Taking Out A Parent Plus Loan Read These 6 Pros And Cons First

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

OUR PROMISE TO YOU: Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

Bottom line: Were here for you. So please learn all you can, email us with any questions, and feel free to visit or not visit any of the loan providers on our site. Read less

Parent Plus Loan Fees

Loan disbursement and default fees are effectively a form of up-front interest. Assuming a 10-year repayment term, a 4% fee is the equivalent of an increase in the interest rate of about seven-eighths to one percentage point. Assuming a 30-year repayment term, a 4% fee is the equivalent of an increase in the interest rate of about one-third to half a percentage point.

The relative impact of a fee is greater with a shorter repayment term or if the borrower prepays the loan, since the fee will be amortized over less time. This is why borrowers who plan to pay off a loan early may wish to avoid up-front fees, if possible.

History of fees on PLUS loans| Year |

|---|

| 4.228% |

| 4.236% |

| 4.248% |

| 4.264% |

| 4.276% |

| 4.272% |

| 4.292% |

If A Parent Is Denied The Parent Plus Loan

A parent borrower who is denied a Direct Parent PLUS Loan because of adverse credit information has certain rights and options. A parent may take the following actions to see if the loan may still be approved:

- Appeal the credit decision: Appeal directly to Federal Direct Loan Program. They can be contacted at 1-800-557-7394 for more information.

- Add an endorser to the loan: Obtain a credit-worthy endorser . An endorser is someone who does not have an adverse credit history and agrees to repay the loan if the student is unable to repay it. The endorser may not be the student. An Endorser Addendum must be completed by the loan co-signer, and submitted to the Federal Direct Loan program for processing. For instructions, please contact Direct Loan Applicant Services at 1-800-557-7394 . A parent with an endorser must complete the MPN each year.

In either of the above cases, it is a requirement that the student 1) Contact our office to let us know if they are pursuing one of the above options, and 2) Complete PLUS Counseling at studentaid.gov before the loan funds can be disbursed to the student.

Don’t Miss: How Do I Find Out My Student Loan Balance

Options To Pay For College

Instead of PLUS Loans, private student loans may be used to fill gaps in need.

Private lenders that issue private student loans typically look at an applicants credit score and income and those of any cosigner. The lenders set their own interest rates, term lengths, and repayment plans. Some do not charge an origination fee.

You may want to compare annual percentage rates among lenders, and decide if a fixed or variable interest rate would be better for your financial situation.

Any time a student or parent needs to borrow money for education, a good plan is a good idea.

Sometimes scholarships can significantly reduce the amount of money that needs to be paid out of pocket for college, and personal savings and wages can also help. But it isnt unusual for students to also need to take out loans.

Parent Plus Loan Limits

You can borrow up to your childs full cost of attendance each school year, minus all other student aid. Your childs school sets the cost of attendance, which is a sum of all education-related expenses.

Student aid such as scholarships, grants, or your childs student loans are applied to this total cost. The difference between student aid granted and remaining costs is how much you can borrow with parent PLUS loans.

You May Like: Am I Qualified For Fha Loan

Getting Denied Can Be A Good Thing

Even if youre certain you wont meet the credit requirements, you might still consider applying for a Parent PLUS loan. Why? Because federal student loan limits are actually higher for students whose parents have been denied the loan. Ironically, if you are denied a Parent PLUS loan, it could trigger greater access to federal student loans for your child.

Who May Be Eligible For Student Loan Forgiveness

If Biden’s program is allowed to move forward, individual borrowers who earned less than $125,000 in either 2020 or 2021 and married couples or heads of households who made less than $250,000 annually in those years could see up to $10,000 of their federal student loan debt forgiven.

If a qualifying borrower also received a federal Pell grant while enrolled in college, the individual is eligible for up to $20,000 of debt forgiveness.

There are a variety of federal student loans and not all are eligible for relief. Federal Direct Loans, including subsidized loans, unsubsidized loans, parent PLUS loans and graduate PLUS loans, are eligible.

But federal student loans that are guaranteed by the government but held by private lenders are not eligible unless the borrower applied to consolidate those loans into a Direct Loan before September 29.

