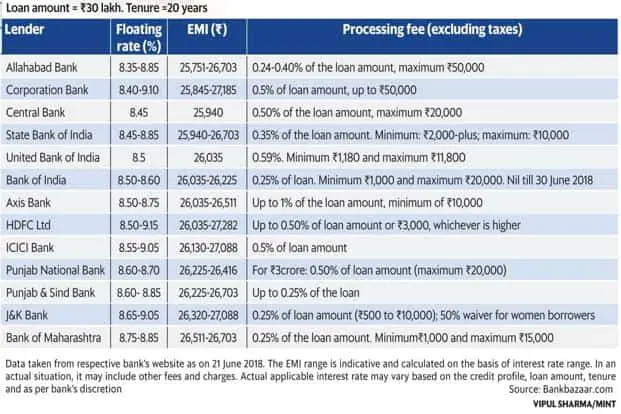

How To Calculate The Effective Interest Rate

The applicable interest rate on home loan consists of two components, the base rate and markup rate. The combination of two is what you will be paying on the loan. Let’s explore these components to give you a better understanding.

- Base Rate: It is the standard lending rate of the bank, applicable for all retail loans. This rate is subject to frequent changes on the basis of multiple inputs.

- This component of a small percentage is added to the base rate to arrive at the EIR for a specific type of home loan and varies from one type to another.

Effective Interest Rate = Base Rate + Markup

- From April 2016 onwards, the Reserve Bank of India has mandated a new method for computing lending rate to replace the base rate system. The is aimed at bringing more accountability and flexibility to the way rates are published by banks and financial institutions in India. RBI mandates banks to fix the interest rate after studying the risk factor associated with lending to borrowers. It takes into account, various factors involved such as repo rate, deposits etc. This MCLR based computation works out to be slightly lower than the erstwhile base rate.

How Does The Federal Reserve Affect Mortgage Rates

Home loans with variable rates likeadjustable-rate mortgages andhome equity line of credit loans are indirectly tied to the federal funds rate. When thefederal funds rates increase, it becomes more expensive for banks to borrow from other banks. The higher costs for the bank can mean a higher interest rate on your mortgage. ARM loans that are in their fixed period are not impacted by this increase. However if you suspect a federal increase is about to happen or it has just happened, you’ll want to move fast if you’re looking to make changes or have yet to lock in a fixed-rate mortgage.

Don’t Miss: Auto Loan Rates Credit Score 600

How To Use Our Mortgage Rate Table

Our mortgage rate table is designed to help you compare the rates youre being offered by lenders to know if it is better or worse. These rates are benchmark rates for those with good credit and not the teaser rates that make everyone think they will get the lowest rate available. Of course, your personal credit profile will be a significant factor in what rate you actually get quoted from a lender, but you will be able to shop for either new purchase or refinance rates with confidence.

How Much Will I Need For A Down Payment

The minimum youll need to put down will depend on the type of mortgage. Many lenders require a minimum of 5% to 20%, whereas others like government-backed ones require at least 3.5%. The VA loan is the exception with no down payment requirements.

Generally, the higher your down payment, the lower your rate may be. Homeowners who put down at least 20 percent will be able to save the most.

Recommended Reading: Nslds Ed Gov Legit

How Do I Qualify For Better Mortgage Rates

Qualifying for better mortgage rates can help you save tens of thousands of dollars over the lifetime of the loan. Here are a few ways you can ensure you find the most competitive rate possible:

- Raise your credit score: A borrowers credit score is a major factor in determining mortgage rates. The higher the credit score, the more likely a borrower can get a lower rate. Its a good idea to review your credit score to see how you can improve it, whether thats by making on-time payments or disputing errors on your credit report.

- Increase your down payment: Most lenders offer lower mortgage rates for those who make a larger down payment. This will depend on the type of mortgage you apply for, but sometimes, putting down at least 20 percent could get you more attractive rates.

- Lower your debt-to-income ratio: Also called DTI, your debt-to-income ratio looks at the total of your monthly debt obligations and divides it by your gross income. Usually, lenders don’t want a DTI of 43% or higher, as that may indicate that you may have challenges meeting your monthly obligations as a borrower. The lower your DTI, the less risky you will appear to the lender, which will be reflected in a lower interest rate.

The Driving Force Behind Mortgage Rates

Mortgage rates are a substantial element of the home buying process. While you likely know what a mortgage rate is if you have begun your home purchase journey, understanding what drives those rates may not be familiar territory.

The average interest rates affixed to home mortgages often fluctuate based on a few different factors. Understanding these can help you better comprehend when your chances increase for a lower interest rate.

