If You Declare Bankruptcy

If you declare bankruptcy, you still have to pay your OSAP loan. This means you must continue to make a regular monthly payment.

Apply to the Repayment Assistance Plan if you cant make these monthly payments.

If youve been out of studies for more than five years, you can ask a bankruptcy court to have your OSAP loan included in your discharge. Contact your bankruptcy trustee for help.

Why You Should Track Your Student Loans

While it might seem complicated, it is essential to keep track of your student loans and the amount of debt you owe, including knowing how much you borrowed and how much you owe once you add interest. This can be helpful while you are in college, and as you start your budgeting process after graduation. Many options exist for repayment plans, including the following:

- Standard plans: Payments are calculated to guarantee loans are paid off within 1030 years.

- Graduated plans: These are designed to ensure loans will be repaid within a certain amount of time, but payments will increase gradually over time.

- Income-based: These repayment plans calculate your monthly payments based on how much you earn, with higher wages equaling higher payments.

Once you have a solid number to start with, you can begin to create a repayment plan to get rid of that debt as quickly as possible. You can develop a repayment plan that works for your salary and lifestyle and pays down the debt quickly to save you money over time. You can always contact your loan servicer to update your payment plan if your situation changes. This does not have a negative impact on your credit.

Campus Based Student Loans

Heartland ECSI is the Universitys contracted servicer for University of Illinois Campus Based Student Loan.

You can view your account online at Heartland ECSI. This website also has an available live chat feature. For more information on accessing and managing Campus Based Student Loan click on the links below:

To discuss Campus Based Student Loan by phone, borrowers may call Heartland ECSI at 549-3274.

Also Check: Does Va Loan Work For Manufactured Homes

Are There Any Fees Associated With Repaying A Federal Student Loan

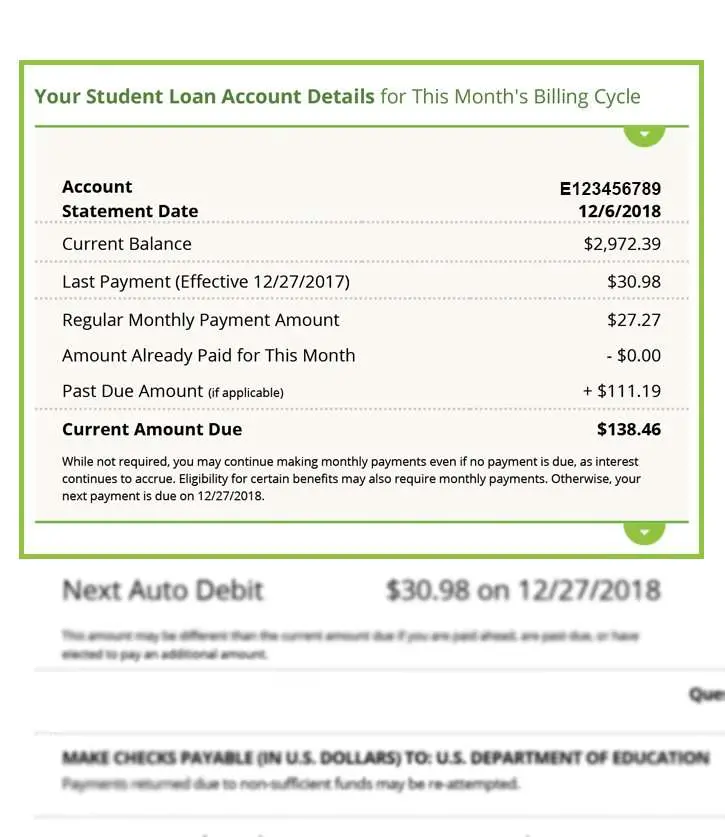

If you are late on a payment or your payment is returned, your lender has the discretion to charge you a fee. * Your lender may charge other fees related to collecting a defaulted loan. Below is a list of possible fees. If you have specific questions regarding fees, contact us.

* The U.S. Department of Education does not assess late or returned payment fees. back

- Late fee: Any payment not received within 15 or more days after the due date may incur a late fee of up to six cents for each late dollar as determined by your lender and described in the terms of your promissory note. Your late fee is calculated based on the unpaid portion of your regular monthly payment amount. You can find information about late fees in the account snapshot on your monthly billing statement.

- Returned payment fee: A payment returned due to non-sufficient funds may be reattempted a maximum of one time. A returned payment may be assessed a $5 fee.

- Miscellaneous fees: You may be charged certain reasonable costs incurred in collecting your loan. Costs can include, but are not limited to, attorney fees and court costs.

