What Documents Do I Need To Provide The Lender To Receive A Va Guaranteed Home Loan

The lender will need a Certificate of Eligibility to prove that you are eligible for a VA guaranteed home loan. Certificates are issued by VAs Loan Eligibility Center in Winston-Salem, North Carolina to eligible persons who apply for the certificate. The Eligibility Center can be reached by calling toll-free 1-888-244-6711. Often times, your lender may be able to access VAs secure web site and obtain a certificate for you.

How Can You Apply?

We strongly recommend that you enlist the services of a Veteran Service Officer before you submit your application for a VA guaranteed home loan. They will review your application, helping ensure it has all the information the VA requires. If you do not have a VSO yet, the NVF will help you find one. Simply call us at 888-777-4443.

You can apply for a VA guaranteed home loan by requesting your lender to obtain a certificate for you through VAs secure web site OR by completing one of the following forms and submitting it to the Loan Eligibility Center in Winston-Salem, North Carolina:

- Veteran/Servicemember:VA Form 26-1880, Request for a Certificate of Eligibility for VA Home Loan Benefits

- Surviving Spouse:VA Form 26-1817, Request for Determination of Loan Guaranty Eligibility Unmarried Surviving Spouse

Wondering How To Qualify For A Va Home Loan

To qualify for a VA loan, the most important document youll need is your VA COE. However, you must remember that your COE is just one part of your eligibility. Ultimately, who qualifies for a VA loan depends on a number of additional factors as well.

You must also satisfy your lenders financial requirements and make sure the property meets all the MPRs.

Check out our Best Rated VA home loan lenders.

What Is Va Loan Entitlement

VA loan entitlement is the dollar amount the Department of Veterans Affairs will guarantee on each VA home loan and helps determine how much a veteran can borrow before needing a down payment. VA loan entitlement is typically either $36,000 or 25% of the loan amount up to the conforming loan limit.

» Eligibility: Do you meet VA loan guidelines?

You May Like: Is Carmax Pre Approval A Hard Inquiry

What Are Va Home Loan Limits For Remaining Entitlement

In some cases, you may have a “remaining entitlement” you can use on a second VA loan. These cases can include having an active VA loan you are still paying back or having fully paid off a previous VA loan for a home you still own. When you have your remaining entitlement, your Certificate of Eligibility will say your basic entitlement is more than $0 but less than $36,000.

Loan limits often apply when you would like to get a VA loan using your remaining entitlement. These VA home loan limits are based on county loan limits published by the Federal Housing Finance Agency. You may also need to make a down payment when you are buying a home with your remaining entitlement. See the VA website for more information.

