What Is A Good Interest Rate On A Mortgage

A good mortgage rate is one where you can comfortably afford the monthly payments and where the other loan details fit your needs. Consider details such as the loan type , length of the loan, origination fees and other costs.

That said, today’s mortgage rates are near historic lows. Freddie Mac’s average rates show what a borrower with a 20% down payment and a strong credit score might be able to get if they were to speak to a lender this week. If you are making a smaller down payment, have a lower or are taking out a non-conforming mortgage, you may see a higher rate. Moneys daily mortgage rate data shows borrowers with 700 credit scores are finding rates around 3.6% right now.

Get Your Mortgage Right And It’s The Easiest Money You’ll Make

Our team of mortgage brokers are whizzes at perfecting a mortgage structure.

Rather than putting all your eggs in one basket at one interest rate, depending on your situation we’ll usually advise splitting your mortgage across different terms and rates. Were pretty clued up about the economy and rate movement so well help you make an informed decision.

Why bother getting so technical?

The devil is really in the detail. When were talking hundreds of thousands of dollars, a fraction of a percent change in interest or repayment rates can save you a packet. This could mean retiring to your super yacht a few years earlier than planned. If that’s your thing.

Are interest rates moving?

The question that is top of mind for most is whether or not interest rates are going to go up or down. This is especially true if youre looking to get into the property market or make a change to an existing portfolio. We might not have a crystal ball, but we keep our blog up to date if you’re after an idea of whats been happening with interest rates lately.

Understanding Different Mortgage Rates

If you’re going to buy a home, you’ll likely need a mortgage. It will probably be the biggest loan you’ve ever taken outand getting it wrong can be a mistake that will cost you for years. So getting it right means educating yourself. Start by checking our mortgage rates tables which we are updated on a daily basis. Then, read below to learn more about how the mortgage market works, which type of mortgage to choose, how to find and lock in the best rate, and more.

Don’t Miss: Usaa Used Car Loans

When To Lock Your Mortgage Rate

Keep an eye on daily rate changes. But if you get a good mortgage rate quote today, dont hesitate to lock it in.

Remember, if you can secure a 30year mortgage rate below 3% or 4%, youre paying less than half as much as most American homebuyers in recent history. Thats not a bad deal.

*Average rates are for sample purposes only. Your own interest rate will be different. See our mortgage rate assumption here.

How Much Can I Borrow For A Mortgage

How much you can borrow for a mortgage varies by person, and depends on your financial situation: your credit, your income, and the amount of cash you have available for a down payment. The general rule of thumb for a conforming mortgage is a 20% down payment. On a $400,000 home, that would mean you need $80,000 up front.

Note that this calculation may be different if you qualify for a different type of mortgage like an FHA or VA loan, which require smaller down payments, or if you’re looking for a “jumbo loan” over $548,250 in most parts of the US in 2021 .

You don’t have to go with the first bank to offer you a mortgage. Like anything else, different servicers offer different fees, closing costs, and products, so you’ll want to get a few estimates before deciding where to get your mortgage.