You May Like: Specialized Loan Servicing Lawsuit

Mortgage Rates By State

Real Estate Economist and Associate Dean in Florida Atlantic University’s College of Business

With mortgage rates near historic lows, what can homebuyers do right now to ensure theyre getting the best deal when purchasing a home?

Individuals should begin their mortgage search before they begin their home search. This will put them at the price point they can best afford and allow them to potentially prioritize their offer with sellers over other buyers, since they will be ready to close quickly.

What causes mortgage rates to rise or fall?

Increases or decreases in 10-year Treasury yields directly influence 30- and 15-year mortgage rates. Currently, the Federal Reserve is actively buying 10-year Treasury notes, which increases the demand for these securities and drives their price up and yields down. So, our near record low mortgage rates are directly tied to the Federal Reserve Board’s response to COVID-19 in efforts to keep financial markets open. When it begins to taper significantly, mortgage rates will rise.

Should current homeowners consider refinancing with rates that are this low?

Canada’s Most Popular Mortgage: The 5

In Canada, out of the $1.2 trillion CAD in outstanding residential mortgages in May 2021, the 5-year fixed rate mortgage takes the crown with over $660 billion, or more than 50%, of all mortgages in Canada. There are more 5-year fixed rate mortgages than all variable rate mortgages combined. The 5-year fixed rate mortgage is so popular that the CMHC uses the Bank of Canada’s 5-Year Benchmark Posted Rate for itsmortgage stress test.

Don’t Miss: How Long Do Sba Loans Take To Get Approved

Should I Choose A Fixed Or Variable Rate

Variable rates allow you to take advantage of future decreases in interest rate. On the other hand, fixed rates are preferable if interest rates rise in the future. Unfortunately, long-term fluctuations in the prime rate are difficult if not impossible to predict.

However, a2001 studyfound that between 19502000, choosing a variable interest rate resulted in lower lifetime mortgage cost than a fixed rate up to 90% of the time. According to the study, if you are comfortable with the risks involved, a variable rate may reduce your long-term mortgage cost.

Which Is Better: Fixed Or Variable Mortgage Rates

Neither fixed nor variable rates are better than the other, they each suit different people in different situations. Fixed rates are incredibly popular due to the stability they offer, but variable rates may offer more savings throughout your term, depending on market conditions.

When deciding, consider your appetite for risk, your financial situation, the market conditions, and the length of your mortgage term.

If you are worried about rates going up or your household budget cannot accommodate much of an increase in your monthly mortgage payments, then fixed rates may be the way for you to go. On the other hand, if you are certain that rates are going to go down during your mortgage term and your budget can absorb increases in your monthly payment, then you may find variable rates more appealing.

Still undecided? Read our guide on fixed vs. variable mortgage rates.

You May Like: Usaa Loan Refinance

How To Calculate Interest On Home Loan

In general, home loans are long-term loans and it is important to figure out your overall interest liability towards the loan at the first place. You can calculate the same using one of the two methods listed below:

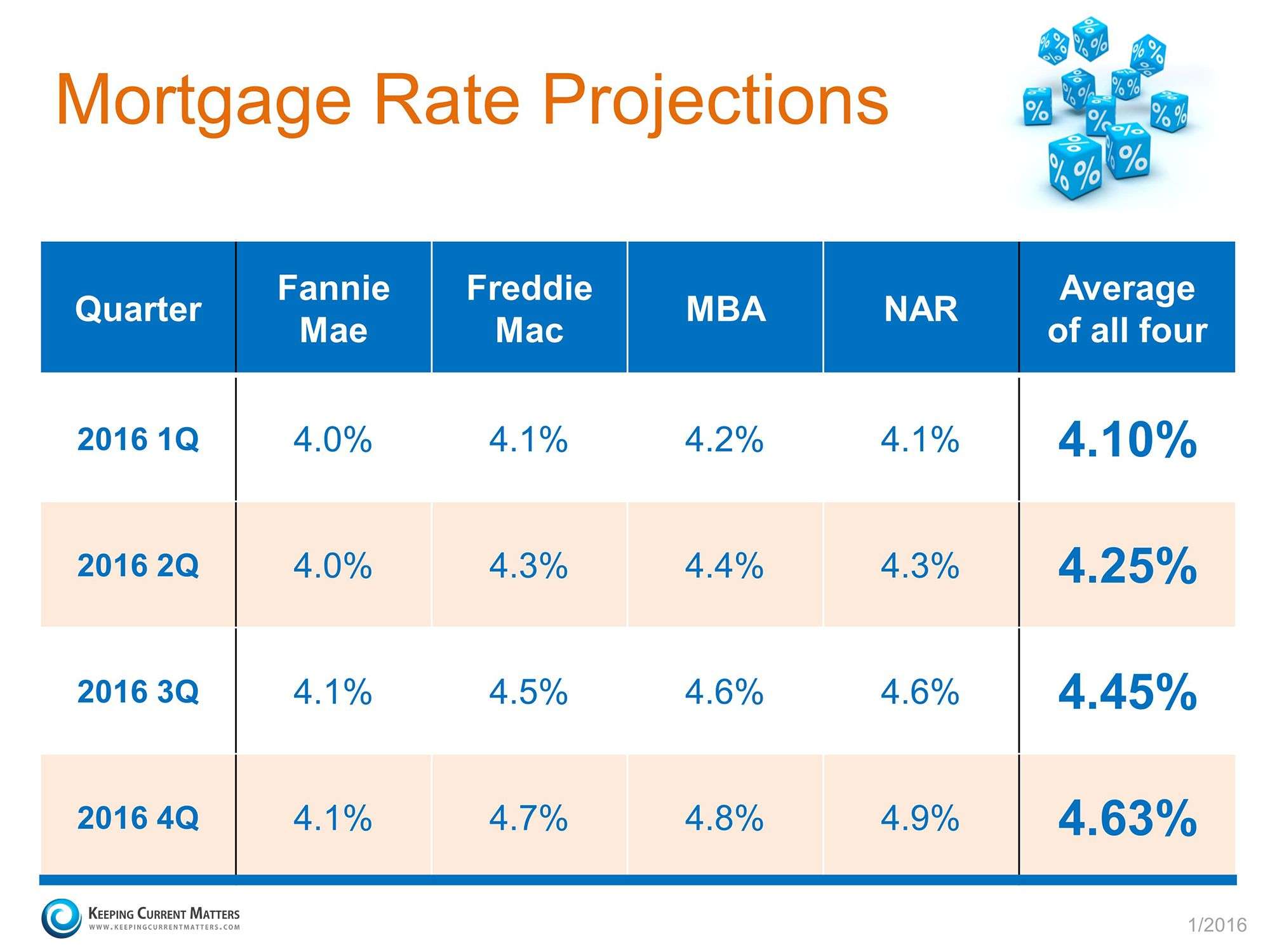

What Are The Mortgage Rate Trends For 2021

This year, rates have fluctuated but overall they have been low compared to rate history. But, many experts believe rates will rise in 2021.

As the economy recovers and the Federal Reserve announced its plan to scale back its low-rate policies the likely outcome will be rising mortgage rates. However, the expectation among experts isnt for skyrocketing rates overnight, but rather a gradual rise over time.

Recently, though, rates have been volatile. News of the Omicron COVID-19 variant has created fresh economic uncertainty and is putting upward pressure on rates. At the same time, rates are getting downward pressure due to the highest inflation in nearly 40 years.

Long term, experts still expect rates to slowly increase as the economy recovers. The recent volatility could continue through the end of the year and into 2022.

Recommended Reading: Usaa Rv Loan Rates Calculator

How Much Does Refinancing Cost

When you refinance a mortgage the closing cost typically range from 3% to 6% of the loan amount. So for a $300,000 loan, you can expect to pay $9,000 to $18,000 in closing costs.

But, each lender will assess your personal situation differently. So its important to shop around and compare offers. Everything from where the property is located to the type of loan youre refinancing into can change what youll pay to refinance.

Year Fixed Mortgage Rates

In a 30 year fixed mortgage, your interest rate stays the same over the 30 year period while you repay the loan, assuming you continue to own the home during this period. Such mortgages tend to be some of the most popular type of home loan thanks to the stability and lower monthly payments they offer borrowers compared to 15 year fixed mortgages.

Recommended Reading: How Long Does The Sba Loan Process Take

Average Mortgage Interest Rate By Credit Score

National rates aren’t the only thing that can sway your mortgage rates personal information like your credit history also can affect the price you’ll pay to borrow.

Your is a number calculated based on your borrowing, credit use, and repayment history, and the score you receive between 300 and 850 acts like a grade point average for how you use credit. You can check your credit score online for free. The higher your score is, the less you’ll pay to borrow money. Generally, 620 is the minimum credit score needed to buy a house, with some exceptions for government-backed loans.

Data from credit scoring company FICO shows that the lower your credit score, the more you’ll pay for credit. Here’s the average interest rate by credit level for a 30-year fixed-rate mortgage of $300,000:

| FICO Score |

According to FICO, only people with credit scores above 660 will truly see interest rates around the national average.

