Bank Of America & Legal Action

Bank of America is not the most aggressive creditor, when it comes to taking legal action against delinquent debtors. Bank of America usually waits nine months after the first delinquency before referring its accounts to outside legal collections. Not every account that is 9 months late will be sent to collections. Bank of America reviews the size of the account balance owed, the state collection laws, and whether the debtors employment history and assets make collection likely.

Recommendation

Bills.com recommends that you look into all your debt relief options before making any decision, in order to weigh all the pros and cons. Use Bills.com’s free Debt Coach tool, which was positively reviewed by the New York Times and by CNN. You can easily review your available debt options, based on your priorities for getting out of debt, and receive a solid idea of what your total costs will be.

Company Pages

Every Penny And Person Counts

An American Bank personal loan is just that personal. Well customize a loan solution that allows you the freedom to purchase a vehicle, plan a long-overdue family reunion, consolidate your debt and more. Secured or unsecured, you can use your credit history and financial resources, or your American Bank CD, to apply for a loan with a variety of repayment options. Well even give you a .25% discount on your rate just for having your loan payment made automatically from your American Bank checking account.

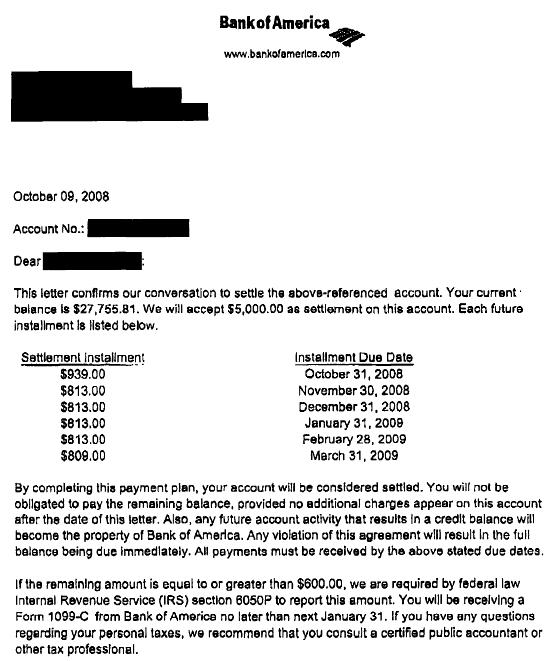

Assistance With Managing Credit Card Debt At Bank Of America

www.bankofamerica.com

Date Submitted: 01/10/2021 04:04 AM

Average star voting: 5

Summary: Bank of America provides assistance to help customers better manage debt. Better debt management can help reduce financial stress.

Match with the search results: Consider a balance transfer or debt consolidation loanbut only if you can save on interest and avoid getting into more debt. To learn more, access Online . read more

You May Like: What Do You Need To Get Personal Loan

Best Debt Consolidation Loans

www.bills.com

Date Submitted: 01/01/2021 11:16 AM

Average star voting: 3

Summary: A debt consolidation loan can help you save on interest if you do it right. Here are our picks for the best debt consolidation loans.

Match with the search results: Bank of America no longer offers debt consolidation loans. They used to advertise a debt consolidation loan marketed to consumers with good . read more

Private Student Loan Consolidation

* Bank of America student financial products are in flux due to recent changes in the way student loans are issued. The following is offered as a historical reference, and outlines a program that may have changed. Bank of America Student Center provides up-to-the-minute information about BOA student services.

Students that need assistance beyond federal loans and scholarships seek private student loans. The Bank of America Student Program Consolidation Loan gives borrowers the flexibility to roll multiple private education loans into one consolidated loan. Eligible loans include those that were used for expenses like textbooks and computers.

A single, consolidated monthly payment offers relief from high interest rates and reduces administration costs on multiple loans. The minimum consolidation loan is valued at $10,000. Borrowers with 48 consecutive on-time payments earn a .78% interest rate reduction and an additional .25% is discounted when participants enroll in an automated withdrawal payment program. Use these ten tips for paying back student loans.

Background Information

Also Check: Which Loan Is Interest Free

Bank Of America Debt Consolidation Loans

www.needhelppayingbills.com

Date Submitted: 06/23/2021 04:48 AM

Average star voting: 5

Summary: Bank of America is a leading financial institution offer many great products from debt consolidation loans to mortgages to checking and savings.

