Theres An Error On My Credit Report What Can I Do

If you find an error on your credit report, make sure that its showing up on all of your credit reports not all bureaus are in contact with each other. Gather information showing that the report is incorrect before reaching out to your lenders.

Typically, lenders ask you to send documentation to prove there was an error. If they accept your claim, theyll reach out to the credit bureau to correct the error.

How long do installment loans stay on my credit report?

On-time payments generally stay on your credit report for up to 10 years. Late payments, defaults and other negative marks often stay on your credit report for up to seven years.

Send A Request For Goodwill Deletion

Writing a goodwill letter can be a viable option for people who are otherwise in good standing with creditors. If youve taken steps to pay down your overall debt and have been paying your monthly bills on time, you might be able to convince your creditor to forgive the late payment.

While theres no guarantee that the creditor will delete the derogatory information, this strategy does get results for some. Goodwill letters are most successful for one-off problems, such as a single missed payment. However, they are not effective for debtors with a history of late payments, defaults or collections.

When writing the letter:

- Take responsibility for the issue that lead to the derogatory mark

- Explain why you didnt pay the account

- If you can, point out good payment history before the incident

Dont Miss: Centurylink Credit Check

Why You Should Keep Student Loans On Your Credit Report

While you may be able to get certain negative information related to your student loans removed from your credit report, its important to remember that you cant remove the loans themselves.

And that can actually be a good thing. While negative information remains on your credit reports for seven years, positive information stays for 10 years. If you make all of your payments on time, even if youve slipped up in the past, that positive payment history can help increase your credit score.

In fact, while negative information can hurt your credit, FICO favors newer information over older items, so paying on time can help make up for past missteps.

You May Like: What Fha Loan Can I Afford

What Should You Do About Your Loans Take Action

The bottom line: Your student loans are likely still a problem even though theyre closed on your credit report. The current freeze on the interest rate and collections due to the coronavirus pandemic is the perfect time to fix your student loan mess. Lets talk. I want to help you develop a strategy to deal with your debt.

Schedule a free 10-minute call with me today. We can go over your options together and help you begin picking up the pieces.

Paying Off A Personal Loan Early

Paying off a personal loan early is similar to paying off a car loan early. It may have a prepayment penalty so that the lender can earn as much interest as possible. And, while closing the account early may ease a financial burden, it can negatively affect your credit in some cases. A personal loan adds to the diversity of your open accounts, so closing it can negatively impact the credit mix category of your FICO score.

Read Also:

Don’t Miss: Who Has The Best Auto Loan Interest Rates

Ask About Your Repayment Options

Once you find your loans, the next step is to figure out your repayment options. Federal student loan borrowers have four options to get out of default:

- repayment in full

- loan rehabilitation

The best option for you will depend on your personal finances and whether you’ve previously consolidated your loans or completed the loan rehabilitation program. If you have an FFEL Consolidation loan, you may be able to consolidate a second time. But loan rehabilitation is limited to once per loan. Check out this guide to learn how to get student loans out of collections.

Most borrowers will want to get out of student loan default quickly to avoid tax refund offset and wage garnishment.

Private loan holders and collection agencies don’t offer the same repayment options. Unless you can find a lender willing to refinance your delinquent debt, your best option will either be negotiating a payoff or filing a student loan complaint in bankruptcy.

Learn More:Can You Settle Student Loans?

Have Your Loans Forgiven

This is another method that only works if you have a federal loan.

Federal student loans have an in-built forgiveness clause, though its important to note that this only applies to certain loans. If you do have a federal loan, the remainder of your loan will be forgiven after 10 years of public service, either with a government agency or an approved nonprofit organization.

However, its important to note that you need to make your payments on time and in full throughout these 10 years to be eligible for this scheme.

Read Also: What Is Credit Card Refinance Loan

Student Loans Increase Your Average Account Age

Average account age, also known as the length of your credit history, accounts for a portion of your VantageScore® or FICO® score.

When you have a long history of responsible credit use, you’re seen as a lower risk to lenders than someone with a shorter credit history. Paying back your student loans over many years increases your average account age, helping you demonstrate financially responsible behavior.

Do Student Loans Fall Off Your Credit Report

Both federal and private student loans fall off your credit report about seven years after your last payment or date of default.

You default after nine months of nonpayment for federal student loans, and you’re not in deferment or forbearance. So you’ll have the negative information for those nine months plus seven years of negative information before the loans fall off your credit report.

Private student loans usually default or are charged off around 120-180 days of nonpayment. Once that status appears on your credit report, it will be another 7.5 years before the loans are removed.

- How long do student loans stay on your credit? Student loans will remain on your credit report until you pay them off, or they’re removed seven years after you default. If you’re trying to buy a home, but your student loans are killing your credit score, you can try to get the loans removed because the loan servicer or collection agency reports inaccurate information.

