Where Can You Get A Home Equity Loan

You can get a home equity loan through a bank, credit union, or online lender. Its a good idea to check out many different offers to compare each one. See which lender offers the lowest interest rates, fewest fees, and best repayment terms. Make sure youre eligible before applying and if you arent eligible on your own, try to find a reliable co-signer to help you qualify.

Most Affordable Markets For Homebuyers

According to 2020 data fromZillow Research, record low mortgage rates have helped to boost affordability for potential homeowners. The table below shows the top 10 most affordable markets to live in for December 2020 and is based on a typical home value of no more than $300,000 . The market and share of income spent on a mortgage may fluctuate based on the current mortgage rate, the typical local homeowner’s income and the typical local home value.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

You May Like: What Car Loan Can I Afford Calculator

Can You Provide An Example Of Cash

Letâs use the following example to walk through calculations for cash-out refinance :

A homeowner owes $100,000 on a first-lien mortgage loan and $45,000 on a second-lien home equity loan.

The current home value is $400,000.

The combined loan amount is $100,000 + $45,000 = $145,000.

The current CLTV is $145,000 / $400,000 = 36%.

With Discover you can borrow up to 90% CLTV 0.90 x $400,000 = $360,000 could be taken out against the current value of the home.

Since you owe $145,000 on your existing loans, the maximum cash-out value you can get is $360,000 – $145,000 = $215,000. While the homeowner does not have to take out the full amount available, finding these values for your home can help you understand the limits of your loan application before you apply.

What Is A Heloc And How Does It Work

A home equity line of credit provides you with a line of credit with a pre-approved limit . Also like a credit card, you can draw from and pay back into it whenever you want. There is, however, no grace period where you wont be charged interest until a certain date the moment you withdraw from the HELOC, interest starts accruing. Compared to mortgages, HELOCs tend to have higher interest rates. They are also usually only offered as variable rates, although some lenders allow you to convert part of your HELOC into a home loan with a fixed rate and term.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Getting A Second Mortgage

A second mortgage is a second loan that you take on your home. You can borrow up to 80% of the appraised value of your home, minus the balance on your first mortgage.

The loan is secured against your home equity. While you pay off your second mortgage, you also need continue to pay off your first mortgage.

If you cant make your payments and your loan goes into default, you may lose your home. If thats the case, your home will be sold to pay off both your first and second mortgages. Your first mortgage lender would be paid first.

If You Have Poor Credit

Home equity loans can be easier to qualify for if you have bad credit, because lenders have a way to manage their risk when your home is securing the loan. Nevertheless, approval is not guaranteed.

Collateral helps, but lendershave to be careful not to lend too much, or they can risk significant losses. It was extremely easy to get approved for first and second mortgages before 2007, but things changed after the housing crisis. Lenders are now evaluating loan applications more carefully.

All mortgage loans typically require extensive documentation, and home equity loans are only approved if you can demonstrate an ability to repay. Lenders are required by law to verify your finances, and you’ll have to provide proof of income, access to tax records, and more. The same legal requirement doesn’t exist for HELOCs, but you’re still very likely to be asked for the same kind of information.

Your credit score directly affects the interest rate you’ll pay. The lower your score, the higher your interest rate is likely to be.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

How Do You Spend Heloc Funds

If youre approved for a HELOC, lenders may allow you to withdraw money during a fixed time known as a draw period.

Once your draw period has ended, your lender may let you renew the credit line. If not, you may need to repay the outstanding amount all at once or over a period of time, which is called a repayment period.

Stamp Duty And Set Up Costs Calculator

The purpose of this calculator is to assist you in estimating the upfront costs associated with your loan. It should be used solely for the purpose of providing you with an indication of the upfront costs you may incur, so you can include an estimate for these amounts into your savings plan. Stamp duty and registration costs have been calculated using the rates from the relevant government authority websites and do not take into account any concessions you may be eligible for or any surcharges or additional and duties that may apply given your individual circumstances. We cannot guarantee that these rates are correct, up to date or are the ones which would apply to you. You should confirm the government costs and duties payable with the relevant government authorities.

We have made a number of assumptions when producing the calculations. Our main assumptions are set out below:

Also Check: Personal Loan To Buy Land

Home Equity Loan Alternatives To Consider

A home equity loan can be attractive if youre looking for ways to borrow money, but there are also other ways to get cash if you need it. So before you pull the trigger on a home equity loan, you should also consider the following:

Personal loans

A personal loan lets you borrow a fixed amount of money with a fixed monthly payment and a fixed repayment term. However, personal loans are not backed with collateral, so you dont have to have a specific amount of home equity or any other collateral to use one.

