Save Save Save And Compare

While there are various schemes like help to buy in place to help you out, the best thing you can do if you want to buy a new property is, rather simply to save as much as you can and put as much as you can up front as a deposit.

Whatever your requirements, if you need a mortgage to help purchase your new property, compare mortgage quotes online to ensure that youre getting the best deals around.

Use our mortgage comparison service to get yourself a list of the cheapest quotes on the market so that you can move in as soon as possible.

Whats Behind The Numbers In Our Loan

This calculator helps you unlock one of the prime factors that lenders consider when making a mortgage loan: The loan-to-value ratio. Sure, a lender is going to determine your ability to repay including your , payment history and all the rest. But most likely, the first thing they look at is the amount of the loan youre requesting compared to the market value of the property.

An LTV of 80% or lower is most lenders sweet spot. They really like making loans with that amount of LTV cushion, though these days most lenders will write loans with LTVs as high as 97%.

Lets see how your LTV shakes out.

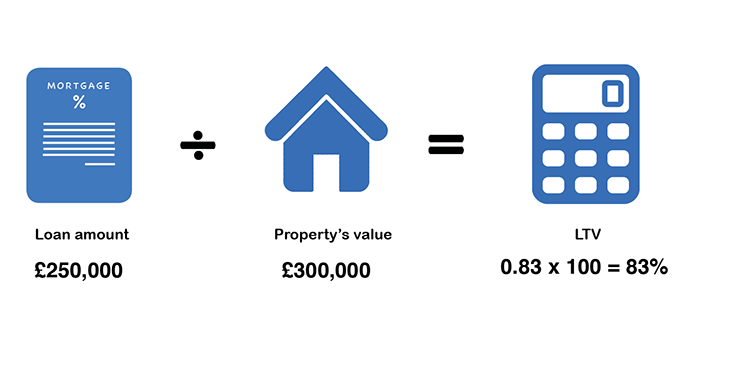

How To Calculate Ltv

To determine your LTV ratio, divide the loan amount by the value of the asset, and then multiply by 100 to get a percentage:

LTV = × 100

If you’re buying a house appraised at $300,000 and your loan amount is $250,000, your LTV ratio at the time of purchase is: x 100, which equals 83.3%.

In other words, the LTV ratio is the portion of the property’s appraised value that isn’t covered by your down payment. If you put 15% down on a loan that covers the rest of the purchase price, then the LTV is 85%.

Lenders and federal housing regulators are most concerned with LTV ratio at the time the loan is issued, but you can calculate LTV at any time during the loan’s repayment period by dividing the amount owed on the loan by the property’s appraised value. As you repay the loan, the amount owed decreases, which tends to lower LTV. If the value of your property increases over time, that also reduces LTV. But if the property’s value drops , that can push LTV higher.

When an LTV ratio is greater than 100%, a borrower is considered “underwater” on the loanthat is, when the market value of the property is less than the balance owed on the loan. LTVs greater than 100% are also possible early in the repayment period, on loans with high closing costs.

Don’t Miss: Usaa Refinance Auto Loan

Ltv Ratio And Home Loan Eligibility

Your eligibility for a home loan will be higher if the LTV ratio is lower. Your chances of getting better terms on your home loan, which included the interest rate, will also be enhanced if the LTV ratio is low. Your lender will inform you of the LTV ratio when you apply for a home loan and if it is towards the lower side, you can negotiate with the lender to offer you lower interest rates, longer repayment tenure, etc. Lower LTV ratios may fetch you lower home loan interest rates simply because the risk associated with lending to you is lower.

Max Ltv By Home Loan Type

- FHA loans go as high as 96.5% LTV

- Conforming loans go as high as 97% LTV

- USDA and VA loans go to a full 100% LTV

- Jumbos, cash-out refis, and investment properties are much more restrictive

- And there is no maximum LTV in many cases for streamline refinances

There are certain LTV limits based on home loan type, with conventional loans typically being more restrictive than government loans.

And mortgage refinance programs often less accommodating than home purchase loans.

At the moment, you can get an FHA loan as high as 96.5% LTV, which is just 3.5% down payment.

You can get a conventional loan as high as 97% LTV, which at just 3% down is higher than it used to be.

