How Long Does Pre

A mortgage pre-qualification letter normally doesn’t have an expiration date. Unlike pre-approvals, which can last up to 90 days, apre-qualificationis good until your financial circumstances change. Essentially, a pre-qualification is an optional first step you can take before obtaining amortgage pre-approval.

How We Calculate Your Home Value

Mortgage data: We use current mortgage information when calculating your home affordability.

Closing costs: We can calculate exactly what closing costs will be in your neighborhood by looking at typical fees and taxes associated with closing on a home.

Homeowners insurance: We assume homeowners insurance is a percentage of your overall home value.

Debt-to-income threshold : We recommend that you do not take on a monthly home payment which is more than 36% of your monthly income. Our tool will not allow that ratio to be higher than 43%.

Mortgage Type: The type of mortgage you choose can have a dramatic impact on the amount of house you can afford, especially if you have limited savings. FHA loans generally require lower down payments , while other loan types can require up to 20% of the home value as a minimum down payment.

…read more

| * Includes a $ required monthly mortgage insurance payment.Other Expenses |

| Accuracy Grade*=A |

Rent vs Buy

How Much House Can I Afford With An Fha Loan

To calculate how much house you can afford, weve made the assumption that with at least a 20% down payment, you might be best served with a conventional loan. However, if you are considering a smaller down payment, down to a minimum of 3.5%, you might apply for an FHA loan.

Loans backed by the FHA also have more relaxed qualifying standards something to consider if you have a lower credit score. If you want to explore an FHA loan further, use our FHA mortgage calculator for more details.

Conventional loans can come with down payments as low as 3%, although qualifying is a bit tougher than with FHA loans.

Also Check: How Much Construction Loan Can I Get

How Will My Debt

When you apply for a mortgage, lenders usually look at your debt-to-income ratio this is your total monthly debt payments divided by your gross monthly income written as a percentage.

Lenders often use the 28/36 rule as a sign of a healthy DTImeaning you wont spend more than 28% of your gross monthly income on mortgage payments and no more than 36% of your income on total debt payments .

If your DTI ratio is higher than the 28/36 rule, some lenders will still approve you for a loan. But theyll charge you higher interest rates and add extra fees like mortgage insurance to protect themselves in case you get in over your head and cant make your mortgage payments.

View Affordability From Two Perspectives:

- Your overallmonthly paymentswhich included household expenses,mortgage payment, home insurance, property taxes, auto loans and any other financial considerations

- How lenders determine what you can afford. Just like lenders, our Affordability Calculator looks at your Debt-to-Income Ratio to determine what home price you can afford.

Read Also: 10000 Loan No Credit Check

How To Vacation On A Budget

Theres nothing better than leaving town with your loved ones as you explore a new city or country. But going on vacation is more expensive than it used to be. The cost of travel, housing and meals out can put a major dent in your finances. You dont want to get to your destination and suddenly realize you dont have enough money to enjoy your trip. This is your time to relax. You shouldnt have to worry about every dollar you spend. Learn how to budget for your upcoming trip, so you can make the most of your time away from work.

How Does Your Credit Score Impact Affordability

Your credit score is the foundation of your finances, and it plays a critical role in determining your mortgage rate. For example, lets say you have a credit score of 740, putting you in the running for a rate of 4.375 percent on a loan for a $400,000 property with a 20 percent down payment. If your credit score is lower 640, for example your rate could be higher than 6 percent. In that scenario, the monthly payment to cover the principal and interest could be $300 cheaper for the higher credit score.

To find out your score, check your credit report at one of the big three agencies: Equifax, Experian and TransUnion.