Andreis Bergeron Founding Member/head Of Brokerage Awningcom

30year mortgage rates forecast: 4.1%

15year mortgage rates forecast: 3.4%

Andreis Bergeron of Awning.com sees 30year interest rates moving slightly above 4% in 2022. In addition to Federal Reserve policy, the Fed Funds rate, and inflation, Bergeron points the finger at the bond market, gross domestic product, and housing trends among the elements that will impact mortgage interest rates in 2022.

Rates are expected to rise in the coming years driven by the largest yearoveryear inflation growth in 30 years and the fact that the Fed Funds are expected to hike rates, he says.

Considering that inflation growth is basically double where current mortgage rates sit, lenders will be forced to increase rates to make a profit margin on their products next year, he continues.

Recommended Reading: Capital One Auto Loan Private Party

Rick Sharga Executive Vice President Realtytrac

30year mortgage rates forecast: 3.75%

15year mortgage rates forecast: 3.25%

I think its likely well see mortgage rates increase in 2022, says Rick Sharga, executive vice president at RealtyTrac.

He explains, The biggest question is whether todays high inflation is transitory, as the Biden Administration claims, or will be more pervasive. Higher inflation almost always results in higher mortgage interest rates. If the Federal Reserve Bank decides it needs to do something more forceful to slow down the rate of inflation, it will probably raise the Fed Funds rate, which creates a higher rate environment overall.

If the Federal Reserve Bank decides it needs to do something more forceful to slow down the rate of inflation, it will probably raise the Fed Funds rate, which creates a higher rate environment overall.

Consider that the spread between the yields on 10year Treasuries and 30year fixedrate mortgages is below its historic level of about 2 points, so mortgage rates could move up a few basis points if that relationship were to simply revert to historically normal levels next year, he adds.

Do I Need Cmhc Insurance

UnderOffice of the Superintendent of Financial Institutions regulations, you are required to purchase CMHC insurance if your down payment is below 20%.

You may beineligible for CMHC insuranceif:

- your purchase price is $1,000,000 or above, or

- your amortization period is longer than 25 years.

In these cases, you must make a down payment of 20% or higher.

You May Like: Navy Federal Auto Loan Pre Approval Hard Inquiry

Is A Variable Rate Better

If youre comparing a variable rate and a fixed rate at the same point in time, a variable rate will almost always be lower than a fixed rate. Just as how a longer term mortgage will have a higher rate when compared to a shorter term mortgage, borrowers will pay a premium for locking-in a fixed rate.

Historically, variable rates have performed better than fixed rates, as found in a 2001 study by theIndividual Finance and Insurance Decisions Centre. Thats because interest rates have generally fallen over the past few decades, meaning that borrowers with a variable mortgage rate would have benefited from falling interest rates.

In todays low interest rate environment, its not certain if interest rates can continue to decrease further. While the focus can be on the direction of the change, you should also pay attention to how large the interest rate changes can be.

Since variable rates are often already priced at a discount to fixed rates, variable rates would be a better choice if interest rates dont move at all. Variable rates might still be a better choice if interest rates only increase slightly and later on in your mortgage term.

A fixed mortgage rate would be better if you think interest rates will significantly rise in the near future. Many borrowers also place value on the peace of mind that a fixed mortgage rate gives. The slightly higher mortgage rate might be worthwhile in exchange for not having to worry about interest rate fluctuations.

The Latest Interest Rate Forecasts

Forecasts for what the Bank of Canada mayor may notdo next week run the gamut from yet another rate hold, to the Bank shocking markets with a 50-bps hike in order to tackle inflation and runaway house prices.

Scotiabank, which for months had led the consensus forecast with its expectation of eight quarter-point rate hikes by 2023, has gone one step further and now expects 225-bps worth of tightening over the next two years, beginning with a 25-bps hike next week.

The BoC would not tighten policy just because of housing, but housing pressures on top of ripping inflation change the equation,writes economist Derek Holt. Waiting to hike until April or later, and doing so tepidly, will be too little, too late and the BoC would risk wearing full responsibility for another massive gain in house prices, more investor activity than even what weve observed so far, and greater housing imbalances and future vulnerabilities.

Holt added that mortgage rate commitments will start accelerating in the weeks ahead and carry on into an environment of rising immigration, no supply and a rebounding economy.

Bringing forward rate hikes is the best medicine for attempting to engineer a soft landing, he wrote. Hard landing risks would rise if the BoC continues to look the other way while maintaining overly accommodative policy.

Bond markets are now pricing in an 86% chance of a 25-bps rate hike at next Wednesdays rate meeting, with a slight chance of a 50-bps hike.

Don’t Miss: 600 Fico Score Auto Loan