Upcoming Eligible Usda Map Changes

USDA had slated changes to its eligibility maps for October 1, 2015. However, according to a source inside USDA, map changes had been postponed.

According to the source, eligibility maps are now reviewed every three to five years. The last review happened in 2014.

USDA runs on a fiscal year of October 1 through September 30. This is why most big changes to the program happen in October. For this reason, watch for a geographical boundary change on October 1, 2020.

Changes are more likely in 2020 and 2021. The reason: The 2020 census. USDA bases its maps on these US-wide population counts that happen every 10 years. Since the USDA has not made major changes to maps since the year 2000, its becoming more and more likely that big updates will happen soon.

Find A Home In A Usda

These loans are only available in USDA-approved rural areas. The loan is for owner-occupant loans to buy a home. While urban areas usually don’t qualify, some areas close to cities do. Additionally, the USDA deems certain urban areas as revitalization zones and temporarily approves them for the loan programs. Just south of San Francisco is Half Moon Bay, where the program has eligible properties.

The Right Credit Score

As is the case with any loan program, you need a minimum credit score to qualify. The USDA and most lenders , require a score of at least 580 to start the process. Even if your score is over 580, but is less than 619, you are still considered high risk. You can apply for a USDA loan and may even secure one, but the lender must highly scrutinize your loan file to make sure you are a good risk. They will take a close look at your credit history, not just the score, to see why your score is so low.

In general, they will need to see some type of housing history with timely payments as well as other debts that you managed responsibly. Dont worry if you dont have a mortgage right now, if you rent, your landlord can provide you with a Verification of Rent. This document states how many times you made your rent payments on time and how long you have paid rent to the landlord.

If your credit score exceeds 620, the lender does not have to evaluate your loan file as closely. This means you do not have to verify your housing history or prove that any old debts are paid off. In addition, if you have any special circumstances on your loan, such as a high debt ratio or you have a short job history, you may be able to secure a waiver and still obtain the loan. Your credit score speaks volumes to lenders as it lets them know how financially responsible you are, so it pays to make your debt payments on time.

Recommended Reading: Va Home Loan For Manufactured Home

How Do I Get A Home Loan With A 550 Credit Score

A credit score of 550 tells banks you are a high-risk borrower, but it does not necessarily render you untouchable. The Federal Housing Administration and the U.S. Department of Agriculture back loans for prospective homeowners with less than attractive scores, such as 550, if they meet certain requirements. Since these programs cover losses if a borrower defaults, lenders are more willing to approve borrowers who otherwise could not qualify for a loan.

Tips

-

You may be eligible for an FHA and/or USDA home mortgage loan, even if your credit score is only 550, by applying for mortgages under these two programs.

Is A Usda Loan Right For You

These mortgage programs are more affordable than traditional mortgages, but they’re only possible if you do not exceed the income maximums and buy a home in a designated rural area. If you’re just above the income threshold or want to live in a city, you’ll need to explore other mortgage options.

A direct deposit of news and advice to help you make the smartest decisions with your money.

Don’t Miss: Aer Loans

Usda Loans: What They Are And Who’s Eligible

Whether you’re moving to the suburbs or the country, this federal mortgage program could save you thousands.

Have you stumbled upon USDA loans during your mortgage search? USDA loans are backed by the US Department of Agriculture — yes, you read that right — as part of its Rural Development program, which promotes homeownership in smaller communities across the country. If you don’t have enough money saved for a down payment or if you’ve been denied a conventional loan, you have a good chance of qualifying for a USDA loan.

Contrary to popular belief, these loans are not just designed for homebuyers in completely rural areas — in fact, 97% of the land in the US is eligible for a USDA loan. This means even if you’re moving just outside of a city, chances are pretty high that you’re moving to a USDA-designated area. That’s great news for the increasing number of buyers looking to jump ship from crowded urban apartments to homes with more square footage and land, following the pandemic.

Let’s find out if this rural development home-buying program is right for you.

Lock In Your Usda Loan Rate

A USDA loan rate lock is a guarantee the USDA lender will provide a specific interest rate by a specific date, thereby protecting the borrower from rate fluctuations during the rate lock period. Rate locks are often set for 30, 45 or 60 days, but can be shorter or longer.

Policies and guidelines on rate locks and when you can lock your rate can vary by lender.

Locking in your interest rate at the right time is key, which means its important to find a lender who understands your needs and the forces that shape USDA loan interest rates.

Read Also: Defaulting On Sba Disaster Loan

Read Also: Aer Allotment

Why Is Rdapply Important

- Convenience – The Internet allows customers access to information 24 hours a day and 7 days a week. For example, customers can fill out and submit their application any time of the day or night from their homes or offices.

