Who Can Qualify For An Fha Construction Loan

The requirements for an FHA construction loan are nearly identical to the requirements on any other FHA mortgage. To qualify for your loan, youll need:

- A minimum credit score of at least 500

- A down payment of at least 10% for credit scores 500 and above and at least 3.5% for credit scores 580 and above

- A debt-to-income ratio of no more than 43%

- Upfront and annual private mortgage insurance

- No delinquencies on FHA loans in the past three years

Get Preapproved For A Mortgage

During the preapproval process, a mortgage lender will review your credit and verify your income to determine how much of a loan it can give you. Getting preapproved is a key step in the FHA lending process: It lets you know how much you can afford to spend on either building a home or buying an existing one.

During this process, your lender will check your credit report and credit score. To qualify for an FHA loan, you need a FICO credit score of at least 500. Be aware, though, that many lenders wont approve you for a mortgage unless your score is higher, often 580 or higher.

Lenders will also review your finances and require you to provide copies of such key documents as your two most recent paycheck stubs, 2 months of bank account statements and the last 2 years of your tax returns.

The Borrower Is Responsible For:

- VA funding fee. You must pay this fee within 15 days of closing in the case of a single-close loan, and within 15 days of the permanent loan closing in the case of a two-close loan. The fee covers the costs of guaranteeing the loan but is waived for several categories of veterans and spouses, including disabled vets and recipients of the Purple Heart. It is also the only fee that can be rolled into the purchase loan.

- Appraisal fees. VA appraisal fees can vary from around $500 to $1,200, depending on where you live. State-by-state VA appraisal fees are listed online.

- Closing costs. The average paid in closing costs across all homebuyers is around 1% of the total loan amount, but VA borrowers may pay even less because there are fewer closing costs. VA loans also have no restrictions on where the money to pay these costs can come from.

- Origination fee. This is typically charged by the lender as part of the closing costs.

- Down payment . If you choose to make a down payment, it will lower your loan amount, saving you money on interest in the long run. If you put at least 5% down, you can also pay a reduced VA funding fee.

- Construction fee. The lender is allowed to charge additional flat charges of up to 2% of the loan amount.

Read Also: How Much Home Loan Will I Get For My Salary

Can You Use A Construction Loan To Buy Land

An FHA construction loan covers all of the costs associated with the build, including the land, plans, permits, fees, labor, and materials. This is good news for FHA borrowers who may not have the financial means to purchase the land or take on an additional loan.

An FHA construction loan may be used to purchase the land so long as the property is going to have a home built on it, said Eric Nerhood, owner of Premier Property Buyers, a company that buys, repairs, and sells homes. Once the home is built, the construction loan will roll into a traditional mortgage.

Fha Construction Loans: How You Can Use Them Build Your Dream Home

An FHA construction loan will allow you to build your own home or even purchase a dilapidated one and renovate it.

If you desire to take out a mortgage to build your very own dream home, you will almost certainly need a home construction loan. These loans may prove valuable if you plan on purchasing and subsequently remodeling a fixer-upper house.

However, most construction loans can be pretty difficult to qualify for unless you have a reasonably high credit score or can afford to put down a hefty amount upfront.

Suppose you feel that you are struggling to qualify for any private construction loan. In that case, your lender might offer you loans that are fully backed by the Federal Housing Administration these loans are known as FHA construction loans. They accept even relatively low credit scores and down payments when compared to private construction loans.

One of the top salient features of an FHA construction loan is that you only pay the total closing costs âprior toâ any construction work. This is because the mortgage automatically converts to a permanent loan after construction.

You May Like: How Long Will It Take To Pay Off My Loan

How Much Down Payment Assistance Can I Get

The amount you can qualify for depends on the DPA program you apply for. For example, in Arizona, the Pima Tucson Homebuyers Solution Program limits assistance to 2.5% to 6% of your sales price, compared to the Pima County/City of Tucson DPA program, which provides assistance up to 10% of the contract sales price.

You can also check the HUD local homebuying programs site to get details about the programs available in your state.

