Cons Of Choosing A Va Mortgage

- They come with a funding fee, which is paid to support the program.

- The funding fee increases after every subsequent use of VA loan benefits. You will pay more in funding fees the second time you borrow a loan.

- The loans could exceed market value.

- The loans are provided only by VA-approved private lenders.

- You cannot purchase a vacation home or an investment property with these loans.

What Is A Jumbo Loan

A jumbo loan lets you finance the difference between the VA loan limit in your county and the value of the home that you want to buy. Say you want a house thats $500,000, but the VA loan limit in your county is only $424,100. How will you finance that extra $75,900? With a jumbo loan.

To use a VA loan to finance this example home or any home thats over the local VA loan limit youll need to come up with 25% of the difference between the home price and the loan limit. So, $75,900 divided by 4 is $18,975. You would have to make a $18,975 down payment to finance your $500,000 home.

That may sound like a lot of money but remember that with a conventional loan youd likely have to put down 20% of the full home value, meaning a $100,000 down payment for our example home. Even with the 25% down payment requirement for jumbo loans, the VA loan is still a great deal.

Va Loan Calculator Estimate Your Monthly Mortgage Payment And Va Funding Fee

About Ryan Guina

Ryan Guina is The Military Wallet’s founder. He is a writer, small business owner, and entrepreneur. He served over six years on active duty in the USAF and is a current member of the Illinois Air National Guard.

Ryan started The Military Wallet in 2007 after separating from active duty military service and has been writing about financial, small business, and military benefits topics since then. He also writes about personal finance and investing at Cash Money Life.

Ryan uses Personal Capital to track and manage his finances. Personal Capital is a free software program that allows him to track his net worth, balance his investment portfolio, track his income and expenses, and much more. You can open a free Personal Capital account here.

Featured In: Ryan’s writing has been featured in the following publications: Forbes, Military.com, US News & World Report, Yahoo Finance, Reserve & National Guard Magazine , Military Influencer Magazine, Cash Money Life, The Military Guide, USAA, Go Banking Rates, and many other publications.

Don’t Miss: Usaa Credit Score For Auto Loan

Can I Use A Va Loan For An Investment Property

No, you may only use VA loans to purchase property that you intend to make your primary residence. According to the federal government, you must occupy the property within sixty days of loan closing and live there for a minimum of one year. After that, you must reside there for the majority of the year.

You may not use a VA loan for purchasing a home you intend to rent out as a landlord or are purchasing simply to sell it later for a higher price. In addition, even if you will be living there on a part-time basis, such as a home purchased as a weekend or summer home, if it is not your primary residence, you cannot buy the house with a VA loan. Before you are granted VA funding, lenders will verify that the home will be your primary residence.

What About The Practice

But, the lender is still a private company and it retains its right to impose its own underwriting conditions above and beyond the VAs requirements. Which raises the question: Will some, most, or all lenders balk at providing large mortgages with zero down payment, even with that cushioning of risk? Only time will tell.

Please contact our support if you are suspicious of any fraudulent activities or have any questions. If you would like to find more information about your benefits, please visit the Official US Government website for theDepartment of Veteran Affairs or the US Department of Housing and Urban Development.

MilitaryVALoan.com is owned and operated by Full Beaker, Inc. NMLS #1019791

Full Beaker, Inc. is not licensed to make residential mortgage loans in New York State. Mortgage loans are arranged with third-party providers. In New York State it is licensed by the Department of Financial Services.Cookie Settings.Do Not Sell My Personal Information.

Also Check: Refinance Fha Loan To Conventional Calculator

Managing Your Mortgage Payment

Your monthly payment is affected by the following factors:

- Home Price: A more expensive house results in larger monthly payments, especially if you are borrowing without making a down payment.

- Downpayment: If you decide to pay something upfront, your monthly payments can decrease at a special rate.

- Interest Rate: Generally, VA home loans are provided at highly competitive interest rates, which make for lower payments every month.

- Funding Fees: You can pay the funding fees either together during the loan closing or get it rolled up into monthly installments, which will increase your monthly payments.

Eligibility Requirements For Va Home Loan Programs

Learn about VA home loan eligibility requirements for a VA direct or VA-backed loan. Find out how to apply for a Certificate of Eligibility to show your lender that you qualify based on your service history and duty status. Keep in mind that for a VA-backed home loan, youll also need to meet your lenders credit and income loan requirements to receive financing.

