Tips Before You Get A Home Equity Line Of Credit

- Determine whether you need extra credit to achieve your goals or could you build and use savings instead

- If you decide you need credit, consider things like flexibility, fees, interest rates and terms and conditions

- Make a clear plan of how you’ll use the money you borrow

- Create a realistic budget for your projects

- Determine the credit limit you need

- Shop around and negotiate with different lenders

- Create a repayment schedule and stick to it

- What do they require for you to qualify

- Whats the best interest rate they can offer you

- How much notice will you be given before an interest rate increase

- What fees apply

New Electronic Alerts From Your Bank

Some banks have started sending new electronic alerts to help you manage your day-to-day finances and avoid unnecessary fees.

What you need to know about these electronic alerts.

Establish a clear plan for how you’ll use a home equity line of credit. Consider a repayment schedule that includes more than just minimum monthly interest. Make a realistic budget for any projects you may want to do.

You may be able to borrow up to 65% of your homes purchase price or market value on a home equity line of credit. This doesnt mean you have to borrow the entire amount. You may find it easier to manage your debt if you borrow less money.

Can You Refinance A Home Equity Loan

How does a home equity loan work when you want to refinance it? Because you normally can refinance one.

People refinance home equity loans for varying reasons, including:

- The borrower needs more cash than the old home equity loan provided

- Better rates are available because the borrowers credit score improved or because interest rates in general have fallen.

- The borrower wants more time to repay the remaining balance. Stretching it over a new term reduces the payment even if the rate stays the same.Refinancing a home equity loan involves costs, however. So you probably shouldnt refinance without a compelling reason.

Don’t Miss: Is Va Loan Worth It

Advantages Of Home Equity Loans

Fast access to equity: A home equity loan puts cash in hand within two to six weeks.

Easier to qualify for: A home equity loan can be a bit easier to qualify for than a cash-out refinance.

Lump sum payout: Youll receive a sum of cash you can use immediately, then repay slowly over time.

Flexible use: There are no limitations to what you can use the money for, whether youre consolidating debt, renovating, paying college tuition or something else.

How Much Can You Borrow With A Home Equity Loan

The amount of money you can borrow through a home equity loan depends on your creditworthiness and the value of your home.

