Medical And Parental Leave

To apply for leave or to extend your leave, complete the Medical and Parental Leave Application .

If applying for medical leave, or changing from parental to medical leave, complete section A of the Medical Professional Attestation for a Medical Leave . You need a medical professional to complete and sign section B of the form.

Paper versions are available through the National Student Loans Service Centre .

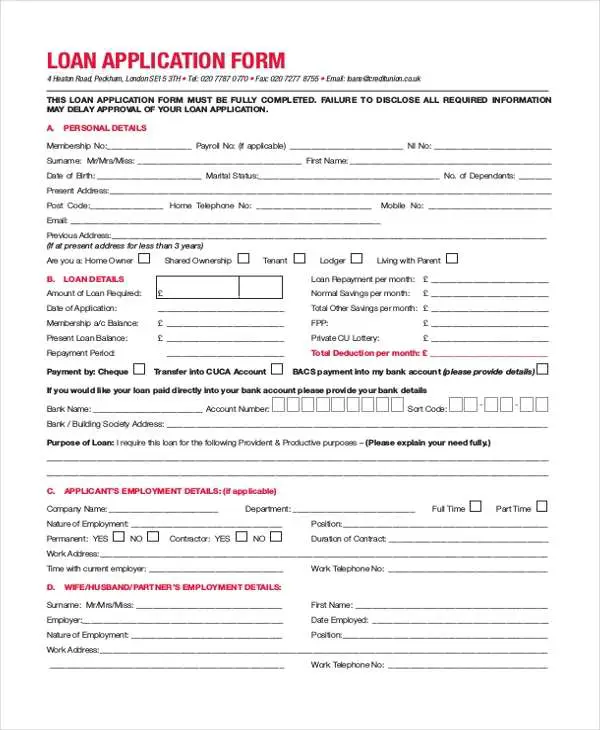

The Way To Complete The Loan Application Form Doc On The Internet:

By utilizing signNow’s comprehensive service, you’re able to perform any essential edits to Loan application form doc, make your customized electronic signature in a few fast steps, and streamline your workflow without leaving your browser.

Create this form in 5 minutes or less

How To Generate An Electronic Signature For The Loan Application Form Doc In The Online Mode

Are you looking for a one-size-fits-all solution to design business business loan application form example? signNow combines ease of use, affordability and security in one online tool, all without forcing extra DDD on you. All you need is smooth internet connection and a device to work on.

Follow the step-by-step instructions below to design your business loan application form pdf:

After that, your loan application form doc is ready. All you have to do is download it or send it via email. signNow makes signing easier and more convenient since it provides users with a number of extra features like Invite to Sign, Add Fields, Merge Documents, etc. And due to its cross-platform nature, signNow works well on any gadget, PC or mobile, irrespective of the OS.

Don’t Miss: Bayview Loan Servicing Lawsuit

The Way To Fill Out The Mortgage Application Form On The Internet:

By making use of signNow’s comprehensive platform, you’re able to complete any important edits to Mortgage application form, make your customized digital signature in a couple fast steps, and streamline your workflow without the need of leaving your browser.

Create this form in 5 minutes or less

Instructions And Help About L Application Lowdoc Form

Laws calm legal forms guide a credit application form is a business form used for providing the legal authority for a business entity to open a line of credit with another business or individual they are typically used in situations where the payment for goods or services will occur after the transaction in this case we are using the credit application form used by Expo many examples of credit application forms can be found online or through many businesses that accept credit arrangements the first step in completing the form is to enter the destination contact information which in this case is EXPO and their fax number once the destination information date and number of pages is filled out you must now start providing your identification information in the next section provide your shipping and billing contact information if they are the same you need to only fill out one side of the contact information while indicating your billing address is the same provide your address fax and pho

Don’t Miss: Fha Loan Limits Texas 2016

Student Contribution Loan Request Form

If you’re studying at a university or college in the Republic of Ireland you will have to pay a student contribution charge. Your university or college can charge up to a maximum of 3000. To cover this charge you can apply for a Student Contribution Loan which is paid in Euros to your university or college as part of the above process, instead of a Tuition Fee Loan.

