Assemble And Organize Your Sba Loan Paperwork

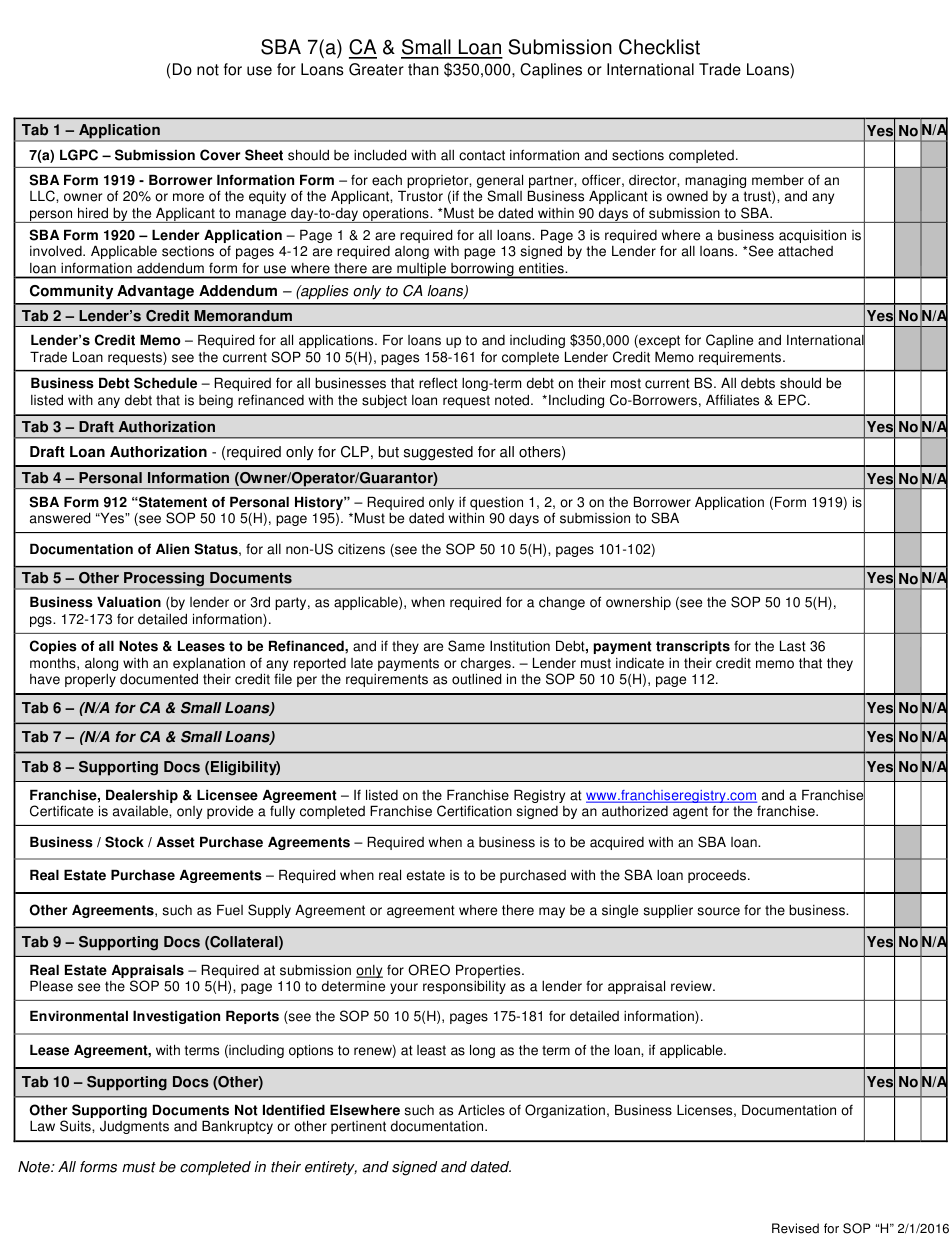

Once you have selected an SBA lender or loan broker, you should begin to assemble the various documents required for your application. The SBA provides a comprehensive checklist, which you can find here. The main documents required are:

- Loan Request Amount & Detailed Allocation of Funds

- Business Financials

- YTD Profit and Loss Statement

- YTD Balance Sheet

- Business Tax Returns

- Personal Tax Returns

- Personal Financial Statement

- Business Overview and History

- Business Lease

If you are getting an SBA loan to buy an existing business, you will also need the following:

- Acquisitions YTD balance sheet and P& L statement

- Acquisitions last two years of business tax returns

- Purchase Agreement .

If you are getting an SBA loan to buy commercial real estate, you will also need to provide the following:

- Real Estate Purchase Agreement

- Rent Rolls and Leases for any Tenants of Your Property

- Property Appraisals

- Any Plans for Remodeling or Build Outs

If you own any other businesses or own rental properties, then you should expect that you will need to provide documentation for those as well .

The overall goal is to convince a bank that your company is well managed and has an attainable plan to be profitable. There are many software tools that can help you put together a business plan.

Much of the speed of your application process will depend on your ability to provide timely documentation.

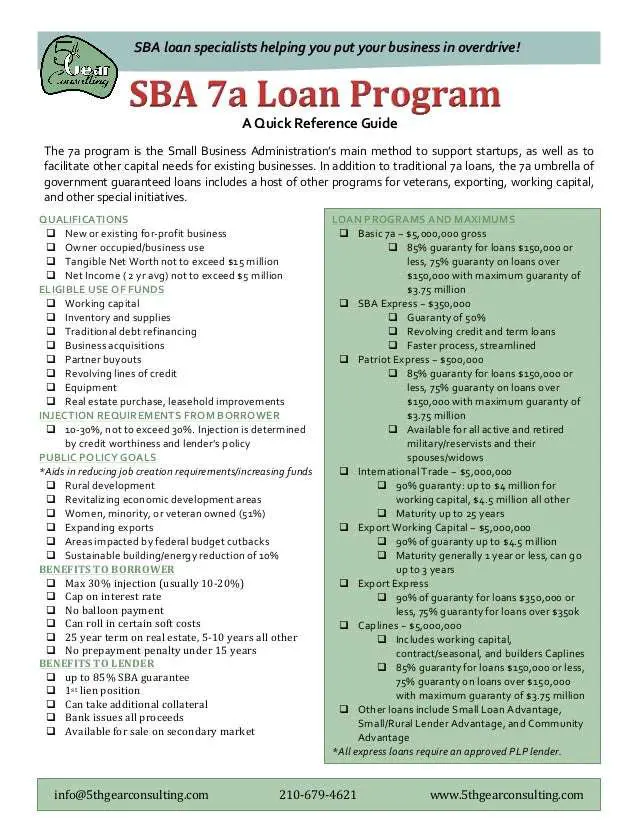

Sba Loans: The Fundamentals

The SBA in SBA loans stands for the Small Business Administration.

The SBA does not make direct loans to small businesses. Rather, the SBA sets the guidelines for loans, which are then made by its partners . The SBA guarantees that these loans will be repaid, thus eliminating some of the risks to the lending partners.

So, when a business applies for an SBA loan, it is applying for a commercial loan, structured according to SBA requirements with an SBA guaranty. SBA-guaranteed loans may not be made to a small business if the borrower has access to other financings at reasonable terms. SBA loan guaranty requirements and practices can change as the government alters its fiscal policy and priorities to meet current economic conditions. Therefore, you cant rely on past policy when seeking assistance in todays market.

The SBA can guarantee as much as 85 percent of the loan proceeds, so while the lending institution will have some risk, it should also be willing to take on more risk than with traditional loans. SBA loans can be as large as $5 million. Most SBA loan services are through banks. You can ask your bank whether it makes SBA-guaranteed loans, or you can go to the SBA website for a list of participating lenders. Besides, the SBA has a microloan guarantee program for loans up to $50,000. These loans are provided through nonprofit community-based organizations. You can find a list of participants on the SBA website.