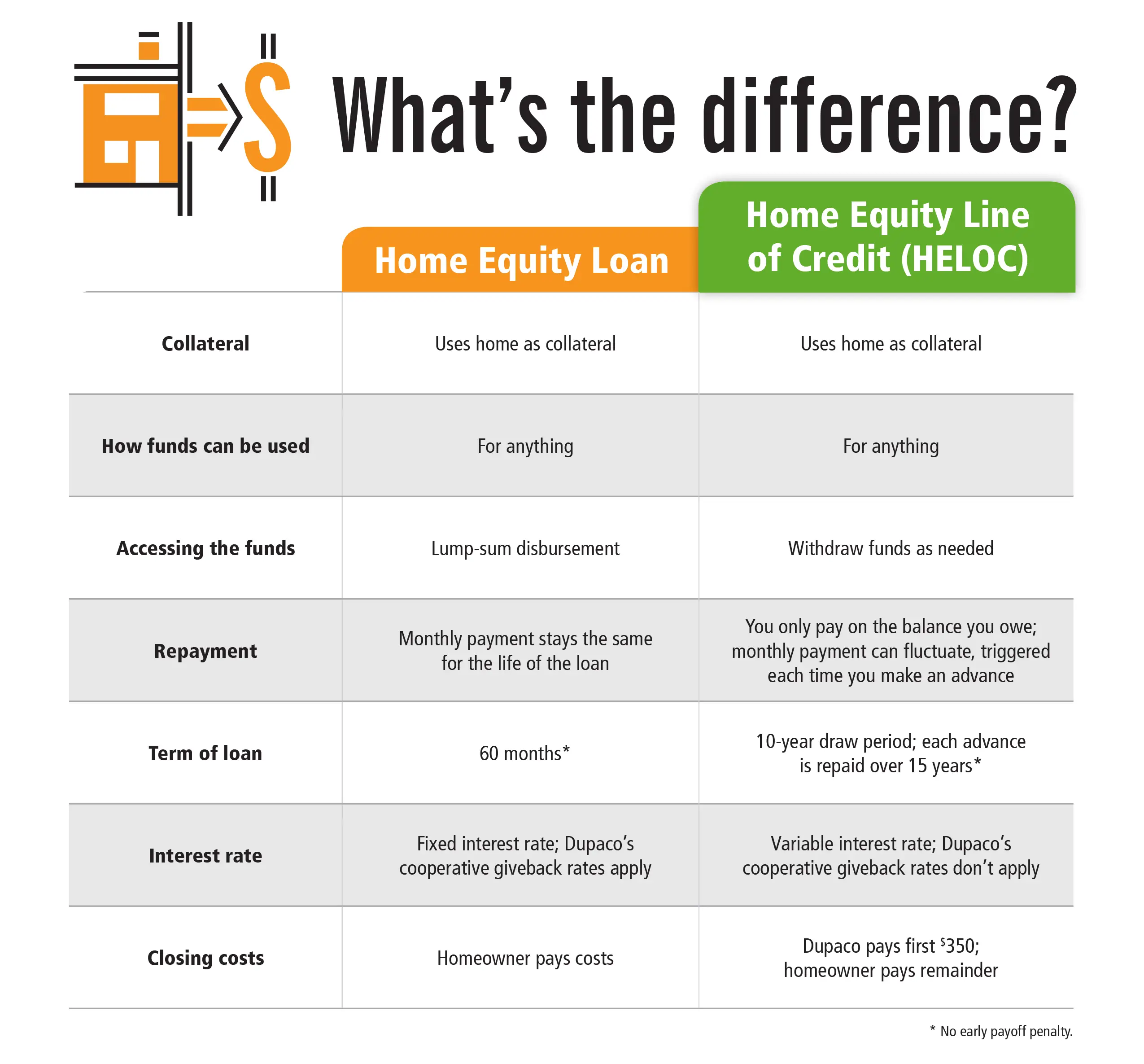

Since the home is used as collateral, how much cash a homeowner can access is partly based on the combined loan-to-value ratio of their primary and second mortgage. As a rule of thumb, the amount you owe on your primary home loan and home equity loan combined cant be more than 75% to 90% of your homes appraised value.

The amount of money you can borrow and the interest rate are also determined by the health of your credit report.

To find your possible loan amount, start by subtracting the amount you owe on your existing mortgage from the market value of your home. For example, if your home is valued at $300,000 and you owe $150,000 on your existing mortgage, you own the remaining $150,000 in home equity.

Most of the time you cant borrow the full amount of equity, but you may be able to tap 75% to 90% of it.

In the example above, that means you could likely borrow between $112,500 and $135,000, minus closing costs.

You could use this money for home improvements, debt consolidation, or to make a down payment on a vacation home or real estate investment property.

You May Like: What’s Better Home Equity Loan Or Line Of Credit

If You Have Poor Credit

Home equity loans can be easier to qualify for if you have bad credit, because lenders have a way to manage their risk when your home is securing the loan. Nevertheless, approval is not guaranteed.

Collateral helps, but lendershave to be careful not to lend too much, or they can risk significant losses. It was extremely easy to get approved for first and second mortgages before 2007, but things changed after the housing crisis. Lenders are now evaluating loan applications more carefully.

All mortgage loans typically require extensive documentation, and home equity loans are only approved if you can demonstrate an ability to repay. Lenders are required by law to verify your finances, and you’ll have to provide proof of income, access to tax records, and more. The same legal requirement doesn’t exist for HELOCs, but you’re still very likely to be asked for the same kind of information.

Your credit score directly affects the interest rate you’ll pay. The lower your score, the higher your interest rate is likely to be.

Funding A Home Improvement Project

Home improvements are one of the most common uses for home equity loans and home equity lines of credit. Home improvements can help boost the value of your current home. Home equity loans are one of the most affordable ways to remodel your home, but keep in the mind the renovation costs they may surpass the amount of the loan.

Recommended Reading: How To Find Student Loan Number

What Is The Downside Of A Home Equity Loan

Other than putting your home on the line, the other downside of a home equity loan is the fees. You may have to pay a fee to have your property valued by the lender, but some lenders pay for this themselves.

