Use Our Interest Rate Calculators

If all of that looks like way too much math to stomach, or if you donât have time to become a spreadsheet expert, you can use our handy financial calculators to do the work for you.

Our repayments calculators will tell you the repayment youâll make on a monthly, fortnightly or weekly basis, and give you the total amount of interest youâll wind up paying on your car, personal or home loan. And our credit card debt payment calculator will show you how long it will take you to pay off a credit card debt, plus how much youâll pay in interest and fees.

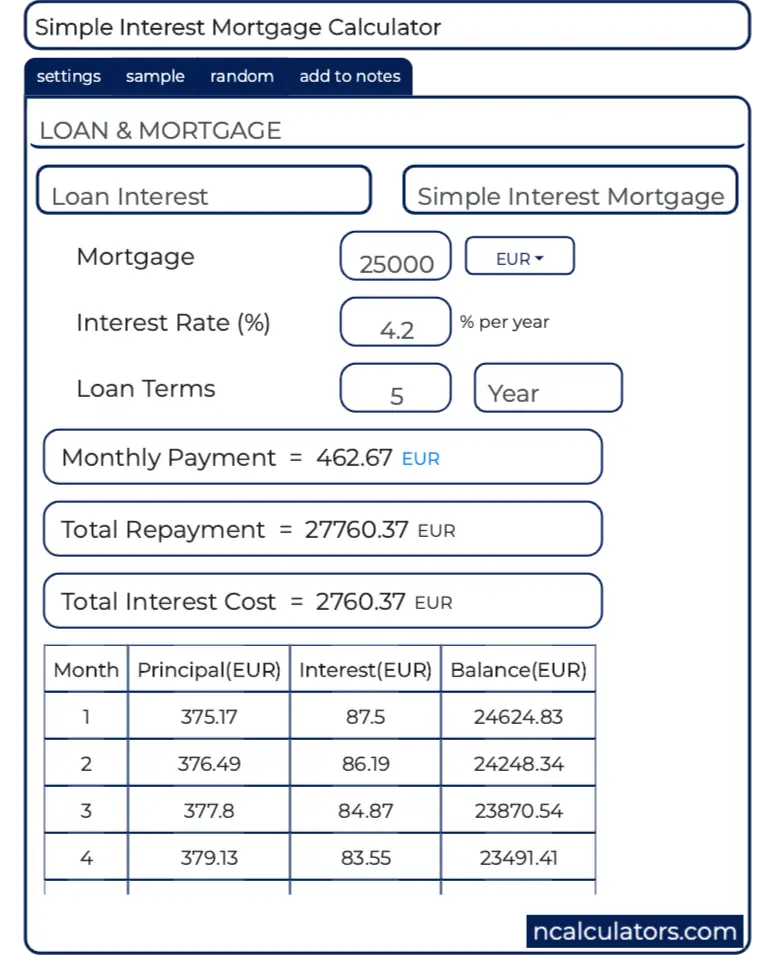

What Is Simple Interest How To Calculate It For Your Home Loan

Simple interest is a fixed charge based on loan principal, and its typically assigned as a percentage. Its a way of calculating how much you owe a lender for borrowing money. That cost of debt is called interest, and it can be determined via simple or compound interest formulas.

Mortgage lenders charge simple interest mortgage rates to borrowers to cover their expenses for paperwork, loan underwriting and other services. This interest is included in your monthly mortgage payments and is part of your expenses as a homeowner.

Its important to understand what simple interest is and how its calculated so you can get a more accurate estimate of your monthly mortgage payments before you submit an offer on a house.

How Can An Interest Rate Calculator Help You

Here are some of the primary benefits that a loan interest rate calculator provides.

- Such a platform helps you with a reliable resource that helps you stay abreast of your outstanding liabilities.

- The tool is also a very potent bank interest rate calculator. If you have availed credit from a bank, you need to repay the entire loan in time. Else, your CIBIL score suffers and your creditworthiness will also reduce.

- An interest rate calculator in India aids you in planning which EMIs have greater priority and which can wait for later.

- Lastly, an interest rate calculator will save you time, eliminate errors and help you stay atop your current financial situation.

Since most loans have long tenures, figuring out their repayment status is often difficult. It is why you need to find an interest rate calculator. Groww has a wide array of financial tools which you will find listed at the end of this page.