Don’t Miss: Defaulting On Sba Loan

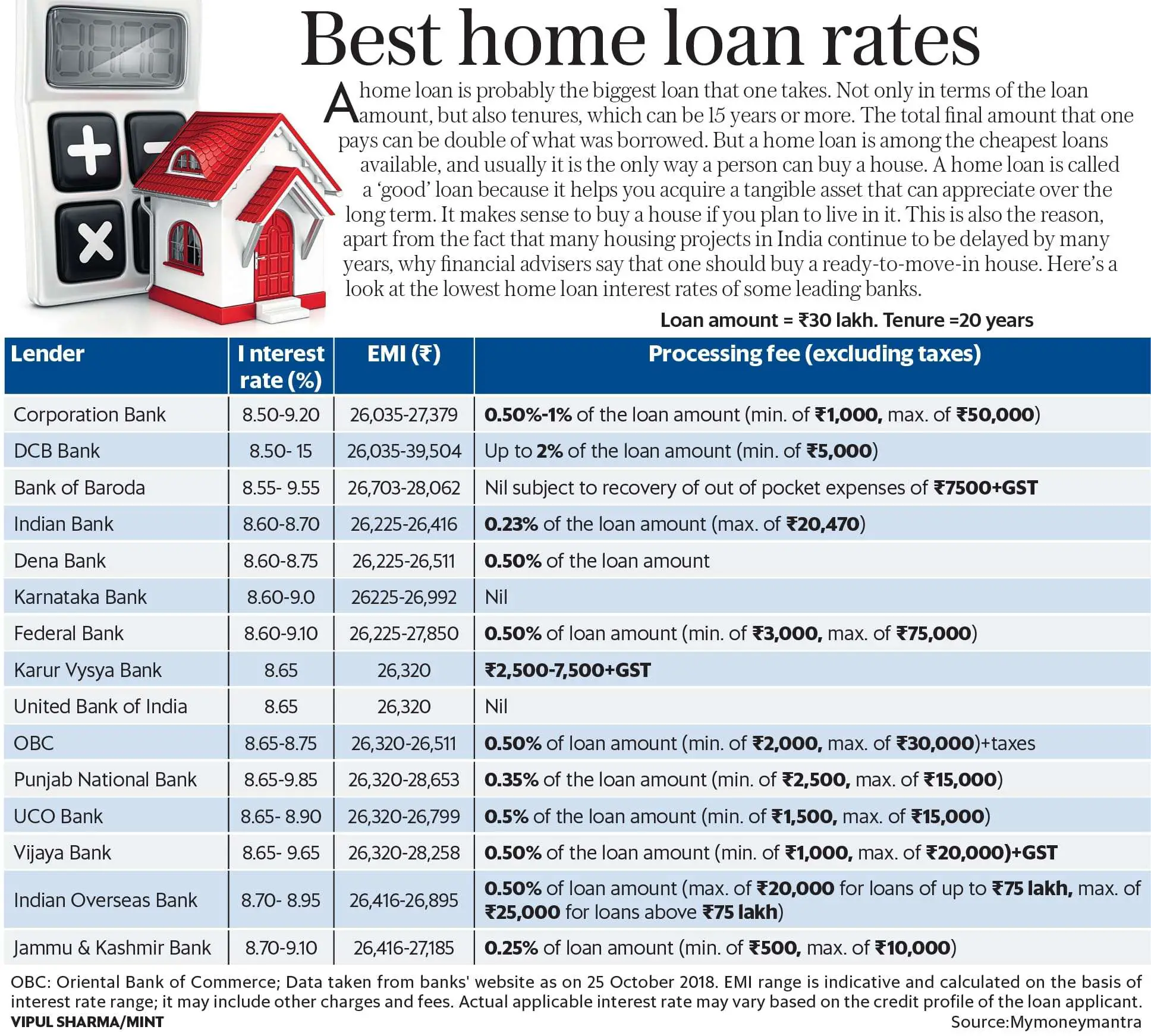

Citibank’s Lowest Home Loan Interest Rate Offers At 675%

Citibank is now offering home loan to its customers starting at 6.75% p.a. The interest rate charged by Citibank is lower than interest rates offered by some of the leading lenders and finance houses in India. The bank has also decided to waive off the processing fee on home loans till 31 December 2020.

Citibank has linked its interest rate to its 91-day treasury bill which is unlike the other lenders who have linked their interest rate to the Reserve Bank of Indias repo rate. So far, linking of interest to an external benchmark which is treasury bill for Citi has been effective for them since the RBIs repo has fallen 115 basis points.

19 November 2020

Canada Vs Usa Mortgage Terms

Canadas mortgage term lengths are relatively short when compared to mortgages in the United States. The most common mortgage in the U.S. is the 30-year fixed mortgage, which means that homeowners dont need to renew their mortgage for the entirety of their amortization. This is a large departure from the Canadian mortgage market, where homeowners expect to renew and renegotiate their mortgage rates often.

Don’t Miss: Avant Vs Upstart

How Do I Choose The Best Mortgage Lender

You should always compare several different lenders when shopping for a home loan. Not only will the rates and fees vary, but the quality of service as well. Regardless of what lender you end up working with, its important to find someone that can help your individual challenges. For example, if youre a military veteran getting a VA loan, youll want to work with someone who has experience with those types of loans.

