Va Loan Limits: No Maximum Loan Amounts In 2021

If youre a military servicemember or veteran, you may have access to a zero-down loan with no limit, as long as you qualify for the payment.

The Department of Veterans Affairs eliminated VA loan limits for most borrowers in 2020. That means first-time VA homebuyers, and others with their full entitlements, can borrow as much as lenders are willing to approve.

So the size of your VA loan now depends more on your financial credentials than on the local housing market.

VA loan limits still come into play for homebuyers who currently have VA loans and have partial entitlement available.

If youre a qualifying veteran, active-duty military servicemember, or an eligible surviving military spouse, now may be a great time to buy, with a shot at a 0% down mortgage and no loan limit on the type of home you can buy.

What Happens If You Foreclose On Va Loan

Borrowers who’ve lost a VA loan to foreclosure will have reduced VA loan entitlement, which will limit how much they can borrow without making a down payment. … Some borrowers may have some basic VA loan entitlement remaining, while others may be able to purchase again using their second-tier entitlement.

Why You Would Use A Va Loan If Your Home Costs More Than The Va Will Guarantee

There are several good reasons to apply for a VA loan. The first is that you may be able to buy a home with a lower down payment than you would with a conventional mortgage, unless you are willing to pay for private mortgage insurance , which may add a fairly substantial amount to your monthly payment.

Interest rates are another important factor in your decision. Because VA loans are guaranteed by the VA, they often have slightly lower interest rates than conventional loans .

That said, it pays to shop around. A mortgage is often the largest purchase you will ever make, and even a few decimal points on your interest rate can save you a substantial amount of money, or cost you thousands, over the life of your loan.

Don’t Miss: Fha Maximum Loan Amount Texas

Va Loan Limits For High

Below is the table for VA loan limits for a one-unit house for 2022. The VA bases these amounts on the county median home values reported by the Federal Housing Administration.

Note: For all counties not listed below, the limit is $647,200. See below the table for the regional loan centers physical and mailing addresses and contact information.

| State | |

| $970,800 | Roanoke |

Shop around to save thousands: As mentioned above, shaving a couple percentage points off your VA loan can save you thousands of dollars over the course of your loan. You can view our list of VA Loan providers to shop and compare interest rates.

