Estimate Your Student Loan Payment

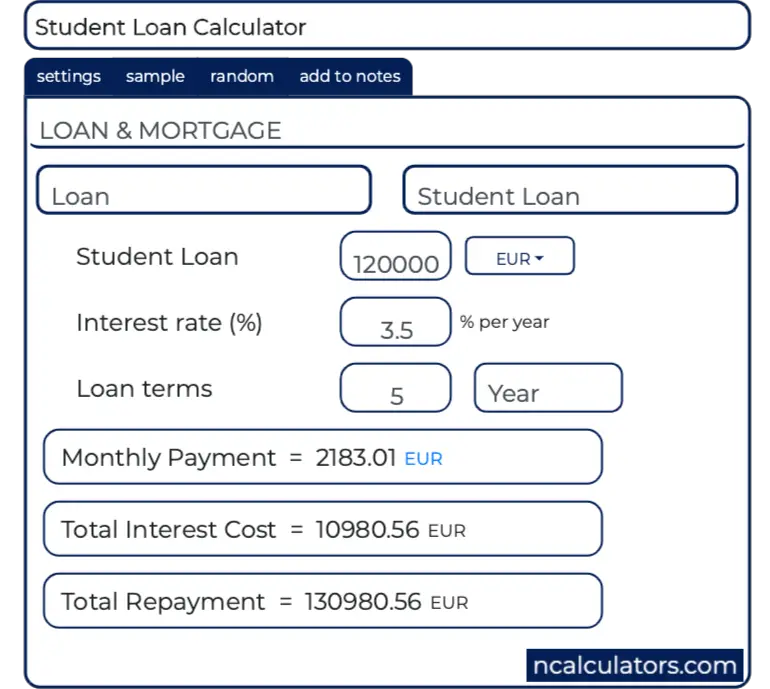

Estimate your student loan payments under a standard repayment plan using the calculator below.

- This is only an estimate! Your actual payment amount is determined by your loan holder based on the amount that you borrowed. However, most student loan programs require at least a $50 payment each month, no matter how small your loan amount.

- Your interest rate depends on your loan type and when you received the loan. for a chart with Direct Loan interest rates.

- The calculator is preset to 120 months and an interest rate of 6.8 percent. You may adjust these.

- It is recommended that your student loan payment be less than 8 percent of your gross income. The minimum salary field is based on this recommendation.

- If you have not made payments while in school or during your grace period, you may have capitalized interest Accrued interest that is added to the principal of your loan that will be added to the principal amount of your loan. This amount should be included in the principal amount in the calculator below in order to give a more accurate estimate of the loan repayment information.

Enter your Principal Amount of Loan, Simple Interest Rate, and Number of Monthly Payments.

Pay Off In 6 Years And 2 Months

The remaining term of the loan is 9 years and 10 months. By paying an extra $150.00 per month, the loan will be paid off in 6 years and 2 months. It is 3 years and 8 months earlier. This results in savings of $4,421.28 in interest payments.

If Pay Extra $150.00 per month

| Remaining Term | 6 years and 2 months |

| Total Payments |

| 9 years and 10 months |

| Total Payments |

| $11,188.54 |

Other Student Loan Calculators

Student loan payoff calculator: Use this calculator to find your debt-free date, and see how extra payments can speed that up.

Student loan refinance calculator: Use this calculator to compare your current loan payment or multiple payments with a refinanced student loan.

Student loan consolidation calculator: Use this calculator to compare your payments under federal loan consolidation plans with your current bills.

Daily student loan interest calculator: Use this calculator to estimate the amount of interest that your loan accrues daily and between payment periods.

Student loan affordability calculator: Use this calculator to determine an affordable monthly student loan payment and how much that allows you to borrow.

Discretionary income calculator: Use this calculator to determine what you would pay under federal income-driven repayment plans.

Weighted average interest rate calculator: Use this calculator to determine the combined interest rate on all your student loans. Youll need that average to estimate your loan payments under federal loan consolidation programs or to compare student loan refinancing offers.