Match with the search results: Find out about debt consolidation from Bank of America. They offer a Clean Sweep program that provides debt help and low interest rate loans.. read more

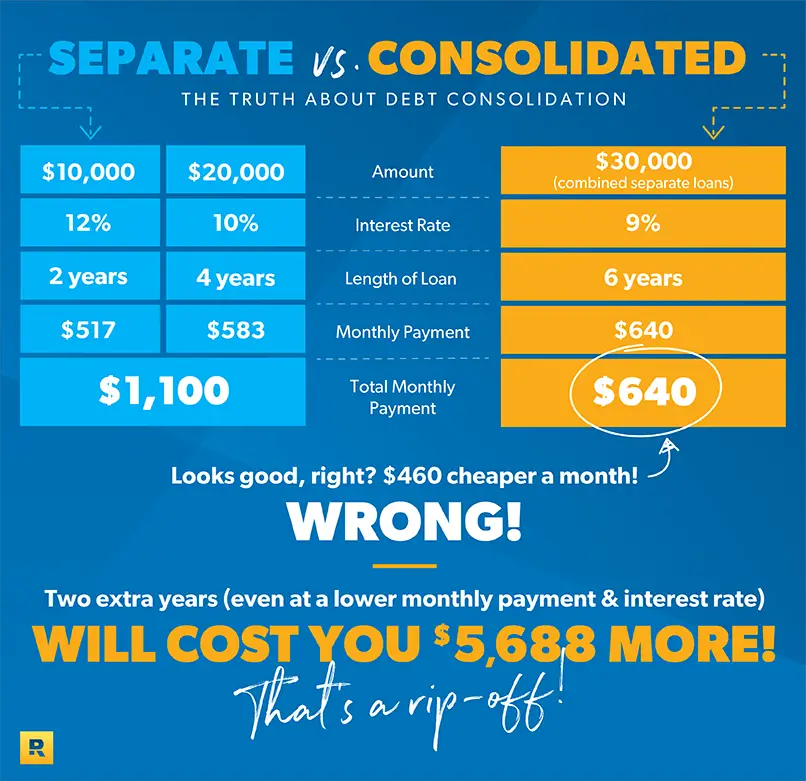

Decide Whether To Consolidate

Ultimately, you need to determine if the new loan makes sense for your business, given your specific finances and priorities.

While you may receive a lower APR on your new debt consolidation loan, there are other factors to consider as well.

For example, the new loan might also have a much longer term, which means youâll end up paying more in interest over time. Additionally, consolidating your business debt into one loan also means youâll be paying interest on interestâyouâll be paying compounded interest with your new loan on top of the initial interest you owed.

On the other hand, a debt consolidation loan can conserve cash flow and make repayment simpler.

Consult your business accountant or other financial advisors if you need help sorting through the different business loan interest rates and terms.

Recommended Reading: How To Take Out Personal Loan With Bad Credit

Tips For Comparing Personal Loans For Debt Consolidation

Personal loans often are available online through traditional banks, credit unions and alternative lending platforms so you can apply quickly and conveniently, without having to visit a bank branch. Many of these lenders also offer competitive interest rates and flexible repayment terms, meaning you may be able to save money by consolidating your other debts.

Consider these tips when comparing personal loans:

Know Before You Borrow

If you decide debt consolidation is right for you, keep the following in mind:

- Debt consolidation isnt debt elimination. Youre restructuring your debt, not eliminating it.

- Understand the costs.Consider the total cost of borrowing. A loan with a longer term may have a lower monthly payment, but it can also increase how much you pay over the life of the loan.

- Avoid future debt. Use good credit habits and create a budget to help control future spending.

- Review alternative methods to pay down debt. If a consolidation loan is not right for you, compare the Snowball vs Avalanche methods of paying down debt.

Recommended Reading: Student Loan Monthly Payment Calculator

How To Qualify For A Debt Consolidation Loan

Build your credit: Loan approval is based mainly on your credit score and ability to repay. It may be possible to get a debt consolidation loan with bad credit, but borrowers with excellent credit have more loan options and may qualify for lower rates. If you have fair or bad credit , it can pay to build your credit before seeking a consolidation loan.

» COMPARE: Best debt consolidation loans for bad credit

Add a co-signer: Adding a co-signer can help you qualify for a debt consolidation loan that you wouldnt be able to on your own due to poor credit or low income. There are risks to your co-signer, though, so that person will need to weigh their decision carefully.

Shop around: Compare rates and terms at multiple lenders before applying for a debt consolidation loan. Most online lenders let you pre-qualify with a soft credit inquiry, which has no impact on your credit scores.

