I Haven’t Paid My Student Loans In Years: A Roadmap To Reentering Repayment

Do you have a defaulted student loan 20 years ago? Maybe you left the country. Or maybe you ignored the bills because you couldn’t afford the payments. Whatever your reason, it’s been years since you’ve dealt with your student loans. But now, you’re ready. Here are step-by-step instructions of what to do when it’s been years since you paid your student loans.

I Believed That I Was Under An Income

I took out about $54,000 in loans. In 2002, I consolidated all my federal loans.

Dear Moneyist,

I took out loans for professional/graduate school during the years 1993 to 1996. I took out about $54,000 in loans. In 2002, I consolidated all my federal loans. The balance is approximately $167,000. I have been paying between $350 and $1,100 per month for the last 20 years.

I believed that I was under an income-driven repayment plan, but recently my loan servicer was changed from Navient NAVI, -3.65% to Aidvantage, and I was able to view my loan information and see different payment plans under IDR. It turns out that I am not under any IDR.

I thought that after 20 to 25 years of payments, any loan balance would be forgiven. I am very disappointed that I was not under one of these plans, and I feel deceived.

Now with the Biden administration announcing student-loan cancellations, I do not know if I should apply for one of the IDR plans now though it would seem unfair to start over, as I have been in regular repayment since 2002. Or do I wait and see if I qualify for cancellation via Biden?

Conflicted

Dear Conflicted,

Its a small consolation, but you are one of at least 2 million people who believed they were on track for loan forgiveness, but realized that their loans did not qualify. Its a bitter pill to swallow. The student-loan forgiveness program is a complex and bureaucratic process ripe for error.

The Moneyist regrets he cannot reply to questions individually.

What Are The Options And Requirements For 10

If you dont want to wait 20 years for student loan forgiveness and want the shortest route to getting your loans gone, youll want 10-year student loan forgiveness.

The only option for this is through the Public Service Loan Forgiveness program, which is available to nonprofit and certain government workers. To be eligible for this 10-year student loan forgiveness program, you must be on an IDR plan and make regular monthly payments.

After making 120 monthly payments, you can apply for student loan forgiveness. Under PSLF, the remaining loan balance is forgiven and isnt considered taxable income by Uncle Sam.

You May Like: Capital One Home Improvement Loan

Who Pays For Student Loan Forgiveness

For federal or state-offered loan forgiveness, it can be logically argued that the taxpayer is ultimately footing the bill their taxes funded the loans for students, and those ex-students wouldnt be repaying the debt in full. For other forgiveness programs, it could be employers or charitable donations that are paying for student loan forgiveness.

Loan Forgiveness For Lawyers

There are about a million jokes about lawyers being bloodsuckers on society, but the federal loan program begs to differ. There is a financial incentive for lawyers to practice in public service or government offices in order to have some portion of their law school loan forgiven.

For example, the Department of Justice provides up to $60,000 in loan forgiveness for lawyers who work there for at least three years. The Air Force Judge Advocate program offers up to $65,000 in loan forgiveness.

The best place to start looking might be your own law school, since several colleges forgive some or all of the student loans for students who make less than $60,000 a year.

That amount varies, so check with your school to get actual requirements and amount forgiven. If you cant qualify for a forgiveness program, look into refinancing your law school debt.

Recommended Reading: How Often Can You Use The Va Loan

Student Loan Discharge For Special Circumstances

While student loan discharge isnt the same as forgiveness, it could leave you debt-free. In rare circumstances, borrowers can get their student loans completely canceled.

There are several situations when you could qualify for federal student loan discharge, including:

| If your school didnt issue a refund to the Education Department |

If you think you could qualify or want to learn more, speak with your loan servicer.

How Many Years Does It Take For A Student Loan To Be Written Off

Student debt is not like other debt, as anything remaining after 30 years is wiped. However, the repayment rate and threshold will dictate how much you pay over those 30 years. The interest charged on the loan could make the difference between paying it all off before 30 years, and having debt left at the end.

Read Also: Is Fha Loan Still Available

If I Die What Happens To My Student Loans

Last Updated on June 15, 2022 by Paschal Alvina

In this article, we answer your questions regarding: if i die what happens to my student loans, what happens to student loans after 25 years, what happens to student loans when you retire, student loan forgiveness death of parent and sallie mae death discharge.