If you’re applying on paper, use the PN1 form at the link above.

Page : Ppp Loan Forgiveness Calculation Form

Business Legal Name DBA or Tradename, if applicable

Enter the same business name used on your PPP application, which should be identical to the name you use on your tax returns.

Business Address/Business TIN /Business Phone/Primary Contact/E-mail Address

Use the same information as on your PPP application unless the information has changed.

SBA PPP Loan Number

This is your E-tran number that the SBA generated for you. Each business gets one E-tran number per PPP loan. If you have multiple businesses and multiple PPP loans, you will have more than one E-tran number. If you donât know where to find this number, speak to your lenderâtheyâll have it on file.

Lender PPP Loan Number

The number the lender has assigned to your loan in their systems. You can find this on your signed loan docs. If you canât find it, your lender will be able to provide it for you.

PPP Loan Amount

The full loan amount you received. You can confirm this amount in your bank records, PPP loan agreement, or in a confirmation email. Your lender should not have charged fees or otherwise taken any amount away.

PPP Loan Disbursement Date

The day the funds arrived in your bank account. You should be able to see this in your bank records or in your online banking portal. If your funds were sent in stages, enter the first date.

Employees at Time of Loan Application/Employees at Time of Forgiveness Application

Enter the number of actual employees, not Full-Time Equivalents .

Covered Period

Don’t Miss: Auto Loan Payment Calculator Usaa

How To Apply For Student Loans In Ontario

onsidering studying further? While you explore your options of enrolling in a trending online diploma program, student loan and its eligibility form a major part of your search. You must be worried about how to pay for your education in Canada and what type of financial aid is available to you once you make your decision to take up an online diploma program.

Being in Ontario gives you access to various resources to continue your education. To cover the rising post-secondary education costs and help you manage your expenses while you study, the government offers student loans to many full-time and part-time students through the Canada Student Loans Program. However, it requires you to prove that you are in financial need. There are various provisions per province for both full-time and part-time students that you can avail of to cover your educational costs.

Applying for an Alberta student loan is different from getting a student loan in Ontario. In Ontario, the Government of Canada works together with the provincial government to provide Integrated Student Loans. You need to apply through the Ontario Student Assistance Program . Effective April 2021, the Government of Canada has suspended the accumulation of interest on Canada Student Loans until March 31, 2023.

In this blog, weâll explore everything about student loans in Ontario. Weâll find answers to some common questions that include:

Letâs dive deeper into each topic.

How To Fill Out The Income

- Who its for: Low-income borrowers anyone planning on applying for public service forgiveness

- Eligible loans: Federal loans

- When to fill it out: While your loans are in repayment

Federal loans come with several different repayment plans based on your income. Each month youll typically pay between 10% and 15% of your income after taxes for 20 to 25 years. The government forgives any remaining debt after the repayment period.

If youre in a low-paying industry, IDR plans are designed to help you avoid defaulting on your student loans. Some even require you to keep a low income to remain eligible. If youre thinking of applying for forgiveness after working for the government or a nonprofit for 10 years, the Department of Education recommends that you repay your loans through an IDR plan.

Also Check: 646 Credit Score Car Loan

What Happens After I Apply

Itâs good to know the process after you apply for OSAP. You must keep checking your account for any updates and act accordingly. If any additional information is required from your side, you want to know the status of your application, or your school needs to provide any details – all this can be taken care of by accessing your account from time to time.

Cases of application cancelling and reassessing can also be addressed through the process.

You Need To Prove Your Income To Get A Loan

As part of your loan application, you have to include your salary and monthly earnings. This is to show a lender that you can afford the loan and that you will be able to make the monthly repayments.

Lenders will have a list of the types of income sources accepted so check this before you apply. Examples of incomes that may be excluded are:

-

Benefit payments such as child benefit, income support, or housing benefit

-

Business profits

-

Reimbursement for expenses

-

Maintenance payments from an ex spouse or partner

-

Non-guaranteed bonuses or sales commission

-

Overseas income such as from holiday lets abroad

-

Rental income from any buy-to-let properties you own

-

Student loans

You need to be able to prove any additional income in your loan application. You can do this by supplying recent bank statements or payslips showing your earnings. If you have this ready in advance it should make the process faster and less stressful.