There are also closing costs associated with a home equity loan that can be expensive, wiping off any savings you made through their lower interest rates. The closing fee can range from 2-5% of the total equity loan value. So, if you took out a £40,000 home equity loan, you could have to pay anywhere between £800 to £2,000 to end the loan.

What If My Home Sells For Less Than The Loan Amount

This is something borrowers need to be aware of, although it is relatively unlikely.

As the maximum borrowed via equity release is 60 per cent, it would need to lose at least 40 per cent of its value before you were in negative equity.

However, if this is something that concerns you it is worth knowing that products offered by ERC members must have a no negative equity guarantee.

This means that, if the money from the eventual sale of the home is not enough to repay the outstanding loan, the borrower or their estate will not need to pay any extra.

However, in such an instance those inheriting the estate would be left with nothing from the value of the former family home.

You can compare equity release rates across ERC member products and find out more about how much you could potentially borrow with This is Money and Age Partnership+’s equity release comparison tool.

Recommended Reading: How To Payoff Car Loan Quickly

What Are The Different Shared Equity Schemes

A few providers offer shared equity schemes. You can find them through:

- House builders

- Local authorities

- The government

Help to Buy offers one of the most common shared equity programmes. It is available to both first-time buyers and home movers, and on new build properties up to certain values based on where youre buying. It enables you to take out an equity loan of up to 20% to supplement a deposit as low as 5%.

An alternative to shared equity is . These schemes work a little differently because you dont purchase the whole property . Instead, you buy a share of the property, and then you pay rent on the other portion. With shared ownership you can later buy a larger share in the property , if you wish, until you eventually own the whole thing.

Pros Of A Home Equity Loan

- Interest rates are fixed. That means your payments wont change over the life of the loan, and the predictable payments can help you budget.

- Interest rates are lower vs. other loans. Because your home is used as collateral, home equity loans have lower interest rates compared to their unsecured counterparts.

- You can use the funds for anything. Lenders generally dont pose restrictions on what you do with the money.

