How Do I Make Payments On My Langley Loans

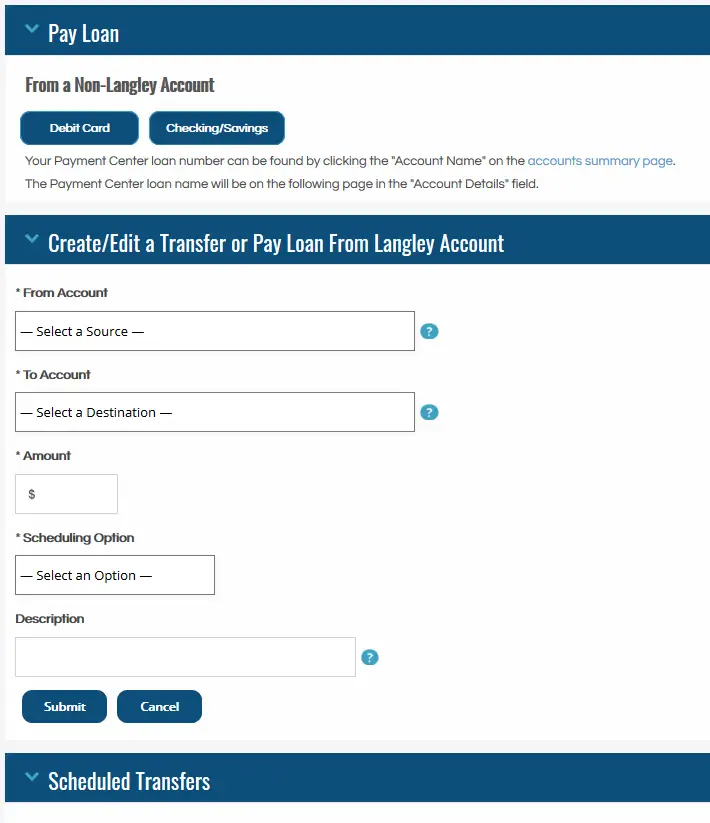

To make payments on your loans, visit the Pay Your Langley Loan menu in Mobile Banking or Transfer & Pay Loan section in Online Banking. There, you can access the Langley Payment Center and securely make payments on your loans from both Langley accounts and accounts from other financial institutions. How to Make a Payment With the Mobile App

Re: Langley Federal Credit Union Pre

Being the inquisitive person that I am, I started asking some questions of Langley, and just thought I would share the responses with the community in case other people with Langley FCU accounts had the same questions. Responses from Langley are in blue. I did add some of my own commentary in red.

1. How often are accounts reviewed for the pre-approved offers? i.e. daily, weekly, monthly?

I can confirm that the offers are based on soft-pulls on credit done ad-hoc — I have a feeling this is likely monthly b/c Langley allows users to see their credit report and it’s updated on a monthly basis.

2. Is there a specific day of the month that the pre-approved offers are posted to a member’s account if they are going to receive an offer?

The offers are posted when our Marketing Team is ready to publish a new offer — So even though there are monthly pulls, it sounds like there may not be a push from the marketing team each month. I am hoping that as the credit union collects more data, they may go to a standard release cycle similar to what we see with PenFed.

3. Do the pre-approved offers include credit line increases for existing card holders?

To the best of my knowledge we have not run credit line increase promotions to existing card holders, but that maybe on the upcoming calendar? — I will be happy to see when this promotion is added. I’ve been holding off on requesting a credit line increase to my LFCU card as I prefer not to take the HP.