What Is Va Loan Entitlement

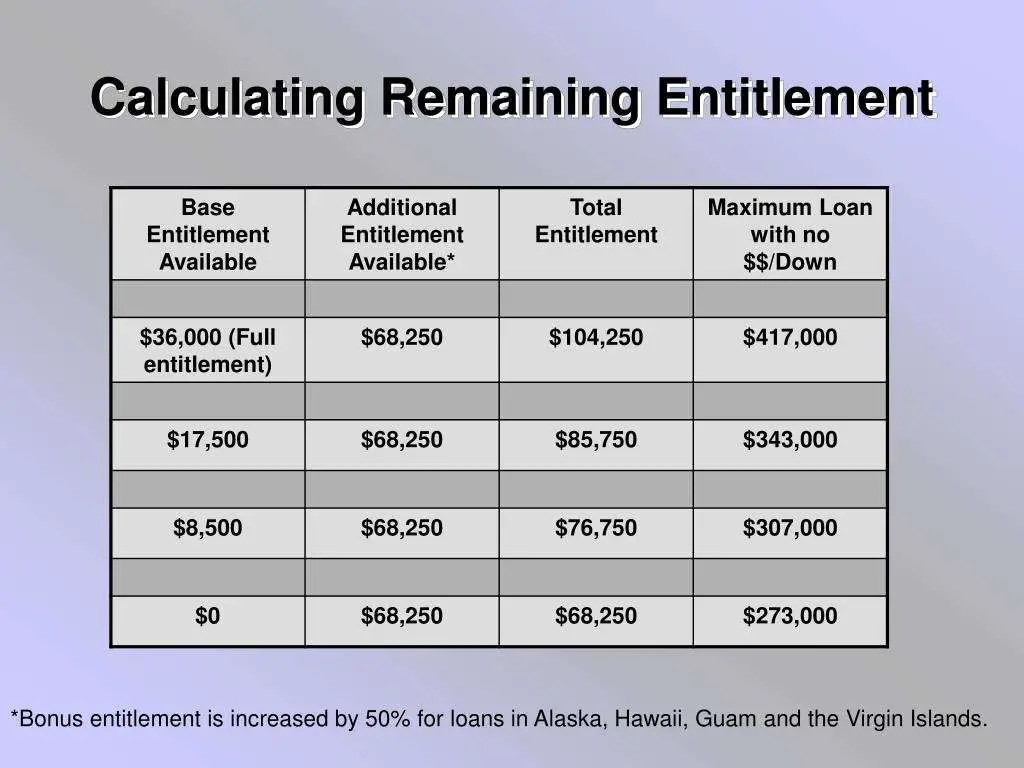

VA loan entitlement is the dollar amount the Department of Veterans Affairs will guarantee on each VA home loan and helps determine how much a veteran can borrow before needing a down payment. VA loan entitlement is typically either $36,000 or 25% of the loan amount up to the conforming loan limit.

You May Like: Is Homeowners Insurance Included In Fha Loan

You May Like: When Should I Refinance My Fha Mortgage

Is There A Minimum Credit Score For A Va Loan

It sounds weird, but the VA doesnt actually act as the lender for VA loans. Instead, they back the loans that conventional lenders like banks and credit unions supply to veterans. So although the VA itself doesnt have minimum credit requirements for a VA loan, the lender you work with on financing your home likely will have a minimum credit score in mind. Usually this hovers around the 620 markconsiderably lower than with a conventional loan.

Va Loan Requirements: Complete Guide To Eligibility

VA loans allow veterans, active military, and eligible spouses to get a mortgage with no money down.

Edited byChris JenningsUpdated January 5, 2022

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

VA loans are for qualifying military service members and eligible surviving spouses, and their biggest draw is that they allow you to buy a home with no money down.

With a VA loan, you also wont have to pay for private mortgage insurance. Instead, VA borrowers pay a funding fee at closing or roll it into their loan.

Heres what you should know about VA loans before you apply:

You May Like: Capital One Car Loan Apr

Basic Entitlement And Bonus Entitlement Together Are Enough For A Va Loan Of $417000 Or More

When added to basic entitlement, bonus entitlement gives eligible veterans enough VA backing for a loan of up to $417,000, or more in high-cost areas. A VA loan officer can help calculate the maximum mortgage loan amount for which the VA will provide its guarantee based on how much entitlement a borrower has available. As a rule of thumb, the maximum loan amount for loans over $144,000 is four times the amount of full entitlement. The calculation for full entitlement in most areas of the country looks like this:

- Basic entitlement is $36,000 x 4 = $144,000

- Bonus entitlement is $70,025 x 4 = 280,100

- $144,000 + $280,100 = $424,100

In some high-cost areas of such as California, New York, New Jersey and other states this calculation can be higher to give eligible veterans the potential to purchase a home in line with higher-priced housing markets.

Va Loan Bonus Entitlement

Bonus entitlement picks up where basic entitlement leaves off. For example, if you purchase a home for $700,000, you’ll use $175,000 in VA loan entitlement .Of the $175,000, $36,000 is basic entitlement, so $175,000 – $36,00 is $139,000 in bonus entitlement.

Those dollars figures may not mean a lot to first-time homebuyers, but those subsequently purchasing a home may need to pay closer attention.

You May Like: How Long Does The Sba Loan Take

What Is The Va Cap

VA Loan Limits for 2021. VA Loans are available up to $548,250 in most areas but can exceed $800,000 for single-family homes in high-cost counties. Loan limits don’t apply to all borrowers. Your VA loan limit or how much you can borrow without making a down payment is directly based on your entitlement.

Va Loan Limit Example

Lets assume youre currently using $60,000 of your VA loan entitlement and want to purchase a new home in a standard cost county . Because the VA guarantees a quarter of the loan amount, the maximum entitlement in this county is currently $161,800.

Heres how the typical VA loan limit calculations look:

- $161,800 – $60,000 in current entitlement = $101,800 remaining entitlement

- $101,800 remaining entitlement x 4 = $407,200

$407,200 represents how much you can borrow before needing a down payment.