Best Debt Consolidation Loans For August 2022

www.wellsfargo.com

Date Submitted: 04/26/2020 04:49 AM

Average star voting: 4

Summary: Explore Bankrate’s expert picks for the best debt consolidation loans available and discover how the right rate can help you manage your debts more effectively.

Match with the search results: Debt consolidation may be a good option if you’re trying to pay off high-interest loans and credit cards and managing multiple monthly payments.. read more

Recommended Reading: Sample Letter To Remove Student Loan From Credit Report

A Great Way To Reduce Your Credit Card Debt At Bank Of America

Taking control of your finances and managing your monthly budget is crucial if you want to avoid unnecessary financial troubles.

If your existing credit card bills and loan repayments are mounting up, it???s time that you consider cutting down your expenses and seek assistance if you need it.

Sooner or later, your debt can pile up way beyond your ability to repay and this will seriously affect your credit status.

More Bank Of America Loans

Bank of America is one of many banks that chooses not to offer personal loans. Instead, it focuses on mortgages, auto loans and credit cards. This limits its risk as a lender but you still have a decently wide selection of options to choose from.

- There are a variety of credit card options through Bank of America. These range from general travel and cashback rewards cards to secured cards that can help you build credit.

- Home loans. Other than home loan products like mortgage refinancing and home equity lines of credit, Bank of America offers mortgages.

- Auto loans. Auto loans through Bank of America typically have low rates and you can borrow up to $100,000 for your next car. In addition, it also offers lease buyouts, refinancing and loans for private party sales.

There are also a few business loans through BoA if you have an established business with an annual revenue of at least $100,000.

You May Like: How Do You Refinance Your Home Loan

Best For Relationship Rewards: Citibank

- Time To Receive Loan:5 Days

- Loan Amount:$2,000 – $30,000

Citibank personal loans are available for a variety of purposes, and can help you earn more ThankYou points if you link to an eligible checking account.

-

Potential to earn ThankYou points

-

Discount for autopay

-

Relatively low annual income requirement

-

Only available to qualifying Citibank customers

-

No pre-qualification option

-

Slow funding time

Citibank offers its valuable ThankYou Rewards loyalty program to eligible customers, which allows you to earn points and redeem them for statement credits, gift cards, purchases, and travel expenses. Many Citi credit cards earn ThankYou points, but you can also earn points by linking an eligible Citi checking account to your Citi loan and performing certain activities.

Depending on the type of checking account you link to your loan, you can earn 50 or 125 ThankYou points per month for a direct deposit and bill payment. Youll also get 50 points per month for making a debit or credit transaction with the checking account.

Citis personal loans come in amounts of $2,000 to $30,000, with APRs ranging from 9.99% to 23.99% . Setting up autopay will get you a small rate discount. Repayment terms run from 12 to 60 months, with several options in between. You may receive loan funds as soon as the next business day if you choose direct deposit for the delivery method, while mailed checks generally take around five business days to arrive.

What Are Alternatives To Bank Loans

While many banks offer personal loans, there are some limitations. Some require memberships, or have too-strict qualification standards. In some cases the minimum loan amount may be higher than what you’re looking for. Consider the following types of lenders along with typical banks:

- Online lenders: Much like traditional banks, many online lenders give you quick and easy access to personal loans. You can usually see if you pre-qualify before applying, which doesnt hurt your credit. After approval, you can usually get funds fairly quicklysometimes within a day. The best online lenders offer little to no fees, flexible repayment terms, and competitive APRs.

- If you have less-than-stellar credit, you may want to reach out to near you for personal loans. While many require a member account first, they offer competitive APRs and low minimum borrow amounts. This is helpful if you dont need to borrow too much to cover an emergency.

- If you want to consolidate debt, a credit card balance transfer may be helpful, especially if you already have an available card. Many credit cards even offer 0% APR for a limited period of time, which may be long enough to help you catch up on payments.

Recommended Reading: How High Can An Fha Loan Go

How To Get Debt Consolidation Loans For Bad Credit

If you have bad credit, you can strengthen your application by improving your debt-to-income ratio. You can do this by increasing your incomewith a side hustle or otherwiseor by paying off some of your smaller, more manageable debts. If you choose to pay down some of your debts, this could also help improve your credit score, accomplishing two things at once.

You may also have better luck applying for secured loans, which are more accessible to applicants with bad credit because they reduce the lenders risk and often come with lower interest rates.