You May Like: How To Apply For Fha Loan Texas

What Types Of Loans Use Simple Interest

Simple interest is used for most common consumer debts, including auto loans, credit cards, student loans and mortgages. However, some lenders do apply compound or precomputed interest to debt, so its important to compare lenders and ask about simple loan options.

Typically, compound interest is utilized in investments, where youre generating a return based on the amount youve invested. This includes 401s, money market accounts, high-yield savings accounts and more.

When And How Interest Is Charged

Interest is charged on mortgages, credit cards, unpaid bills, business loans, personal loans, auto loans basically, any type of financial borrowing. Lenders will charge different interest rates for different types of borrowing depending on credit worthiness and the security of the loan. Personal loans, credit cards, and unsecured loans are usually charged higher interest rates since they are riskier resulting in higher default rates.

It’s crucial to understand how interest rates are calculated before you sign up for a loan. Fortunately, this loan interest calculator makes the math easy.

Recommended Reading: How To Transfer Parent Plus Loan To Child

S To Calculate Interest On Loan

Please follow the below steps.

Interest = P * r * t

Example #1

Let us take an example, Trevor, who has deposited his money at ABC Bank Ltd. As per the bank policy, Trevor has been offered an interest rate of 6% on a sum of $1,000 that has been deposited for a period of 3 years. Calculate the interest to be earned by Trevor at the end of 3 years.

Solution:

- Outstanding principal sum, P = $1,000

- Rate of interest, r = 6%

- Tenure of deposit, t = 3 years

Use the above data for the calculation of interest.

The interest earned by Trevor can be calculated as,

Interest = $1,000 * 6% * 3

Therefore, Trevor will earn an interest of $180 at the end of 3 years.

Example #2

Solution:

- Outstanding principal sum, P = $5,000

- Rate of interest, r = 8%

- Number of payments per year, N = 2

Use the above data for calculation of interest charged for 1st six months.

Home Equity Loan Calculator

If you need to take out a home equity loan, youll first need to see how much you can borrow with a home equity loan calculator.

Enter your address, the estimated value of your home, your estimated mortgage balance and your credit score. Even though your available home equity is a major part of how much you can borrow through a home equity loan, your credit score will also factor into the loan amount and your interest rate.

You May Like: What Is The Lowest Auto Loan Interest Rate

Buying A Car With Cash Instead

Although most car purchases are made with auto loans in the U.S., there are benefits to buying a car outright with cash.

There are a lot of benefits to paying with cash for a car purchase, but that doesn’t mean everyone should do it. Situations exist where financing with an auto loan can make more sense to a car buyer, even if they have enough saved funds to purchase the car in a single payment. For example, if a very low interest rate auto loan is offered on a car purchase and there exist other opportunities to make greater investments with the funds, it might be more worthwhile to invest the money instead to receive a higher return. Also, a car buyer striving to achieve a higher credit score can choose the financing option, and never miss a single monthly payment on their new car in order to build their scores, which aid other areas of personal finance. It is up to each individual to determine which the right decision is.

The Basic Mechanism Of Base Rate And Base Financing Rate

When borrowers take up a home loan with a bank, they will give them a home loan facility with interest rates.

Usually, it will be like this.

Base Rate + 1.25% = XX%

You can find your home loan interest rates in the bank letter offer. Typically, on the front page or the first few pages.

Just in case you have misplaced the letter offer, you can go back to the bank and check your home loan interest rates.

BR stands for Base Rate.

The Base Rate is calculated against each banks cost of funds and Statutory Reserve Requirement , along with the borrowers credit risk, liquidity premium, operating cost, and profit margin.

In short, Base Rate is a mechanism the bank refers to when decides on the interest rate for your home loan package.

Recommended Reading: Who Is The Best Loan Company For Bad Credit

Ensure The Function Works Correctly

After writing your function, you might want to test it to ensure that it is working. To do this, you can perform the calculation using the value given by your function. If the equation is valid, then your function is working correctly and you can use this spreadsheet to calculate your loan interest.

Related:How To Create a Balance Sheet in Excel

How To Use This Car Loan Payoff Calculator

To use the calculator, make sure you have the following information available:

- Vehicle purchase price: This is the amount you financed to purchase your vehicle.