Also Check: How To Transfer Car Loan From One Bank To Another

How Much Of A Down Payment Do You Need For A House

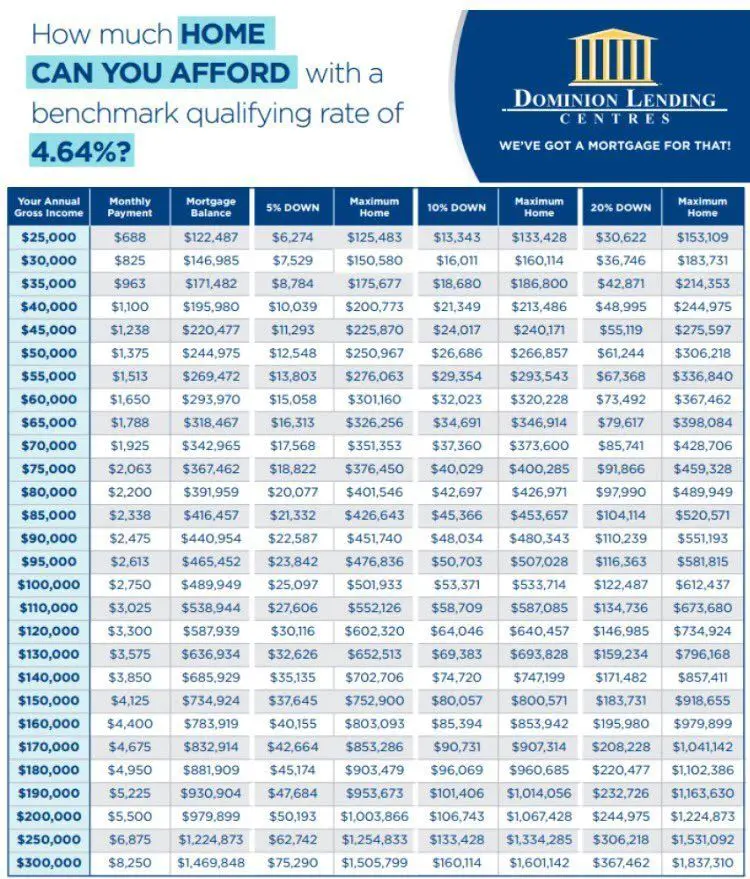

A 20% down payment is standard, if you can afford it. Though some mortgage loans may only require as little as 3.5 percent down, or none at all, a larger down payment will have a greater impact on your monthly mortgage payment.Your down payment effectively reduces the total amount of your home loan, which increases your home affordability estimate, and at the same time, decreases your mortgage payment each month. For example, below is a chart showing how a certain level of down payments, based on a percentage of the sale price, directly impacts your monthly mortgage payment :

| Percentage |

|---|

List out your expenses and then add them together to get your total monthly spending.

Three Homebuyers’ Financial Situations

| $0 | $185,000 |

House #1 is a 1930s-era three-bedroom ranch in Ann Arbor, Michigan. This 831 square-foot home has a wonderful backyard and includes a two-car garage. The house is a deal at a listing price of just $135,000. So who can afford this house?

Analysis: All three of our homebuyers can afford this one. For Teresa and Martin, who can both afford a 20% down payment , the monthly payment will be around $800, well within their respective budgets. Paul and Grace can afford to make a down payment of $7,000, just over 5% of the home value, which means theyâll need a mortgage of about $128,000. In Ann Arbor, their mortgage, tax and insurance payments will be around $950 dollars a month. Combined with their debt payments, that adds up to $1,200 â or around 34% of their income.

House #2 is a 2,100-square-foot home in San Jose, California. Built in 1941, it sits on a 10,000-square-foot lot, and has three bedrooms and two bathrooms. Itâs listed for $820,000, but could probably be bought for $815,000. So who can afford this house?

House #3 is a two-story brick cottage in Houston, Texas. With four bedrooms and three baths, this 3,000-square-foot home costs $300,000. So who can afford this house?

You May Like: Pay My Loan Citizens One

Summary Of Moneys Guide To Home Affordability

How much house you can afford depends mainly on two factors: your eligibility for a mortgage loan and your actual budget when it comes to paying a monthly bill, along with taxes and insurance. Remember these steps when youre getting ready to make your home purchase:

- Calculate your monthly debt and compare it to your gross income to get an idea of your DTI.

- Take into account other monthly expenses such as utilities and groceries.

- Save up for a down payment.

- Consider all your loan options, such as FHA and VA loans.

- Use a mortgage calculator to avoid any surprises.

What Is Private Mortgage Insurance

Mortgage insurance protects the mortgage lender against loss if a borrower defaults on a loan. Private mortgage insurance is required for borrowers of conventional loans with a down payment of less than 20%.PMI typically costs between .05% to 1% of the entire loan amount. If you buy a $200,000 house, your private mortgage insurance will cost roughly $2,000 annually or $14,000 over the course of seven years.Deciding whether or not PMI is right for you depends on a few different factors. Although PMI raises your monthly payment, it may allow you to purchase a home sooner, which means you can begin earning equity. Its important to speak to your lender about the terms of your PMI before making a final decision.

You May Like: 10000 Personal Loan Bad Credit

Do I Qualify For A Mortgage

A mortgage calculator can be helpful when estimating your home buying budget. But remember even if you can afford the monthly payments, you still need to qualify for a home loan.