To find a trusted lender, you can look at online reviews, or even better, ask around. Your real estate agent and friends who recently purchased a home are great sources for mortgage lender recommendations. Try comparing a variety of different mortgage lenders. The best mortgage lender for you may be a bank, credit union, mortgage broker, or an online mortgage lender, depending on your situation.

What Is The Difference Between Interest Rate And Apr

Interest rate is a percentage of the total loan balance paid to the lender on a monthly basis . The annual percentage rate, or APR, is the total borrowing cost as a percentage of the loan amount, which includes the interest rate plus any additional fees like discount points and other costs associated with procuring the loan.

You May Like: Becu Auto Loan Early Payoff Penalty

Whats Happening With Uk Interest Rates

The Bank of England raised interest rates to 1.25% on 16 June. It was the fifth rise since December 2021, when Bank rate stood at just 0.1%, and will add around £312 a year onto the cost of a £200,000 mortgage .

The next interest rate decision will be on 4 August, when the Bank may well decide to raise rates again in the continuing battle against inflation, which shows little sign of abating.

Existing Bank rate-linked mortgages, such as base rate trackers mirror interest rate rises, while the cost of many new fixed rate deals have already factored them in.

As well as climbing mortgage rates, those looking to buy or move home are also facing asking prices at 10.5% higher compared to just 12 months ago, according to the latest house price report from Halifax. However, this was the lowest annual house price inflation recorded this year.

How To Shop For The Best Mortgage Rate

When you are ready to apply for a loan, you can reach out to a local mortgage broker or search online. Make sure to consider your current financial situation and your goals when searching for a mortgage. Things that affect what the interest rate you might get on your mortgage include: your credit score, down payment, loan-to-value ratio and your debt-to-income ratio. Having a good credit score, a larger down payment, a low DTI, a low LTV, or any combination of those factors can help you get a lower interest rate. Apart from the mortgage interest rate, other factors including closing costs, fees, discount points and taxes might also affect the cost of your house. Make sure to comparison shop with multiple lenders — like credit unions and online lenders in addition to local and national banks — in order to get a mortgage loan that’s the best fit for you.

Don’t Miss: Refinance Car Through Usaa

Avoid Higher Rates With A Short

In a rising mortgage rate environment, there are certain strategies you can use to secure a lower interest rate. One is choosing a shorter loan term.

Homeowners who refinance from a 30-year mortgage into a 15-year mortgage often secure far lower interest rates. Just look at Freddie Macs survey as an example:

On November 18, 2021, 30-year fixed rates were averaging 3.10%. But 15-year fixed rates were averaging just 2.39% more than 50 basis points lower than a 30-year loan term.

And thats not unusual.

15-year fixed rates are almost always significantly lower than 30-year rates.

That represents a huge savings opportunity for homeowners who refinance into a 15-year mortgage. Doing so could easily save you thousands over the life of the loan.

Just keep in mind that 15-year loan terms come with higher payments. So youll need to compare your options and choose the loan type that makes the most sense for your monthly budget.

Current Mortgage Rates For June 20 202: Rates Go Up

Today, the average interest rate for a 30-year fixed mortgage is at almost 6%. See how that affects your mortgage plans.

A couple of mortgage rates are higher again today, with 15-year fixed and 30-year fixed mortgage rates both climbing substantially. We also saw an inflation in the average rate of 5/1 adjustable-rate mortgages.

Mortgage rates have been consistently going up since the start of this year, and are expected to keep climbing throughout 2022. In general, interest rates are dynamic — they rise and fall on a daily basis depending on economic factors, including inflation and the federal funds rate, which the Federal Reserve has already increased three times this year. Because the Fed plans to keep hiking interest rates in order to contain inflation, prospective homebuyers will likely be able to lock in a lower rate now rather than later this year. Interviewing multiple lenders to compare rates and fees will help you find the best option for your financial situation.

Keep in mind that home prices come down not only to interest rates but a variety of factors. While we can’t predict in the long term how the Fed’s policies will impact the housing market, higher rates means that homebuyers will in the short term be dealing with steeper monthly payments.