- Loan term: The amount of time over which you agreed to pay back the amount you borrowed. For example, 60 months is a common auto loan term.

- Annual percentage rate : This is the auto loan interest rate you agreed to pay, expressed as an annualized percentage, including any applicable lender fees.

- Remaining months: The number of months you have left on your loan.

- Increased monthly payment: The amount you want to increase your monthly car payment .

- Current monthly payment: This is how much youâre currently paying toward your loan every month.

- Loan term shortened by: The number of months your loan would be reduced by if you increased your payment amount.

- Total interest savings: The amount youâll save in interest if you make the additional payments suggested by the calculator.

You May Like: How Soon Can I Sell My Va Loan Home

Examples Of Interest Formula

Lets take an example to understand the calculation of Interest in a better manner.

Example #1

Let us take a simple example of $1,000 borrowed by Travis from his friend Tony. Travis promised to pay a simple interest of 5% for three years, and then he will repay the loan to Tony. First, calculate the interest to be incurred by Travis.

Solution:

Simple Interest is calculated using the formula given below

Simple Interest = P * r * t

- Simple Interest = $1,000 * 5% * 3

- Simple Interest = $150

Therefore, Travis will incur an interest expense of $150 during the loan tenure.

Example #2

Let us take the example of Dennis, who borrowed $2,000 from the bank. The bank charged interest at the rate of 7% compounded annually. The loan is for a period of 5 years. Calculate the interest expense to be incurred by Dennis.

Solution:

Compound Interest is calculated using the formula given below

Compound Interest = P *

- Compound Interest = $2,000 *

- Compound Interest = $805.10

Therefore, Dennis will incur an interest expense of $805 during the loan tenure.

Example #3

Let us take another example to understand the difference between simple interest and compound interest. Monty has decided to start a small hatchery for which is planning to borrow a sum of $5,000 for 5 years. The lender has offered two options-

- 6.0% interest to be compounded annually

- 6.5% simple interest rate.

Help Monty to decide which is a cheaper option for him.

1st Option

Compound Interest is calculated using the formula given below

Calculating Interest On A Credit Card

Itâs a good idea to think of using a credit card as taking out a loan. Itâs money that is not yours, youâre paying to use it, and itâs best that you pay it back as soon as you can.

For the most part, working out how much you pay in interest on your credit card balance works much the same way as for any other loan. The main differences are:

- Your basic repayment is a minimum amount set by your credit card company. It might be a set dollar amount, similar to any other loan, or it might be a percentage of your balance. Itâs best to pay more than the minimum amount, because often, it doesnât even cover the cost of interest. Paying only the minimum is how you wind up with a massive credit card debt.

- If you make purchases on your card before paying off previous amounts, it will be added to your balance and youâll pay interest on the whole lot. This will change your minimum payment amount as well, if the minimum payment is based on a percentage of your balance.

Itâs always a good idea to pay off as much of your credit card balance as you can, as early as you can. This way, you avoid getting hit by high interest rates.

So when youâre calculating your interest, just remember to use the right amount for your repayment value and add any extra purchases onto your balance, and the above method should work to calculate your interest.

Read Also: Which Is Better Parent Plus Loan Or Private Student Loan

Start With The Interest Rate

The higher your credit score, the lower the interest rate you will likely qualify for on a personal loan. If you think you might be in the market for a personal loan in the future, its a good idea to get to work building up your credit score. Contest any errors in your credit report, pay your bills on time and keep your credit utilization ratio below 30%.

Once you’re ready to shop for a personal loan, don’t just look at one source. Compare the rates you can get from credit unions, traditional banks, online-only lenders and peer-to-peer lending sites.

When you’ve found the best interest rates, take a look at the other terms of the loans on offer. For example, its generally a good idea to steer clear of installment loans that come with pricey credit life and credit disability insurance policies. These policies should be voluntary but employees of lending companies often pitch them as mandatory for anyone who wants a loan. Some applicants will be told they can simply roll the cost of the insurance policies into their personal loan, financing the add-ons with borrowed money.

This makes these already high-interest loans even more expensive because it raises the effective interest rate of the loan. A small short-term loan is not worth getting into long-term debt that you can’t pay off.