- How long do defaulted student loans stay on credit reports? Defaulted student loans will remain on your credit report seven years after the default status was entered on your credit report.

- What does it mean if my student loan is closed on my credit report? Your student loan can show closed on your credit report if you paid it in full, negotiated a settlement, refinancing with a private lender, or consolidated them into a Direct Consolidation Loan.

Learn More:Do This When Defaulted Student Loans Not Showing On Credit Report

Recommended Reading: Personal Loans Online Same Day Deposit

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Does Biden’s Student Loan Forgiveness Plan Work

In August 2022, President Joe Biden announced that student loan borrowers would have up to $20,000 of their student debt forgiven. This forgiveness plan only applies to the following types of borrowers:

- Only federal student loan borrowers will benefit from the plan. Private loans will not be forgiven as a part of the new program.

- Only borrowers that make less than $125,000 a year, and married couples or heads of households that make less than $250,000 a year will be automatically eligible for $10,000 of debt forgiveness. The income threshold will pull from 2020 or 2021 tax years.

- If a borrower meets the qualifications above and also received a Pell Grant during enrollment, they will be eligible for up to $20,000 in student debt forgiveness.

That being said, in order to qualify for the forgiveness plan, borrowers must apply to the program and prove eligibility. The debt won’t automatically be forgiven.

Read Also: How To Calculate Student Loan Payments Based On Income

What Should I Do If My Student Loans Fall Off My Credit Report

There’s no statute of limitations for federal student loan debt. So even if your loans no longer show in your credit history, you still owe your loans. They didn’t go away. And that means the U.S. Department of Education can still garnish your wages, take your tax refund, and offset your Social Security Benefits.

In addition, your defaulted federal student loans will remain on the CAIVRS database, and that will stop you from getting a federally backed mortgage and qualifying for new Federal Student Aid.

You can avoid these consequences by getting out of default by:

Neither option will put the payment history back on your report if it’s already been removed from your credit report after 7.5 years. However, loan consolidation and rehabilitation will put the loan amount back on your credit report. Adding the loan balances back to your report shouldn’t hurt your FICO score.

Plus, you qualify for affordable repayment options, loan forgiveness, and new Federal Student Aid to go back to school once you’re out of default.

Note: Private student loans do have a statute of limitations. A private lender could still sue you if the time limit runs out. But you would have a defense that the time to collect has passed.

Whats Next For Your Private Student Loan Debt

If youre looking for a more stable financial future, there are better ways to get out of private student loan debt than defaulting and trying to stall for time.

Although private debt doesnt have the same options as federal debt , you can often work with your lender to find a manageable solution for repayment.

And private loans are usually good candidates for refinancing if you or a cosigner can qualify since this comes with the opportunity to adjust your monthly payments and possibly even lower your interest rate. This method can be a game changer if you can get the right deal on your refinanced loan.

Even better, you might be eligible for student loan repayment assistance and not know it. This list of student loan assistance programs could get you out of debt more quickly than you thought possible.

Student loans can feel like a huge burden, but theres always light at the end of the tunnel. If youre proactive about finding the right repayment strategy, then you can steadily work your way toward financial freedom.

Renee Morad contributed to this report.

Also Check: Who Has The Best Student Loan Refinance Rates

How Do Student Loans Show Up On Your Credit Report

David J. Rubin is a fact checker for The Balance with more than 30 years in editing and publishing. The majority of his experience lies within the legal and financial spaces. At legal publisher Matthew Bender & Co./LexisNexis, he was a manager of R& D, programmer analyst, and senior copy editor.

skynesher / Getty Images

How Long Do Student Loans Stay On Your Credit Reports

Delinquency or default can remain on your credit reports for up to seven years. During that time, lenders may be reluctant to offer you additional credit.

If youre struggling to meet your federal loan obligations, research options for repayment aid. For example, you might be eligible for lower monthly payments through an income-driven repayment plan. Talk to your loan servicer to find the best solution for you. Private loans are often less lenient regarding delinquency and default, so it’s important to know the terms and conditions of your loan.

Also Check: Can You Get An Auto Loan Online

Can A Creditor Reopen A Closed Account

It may be possible to reopen a closed credit card account, depending on the credit card issuer, as well as why and how long ago your account was closed. But theres no guarantee that the credit card issuer will reopen your account. But it may be worth asking other issuers if youd like to reopen your account.

If Your Loan Was In Default

According to the Department of Education, almost 7.5 million borrowers defaulted on their federal student loans in May 2022. The Department of Education hasnât taken any action to collect these past-due debts since the beginning of the deferment, and borrowers may even have the opportunity to clean up their credit.