Don’t Miss: Fha Loan Limits In Texas

How Do I Compare Current Mortgage Rates

Because mortgage rates are so individual to the borrower, the best way to find the rates available to you is to get quotes from multiple lenders. If you’re early in the homebuying process, apply for prequalification and/or preapproval with several lenders to compare and contrast what they’re offering.

If you want a broader idea without yet talking to lenders directly, you can use the tool below to get a general sense of the rates that might be available to you.

Its Not All About Interest Rates Wait What But What About Those Big Rate Numbers All The Banks Use To Advertise Their Home Loans

Its actually about your long term plan

The way we structure your mortgage is tailored to work with the lifestyle you want to lead. You might be starting a family or buying a Ferrari in the next few years and your mortgage structure needs to reflect that.

Not all banks are created equal

All the banks will differ when it comes to home loans pricing, policies and service. You need a broker who can give you unbiased advice on what will work best for your situation.

Choose an impartial mortgage adviser

Unlike many others, Squirrel mortgage brokers are not paid by commission so there’s no incentive to push you into anything. We can recommend a bank and home loan that works to your advantage and not the other way around.

Also Check: Usaa Pre Qualify Home Loan

Can 30year Mortgage Rates Go Lower

The short answer is that mortgage rates could always go lower. But you shouldnt expect them to.

The recordlow rates seen in 2020 and 2021 were largely due to the Coronavirus pandemic.

When the economy crashed early on during Covid, the Federal Reserve forced interest rates down to keep money circulating.

In addition, investors tend to purchase mortgagebacked securities during tough economic times because they are a relatively safe investment. MBS prices control mortgage rates and the flood of capital into MBS during the pandemic helped keep rates low.

But those lowrate pressures were never meant to be permanent.