You may reduce this extra cost by paying more than your current amount due to cover the amount of your fee. If a fee is charged to your account, we will include detailed information about the fee on your monthly billing statement.

How Can I Change My Repayment Plan

To explore options or make changes to your repayment plan, contact us, log in to your Nelnet.com account, or see Repayment Plans. You can also visit the office of Federal Student Aid’s website at StudentAid.gov to review other options like consolidation.

You may prepay your loan at any time without penalty, regardless of repayment plan.

To learn more about the various repayment plans you may be eligible for, log in to your Nelnet.com account and click Repayment Options.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Will Changing Repayment Plans Or Postponing My Payments Using A Deferment Or Forbearance Hurt My Credit History

No. The type of repayment plan used to repay a student loan is not reported to the consumer reporting agencies. Using a deferment or forbearance for your student loan will not adversely affect your credit history. Making a late payment could impact your credit history, so let us know immediately if you have trouble making a payment we can help!

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Also Check: Can You Refinance An Fha Loan

Does Nelnet Own My Student Loan

It’s possible Nelnet owns your student loan. However, we also act as a student loan servicer in other words, we provide customer service on behalf of many lenders and the U.S. Department of Education . Get details on all of your federal student loan with Nelnet and other loan holders and servicers online by logging in to StudentAid.gov. If you havent already, you will need to create an FSA ID to access your account with EDs office of Federal Student Aid.

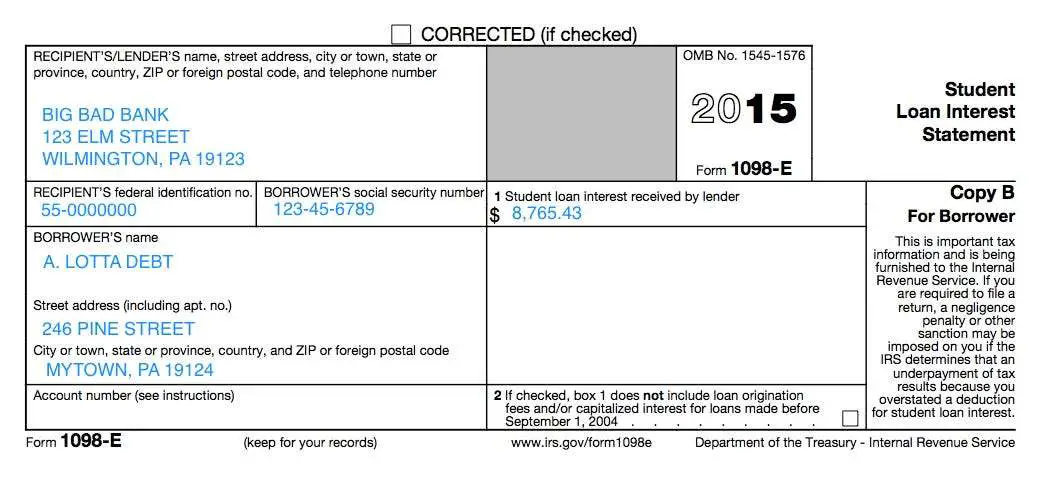

Is The Amount Of Interest Higher Than You Expected

Capitalized interest may be counted as interest paid on the 1098E. That capitalized interest and your origination fees may be tax deductible. If you have more questions on your 1098-E, please contact a tax advisor.

Please note: Because fewer loan payments were required and interest rates were at 0% for much of 2020, your interest paid was likely lower than in previous years.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Where To Get Professional Help For Your Student Loans

It sounds like it could be confusing, but it doesnt have to be. You can do most things yourself on StudentLoans.gov. You can also call your lender to get started.

If youre not quite sure where to start or what to do, consider hiring a CFA to help you with your student loans. We recommend The Student Loan Planner to help you put together a solid financial plan for your student loan debt. Check out The Student Loan Planner here.

What are some of the biggest issues you have had with your student loan servicer? Tell us in the comments section below.

Robert Farrington is Americas Millennial Money Expert® and Americas Student Loan Debt Expert, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page, or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications including the New York Times, Washington Post, Fox, ABC, NBC, and more. He is also a regular contributor to Forbes.

Editorial Disclaimer:

Who Needs To Start Repaying

You may need to start paying back your OSAP loan six months after your study period ends.

Youll be making payments to the National Student Loans Service Centre , not to OSAP.