If you dont own a home, or if you dont have enough equity in your house or apartment to be able to take advantage of a home equity loan, a personal loan could be a better option.

If you need to access a line of credit to make some purchases and you dont expect to take more than a year to pay off your debt, you should consider a credit card with an introductory interest rate offer. Many of the top options let you earn rewards on your spending while enjoying zero interest on purchases or zero interest on balance transfers for 15 months or even longer.

Related: How to get the best credit card when you have an excellent credit score.

Home equity lines of credit

As mentioned earlier, a HELOC works similarly to a home equity loan in that you borrow cash against the value in your home. But a HELOC acts as a line of credit thats available as you need it, and you only pay back the money you take out.

Refinancing your mortgage

Have At Least 15 Percent To 20 Percent Equity In Your Home

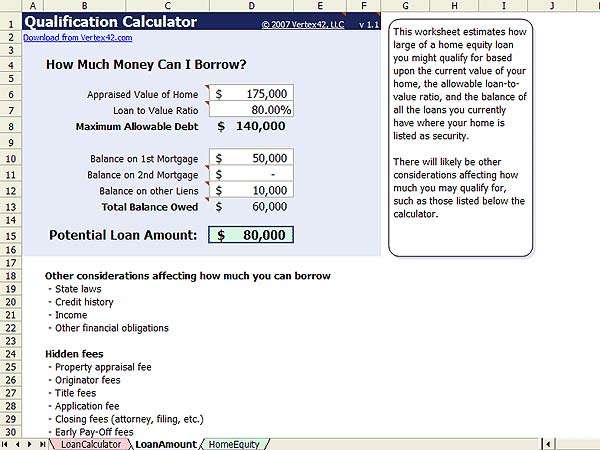

Equity is the difference between how much you owe on your mortgage and the homes market value. Lenders use this number to calculate the loan-to-value ratio, or LTV, a factor that helps determine whether you qualify for a home equity loan.

To determine your LTV, divide your current loan balance by the appraised value of your home. For instance, if your loan balance is $150,000 and an appraiser values your home at $450,000, you would divide the balance by the appraisal and get 0.33, or 33 percent. This is your LTV ratio. Since your LTV ratio is 33 percent, you have 67 percent equity in your home.

This also determines how much you can borrow. You can usually borrow up to a combined loan-to-value ratio of 85 percent, meaning the sum of your mortgage and your desired loan can make up no more than 85 percent of your homes value. In the above example, 85 percent of the homes value is $382,500. If you subtract your mortgage balance, that leaves you with $232,500 of equity to borrow with a loan.

There are a few ways to build home equity. Making mortgage payments will increase the amount of equity you have in your home, and making more than the minimum payment will increase that equity even faster. You can also work on renovations that increase the homes value although keep in mind that if you wait to make home renovations using a home equity loan, you could see tax benefits.

You May Like: Can You Buy A Manufactured Home With A Va Loan

Home Equity: What It Is And Why It Matters

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

It is often said that homeownership builds wealth. So, what is home equity, and how can it enhance your net worth?

Choose Your Debt Amount

Home> Real Estate> How to Get a Mortgage> Home Equity Loans

Need some extra cash? Home equity loans are a convenient, low-cost way to borrow large sums at favorable rates.

Home equity loans for debt consolidation will have a much lower interest rate than credit cards, but you can also use the equity in your home for large home improvement projects like a kitchen remodel or even a down payment for another property.

Whats not to love about that?

The equity figure in home equity loans is a simple math equation: Homes value minus amount owed = home equity. So, if your home is worth $200,000 and you owe $125,000, you have $75,000 worth of equity.

Most lenders offer an 80% loan-to-value rate based on your equity. With the $75,000 equity example, you could qualify for up to a $60,000 loan .

You would receive the $60,000 in a lump sum, then begin a monthly repayment schedule at a fixed rate for anywhere from 5-to-15 years, though most are 5-year loans.

And now that often-asked question: Can I get a home equity loan for anything?

The answer is YES! Anything your heart desires. Lenders wont follow you around to see how the money is spent.

If you qualify for a home equity loan, the cash can be used for financing your daughters wedding, taking a family vacation to Europe, getting some front-row Broadway tickets to Hamilton, purchasing season tickets for your favorite sports teams, paying off your student loan or even making home improvements.

Read Also: What Happens If You Default On Sba Loan

Difference Between A Home Equity Loan And Line Of Credit

Confused by what the difference is between a home equity loan and a home equity line of credit? We dont blame you, especially as both are common forms of second mortgages.

It may help to consider that under a HELOC, you are given access to revolving credit for which interest is only charged on monies borrowed. In contrast, a home equity loan is a long-term loan on which interest is charged on the full balance of a lump sum of money lent for the lifetime of the loan.