Through the departmentâs Fresh Start initiative, borrowers can rehabilitate their loans and change their credit history to show the loans as âcurrentâ rather than âin collections.â Fresh Start will continue for one year after the federal payment pause ends.

The impact of removing a collection account from your credit report will be different for each borrower, but if you have several loans in collections or you have loans that went to collections more recently, rehabilitation could significantly increase your credit scores.

Recommended Reading: How Much Is The Average Student Loan Monthly Payment

Removing Student Loans From Your Credit Report If Your Loans Were Wrongly Placed In Default

If your loans should have been placed in deferment or forbearance and something went wrong, it is possible that the loans were wrongfully placed in default. If thats the case, the easiest way to figure out how to remove student loans from your credit report is to contact your loan servicer.

Your loan servicer may be able to correct the mistake if it conducts a review of your account history and discovers that a default was improperly reported. You also have the option to appeal the inaccurate information with Equifax, Experian and TransUnion just as you do with fraudulent loans.

If you can prove that you didnt default because your loans should have been in forbearance or deferment, then you can get the record of the delinquency removed.

What Is A Credit Report

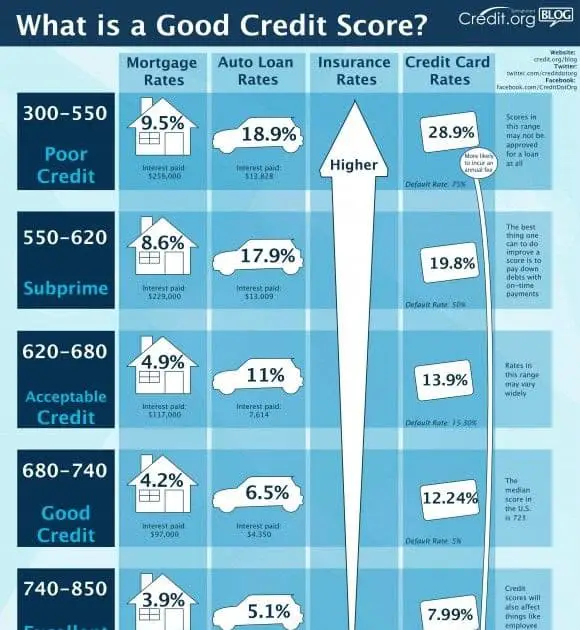

Before considering the impact of student loans on your , its helpful to review what a credit report is. Its a statement that includes details about your current and prior credit activity, such as your history of loan payments or the status of your credit card accounts.

These statements are compiled by credit reporting companies who collect financial data about you from a range of sources, such as lenders or credit card companies. Lenders use credit reports to make decisions about whether to offer you a loan or what interest rate they will give you. Other companies use credit reports to make decisions about you as well for example, when you rent an apartment, secure an insurance policy, or sign up for internet service.

Don’t Miss: How To Minimize Student Loan Debt

Is It Possible To Have Your Student Loans Deleted From Your Credit Report

Yes, If you make a mistake on your student loans, the smallest of mistakes can lead to the immediate erasure of all or part of your debt.However, if youve repaid them , they may be removed from your credit report if reported incorrectly. You must dispute the record to remove it from your credit report

Also Check: Does Apple Card Affect Credit Score

Does Paying Off Student Loans Improve Credit

Paying off the loan in full looks good on your credit history, but it may not have a dramatic impact on your credit score. Your positive payment history on the account will remain part of your credit report for up to 10 years and will thus have some positive impact on your credit for years to come.

Don’t Miss: Can I Pay Off Sallie Mae Loan Early

Can You Ask Creditors To Report Paid Debts

Positive information on your credit reports can remain there indefinitely, but it will likely be removed at some point. For example, a mortgage lender may remove a mortgage that was paid as agreed 10 years after the date of last activity.

Its up to the lender to decide whether it reports your account information to the three credit bureaus. That includes your debt thats been paid as agreed. You can call the lender and ask it to report the information, but it might say no. However, you can add positive information to your credit reports by using your existing credit responsibly, like paying off credit card balances each month.

If You Were Approved For Deferment Or Forbearance

If you believe your loan was wrongly placed in default, but you were approved for a deferment or forbearance, there is a chance your loan servicers files arent up to date. You can contact the loan servicer and ask them to confirm the start and end dates of any deferments or forbearances that were applied to your account.

If the loan servicer doesnt have the correct dates, provide documentation with the correct information and ask that your student loans be accurately reported to the credit bureaus. Under the Fair Credit Reporting Act, a borrower may appeal the accuracy and validity of the information reported to the credit bureau and reflected on their credit report.

Recommended: Student Loan Deferment vs Forbearance: Whats the Difference?

Don’t Miss: What Are Commercial Loan Rates Now