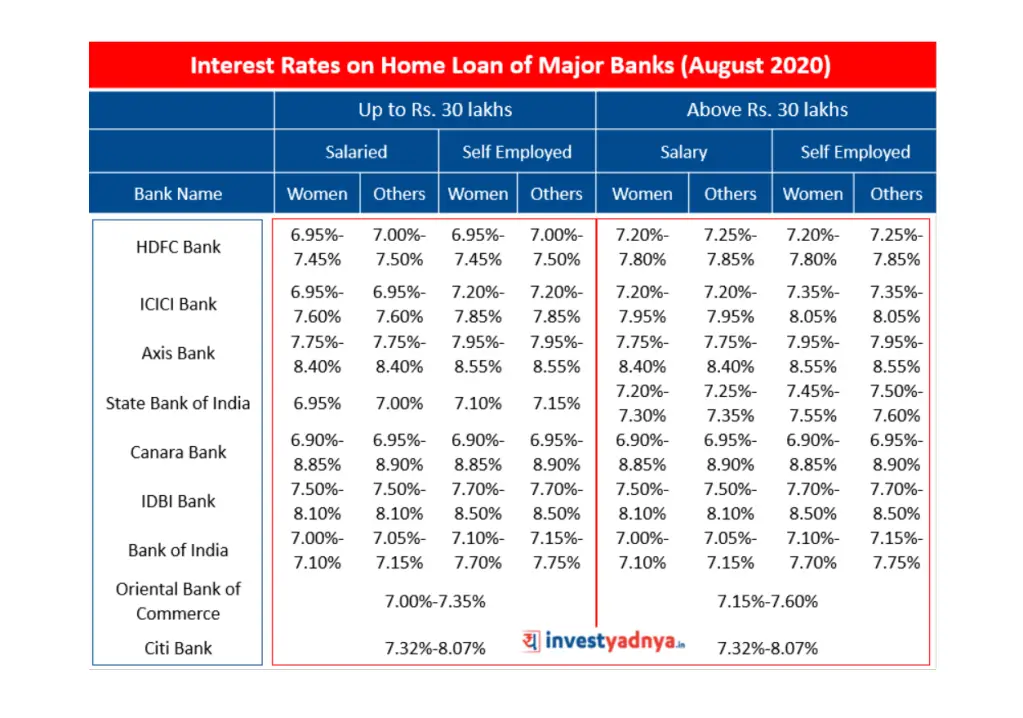

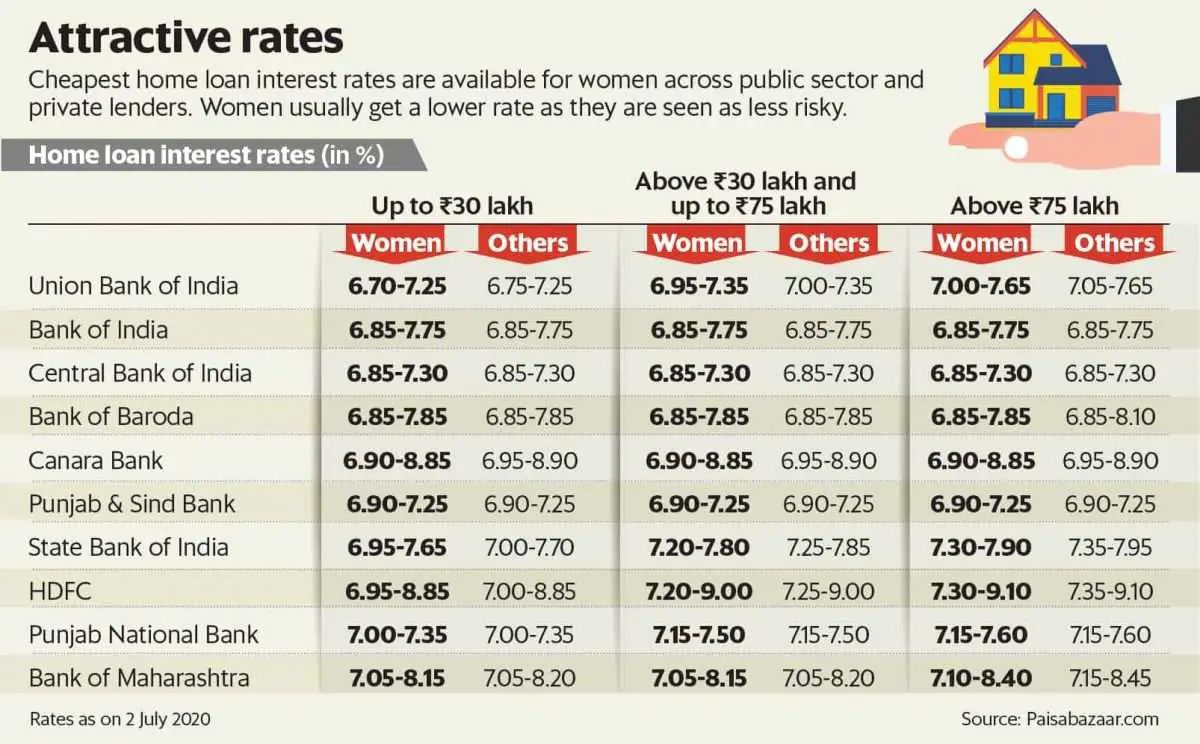

Special Home Loan Offers Announced By Leading Banks As Part Of The Festive Season Offers

As part of the upcoming festive season in the country, leading banks are offering special home loan offers to attract customers to avail home loans. State Bank of India is offering attractive interest rates starting at 6.90% p.a. for home loans of up to Rs.30 lakh and 7.00% p.a. for home loans above Rs.30 lakh. Those applying through the banks YONO mobile application get an additional interest rate concession of 5 basis points. Applicants across 8 metro cities in India will get a concession in interest rate of 20 basis points for home loans of up to Rs.3 crore. In the rest of the country, this will be applicable for home loans ranging from Rs.30 lakh to Rs.2 crore. For home loans of above Rs.75 lakh, there will be an interest rate concession of 25 basis points. All interest rate concessions are also linked ot the credit scores of applicants.

23 October 2020

Don’t Miss: What Happens If You Default On A Sba Loan

Where Can I Compare Mortgage Interest Rates

There are many price comparison sites that allow you to compare mortgage interest rates, based on your own personal criteria.