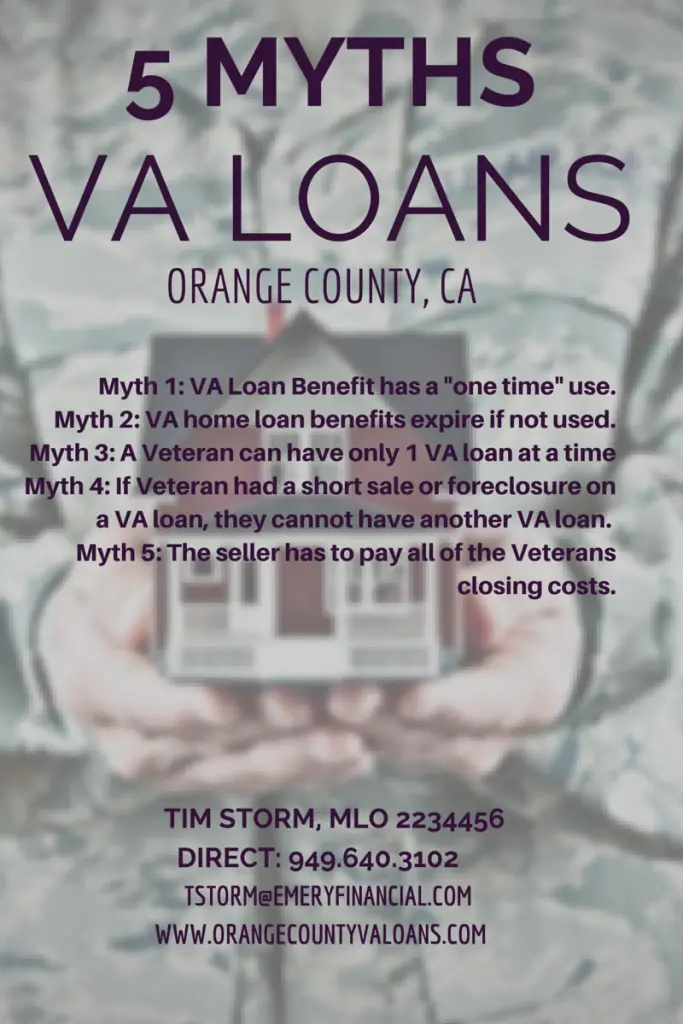

How Many Times Can You Get Va Loans

You can get VA loans as many times as you wish. Keep in mind that the rules and requirements may change each time you apply for a new VA home loan. In most instances you can only carry one VA mortgage at a time, so you would probably have to payoff your existing mortgage before qualifying for the next one.

Also, make sure you dont have any unpaid periods of active duty service when applying again. You also must wait at least two years to reapply if your initial application was denied or withdrawn.

Don’t Miss: Can You Refinance With A Fha Loan

Va Loan Limits Dont Restrict How Much You Can Borrow

If you’re subject to VA loan limits and have found a property you really love and can afford you can still get a VA loan if it’s over the county limit. Its just a matter of coming up with a down payment. The required down payment will be subject to a formula based on your entitlement and home price.

Loan Limits Based On Entitlement

There are also limits on what VA will guaranty based on a veterans entitlement. The standard entitlement for an eligible veteran is $36,000. If a veteran has this amount, then he or she can purchase a home for up to the countys VA guaranty limit without a down payment.

The entitlement amount is a little misleading. The maximum VA guaranty limit used to be $144,000, which is where the $36,000 number came from . However, with rising home prices, VA increased guaranty limits. The actual guaranty limit for a $970,800 home is $113,275, for instance. But the same $36,000 is used to reflect the fact that the qualified veteran has full entitlement and get a loan up to the county limit with no down payment.

In some cases, a veteran can use part of their entitlement but have some left over for an additional purchase. For instance heres an example if a veteran purchased a home but only used $10,000 of his or her entitlement.

According to VAs benefit website, heres the formula to figure out how much this veteran would be able to buy the second time around:

County limit x 25% = Maximum Guaranty

Maximum Guaranty Entitlement Used = Entitlement Available

Entitlement Available x 4 = Maximum loan without a down payment.

Sounds confusing, but lets look at the example above to put it into real terms. Assuming the county has the standard guaranty limit of $453,100:

$453,100 x 25% = $113,275

$113,275 $10,000 = $103,275

$103,275 x 4 = $413,100.

Don’t Miss: Stilt Loan Processing Time

Va Loans And Rental Properties

Though the US Department of Veterans Affairs does not provide loans for rental or investment properties, it does provide mortgages for multi-unit properties.

So, if you are planning to live in one unit and rent the others, you can use your VA homes to earn a rental income with up to four total units.

In addition to meeting the departments and lenders requirements, you must also take care of the occupancy requirements if this is the route you want to take.

Some lenders might expect you to prove that youll be living in the house for at least 12 months after the loan closing.

For multi-unit homes to qualify for VA loans, they must meet unique guidelines that differ from single-unit homes.

All units must have separate utility services or joint water, sewer, gas, and electricity lines. The house must also have individual shut-offs for all units.