In recent history, the maximum was 95% LTV, but now Fannie Mae and Freddie Mac are competing directly with the FHA.

You can get either a VA loan or USDA loan at 100% LTV .

These are the most flexible loan programs LTV-wise, but they are also only available to veterans or those living in rural areas, respectively. So not everyone will qualify for these types of mortgage loans.

There are also proprietary home buying programs from various private mortgage lenders that allow for 100% LTV financing if you take the time to shop around.

If its a jumbo home loan, a cash-out refinance, or an investment property, the loan-to-value will be a lot more limited, potentially capped at just 70-80% LTV, depending on all the attributes.

This can happen due to negative amortization and/or home price depreciation.

Also Check: How To Transfer Car Loan To Another Person

Combined Loan To Value Ratio

Combined loan to value ratio is the proportion of loans in relation to its value. The term “combined loan to value” adds additional specificity to the basic loan to value which simply indicates the ratio between one primary loan and the property value. When “combined” is added, it indicates that additional loans on the property have been considered in the calculation of the percentage ratio.

The aggregate principal balance of all mortgages on a property divided by its appraised value or purchase price, whichever is less. Distinguishing CLTV from LTV serves to identify loan scenarios that involve more than one mortgage. For example, a property valued at $100,000 with a single mortgage of $50,000 has an LTV of 50%. A similar property with a value of $100,000 with a first mortgage of $50,000 and a second mortgage of $25,000 has an aggregate mortgage balance of $75,000. The CLTV is 75%.

Combined loan to value is an amount in addition to the Loan to Value, which simply represents the first position mortgage or loan as a percentage of the property’s value.

A Quick Underwater Loan

Property value: $400,000 Loan amount: $500,000 Loan-to-value ratio : 125%

As you can see, the underwater borrower has a LTV ratio greater than 100% , which is a major issue from a risk standpoint.

For the record, you get 1.25 by dividing 500 by 400.

The problem with homeowners in these situations is that they have little incentive to stick around, even with a modified mortgage payment, as theyre so far in the red that theres little hope of recouping home value losses.

However, the popular Home Affordable Refinance Program allowed millions of underwater homeowners to refinance to lower rates with no LTV limit. And many of these folks are probably now back in the black.

Today, this type of program still exists, but is a permanent option known as a high-LTV refinance, or HIRO for short.

So there are options to refinance and get a lower interest rate, as long as your loan is owned by Fannie Mae or Freddie Mac, no matter the mortgage balance relative to the property value.

Same goes for FHA loans and VA mortgages thanks to the FHA streamline refinance and the VA IRRRL option.

Despite being far behind new homeowners entering the market in terms of building home equity, many of these formerly-underwater borrowers now have lots of equity thanks to rising home prices and several years of paying down their mortgages.

Also Check: What Happens If You Default On Sba Loan

What Is A Good Ltv Ratio

Ideal LTV ratios vary depending on the lender and the type of loan.

| Loan type | |

|---|---|

| Refinance* | 80% |

- Conventional loan The magic LTV ratio for most lenders is 80 percent. This means you can afford to make a 20 percent down payment, and as a borrower, you wont have to pay private mortgage insurance.

- FHA loan Generally, an LTV ratio of 96.5 percent will suffice for securing an FHA loan. Keep in mind that the minimum 3.5 percent down payment requirement for FHA loans means youll need to pay mortgage insurance.

- VA loan If youre a service member or veteran, you can have a 100 percent LTV ratio with a VA loan , provided you meet other requirements for approval.

- USDA loan Available to low- and moderate-income homebuyers in rural areas, the United States Department of Agriculture gives certain borrowers the ability to get approved with a 100 percent LTV ratio, as well.

- Refinancing If youre considering refinancing your mortgage, most lenders will want to see an LTV ratio of 80 percent or lower .

Typically, lenders prefer loans with lower LTV ratios, but acknowledge that many borrowers are unable to provide a significant down payment, Joseph says.