What Is An Sba 7 Loan

The SBA 7 loan is one of several commercial loans that are government-backed and that provide small, U.S.-based businesses with funding. Businesses can use these for real estate, working capital, or equipment.

The SBA doesnt lend this money directly to businesses. Instead, a bank or financial institution provides the loan, and the SBA backs a certain amount of it.

Recommended Reading: Gustan Cho Mortgage Reviews

Ways To Use Your Sba Loan

The funds you receive from a small business loan can be used for various purposes. Depending on the time of year and what your company needs to accomplish, your reasons for applying for an SBA loan may drastically differ from a business owner within another industry.

Here are six of the many ways you can use an SBA loan to quickly grow your business:

Good Credit Is Needed

An SBA guarantee, though helpful, doesnt mean you will qualify straightaway for 7A loans. You as the business owner need to show a sound personal and business credit score. The necessary credit score changes based on lender requirements, though 620+ is a good average to base your eligibility on.

Dont have the strongest credit score? Talk with potential lenders to see if they can consider the total financial health of your business.

Recommended Reading: Can A Va Loan Be Used For An Investment Property

A Guide To The Sba 7 Loan

The 7 loan is the Small Business Administrations primary and most popular vehicle for providing financial assistance to small business owners. The SBA 7 loan typically offers lower down payments, longer terms and greater flexibility than other loan programs, making it an excellent option for small business owners in need of financing.

This eBook provides a high-level overview of the SBA 7 program, including information on:

- Eligible use of proceeds and restrictions

- How to apply for an SBA 7 loan

Just about every small business expert will tell you that you shouldnt try to navigate the application process alone. Download the eBook today to learn more.

What Are The Collateral Requirements

You dont have to have collateral to get an SBA loan. However, the SBA will require the applicant to pledge collateral when it is available to fully secure the loan. If there is not sufficient collateral in the business, the SBA must take available equity in the personal real estate of any owners with 20% or more ownership.

SBA 7 Small Loans of $25,000 or less do not require collateral.

Personal guarantees are also generally required. An individual who owns 20% or more of the business must provide a full unlimited personal guarantee. And each loan must be guaranteed by at least one individual or entity. Sometimes the SBA may require a personal guarantee from a key person in the business even if they dont own 20% or more of the business. Spouses may be required to sign a personal guarantee when the combined interest of the two spouses and minor children totals 20% or more. In addition, non-owner spouses will be required to sign off if jointly held collateral is pledged.

Note that startup businesses require the small business owner to contribute at least 10 percent of the total project costs. While you may think of this as a down payment, it is officially called an equity injection.

Read Also: How Long Does An Sba Loan Take To Get Approved

Why Use An Sba Loan

SBA loans are designed to make it easier for small businesses to get funding. If your business has exhausted all other financing options, you may be able to get an SBA loan. Whats more, the government caps interest rates on SBA loans, meaning youll never have to pay the high interest rates often associated with other types of business loans.

Max rates are pegged to a base rate, using the prime rate, LIBOR rate, or an optional peg ratebut usually the prime rate published by the Wall Street Journal. In general, the prime rate is 300 points above the federal funds rate. At the end of 2020, the target federal funds rate was 0%-0.25%.

This table shows the maximum loan amounts:

| Loan Amount |

|---|

-

Purchase machinery, furniture, supplies, or materials

A Flexible Commercial Finance Product

The SBA 7 Loan Program is one of the most flexible commercial finance products available today. Proceeds can be used for a wide variety of business purposes, including purchase of owner occupied real estate, leasehold improvements, equipment, working capital, business acquisition, partner buy outs and business startup expenses.