Don’t Miss: How To Get A Car Loan When Self Employed

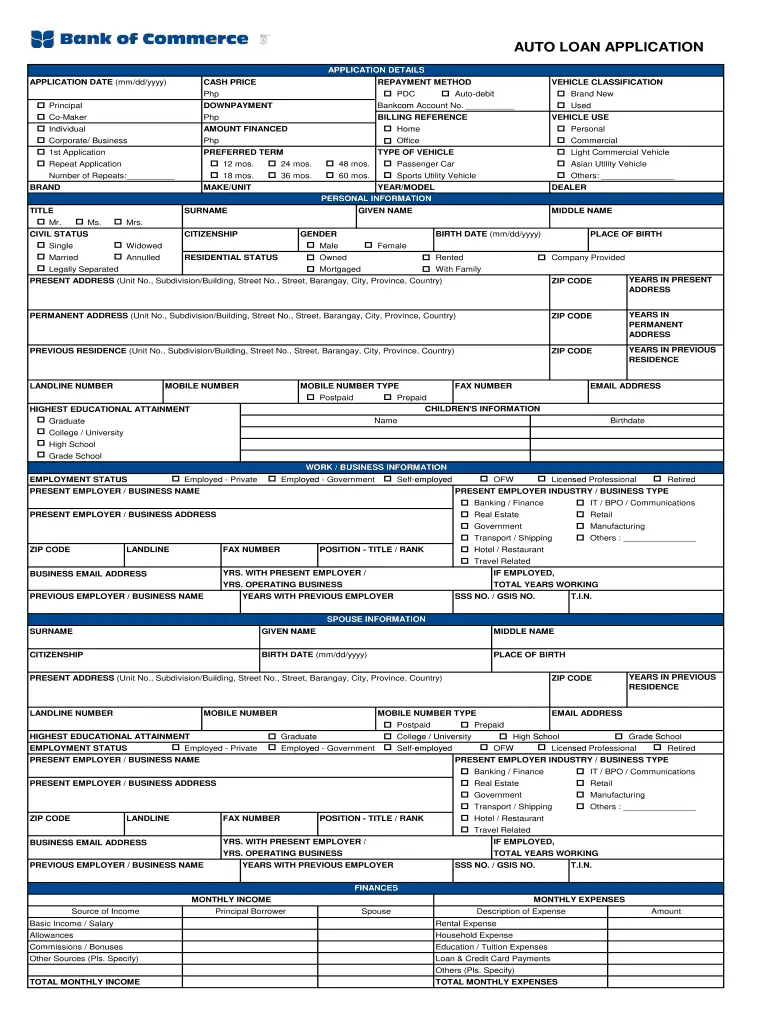

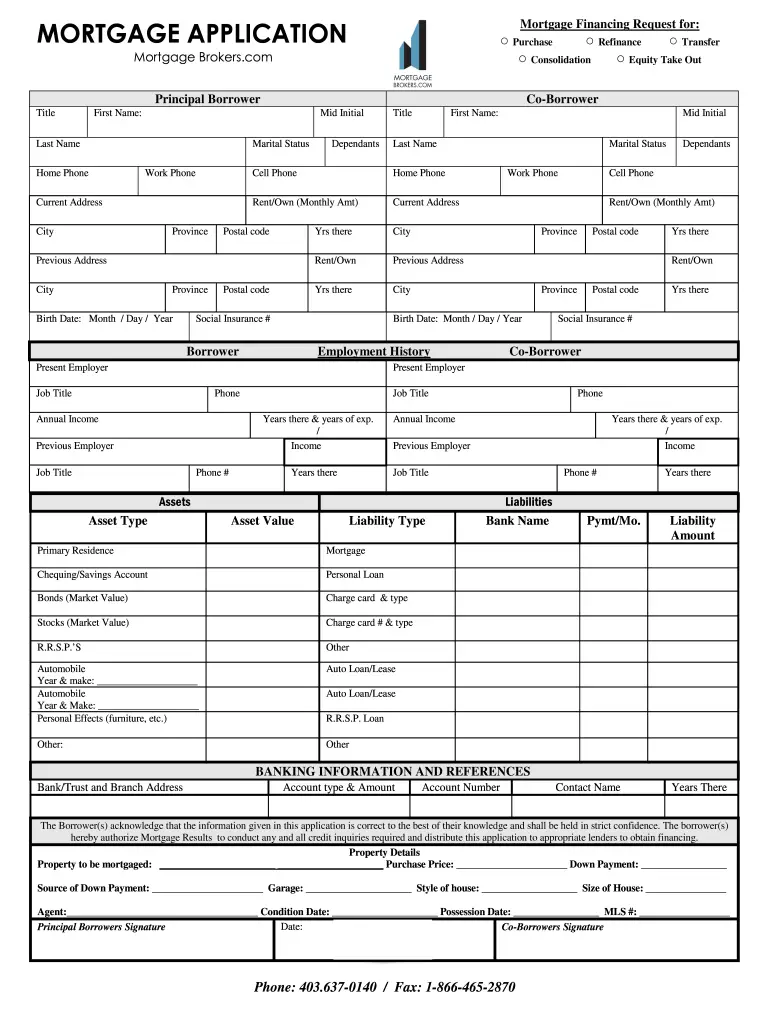

What Should A Home Loan Application Form Include

Home loan application forms need to include all necessary information that permits lenders to decide whether or not to approve a loan. This includes:

- Borrowers information: The name, age, marital status, dependents, and social security numbers of any borrowers needs to be included on the form. Youll also want to obtain information such as the borrowers current employment status and place of employment.

- Financial information: Banks need to know all sorts of financial information. Credit history, current assets, and outstanding debts need to be on the home loan or home equity loan application form.

- Property information: This section contains details about the property the borrower wants to purchase, including its address, cost, and valuation.

- Declarations: Borrowers are required to explain how they plan to use a property, whether they will reside there permanently, live in it part-time, or rent it out to other people.

- Signatures: Borrowers must sign that they believe the information theyve provided is accurate. If the loan is approved, the lenders will also need to sign the application form.

Students With Children Or Adult Dependants

If you are a full time student and have children or adult dependants, you can apply for extra help with your costs at the same time as applying for a Student Loan/ and or grant.

Parents, husbands, wives and partners of students