- Identity Security-Information submitted to the Federal Government remains safe and secure because every customer has a unique User ID and password and only authorized USDA employees can access the information.

- Reduced Paper Consumption – Over time, RDApply will save paper, which benefits the environment.

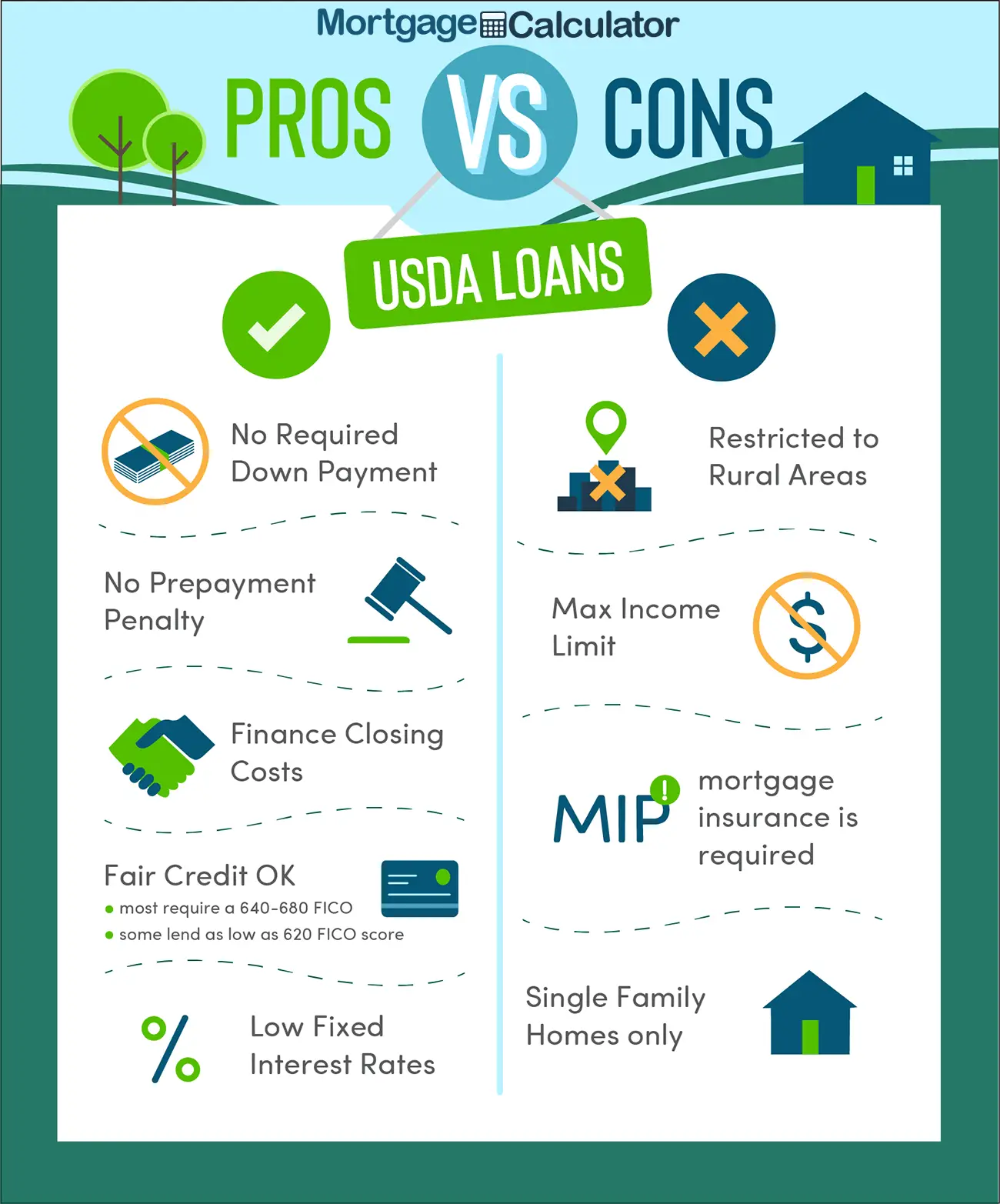

Disadvantages Of Usda Loans

There are certain drawbacks to USDA loans that borrowers may not encounter with conventional mortgages or mortgages through other government programs such as FHA and VA. These include:

- Geographical requirements: Homes must be located in an eligible rural area with a population of 35,000 or less. Also, the home cannot be designed for income-producing activities, which could rule out certain rural properties.

- Second property/vacation homes not allowed: The property must be used as the borrowers primary residence.