Catching Up On Changes To Va Loan Limits

From the moment the VA home loan program was first created in 1944, service members were limited in the amount they could borrow. The tradeoff was twofold: You didnt need a down payment and your interest rates were usually lower than a conventional mortgage. At times, those loan ceilings could make it more difficult for eligible veterans and active duty members to buy their dream home, especially in high-cost real estate markets.

You May Like: Can I Use A Va Loan For A Second House

Va Loan Limits For 2022

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Starting in 2020, VA loan limits were eliminated for active-duty military and veterans who have full VA loan entitlement.

However, loan limits still apply to mortgage applicants who have defaulted on a VA loan or have other active VA loans.

Heres what you need to know.

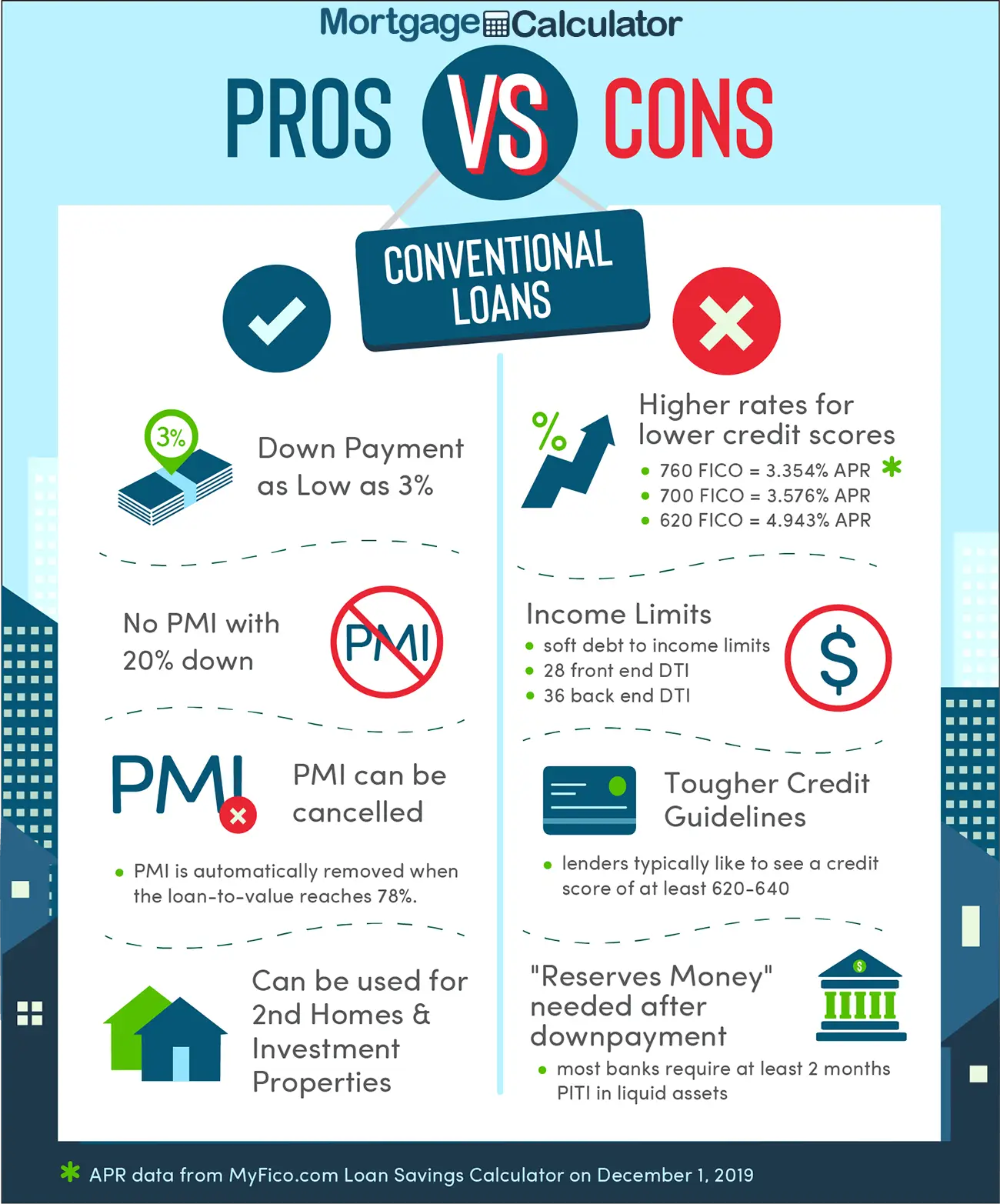

» MORE:VA loan or conventional loan?