Also Check: What Credit Score Does Usaa Use For Mortgage

Sba 7 Loans Frequently Asked Questions

The U.S. Small Business Administration runs several business loan programs, including the 7, 8, 504, microloan, and disaster loan programs. These programs can help entrepreneurs start small businesses and help existing businesses with working capital, expanding, and during emergencies.

The SBA doesnt lend money directly. Instead, it partners with approved lenders and guarantees 40% to 85% of the loan, depending on the loan program and loan amount. The guarantee allows lenders to offer larger loans and more favorable terms to small businesses, knowing that theyll at least get a portion of the loan back from the SBA if the business is unable to repay the loan.

While youll apply for an SBA loan through a lender, the SBA has set guidelines for the minimum qualifications, loan amounts, terms, and interest rates. The SBA may also make the final lending decision, although it also delegates the processing and servicing to the lender.

The 7 program is the SBAs general small business loan program and one of the most popular loan options.

There are several types of 7 loans, including standard, small, and express loans, as well as loans for export and international trade businesses. These loans can be used for a variety of purposes, including buying inventory, equipment, working capital, and refinancing other business loans.

Certain types of businesses arent eligible, based on the type of business, industry, or owner.

Sba 8 Business Development Loans

Each year, the governmentaimsto give out at least 5 percent of all federal contracting dollars to disadvantaged small business owners. One of the mechanisms they use to achieve that goal is the SBAs 8 Business Development program.

Businesses approved for the program can earnsole-source government contractsof up to $4 million for goods and services and $6.5 million for manufacturing.

To qualify for 8 financing, small businesses must be at least 51 percent owned by a U.S. citizen entrepreneur who is socially or economically disadvantaged. Owners must have less than $4 million in assets and a personal net worth of $250,000 or less their average adjusted gross income over the previous three years needs to be $250,000 or less, too. Owners must also manage day-to-day operations and their business needs to have a track record of successful performance.

To find out whether youre eligible for an 8 Business Development loan, clickhere to visit the SBAs Am I Eligible? page.

Recommended Reading: Refinance Conventional Loan

What You Need To Know About Sba Express Financing

SBA Express loans fall under the federal governments SBA Loan Guarantee Program. Though similar to the SBA 7 loan, which offers up to $5 million and has a guarantee of up to 85% of the loan amount, the express loan sets itself apart by being approved or denied within 36 hours. If approved, funds become available to the business owner within 90 days. This is a far cry from the notoriously grueling process surrounding the SBA 7 loan, which requires lengthy application paperwork and even longer lead times for approvals or denials. Still, an unprepared borrower will always have a harder time in trying to get approvedno matter what loan program they apply for. That’s why we break down the entire process in detail, to help get prospective borrowers up to speed and ready to receive the funding they’re after. We want our clients to apply for their SBA Express loans with the highest confidence, backed by the knowledge of our lending specialists.

What Is The Repayment Term For An Sba 7 Loan

The length of the loan will depend on how the loan proceeds will be used. Generally the SBA requires the lender to make the loan for the shortest period of time based on how the loan proceeds will be used, the useful life of assets acquired, and the borrowers ability to repay.

The SBA guidelines require the following loan repayment terms:

- Working capital and inventory: up to ten years.

- Equipment, fixtures, or furniture loans: up to ten years, though it can be extended to 15 years if the useful life of the asset justifies it.

- Real estate: up to 25 years, with extensions in some cases involving construction or renovation.

- Leasehold improvements: up to 10 years plus up to an additional 12 months allowed to complete improvements.

- Mixed purpose loans may result in a blended maturity date.

Read Also: Usaa Vehicle Loan Rates

How Does The Sba 7 Loan Differ From The Sba 504 Loan

Another option for real estate and land loans is the SBA 504 loan program. Compared to the SBA 7 loan, the SBA 504 loan:

-

is a larger loan, with a minimum of $125,000 and a maximum of $20 million

-

has a fixed interest rate

-

has a 20-year maturity rate for real estate and land and

-

requires a 10% borrower down payment.

