Can I Sell My Car With A Loan

It is possible to sell your car with an outstanding loan, but you may have to go through a few extra steps. If your car is worth less than what you currently owe on the loan, you have what’s known as negative equity meaning you may need to pay the difference out of pocket or refinance the remaining amount with a different type of loan.

If your car is worth more than what you currently owe, on the other hand, you may be able to pocket the difference in cash when you sell the car. Whatever your situation, reach out to your lender about your options, as each lender sets different rules for selling a car with a loan.

Compare Auto Loan Rates In August 2022

- Auto Loan Rates

- Wide range of repayment options

Cons

- Good to excellent credit required

- No prequalification offered

Who this lender is best for: Lightstream is best for those looking to finance their vehicle as soon as possible and prefer a fully online experience.

Impact on financial wellness: You will undergo a hard credit check following application submission you cannot prequalify to check your rates ahead of applying.

Time to receive funds: Funds become available as soon as the day you apply.

Fees: Lightstream has no fees.

Additional requirements: While credit requirements are not disclosed, the most competitive rates will only be offered to those with excellent credit.

Special features: Repayment terms ranging from 36 to 84 months and the ability to borrow as much as $100,000.

| LENDER |

|---|

- Discount for members only

- High minimum loan amount

Who this lender is best for: Best if you intend to finance your vehicle via a dealership rather than fully alone. To receive the most competitive rates, it is also best for those that hold an account with Bank of America.

Impact on financial wellness: Following the application, you can expect a hard credit check.

Time to receive funds: Funds will become available as soon as the same business day.

Fees: You can expect to pay title and state fees in some states

Additional requirements: Bank of America requires that the car you’re financing be no more than 10 years old, with no more than 125,000 miles and valued at no less than $6,000.

Negative Capital One Auto Finance Reviews

Naturally, not everyone has a great experience with Capital One Auto Finance. Here are two Capital One Auto Finance reviews that speak to some potential pitfalls of the company:

I refinanced my vehicle back in October 2020 and to this day have not received my title. Upon moving to Florida, I had to call and request my title and was told 49 days, and its past 90 days, and Im still being told its coming. I have been trying to make a corporate complaint, and it has gone .

Robert G. via BBB

After paying on my car loan in a timely manner and paying it off early, lost my title by being cheap and using first-class mail. They now are forcing me to get a duplicate title and any fees associated with the replacement.

John D. via Trustpilot

One rule of thumb for customer reviews is that as a company grows, it will receive more complaints. With Capital One among the 10 largest banks in the U.S., Capital One Auto Finance reviews are mixed.

Capital One is a BBB-accredited business and carries an A rating from the agency, but customers on the BBB website give it 1.1 out of 5.0 stars based on more than 750 Capital One Auto Finance reviews. The BBB has fielded over 7,400 complaints against Capital One in the past three years. On Trustpilot, the bank has a 1.3 out of 5.0-star rating average from more than 1,000 Capital One Auto Finance reviews.

Don’t Miss: How Much Can I Get Approved For Va Home Loan

Can I Get Pre

Less than excellent credit need not prevent you from receiving a car loan pre-approval. The reviewed auto lenders all share a commitment to work with consumers of every credit type, including those with bad credit or no credit at all.

Lenders can risk bad credit loans because of several reasons. The most important is that a financed vehicle serves as collateral for the loan.

Unlike a personal loan, if you miss payments, the dealer is likely to repossess the car. However, a personal loan is usually harder to get.

In addition, a dealer may require a down payment and a higher-than-average annual percentage rate on the loan. It may ask a borrower to follow a weekly or bi-weekly automatic payment schedule and may even require the borrower to visit the dealership and pay in person.

Alternatively, you may have to set up a direct deposit schedule with the dealer. A direct deposit is an electronic loan payment from your bank account to the recipients.

You may have to accept a longer loan term than you had planned a car loan term can be as long as eight years although a shorter auto financing term may be possible.

Your income is a determining factor for any pre-approved car loan. Most lenders set a minimum threshold for monthly income for prequalification that will allow you to afford the monthly payment amount.

What Are Car Loans And How Do They Work

Auto loans are secured loans that use the car youre buying as collateral. Youre typically asked to pay a fixed interest rate and monthly payment for 24 to 84 months, at which point your car will be paid off. Many dealerships offer their own financing, but you can also find auto loans at national banks, local credit unions and online lenders.

Because when you finance a car its a secured loan, they tend to come with lower interest rates than unsecured loan options like personal loans. As of July 27, 3033, the average APRs according to a Bankrate study are the following.

Recommended Reading: Can I Refinance Sallie Mae Student Loan

How Much Can You Borrow

Using Capital One Auto, you can choose to apply for either a joint or a single loan. This will help cover the costs of a new or used vehicle.

