How To Calculate An Amount To Be Financed

This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin. This article has been viewed 47,132 times.

The full price of a major purchase such as a house, boat or car is rarely financed. Most lenders for these types of loans require a down payment of some sort, usually expressed as a percentage. Additionally, mortgage loans list a different figure, “amount financed,” which does not include prepaid fees paid to the lender. Knowing how to calculate an amount to be financed will help you make informed consumer decisions.

Utilize An Online Calculator

Use an online loan calculator to determine the total finance charges for the life of the loan, assuming it is not paid off early. Enter loan terms, including balance , length of loan and interest rate , into the calculator and hit the “Show/Recalculate Amortization Table” button. Finance charges will be automatically calculated and displayed. In our example, the total finance charges for the life of the loan will be $15,957.59.

References

Do Not Forget About Car Insurance

Some people forget about the cost of car insurance while budgeting for a new car. It is essential to work that cost into your monthly budget. All 50 states require drivers to have some kind of auto insurance, so this step isnt optional.

Insurance costs vary by the car you drive. If youre considering a new car, get a new insurance quote. This quote will help you more accurately budget for your new car.

Don’t Miss: How Much Car Payment Can I Afford Based On Salary

How To Get Mortgage License

Category: Loans 1. Getting Started: State-Licensed Individuals NMLS All state licensed MLOs and certain individuals as mandated by their state agency are required to pass the National SAFE MLO test, complete pre-licensure MLO License Requirements · complete a minimum of 20 hours of NMLS-approved education, including any state-specific requirements

How Do Finance Charges Work For Loans

Finance charges for closed-end loans loans with a predetermined amount and payment schedule are based on the annual percentage rate plus any fees. This gives you the amount of non-compounding interest youll pay each year. The APR may also include fees, but not always. When it doesnt, youll add the fees, which vary from loan to loan, onto the APR.

To calculate your total interest paid, you can simply subtract your loan amount from your total payments .

For example, if you have a five-year car loan for a $15,000 car with a monthly payment of $300, the total cost of the loan is $18,000 . Now, subtract the amount you borrowed from the total cost to get the cost of the interest, $3,000 . If there are no other fees, this is your finance charge.

If there are other fees, such as a 1% origination fee, add this to get your finance charge. On the same loan, a 1% origination fee would be $150 , so your total finance charge would be $3,150 .

You May Like: How Much Land Can You Buy With A Va Loan

How Should I Review The Finance Charge When Refinancing

The finance charge is the variable you need to look at to do an apple to apple comparison when considering student loan refinancing offers in order to make a fully informed decision.

For example, when you refinance your student loans, you may hear your FitBUX Coach say something like, Refinancing will save you $4,000.

What your Coach is referring to is how much you would reduce the finance charge by refinancing to a lower interest rate loan relative to your current loan situation, ALL else being equal

Of course, there is nothing wrong with saving money by getting a lower rate AND a shorter term. You just need to keep in mind that a shorter term will mostly likely mean higher required monthly payments. This, in turn, could reduce your budget flexibility.

To learn more about this, be sure to check out our free 3 secrets of student loan refinancing webinar. You can also read our Ultimate Guide To Student Loan Refinancing.

What Fees Are Included In A Credit Card Finance Charge

Finance charges include any fees paid to the lender, such as:2

- Interest

- Balance transfer fees

The most common type of finance charge is the interest that youre charged if you dont pay off your credit card balance in full every month. Most other fees are usually flat fees, such as annual fees or late fees. Some credit cards may charge flat fees for cash advances or balance transfers, too. Other finance charges, such as foreign transaction fees, are typically calculated as a percentage of the transaction value.

You May Like: Usaa Preferred Dealerships

What Is The Difference Between A Finance Charge And Interest

A finance charge refers to the cost of borrowing money in the local currency, i.e. U.S. dollars in the United States. This includes any fees attached to the loan in addition to the interest.

Interest can be a part of a finance charge, but you can have a finance charge without interest, such as a one-time loan origination fee .

In short, interest is a finance charge, but a finance charge doesnt always include interest.

What Is A Finance Charge And How Is It Calculated

Shutterstock

You’ve probably seen the scary line item “finance charge” on your credit card statement. Here’s what it means.

As a consumer these days it’s easy to feel like you spend half your money on charges you don’t see coming or, most of the time, even understand.

Order a $5 beer and the bill asks for $6.50 after taxes and tip.

Flying overseas? That discount ticket you got so excited over will cost an extra $200 in “departure charges.”

Heaven help you if you’ve ordered concert tickets.