You dont need to start paying back your OSAP loan if your school confirms your enrolment for the next study period and we approve your application for one of the following programs:

- OSAP for Full-Time Students

If you received loans through the OSAP micro-credentials program, learn about repayment for micro-credentials programs.

Read Also: Average Motorcycle Apr

If Youre Having Trouble Repaying

If you need help with repaying your Canada Student Loan, you may qualify for the Repayment Assistance Plan .

If youre having trouble repaying a provincial student loan, contact your student aid office. For repayment assistance with a loan or line of credit provided by your financial institution, contact your branch to determine what your options are.

Understand that by making your payments smaller, it will take you longer to pay back your loan. Youll end up paying more interest on your loan.

If you consider refinancing or consolidating your student loan, note that there are important disadvantages.

If you transfer your federal or provincial student loan to a private lender, you will lose any tax deductions on your student loan interest. You wont qualify for the interest free period while you’re in school and will end up paying more interest over time.

William D Ford Federal Direct Student Loan

In the Direct Loan program, the U.S. Department of Education is the lender for your student loan. There are two types of student loans in the Direct Loan program subsidized and unsubsidized. These loans are not based on your credit rating/score and do not require a credit check.

- The Direct Subsidized Loan is based on need. Interest on the Direct Subsidized Loan does not accrue while you are in school and during your grace period.

- The Direct Unsubsidized Loan is not based on need. Interest on the Direct Unsubsidized Loan does accrue once the loan is disbursed.

Loan Request Process: If you were not initially awarded a Federal Direct Student Loan and are interested in requesting one, or if you were only awarded a Subsidized loan and would like to request an Unsubsidized loan, you must complete and submit the online Federal Direct Loan Request Form.

| Students who will be offered aSubsidized loan automatically: | Students who need to submita loan request form: |

|---|---|

|

|

You May Like: Can You Refinance An Fha Loan

How Can I Pay Less Interest

In general, to pay less interest over the life of your loan, you can make payments toward your student loan when they arent due . You can also make extra payments or pay more than your regular monthly payment amount when youre in repayment. All of these scenarios cause less interest to accrue overall. To learn more about how interest accrues and capitalizes, and how to minimize the interest you pay, see What Does It Mean That Interest Is Capitalized?.

Where Can I Find My Loan Number Osap

4/5loannumberLoansloannumberLoans

Keeping this in consideration, how do I check my OSAP loan?

Sign in to your National Student Loans Service Centre account. With your account, you can: check your student loans status and balances. update your contact information.

Secondly, where can I find my OSAP Access Number? The OSAP Access Number is a nine-digit number that is assigned to each person who has:

Considering this, where do I find my student loan balance?

Use your My Federal Student Aid account or the National Student Loan Data System to find out how much you owe in federal loans and visit AnnualCreditReport.com or call your school’s financial aid office to find out your private loan balance.

Does OSAP forgive loans?

Repayment Assistance PlanEach term of repayment assistance is for 6 months. To remain eligible to apply, borrowers must keep their loans in good standing. After 15 years since full-time studies, any remaining student loan debt is forgiven. For students with disabilities, any remaining debt is forgiven after 10 years.

Customer Number 888-815-4514 – by the Numbers

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

My Parent Or Another Third Party Is Making Payments On My Account How Can Third Parties Continue Making Payments On My Account If They Dont Receive A Statement

Your parent, co-signer, endorser, or other third parties can quickly and easily make payments by logging in to a free online authorized payer account at Nelnet.com. First, you need to set up the third party as an authorized payer. Remember that authorized payers have access to your account details, including account number, due date, amount due , payment amount, payoff amount, accrued interest, account balance, interest rate, loan type, and payment history.

Follow these easy steps one time to set up an authorized payer:

If you would like to give copies of your Nelnet statements and correspondence to a third party, print or save the documents from your Nelnet.com account inbox and send them by email or post office mail.

How To Find Out Who Owns Your Student Loans

There are thousands of financial products and services out there, and we believe in helping you understand which is best for you, how it works, and will it actually help you achieve your financial goals. We’re proud of our content and guidance, and the information we provide is objective, independent, and free.

But we do have to make money to pay our team and keep this website running! Our partners compensate us. TheCollegeInvestor.com has an advertising relationship with some or all of the offers included on this page, which may impact how, where, and in what order products and services may appear. The College Investor does not include all companies or offers available in the marketplace. And our partners can never pay us to guarantee favorable reviews .

For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. TheCollegeInvestor.com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product’s website. All products and services are presented without warranty.