In this example, you can purchase a home with $0 down up to $407,200. Anything above that mark would require a down payment equal to 25 percent of the difference between that ceiling and the purchase price.

Read Also: How To Get Approved For Capital One Auto Loan

Va Entitlement Codes And Certificate Of Eligibility

The Certificate of Eligibility is an important document that verifies your military service to lenders. At the top of your COE, youll see a two-digit VA entitlement code that tells lenders the nature of your military service. VA loan eligibility requirements vary based on the timing of when you have served for example, a Vietnam War Veteran would need 90 days active duty to qualify for a VA home loan, while a Veteran who served during peacetime would require 181 days or more of continuous service to qualify.

Wondering how to get your COE? The team at SoCal VA Homes can get it for you in a matter of seconds. If you see a VA entitlement code 05 at the top of your COE, this means that youve used a VA loan in the past and have since had your entitlement restored. For more information on VA entitlement codes and loan eligibility, see our COE page.

What Is A Va Loan

A VA loan is a type of loan backed by the U.S. Department of Veterans Affairs that helps veterans, service members and some eligible surviving spouses become homeowners. Although these loans are generally provided by private lenders like mortgage companies and banks, the VA guarantees a portion of the loan so that lenders can offer those who are eligible more favorable terms.

Also Check: Refinance Usaa Car Loan

What If I Want To Buy A House Thats Above The Maximum Va Loan In My County

If youve fallen in love with a house that tops the maximum in your area, dont despair. When you look up the VA loan limits in your county, the number you see wont tell you the maximum value of the home you can get with a VA loan. Instead, it tells you the limit of what you can get if you put $0 down.

If you have some money for a down payment, though, these limits might not apply to you. Got some money saved and want to buy a house thats over the VA loan limits? What you need is a jumbo loan.

How To Calculate Your Va Loan Limit Amount

If you dont currently have VA entitlement, your lender is the best resource for determining your maximum VA loan limit. However, if you want to crunch some numbers yourself, heres an example of how the calculations would work.

Well assume you want to buy a home with no down payment in a county with a county entitlement limit of $144,000 and have used $70,000 of your current entitlement.

| Subtract the maximum entitlement from the current entitlement | $144,000 – $70,000 = $74,000 |

| The result is your VA loan limit with no down payment | $296,000 |

In this example, the maximum loan you could get without making a down payment is $296,000 you would need a down payment for a more expensive home.

Recommended Reading: Is Loan Lease Payoff Worth It

Whats My Va Loan Limit

That depends. VA loan limits vary by county. In fact, within a single state the limit could differ by as much as $500,000 between counties. Limits are higher in wealthier counties where the cost of living is higher. In most places around the country, the current limit is $424,100. That applies to loans closed on or after January 1, 2017. But limits can top a million dollars in the most expensive counties.

How To Buy A House That Costs More Than The Maximum Va Loan Guarantee

If you do not have your full entitlement and want to use the VA loan to buy a house that costs more than $144,000, you may need to put make a down payment on the loan. The amount of the down payment will depend on your lenders policies, the cost of your home, the amount you are borrowing, your income, credit profile, debt-to-income ratio and other factors.

If you want to buy a home that costs more than the loan guarantee, you need to make a down payment, usually 25% of the amount above the VA loan limit.

For example, if you want to buy a home that costs $747,200 in a county with a loan limit of $647,200, you would likely need to make a $25,000 down payment .

Larger down payment may be a good idea: You can always make a larger down payment if you have the available funds, and there are some benefits to doing so. For example, a larger down payment reduces your outstanding balance on your home, reduces your monthly payments and reduces the amount of interest you pay over the life of the loan.

Additional loan costs to consider: You still may need to come up with the VA loan funding fee, which the VA charges for guaranteeing your loan. However, the funding fee may be waived for some disabled veterans. Alternatively, you can often roll the funding fee into your loan.

You May Like: Bayview Home Loans

How Does My County Loan Limit Affect Me

You may need to make a down payment if youre using remaining entitlement and your loan amount is over $144,000. This is because most lenders require that your entitlement, down payment, or a combination of both covers at least 25% of your total loan amount.