Added to this pile is the mysterious “finance charge,” a line item that appears on many bills with typically little explanation. Most specifically, this is a common feature on credit card bills and other lending statements.

Here’s what it means and what, exactly, you’re paying for.

Don’t Miss: Mlo License Ca

Summers Others Cite Growing Chance Of Recession

It is important to understand that while most coverage of this topic discusses finance charges in the context of , as will this piece for demonstrative purposes, they apply to all forms of lending. When you pay interest on your student loans or if you have an administrative fee as part of your mortgage, you are paying finance charges.

How To Calculate Finance Charges

You can figure it out by applying the formula given above that states you should multiply your balance with the periodic rate. For instance in case of a credit of $1,000 with an APR of 19% the monthly rate is 19/12 = 1.5833%.

The rule says that you first need to calculate the periodic rate by dividing the nominal rate by the number of billing cycles in the year. Then the balance gets multiplied by the period rate in order to have the corresponding amount of the finance charge.

Finance charge calculation methods in credit cards

Basically the issuer of the card may choose one of the following methods to calculate the finance charge value:

-

First two approaches either consider the ending balance or the previous balance. These two are the simplest methods and they take account of the amount owed at the end/beginning of the billing cycle.

-

Daily balance approach that means the lender will sum your finance charge for each day of the billing cycle. To do this calculation yourself, you need to know your exact credit card balance everyday of the billing cycle by considering the balance of each day.

-

Adjusted balance method is a bit more complicated as it subtracts the payments you make during the billing period from the balance at the cycles beginning.

Read Also: 600 Credit Score Auto Loan Rates

How To Use This Calculator

The APR calculator determines a loans APR based on its interest rate, fees and terms. You can use it as you compare offers by entering the following details:

- Loan amount: How much you plan to borrow.

- Finance charges: Required fees from the lender, such as an origination fee or mortgage broker fee. Situational fees, such as a late payment fee, generally arent included in APR calculations.

- Interest rate: The interest rate that the lender charges on the loan.

- Term: The number of years you have to repay the loan.

Often, the Federal Truth in Lending Act requires lenders to tell you the APR, so you wont have to calculate it on your own. In some cases there are even templates that lenders must use, such as the Loan Estimate form for mortgages. When reviewing that form, you can find the interest rate on the first page and the loans APR on page three.

However, if youre comparing loan offers from different lenders, its sometimes helpful to look into the details and do the APR calculations on your own. For example, mortgage lenders might be able to exclude certain fees from their APR calculations, and you want to make sure the APRs you’re comparing are based on the same financing charges.

Calculating Shorter Billing Cycles

The billing cycle for credit cards can be shorter than a 30-day month to accommodate weekends and holidays. If so, calculate the finance charge as follows:

balance X APR X days in billing cycle / 365

Example: If your billing cycle is 25 days long, the finance charge for that billing period would be:

500 x 0.18 X 25 / 365 = $6.16

You might notice that the finance charge is lower in this example even though the balance and interest rate are the same. That’s because you’re paying interest for fewer days, 25 vs. 31. The total annual finance charges paid on your account would end up being roughly the same.