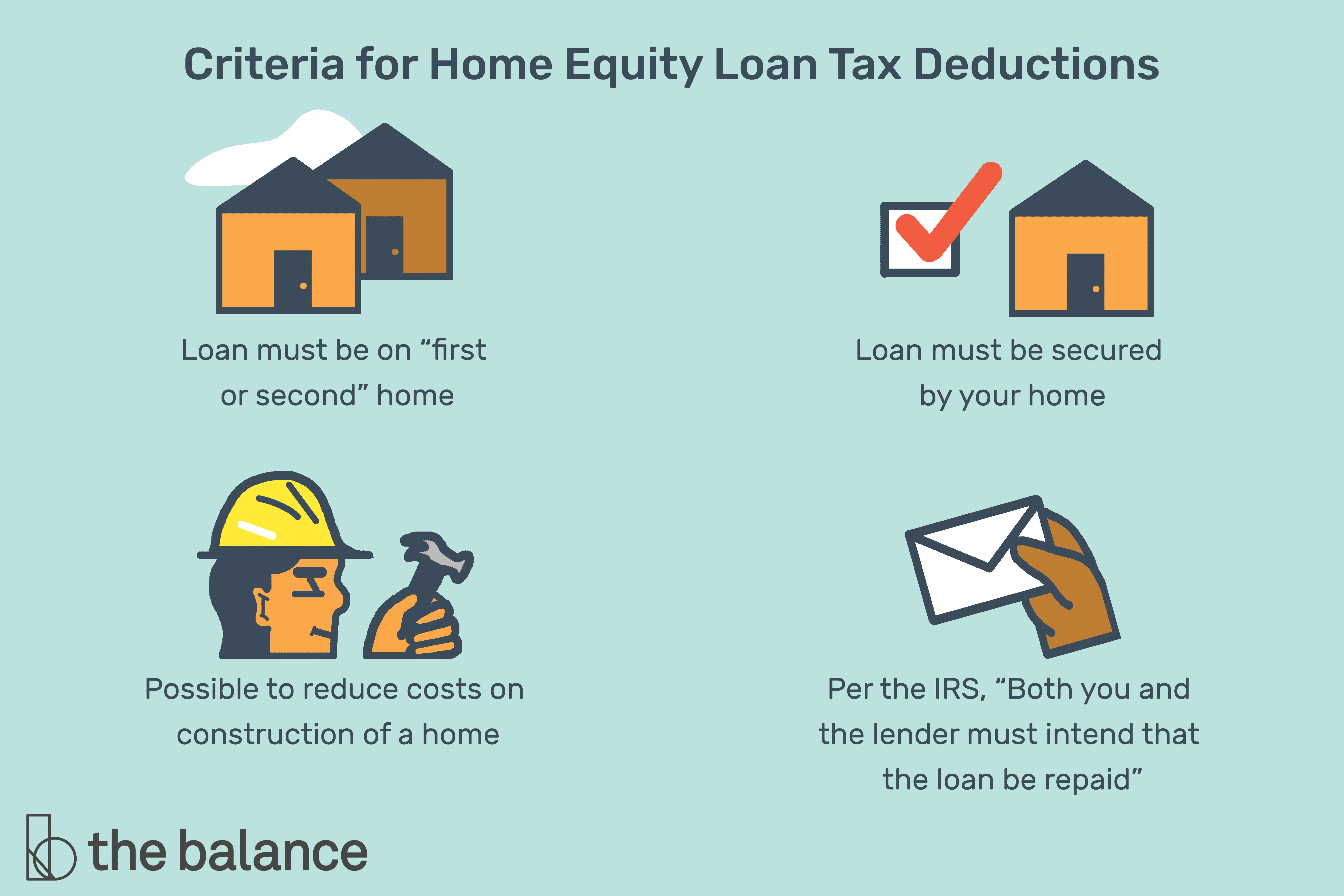

- The interest may be tax-deductible. If you use the loan to “substantially improve” your home, the IRS allows you to deduct the interest payments on your taxes.

You May Like: How To Fill Out Schedule C For Ppp Loan

What Is Help To Buy

Help to Buy: Equity Loan is a government scheme that helps first-time buyers get onto the property ladder with a 5% deposit .

Its available on new-build homes, which can come at a premium cost. But who doesnt love buying something new and shiny? The property must be from a Help to Buy-registered builder.

The Help to Buy: Equity Loan closes on 31 March 2023 and will close to new applications on 31 October 2022. To qualify, you’ll need to have completed your purchase by the October deadline.

The scheme is only open to first-time buyers and regional property price caps have also been introduced, which we explain fully below.

To be eligible you need to:

-

be over 18 years old

-

be a first-time buyer. You cannot have owned or inherited a property or land anywhere in the world previously

-

have not had any form of Sharia mortgage finance.

How Does An Ontario Home Equity Loan Work

Are you wondering how does an Ontario home equity loan work? Read on. Weve put together the information youll need.

The first step is finding out how much equity you actually have. The quickest way to do that is to use a home loan equity calculator like the one that we have on our website. Once youve got that figure worked out, there are some other aspects you need to get through.

Recommended Reading: How Can Someone Take Over My Car Loan

Pay More Than The Minimum

If you want to build equity more quickly, you can always pay more than your required payment each month. Making an extra payment each year on your own or through biweekly payments or even paying an extra $100 a month can help you chip away at your loans principal balance as well as help homeowners increase their home equity at a faster rate.

Stay In Your Home 5 Years Or More

Youll build equity if your home increases in value. Of course, no home is guaranteed to see its value jump, but you will increase your odds if you stay in your residence for a greater number of years.

Plan on staying in your home for 5 years or more if you want to see its value jump enough to give you an equity boost.

Also Check: What Is The Best Loan For College

Things To Know Before You Apply

Help to Buy: Equity Loan is not a discount scheme or a price reduction the cost of the home will be the same whether or not you get an equity loan.

We do not charge interest on the equity loan for the first five years, but you will start to pay it from year 6.

The total equity loan amount you repay is linked to the value of your home at the time you want to repay, and not the amount you originally borrowed.

You must have a repayment mortgage, and it must be valid for the duration of the equity loan.

An equity loan is secured against your home by a legal charge in the same way a repayment mortgage is.

Help to Buy: Equity Loan is exempt from regulation by the Financial Conduct Authority.