If you are supporting a student during their studies, you’ll need to fill in the relevant forms at:

If your total household income has dropped by five per cent or more since tax year 2017-2018, the student can be reassessed based on the current tax year. Complete the ‘Confirmation of Income from Employment form 2019/20’.

If you didn’t sign the paper form when you supported a student’s application for finance, you’ll need to fill in a parent or partner signature form.

Also Check: Usaa Personal Loan With Cosigner

Celebrities That Got A Ppp Loan

1. Report: Learn Which Celebrities Got PPP Loans Accountable Millions in PPP Funds Went to Wealthy Celebrities, Musicians, Influencers Mark Wahlberg, who received more than $500,000 Rae Sremmurd, who Celebrities That Got Ppp Loan · Khloe Kardashian is a TV reality celebrity she is a beneficiary

How To Fill Out A Loan Application

If you want to buy a property but you dont have enough finances, chances are, youll want to file a loan application. Filling out a loan application is just like filling out a school application, but a bit more complicated. Generally, loan applications will ask for your personal information, and other details your lender needs.

Forms can be a bit confusing, and its not unusual to miss something. I often fill out forms using pencil and I also write in UPPERCASE letters to ensure clarity. It is always best to fill out each form neatly, and review afterwards to make sure youve filled out everything you need to fill out. You might want to familiarize some application examples in PDF found in this source.