Makes Calculating The Interest On Your Loan Easy

This loan interest calculator figures how much of your monthly payment is…show more instructions

If you would like to know the same information using an interest only loan try this interest only loan calculator as well. Alternatively, if you want to figure the actual interest rate on your loan this interest rate calculator can help.

You May Like: What Is The Best Loan Company

Bond: Predetermined Lump Sum Paid At Loan Maturity

This kind of loan is rarely made except in the form of bonds. Technically, bonds operate differently from more conventional loans in that borrowers make a predetermined payment at maturity. The face, or par value of a bond, is the amount paid by the issuer when the bond matures, assuming the borrower doesn’t default. Face value denotes the amount received at maturity.

Two common bond types are coupon and zero-coupon bonds. With coupon bonds, lenders base coupon interest payments on a percentage of the face value. Coupon interest payments occur at predetermined intervals, usually annually or semi-annually. Zero-coupon bonds do not pay interest directly. Instead, borrowers sell bonds at a deep discount to their face value, then pay the face value when the bond matures. Users should note that the calculator above runs calculations for zero-coupon bonds.

After a borrower issues a bond, its value will fluctuate based on interest rates, market forces, and many other factors. While this does not change the bond’s value at maturity, a bond’s market price can still vary during its lifetime.

Determine Your Mortgage Principal

The initial loan amount is referred to as the mortgage principal.

For example, someone with $100,000 cash can make a 20% down payment on a $500,000 home, but will need to borrow $400,000 from the bank to complete the purchase. The mortgage principal is $400,000.

If you have a fixed-rate mortgage, you’ll pay the same amount each month. With each monthly mortgage payment, more money will go toward your principal, and less will go toward paying interest.

Also Check: How Long Before Refinancing Home Loan

Calculate Compound Interest On A Loan Using Fv Function

You can also calculate compound interest on a loan in Excel usingthe FV function.

Introduction to FV Function

Function Objective:

Calculates the future value of an investment based on a constant interest rate. You can use FV with either periodic, constant payments, or a single lump-sum payment.

Syntax:

| The total number of payment periods in an annuity. | ||

| Pmt | Required | The payment that is to be made per period. It is fixed or constant over the life of the loan or mortgage. Typically, pmt contains only the principal and interest but no fees or taxes. If pmt is omitted, you must include the pv argument. |

| Pv | Optional | The present value, or the total amount that a series of future payments is worth now. Also known as the principal. |

| Type | Required | The number 0 or 1. It indicates the time when the payments are due. If the type is omitted, it is assumed to be 0. |

Return Parameter:

Future value.

Step 1:

- First, we will select cell C10 and write down the formula below for compound interest for the first month.

=FV

Formula Breakdown:

- C4 = Rate = Annual Interest Rate = 4%

As we are calculating on monthly basis, we have divided it by the number of months in a year, 12.

- C7 = Npr = Total number of payments = 60

We have 5 years to pay back the loan. 5 years have a total of = 60 months

- 0 = Pmt = The payment made each period.

- -C8 = Pv = The present value.

Step 2:

Read more:How to Calculate Home Loan Interest in Excel

How To Calculate Interest Rates

Most personal loans are amortized with a fixed interest rate, expressed as an APR. An amortized loan means the lender works out a schedule of repayment where the monthly payment amount stays the same but the interest is based on the unpaid principal balance at the beginning of the month. Each month, you pay less towards interest and more towards the principal due to the declining principal balance.

To calculate the amount of interest due for your first month, divide your APR by the number of payments in the year. Then, multiply that by the loan principal to get the interest due.

x principal loan balance = interest

For example, if your loan amount is $10,000, your loan term is five years and your APR is 5%, the equation would be:

x $10,000 = $41.67

In the following months, subtract the interest paid the prior month from the repayment amount to get the amount you paid to the principal.

Total payment amount interest paid = Amount paid toward the principal balance

Using the example above, the payment amount would be $188.71 so the equation would be:

$188.71 $41.67 = $147.05

Then, subtract the amount that was paid to the principal from the total principal amount to get your new balance for the second month.

$10,000 $147.05 = $9,852.95

The new balance can then be added into the first equation to get the next months interest payment.

x $9,852.95 = $41.05

Read Also: What Is Fha And Conventional Loan