Who Are Va Loans Best For

When we think about VA loans, veterans, active military members, and their family members come to mind. But did you know that eight uniformed branches can take advantage of VA loans?

The eight branches that can qualify for VA home loans are:

10 Best VA Home Loans 2022

Compare 2022’s Best VA Home Loans. Federally Insured. 0% Down. Active Duty, Vet & Family. Tap to Compare Rates. No Money Down.

Comparing is quick, easy, and free!

- Air Force

- The U.S. Public Health Service

- The National Oceanic and Atmospheric Administration

But, when are VA loans a wise choice?

VA mortgages might be the best choice if you dont have enough funds to make a downpayment or you can qualify at a comparatively lower interest rate.

You May Like: Capital One Auto Loans Rates

How To Calculate Your 2022 Va Loan Limits

If you have full entitlement, as indicated in your Certificate of Eligibility, a VA loan limit does not apply. You can borrow the maximum amount the lender will approve you for with no down payment, and the Department of Veterans Affairs will guarantee up to 25% of the loan.

The amount you can borrow with no down payment will be lower if you have reduced VA entitlement, and youre subject to a loan limit. Youll need to know how much VA entitlement youve already used to calculate this figure.

Heres a step-by-step breakdown you can use to calculate your VA loan limit:

Heres an example using the same steps above:

What If I Cant Get A Va Loan Right Now

If you had a previous VA loan that ended in foreclosure or a short sale and you cant afford to repay the funds at this time, you wont be able to get a new VA loan right now. However, you may qualify for another government-backed mortgage with 0% or low money down:

- USDA loans: USDA loans are 0% down payment mortgages. Theyre available to low- and moderate-income borrowers in qualifying rural and suburban areas.

- FHA loans: The Federal Housing Administration backs mortgages for borrowers with credit scores as low as 580 and down payments of 3.5%. These mortgages are subject to FHA loan limits, but they are available nationwide and there are no income restrictions, as there are with USDA loans.

Keep in mind that the government keeps record of defaults on any federal debt. That includes other government-backed mortgages and even student loans. Your lender may inform you that you have a CAIVRS alert and youre not eligible for any government loan. If this is the case, check with your lender how long you have to wait to apply.

Read Also: Capital One Preapproved Auto Financing

Va Loan County Loan Limit Explained

Conforming loan limits specify the maximum amount you can borrow to purchase a single-family one-unit property without a down payment. Its capped at $647,200 in most areas, but some locations are designated as high-cost areas and have county loan limits of up to 50% higher. You can look up the 2022 limits for your county by using this resource.

Eligibility Requirements For Va Home Loans

The eligibility requirements for VA home loans differ from service type to service type. However, all applicants must apply for the COE to validate their eligibility.

You must meet any one of the conditions stated above to qualify for the loan. But, if you cannot meet either of the conditions, there is still a slight possibility that you might qualify if your discharge falls under one of the following categories:

- You were discharged due to hardship, reduction in force, or at the convenience of the government.

- You were discharged due to a service-connected disability.

- You served at least 21 months of the two-year enlistment and were discharged early.

Here are eligibility requirements for different service types.

You May Like: Are Auto Loans Amortized

One Loan At A Time: Restore Your Full Entitlement

If youve previously had a VA loan that youve already paid off, youll typically also have to sell the home to have your full entitlement restored.