For more information go to who is eligible

What Are Todays Home Equity Mortgage Rates

As noted above, home equity loan rates are more sensitive to your credit history than first mortgages. Rates can also vary more between lenders, which makes it important to shop for a good deal.

To get an accurate quote, youll need to provide an estimate of your credit score and your property value.

You May Like: When Will My Home Loan Be Paid Off

Under The Rule Can I Waive My Right To Cancel The Contract

If you have a personal financial emergency like damage to your home from a storm or other natural disaster you can waive your right to cancel. That eliminates the three-day waiting period so you can get the money sooner. To waive your right:

- You must give the lender a written statement describing the emergency and stating that you are waiving your right to cancel.

- The statement must be dated and signed by you and anyone else who also owns the home.

Your right to cancel gives you extra time to think about putting your home up as collateral for the financing to help you avoid losing your home to foreclosure. If you have a personal financial emergency, you can waive this right, but be sure thats what you want before you waive it.

Transfer Your Home Equity Line Of Credit

When your mortgage comes up for renewal, you may consider transferring your mortgage and home equity line of credit. Youll likely have to pay legal, administrative, discharge and registration costs as part of the switch.

You may also be required to pay off all other forms of credit, such as credit cards, that may be included within a home equity line of credit combined with a mortgage.

You may be able to negotiate with a lender to cover some costs to transfer any credit products you may have. This can be difficult if you have different sub-accounts within your home equity line of credit combined with a mortgage that have different maturity dates.

Ask your lender what transfer fees apply.

Also Check: Small Loans No Credit Checks

Focus On Paying Off Your Mortgage

A portion of each mortgage payment you make will go toward the principal balance of your home loan. The rest will usually go toward paying interest, property taxes and homeowners insurance.

When you first start making your mortgage payments, a smaller amount will go toward reducing your principal balance and more will go toward your interest. The good news, though, is that the longer you have your mortgage, the more money will go toward reducing your principal balance and building your equity.

But its important to be aware that some loans dont operate this way.

If you take out an interest-only or other non-amortizing mortgage, you wont reduce your principal balance or build equity. Instead, your payments will only go toward paying your interest, property taxes and insurance. Eventually, youll need to pay a lump sum to pay off your principal balance.

What Can You Use Home Equity Loan Funds For

You can use the funds you borrow from your home equity for any purpose, but its prudent to have an important goal for the money, as it can be tempting to use it to cover everyday expenses and make unnecessary purchases that youll have to pay back, with interest.

Can you use a home equity loan for a down payment?

You can use a home equity loan to access the equity in your current home to apply toward a down payment on your next home. This is a popular way to allow you to make a sizable down payment on a new home without needing to sell your current home concurrently.

Keep in mind that your overall debt will be factored into your debt-to-income ratio , which can affect your interest rate and eligibility for your new mortgage.

When your old home sells, the proceeds will first pay off your remaining mortgage balance, then your home equity loan. Any money left over will be distributed to you in cash.

Can you use a home equity loan to pay off your mortgage?

A home equity loan can be used to pay off your current mortgage, but this only makes sense if you can get a lower interest rate than your current mortgage. If you can, this will allow you to save on interest and thereby reduce your monthly payment.

Also Check: When Can I Drop Pmi On An Fha Loan

How Does A Land Equity Loan Work

An increase in the amount of money you borrow because of your collateral results in a reduced interest rate and a bigger borrowing amount because of the secured nature of the loan. Your loan amount will be less than the amount of equity or land value that you actually have. In addition to the principal, you will be required to make interest payments.

Get Money From Your Home Equity Line Of Credit

Your lender may give you a card to access the money in your home equity line of credit. You can use this access card to make purchases, get cash from ATMs and do online banking. You may also be given cheques.

These access cards don’t work like a credit card. Interest is calculated daily on your home equity line of credit withdrawals and purchases.

Your lender may issue you a credit card as a sub-account of your home equity line of credit combined with a mortgage. These credit cards may have a higher interest rate than your home equity line of credit but a lower interest rate than most credit cards.

Ask your lender for more details about how you can access your home equity line of credit.

You May Like: How Much Interest Am I Paying On My Home Loan