Read Also: Www Capitalone Com Auto Pre Approval

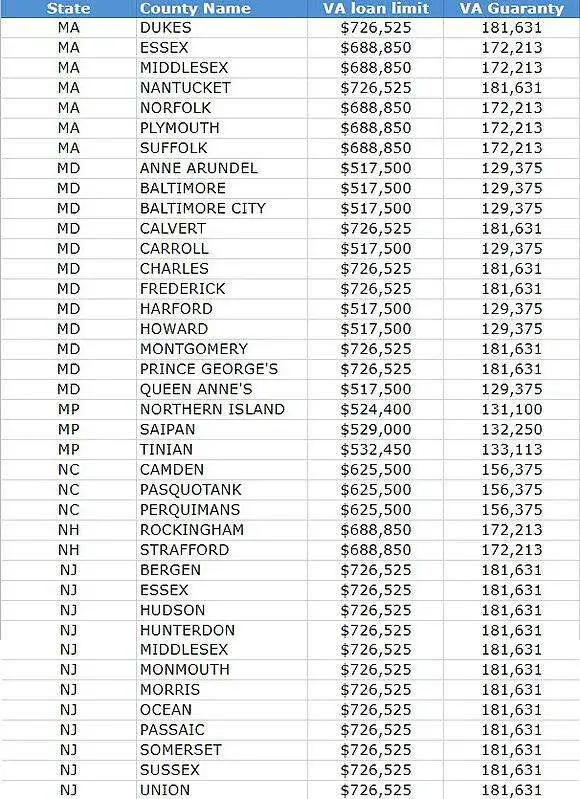

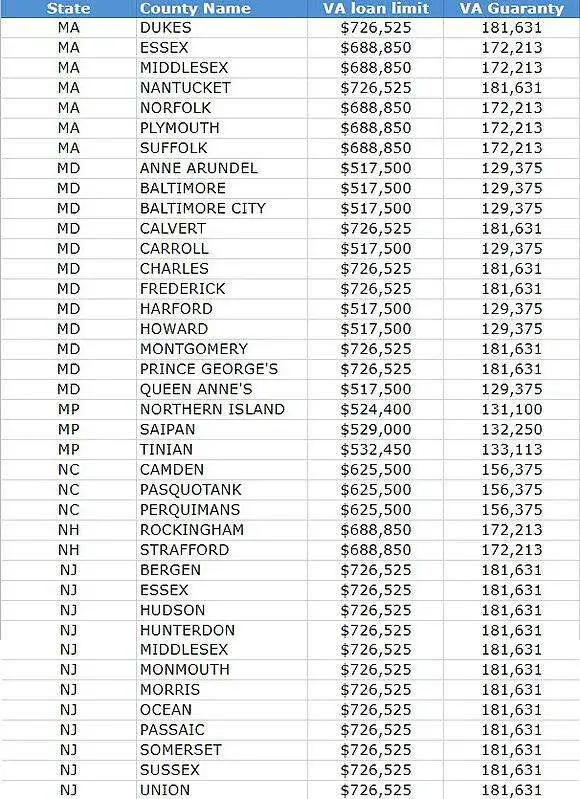

Loan Limits: Before And After

As Military Benefits points out, January 1, 2020, brought major changes for VA loan limits, and those changes had many borrowers scrutinizing their VA loan entitlement amounts. Why? Borrowers who had their full entitlement at the beginning of 2020 are no longer subject to loan limits. While they must have sufficient income and resources to secure the loan that theyre seeking, borrowers with full entitlements no longer have to worry about staying below conforming loan limits. The VA will provide a 25-percent guarantee for these loans. However, borrowers who have already used part of their entitlement must play by the old rules. Anyone without full entitlement who takes out a VA loan must stay below the conforming loan limits or make up the difference with a down payment.

_____

What is my VA loan entitlement amount? Whats the best way to secure my Certificate of Eligibility? Can you buy a fixer-upper with a VA loan? Does the VA offer a way to refinance my existing property? When you have questions about the VA loan program, the team at PrimeLending: Manhattan, KS, is happy to help you find the clear, useful answers that you need to make smart decisions. We listen carefully, offer personalized guidance, and use our expertise to ensure that the process moves as smoothly as possible. To learn more about our services, contact us today.