Related:Can I Get A Debt Consolidation Loan With Bad Credit?

How Debt Consolidation Loans Work

To start consolidating debt, apply for a personal loan through your bank or another lender. Once your lender approves you for a debt consolidation loan, it may offer to pay off your other debts automaticallyor you will take the cash and pay them off yourself.

After your pre-existing debts are repaid with your new debt consolidation loan funds, youll make a single payment on your new loan every month. While debt consolidation often reduces your monthly payment, it accomplishes this by extending the loan period of the consolidated loans. Debt consolidation also streamlines payments and makes it easier to manage finances, like having a single monthly payment due date.

You May Like: How To Apply For Parent Plus Loan

Apply For A Bank Loan

After you’ve shopped around for quotes from different lenders and found the right offer for you, you can complete the application process. If approved, you can sign the loan agreement. You’ll need to provide some personal information and bank account details for debt consolidation loans, you may be able to provide creditor information for the lender to send the funds.

Some companies will disburse loan funds as soon as the same or the next day, while others may take several business days. You’ll typically be given an online dashboard from which you can view your payoff timeline, make payments, and otherwise manage your loan.

What Is Debt Consolidation

Debt consolidation is when you consolidate multiple sources of debt for example, credit cards, personal loans, payday loans, or medical bills into a single loan. Some common reasons for consolidating debt include:

- Simplifying your finances by combining your debt into a single monthly payment

- Consolidating high-interest debt, like credit card debt, into a lower-interest loan

- Consolidating debt with a variable interest rate into a fixed-rate loan

- Reducing your monthly payment by getting a longer loan term

- Being able to budget better with fixed, monthly payments

The two most common ways of consolidating debt are balance transfer credit cards and debt consolidation loans. With a debt consolidation loan, you take out a loan to pay off your existing debt and pay off the new loan over a fixed time period. A balance transfer credit card comes with an introductory 0% APR, making it a good move if you qualify for one of these cards. Whether you use a balance transfer credit card or a debt consolidation loan, it is essential to make a plan to pay off the consolidated debt before the loan term ends or an introductory APR expires.

Recommended Reading: Can I Refinance My Fha Loan

Cons Of Debt Consolidation

Risks of debt consolidation vary depending on the approach and form you take with your consolidation.

- You still owe the debt:Debt consolidation may make managing your debt a lot easier, but it does not eliminate it completely. You still owe the same amount of money. And if you dont decrease your spending, you will owe even more and be no closer to being debt free.

- Good credit is often required:To secure interest rates that make consolidation worthwhile, you need to have good credit. If you dont, your interest rate may be similar to what youre paying now.

- Upfront costs may be involved:Many debt consolidation options come with fees and costs, whether a balance transfer fee or closing costs.

- Assets could be at risk:If you consolidate unsecured debt into a secured loan, you will need to put up collateral to acquire immediate cash. Your assets could be at risk if you fail to repay the loan.

Do You Have To Close Credit Cards After Debt Consolidation

You can keep your credit cards open even after you take out a debt consolation loan. Ideally, you should use your loan to pay off credit card debt, then use credit cards only to pay for what you know you can afford to pay off at the end of each month. If you’re worried about racking up credit card debt all over again, look into how closing the account will impact your credit score.

You might decide to keep one or two cards open for emergencies or daily spending, and close the rest of your credit cards. Use a credit score simulator like to see how much your score might drop before you start closing accounts.

Recommended Reading: Home Equity Loan For Home Improvements

See What Benefits Are Being Offered

Private lenders once played a larger role in the student loan market than they do today. In the past, students submitted the Free Application for Federal Student Aid , to the Department of Education, before being referred to private lenders for loan fulfillment. In other words the Federal Government would determine your eligibility for subsidized loans, and then a private credit union, bank or loan servicer would provide the funds.

Bank of America was active in that market, providing financing for participants in the Federal Family Education Loan Program . Stafford Loans, and other government-subsidized initiatives, including consolidation loans, were among BOAs stable of student assistance programs. Today, regional and national banks extend attractive private student loan products, but they are no longer included in the federal financial aid process.

The Health Care and Educatioon Reconciliation Act of 2010 made fundamental changes in the way student loans are administered. Subsidies for banks that gave student loans were eliminated, and the student loan program took on a self-funded model. By cutting out the middleman the private lender the Department of Education administers funding with greater efficiency, thus expanding educational opportunity among borrowers.