With new car loans, you can borrow between $4,000 and $50,000 from Capital One to finance the vehicle.

If you decide to purchase a used car, the vehicle must be no more than 7 years old and has to have fewer than 120,000 miles. Be sure to factor in the trade-in value of your former car if this case applies to you.

There are a few states in which the vehicle year can be 10-12 years old.

Capital One Auto Finance Review Auto Loan

How Do I Qualify? How Do I Qualify? Our Auto Navigator tool allows us to check if you pre-qualify for financing without impacting the credit score. How

CapitalOne would have highlighted this option to you to get you into a lower interest rate when you got pre-qualified during your application process for your

Hard Vs Soft Credit Inquiries. CAPITAL ONE BANK, TARGET PRE-APPROVED CAR LOANS, AUTO FINANCE NEWS The Homework Guy, Kevin Hunter.

Capital One auto and car financing is available at Ocean Honda, sit down with a credit specialist and get pre-approved for an auto loan today.

Recommended Reading: Which Loan Has The Highest Interest Rate

What Does Auto Navigator Show

Auto Navigator clearly shows various specifications of vehicles like the model, mileage, kilometers covered, etc. from its inventory. It also indicates payment options so that you can plan your expenses and savings accordingly before deciding to buy your dream car. It shows monthly payment amount, APR, and other personal terms so that there is transparency in the selected offer.

What Credit Score Is Needed To Buy A Car

There is no official one-size-fits-all credit score needed to buy a car. Instead, each lender sets its own criteria, so there may be different cutoff points for different lenders.

That said, its definitely easier to get approved for a car loan if you have a good credit score. The lower your credit score, the harder it may be to find a lender, and if you do, youll usually pay a lot more for financing. Thats why most people who end up taking out an auto loan have a good or excellent credit score.According to Experians State of the Automotive Finance report from the second quarter of 2021, heres how many people got car loans within the different credit score ranges:

| Deep subprime | 1.98% |

The lower your credit score, the lower your chances of you being able to buy a car. If your credit score needs a lot of work, it may be hard to find a lender who will approve you for a car loan.

Recommended Reading: How To Find Out How Much Student Loan You Owe

How To Use Capital One

The best way to register would be to visit your local branch of the bank and talk to the agent about opening an account and sending money internationally. That way, you will get all of the necessary and up to date information. There is an attractive account offer 360 accounts, which seems like a good option to handle your money online.

Recommended Reading: How Long For Sba Loan Approval

Choose Your Vehicle Or Dealership

The first step to getting a Capital One auto loan is to browse the Auto Navigator site for vehicles and dealers in your area. If you narrow your choices down to a single vehicle, you can get prequalified right on that page for an auto loan. You can also simply view dealership inventory in your area and find out which dealers work with Capital One.

Read Also: Refinance Conventional Loan

Recommended Reading: What Is The Ppp Loan Forgiveness

How Do I Get Pre

All the auto lenders featured in this review offer an instant pre-approval decision when you complete a short loan request form or answer a few online questions. An auto loan pre-approval is a necessary step toward getting you the loan you want, although it doesnt guarantee final approval.

Note that you can also fill out a loan application for a pre-approved loan at a financial institution like your online banking branch or local credit union. You will have to join the credit union before starting the car buying process.

Before receiving your loan, youll have to fill out a more extensive credit application and likely submit to a hard inquiry of your credit. A hard credit pull can temporarily cause your credit score to drop by five to 10 points, but the effect wears off within one year.

Capital One Auto Finance Application Process

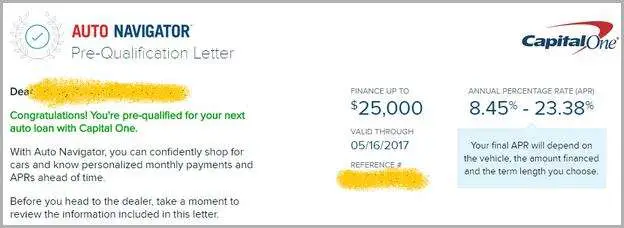

While you can apply for pre-qualification online, youll need to apply for a car loan through a participating dealership. You can bring your pre-qualification letter with you to streamline this process. Remember, its good for 30 days.

When you officially apply for a car loan through a dealership, Capital One will run a hard credit inquiry and give you your official financing terms.

Dont Miss: Gustan Cho Mortgage Reviews

Read Also: What Is The Fha Loan Limit In Maricopa County

Re: Denied After Preapproved

I am afraid you likely made some mistakes here. First never drive the car off the lot unless you have financing you can live with, I doubt you can live with 18% and the reality is by taking the car off the lot you took away all of the incentive for the dealership to get you a better rate. I would suggest working directly with Capital One and also work with a credit union. You don’t post any credit vitals so its tough to say what your options are but with rare exception a credit union will give you the best rates. DCU is one of the favorites here but of course every community has a credit union and many of them are excellent to work with. I think you will have to take the initiative to get a better APR because the dealership has no incentive to do anything for you.