- Income limits: Borrowers must meet specific income requirements based on where they live. If you exceed the income limits, you will not qualify for a USDA loan.

- USDA up-front fee: Borrowers must pay an up-front fee for a USDA guaranteed loan or have that fee rolled into the mortgage loan amount. Depending on that loan amount, this could be several thousand dollars.

- Streamlined refinancing limitations: To qualify for a refinance, you must have a record of 12 consecutive, on-time mortgage payments, and the home must be your primary residence. This program only applies to mortgages with 30-year terms and is not available in all states.

Also Check: Avant Refinance

How Does A Usda Mortgage Work

There are two main categories of USDA section 502 loans: single-family housing guaranteed loans and single-family housing direct home loans.

- Single-Family Housing Direct Home Loans: These loans provide payment assistance to help low- and very-low-income applicants repay their mortgage. The property must be located in an eligible rural area, and income requirements vary based on where the borrower lives. The repayment period could be up to 33 years, with the possibility of reaching 38 years for qualified borrowers.

- Section 502 Guaranteed Rural Housing Loan: This program helps low- and moderate-income applicants receive 100% financing on their home with no down payment. Repayment for these loans is offered at 30-year fixed-rate terms only. As with the direct home loans, applicants for the guaranteed loan must meet income requirements, and the property must be located in an eligible rural area.

Neither loan requires mortgage insurance. Instead, the lender pays an annual guarantee fee to the USDA and recoups that fee in the monthly mortgage loan payment.

Usda Income Limits And Eligibility Map

Before you start shopping for a home, call us to see if you can qualify for this preferred loan type. One main qualification is that the home must be in an eligible “Rural” area. Visit our USDA Rural Development eligibility map documentation. There are also maximum income limitations which must be bet. Visit the Rural Development Income Limits on USDA website to confirm eligibility. If you qualify, a USDA Rural Development Loan may be the best mortgage available!

Also Check: How To Transfer A Car Loan

Determine Your Fha Loan Limit

FHA loan limits vary, depending on the area in which you plan to buy your home. Go to the search page for FHA Mortgage Limits, and use the pull-down menu to select the state. Enter the county where you plan to buy your home. Click Send. The next page that comes up will show the limits available for FHA insured loans, based on the type of property — single-family up to four-family dwelling.

How Usda Loan Programs Work

There are three USDA home loan programs:

Loan guarantees: The USDA guarantees a mortgage issued by a participating local lender similar to an FHA loan and VA-backed loans allowing you to get low mortgage interest rates, even without a down payment. If you put little or no money down, you will have to pay a mortgage insurance premium, though.

Direct loans: Issued by the USDA, these mortgages are for low- and very low-income applicants. Income thresholds vary by region. With subsidies, interest rates can be as low as 1%.

Home improvement loans and grants: These loans or outright financial awards permit homeowners to repair or upgrade their homes. Packages can also combine a loan and a grant, providing up to $27,500 in assistance.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Qualifying For The Usda Rural Development Loan

Qualifying for the USDA Rural Development Loan is easier than qualifying for most other loans. However, you have to meet one strict requirement you cannot be eligible for any other type of financing. This means any other government program or conventional loan. If you are able to secure a different type of financing, you would not be eligible for a USDA loan.

If you are unable to qualify for any other financing, you have to meet the following requirements:

- You must live in the home

- You must not own any other properties

- You must be a US citizen

- Everyone on the loan must live in the home

If you meet these requirements, you can apply for a USDA loan.

What Will I Have To Do To Get The Level 2 Eauthentication Account

If you do not have a Level 2 eAuthentication Account or just have a Level 1 Account, you must submit certain information to the eAuthentication system, such as name, address, DOB, etc.

After your submitted information is accepted, you will be sent an activation email. You must activate the account from that email. That gives you partial access. You will receive a second email requesting you to verify your Level 2 access. You can either 1) use the Online Self-Service or 2) Visit a Local Registration Authority to verify your identity. The Online Self-Service will verify your identity on-line by programmatically asking and receiving correct answers to a series of multiple choice questions that only you should know the answers to.

Also Check: How Much To Loan Officers Make

Rural And Islands Housing Funds

The £25 million Rural Housing Fund and the new £5 million Islands Housing Fund will run from 2016-17 to 2021.

Both funds aim to increase the supply of affordable housing of all tenures in rural Scotland and contribute to our 50,000 affordable homes target.

The Islands Housing Fund provides £5 million ring-fenced for islands housing projects.