How To Calculate Your 2022 Va Loan Limits

If you have full entitlement, as indicated in your Certificate of Eligibility, a VA loan limit does not apply. You can borrow the maximum amount the lender will approve you for with no down payment, and the Department of Veterans Affairs will guarantee up to 25% of the loan.

The amount you can borrow with no down payment will be lower if you have reduced VA entitlement, and youre subject to a loan limit. Youll need to know how much VA entitlement youve already used to calculate this figure.

Heres a step-by-step breakdown you can use to calculate your VA loan limit:

Heres an example using the same steps above:

Also Check: Is Bayview Loan Servicing Legitimate

How Much Is The Funding Fee On A Va Jumbo Loan

Requirements for the VA funding fee for a VA jumbo loan are the same as they would be for a regular VA loan. VA loans dont have mortgage insurance, but the funding fee is intended to help fund the program and can be paid either upfront or financed into the loan amount in many cases. The exception to this rule occurs with certain refinance transactions including cash out on jumbo loans.

The funding fee for regular VA loans is anywhere between 1.4% and 3.6%. The amount of the required funding fee is dependent on the size of your down payment , and in some cases whether its your first use of a VA loan or a subsequent use. The exception to the range are VA Streamlines also referred to as interest rate reduction refinance loans which have a 0.5% funding fee.

Youre exempt from the VA funding fee if youre currently receiving VA disability payments or youre a surviving spouse receiving dependency and indemnity compensation. Theres another exemption thats been added relatively recently for clients who returned to active duty after receiving a Purple Heart.

How Was The 2022 Conforming Loan Limit And Va Loan Limit Determined

Each year, loan limit adjustments are made based on the changes that occurred in the average price of a home in the United States. This adjustment is required by the Housing and Economic Recovery Act.

The limits for 2022 were increased and adjusted in alignment with the changes and trends related to home prices over the last year. Between the third quarters of 2020 and 2021, house prices increased about 18.05% on average. The baseline loan limits for 2022 were then increased by the same percentage.

Recommended Reading: Usaa Pre Approval Car Loan

How Are Mortgage Limits Changing In 2021

As a result of the amendments made in 2020, an applicant with full entitlement will not be subject to any loan limits.

Most counties now have a maximum loan limit of $548,250, up from $510,400 in 2020. Prices can also reach $822,375 in other counties, an increase from $765,600 in 2020.

While these limits represent the amount you can borrow without making a downpayment, they do not represent a cap or maximum loan amount.

If the house costs more than your loan limit, you can still borrow the amount, provided that you are willing to pay a downpayment to make up the difference.

What Is The Maximum Amount You Can Borrow For A Va Loan

Assuming you have your full entitlement, there is no limit at least not officially. Keep in mind that a mortgage lender still needs to approve your VA home loan, and they will always try to reduce their risk exposure as much as possible. That means combing through your financial records, credit scores, debt-to-income ratio, employment status and other risk factors to determine what a reasonable loan figure would be. So, while the VA itself doesnt limit how much you can borrow, your lender definitely will.

You May Like: Upstart Early Payoff Penalty

Va Loan Limits For 2021

The 2021 conventional loan limits set by the Federal Housing Finance Agency for Fannie Mae and Freddie Mac will apply to VA loans when determining themaximum guaranty amount, if applicable.

The new loan limits are effective for VA loans with closing on and after January 1, 2021

Loan limits and entitlement requirements do not apply to IRRRLs

Important Reminders Regarding VA Guaranty and Homebridge VA Maximum Loan Amount

Brokers are encouraged to read the below information as it contains specific reminders regarding Homebridge requirements and VA maximum loan amounts

Loan Amount: First Time Use, Veteran has Full Entitlement or Full Entitlement will be Restored

While VA eliminated the use of county limits when determining the guaranty for Veterans with first time use, full entitlement, or full entitlement will be restored, with the Blue Water Navy Act, Homebridge applies the following to VA transactions with 100% financing for all LTVs:

- The maximum total loan amount for a VA loan is $1,500,000. Loan amounts > $1,000,000 to $1,500,000 will require Homebridge management review and approval

- Loan amounts up to $2,000,000 will be considered on a case-by-case basis with Homebridge management review and approval. A down payment, determined by Homebridge management, will be required on loan amounts > $1,500,000 to $2,000,000

- 1-unit transactions are subject to the following credit score and loan amount restrictions:

Va Loan Limits: The Basics

There are technically no limits to VA loans. There are only limits to how much the VA will guarantee. The VA will guarantee up to 25% of the loan amount for lenders in the event that you default on your loan. The amount the VA will guarantee is dependent on the amount of your VA entitlement.