Don’t Miss: Fla Servicing Student Loan Forgiveness

Should You Get Parent Plus Loans

Parent PLUS loans can help some families pay for college, but they wont be right for everyone. First, consider whether you should borrow for your childs education at all.

Consider how adding new student loan payments will affect your finances. If theyd stretch your budget too thin or detract from other important financial goals like retirement, that might be a sign that its wise to reconsider.

If you can afford this new debt, also investigate alternatives to parent PLUS loans. Max out other , such as scholarships, savings, and lower-cost undergraduate federal loans, first.

Private student loans might be a better fit for some borrowers, too. Parents who dont want to shoulder this debt alone, for example, could co-sign a private student loan with their childmaking both family members legally responsible for this debt.

When Should You Use A Parent Plus Loan

Parent PLUS Loans should only be used to cover gaps in paying for college expenses, and only as a last choice. After grants, scholarships, work-study, out-of-pocket savings, and family contributions, you may still need loans to make up the difference. But before you take out a Parent PLUS Loan, your child should take out loans in their own name to cover as much of their college education as they can. If you are ineligible for a Parent PLUS Loan, your child may be able to obtain an increased subsidized loan.

Also Check: How To Pay Sba Loan

Parent Plus Loans Interest Rates

Parent PLUS loan interest rates may be a shock to families who are used to paying rates for undergraduate federal student loans. While undergraduate loans to students are currently issued at a rate of roughly 4.5%, rates for Parent PLUS loans are roughly 7.1%.

Now think about how much more you can borrow with a Parent PLUS Loans versus a traditional undergraduate student loan. While federal student loans are generally capped for dependent students at $31,000 for an entire undergraduate degree, Parent PLUS loans are capped by the total cost of attendance minus other sources of financial aid.

Relatively High Interest Rates And Fees

Parent PLUS loans have the highest interest rates and fees of all other loans offered at the federal level.

For the 2022-23 school year, direct subsidized and unsubsidized loans for undergrads have a 4.99% fixed interest rate and 1.057% loan distribution fee PLUS loans have a 7.54% rate and 4.228% fee.

You May Like: How To Calculate Debt To Income Ratio For Car Loan

Differences From Stafford And Perkins Loans

- There are no limits on the amount borrowed up to the cost of attendance minus other financial aid. Living expenses are considered part of the cost of attendance.

- The repayment schedule for Direct PLUS Loans disbursed on or after July 1, 2008 is the same as the schedule for Stafford loans. However, for Direct PLUS Loans first disbursed before July 1, 2008, the repayment period begins at the time the PLUS loan is fully disbursed, and the first payment is due within 60 days after the final disbursement. Repayment may be deferred while at least a half-time student however, the unpaid interest is added to the principal.

- The interest rate is currently fixed at 6.28% and charged from the date of the first disbursement until the loan is paid in full.

- For undergraduate students, the loan is a commitment by the parent, rather than the student.

- Several different repayment plans are available.

- Do not have the postponement and discharge options available with Stafford loans.

Denied A Parent Plus Loan

If you are found to have adverse credit history, you may still be able to borrow from the Parent PLUS Loan program. You have two options: submit a successful extenuating circumstances appeal for an exceptional circumstance, or reapply with a cosigner who does not have an adverse credit history.

If you want to appeal the decision, you must submit a request to appeal the decision and provide information regarding your denial decision. If successful, you may be required to completed loan counseling prior to receiving the Parent PLUS loan funds.

If you would like to apply with a cosigner who does not have adverse credit, the cosigner would need to complete an endorser application.

Now, if neither of these options works for you, your denial of a Parent PLUS Loan would actually make your dependent undergraduate student eligible for independent undergraduate student Stafford loan limits. Meaning, they will have access to additional loan funds they can borrow under their name to help pay their own college costs.

Also Check: What Is Bridge Loan Financing

Parent Plus Loan Interest Rate

The interest rates on Parent PLUS Loans are fixed and do not change over the life of the loan. The interest rate for the 2020-2021 academic year is 5.30%.

Every year on July 1, interest rates are reset based on current market rates.