How Auto Navigator Works

I filled out some basic information and Capital One pre-approved a loan limit before I began shopping. This gave me the confidence that I could be flexible and not stuck negotiating small points to get to a set monthly payment or price. And, it was not a hard credit approval which dings your credit score if I changed my mind or went with another lender my credit would be unaffected.

I was able to weigh the terms of different loan lengths in the app I could see and adjust the downpayment, trade in value, price of the car, interest rate and loan length of 4 year, 5 year or 7 year loan and pick the one that was the best fit for me. 7 year loans are the max that Capital One will finance, but 4 or 5 are best longer loans will have you owing money on a car that is worth less than your loan iswhich is financially unhealthy.

One great feature in the Capital One Auto Navigator is that you can shop from dealers that accept the loan.

Read Also: What Kind Of Loan Can I Get For Home Improvements

Capital One Auto Loan Availability

You cant use a Capital One auto loan for just any vehicle on the market. Once you get prequalified with Capital One, you can shop from 12,000 dealerships nationwide. These dealers are part of the Capital One Auto Navigator network. The Auto Navigator buying service allows you to browse the inventory of dealerships in your area.

Your Capital One auto loan is only finalized when you visit a dealership. So, you may not know the exact APR and payment amounts until you visit a dealer in person. You can only prequalify online, not start the official loan.

How Capital One Auto Navigator Works

For auto purchase financing, Capital One Auto Navigator enables car buyers to shop for a car and apply for a pre-qualified loan offer on its website or through a downloadable mobile app. New and used car financing is limited to one of more than 12,000 dealerships available on the Capital One Auto Navigator tool. Car buyers request pre-qualified offers for the specific vehicles they are interested in and can try different payment scenarios by adjusting factors like down payment amount or term length.

After pre-qualifying online for a Capital One Auto Finance loan, car buyers take their saved offer to the dealership, where application paperwork is completed and a hard credit inquiry is done. Dealers may also provide offers from other lenders at this point, and car buyers are free to go with the best loan available.

You May Like: Can Student Pay Parent Plus Loan

Capital One Auto Loan Rates

With Capital One, lenders set their own requirements. The companys lowest rates are only available to potential borrowers with good or excellent credit scores. In general, the best rates are available to those with a FICO score of 690 and up. Borrowers with fair or bad credit will not qualify for the lowest auto loan interest rates offered by the company.

Your max loan amount and APR depend on the following factors:

- Term length

- Income

Capital One Auto Loans Review Lendedu

Capital One offers new and used auto financing. The website allows you to pre-qualify, individually or jointly, for an auto loan based on

Capital One Auto Finance Company capital one car loan Capital One Preapproved Auto Loan capital one car loan Welcome to our Capital One Pre-Approval

Applying for a car loan is easy with Benton Nissan of Hoover thanks to our convenient online application. Contact our experts for more information.

Also Check: Can You Get An Fha Loan If You Owe Taxes

Capital One Auto Financing Restrictions

Certain brands and types of vehicles arent eligible for a Capital One auto loan. These include:

- Oldsmobile

- Vehicles with a history of chronic malfunctions

- Branded title vehicles

- Lease buyouts

There is also a vehicle age restriction for Capital One auto loans. For purchase loans, vehicles must be model years 2010 or newer with fewer than 120,000 miles. Refinancing loans are only available for vehicles up to seven years old that have an established resale value.

How Capital One Auto Loans Work

Capital One auto loans are only available at certain dealerships. While this lender does have a wide array of dealers available, theres no option for other financing for private party purchases, and this could limit your ability to purchase from some independent dealerships. Information on dealers that work with this lender is available on Capital Ones website, and is worth checking out in advance if you want to work with a certain dealership or find a specific vehicle.

Loan terms range from 24 to 84 months and loans are available in the contiguous 48 states.

Other requirements include:

- A minimum income between $1,500 and $1,800 a month, depending on credit

- A minimum financing amount of $4,000

- Used vehicles must be model year 2011 or newer and have less than 120,000 miles. However, Capital One states that financing may be available for vehicles model year 2009 or newer and with 150,000 miles.

A Capital One auto loan might be for you if you have a nonprime or subprime credit score. In these credit categories, borrowers may be rejected by many lenders or offered high interest rates.

Capital One works with borrowers with credit scores as low as 500. Auto loan interest rates at Capital One tend to start lower than the typical interest rates, and could help people in this credit category get lower interest rates, too.

Recommended Reading: What Size Mortgage Loan Can I Qualify For