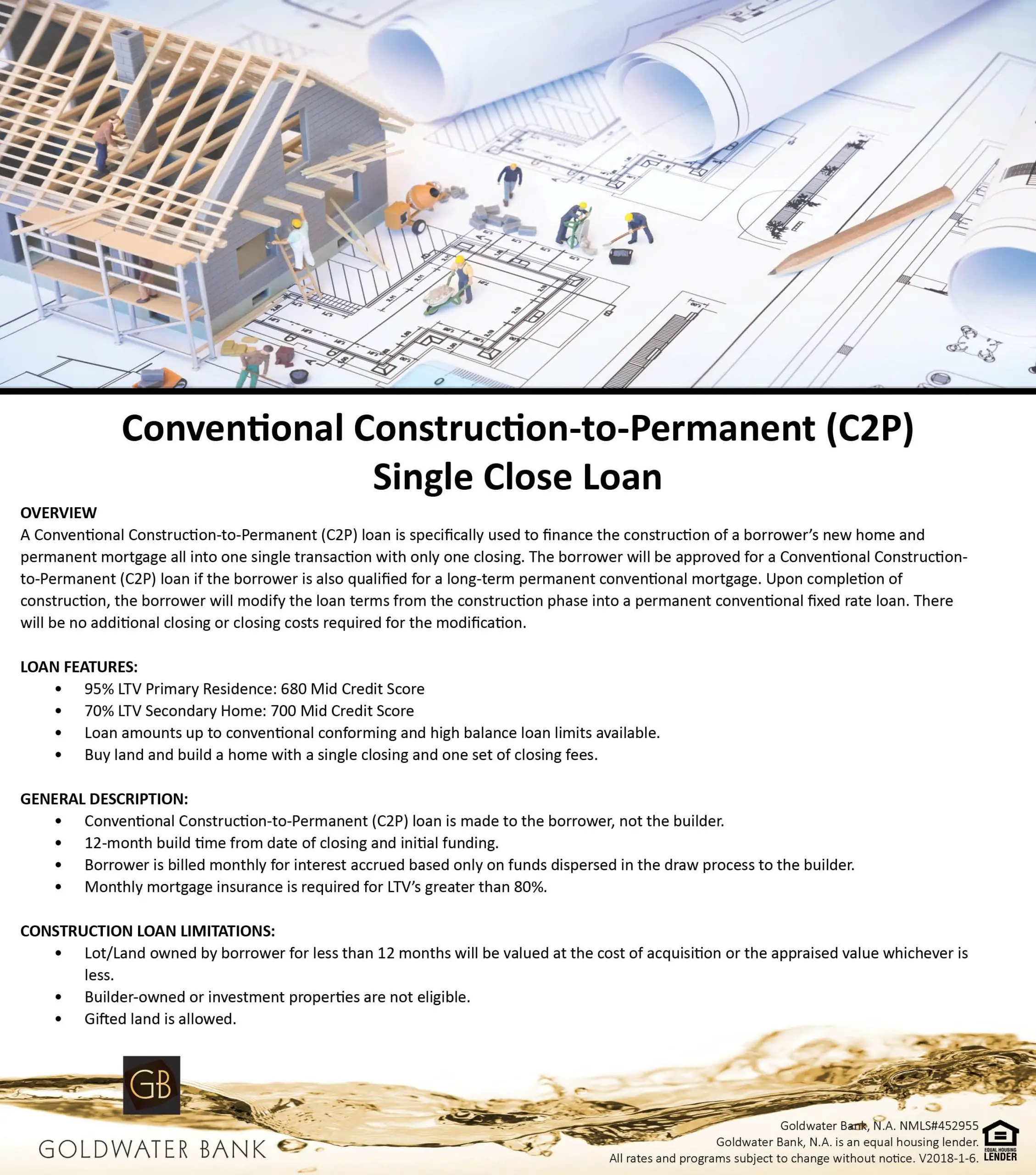

Option One: Fha Construction To Permanent Loan

The FHAconstruction to permanent loan allows you to finance the cost of your home’s construction and, once complete, convert it to a permanent mortgage with just one closing. If you already own a parcel of land, you can refinance your land loan into an FHA C2P loan. You can also considerFHA Streamline Refinancethat may save you some money in closing costs. The primary benefit of a C2P loan is avoiding two sets of closing costs and not worrying aboutqualifying for loansagain.

As with any construction loan, your lender must approve your contractor’s plan before funding begins. Once approved, your lender will provide a draw schedule. This provides your contractor with more money every time they accomplish a milestone.