So if youre able and willing to make a down payment, you may be able to borrow more than the county loan limit with a VA-backed loan. Remember, your lender will still need to approve you for a loan. The lender will determine the size of loan you can afford based on your:

- Income

- Assets

We dont require a minimum credit score, but some lenders may have different credit score requirements. Be sure to contact more than one lender to compare.

Note: You may have heard the terms additional entitlement, bonus entitlement, or tier 2 entitlement. We use these terms when we communicate with lenders about VA-backed loans over $144,000. You wont need to use these terms when applying for a loan.

And Now For Some Final Words Of Advice

If you decide to work with a realtor, it’s a good idea to find one who is familiar with VA loans. As weve just covered, VA loans come with their own set of limits and complications and working with a real estate agent who doesnt know the system can make the homebuying process more of a headache.

Cultivate your credit. What do we mean by that? First, know what your credit score is now and then work on making your credit as good as it can be. That means paying off credit card bills in full every month you can afford to do so. And dont charge big purchases until after you close on your home to avoid setting off any alarm bells for your lender.

Dont be afraid to ask for help. Were not saying its as tough as basic training, but navigating the homebuying process can be pretty tough. Reach out to the VA and other veterans groups if you need to.

More from SmartAsset

You May Like: Usaa Personal Loan Credit Requirements

How Much Entitlement Does The Va Provide

Entitlement can be confusing for even the most experienced mortgage professionals. But it really just involves a bit of math. In most areas of the country, basic entitlement is $36,000. Additionally, secondary entitlement is $70,025. Adding those together gives you a total of $106,024 for eligible veterans. In higher cost areas, it may be even more.Additionally, the VA insures a quarter of the loan amount for loans over $144,000. Therefore, you can multiply that entitlement amount, $106,024, by four for a maximum loan amount of $424,100. Thats the total amount qualified buyers could borrow before having to factor in a down payment.

How To Apply For A Va Home Loan

Applying for a VA loan is different from applying for a conventional mortgage in that youll need to find a lender who knows how to process VA loans and you might find the process is smoothest if you choose a lender who specializes in them.

Youll also need to get a certificate of eligibility telling your lender youre eligible for the VA mortgage program and have an entitlement to use. You can have your lender pull your COE for you, or you can apply online or by mail.

Heres the documentation youll need to get your COE:

| Status | |

|---|---|

| Statement of service signed by your commander, adjutant, or personnel officer | |

| Current or former activated National Guard or Reserve member | Copy of your discharge or separation papers . |

| Current member of the National Guard or Reserves, and have never been activated | Statement of service signed by your commander, adjutant, or personnel officer |

| Discharged member of the National Guard and were never activated |

|

| Discharged member of the Reserves and were never activated |

|

| Surviving spouse | The Veterans discharge documents if available and other documents depending on if you’re receiving Dependency & Indemnity Compensation benefits. To see the full list of required documentation, . |

Recommended Reading: Avant Vs Upstart

What Document Does The Va Use To Determine The Amount Of A Veterans Entitlement

A Certificate of Eligibility , a required document in the VA loan application process, helps the lender calculate a potential military borrowers entitlement. VA entitlement refers to the amount the U.S. Department of Veterans Affairs would be willing to back for qualified VA-eligible borrower.

How Lenders Determine Loan Size

The private mortgage lender who issues your VA-backed loan will still base your loan size on your ability to repay the loan. Theyll look at several key factors:

- VA borrowers typically need credit scores of at least 580 to 620 to qualify, though some lenders have more flexible credit score requirements

- Income: Lenders must verify your income for the past two years to make sure you earn enough steady income to make your monthly mortgage payment

- Debt-to-income ratio : Your DTI reflects your current monthly debt payments to your monthly income. The lender will follow the automated underwriting response to help determine eligibility. The VA gives the lender discretion to approve borrowers at a higher DTI if they have other compensating factors.

Plus, some lenders may set their own maximum loan limit. So even if you can afford a $5 million VA loan, you may have a hard time finding a lender for that loan amount.

Although there are no VA home loan limits in 2021, your lender and personal finances will dictate how much you can borrow.

Not having a loan limit can provide you more flexibility as a borrower, since you dont need to worry about finding a home within the local limits.

Recommended Reading: What Loan Options Are Strongly Recommended For First Time Buyers