It’s important, however, to not focus solely on the rate that a lender offers, but the total cost of the mortgage across the term of the deal. This way, you’ll factor in any fees and cashback associated with the deal as well as the interest being charged.

This is where the APRC can help.

Key Mortgage Terms Explained

We know that when it comes to choosing a mortgage, there’s a lot of jargon to get your head around. That’s why we’ve listed some common mortgage terms here.

Loan-to-value

This represents the percentage of the property value you want to borrow. For example, a £100,000 property with an £80,000 mortgage would be an 80% LTV. The maximum LTV we’ll lend you depends on your individual situation, the property, the loan you choose and the amount you borrow.

Initial interest rate This is the initial percentage rate at which we calculate the interest on the mortgage.

Variable rateWhen your initial mortgage rate ends, the interest on your mortgage will be calculated using the HSBC Standard Variable Rate or HSBC Buy to Let Variable rate. This will vary over the term of the loan and is set internally. HSBC Standard Variable Rate and HSBC Buy to Let Variable Rate do not track the Bank of England base rate.

Initial interest rate period This is the period during which the fixed or tracker rate applies. For fixed and tracker rate mortgages, when the specified period expires, the rate will revert to the HSBC Standard Variable Rate/Buy-to-let Variable Rate.

Annual Percentage Rate of Charge The APRC represents the overall cost for comparison and can be used to compare mortgages.

Booking feeA fee charged on some mortgages to secure a particular mortgage deal.

Annual overpayment allowance

Also Check: How To Calculate Va Loan Amount

The End Of The Fixed Period

Fixed-rate mortgages

When your fixed period ends the rate will move to the HSBC Standard Variable Rate, unless you switch your HSBC rate.

Tracker mortgages

The tracker mortgage will track the Bank of England base rate for a 2-year fixed period, then it will move to the HSBC Standard Variable Rate, unless you switch your HSBC rate.

Current standard variable rate

Our current standard variable rate for residential mortgages is 3.54%, effective from 1st April 2020. These rates only apply when a fixed or tracker rate no longer applies.

What Controls A Variable Interest Rate

Your variable interest rate is directly controlled by your lender via theirPrime Rate. Each lender can choose to increase or decrease their own prime rate, in turn increasing or decreasing your variable interest rate.

Lenders will usually adjust their prime rate to reflect changes in theBank of Canadas Policy Interest Rate. This means that lenders will tend to have similar or identical prime rates. All major Canadian banks currently have a prime rate of 2.45%.

Don’t Miss: Usaa Auto Loan Apr

Year Mortgage Rates Chart: Where Are Rates Now

Mortgage interest rates fell to record lows in 2020 and 2021 during the Covid pandemic.

Emergency actions by the Federal Reserve helped to push mortgage rates below 3% and keep them low.

But, with the economy in recovery mode, mortgage interest rates have risen since their alltime low in January 2021. And theyre likely to keep rising in 2022.

How Do I Get The Best Mortgage Interest Rate

The right deal for you will depend on your circumstances and what you want from a mortgage. In most cases you’ll need to meet certain conditions to qualify for the most competitive rates on offer.

Follow these steps to increase your chances of getting a great deal:

- Have a good credit record. Lenders are very thorough in checking your credit history when assessing your application – they want to know that you are good at repaying debt, so the better your credit score, the better your chances of being approved. Find out more in our guide to how to improve your credit score.

- Build a bigger deposit. The best rates are reserved for people borrowing at a lower loan to value ratio – i.e. borrowing a relatively small percentage of the property price. You can achieve this by saving a bigger deposit, or, if you already own a property, increasing your equity by paying down your mortgage each month.

- Shop around. There are dozens of different mortgage lenders, from the big, high-street names you are familiar with to challenger brands that are exclusively online. Each will have a range of different products on offer, and it pays to take time working out the most suitable deal for you.

- Use an independent, whole-of-market mortgage broker. Not only are mortgage brokers familiar with the different products on offer and able to advise on the lenders most likely to accept you, but they have access to mortgage deals which you can’t get by applying directly.

Also Check: What Is The Average Interest Rate On A Commercial Loan