You must also get an SBA 504 loan from a Certified Development Company rather than from a bank or traditional lending institution.

Look For The Appropriate Sba Lender

Gathering all the requirements and having down payment is one part of the equation. Finding the SBA lender that will cater to your business needs can be quite challenging since SBA lenders who offer loans to startups are limited. Plus, most lenders dont advertise whether they work for startups or not.

One good way of finding the right lender for your business is to use a broker or a consulting company that has a proven track record of working with SBA lenders. They would know which firms you can work with based off of your industry and your financial profile. Theyre capable of matching you with someone more likely to fund your loan.

Also Check: 84 Month Auto Loan Usaa

Buying A Business / Financing Goodwill

The 7a can be used to buy a business. Typically, the max loan is 10 years if just financing goodwill / blue sky / intangible assets. If there is some long life equipment included then longer term amortizations are possible, and if commercial property is included the loan term could be as long as 25 years as the rules for the SBA 7a allow for a 25 year amortization if the largest percentage of the use of proceeds for the loan is for commercial real estate.

Borrowing More than $5 million

Typically the maximum 7a loan will be $5 million whether the loan is for a business purchase, refinance, property purchase , but it is possible for very especially strong transactions to borrow more than $5 million as there are a few lenders who offer a second mortgage that they will put behind a first position SBA 7a loan. This does not happen very often, but it is a possibility for the right type of transaction, although it could require that the borrower put up/have additional collateral.

Recommended Reading: Are There Student Loan Forgiveness Programs

Benefits To The Lending Agency

A guarantee makes accepting a small business loan a sound financial decision for a lending agency. Simply put, the loan institution can count on at least the guaranteed percentage returning to them.

More so, the guarantee allows the lender the chance to build out a bigger and more diverse portfolio they can rely on for profits.

Read Also: What Loan Options Are Strongly Recommended For First Time Buyers

Sba 7 Loan Rates And Fees

Like any other business loan, 7 loans aren’t free under normal circumstances anyway. Right now, the SBA has special provisions in place to make cheap, forgivable loans to small businesses in response to the coronavirus. But, under normal circumstances, there are charges to get 7 loans in the form of both interest rates and fees.

Business Services And Office

If your company has fewer than 500 employees, the SBA 7 can boost your resources for day-to-day operational costs, expansion, inventory needs, and even refinancing debt when you can’t get funding through normal channels. The SBA also focuses on boosting female business owners, since the lack of financing for female entrepreneurs has been identified as a huge problem. SBA 7 loan for office-based companies can be used for anything from buying or leasing office space, to purchasing equipment, and even meeting payroll expenses.

Recommended Reading: Car Loan Interest Rates Credit Score 650

What Are The Differences Between An Sba 504 And 7a Loans

An SBA 504 loan is commercial real estate financing for owner-occupied properties. These loans require only a 10 percent down payment by the small business owner and funding amounts range from $125,000 to $20 million.

On the other hand, SBA 7a loans can be used to buy a business or obtain working capital. The maximum loan for an SBA 7a loan amount is $5 million.

A 504 loans interest rate is fixed, and no outside collateral is required. Also, fees are lower compared to a 7a loan.

Currently, 504 loans are amortized over 20 years, and as of April 2018 they began accepting applications for 25-year term SBA 504 loans.

The interest rate on a 7a loan, however, can be adjustable and tied to the prime interest rate. Collateral is required, at 90 percent. These loans are amortized over 25 years.

Heres some history and more specifics on each program: The SBA 504 loan program was designed for small businesses to finance commercial real estate or large equipment for use in business operations.

The 7a loan program was originally designed for higher-risk loans for things like the acquisition or starting of a business, working capital, or furniture and fixtures and leasehold improvements.

You May Like: Who Can Qualify For An Fha Loan