To see if you qualify for a mortgage, a lender will check your:

- Borrowers with higher credit scores tend to have more loan options. But mortgages are secured loans, which means you dont always need stellar credit to qualify. Some lenders can approve FHA loans for borrowers with FICO scores as low as 580

- Loan-to-value ratio : LTV measures your loan amount against your new homes value. For example, borrowing $200,000 to buy a $200,000 home equals 100% LTV. Lenders can offer VA or USDA loans at 100% LTV, but not everyone is eligible for these programs. FHA loans cant exceed 96.5% LTV, which leaves 3.5% as the minimum down payment. Conventional loans can reach 97% LTV, meaning they allow a 3% down payment

- Home appraisal: A home appraisal identifies the homes value. Lenders wont approve loan amounts that exceed the homes value, regardless of the homes listing price or agreed-upon purchase price

- Personal finances: Lenders must verify your income to make sure you can afford the loan payments. Theyll check W-2s, bank statements, and employment records. If youre self-employed, a lender will likely ask to see tax records

You can ask for a mortgage pre-approval or a prequalification to see your loan options and real budget based on your personal finances.

Compare Top Va Purchase Lenders

Take the guesswork out of finding a VA Loan provider. Veterans United Home Loans created this site to educate and empower military homebuyers. Regardless of what lender you pick, it’s always a good idea to compare and know your options.

- NMLS #1907 Loading Reviews

- Veterans United ranks No. 1 in Customer Ratings for VA purchase lenders, according to ratings and reviews collected by TrustPilot.

- In 2021, Veterans United closed 68,763 VA Purchase Loans.

- Customer Ratings: Customer Ratings based on ratings and reviews provided by TrustPilot. VALoans.com is not affiliated with TrustPilot and has no control or influence on how users rate each lender.

- 2021 VA Loans: Total VA loan volume for fiscal year 2021 as reported by the Department of Veterans Affairs .

VALoans.com Advertiser Information

Read Also: How Much Loan Can I Afford Based On Monthly Payment

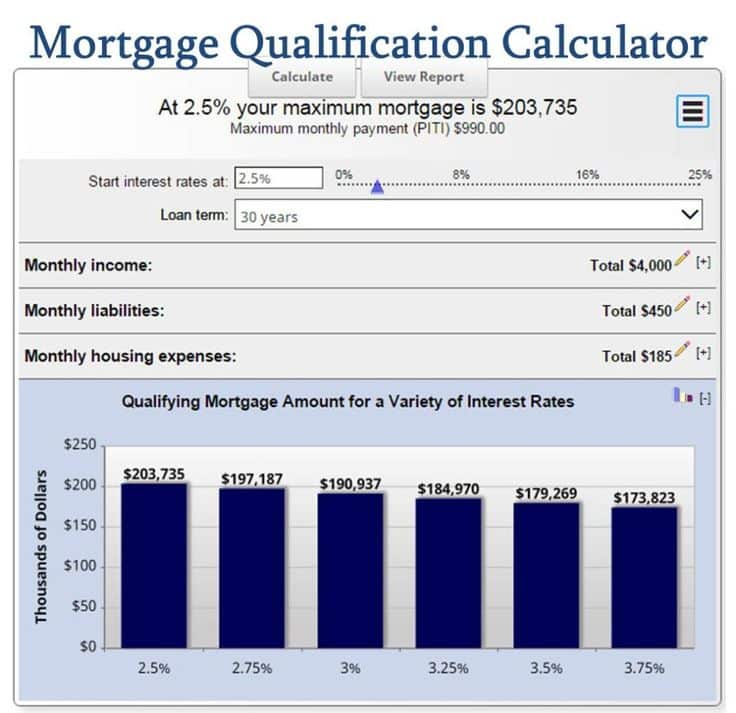

How To Interpret The Results

The calculator shows two sets of results:

Most lenders require borrowers to keep housing costs to 28% or less of their pretax income. Your total debt payments cant usually be more than 36% of your pretax income.

Some mortgage programs – FHA, for example – qualify borrowers with housing costs up to 31% of their pretax income, and allow total debts up to 43% of pretax income.

Use our Debt-to-income Calculator to find your DTI ratio and learn more about debts role in your home purchase.

A Home Affordability Calculator Doesnt Tell You:

- Whether the lender will approve you for financing at the sales price shown

- What your final mortgage interest rate or closing costs will be

- How much your payment might vary based on your actual credit score

The bottom line: While the home affordability calculator gives you an idea of what you might qualify for, youre better off getting a mortgage preapproval if youre looking for a dollar amount based on your unique financial circumstances.