What Is Home Equity And How Do You Calculate It

Home equity is the stake you have in your property, as opposed to the lender’s stake. To calculate your home equity, subtract your current mortgage balance from the appraised value of your home. Over time, you build up equity in your home as you make payments on your mortgage. Home equity is one way to measure your personal wealth, since you can borrow from your home equity in the form of loans or lines of credit.

Youll need a substantial amount of equity in your home to qualify for a home equity loan. A home equity calculator can help you figure out how much you can borrow.

Recommended Reading: Can I Refinance My Car Loan With The Same Lender

How Much Mortgage Can I Qualify For

Lenders have apre-qualification processthat takes your finances into account to determine how much they are willing to lend you. Once the lender has completed a preliminary review, they generally provide a pre-qualification letter that states how much mortgage you qualify for. Get pre-qualified by a lender toconfirm your affordability.

Is A Home Equity Loan A Good Option For A Small Amount Of Financing

If you only need to borrow a small amount of money, it might be better to consider alternatives to a home equity loan. are a solution for small, short-term financing needs. You dont have a lengthy application process and can use the credit in any way that you want. The interest rates on credit cards, however, are very high. So, this is not the best option if you cant pay back the balance within a few months.

Personal loans can be a good way to get a smaller amount of money for a short period of time. You can apply online and often receive the funds within one day. The application process for a personal loan is much quicker and easier than it is for a home equity loan.

Lenders may provide personal loans for amounts starting at around $500 to $1,000. The interest rate on a personal loan is higher than it is for a home equity loan because it is an unsecured loan. Interest rates are still much lower than they would be on a credit card, though. Personal loans usually have terms of around two to seven years.

You May Like: Avant Refinance

Heloc In Canada: Minimum Requirements For A Home Equity Line Of Credit

A home equity line of credit or HELOC is a great way to unlock the value of your investment in home. Because a HELOC is a secured line of credit, you gain many advantages.

- The interest rates are more reasonable than those of credit cards.

- Prepayment penalties are nonexistent.

- You can withdraw large sums of money when you need them.

These credit lines offer great benefits but are available only when you meet the basic requirements, such as minimum equity requirements, as well as having strong credit and fully confirmable personal income . In some cases, stated income credit lines may be available for those with strong equity and exceptional credit..

How Much Can You Borrow With A Home Equity Loan

A home equity loan generally allows you to borrow around 80% to 85% of your homes value, minus what you owe on your mortgage. You can do some simple math to estimate how much you might be able to borrow.

For example, say your home is worth $350,000, your mortgage balance is $200,000 and your lender will allow you to borrow up to 85% of your homes value. Multiply your home’s value by the percentage you can borrow . That gives you a maximum of $297,500 in value that could be borrowed. Subtract the amount remaining on your mortgage , and you’ll get the approximate sum you can borrow as a home equity loan in this case, $97,500.

Alternately, you can ditch the math and use our home equity loan calculator.

You May Like: Usaa Used Car Refinance Rates

When Does A Home Equity Loan Make Sense

While the pandemic created unique challenges in nearly every sector of the economy, the US housing market surprised everyone by holding strong, and that pattern has continued into 2021.

Recent data from the National Association of Realtors shows that, from June 2020 to June 2021, the median price for single-family existing homes saw a near-record year-over-year increase of 22.9%. And interest rates for many financial products continue teetering near record lows.

This has left many consumers wondering if nows the best time to access the equity thats built up in their homes over the last few years. If you have a lot of cash trapped in your home, its smart to learn more about home equity products, how they work and how you can use them to reach specific financial goals. Lets take a deeper look at home equity loans and why now may be a great time to consider one.

Is A Heloc The Right Choice For You

Although taking out a HELOC can be incredibly beneficial for homeowners, both in the short and the long-term, pursuing this option under the wrong circumstances can be a big mistake.

To that end, you should never make the decision to take out a HELOC on a whim. Instead, take all the time you need to consider whether it is truly the right option for your specific circumstances. There are a few questions you should ask yourself to help you determine whether its practical for you to take out a HELOC.

One of the most important things to consider before taking out a HELOC is whether the funds are meant to provide a temporary fix or a practical investment. Many homeowners are able to consolidate their debt and greatly reduce their total interest rate on that debt by taking out a HELOC. However, doing so if you struggle with budgeting or you want to make purchases that are impractical based on your financial situation can leave you under a mountain of larger debt that youll later struggle to pay off.

This is why its critical that you speak to a HELOC specialist who can guide you given your current personal and financial situation.

For example, a good use of a HELOC is for home improvement or renovation expenses, which are likely to add value to your home, providing financial benefits well into the future.

Also Check: Do Loan Originators Make Commission