However, the VA allows for a one-time restoration of full entitlement for homeowners who have paid off their VA loan but still own the property they used the loan to purchase. This can be used in circumstances where youve either finished paying off your VA loan and now own your home outright or youve refinanced your VA loan into a different loan type, such as a conventional loan.

Youll have to apply for entitlement restoration through the VA. You can only use this type of restoration once in the future, youll have to follow the standard rule of selling the property before you can have your entitlement restored.

Make A Down Payment To Increase Loan Limits

When you purchase a property for more than the VA loan limit, you have to come up with a down payment. Your down payment effectively guarantees the portion VA doesnt cover.

In the example above, you would come up with 25% of the $100,000 the amount by which you exceeded the VA limit. So, in this case, you would need a $25,000 down payment to buy the $553,100 house.

The same formula can be used for any VA purchase above VAs limits:

< Lesser of Home Price or Appraised Value

Minus VA guaranty limit for the county

Times 25%

= Equals the amount of down payment needed

Using this formula, you can see that there is no limit to the purchase price of the house, as long as you have the down payment required to fill the gap. Talk to one of our VA home loan experts if you may need to make a down payment on a home youre interested in.

Read Also: Investment Property Loans For Veterans

Va Loan Limit Calculator For 2022

VA loans are available up to $647,200 in most areas but can exceed $900,000 for single-family homes in high-cost counties. Calculate your VA loan limit to see your personalized loan limits don’t apply to all borrowers.

Your VA loan limit or how much you can borrow without making a down payment is directly based on your entitlement. In many cases, you may have no limit whatsoever.

Heres what you need to know about calculating your VA mortgage limits and how they may apply to you.

Native American Direct Loan Program

If you or your spouse are a Native American veteran, you can opt for the NADL program to purchase, renovate, and build a home on Federal trust land, given you meet the following conditions.

- You have a valid VA COE.

- You currently reside in the house you are using your NADL benefits for.

- You can prove that you have enough funds to pay for the monthly installment of a NADL.

- You can meet your lenders financial and credit requirements.

- Your tribal government has an MOU with the VA on how the plan will work on the trust land.

Also Check: Prosper Loan Denied After Funding

Va Loan Limits And What Lenders Will Actually Lend

Most military members and veterans are eligible for a basic VA loan entitlement, which amounts to $36,000. Lenders will normally allow veterans to borrow up to four times the basic entitlement without a down payment, provided they have the income and credit to qualify for the loan and provided the property appraises for at least the purchase price. The VA will guarantee the full loan up to $144,000.

The maximum guarantee for VA loans over $144,000 is up to 25% of the county loan limit. The lowest county limit is $647,200. The high-cost county limits are listed in the table further down the article.

This means that if your home costs more than $144,000, the VA will only guarantee 25% of the loan, up to the $647,200 limit or the limit for high-cost counties. The guarantee makes these types of loans more attractive to the lender, which, in turn, may help the borrower obtain favorable loan rates.

What Is The Va Loan Limit

The VA home loan limit is the maximum amount an applicant can borrow without making a downpayment. However, an applicant with full entitlement is not restricted to any VA loan limits, meaning they can borrow as much as they qualify for.

What is entitlement?

Remember when we said that the VA will pay a certain amount to the lenders if the borrower defaults in any way?

This certain amount is called entitlementit can be either $36000 or 25% of the loan amount. A borrower who has not used their VA loan benefits or has repaid their previous loan fully has full-entitlement.

Also Check: Apply For Second Upstart Loan

See What You Qualify For

Answer a few questions below to speak with a specialist about what your military service has earned you.

Chris Birk is the author of The Book on VA Loans: An Essential Guide to Maximizing Your Home Loan Benefits.

An award-winning former journalist, Chris writes about mortgages and homebuying for a host of sites and publications. His analysis and articles have appeared at The New York Times, the Wall Street Journal, USA Today, ABC News, CBS News, Military.com and more.

More than 300,000 people follow VA Loans Insider, his interactive VA loan community on Facebook.