Eq: 823 Tu: 830Eq: 850 Tu: 850

Gouverneur Savings And Loan

1. John L Bartlett, Gouverneur Savings & Loan Bloomberg.com John L Bartlett is Former Vice President at Gouverneur Savings & Loan. See John L Bartletts compensation, career history, education, & memberships. Founded in 1892, Gouverneur Savings & Loan Association, a subsidiary of Gouverneur Bancorp, provides financial and banking services

Don’t Miss: What Is Loan To Value Calculator

About Langley Federal Credit Union Langley Federal Credit Union Customers Added This Company Profile To The Doxo Directory Doxo Is Used By These Customers To Manage And Pay Their Langley Federal Credit Union Bills All In One Place When Adding Langley Federal Credit Union To Their Bills & Accounts List Doxo Users Indicate The Types Of Services They Receive From Langley Federal Credit Union Which Determines The Service And Industry Group Shown In This Profile Of Langley Federal Credit Unionhelp

General information about Langley Federal Credit Union

| Services doxo users have associated this company with these services.help |

| Industry groups comprise multiple related services.help |

| doxo users have indicated this company does business in these areas.help |

Common questions, curated and answered by doxo, about paying Langley Federal Credit Union bills.

How can I pay my Langley Federal Credit Union bill?

How can I contact Langley Federal Credit Union about my bill?

I’m looking for my bill. Where can I find it?

Can I pay all my Langley Federal Credit Union bills on doxo?

Bluevine Ppp Loan Lenders

1. Paycheck Protection Program: Documents Needed to Apply BlueVine is an official direct non-bank lender for the government-backed SBA Paycheck Protection Program. Our entire PPP application process, PPP repayment starts ten months after your covered period ends. Your covered period is the time frame during which you must spend your

Don’t Miss: What Happens If I Refinance My Car Loan

Applying For A Loan W/ Langley Credit Union

Whether you’re applying for an auto, mortgage, or personal loan, Langley Credit Union has extremely competitive rates. The problem? You need great credit to get those loan terms . Your first step to determine if you’re eligible for top-tier rates is to pull your Credit Report.

You can review your Credit Report and find every inaccurate item , or contact a Credit Repair company, like Credit Glory, to walk you through that entire process.

You can schedule a free consultation with Credit Glory, or call one of their Credit Specialists, here

Langley Federal Credit Union

Pay Your Bills Securely with doxo

- State-of-the-art security

- Free mobile app available on Google Play & Apple App Store

- Never miss a due date with reminders and scheduled payments

- Real-time tracking and bill history

- Pay thousands of billers directly from your phone

doxo is a secure all-in-one service to organize all your provider accounts in a single app, enabling reliable payment delivery to thousands of billers. doxo is not an affiliate of Langley Federal Credit Union. Logos and other trademarks within this site are the property of their respective owners. No endorsement has been given nor is implied. Payments are free with a linked bank account. Other payments may have a fee, which will be clearly displayed before checkout. Learn about doxo and how we protect users’ payments.

Read Also: Why Should I Refinance My Car Loan

How Do Langley Federal Credit Union Auto Loans Work

If you choose repayment terms of up to 48 months, youll have access to low interest rates of 2.24%.

Any periods above this and your interest rate will increase a little to a 2.99% starting rate.

If you choose to pay your loan back using a Langley checking account, youll get 10% of your interest payment refunded each month.

Can You Catch Up On A Late Car Payment

It also depends on your relationship with the lender. If you have a solid history of on-time payments with the lender, you might be given the opportunity to catch up within a reasonable period of time. If, however, you have a record of late car payments, the lender may view you as a high risk for default and choose to act more quickly.

You May Like: Is My Area Eligible For Usda Loan

What To Do If You Can’t Afford To Make A Loan Payment

If you can afford the payment , the lender and make immediate arrangements. Be prepared to pay a late fee. If you cant afford to make the payment, but it is just one time, you can ask for a loan deferment, which pushes the amount owed to the end of the loan term. You may just owe the interest on the missed …

What Is Receivables Financing

Category: Loans 1. Accounts Receivable Financing Definition Investopedia Accounts receivable financing is a type of financing arrangement in which a company receives financing capital related to a portion of its accounts Understanding AR Financing · Structuring Receivables financing is when a business receives funding based on issued invoices. Those

Don’t Miss: Where To Apply For Ppp Loan

Langley Federal Credit Union Auto Loanlatest News

-

langley federal credit union auto loan

Located right next to the University of Washington, our staffs are friendly….