Read Also: Notary Loan Signing Agent Databases

How To Write Off Your Student Loan Interest Repayments

- Who its for: Anyone who has student debt, makes less than $80,000 a year before taxes and files a joint tax return if married

- Eligible loans: Federal and private student loans

- When to fill it out: By the federal deadline to file tax returns

If you pay more than $600 in interest on your education loans each year, you might be able to deduct up to $2,500 from your federal income taxes. Youll have to be eligible, however. First, you cant make more than $80,000 a year . And you cant cheat that income requirement by filing separate taxes if youre married. You also cant be claimed as a dependent on anyones taxes.

Writing off your interest payments is a bit more complicated than you think, though you wont have to crunch any numbers if you use a tax filing software like Turbotax or a CPA. You also arent required to submit any forms, though you will need to get a 1098-E from your servicer.

What Happens After You Apply For A Loan

If you’ve been approved for a loan and you accept the loan offer, you’ll need to sign the loan agreement. This may be sent to you electronically or in the post.

After the lender has received the signed agreement, it will transfer the loan directly to your bank account. This can take anything from a few hours to a few days.

Once you have the money, your first payment will normally be due the following month, unless you have chosen to take a payment holiday, in which case, you will be told exactly when you will need to pay it by.

Find out more about how to manage your loan.

You May Like: Capital One Pre Approved Car Loan

How To Edit Your Pdf International Loan Application Forms Online

Editing your form online is quite effortless. There is no need to download any software through your computer or phone to use this feature. CocoDoc offers an easy software to edit your document directly through any web browser you use. The entire interface is well-organized.

Follow the step-by-step guide below to eidt your PDF files online:

- Search CocoDoc official website on your laptop where you have your file.

- Seek the Edit PDF Online option and press it.

- Then you will browse this online tool page. Just drag and drop the document, or select the file through the Choose File option.

- Once the document is uploaded, you can edit it using the toolbar as you needed.

- When the modification is finished, press the Download option to save the file.

How To Make An Signature For Your Loan Application Form Doc In Chrome

Google Chromes browser has gained its worldwide popularity due to its number of useful features, extensions and integrations. For instance, browser extensions make it possible to keep all the tools you need a click away. With the collaboration between signNow and Chrome, easily find its extension in the Web Store and use it to design business business loan application form example right in your browser.

The guidelines below will help you create an signature for signing business loan application form pdf in Chrome:

Once youve finished signing your loan application form doc, decide what you wish to do next download it or share the doc with other parties involved. The signNow extension offers you a range of features to guarantee a much better signing experience.

Recommended Reading: Average Interest Rate For Commercial Real Estate Loan

What Are Eligibility Criteria For A Loan

Eligibility criteria are the lending conditions you need to meet when applying for a loan.

Lenders usually have certain rules about how much borrowers need to earn, how old they have to be and the state of their credit record. You may be able to find these on a lenders website.

It’s unlikely you’ll be approved for a loan if you do not meet a lender’s eligibility criteria.

How To Fill Out The Pslf Application Form In 5 Steps

- Step 1: Fill out the borrower information.

- Step 2: Read and sign the borrower request, understandings, certification and authorization.

- Step 3: Provide information about your employer.

- Step 4: Bring your application to your employer for certification.

- Step 5: Sign and submit your application to FedLoan.

You can complete the PSLF application form online by using the PSLF Help Tool on StudentLoans.gov or by and filling it out yourself.

If you choose to fill it out yourself, you can type in your answers or print them by hand using dark ink. Make sure your name and Social Security number are on all pages. Write all dates as numerals in the following order: month, day and year .

Regardless of the method you use to fill out the form, you need to print the PDF to have it certified by your current employer.

Step 1: Fill out the borrower information.

Enter your Social Security number, birthday, name and contact information under Section 1:Borrower information. If anything has changed about your personal information since you took out your student loans or submitted your most recent ECF, check the box at the top of the section.

Step 2: Read and sign the borrower request, understandings, certification and authorization.

Check the box at the bottom of this section if your employer closed or will not certify your employment. If this is the case, the DoE will contact you to find another way to verify your employment.

Should I go into forbearance?

US Department of Education

Don’t Miss: Car Loans Usaa