Most lenders only require you to make interest payments. However, with each draw, your payments will increase. After the construction has ended and you have received a certificate of occupancy, your loan balance will convert to a permanent mortgage. At this point, your payments will amortize over a15 or 30-year termas with a regularconventional loan.

This type of loan is perfect for those who want to avoid the hassle of two separate loans and twoclosing costs. You can begin this process by talking with an FHA-approved C2P lender.

Recommended Reading: Monthly Student Loan Payment Average

What Is The Fha One

The FHA One-Time Close Construction loan is a product that allows borrowers to combine financing for a lot purchase, construction and permanent mortgage into one first mortgage loan. Ideally suited for borrowers who are purchasing new construction, the FHA OTC loan offers the benefits of low money down financing, competitive interest rates and one closing for all financing.

- Modular and Manufactured homes:

- Maximum of $250,000 disbursement at closing for land acquisition or payoff.

Requirements For Fha Construction Loan

A regular FHA construction home loan makes it possible for even low to middle-income homebuyers to avail of a loan on a credit score that might be as low as 580. Similarly, the down payment could also be as low as 3.5 percent of the project’s total cost.

Sometimes, FHA loans might also allow for a higher than normal debt-to-income ratio. This is a measure of how easily you will be able to pay off your total debt. However, this depends entirely on the discretion of your lending institution.

A 203k loan is a classic example of an FHA backed loan targeted towards our society’s lower-income segment.

You May Like: How To Calculate Annual Loan Payment

S For Financing With An Fha Construction

Secure the land. You need to own the property upon which you will build your home or use the loan to buy the land.

Get approved. These are the minimum qualifying requirements for an FHA loan:

-

A credit score of 580+

-

A debt-to-income ratio of 43% max

-

A 3.5% down for a HUD-approved project

-

A 10% down if not HUD-approved

-

A loan amount doesn’t exceed FHA loan limits.

A Licensed Contractor

FHA construction loan requires a licensed contractor or builder. Be mindful that the contractor may be asked to provide documentation that confirms that they are licensed and insured.

Get a Home Appraisal

You’ll be asked to get an appraisal that confirms the building materials meet FHA’s minimum property standards.

Final Closing and Funding

If the appraised amount is enough to cover expenses, then you’ll be ready to close. Otherwise, you’ll need to come up with the difference or reduce your renovation costs.

Request Draws as the Work is Completed

The contractor will get paid as the work gets completed according to the schedule you set before closing.

Change to a Permanent Loan

When the home is complete, and you’re ready to move in, the lender closes the construction loan and promptly converts the construction loan to a permanent mortgage.

Fannie Mae Homestyle Renovation Loan

This conventional renovation loan works like the FHA 203 program, but allows for down payments as low as 3% with a minimum 620 credit score. An added bonus of the HomeStyle loan: You can do some of the repairs yourself and roll some of your monthly payments into the loan amount if you cant live in the home while its undergoing repairs.

Recommended Reading: Can Veteran’s Spouse Use Va Home Loan

How An Fha One

A. Donahue Baker, co-founder and president of Money Avenue, says the FHA construction-to-permanent loan basically involves four steps.

First, you get qualified by an approved lender. Then, your builder and general contractor get qualified for the loan. Next, your home design plans get qualified for the loan. Lastly, you close on the loan and begin the process of building your dream home, he says.

1. Find the land youll build on

When it comes to the land purchase, you have options.

It can be vacant land you already own thats paid off land with an existing loan from a bank or private party with the balance to be paid off at closing or land you wish to place under contract to be paid off at closing.

The land should not require a teardown of the property or have multiple properties on it, cautions Richie Duncan, senior loan officer with Nationwide Home Loans Group.

2. Get pre-qualified for financing

Before you can finalize your budget and building plans, you need to get prequalified with a lender. The prequalification process will determine how much you qualify for and what your lenders borrowing limits are.

If you dont have the land and builder chosen yet, your prequalification could expire and market conditions like interest rates increasing could heavily reduce the amount you can borrow, Duncan notes.

So, you might want to have a contractor selected even before you begin the mortgage process.