Also Check: Va Home Loan Statement Of Service

What Is The Process For Applying For An Income

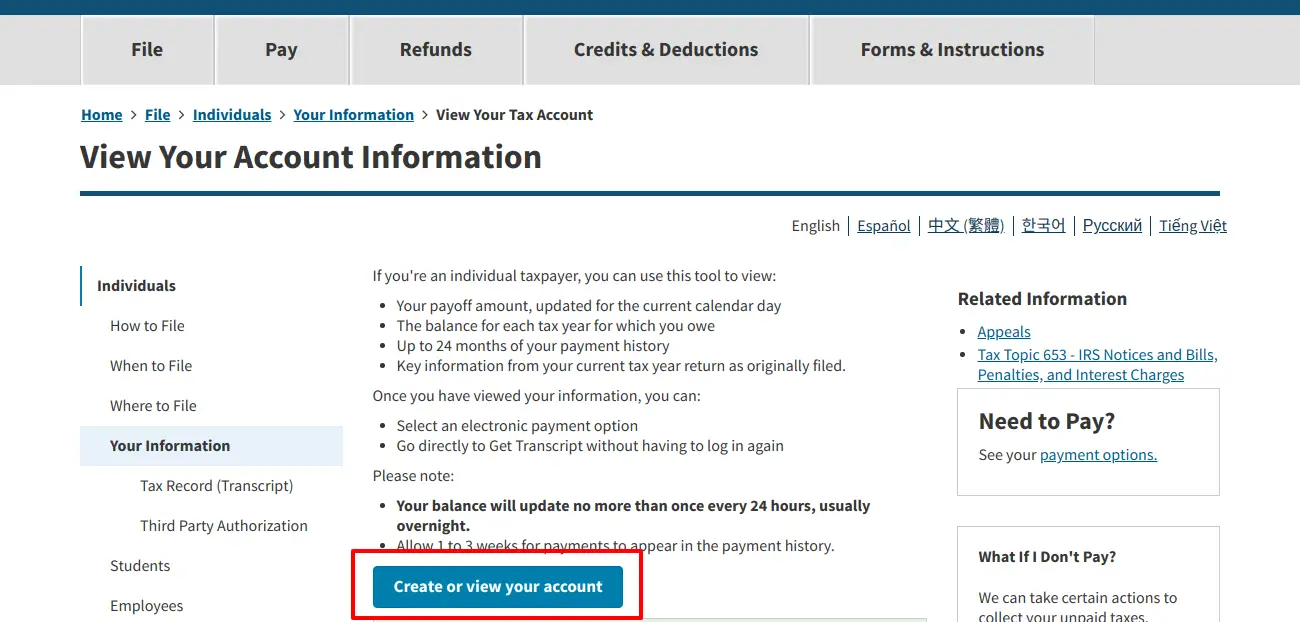

When you apply online via your Nelnet.com account for an IDR Plan, you will be directed to log in to StudentAid.gov, where you can submit your application to us. Through the online application, you have the option to securely transfer your Adjusted Gross Income information from your federal tax form to your online application using the IRS Data Retrieval Tool.

Please note, if you elect to send alternative documentation of your income or indicate on your application that the Adjusted Gross Income from your tax return doesn’t reflect your current income, you must send supporting income documentation to the address or fax number below before we can review and process your repayment plan request.

Nelnet Fax: 866.545.9196

What Is The Difference Between Auto Debit And Making A One

Auto debit is a convenient, simple payment option that offers you the peace of mind that comes with knowing your student loan payments are being made accurately and on time every month. You only have to sign up once to have all of your monthly payments made automatically.

Your Nelnet.com account allows you to make a one-time online payment even when your student loan payment is not due. Plus, you can direct your payment to specific loan groups. For more information on these and other ways to pay, see How to Make a Payment.

You May Like: How To Transfer Car Loan To Another Person

How Often Do You Report My Loan Information To The Consumer Reporting Agencies

Nelnet reports credit information monthly to the four consumer reporting agencies . Until an account reaches 90 days past due, it’s reported as up to date. When an account reaches 90 days past due, it’s reported as delinquent. Once your account has been reported to the consumer reporting agencies as delinquent, the information may remain on your credit history for as long as seven years.

Federal Direct Student Loan Program

The William D. Ford Federal Direct Student Loan program is funded directly from the U.S. Department of Education. For Federal Direct Loan and Federal Stafford Loan repayment information, borrowers must contact their loan servicer for repayment information. Borrowers can access their loan history at Federal Student Aid.

To sign Master Promissory Note:

Also Check: How Much To Loan Officers Make