-

langley federal credit union auto loan

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec a…

-

langley federal credit union auto loan

Sed ut perspiciatis unde omnis iste natus error sit voluptatem…

-

langley federal credit union auto loan

Enjoy our casual and relaxing dining atmosphere. You can quickly…

Cant Make Your Car Payments Youve Got Options

Having a car provides many conveniences. You do not have to worry about lugging groceries on the bus or waiting 45 minutes for the train. However, for those experiencing financial problems, having to pay a car loan can make owning a car seem more like a burden than a convenience. If you are behind with payments, or worried you will be soon, assessing your financial situation and actively pursuing your options can help you make the best of a difficult situation.

What happens if you stop making car payments?When you first fall behind, your lender may call you and/or send you letters in an attempt to collect the delinquent amount. If you continue to miss payments, and do not reach an agreement with your lender, the car will likely be repossessed. If reported, the late payments and repossession can damage your credit score and make it harder to get credit in the future. How long the lender will wait before repossessing the car depends on where you live and the specific policies of your lender. Some states allow cars to be repossessed after one missed payment.

If you cannot sell the car at all, you can see if the lender would be willing to accept the car back. This is called a voluntary repossession. Most lenders report voluntary repossessions on credit reports , so you may only want to consider it if other options have not worked out or if the lender is willing to give you something in exchange for turning in the car, such as a reduction in the amount you need to repay.

Also Check: How Does An Auto Loan Affect Your Credit Score

Langley Federal Credit Union Overnight Payoff Address

Most people will need to know the Overnight address for their Langley Federal Credit Union loans and other mortgage services.

However, if you need to know the overnight mailing address, this section of the guide will assist you.

The Langley Federal Credit Union Overnight Payoff Address is 721 Lakefront Commons, Suite 105, Newport News VA 23606.

That is the overnight address which is sometimes different from the regular mailing address for mortgage or auto loan payments.

For confirmation or verification of the overnight address, please contact the Mortgage or Loan department.

Magnolia Bank Fha Loan

1. Magnolia Bank Magnolia Bank Mortgage helping homeowners since 1919. Call 1-800-276-2965 to speak with a Mortgage Loan Originator about your purchase home loan or Explore flexible lending options with the benefit of local decision making and competitive rates. Home Loans Magnolia Bank Our Mortgage Loans · Conventional

Don’t Miss: Can You Get Down Payment Assistance With Conventional Loan

Student Loan Forgiveness For Frontline Health Workers Act

1. Student Loan Forgiveness for Frontline Health Workers Act Shown Here: Introduced in House To provide student loan forgiveness to health care workers who are on the front line in response to COVID19. The Student Loan Forgiveness for Frontline Health Workers Act would establish a federal and private loan

Langley Federal Credit Union Pre

I know there is not too much on the forums about LFCU, but wanted to bring this up for anyone that is currently a member.

Langley recently updated their website and as part of the re-design, they flaunt “Pre-Approved Offers” including credit cards and other products such as car loans. Based on their website, it indicates “from time to time, you may be eligible for pre-approved offers”. Has anyone had any experience with receiving the pre-approved offers in the new Langley site that went live on June 19th? Any data sets or any other details? I have an LFCU account with a credit card and paid off car loan no pre-approved offers section showing for me.

Below is a screen capture from the above site. It’s a fake name/account they used to give an example of what the pre-approved offer would look like.

Eq: 823 Tu: 830Eq: 850 Tu: 850PenFed Power Cash 50k | AMEX Blue Cash 49.5k | Cap One QSMC 26.5k | AMEX Platinum NPSL | USAA Signature Visa 25k

Don’t Miss: How Long Does Loan Pre Approval Take

Frequently Asked Questions And Answers

What are some popular services for banks & credit unions?

Some popular services for banks & credit unions include:

What are people saying about banks & credit unions services in Virginia Beach, VA?