The funds have two parts:

a main fund that offers capital support for direct provision of new affordable housing, and refurbishment of existing empty properties

a small fund that contributes to feasibility studies

Your Current Browser Is Outdated We Recommend That You Update Your Browser Click Here To Update

An official website of the United States government

The .gov means its official. Federal government websites always use a .gov or .mil domain. Before sharing sensitive information online, make sure youre on a .gov or .mil site by inspecting your browsers address bar.

This site is also protected by an SSL certificate thats been signed by the U.S. government. The https:// means all transmitted data is encrypted in other words, any information or browsing history that you provide is transmitted securely.

Don’t Miss: Personal Loan To Buy Land

How To Qualify For A Usda Loan

There are several eligibility requirements for each section 502 loan. For the direct loans, applicant requirements include:

- Must be without decent, safe and sanitary housing

- Must not be able to get a loan from other resources with terms they can reasonably meet

- Must occupy the property as their primary residence

- Must be legally able to take on a loan

- Must meet income eligibility, which is based on where they live

- Must meet citizenship or eligible noncitizen requirements

- Must not be suspended or barred from taking part in federal programs

Property requirements include:

- Must be in a rural area with a population of less than 35,000

- Must be approximately 2,000 square feet or less

- The property must have a market value less than the applicable area loan limit

- The property cannot include an in-ground swimming pool

- The property cannot be designed for income-producing activities

For guaranteed loans, the applicant must meet the income requirements, agree to use the home as their primary residence, and be a U.S. citizen, a U.S. noncitizen national or qualified alien. Of course, the property must be located in an eligible rural area.

If you dont qualify for a USDA loan, a Federal Housing Authority loan could be a good option.

How To Get A Usda Home Loan

For a guaranteed loan, check out the USDA’s list of approved lenders. These lenders offer USDA loans, but the USDA does not recommend specific lenders. You should shop around to make sure you’re getting the best terms. For a direct loan, apply directly to USDA Rural Development. The financing for these loans comes from the government.

Don’t Miss: Usaa Auto Refinance Rates

Contact North Avenue Capital To Find Out About Usda Rural Development Business Loans

At North Avenue Capital, we have assisted many business owners apply and close USDA-backed USDA Business and Industry Loans that helped them achieve their dreams and goals. We understand how these loans benefit employers and employees, who are living in rural areas and want to make a difference in their communities. We have offices in Northeast Florida, Nevada, Arkansas, Georgia, Tennessee and Texas, and are able to partner with lenders in all 50 states and US territories. Get in touch with us today to learn more about how we can help you with qualifying for a USDA B& I Loan.

Florida Headquarters

Advantages Of Usda Loans

You might be able to become a homeowner sooner without this obstacle in your way.

Lower interest rates

You can lock in a lower interest rate with a USDA loan than a conventional loan, especially if you have a good to excellent credit score. This could save you tens of thousands of dollars in interest over the lifetime of the loan.

Less expensive mortgage insurance

Although USDA loans do require mortgage insurance called a guarantee fee, it’s much more affordable than private mortgage insurance and FHA insurance. You’ll pay an upfront fee at closing equal to 1% of your loan amount and 0.35% of the loan amount annually .

More thorough appraisal

Lenders order an appraisal to determine a property’s value before finalizing your loan. This ensures they are not lending you more money than the home is worth, protecting their investment. USDA appraisals have stricter guidelines than conventional loans, which could save you from pulling the trigger on a home requiring expensive repairs.

Designed for low-income buyers

If a conventional lender has turned you down because of your income, a USDA loan might be the right option towards homeownership.

Recommended Reading: How Do I Find Out My Auto Loan Account Number

How Do Usda Loans Compare To Conventional Loans

A USDA loan and a conventional loan are both a kind of mortgage you get to finance a home. Conventional just means a type of mortgage that isnt backed by the government, like FHA, USDA and VA loans.

You pay them all back the same way, in monthly payments with interest. But USDA loans, like other government-backed loans, are different in a few ways.

What Is A Usda Loan

In 1991, the U.S. Department of Agriculture introduced the Single Family Housing Guaranteed Loan Program to boost homeownership in rural America. As a result, low- and moderate-income home-buyers who may otherwise not qualify for a traditional mortgage can apply for a government-backed loan to purchase, construct and renovate homes in eligible rural areas. During the 2019 fiscal year, lenders issued nearly 100,000 loans under this program.

USDA mortgage loans do not require a down payment, and they usually come with low interest rates. Payback periods for USDA loans may stretch to 33 years and possibly even 38 years for very low-income applicants. Under the USDA mortgage terms, the USDA guarantees 90% of the USDA loan if the borrower defaults.

Fixed interest rates on USDA loans are based on current market rates, which, as of February 2021, are 2.62%, with an average percentage rate of 2.803%.

You May Like: Drb Student Loan Refinance Reviews