The interest on a Parent PLUS Loan starts to add up from the date the loan is first disbursed. If the borrower does not pay the interest as it accrues, it will be capitalized , increasing the size of the loan.

The Money Goes Straight To Your Child’s School

The government sends the money to your child’s school, typically in installments at the start of the semester or quarter. The school will use these funds to cover the cost of tuition, room and board, and other fees. If there’s any money left, the school will send you a check with the remaining balance.

Read Also: What Is An Upside Down Car Loan

Why You Might Need A Financial Professional

Even after all that work, you still may have some complicated questions to sort through, including which income-driven plan makes the most financial sense for your circumstances. For example, Pay as You Earn and Revised Pay as You Earn are the most affordable, basing your payment on 10% of your income, but REPAYE counts spousal income in the payment calculation, while PAYE has stricter eligibility parameters. Married people may benefit more from the Pay as Your Earn and Income-Based Repayment plans, because these plans calculate payment off a single income. But that also means filing taxes as married, filing separately to qualify. Experts typically recommend changing your tax filing status the year before in preparation for consolidating.

Finding the right advice isnt always easy.

Loan servicers and financial aid officers cannot provide any tax or personal finance advice, and tax professionals dont understand student loan payment, Amrein says.

Thats why a financial advisor with a Certified Student Loan Planner designation and a tax background may be worth consulting. Check the Certified Student Loan Advisors Institute for someone in your area. This person can also help you assess whether jumping through the hoops to complete a double consolidation is worth the work for your personal circumstances.

Youll have to understand the numbers, Amrein says.

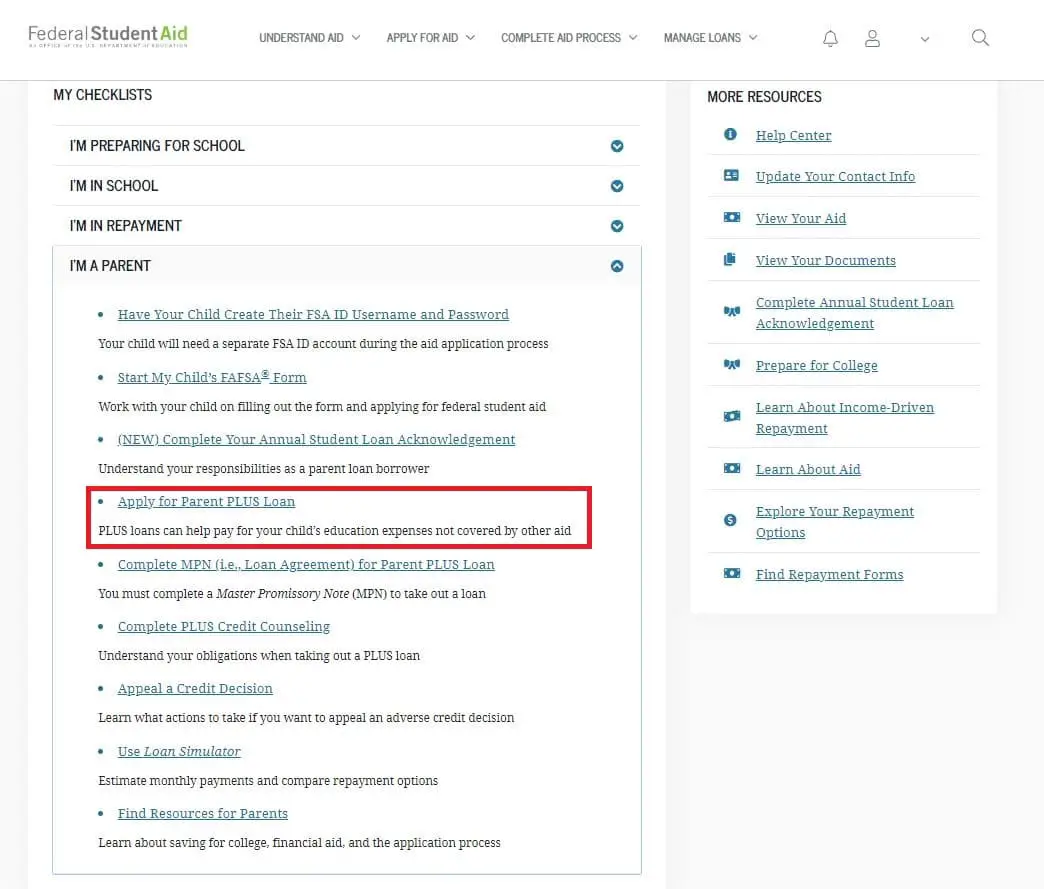

Plus Loan Eligibility And Application Process

From the Department of Educations website:

To take out a Direct Loan for the first time, you must complete a PLUS Application and master promissory note . The MPN is a legal document in which you promise to repay your loan and any accrued interest and fees to the Department. It also explains the terms and conditions of your loan. The MPN will be provided either by your child’s school or the Department.

If your child’s school offers the option of completing the MPN electronically, you can do so online at the StudentLoans.gov website. If you are borrowing Direct PLUS Loans for more than one student, you’ll need to complete a separate MPN for each one. To complete an MPN online, you will be required to use your Department of Education-issued PIN . If you do not have a PIN, you may request one from the official PIN site.

In most cases, once you’ve submitted the MPN and it’s been accepted, you won’t have to fill out a new MPN for future loans you receive to pay for the educational expenses of the same student. Unless your child’s school does not allow more than one loan to be made under the same MPN, you can borrow additional Direct Loans on a single MPN for up to 10 years.

You’ll receive a disclosure statement that gives you specific information about any loan that the school plans to disburse under your MPN, including the loan amount and loan fees, and the expected loan disbursement dates and amounts.

You May Like: When Can I Apply For Grad Plus Loan

Parent Plus Loan Deferment Forbearance And Forgiveness

On the loan application, you can choose to defer parent PLUS loan payments during your students enrollment or begin making immediate full payments.

You can defer or seek forbearance for parent PLUS loans in other situations, too: if you lose a job, return to school, or encounter financial hardship or other qualifying circumstances. These loans are eligible for many other federal benefits and protections as well, such as forgiveness through the Public Service Loan Forgiveness program or other avenues, such as closure of your students school, or a death of the borrower or student.

You Have A Few Different Options For Repayment

Although Parent PLUS Loans have the disadvantage of an origination fee , they win points for flexible repayment plans.

Parent PLUS Loans are eligible for the following plans:

- Standard Repayment Plan: Pay your loans off with fixed monthly payments over 10 years.

- Graduated Repayment Plan: Start with small payments that gradually increase over a term of 10 years.

- Extended Repayment Plan: Pay fixed or graduated payments over 25 years.

- Income-Contingent Repayment: If you consolidate first, youll pay 20% of your discretionary income or what youd pay on a 12-year plan, whichever is lower. If you still have a balance left after 25 years, you could be eligible for student loan forgiveness.

As you can see, you have several options for repayment. They can make your monthly bills go higher or lower. You might make extra payments to pay the loan off as fast as possible or extend your term to 20 or 25 years for some financial relief.

These flexible repayment plans can be a lifesaver in the event you lose your job or run into financial hardship. Note that private student loan companies typically dont offer these same protections, but some will allow you to pause payments through forbearance under certain circumstances.

If youre concerned about your ability to pay back a parent loan, a federal Parent PLUS Loan might be the most accommodating option. But if you dont anticipate trouble with repayment, you might prefer a private lender.

Recommended Reading: Which Student Loan Is Better Subsidized Or Unsubsidized

Cons Of Private Student Loans

- Private student loans dont always offer deferment or forbearance options.

- Private student loans can have variable interest rates, meaning while the rate may be lower at the time you borrow the money, it can increase later on.

- For borrowers with poor credit, the interest rate on a private student loan may be considerably higher than the interest rate on a Parent PLUS Loan.

Similarities With Stafford And Perkins Loans

PLUS loans share some similarities with the Stafford and Perkins loans offered to students:

- Offered under Title IV of the Higher Education Act of 1965 and are therefore backed by the full faith of the United States Government

- Can be consolidated through the federal student loan consolidation program

Recommended Reading: When Can I Sell My House Fha Loan