If you have federal student loans, the U.S. Department of Education will notify your family or other representative that theyre eligible to make a claim on your estate to pay off the debt. Its possible to request a waiver of the claim if you have no assets or income but be aware that this doesnt discharge the debtit just allows someone else to make payments on it instead of you. Read on to know more on: if i die what happens to my student loans, what happens to student loans after 25 years, what happens to student loans when you retire, student loan forgiveness death of parent and sallie mae death discharge.

If you have private student loans, theyre likely going to be discharged when you die because they are unsecured debts . However, if these loans were taken out within 90 days of an illness or injury, they may not be discharged at all if the lender can show that it was reasonable for them to assume that your death would leave them unable to pay off the loan.

Federal Perkins Loan Cancellation

Federal Perkins Loans have a separate forgiveness program because your school is the lender, not the federal government. To apply, contact the financial aid office at the school that administered your Perkins Loan and request the application forms. You need to be a full-time employee in a qualified career.

Qualifying Perkins Loan Forgiveness Jobs:

- Soldier in hostile fire or imminent danger pay areas

- Law enforcement or corrections officer

- Nurse or medical technician

- VISTA or Peace Corps volunteer

- Librarian with a masters degree

- Attorney employed in a federal public or community defender organization

- Employee for public or nonprofit organization that serves high-risk children and their families from low-income communities

- Staff member for educational component of the Head Start program

- Staff member for a state-licensed or regulated pre-kindergarten or child care program

- Professional provider of early intervention services for the disabled

- Speech pathologist with a masters degree

- Special education teacher for children with disabilities in public, other nonprofit schools or educational service agency

- Teacher in a field designated by the state as teacher shortage areas

- Teacher in a designated educational service agency that serves students from low-income families

- Faculty member at a tribal college or university

Recommended Reading: Where Can I Get An Emergency Loan

Fed Issues Another Big Rate Hike What Inflation And Higher Interest Rates Mean For You

What’s happening

In an effort to quell stubborn inflation, the Federal Reserve raised interest rates again on Wednesday — and anticipates more rate hikes in the future.

Why it matters

As the Fed continues to drive up interest rates, there will be consequences: an increase in interest rates for mortgages, credit cards and loans, and most likely an uptick in unemployment.

What it means for you

Rising consumer prices, unpredictable stock prices, increased costs to borrow money and the threat of layoffs could be particularly devastating for low- and middle-income Americans.

The US Federal Reserve increased rates by 75 basis points on Wednesday, marking the fifth — and likely not the last — rate hike of the year. As rates rise, the cost of borrowing also becomes more expensive.

This week’s rate increase was in response to persistent inflation, which rose by 0.1% from July to August, despite slightly cooling year over year. Though gas prices decreased, the cost of food and housing continues to climb, according to the latest Consumer Price Index report.

Many worry that further increases to the cost of borrowing money could contract the economy too much, sending us into a recession: a shrinking, rather than growing, economy. The Fed acknowledges the adverse effects and potential risks of this restrictive monetary policy.

Federal Employee Student Loan Forgiveness

Whether or not you qualify for PSLF, federal employee student loan forgiveness could be another option for aid. In exchange for three years of continuous service, you could receive as much as $10,000 annually for your outstanding education debt, depending on the government agency that employs you.

Whos eligible?

Employees in good standing at various federal agencies, including the Departments of Defense, Justice and State as well as the SEC.

Which loans qualify?

All federal student loans, including Perkins and federal family education loans, are eligible.

How do you apply?

Talk to your current or prospective agencys human resources department.

You May Like: How To Figure Interest Rate On Auto Loan

Student Loan Forgiveness: Which Loans Are Eligible

Only direct loans made by the federal government are eligible for forgiveness. Stafford loans, which were replaced by direct loans in 2010, are also still eligible. If you have other kinds of federal loans, you might be able to consolidate them into one direct consolidation loan, which may give you access to additional income-driven repayment plan options. Non-federal loans do not qualify for forgiveness.