This is a review for a banks & credit unions business in Virginia Beach, VA:

“Fantastic customer service I have been in many times and they are nothing but nice!! They are always friendly and as accommodating as possible since not everything is in there control. They event went out of there way to help me in a couple of instincts. Very happy with this branch!!”

Langley Federal Credit Union Payoff Address

The Langley Federal Credit Union payoff address is PO Box 120128, Newport News VA 23612.

Hence, if you need the official payoff mailing address for Langley Federal Credit Union, you need to use the address PO Box 120128, Newport News VA 23612.

That is the Standard or Regular mailing address.

Please note that the payment mailing address for the mortgage loan may be different and if that is actually the case for you, we will advise you to contact Langley Federal Credit Union for assistance.

You May Like: How To Get The Ppp Loan

Your Credit Score: Everything You Need To Know

Your credit score can have a major impact on your life. Not only do creditors typically check your score when deciding whether or not to approve your loan application and what interest rate to charge you if you are approved, but landlords, insurance companies, and even employers often check it as well. Having a good score can help you achieve your goals quickly and at the lowest possible cost.

What is a credit score?Your credit score is a mathematical assessment of the likelihood you will repay what you borrow. It is based on the information in your credit report, which tracks your credit-related activity. Types of credit include credit cards, store cards, personal loans, car loans, mortgages, student loans, and lines of credit.

For each account, your report shows who it is with, your payment history, the initial amount borrowed or credit limit , the current amount owed, and when it was opened/taken out. Your report also shows if you have experienced any credit-related legal actions, such as a judgment, foreclosure, bankruptcy, or repossession, and who has pulled your report .

There are three major credit bureaus that compile and maintain credit reports: Equifax, Experian, and TransUnion. Theoretically, all three of your reports should be the same, but it is not uncommon for creditors to report to only one or two of the bureaus.

The following are the factors that are used to calculate your FICO score:

Improving your score Following these habits can boost your score:

Langley Federal Credit Union Auto Loan Payoff Address Overnight

Langley Federal Credit Union payoff address Guys!! If you have no idea about the Langley Federal Credit Union Auto Loan Payoff Address overnight?

and Are you looking for a Langley federal credit union mailing address? We provided complete information from multiple sources and sorted them by user interest.

Therefore, you can easily access information about theLangley federal credit union overnight payoff address by following this article at last.

Recommended Reading: What Are Home Loan Rates

Langley Federal Credit Union Auto Loans

Langley Federal Credit Union was established in 1935 by 25 members of the National Advisory Committee for Aeronautics, or NACA. Since its first deposit, LFCU has cultivated a business practice with a primary focus on its members. Known as a full-service credit union, members enjoy benefits not found in traditional banking systems.

While its checking, savings and loan departments are well-known throughout the credit union world as being some of the most solid, its auto loan options are what set this credit union apart from the masses. Headquartered in Newport News, Virginia, Langley FCU is the ideal destination for your car loan needs.

Langley Credit Union Vs Major Banks

The short answer is… it completely depends . Not all Credit Unions are good. Not all banks are bad. Credit Unions, like Langley Credit Union, are great for high CD rates & low interest loans / credit cards. The trade off? They’re not as good because their resources, generally, are more limited for website services, apps, etc.

Keep in mind, you’ll have to apply for a membership to get accepted. This means they’ll most-likely review your Credit Report & determine if you’re eligible. We recommend speaking with a Credit Repair company, like Credit Glory, to understand how you can potentially improve your Credit Score .

Banks, on the other hand, are in-it to make a profit. Generally, this means higher fees . Banks also generally don’t focus on the community the same way Credit Unions do. Credit Unions have memberships, while banks are generally open to anyone, anywhere. The primary pros of banks are generally better business services that are tailored to individual situations in a more comprehensive way. Also, if you plan to travel internationally, you save a lot of headache with a major bank account .

Read Also: How Much Loan Am I Eligible For