MORTGAGE CALCULATOR TIP

Our calculator is pre-set to a conservative 28% DTI ratio. You can slide the bar up to an aggressive 50% DTI ratio to see how much more home you can buy. However, be sure your budget can handle the extra debt lenders dont look at expenses like utilities, car insurance, phone bills, home maintenance or groceries when they qualify you for a home loan. Lenders may also require a higher credit score, or extra mortgage reserves to cover a few months worth of mortgage payments, if the high payment becomes unaffordable.

Don’t Miss: How To Find Your Mortgage Loan Number

House Affordability Based On Fixed Monthly Budgets

This is a separate calculator used to estimate house affordability based on monthly allocations of a fixed amount for housing costs.

In the U.S., conventional, FHA, and other mortgage lenders like to use two ratios, called the front-end and back-end ratios, to determine how much money they are willing to loan. They are basic debt-to-income ratios , albeit slightly different and explained below. For more information about or to do calculations involving debt-to-income ratios, please visit the Debt-to-Income Ratio Calculator.

Because they are used by lenders to assess the risk of lending to each home-buyer, home-buyers can strive to lower their DTI in order to not only be able to qualify for a mortgage, but for a favorable one. The lower the DTI, the more likely a home-buyer is to get a good deal.

Why Affordability Matters

Unless you can pay cash for a house, youll rely on a mortgage lender to cover the expense. Youll then have to pay that lender for 15 or 30 years, depending on the terms you choose.

Read more: 15-year mortgages vs. 30-year mortgages: how to choose

As with any loan, mortgage lenders like to keep their risk low. Youll complete an application and wait for approval, and that approval will typically limit your loan to a certain amount. This limit is based on various factors, including your credit score and debt-to-income ratio .

But even if a lender says youre approved for a $500,000 or $1 million house, that doesnt mean you should go for it. You also need to look at what you can reasonably afford to pay each month.

Thats where the three rules of home affordability can help out.

Don’t Miss: How To Get An Rv Loan With Bad Credit

Bringing It All Together

As you can see, there are a number of factors that determine how large of a mortgage you can get. If you get access to your FICO score and crunch some numbers, you can get a rough idea of your borrowing capacity. You can also seek assistance from your bank or a mortgage broker.

All of this, however, still leaves one important question.

How Much Mortgage Can I Afford

Even though Martin can technically afford House #2 and Teresa can technically afford House #3, both of them may decide not to. If Martin waits another year to buy, he can use some of his high income to save for a larger down payment. Teresa may want to find a slightly cheaper home so sheâs not right at that maximum of paying 36% of her pre-tax income toward debt.

The problem is that some people believe the answer to âHow much house can I afford with my salary?â is the same as the answer to âWhat size mortgage do I qualify for?â What a bank is willing to lend you is definitely important to know as you begin house hunting. But ultimately, you have to live with that decision. You have to make the mortgage payments each month and live on the remainder of your income.

So that means youâve got to take a look at your finances. The factors you should be looking at when considering taking out a mortgage include:

- Private mortgage insurance

- Local real estate market

Plugging all of these relevant numbers into a home affordability calculator can help you determine the answer to how much home you can reasonably afford.

But beyond that youâve got to think about your lifestyle, such as how much money you have leftover for travel, retirement, other financial goals, etc. You might find that you donât want to buy the most expensive home that fits in your budget.

You May Like: Sofi Student Loan Refinance Rates

What Is Gross Monthly Income

Your gross monthly income is the sum of everything you earn in one month, before taxes or deductions. This includes your base monthly income and any additional commissions, bonuses, tips and investment income that you earn each month. To calculate your gross monthly income, take your total annual income and divide it by 12. If you’re hourly, you can multiply your hourly wage by how many hours a week you work, then multiply that number by 52 to get your annual salary. Divide your annual salary by 12 to get your gross monthly income.

Conventional Loan Max Dti

The maximum DTI for a conventional loan through an Automated Underwriting System is 50%. For manually underwritten loans, the maximum front-end DTI is 36% and back-end is 43%. If the borrower has astrong credit scoreor lots of cash in reserve, sometimes exceptions can be made for DTIs as high as 45% for manually underwritten loans.

| Automated underwriting |

|---|

| 41% |

Read Also: How To Pay Back Student Loan Debt