About the author:Anna Helhoski is a writer and NerdWallet’s authority on student loans. Her work has appeared in The Associated Press, The New York Times, The Washington Post and USA Today. Read more

Also Check: How Do I Refinance My Sallie Mae Student Loan

How Do I Refinance My Student Loans

If youre ready to refinance your student loans, follow these four steps:

Research and compare lenders. Be sure to compare as many lenders as possible to find the right loan for you. Consider not only interest rates but also repayment terms, any fees charged by the lender, and eligibility requirements.

Pick your loan option. After youve compared lenders, choose the loan option that best suits your needs.

Complete the application. Once youve picked a lender, youll need to fill out a full application and submit any required documentation, such as tax returns or pay stubs.

Manage your payments. If youre approved, continue making payments on your old loans while the refinance is processed. Afterward, youll start making payments on your new loan. You might also consider signing up for autopay so you wont miss any payments in the future many lenders offer a rate discount to borrowers who set up automatic payments.

If You Have A Plan 4 Loan And A Plan 2 Loan

You pay back 9% of your income over the Plan 4 threshold .

If your income is under the Plan 2 threshold , your repayments only go towards your Plan 4 loan.

If your income is over the Plan 2 threshold, your repayments go towards both your loans.

Example

You have a Plan 4 loan and a Plan 2 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Plan 4 monthly threshold of £2,114 and the Plan 2 threshold of £2,274.

Your income is £286 over the Plan 4 threshold which is the lowest of both plans.

You will pay back £25 and repayments will go towards both plans.

Don’t Miss: Loan Was Charged Off But Vehicle Was Never Repossessed

If You Have A Plan 4 Loan And A Plan 1 Loan

You pay back 9% of your income over the Plan 1 threshold .

If your income is under the Plan 4 threshold , your repayments only go towards your Plan 1 loan.

If your income is over the Plan 4 threshold, your repayments go towards both your loans.

Example

You have a Plan 4 loan and a Plan 1 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Plan 4 monthly threshold of £2,114 and the Plan 1 threshold of £1,682.

Your income is £718 over the Plan 1 threshold which is the lowest of both plans.

You will pay back £64 and repayments will go towards both plans.

Student Loan Projection Calculator

Use the calculator below to estimate the loan balance and repayment obligation after graduation. This calculator is mainly for those still in college or who haven’t started. Before estimating, it may be helpful to first consult our College Cost Calculator to get a rough idea of how much college may cost.

| To Graduate In |

| Do you pay interest during school years?Yes |

| Total Interest: | $23,234.95 |

You need to make $45,790 per year or more to repay the loan with less stress.

In the U.S., there are several types of student loan providers: government and private. Federal and state governments provide the lion’s share of student loans in the country and offer the considerable advantage of being subsidized. This means that students are not required to pay interest on their student loans while they are still considered students. Therefore, the cost of public, subsidized loans is lower than those offered by the private sector. As a matter of fact, federal student loans have some of the lowest interest rates around and do not require cosignatories, simply proof of acceptance to an educational institution. For these reasons, more than 90% of student debt today is in the form of federal loans.

Read Also: What Is Fha 203k Loan Program

Should You Refinance Student Loans During The Covid

This mainly depends on what type of student loans you have.

-

If you have private student loans, refinancing might get you a lower interest rate or reduced monthly payment , which could help you more easily manage your loans during the COVID-19 pandemic. Also keep in mind thatcurrent student loan refinance rateshave fallen dramatically, which means you might qualify for a much lower rate than what you have right now.

-

If you have federal student loans, its likely better to wait before consolidating with a private lender. Due to the pandemic, federals student loan payments and interest accrual have beensuspended during the pandemicthrough at least Sept. 30, 2021. If you refinance your federal student loans, youll lose access to this suspension as well as other federal benefits and protections, such as income-driven repayment plans and student loan forgiveness programs.