In 2020, borrowers with federal student loans who attended for-profit colleges and sought loan forgiveness because their school defrauded them or broke specific laws were dealt a setback when then-President Trump vetoed a bipartisan resolution that would have overturned new regulations that make it much more difficult to access loan forgiveness. The new, more onerous regulations went into effect on July 1, 2020.

As of Aug. 23, 2022, under the Biden administration, the United States Department of Education has approved $32 billion in student loan debt relief for over 1.6 million borrowers, a significant number of whom were victims of for-profit college fraud.

The Biden administration announced measures to help student loan borrowers because of the COVID-19 pandemic. This includes debt cancellation of up to $20,000 for recipients of Pell Grants with loans through the Department of Education and as much as $10,000 for non-Pell Grant recipients. This is in addition to student loan forbearance that expires on Dec. 31, 2022.

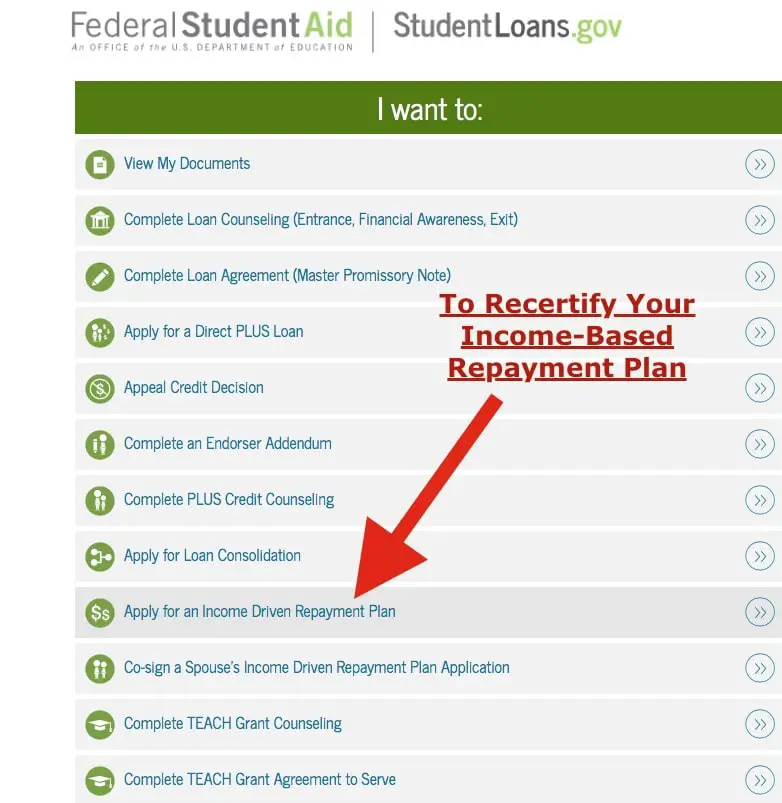

Heres What Youll Need

Federal Student Aid ID

Use your FSA ID to sign in to the StudentLoans.gov website and start your Income-Driven Repayment Plan Request. If you don’t have an FSA ID, visit www.fsaid.ed.gov.

Personal Information

Youll need your address, email address, and phone number.

Spousal Information

Your spouse will also need to sign the electronic application unless you are separated or cannot reasonably access your spouse’s income.

Income Information

Once you’ve started your Income-Driven Repayment Plan Request online, you’ll be linked to the IRS Data Retrieval Tool. It’s the easiest way to access and transfer your IRS tax return information. Using the online tool helps ensure your information is complete and that processing will be timely.

Once you’re on the IRS website, you’ll be asked to enter personal information to display your IRS tax return information. You’ll then be able to easily transfer your information from the IRS website and return to your Income-Driven Repayment Plan Request on the StudentLoans.gov website.

If your income is significantly different from your most recently filed tax return, after completing the electronic application, you’re required to provide Nelnet with proof of your current dated gross income . Proof of income needs to be from all sources . Acceptable documents include a pay stub or a signed letter from your employer on company letterhead. Documents must be dated in the last 90 days and include the following:

Read Also: Where Can I Loan 30k

John R Justice Student Loan Repayment Program

The John R. Justice Program helps lawyers in the public sector. If youre a public defender, you could earn up to $10,000 per year for a maximum of $60,000.