Read Also: Fha Limits In Texas

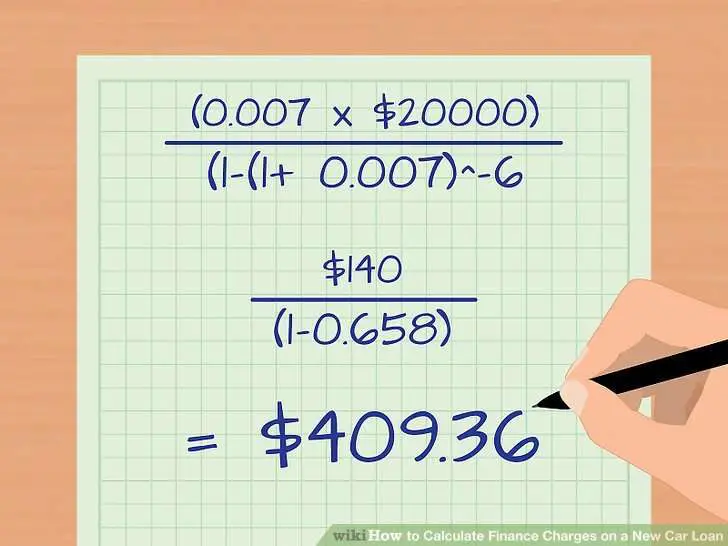

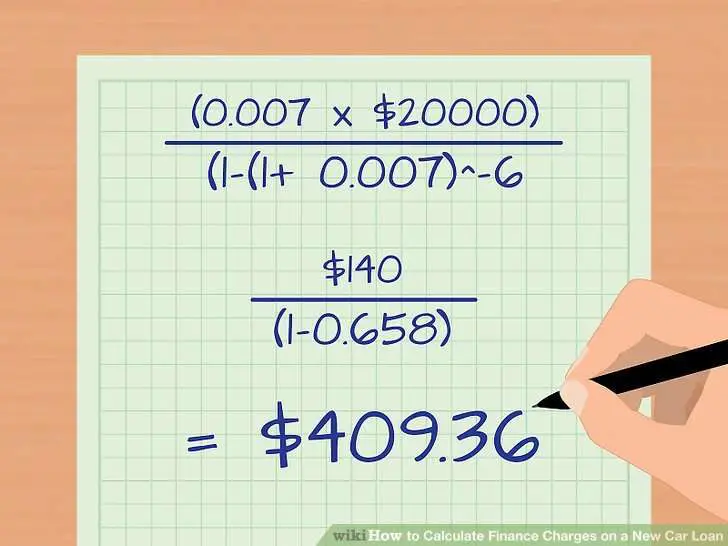

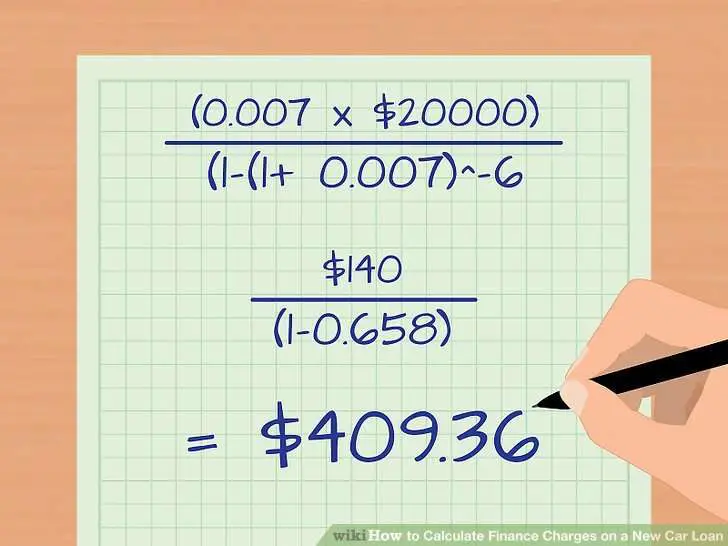

How To Calculate Finance Charge On A Car Loan

How do you calculate the finance charge on a car loan? To calculate the finance charge on a car loan, you need to multiply the average daily balance by the daily rate . The result is the interest charged for that billing cycle. Multiply that number by the number of cycles in the year for your annual interest rate.

Lets take a look at an example:

You buy a $20,000 car with no money down and pay it off over 60 months. You have negotiated an APR of 3.75%. Your monthly payment will be $373.22, but that payment includes some interest, as you can see in Table 1.

The interest paid each month will decrease as you pay off your balance, and after five years, your loan will be paid off. The above example shows that you will pay $2,779.69 in total interest.

How Are Finance Charges Calculated

Since your finance charge depends on multiple factors, including the account balance and your cards interest rate, it will typically vary from month to month. Each charge is calculated separately, based on the rules in your card member agreement. To understand how interest charges are calculated, see How to Calculate Interest Rates.

- Any interest accrued from carrying the balance

- A flat cash advance fee, plus any interest on the cash that you withdrew

- Any foreign transaction fees

Some card companies have a minimum finance charge youll be charged a dollar even if your calculated finance charge is less than that.

Don’t Miss: Usaa Consolidate Student Loans

What Is A Finance Charge On A Loan

By Joseph Reinke, CFA, Founder of FitBUX

One question we are often asked by FitBUX Members who use our free student loan refinance serivce is, What is a finance charge on a loan? This article discuss what a finance charge is, how you can reduce it, and answers a few other related questions.

Variations In Credit Card Issuer Finance Charge Calculation Methods

The examples weve done so far are simple ways to calculate your finance charge but still may not represent the finance charge you see on your billing statement. Thats because your creditor will use one of five finance charge calculation methods that take into account transactions made on your credit card in the current or previous billing cycle.

Check your credit card agreement or the back of your credit card statement to determine how your finance charge is calculated and whether new purchases are included in the balance calculation.

The ending balance and previous balance methods are easier to calculate. The finance charge is calculated based on the balance at the end or beginning of the billing cycle.