For the purposes of this discussion, VA loan limits can be defined as the amount you can borrow without having to make a down payment.

Most people getting a VA loan are going to have whats referred to as full entitlement. If you have full entitlement, as of 2020, you dont have a loan limit. The VA will guarantee 25% of whatever a lender is willing to approve you for.

You have full entitlement under any of the following four scenarios:

- Youve never used your VA loan entitlement.

- Youve used your entitlement to buy or refinance a property previously, but youve since sold and fully paid off your VA loan.

- You had a previous VA loan that wasnt fully paid off because of a foreclosure or short sale, but youve since fully repaid the VA.

- You paid off a VA loan without selling the property. You can have your entitlement restored this way one time.

If your COE says that you have some number greater than zero, but less than $36,000, you have remaining entitlement, but not full entitlement. This is also referred to as impacted entitlement. If thats the case, you are subject to a loan limit if you want to buy a home without a down payment.

Read Also: Do Underwriters Verify Bank Statements

Does The Va Entitlement Benefit Last Forever

That would be nice. Unfortunately, its possible to permanently lose your VA loan entitlement. For example, if the homeowner defaults on the VA loan and the lender forecloses on the property and sells it for less than what was owed, the VA has to reimburse the lender the full 25% initially guaranteed.

The VAs payment to the lender would be deducted from the homeowners total entitlement. This portion of the entitlement would no longer be accessible unless the homeowner repaid the VA the losses. And that aforementioned one-time restoration of entitlement benefit? Not applicable in this scenario.

Read Also: What Is Certificate Of Eligibility Va Home Loan

What Are The Va Jumbo Loan Rates

VA jumbo loan rates are often similar to the rates you can get on a regular VA loan. It just depends upon the appetite of the bond market at the time you apply for your mortgage. Your rate wont necessarily be higher because the loan amount is higher. It can be, but there doesnt have to be a correlation. Its all up to investors.

To get an idea of the VA loan rates, check out our mortgage rates.

Read Also: Usaa Auto Loan Credit Score

Va Jumbo Loan Limits Rates And Requirements

VA loans are a great benefit to our countrys eligible active-duty service members, reservists, members of the National Guard, veterans and qualifying surviving spouses. There are a lot of benefits, including no down payment, rates that are typically lower and some more flexible qualification requirements in many cases.

But what happens if you live in an expensive area or just need a loan thats a little bit bigger? A VA jumbo loan can help you buy or refinance that home. Well spend the rest of this post going over what you need to know to get a VA jumbo loan and whether it makes sense for you. But first, lets get back to the basics.

Va Loan Appraisal And Home Inspection

A VA loan appraisal comes with a two-fold purpose. The first is to evaluate the actual value of the property, and the second is to ensure the house meets all the MPRs and is safe for living.

However, you must also note that an appraisal is not a home inspection. In short, the VA would not be responsible for anything. So, make sure you get the home inspection done before closing on the loan.

Recommended Reading: California Loan Officer License

If You Have Remaining Entitlement You Do Have A Home Loan Limit

With remaining entitlement, your VA home loan limit is based on the county loan limit where you live. This means that if you default on your loan, well pay your lender up to 25% of the county loan limit minus the amount of your entitlement youve already used.

You can use your remaining entitlementeither on its own or together with a down paymentto take out another VA home loan.

You may have remaining entitlement if any of these are true:

- You have an active VA loan youre still paying back, or

- You paid a previous VA loan in full and still own the home, or

- You refinanced your VA loan into a non-VA loan and still own the home, or

- You had a compromise claim on a previous VA loan and didnt repay us in full, or

- You had a deed in lieu of foreclosure on a previous VA loan , or

- You had a foreclosure on a previous VA loan and didnt repay us in full