How To Calculate The Loan

- Its actually one of the easiest calculations you can make

- Simply divide the loan amount by the appraised value or purchase price

- And youll wind up with a percentage known as your LTV

- The tricky part might be agreeing on a sales price and getting the home to appraise at value

Simply put, the loan-to-value ratio, or LTV ratio as its more commonly known in the industry, is the mortgage loan amount divided by the lower of the purchase price or appraised value of the property.

If were talking existing mortgages , its the outstanding loan balance divided by the appraised value.

When calculating it, you will wind up with a percentage. That number is your LTV. And the lower the better here folks!

Its actually very easy to calculate and takes just one step. You dont even need a mortgage calculator. In fact, you might be able to run the numbers in your head. Honest!

Lets calculate a typical LTV ratio:

Property value: $500,000 Loan amount: $350,000 Loan-to-value ratio : 70%

In the above example, we would divide $350,000 by $500,000 to come up with a loan-to-value ratio of 70%.

Using a basic household calculator, not a so-called LTV calculator, simply enter in 350,000, then hit the divide symbol, then enter 500,000. You should see 0.7, which translates to 70% LTV. Thats it, all done!

LTV ratios are extremely important when it comes to mortgage rate pricing because they represent how much skin you have in the game, which is a key risk factor used by lenders.

Recommended Reading: How To Get Loan Originator License

Ltv For Mortgage Vs Refinance

Lenders use loan-to-value calculations on both purchase and refinance transactions. But the math to determine your LTV changes based on the purpose of the loan.

For a home purchase, LTV is based on the sales price of the home unless the home appraises for less than its purchase price. When this happens, your homes LTV is based on the lower appraised value, not the homes purchase price.

With a refinance, LTV is always based on your homes appraised value, not the original purchase price of the home.

Loan to value is especially important when using a cash out refinance, as the lenders maximum LTV will determine how much equity you can pull out of your home.

How To Lower Your Ltv

Generally speaking, reducing LTV on your loans, especially on mortgage loans, means lower total costs over the life of the loan. Because there are only two variables that determine LTV ratiothe loan amount and the value of the assetthe approaches to reducing LTV are pretty straightforward:

- Make a larger down payment.Saving for a big down payment may test your patience if you’re really eager to get into a house or car, but it can be worth it in the long run.

- Set your sights on more affordable targets. Buying a home that’s a little older or smaller than the house of your dreams could allow your current savings to serve as a larger portion of the purchase price.

Whether you’re applying for an auto loan or a mortgage, it’s important to understand how your LTV ratio affects overall borrowing costs, what you can do to decrease LTV, and how doing so can save you money over the lifetime of a loan.

You May Like: Max Fha Loan Amount Texas 2021

What Does Ltv Mean For Your Mortgage

The LTV affects the amount you can borrow, and the rate you can borrow at. The lower the LTV, the better the mortgage rates available to you will be.

To find out which mortgage deals you are likely to be eligible for, you will need to work out your LTV, which means establishing what percentage of the property value you need to borrow, and how much you can cover with your deposit.

You can do this by dividing your mortgage amount by the value of the property. You then multiply this number by 100 to get your LTV.

For example, if youre buying a property worth £250,000, and have a deposit of £50,000, youll need to borrow £200,000.

To find out what your LTV is, you need to divide £200,000 by £250,000.

This equals 0.8, which, when multiplied by 100, comes to 80%.

That means your LTV is 80% and your deposit is 20%, so you should look for mortgage deals with an 80% LTV.

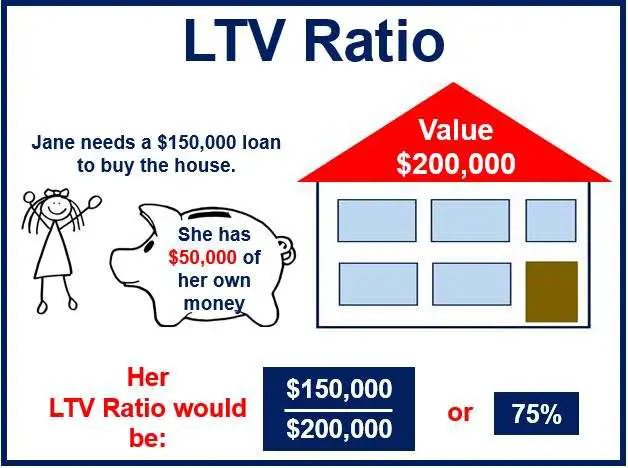

What Does Ltv Mean

Your loan to value ratio compares the size of your mortgage loan to the value of the home.