3. Hire a builder and draw up plans

Build A Home On Your Own Lot

If you already own a plot of land on which you intend to build a home, you are a step ahead in the process. Your land equity will cover the 3.5% down payment requirement for an FHA One-Time Close loan.

The most important step in building a home on your own lot is selecting the contractor. A licensed general contractor has a wealth of knowledge and is going to be your best resource in selecting the land to build on, giving you floorplan options, and guiding you in making the best decisions.

Recommended Reading: What Does The Va Home Loan Do

Fha Construction Loans: The Bottom Line

FHA loans aren’t just for purchasing a pristine and perfect property. You can also use them toward building your dream house or for rehabilitating a fixer-upper.

Regardless of your goals, it’s important to find a lender, builder, and contractor who are experienced in these unique types of FHA loans, as they require additional paperwork and documentation before approval.

Pros And Cons Of An Fha New Construction Loan

This loan is designed to combat the more costly and cumbersome traditional construction loan program, says Brandon Mushlin with BuildBuyRefi.com.

Otherwise, youd have to deal with multiple loans, multiple underwrites from different banks and underwriters, multiple appraisals, multiple fees, and multiple possible changes in economic conditions that could impact interest rates in outcomes desired to achieve the end result, Mushlin explains.

However, lenders offering FHA new construction loans arent easy to find and it may be difficult to qualify.

Standards arent quite as lenient as for a traditional FHA loan. For instance, you need a higher credit score. And theres a lot more paperwork and red tape involved, so the process will take longer than a traditional mortgage.

Youll have to decide whether this loan is right for your needs based on your timeline, budget, credit score, and other criteria.

Read Also: Credit Union Home Equity Loan

How Fha 203 Rehabilitation Loan Work

house is already standing

- Bank statements proving the ability to pay a down payment

- Proof of two established credit accounts

- ââValid government-issued ID, such as a driver’s license or passport

- Proof of a Social Security number

- Original pay stubs, W-2 forms, or valid tax returns from the past two years

- Signed and dated letters indicating the source and amount of any monetary giftsâthese must explicitly state the money does not need to be repaid

approved consultant supervise the project

General Descriptions & Loan Amounts:

- 12-month build time from date of closing and funding

- 96.5% LTV based on Total Acquisition Cost Land/Home

- 680 Mid FICO score required

- Single Family Residence, owner occupied

- One loan purchases land and builds the home

- Loan amounts up to FHA conforming and high balance loan limits

- One Time Close transaction

- Borrower receives a bill monthly for construction interest accrual based upon funds dispersed thru the draw process to the builder

Also Check: Who To Call About Student Loan Garnishment

How To Get An Fha Construction Loan

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

If youve always dreamed of building your own home, but your credit score isnt high enough for a regular construction loan, an FHA construction loan can help. Backed by the Federal Housing Administration, FHA construction loans have a minimum 500 credit score requirement with a 10% down payment meaning you could build your dream home, even with less-than-perfect credit.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Don’t Miss: How To Sell Car With Loan Still On It

Find A Mortgage That Fits Your Life

See what mortgage you qualify for

Youre probably looking into FHA construction loans because youve just found the perfect piece of land, but its missing one crucial detail: a house. Or maybe youve been thinking about harnessing your inner Chip and Joanna Gaines, and youve finally decided to buy that fixer-upper on the good side of the street.

With the right lending option, your dream home-to-be can become a reality. And that right lending option might be a Federal Housing Administration construction loan.

An FHA loan comes with fewer underwriting requirements than conventional loans, which makes it a hit with first-time home buyers.

As long as other qualifications are met, FHA construction loan lenders are willing to work with borrowers who have lower-range credit scores and plan on making down payments that are less than the traditional 20%.

Before you pick up a hammer, youll want to build up your FHA building loan expertise. Use this guide to learn everything youll need to know before you apply, including FHA construction loan requirements, how to apply, types of FHA loans and even FHA construction loan alternatives.

What You Need To Know

- You can qualify for an FHA construction loan with a credit score as low as 500 and a down payment from 3.5% to 10%

- FHA construction loans are used to build new homes or repair and renovate existing homes

- The FHA construction loan combines a short-term construction loan with a permanent mortgage. You get the money to build upfront, and once construction is done, the loan switches over to a mortgage

Read Also: Did Student Loans Get Deferred Again