Learn more: When Student Loan Refi Is a Good Idea and When to Reconsider

How To Use Credit Karmas Student Loan Calculator

If youre applying for student loans or getting ready to start repaying your existing loans, Credit Karmas student loan calculator is a useful tool to have on hand. The calculator can help you determine how much your potential monthly payments will be and how soon you may be able to pay off your loans. Keep in mind, the calculator only provides an estimate based on the information you provide. The calculator cant account for additional factors like fees or alternative payment plans.

Heres the information youll need to calculate your estimated monthly student loan payments.

Read Also: What Is Chfa Loan Colorado

Applying For Federal Financial Aid

The process for obtaining federal financial aid is relatively easy. You fill out a single form, the Free Application for Federal Student Aid and send it to your schools financial aid office. Then they do the rest. The FAFSA is your single gateway to Stafford loans, Perkins loans and PLUS loans. Many colleges also use it to determine your eligibility for scholarships and other options offered by your state or school, so you could qualify for even more financial aid.

There is really no reason not to complete a FAFSA. Many students believe they wont qualify for financial aid because their parents make too much money, but in reality the formula to determine eligibility considers many factors besides income. By the same token, grades and age are not considered in determining eligibility for most types of federal financial aid, so you wont be disqualified on account of a low GPA.

What Do I Need To Qualify For Student Loan Refinancing

The requirements to qualify for refinancing can vary by lender. However, there are a few common eligibility criteria youll likely come across, including:

-

Good credit: Youll typically need good to excellent credit to qualify for refinancing a good credit score is usually considered to be 700 or higher. While some lenders offer refinancing for bad credit, these loans generally come with higher interest rates compared to good credit loans.

-

Verifiable income: Some lenders have a minimum required income while others dont but in either case, youll likely need to provide documentation showing proof of income.

-

Low debt-to-income ratio: Your debt-to-income ratio is the amount you owe in debt payments each month compared to your income. Lenders typically like to see a DTI ratio of 50% or below though keep in mind that some lenders might require lower ratios than this.

-

Loan information: The lender will need information regarding each of the student loans you want to refinance, such as loan balances, your current lenders, and what schools you attended.

If youre struggling to get approved for refinancing on your own, consider applying with a cosigner to improve your chances. A cosigner simply needs to be someone with good credit such as a parent, other relative, or trusted friend whos willing to share responsibility for the loan.

Even if you dont need a cosigner to qualify, having one could get you a lower interest rate than youd get on your own.

Read Also: How To Apply For Federal Student Loan Forgiveness

Consider Deferment Or Forbearance

If youre experiencing difficulties affording loans in the short termwhile recovering from an injury, for example, or during a few months break in employmentyou can apply for deferment or forbearance through your loan servicer. You wont be required to make payments during this time. The main difference between the two is in the fact that subsidized federal loans do not accrue interest during periods of deferment, while all loans accrue interest in forbearance.

Private loans generally refer to a pause in payments as forbearance, rather than deferment, and in nearly all cases, interest will accrue.

Student Loan Repayment Options

It is not uncommon for new graduates to struggle to repay their student loans. Unfortunate circumstances such as flaccid job markets or recessions can exacerbate situations. For federal student loans, there are some alternative solutions that can aid in dwindling down student loan payments. Income-based repayment plans can potentially cap the amount that students repay each month based on available income if they find that their student loans become increasingly harder to pay off. These plans prolong the life of the loans, but they relieve the burden of large monthly payments. There are also graduate repayment plans that slowly ramp up monthly payments over time, presumably in conjunction with projected salaries as people progress through their careers. Extended graduated repayment plans allow borrowers to extend their loans for up to 25 years. For some income-linked plans, in the end, the remaining balance may be forgiven, especially for those in public services.

The major repayment plans for federal student loans are listed below.

| Plans | |

| Low-income borrowers with Federal Family Education Loans | No |

* Loan forgives tax-free after 120 qualifying loan payments for these in public services. It is not income tax-free and only forgives at the end of the loan term for others.