For example: If your home is worth $200,000, and you have a mortgage for $180,000, your loan to value ratio is 90% because the loan makes up 90% of the total price.

You can also think about LTV in terms of your down payment.

If you put 20% down, that means youre borrowing 80% of the homes value. So your loan to value ratio is 80%.

LTV is one of the main numbers a lender looks at when deciding to approve you for a home purchase or refinance.

Recommended Reading: Arvest Construction Loans

Most Lenders Want You To Have At Least 20 Percent Equity

Loan-to-Value Requirements: Conventional Mortgage Loans

Youve probably heard that you need at least 20 percent equityor an LTV of 80 percent or lessto get a conventional loan to refinance your mortgage. However, thats not always the case.

Strictly speaking, you only need 5 percent equity in some cases to get a conventional refinance. However, if your equity is less than 20 percent, then youll likely face higher interest rates and fees, plus youll have to take out mortgage insurance.

Most lenders want you to have at least 20 percent equity. They will also usually waive the mortgage insurance requirement if your LTV is less than 80 percent and you have a good history of paying your bills on time.

You should speak to your lender about their flexibility with your home refinance if your existing loan is owned by Fannie Mae or Freddie Mac. Traditional refinances can sometimes work with an LTV higher than 80 percent if these programs own your loan and if youre not seeking a cash-out refinance.

There are many options outside of a traditional refinance.

Loan-to-Value Requirements: Home Equity Loans

One significant benefit of refinancing with a home equity loan is the difference in cash paid at closing. Traditional refinancing can require thousands of dollars at closing. With a home equity loan, like at Discover Home Loans, there is no cash due at closing.

Loan-to-Value Requirements: FHA Mortgage Loans

Streamlined refinances

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: Is First Loan Com Legit

Loan To Value Analysis

Loan to value is an important metric that categorizes borrowers. Though it is not the only metric that determines high-risk borrowers, it indicates how risky a loan is, and how the borrower will be motivated to settle the loan. It also determines how much borrowing will cost the borrower. The higher the loan to value ratio, the more expensive the loan.

Key factors that affect the loan to value ratio is the equity contribution of the borrower, the selling price and the appraised value. If the appraised value is high, that means a large denominator and hence a lower loan to value ratio. It can also be reduced by increasing the equity contribution of the borrower and reducing the selling price.

A major advantage of loan to value is that it gives a lender a measure of the level of exposure to risk he will have in granting a loan. The limitation of loan to value is that it considers only the primary mortgage that the owner owes, and not including other obligations like a second mortgage. A combined loan to value is more comprehensive in determining the likelihood of a borrower settling the loan.

How Ltv Is Used By Lenders

A LTV ratio is only one factor in determining eligibility for securing a mortgage, a home-equity loan, or a line of credit. However, it can play a substantial role in the interest rate that a borrower is able to secure.

Most lenders offer mortgage and home-equity applicants the lowest possible interest rate when their LTV ratio is at or below 80%. A higher LTV ratio does not exclude borrowers from being approved for a mortgage, although the interest on the loan may rise as the LTV ratio increases. For example, a borrower with an LTV ratio of 95% may be approved for a mortgage. However, their interest rate may be a full percentage point higher than the interest rate given to a borrower with an LTV ratio of 75%.

If the LTV ratio is higher than 80%, a borrower may be required to purchase private mortgage insurance . This can add anywhere from 0.5% to 1% to the total amount of the loan on an annual basis. For example, PMI with a rate of 1% on a $100,000 loan would add an additional $1,000 to the total amount paid per year . PMI payments are required until the LTV ratio is 80% or lower. The LTV ratio will decrease as you pay down your loan and as the value of your home increases over time.

In general, the lower the LTV ratio, the greater the chance that the loan will be approved and the lower the interest rate is likely to be. In addition, as a borrower, it’s less likely that you will be required to purchase private mortgage insurance .

Read Also: Oneaz Auto Loan