The adjusted balance method is slightly more complicated it takes the balance at the beginning of the billing cycle and subtracts payments you made during the cycle.

The daily balance method sums up your finance charge for each day of the month. To do this calculation yourself, you need to know your exact credit card balance every day of the billing cycle. Then, multiply each days balance by the daily rate . Add up each days finance charge to get the monthly finance charge.

You may not have a finance charge if you have a 0% interest rate promotion or if you’ve paid the balance before the grace period.

Also Check: Upstart Second Loan

Improving Your Credit Can Get You Lower Rates

Lenders may offer you a different APR on your loan depending on your creditworthiness and the repayment term you choose. Those applicants with higher credit scores and lower debt-to-income ratios may qualify for lower interest rates and finance charges, leading to a lower APR.

To improve your credit and avoid late payment fees, make all your debt payments on time. Paying down your credit card balances can also help your credit by lowering your .

If you need to borrow money now and dont have time to improve your credit first, you can still compare lenders offers to figure out which loan has the lowest APR. Often, you can start by getting prequalified or preapproved for a loan to see your estimated APRs and terms.

All else being equal, the lowest APR may be best. However, keep the big picture in mind before taking out a loan. For example, lenders may offer you a lower rate on shorter-term loans, which can lead to a lower APR but higher monthly payments. If thats not affordable, the longer-term loan with a higher APR may be best.

Should You Compare Mortgage Rate Or Apr

When comparing loan offers with the same terms and similar fees, the mortgage with the lowest interest rate is usually the best deal.

After you submit a mortgage application, the lender provides a three-page document called a Loan Estimate. Page 3 of the Loan Estimate has a “Comparisons” section that lists not only the APR but also how much the loan will cost in the first five years. This includes the loan costs, plus 60 months of principal, interest and any mortgage insurance.

The “Comparisons” sections of the Loan Estimates are useful in side-by-side comparisons of all the mortgage offers you receive.

You May Like: How Long Does Sba Loan Take

Explore Your Financing Options At Westbrook Honda

Weve answered the question: What is a simple interest loan? Now, dont hesitate to contact us with any questions like what is MSRP and what is a good interest rate? Our finance specialists are standing by to help you secure a car loan and payment schedule that is the best fit with your budget. Planning on trading in your old car? Use our value your trade tool to get a quick estimate of how much your car is worth, and apply that towards your down payment. Were ready to put you behind the wheel of a new Honda or dependable pre-owned vehicle of your choice today!

Dont Miss: How To Remove Car Door Panel

Dcu Visa Credit Card Finance Charges

-

Interest is a fee charged on every Visa account that is not paid in full by the payment due date or on every Visa account that has a cash advance.

-

The Finance Charge formula is:

Average Daily Balance x Annual Percentage Rate x Number of Days in Billing Cycle ÷ 365

-

To determine your Average Daily Balance:

Add up the end-of-the-day balances for every day of the billing cycle. You can find the dates of the billing cycle on your monthly Visa Statement. Divide the total of the end-of-the-day balances by the number of days in the billing cycle. This is your Average Daily Balance.

Read Also: Typical Motorcycle Loan

What Is The Unpaid Balance Method

The unpaid balance method is a way to calculate finance charges, but it’s used less often than the average daily balance method. With this option, your finance charge is based on your unpaid balance. You calculate the interest on your unpaid balance and add it to your total unpaid balance. Add on any new purchases and subtract any payments and credits.

When Is A Finance Charge Assessed

There is no single method for assessing finance charges. Lenders can calculate them at any point based on the details of the loan.

However, when your lender assesses a finance charge is actually quite significant. Particularly for percent-based charges, it can make a big difference in how much you pay. As an example, here is how credit card interest is typically assessed:

Your credit card has what is called a “billing cycle.” This is the period of time during which any charges you make show up on your next bill. A credit card billing cycle is one month, although formally the credit card company might list the billing cycle as anywhere from 24 to 33 days depending on how it lists weekends and holidays.

At the end of each billing cycle your credit card company sends you a bill for that month’s spending. It then closes the billing cycle and begins a new one for the coming month.

A credit card company applies interest and finance charges at the end of each billing cycle based on whether or not the previous bill was paid in full. If you paid your entire balance on the last bill then it doesn’t apply any interest to the new one. If you have an unpaid balance at the end of a billing cycle it applies interest typically to both the previous balance and the most recent purchases.

To demonstrate, let’s walk through a credit card with a billing cycle that started on May 5 and ended on June 4.

May 4: at 11:59 p.m. the previous billing cycle ends.

Don’t Miss: Do Mortgage Loan Officers Make Commission