Recommended Reading: Why Are Home Equity Loan Rates Higher Than Mortgage Rates

What Are The Requirements For A Student Loan

Youll need good credit and a steady strong income to qualify for a private student loan. Different lenders have different standards, but most ask for a credit score of at least 640 and earnings of at least $24,000 per year.

If youre not quite there yet, applying with a cosigner will seriously increase your chances of private student loan approval. Your cosigner will need to meet the requirements and agree to take responsibility if you cant repay your loan. Many lenders offer cosigner release after you make a certain number of on-time payments.

Use Your Results To Save Money

If you have unsubsidized or private student loans, you can lower your total to repay by making monthly interest payments while youre going to school. Or, you may opt to make a lump sum payment of the total interest that accrues before repayment begins. Either method will prevent the interest that accrues from being capitalized. The result: a lower monthly bill amount.

You can submit more than your monthly minimum to pay off your loan faster. The quicker you finish paying your loans, the more youll save in interest. Learn how to pay off your student loans fast.

If youre having trouble making payments on your federal loans, you can extend the term to 20 or 25 years with an income-driven repayment plan. Income-driven plans lower your monthly loan payments, but increase the total interest youll pay throughout the life of your loan.

Private lenders may allow you to lower monthly payment temporarily. To permanently lower monthly payments youll need to refinance student loans. By doing so, you replace your current loan or loans with a new, private loan at a lower interest rate. To qualify youll need a credit score in the high 600s and steady income, or a co-signer who does.

Also Check: Which Bank Gives Lowest Interest Rate For Home Loan

Whats The Difference Between Student Loan Refinancing And Student Loan Consolidation

Refinancing and consolidation are both ways to combine student loans. However, they mean something different for federal and private student loans. Heres how it breaks down:

-

Federal student loan consolidation: If you have federal student loans, you can consolidate them into a federal Direct Consolidation Loan. The interest rate on a Direct Consolidation Loan is the weighted average of the loans you consolidated. You also have the choice to extend your repayment term up to 30 years.

-

Private student loan refinancing: Private student loan consolidationand refinancing refer to the same process paying off your old loans with a new private loan. Through refinancing, you might be able to get a lower interest rate or extend your term to reduce your monthly payment. Remember that you can consolidate both federal and private student loans, but doing so will cost you access to federal benefits and protections.

Learn more: Student Loan Consolidation vs. Student Loan Refinancing

How To Use This Calculator

Youll get the most accurate results if you enter your loan amounts separately with their precise interest rates, but you can also estimate or use the sample loan amounts and interest rate provided.

You may have a mix of federal and private loans. If you dont know how much you owe, search for your federal loans in the National Student Loan Data System or contact your private student loan lender.

This calculator assumes youll be paying monthly for 10 years once repayment begins, which is the standard term for federal loans and many private loans.

Enter the total amount you borrowed for each loan. You can enter up to three loans for each year youre in school, up to four years. Its possible to include 12 loans total.

Enter the interest rate for each loan amount. Your interest rates will vary depending on whether your loans are federal or private, the year you borrowed and, in some cases, your credit score. Check with your federal loan servicer or your private lender to find out your interest rate.

Interest will accrue daily on unsubsidized federal and private loans while youre in college. The total amount accrued will capitalize and be added to your total loan amount when repayment begins. During repayment, interest will continue to accrue and will be included as part of your monthly bill amount.

Select Yes if you have a subsidized federal loan or No if you have an unsubsidized federal loan or a private loan.

Recommended Reading: What Is Personal Loan Used For

Can You Refinance A Student Loan More Than Once

Yes, theres no limit to how often you can refinance a student loan. For example, you might choose to refinance again if your credit score has improved and you can get a better rate. Or you might refinance again to extend your repayment term and reduce your monthly payment.

Learn more: How Often Can You Refinance Student Loans?