Herbert S. Garten Loan Repayment Assistance Program

This student loan forgiveness program helps repay student loans for 100-plus attorneys each year. Youll need to work at a qualifying organization. The program uses a lottery system to pick a few lucky recipients every year.

State and university-sponsored LRAPs

Like teachers and doctors, lawyers might also qualify for state or local repayment assistance programs. The Florida Bar Foundation, for instance, awards forgivable loans of up to $5,000 to lawyers in Florida.

In addition, some universities help their alumni pay back their loans. The University of Virginia School of Law, for instance, will cover up to 100% of student debt for graduates who make less than $65,000 per year. This program encourages its students to work in public service.

See if your state offers loan repayment assistance. Since theres no central database of schools and employers that offer repayment help, talk to your alma mater or employer about how to get repayment help.

What If The Co

In the eyes of a lender, the primary borrower and co-signer on an agreement both have equal responsibility to repay debt. If a co-signer on an agreement dies, it can cause problems. Some agreements state that if the co-signer passes away, the student loan is automatically put into default, regardless of whether the primary borrower has continued to make payments. At this point, the lender can demand the full payment of the loan which would cause financial hardship for the primary borrower.

These clauses have become less common, but it is definitely something to watch out for. If youre concerned about this, take a minute to review your agreement to identify if this condition is applicable to your co-signed student debt.

Related:What Happens if your Co-signer Declares Bankruptcy?

Don’t Miss: How To Negotiate Student Loan Debt

Consolidating Your Student Loans To Reduce Student Loan Payments And Interest

A Direct Consolidation Loan allows you to combine one or more of your federal student loans into a single loan with one monthly payment. This kind of loan can be helpful if you want to reduce your interest rate, you don’t qualify for another payment plan program, you qualify for another payment program but still can’t afford the payments, or you want to get out of default.

Student Loan Forgiveness For Private Education Debt

The vast majority of student loan forgiveness programs apply toward federally-held education debt. With that said, some state-based LRAPs dont make a distinction between offering repayment assistance for federal or private loans, and employers are equally incentivized to match your federal or private loan payments.

The only kind of student loan forgiveness that some reputable private lenders offer is in the case of disability or death. Contact your private lender whether it be a bank, credit union or other financial institution to learn about its policy. You might also find this policy detailed in your loan closure documents.

Here are examples of lenders that do offer student loan forgiveness for disability:

| Lender |

|---|

|

Also Check: How To Apply For More Student Loan Money

Biden Student Loan Forgiveness

Biden issued an executive order to eliminate $10,000 in student loan debt for people making less than $125,000 and an extra $10,000 for those who received Pell Grants while in school.

It means more than 90% of the 47 million student loan borrowers will get some form of relief from the debt they racked up pursuing a college education. The executive order will completely eliminate the debt of an estimated 12 million borrowers and that number could grow to 20 million.

The Department of Education is creating forms that will be distributed in October that will require borrowers to prove they qualify under the income standards. The DOE says borrowers can expect relief within 4-6 weeks.

Here are some other tidbits of news that you should know if youre hoping for relief from student loans:

Nurse Corps Loan Program

The Nurse Corps Repayment Program supports registered nurses , advanced practice registered nurses , and nurse faculty by paying up to 85% of their unpaid nursing education debt.

You must work at an eligible Critical Shortage Facility in a high need area , and have attended an accredited school of nursing . You must also fulfill two years of work in this area.

You can learn more about this program here.

Related: Don’t forget to check out our full guide to Student Loan Forgiveness For Nurses.

You May Like: Loan Payoff Calculator Extra Payments

Are Student Loans Automatically Forgiven After 25 Years

This post may contain affiliate links. You can read our full affiliate disclosure here.

Are student loans automatically forgiven after 25 years? Well, it depends. On certain income-driven repayment plans, your student loan balance is forgiven after 25 years of on-time repayment. Other income-driven plans will let you off the hook in 20. And there are loan forgiveness programs that will cancel your debt even sooner.

If youre wondering if student loans are automatically forgiven after 25 years, read on for the full story.